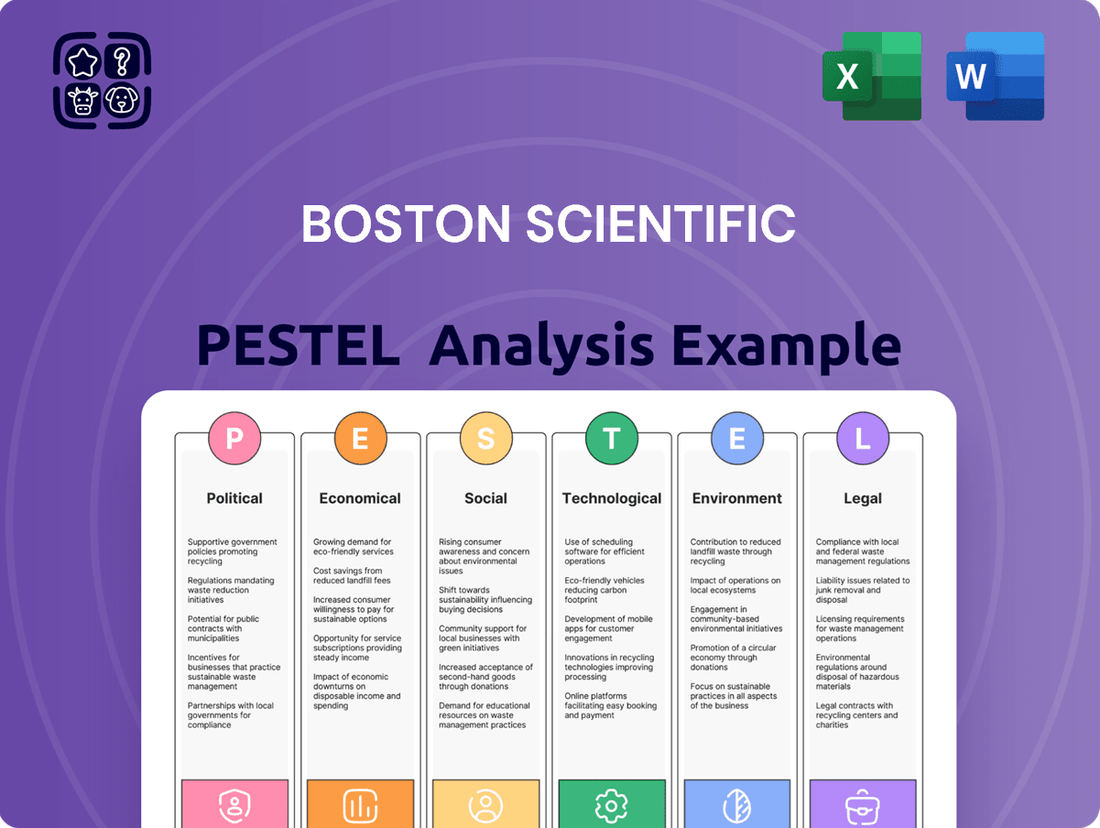

Boston Scientific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Scientific Bundle

Navigate the complex external landscape impacting Boston Scientific with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the medical device industry and Boston Scientific's strategic direction. Gain the critical insights needed to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and empower your strategic decision-making.

Political factors

Government healthcare policies and reforms in major markets like the U.S. and the EU significantly shape Boston Scientific's ability to access markets and gain product approvals. These policies increasingly demand robust evidence of clinical outcomes, comparative effectiveness, and cost-efficiency, directly impacting how the company's devices are reimbursed. For instance, the U.S. Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, signals a broader trend towards cost containment that could influence medical device pricing and reimbursement discussions moving forward.

Changes in global trade policies and tariffs represent a significant political factor for Boston Scientific. While the company initially projected a more substantial impact, they have since revised their full-year 2025 tariff estimate downward. This adjustment suggests a dynamic and evolving international trade environment that requires ongoing strategic monitoring.

Tariffs can directly influence Boston Scientific's cost of goods sold and overall profitability by increasing the expense of imported components or finished medical devices. For instance, if key manufacturing materials or devices are subject to new or increased tariffs, it could necessitate price adjustments or a reassessment of sourcing strategies. The company's ability to navigate these trade shifts is crucial for maintaining competitive pricing and financial stability in its global markets.

Global political stability and geopolitical events can introduce significant uncertainties for Boston Scientific, impacting everything from supply chains to market access. For instance, ongoing geopolitical tensions in regions where the company operates or sources materials can lead to currency volatility, affecting reported earnings. The company's 2023 10-K filing, for example, specifically mentions risks associated with political instability and trade disputes impacting its international business.

