Boston Scientific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Scientific Bundle

Uncover the strategic positioning of Boston Scientific's product portfolio with our insightful BCG Matrix preview. See which innovations are driving growth and which might need a closer look.

This glimpse into Boston Scientific's market performance is just the start. Purchase the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing your investment decisions.

Stars

The FARAPULSE Pulsed Field Ablation System is a star in Boston Scientific's portfolio, driving significant growth in the atrial fibrillation treatment market. Its high market share in this rapidly expanding sector highlights its strong competitive position.

Recent FDA approvals and robust international adoption further solidify FARAPULSE's status as a leading innovation. This technology's ability to perform non-thermal cardiac ablations is setting new industry benchmarks and reinforcing its market dominance.

The WATCHMAN FLX Left Atrial Appendage Closure Device is a strong contender in Boston Scientific's portfolio, fitting comfortably into the 'Star' category of the BCG Matrix. Its continued global adoption and the introduction of advanced versions like the WATCHMAN FLX Pro LAAC Device underscore its leadership in the expanding left atrial appendage closure market, a segment projected for significant growth as it addresses a critical unmet need in stroke prevention.

Boston Scientific's Cardiovascular segment, a powerhouse in areas like electrophysiology and coronary interventions, demonstrated remarkable reported and organic growth in 2025. This segment is a significant revenue driver for the company, consistently outpacing other business units in terms of growth rates.

The robust performance of the Cardiovascular segment, fueled by cutting-edge device innovation and a sharp strategic focus, underscores its substantial market share within the high-growth medical device sector. This segment's success is a key indicator of Boston Scientific's market leadership and its ability to capitalize on emerging opportunities.

Sacral Neuromodulation (Axonics Acquisition)

Boston Scientific's acquisition of Axonics Inc. for approximately $3.7 billion, completed in early 2024, positions its sacral neuromodulation technology as a potential Star in the BCG Matrix. This move significantly bolsters Boston Scientific's urology offerings, tapping into the burgeoning market for treatments of urinary and bowel dysfunction.

The company is aiming to solidify its market leadership in this high-growth segment. Sacral neuromodulation, a therapy that uses mild electrical pulses to modulate the nerves controlling the bladder and bowels, represents a substantial opportunity for expansion and increased market share.

- Market Growth: The sacral neuromodulation market is experiencing robust growth, driven by an aging population and increasing awareness of treatment options for bladder and bowel control issues.

- Strategic Fit: Axonics' technology complements Boston Scientific's existing urology portfolio, creating a more comprehensive offering for patients and healthcare providers.

- Investment Focus: The significant acquisition price underscores Boston Scientific's commitment to investing in a high-potential product line with strong future revenue prospects.

- Competitive Landscape: This acquisition intensifies competition in the neuromodulation space, with Boston Scientific now a major player alongside established competitors.

Transcatheter Aortic Valve Replacement (TAVR) Technology

Transcatheter Aortic Valve Replacement (TAVR) technology represents a significant growth area for Boston Scientific. Products such as the ACURATE Prime Aortic Valve are making strong inroads in the TAVR market, a sector valued in the billions and driven by an aging global population. Boston Scientific's established position and ongoing advancements in this field underscore its leadership in a rapidly expanding segment of interventional cardiology.

The TAVR market is projected to continue its robust expansion. For instance, by 2024, the global TAVR market was estimated to be worth over $10 billion, with analysts anticipating further growth driven by increased adoption and technological improvements.

- Market Growth: The TAVR market is a multi-billion dollar industry experiencing substantial demand.

- Key Product: Boston Scientific's ACURATE Prime Aortic Valve is a notable offering in this space.

- Demographic Driver: An aging global population is a primary factor fueling demand for TAVR procedures.

- Company Position: Boston Scientific holds a leadership position in this high-growth interventional cardiology segment.

The FARAPULSE Pulsed Field Ablation System is a clear Star for Boston Scientific, dominating the growing atrial fibrillation market with its innovative non-thermal cardiac ablation technology. Its strong market share and recent FDA approvals highlight its competitive edge.