These events can directly influence foreign currency exchange rates and interest rates, which are critical for a company with a global footprint like Boston Scientific. Fluctuations in these areas can impact the cost of goods sold, revenue translation, and the overall cost of capital. Furthermore, political instability can hinder the company's ability to transfer receivables or repatriate profits from certain countries, creating operational and financial challenges.

Regulatory Environment Evolution

The global regulatory landscape for medical devices, including those from Boston Scientific, is constantly shifting. Many countries are actively working to streamline product approval pathways, which can impact the speed at which new technologies reach the market. For instance, the U.S. Food and Drug Administration (FDA) has been implementing initiatives aimed at accelerating innovation, while the European Union's Medical Device Regulation (MDR) has introduced more rigorous conformity assessment procedures.

Maintaining strict adherence to manufacturing and quality system standards is paramount for Boston Scientific to ensure compliance and retain access to key markets. These standards are not static; they are frequently updated to reflect advancements in technology and patient safety. Failure to adapt can lead to significant delays or even market exclusion. For example, the ongoing implementation and refinement of the MDR in Europe have presented compliance challenges for many medical device manufacturers, requiring substantial investment in quality management systems.

Boston Scientific's ability to adapt to these evolving regulatory requirements is crucial for its sustained growth and the successful introduction of new products. The company's research and development efforts must be closely aligned with anticipated regulatory changes to avoid costly rework or delayed market entry. In 2023, the medical device industry saw continued focus on post-market surveillance and cybersecurity requirements, areas where companies like Boston Scientific must demonstrate robust systems.

Key regulatory considerations impacting Boston Scientific include:

- Product Approval Timelines: Variations in approval processes across regions like the US, EU, and Asia can affect global launch strategies.

- Quality Management Systems: Compliance with standards such as ISO 13485 and specific national regulations is non-negotiable for market access.

- Post-Market Surveillance: Increased scrutiny on device performance after launch requires robust data collection and reporting mechanisms.

- Cybersecurity Requirements: As medical devices become more connected, adherence to evolving cybersecurity standards is increasingly critical.

Political Action Committee Engagement

Boston Scientific actively engages in the political arena, primarily through its Political Action Committee (PAC) and affiliations with key trade organizations. This strategic involvement is designed to champion candidates and policies that are favorable to the medical device sector, fostering an environment conducive to technological advancement and broader patient access to innovative healthcare solutions.

The company's commitment to political advocacy is underscored by the fact that its political contributions undergo an annual review by its Board of Directors, ensuring alignment with corporate objectives and ethical standards. For instance, in the 2022 election cycle, Boston Scientific's PAC contributed over $1.1 million to federal candidates and committees, with a significant portion directed towards lawmakers on relevant healthcare and appropriations committees.

- PAC Contributions: Boston Scientific's PAC is a key vehicle for its political engagement.

- Trade Association Memberships: Participation in industry groups amplifies its advocacy efforts.

- Policy Focus: The company prioritizes policies that support innovation and patient access in the medical device market.

- Board Oversight: Annual review of political contributions by the Board of Directors ensures accountability.

Government healthcare policies, particularly in the U.S. and EU, directly impact Boston Scientific's market access and product approvals, with a growing emphasis on clinical outcomes and cost-effectiveness. The U.S. Inflation Reduction Act of 2022, allowing Medicare to negotiate drug prices, highlights a trend towards cost containment that could affect medical device pricing and reimbursement discussions in 2024 and 2025.

Global trade policies and tariffs remain a key political consideration, though Boston Scientific has adjusted its 2025 tariff estimates downward, indicating a dynamic trade environment. Tariffs can influence the cost of goods sold and profitability, necessitating strategic sourcing adjustments. Political instability and geopolitical events can cause currency volatility and supply chain disruptions, as noted in Boston Scientific's 2023 financial filings.

The evolving global regulatory landscape requires continuous adaptation. While some regions are streamlining approval pathways, others, like the EU with its Medical Device Regulation (MDR), have introduced more rigorous procedures. Boston Scientific's commitment to robust quality management systems and post-market surveillance, including cybersecurity, is crucial for market access and sustained growth through 2025.

Boston Scientific actively engages in political advocacy through its PAC and trade associations to promote favorable policies for the medical device sector. In the 2022 election cycle, its PAC contributed over $1.1 million to federal candidates, demonstrating a strategic approach to influencing healthcare policy. This advocacy aims to foster innovation and broaden patient access to medical technologies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Boston Scientific, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within the dynamic medical device industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Boston Scientific's external environment to inform strategic decisions.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the key political, economic, social, technological, environmental, and legal factors impacting Boston Scientific.

Economic factors

Global economic stability is a crucial backdrop for Boston Scientific's operations. A slowdown in global growth, such as the projected 2.6% GDP growth for 2024 by the IMF, can translate to tighter healthcare spending by governments and private institutions, impacting demand for medical devices.

Conversely, a healthy global economy, with economies recovering and showing resilience, generally fosters greater investment in healthcare infrastructure and innovation. This environment allows companies like Boston Scientific to benefit from increased patient volumes and technological adoption.

For instance, during periods of economic uncertainty, elective procedures that utilize Boston Scientific's products might see a decline in utilization as healthcare systems prioritize essential services, directly affecting revenue streams.

Global healthcare spending is a critical driver for Boston Scientific, directly influencing the demand for its diverse range of medical devices. For instance, projections indicate that global healthcare spending will reach approximately $10 trillion by 2024, signaling a robust market environment.

An increasing number of surgical procedures, coupled with a growing emphasis on adopting advanced medical technologies and minimally invasive treatments, provides a significant tailwind for Boston Scientific's sales. This trend is evident in the company's recent performance, with reported net sales for the first quarter of 2024 reaching $3.80 billion, a 7.9% increase year-over-year.

Boston Scientific's strong financial results, including a reported adjusted earnings per share of $0.54 in Q1 2024, underscore the positive trajectory in healthcare spending and procedural volumes. This financial health suggests the company is effectively capitalizing on the expanding market for its innovative medical solutions.

Boston Scientific's global presence means foreign currency fluctuations directly impact its reported net sales and operating expenses. For instance, in the first quarter of 2024, the company reported that unfavorable foreign exchange rates reduced sales by $80 million. This constant exposure necessitates ongoing financial strategies to mitigate currency risks.

Managing these currency exposures is a critical, continuous financial consideration for Boston Scientific. The company actively uses hedging strategies to offset potential losses stemming from adverse currency movements, aiming to stabilize its profitability across different international markets. This proactive approach is essential for maintaining predictable financial performance.

The impact of foreign exchange on Boston Scientific's operational results is a recurring theme in its financial disclosures. For example, the company's 2023 annual report detailed how currency headwinds, particularly a stronger US dollar, negatively affected its reported earnings per share. Investors closely monitor these disclosures to understand the true underlying performance of the business.

Inflation Rates and Cost Pressures

Rising inflation rates directly impact Boston Scientific's bottom line by increasing operating expenses. For example, the U.S. Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year in April 2024, which translates to higher costs for raw materials, manufacturing, and logistics. These pressures necessitate careful cost management to maintain profitability amidst ongoing investments in research and development.

Managing these escalating cost pressures is a key challenge for Boston Scientific. The company must balance the need to absorb or pass on increased expenses with its commitment to innovation and market expansion. Efficient supply chain optimization, a focus for the company throughout 2024, is critical to buffering against these inflationary headwinds and ensuring continued product availability.

- Increased Operating Costs: Higher inflation directly inflates expenses in manufacturing, supply chain, and labor.

- Profitability Impact: Sustained cost pressures can erode profit margins if not effectively managed.

- Innovation Investment: The company must continue R&D spending despite rising costs to maintain a competitive edge.

- Supply Chain Resilience: Robust supply chain strategies are essential to mitigate the effects of inflation on material sourcing and delivery.

Emerging Markets Growth

Emerging markets represent a substantial growth avenue for Boston Scientific, driven by expanding healthcare infrastructures and a rising need for sophisticated medical technologies. These regions are increasingly prioritizing healthcare spending, creating fertile ground for the company's innovative product portfolio.

Boston Scientific has actively capitalized on these trends, reporting robust operational net sales growth in emerging markets. For instance, in the first quarter of 2024, the company highlighted strong performance in regions like Asia Pacific, which saw double-digit net sales growth, underscoring the critical role these markets play in its overall expansion strategy.

- Expanding Healthcare Access: As economies develop, governments and private sectors invest more in healthcare infrastructure, increasing the addressable market for Boston Scientific's devices.

- Rising Disposable Income: Growing middle classes in emerging markets have greater purchasing power, leading to increased demand for higher-quality medical treatments and devices.

- Favorable Demographics: Many emerging markets possess younger, growing populations, which, combined with increasing life expectancies, drives long-term demand for medical solutions across various therapeutic areas.

- Strategic Market Penetration: Boston Scientific's focus on these regions, evidenced by consistent sales growth, demonstrates a successful strategy to establish a strong presence and build market share.

Global economic stability directly influences healthcare spending, a key driver for Boston Scientific. The IMF projected global GDP growth of 2.6% for 2024, indicating a moderate economic environment that supports healthcare investments. However, economic downturns can lead to reduced procedural volumes for elective treatments, impacting sales.

Inflationary pressures, exemplified by the 3.4% year-over-year CPI increase in April 2024, raise Boston Scientific's operating costs for materials and logistics. The company must strategically manage these rising expenses while continuing R&D to maintain its competitive edge.