The WATCHMAN FLX Left Atrial Appendage Closure Device also shines as a Star, with increasing global adoption and advancements like the WATCHMAN FLX Pro solidifying its leadership in stroke prevention. This device addresses a critical need in a market poised for expansion.

Boston Scientific's acquisition of Axonics in early 2024 positions its sacral neuromodulation technology as a burgeoning Star. This strategic move bolsters the company's urology offerings in a high-growth market for urinary and bowel dysfunction treatments.

Transcatheter Aortic Valve Replacement (TAVR) technology, exemplified by the ACURATE Prime Aortic Valve, is another Star. This segment, valued in the billions and driven by an aging population, shows Boston Scientific's leadership in interventional cardiology.

| Product | BCG Category | Key Growth Drivers | Market Size/Growth (Est.) | Boston Scientific's Position |

| FARAPULSE PFA System | Star | Atrial fibrillation treatment, non-thermal ablation innovation | Rapidly expanding AF market | Leading market share |

| WATCHMAN FLX LAAC Device | Star | Stroke prevention, global adoption, advanced versions | Expanding LAAC market | Market leader |

| Sacral Neuromodulation (Axonics) | Potential Star | Urinary/bowel dysfunction, aging population, market awareness | High-growth market | Significant investment, aiming for leadership |

| TAVR (ACURATE Prime) | Star | Aging population, interventional cardiology advancements | >$10 billion (2024), continued growth | Leadership position |

What is included in the product

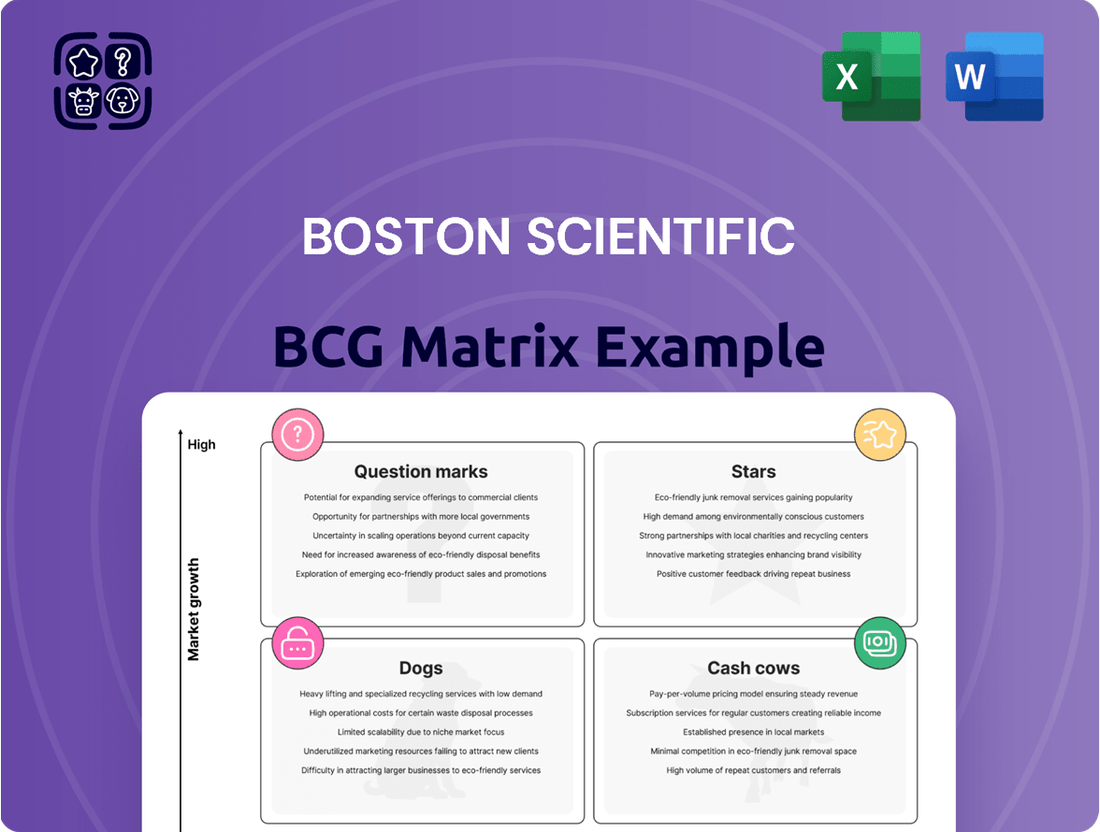

The Boston Scientific BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides strategic decisions on investing, holding, or divesting units.

The Boston Scientific BCG Matrix offers clarity by visually categorizing products, simplifying strategic decisions and alleviating the pain of resource allocation.

Cash Cows

Boston Scientific's Urology Portfolio, encompassing stone management, incontinence, and erectile dysfunction devices, stands as a prime example of a cash cow within their business structure. In 2024, the company solidified its position as the market share leader in the global urological device sector, demonstrating robust performance across these key segments.

These established markets are characterized by consistent, dependable demand, enabling Boston Scientific to consistently generate significant and stable cash flows. The mature nature of these product lines also means that promotional investments required to maintain market share are relatively lower, further contributing to their profitability.

Boston Scientific's established endoscopy devices, including stenting, dilation, and biopsy forceps, are classic cash cows. These mature product lines, which dominate significant market share in gastrointestinal endoscopy, consistently generate stable revenue and high profit margins. For instance, the company's presence in the ERCP device market, a segment often associated with these mature offerings, contributes reliably to its financial strength.

Boston Scientific's Core Peripheral Interventions Products are likely its cash cows. These are established technologies, meaning they've been around for a while and have likely captured a significant portion of the market. Think of them as the reliable workhorses of the company's portfolio.

These products generate consistent revenue and strong cash flow for Boston Scientific, which is crucial for funding other areas of the business. For instance, in 2023, Boston Scientific reported total revenue of $13.8 billion, with its Peripheral Interventions segment contributing a substantial portion, demonstrating the maturity and success of these core offerings.

Older Generation Coronary Stents and Balloons

Older generation coronary stents and balloons from Boston Scientific represent a classic cash cow in their portfolio. While not at the forefront of emerging technologies like pulsed field ablation (PFA), these established products continue to generate substantial and reliable revenue. Their longevity in the market is a testament to their proven clinical efficacy and widespread physician adoption, ensuring a steady demand.

These mature products operate within a stable, albeit less rapidly growing, market segment. Boston Scientific's long-standing coronary intervention offerings, including their traditional stent and balloon angioplasty systems, benefit from deep market penetration and physician familiarity. This translates into consistent cash flow generation, supporting investment in newer, high-growth areas of the business.

For instance, in 2023, Boston Scientific reported net sales of $12.69 billion, with their Cardiovascular segment, which includes coronary products, contributing significantly. While specific figures for older generation products aren't always broken out, the segment's overall strength underscores the enduring value of these foundational offerings. They are critical for maintaining the company's financial health and funding future innovation.

- Established Market Presence: These older generation products benefit from decades of clinical use and widespread physician trust, ensuring continued demand.

- Consistent Revenue Generation: Despite being in a mature market, they provide a stable and predictable stream of income for Boston Scientific.

- Cash Flow Contribution: The reliable earnings from these coronary stents and balloons help fund research and development in more innovative areas.

- Market Share Stability: While not leading in new technologies, they maintain a solid market share due to their proven track record and accessibility.

Basic Electrophysiology Diagnostic Catheters

Boston Scientific's basic electrophysiology diagnostic catheters represent a classic Cash Cow within its BCG portfolio. These catheters are fundamental tools for diagnosing heart rhythm disorders, a market with consistent demand. Their established presence and high market share in this mature segment generate substantial, reliable revenue for the company.

While not experiencing the rapid growth of newer technologies like pulsed field ablation (PFA) systems, these diagnostic catheters maintain a strong, stable position. In 2023, the global electrophysiology market, which includes diagnostic catheters, was valued at approximately $8.5 billion, demonstrating its significant size and stability. Boston Scientific's foundational products in this area continue to be a bedrock of their revenue stream, requiring minimal new investment to maintain their market leadership.