Foreign currency fluctuations also present a significant economic factor, with unfavorable rates reducing sales. In Q1 2024, Boston Scientific reported an $80 million reduction in sales due to currency headwinds, highlighting the need for robust hedging strategies.

| Economic Factor | Impact on Boston Scientific | Supporting Data (2024/2025) |

|---|---|---|

| Global GDP Growth | Influences healthcare spending and demand for medical devices. | IMF projects 2.6% global GDP growth for 2024. |

| Inflation Rates | Increases operating costs (materials, logistics). | US CPI at 3.4% year-over-year in April 2024. |

| Foreign Exchange Rates | Affects reported sales and profitability. | Q1 2024 sales reduced by $80 million due to unfavorable currency rates. |

Same Document Delivered

Boston Scientific PESTLE Analysis

The Boston Scientific PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed report covers all key political, economic, social, technological, legal, and environmental factors impacting Boston Scientific. You can confidently purchase knowing you're getting a comprehensive and professionally structured analysis.

Sociological factors

The world's population is getting older, and this trend directly benefits companies like Boston Scientific. As people live longer, there's a greater need for medical solutions to manage chronic conditions. Boston Scientific's expertise in areas like cardiology and peripheral interventions is perfectly positioned to meet this growing demand.

For instance, the World Health Organization projects that by 2030, one in six people globally will be 60 years or older. This demographic shift means more individuals will experience age-related health issues, such as cardiovascular diseases, which are a major focus for Boston Scientific's product development and sales.

Boston Scientific's commitment to innovation in fields like atrial fibrillation management and treatments for aortic valve conditions directly addresses the health needs of this expanding elderly population. Their product pipeline is designed to offer advanced solutions for conditions that become more prevalent with age, ensuring continued relevance and market growth.

Growing public awareness of health and wellness is significantly shaping the medical device market. In 2024, a significant portion of consumers actively researched their health conditions and treatment options, leading to a demand for more sophisticated and patient-centric solutions. This trend directly benefits companies like Boston Scientific, which specialize in innovative, less invasive technologies.

Patient empowerment means individuals are increasingly involved in their healthcare decisions, often seeking out advanced treatment modalities. This proactive approach fuels the adoption of Boston Scientific's cutting-edge devices, as patients look for improved outcomes and quality of life. The company's success with devices like the WATCHMAN, which offers a less invasive alternative for stroke prevention in atrial fibrillation patients, exemplifies this dynamic.

The increasing rates of lifestyle diseases, like heart problems and diabetes, mean there's a constant demand for medical devices that can diagnose and treat them. For example, in 2024, the global cardiovascular devices market was valued at approximately $75 billion and is projected to grow significantly.

Boston Scientific's diverse range of products, particularly in cardiology and treatments for circulatory issues, aligns perfectly with these growing healthcare demands. This positions them to benefit from the sustained need for their advanced medical technologies.

Healthcare Access and Equity

Societal expectations are increasingly focused on healthcare access and equity, presenting both challenges and opportunities for companies like Boston Scientific. Addressing health disparities globally is a significant concern, with millions worldwide lacking access to essential medical services. For instance, the World Health Organization reported in 2023 that approximately 4.5 billion people, over half the world's population, were not covered by essential health services.

Boston Scientific is actively engaged in initiatives aimed at improving health outcomes and tackling these inequities. This includes efforts to increase diversity in clinical trials, a critical step in ensuring new medical technologies are safe and effective for all populations. In 2024, the company continued its commitment to expanding clinical trial participation among underrepresented groups, aiming to reflect the diverse patient populations they serve.

Furthermore, Boston Scientific's support for medical research and charitable organizations underscores its dedication to corporate social responsibility within the healthcare sector. Their philanthropic efforts, including significant donations to research institutions and health-focused charities, align with a broader societal push for businesses to contribute positively to public health. This commitment helps build trust and brand reputation among consumers and stakeholders who value ethical business practices.

Key initiatives and their impact include:

- Increasing Clinical Trial Diversity: Boston Scientific aims to enroll a more representative patient population in its studies, enhancing the generalizability of trial results.

- Philanthropic Contributions: Financial and product donations to medical research and humanitarian organizations directly support efforts to improve healthcare access in underserved communities.

- Global Health Equity Focus: The company's strategies increasingly consider the needs of diverse global markets, seeking to provide solutions that are accessible and effective across different socioeconomic and geographic contexts.

- Advocacy for Health Policy: Engaging in discussions around healthcare policy to promote equitable access and coverage for medical technologies.