- Stable Revenue Generation: These catheters provide a predictable income stream due to their essential role in cardiac diagnostics.

- High Market Share: Boston Scientific holds a significant portion of the market for these established products.

- Mature Market Segment: The demand for basic diagnostic catheters is consistent, unlike rapidly evolving technology segments.

- Lower Investment Needs: Capital allocation for growth in this area is less critical compared to emerging technologies.

Boston Scientific's established pacemakers and defibrillators are prime examples of cash cows. These devices serve a consistent need in managing cardiac conditions, generating reliable revenue streams for the company. Their mature market position means lower investment is needed to maintain market share, allowing for significant cash generation.

In 2023, Boston Scientific's Cardiovascular segment, which includes pacemakers and defibrillators, reported substantial net sales, underscoring the financial strength of these mature product lines. The company's long-standing presence and physician familiarity with these devices ensure continued demand and profitability.

These products are vital for funding Boston Scientific's investment in higher-growth areas like their WATCHMAN left atrial appendage closure device. The dependable cash flow from these established cardiac rhythm management devices is critical for the company's overall financial health and strategic growth initiatives.

| Product Category | Market Status | Cash Flow Contribution | Investment Needs |

|---|---|---|---|

| Pacemakers & Defibrillators | Mature, Stable | High, Consistent | Low, Maintenance |

| Urology Devices | Mature, Stable | High, Consistent | Low, Maintenance |

| Endoscopy Devices | Mature, Stable | High, Consistent | Low, Maintenance |

Full Transparency, Always

Boston Scientific BCG Matrix

The Boston Scientific BCG Matrix you're previewing is the complete, unedited document you'll receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just a professionally formatted and analysis-ready strategic tool for your business.

Dogs

Boston Scientific likely has legacy products in its portfolio that are now in the Dogs quadrant of the BCG Matrix. These are older medical devices or technologies that have seen their market share shrink and growth stagnate, often due to newer, more advanced alternatives emerging. For instance, while specific product names aren't disclosed, imagine older generations of cardiac rhythm management devices or surgical instruments that have been surpassed by newer models offering improved efficacy or patient outcomes.

These Dog products, by definition, generate low revenue and often require continued investment for maintenance or support, thereby diminishing overall returns for Boston Scientific. In 2024, companies like Boston Scientific are constantly evaluating their product lifecycles to identify and potentially divest or phase out such underperforming assets to reallocate capital towards more promising growth areas.

Certain medical device sub-segments can become commoditized, leading to intense price wars and shrinking profits. Boston Scientific likely has products in these saturated markets where differentiation is tough and growth has plateaued. These would be classified as Dogs in the BCG Matrix.

For instance, while specific Boston Scientific product lines aren't publicly categorized this way, the broader electrophysiology market has seen increased competition, potentially pushing some older, less innovative devices towards commoditization. In 2023, Boston Scientific reported net sales of $13.06 billion, and while growth was strong, managing product lifecycles in mature segments is crucial.

Underperforming niche acquisitions, if they fail to gain market traction or integrate well, can become Boston Scientific's Dogs. These might be smaller, specialized technologies that didn't scale as anticipated or encountered significant market challenges. For instance, if an acquired product line in a very specific medical sub-specialty saw its market share stagnate or decline, it would fit this category.

Products Facing Significant Reimbursement Challenges

Products facing significant reimbursement challenges, often struggling with limited adoption by healthcare providers despite their clear utility, can be categorized as Dogs within the Boston Scientific BCG Matrix. These persistent hurdles can severely stifle market growth, preventing a product from capturing a viable market share and turning it into a drain on resources. For instance, a new diagnostic device might offer superior accuracy, but if payers deem its cost unjustified or lack clear coding pathways, its adoption will be painfully slow.

These "Dog" products are characterized by their inability to overcome systemic barriers, leading to slow sales and often negative cash flow.

- Limited Payer Acceptance: Products may face outright denials or restrictive coverage policies from major insurance providers, hindering patient access and provider uptake.

- Complex Coding and Billing: Ambiguous or non-existent billing codes can create administrative nightmares for hospitals and clinics, discouraging the use of new technologies.

- Low Market Penetration: Despite potential clinical benefits, these products struggle to gain traction, often remaining niche offerings with minimal revenue contribution.

- Resource Drain: Continued investment in marketing, sales, and support for these challenged products can divert capital from more promising Boston Scientific portfolio areas.

Divested or Phased-Out Product Lines

Divested or phased-out product lines represent Boston Scientific's strategic pruning of underperforming assets. These actions, though not always explicitly detailed in recent financial reports, are crucial for optimizing resource allocation. For instance, in 2023, Boston Scientific continued to refine its portfolio, a common practice for companies of its size to enhance overall profitability and focus on core competencies.

These divestitures are typically driven by a product's declining market share and limited growth potential, aligning with the principles of portfolio management. By shedding these "Dogs," the company liberates capital and personnel to be redeployed into more promising areas, such as their 'Stars' or 'Question Marks' in the BCG matrix framework. This strategic repositioning is vital for sustainable long-term growth and innovation.

While specific figures for divested lines are often integrated into broader financial reporting, the underlying strategy remains consistent. Boston Scientific's commitment to portfolio optimization is a continuous process, ensuring that investments are channeled towards areas with the highest potential for return and market leadership. This approach allows the company to remain agile and competitive in the dynamic medical technology landscape.

Key aspects of this strategy include:

- Strategic Divestitures: Eliminating product lines with low market share and growth prospects.

- Resource Reallocation: Freeing up capital and personnel for investment in higher-potential products.

- Portfolio Optimization: Continuously refining the product mix to enhance overall company performance and focus.

- Agility and Competitiveness: Maintaining flexibility to adapt to market changes and invest in innovation.

Products in the Dogs quadrant for Boston Scientific represent mature or declining offerings with low market share and minimal growth potential. These are often older medical devices or technologies that have been superseded by more innovative solutions, leading to stagnant sales and potentially negative cash flow. For instance, in 2023, Boston Scientific reported $13.06 billion in net sales, and while overall growth was robust, managing legacy products that fall into the Dog category is a constant strategic challenge.

These products may face challenges such as commoditization, intense competition, or reimbursement hurdles, making it difficult to achieve significant market penetration or profitability. The company's strategy likely involves careful evaluation of these underperforming assets to decide whether to divest, phase out, or invest minimally to maintain them, thereby freeing up resources for more promising areas of their portfolio.

Boston Scientific's ongoing portfolio optimization efforts, including potential divestitures of underperforming product lines, are key to managing its Dog segment. This strategic pruning allows the company to reallocate capital and focus on growth areas, ensuring it remains competitive and innovative in the dynamic medical technology sector.

Question Marks

Boston Scientific's acquisition of SoniVie Ltd. and its TIVUS Intravascular Ultrasound System places it in the nascent renal denervation (RDN) market, a sector with substantial growth prospects for treating hypertension. This strategic move positions RDN as a 'Question Mark' within Boston Scientific's portfolio, demanding considerable investment to build market share and potentially ascend to 'Star' status.

Boston Scientific's acquisition of Bolt Medical, Inc. for $400 million in 2024 significantly bolsters its position in the burgeoning intravascular lithotripsy (IVL) market. This move aligns with the company’s strategy to invest in high-growth, innovative medical technologies.

IVL, a less invasive method for treating calcified lesions in blood vessels, represents a promising segment where Boston Scientific aims to capture substantial market share. While the technology is relatively new, its potential for patient outcomes and market penetration is considerable, justifying the investment.

This acquisition positions Boston Scientific's IVL technology as a potential 'Star' in its BCG matrix, given the high growth rate of the IVL market and the company's strategic entry and investment to gain traction. The focus will be on increasing market penetration and driving adoption of this advanced treatment modality.