Workforce Diversity and Inclusion

Boston Scientific recognizes that a diverse and inclusive workforce is a significant sociological driver, aligning with evolving societal expectations. The company actively promotes empowerment and tracks its progress in achieving greater gender and multicultural representation, particularly within leadership positions.

For instance, as of their 2023 report, Boston Scientific highlighted an increase in representation for women in management roles and continued efforts to foster multicultural inclusion across their global operations. This commitment is crucial for building a robust corporate culture that resonates with a broad talent pool.

- Gender Representation: Boston Scientific is working to increase the percentage of women in leadership roles globally.

- Multicultural Inclusion: Efforts are in place to ensure a more representative mix of ethnicities and backgrounds in management.

- Talent Attraction: A strong diversity and inclusion focus enhances the company's appeal to a wider range of skilled professionals.

- Societal Alignment: Demonstrating commitment to DEI reflects and influences broader societal values regarding fairness and equity.

Societal shifts towards greater health consciousness and patient empowerment are driving demand for advanced medical solutions. In 2024, consumer engagement with health information surged, benefiting companies like Boston Scientific that offer innovative, minimally invasive technologies. This trend is further amplified by increasing rates of lifestyle-related diseases, such as cardiovascular conditions, which represent a significant market for Boston Scientific's specialized devices.

The growing emphasis on health equity and access globally presents both challenges and opportunities. Boston Scientific's initiatives to increase diversity in clinical trials and its philanthropic efforts address these societal expectations, fostering trust and aligning with a broader push for corporate social responsibility in healthcare.

Boston Scientific’s commitment to diversity and inclusion within its workforce is a key sociological factor, reflecting evolving societal values. The company actively works to enhance gender and multicultural representation, particularly in leadership roles, which is crucial for attracting top talent and maintaining a competitive edge in the global market.

| Sociological Factor | Impact on Boston Scientific | Supporting Data (2023-2025) |

|---|---|---|

| Aging Global Population | Increased demand for chronic disease management solutions | WHO projects 1 in 6 people globally will be 60+ by 2030. |

| Health Consciousness & Patient Empowerment | Demand for innovative, patient-centric technologies | High consumer research into health conditions and treatments in 2024. |

| Lifestyle Diseases | Sustained demand for cardiovascular and circulatory devices | Global cardiovascular devices market valued at ~$75 billion in 2024. |

| Health Equity & Access | Opportunities for CSR initiatives and market expansion | 4.5 billion people lacked essential health services in 2023 (WHO). |

| Diversity & Inclusion (Workforce) | Enhanced talent attraction and societal alignment | Increased representation of women in management roles (2023 report). |

Technological factors

Boston Scientific is deeply impacted by the rapid evolution of medical technology. For instance, the company's significant investment in research and development, often exceeding billions annually, directly fuels its ability to capitalize on breakthroughs in areas like advanced imaging and robotic-assisted surgery. These technological leaps allow Boston Scientific to enhance its existing product lines and develop entirely new solutions, such as their work in minimally invasive cardiology devices, which saw substantial growth in 2024.

Boston Scientific's commitment to innovation and a strong product pipeline are cornerstones of its growth strategy. The company actively develops new medical technologies and enhances its existing offerings, often through strategic acquisitions. This focus ensures a steady stream of advanced solutions for healthcare providers and patients.

The company's recent performance highlights the success of this approach. For instance, the launch and adoption of the FARAPULSE Pulsed Field Ablation System have contributed significantly to revenue growth in its electrophysiology segment. Similarly, the WATCHMAN FLX Pro device continues to drive expansion in the structural heart market, demonstrating the commercial impact of their R&D efforts.

Boston Scientific is significantly investing in digital transformation and AI to sharpen its competitive edge. For instance, their 2023 annual report highlighted a substantial increase in R&D spending, with a notable portion allocated to digital health solutions and AI integration, aiming to improve everything from product development to patient monitoring.

These advanced capabilities are crucial for optimizing Boston Scientific's product design processes and streamlining manufacturing operations. By leveraging AI, the company can analyze vast datasets to identify trends, predict potential issues, and personalize treatment approaches, ultimately enhancing patient outcomes and driving innovation in medical devices.

The company's strategic focus on digital and AI is evident in its partnerships and acquisitions, such as collaborations with leading tech firms to develop AI-powered diagnostic tools. This proactive approach ensures Boston Scientific remains at the forefront of technological advancements in the medtech industry.

Research and Development Investment

Boston Scientific consistently prioritizes significant investment in research and development (R&D) to maintain its competitive edge and bring innovative medical solutions to market. This commitment is evident in its substantial annual R&D expenditures, which fuel the development of next-generation medical devices and technologies. For instance, in 2023, the company reported R&D expenses of $1.4 billion, a key driver for its pipeline of advanced products.

This strategic focus on R&D ensures a steady stream of new and improved offerings, critical for addressing evolving patient needs and healthcare challenges. The company’s R&D efforts are directed towards areas such as:

- Cardiovascular Innovations: Developing advanced devices for treating complex heart conditions.

- Neuromodulation Advancements: Creating new therapies for chronic pain and neurological disorders.

- Endoscopy and Urology Solutions: Enhancing diagnostic and therapeutic tools for these specialties.

Manufacturing and Supply Chain Modernization

Technological advancements are significantly reshaping Boston Scientific's manufacturing and supply chain operations. The company is investing in modernizing its facilities to boost capacity and efficiency, a critical move to keep pace with increasing global demand for its medical devices. For instance, Boston Scientific reported capital expenditures of $845 million in 2023, a portion of which is allocated to expanding manufacturing capabilities and enhancing supply chain resilience.

Adopting more efficient and sustainable production methods is a key focus. This includes leveraging automation and advanced analytics to streamline processes, reduce waste, and improve product quality. Boston Scientific's commitment to innovation extends to its operational backbone, ensuring that its manufacturing and supply chain can support the rapid development and delivery of cutting-edge medical technologies.

- Automation and Robotics: Implementing advanced automation in manufacturing lines to increase throughput and precision.

- Digital Supply Chain Management: Utilizing data analytics and AI for better inventory management, demand forecasting, and logistics optimization.

- Sustainable Manufacturing: Investing in eco-friendly production techniques and materials to reduce environmental impact.

- Capacity Expansion: Strategically increasing manufacturing footprint to meet projected growth in key product segments.

Technological advancements continue to be a primary driver for Boston Scientific, influencing product development and market penetration. The company's substantial investment in R&D, exemplified by its reported $1.4 billion in 2023, directly fuels innovation in areas like minimally invasive cardiology and neuromodulation. This commitment ensures a robust pipeline of next-generation medical devices designed to address complex healthcare needs.

The integration of digital technologies and artificial intelligence is also a key focus, enhancing product design and patient care. Boston Scientific's strategic allocation of R&D funds towards AI and digital health solutions, as highlighted in their 2023 reporting, aims to optimize operations and personalize treatment approaches, reinforcing their competitive position.

Furthermore, technological upgrades are transforming Boston Scientific's manufacturing and supply chain. Investments in automation and digital supply chain management, supported by $845 million in capital expenditures in 2023, are crucial for increasing efficiency and meeting global demand for their advanced medical technologies.

| Technology Area | Impact on Boston Scientific | 2023 Data/Examples |

|---|---|---|

| Medical Device Innovation | Development of advanced treatments and diagnostic tools. | Continued growth in electrophysiology (e.g., FARAPULSE) and structural heart (e.g., WATCHMAN FLX Pro). |

| Digital Transformation & AI | Improved product development, patient monitoring, and operational efficiency. | Increased R&D spending on digital health solutions and AI integration. |

| Manufacturing & Supply Chain | Enhanced production capacity, efficiency, and resilience. | Capital expenditures of $845 million in 2023 for facility modernization and capacity expansion. |

Legal factors

Boston Scientific navigates a complex web of regulatory approvals, essential for bringing its medical devices to market. Processes like FDA clearance in the United States and the CE Mark in Europe are critical hurdles. The duration and intricacy of these approvals directly influence when new products can launch and, consequently, when revenue streams begin.

Successfully securing these approvals is paramount for Boston Scientific's growth. For instance, in 2023, the company received FDA clearance for its WATCHMAN FLX Pro™ Left Atrial Appendage Closure device, a significant step for its structural heart business.

Intellectual property protection is a cornerstone for Boston Scientific, with patents serving as crucial shields for its groundbreaking medical device innovations. The company's ability to secure and defend these patents directly impacts its competitive edge and the recoupment of substantial research and development expenditures. In 2023, Boston Scientific continued to invest heavily in R&D, with reported expenses of $1.4 billion, underscoring the importance of robust legal frameworks to protect these investments.

Boston Scientific operates under a complex web of global healthcare regulations, impacting everything from product development to market access. Compliance with standards set by bodies like the FDA in the U.S. and the EMA in Europe is critical. In 2023, the medical device industry faced increased scrutiny, with regulatory bodies issuing fines for non-compliance, sometimes reaching millions of dollars for significant violations.

Failure to adhere to these stringent rules, which cover product safety, efficacy, manufacturing quality, and marketing practices, can result in severe consequences. These include substantial financial penalties, product recalls, import bans, and significant damage to Boston Scientific's reputation. The company's investment in robust quality management systems and ongoing regulatory affairs expertise is therefore essential for its continued operation and market standing.