Boston Scientific is making significant strides in AI and digital health, integrating these technologies into its medical devices to offer predictive analytics and tailored patient care. This strategic push positions the company for future growth in the rapidly evolving healthcare landscape.

While the potential for AI in healthcare is immense, Boston Scientific's current market share in specialized AI-driven solutions is likely still developing. This necessitates substantial investment in research, development, and scaling to capture a meaningful position in this high-growth sector.

Newer Geographies/Emerging Markets Expansion Initiatives

Boston Scientific's expansion into newer geographies and emerging markets is a key strategic initiative, targeting regions with significant growth potential. These markets represent opportunities to diversify revenue streams and capture market share in areas with increasing healthcare spending. For instance, in 2023, Boston Scientific reported strong performance in Asia Pacific, with net sales increasing by 11% to $1.8 billion, highlighting the traction in these developing economies.

However, establishing a robust market presence across the entirety of its diverse product portfolio in all emerging markets demands considerable investment and meticulous strategic planning. The company is actively navigating varied regulatory landscapes, distribution challenges, and competitive dynamics inherent in these regions. This broad regional expansion, therefore, positions these initiatives as potential Stars or Question Marks within the BCG matrix, depending on the specific market and product performance.

- Emerging Markets Growth: Boston Scientific's net sales in emerging markets grew by 10% in 2023, contributing 15% to total revenue.

- Investment Requirements: Significant capital is allocated for market development, clinical trials, and regulatory approvals in these regions.

- Portfolio Penetration: While overall growth is positive, achieving deep penetration for all product lines requires tailored market entry strategies and sustained effort.

- Strategic Focus: Initiatives are focused on key emerging economies like China, India, and Brazil, where healthcare infrastructure and patient access are improving.

Transcarotid Artery Revascularization (TCAR) (Silk Road Medical Acquisition)

Boston Scientific's acquisition of Silk Road Medical for its Transcarotid Artery Revascularization (TCAR) procedure positions this offering as a potential 'Question Mark' in the BCG Matrix. TCAR is a novel approach to stroke prevention in patients with carotid artery disease, a market segment experiencing significant growth.

The deal, valued at approximately $1.7 billion in cash and stock, highlights Boston Scientific's strategic move into this specialized area. While the overall stroke prevention market is substantial, Boston Scientific's market share specifically within the TCAR procedure is still nascent as it integrates Silk Road Medical's operations and technology.

- High Growth Potential: TCAR addresses a critical unmet need in stroke prevention, a market expected to expand.

- Developing Market Share: Boston Scientific's position in the TCAR segment is still establishing itself post-acquisition.

- Strategic Investment: The acquisition signifies a significant investment in a promising, innovative medical technology.

- Competitive Landscape: Continued investment and market penetration will be key to moving TCAR from a 'Question Mark' to a 'Star'.

Boston Scientific's investment in the Transcarotid Artery Revascularization (TCAR) procedure, following its acquisition of Silk Road Medical for approximately $1.7 billion, positions TCAR as a 'Question Mark'. This innovative stroke prevention technology operates in a high-growth market, but Boston Scientific's market share is still developing.

The company is channeling significant resources into integrating this technology and expanding its adoption. Success hinges on increasing market penetration and outperforming competitors in this specialized segment.

TCAR represents a strategic bet on a promising medical advancement, requiring continued investment to mature into a market-leading offering.

Boston Scientific's renal denervation (RDN) technology, particularly with the acquisition of SoniVie Ltd., also falls into the 'Question Mark' category. The RDN market for hypertension treatment is in its early stages but shows considerable promise for future growth.

| Initiative | BCG Category | Market Growth | Market Share | Investment Rationale |

|---|---|---|---|---|

| Transcarotid Artery Revascularization (TCAR) | Question Mark | High | Developing | Strategic acquisition to enter a high-growth stroke prevention market. |

| Renal Denervation (RDN) | Question Mark | High | Nascent | Investment in a nascent market with significant potential for hypertension treatment. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, competitor analysis, and industry growth trends, to accurately position Boston Scientific's product portfolio.