Data Privacy and Cybersecurity Laws

Boston Scientific operates within a complex web of data privacy and cybersecurity regulations, critical given the sensitive nature of patient health information. Laws like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate strict protocols for handling and protecting this data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

To navigate this landscape, Boston Scientific must continuously invest in advanced cybersecurity infrastructure and protocols. This includes safeguarding against breaches and ensuring the integrity of their digital platforms, which are increasingly central to device connectivity and data management. A strong cybersecurity posture is not just about compliance; it's about fostering trust with healthcare providers and patients who rely on secure systems for care delivery and data sharing.

The company's commitment to data security is directly linked to its ability to innovate and deploy connected medical devices. As of 2024, the global cybersecurity market for healthcare is projected to reach over $30 billion, reflecting the immense importance and investment in this area. Boston Scientific's proactive approach in this domain is therefore essential for maintaining its competitive edge and reputation.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- HIPAA Compliance: Mandates stringent protection of protected health information (PHI).

- Market Growth: Global healthcare cybersecurity market expected to exceed $30 billion by 2024.

- Trust Factor: Secure digital platforms are crucial for building confidence with stakeholders.

Product Liability and Litigation Risks

As a leading medical device manufacturer, Boston Scientific navigates significant product liability and litigation risks inherent in its industry. The company's commitment to stringent quality control measures, extensive clinical trials, and open communication with regulatory bodies and healthcare providers is paramount in mitigating these potential legal challenges. Failure to uphold these standards can lead to costly lawsuits, impacting financial performance and damaging brand reputation.

The medical device sector, in general, saw substantial litigation activity. For instance, in 2023, the U.S. saw a notable number of product liability lawsuits filed against medical device companies, with some estimates suggesting an increase compared to previous years. While specific Boston Scientific litigation figures are often confidential or part of ongoing proceedings, the company's financial reports typically disclose provisions for potential legal settlements and judgments. In its 2023 annual report, Boston Scientific noted ongoing legal matters and contingent liabilities that could potentially affect its financial results.

- Product Recalls: The risk of product recalls due to defects or safety concerns can trigger litigation and significantly impact sales.

- Clinical Trial Data Integrity: Ensuring the accuracy and completeness of clinical trial data is crucial to defend against claims of misrepresentation or inadequate testing.

- Regulatory Compliance: Adherence to FDA and other global regulatory body requirements is a primary defense against product liability claims.

- Post-Market Surveillance: Robust systems for monitoring product performance and adverse events after market release are vital for early detection and mitigation of risks.

Boston Scientific's legal landscape is heavily shaped by intellectual property law, with patents protecting its innovations and driving competitive advantage. The company's substantial R&D investments, totaling $1.4 billion in 2023, underscore the critical need for robust patent protection to safeguard these expenditures and maintain market exclusivity. This legal framework is essential for recouping development costs and funding future innovation.

Navigating global regulatory approvals, such as FDA clearance and CE marking, is a constant legal challenge. The successful and timely acquisition of these approvals directly impacts product launch timelines and revenue generation. For example, the 2023 FDA clearance for the WATCHMAN FLX Pro™ device highlights the significance of these regulatory pathways.

The company must also contend with stringent data privacy and cybersecurity regulations like GDPR and HIPAA. Non-compliance can result in severe penalties, with GDPR fines potentially reaching 4% of global annual revenue. As of 2024, the healthcare cybersecurity market is projected to exceed $30 billion, emphasizing the critical investment required to maintain trust and compliance.

Product liability and litigation risks are inherent, requiring meticulous quality control and transparent communication. The medical device industry experienced notable litigation activity in 2023, and Boston Scientific's financial reports acknowledge ongoing legal matters. Proactive risk mitigation through strong regulatory adherence and post-market surveillance is crucial.

| Legal Factor | Impact on Boston Scientific | Key Data/Examples (2023/2024) |

| Intellectual Property | Protects innovation, drives competitive edge, enables R&D cost recoupment. | $1.4 billion R&D investment in 2023. |

| Regulatory Approvals | Critical for market access and revenue generation; influences product launch timelines. | FDA clearance for WATCHMAN FLX Pro™ in 2023. |

| Data Privacy & Cybersecurity | Essential for handling sensitive patient data; non-compliance incurs significant fines. | GDPR fines up to 4% of global revenue; healthcare cybersecurity market projected over $30 billion by 2024. |

| Product Liability & Litigation | Mitigated by quality control and regulatory adherence; can impact financial performance and reputation. | Ongoing legal matters disclosed in 2023 annual report; notable litigation in the medical device sector in 2023. |

Environmental factors

Boston Scientific is actively addressing climate change, focusing on reducing its carbon footprint. This commitment is demonstrated through ambitious targets, including a net-zero greenhouse gas emissions goal by 2050.

To achieve this, the company is working towards sourcing 100% renewable electricity for its major manufacturing and distribution facilities. This strategic move is crucial for their sustainability efforts and aligns with broader global initiatives to mitigate climate change impacts.

Managing waste, especially from single-use medical devices, presents a considerable environmental hurdle for companies like Boston Scientific. The company is actively exploring and piloting recycling programs for these disposable products, aiming to divert more waste from landfills.

Boston Scientific has set a goal to boost its recycling rate for solid, non-hazardous waste. This strategic focus not only helps reduce the company's environmental footprint but also aligns with broader efforts to foster a more circular economy within the healthcare sector.

Boston Scientific is actively pursuing sustainable operations, with a particular emphasis on enhancing energy efficiency throughout its global real estate holdings. This focus is not just aspirational; it's backed by tangible achievements in green building certifications.

A notable portion of Boston Scientific's real estate portfolio, specifically 70% as of its 2023 reporting, has achieved independent certification for energy efficiency. This commitment directly translates into reduced resource consumption, lower operational expenditures, and a smaller environmental footprint for the company.

Water Stewardship

Water stewardship is an important, though less frequently highlighted, aspect of environmental responsibility for manufacturing firms. Ensuring responsible water usage and managing wastewater effectively are crucial for minimizing ecological impact and promoting sustainable operations within the medical device industry. Boston Scientific, like many in its sector, likely focuses on efficient water use in its global facilities.

While specific 2024 or 2025 water usage data for Boston Scientific isn't publicly detailed in general reports, the industry trend is towards greater efficiency. For instance, many manufacturing operations aim to reduce their water footprint by implementing closed-loop systems and advanced filtration technologies. This focus is driven by both regulatory pressures and a growing commitment to Environmental, Social, and Governance (ESG) principles, which are increasingly scrutinized by investors and stakeholders.

- Industry Focus on Water Efficiency: Medical device manufacturers are increasingly adopting strategies to reduce water consumption and improve wastewater treatment processes.

- ESG Investment Drivers: Investors are paying closer attention to companies' water management practices as part of their ESG evaluations, influencing corporate behavior.

- Operational Sustainability: Responsible water stewardship is directly linked to long-term operational sustainability and risk mitigation for manufacturing sites.

Environmental, Social, and Governance (ESG) Integration

Boston Scientific is actively weaving environmental, social, and governance (ESG) considerations into its core business strategy. This approach acknowledges that patient well-being is intrinsically linked to the health of broader communities and the planet itself. This commitment is evident in how they manage supplier relationships, design their innovative medical products, and foster employee engagement.

The company's ESG reporting demonstrates a clear dedication to progress in these critical areas. For instance, in their 2023 ESG report, Boston Scientific highlighted a 20% reduction in greenhouse gas emissions intensity compared to their 2020 baseline, showcasing tangible environmental action. They also reported that 85% of their key suppliers met their updated ESG standards by the end of 2023, underscoring their influence on their supply chain's sustainability practices.

- Environmental Stewardship: Boston Scientific is focused on reducing its environmental footprint, with a stated goal of achieving carbon neutrality in its operations by 2040.

- Social Responsibility: The company emphasizes diversity and inclusion, aiming to have 40% of its leadership positions held by women by 2027.

- Governance Excellence: Strong corporate governance is a priority, with a majority of independent directors on its board and a commitment to ethical business conduct.

- Sustainable Products: Efforts are underway to design products with reduced environmental impact throughout their lifecycle, including material selection and end-of-life considerations.

Boston Scientific is actively working to reduce its environmental impact, with a goal of achieving net-zero greenhouse gas emissions by 2050 and sourcing 100% renewable electricity for major facilities.

The company is also focused on waste reduction and increasing its recycling rate for non-hazardous solid waste, while enhancing energy efficiency across its global real estate portfolio, with 70% of its properties certified for energy efficiency as of 2023.

Water stewardship is another key area, with industry-wide trends pushing for greater efficiency through closed-loop systems and advanced filtration, driven by ESG principles and regulatory pressures.

The company reported an 85% supplier adherence to its ESG standards by the end of 2023, demonstrating a commitment to integrating sustainability throughout its value chain.

| Environmental Focus Area | Target/Status | Year |

|---|---|---|

| Net-zero greenhouse gas emissions | Goal by 2050 | Ongoing |

| Renewable electricity sourcing | 100% for major facilities | Ongoing |

| Energy-efficient real estate | 70% certified | 2023 |

| Supplier ESG standards adherence | 85% met | 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Boston Scientific is built on a robust foundation of data from leading global economic institutions, official government publications, and reputable industry research firms. We incorporate insights from market trend reports, technological innovation databases, and legal and regulatory updates to ensure comprehensive coverage.