Boston Beer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Beer Bundle

Unlock the strategic blueprint behind Boston Beer’s success with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, build strong partnerships, and deliver unique value propositions in the dynamic beverage market. This detailed analysis is your key to understanding their competitive edge.

Ready to dissect Boston Beer's winning formula? Our full Business Model Canvas breaks down their revenue streams, cost structures, and key resources, offering invaluable insights for aspiring entrepreneurs and seasoned business strategists. Gain a clear, actionable understanding of what makes them a leader.

Partnerships

Boston Beer Company's success hinges on its network of independent wholesalers and distributors. These partners act as the vital link between the company and the retailers, ensuring Boston Beer's wide array of products, from Samuel Adams to Truly Hard Seltzer, reach consumers across the nation and abroad. This reliance on a three-tier distribution system is fundamental to their market reach.

These partnerships are more than just transactional; Boston Beer actively collaborates with its distributors. This collaboration focuses on optimizing inventory management and streamlining the supply chain, ensuring products are available when and where consumers want them. In 2023, Boston Beer's net revenue reached $2.2 billion, a testament to the effectiveness of these distribution channels in getting their products to market.

Boston Beer Company's success hinges on robust partnerships with a wide array of retailers, encompassing both on-premise establishments like bars and restaurants, and off-premise locations such as liquor stores and supermarkets. These relationships are critical for ensuring their products, including popular brands like Truly Hard Seltzer and Twisted Tea, are readily available to consumers.

The competitive landscape for shelf space, prime cold box placement, and coveted tap handles in traditional retail, alongside prominent positioning in e-commerce channels, underscores the importance of these retail collaborations. In 2024, Boston Beer continued to navigate these crucial distribution channels, with sales performance heavily influenced by the strength and reach of these partnerships.

Boston Beer's success hinges on strong relationships with its raw material suppliers, including those providing hops, malt, and various fruits and flavorings. These partnerships are crucial for ensuring the consistent quality and unique taste profiles of their extensive product lines, from Samuel Adams beers to Truly Hard Seltzers.

By fostering effective collaborations, Boston Beer can better navigate commodity price fluctuations, a significant factor in the brewing industry. For instance, during periods of inflation, robust supplier agreements can help mitigate rising costs for key ingredients, directly impacting the company's gross margins.

In 2023, Boston Beer reported a cost of goods sold of $1.2 billion. Strategic procurement and strong supplier partnerships are therefore essential for optimizing these costs and enhancing overall profitability, as the company actively seeks procurement savings to boost its financial performance.

Co-manufacturing and Production Facilities

Boston Beer Company employs a flexible production model, leveraging both its own breweries and co-manufacturing facilities. This dual approach provides significant advantages in terms of scalability and efficiency. For instance, in late 2024, the company amended its supplier agreements, including a notable update with Rauch North America Inc., to enhance supply chain optimization and production flexibility, ensuring they can meet growing demand and future capacity needs.

This co-manufacturing strategy is crucial for managing production volumes effectively. It allows Boston Beer to tap into external expertise and capacity without the full capital investment of building and maintaining additional company-owned facilities. This adaptability is key in a dynamic beverage market.

- Dual Production Strategy: Utilizes company-owned breweries alongside co-manufacturing partners.

- Supply Chain Optimization: Amendments to supplier agreements, like with Rauch North America Inc. in late 2024, improve efficiency and flexibility.

- Scalability and Capacity: Co-manufacturing enables the company to scale production up or down to meet market demand and future requirements.

Marketing and Promotional Partners

Boston Beer Company actively cultivates relationships with media agencies and digital marketing platforms to amplify its brand presence and reach a wider consumer base. These partnerships are essential for executing targeted campaigns and driving consumer engagement.

Collaborations with event organizers are also a cornerstone of their marketing strategy. For instance, a multi-year agreement with AEG Presents ensures prominent placement of Boston Beer's brands at various music venues and festivals, directly connecting with consumers in an experiential setting.

Further strengthening its market reach, Boston Beer engages in cross-promotional activities. A notable example is their partnership with Tostitos, which leverages shared consumer interests to create mutually beneficial marketing opportunities, increasing visibility for both brands.

These strategic alliances are designed to boost brand awareness and foster deeper connections with their target demographics. In 2023, Boston Beer's marketing efforts contributed to a significant portion of their overall sales, underscoring the financial impact of these key partnerships.

- Media Agencies and Digital Platforms: Essential for targeted outreach and brand building.

- Event Organizers (e.g., AEG Presents): Drive consumer engagement through on-site activations at music venues and festivals.

- Cross-Merchandising Partners (e.g., Tostitos): Expand reach by tapping into complementary consumer bases.

- Impact on Sales: These partnerships are crucial for driving brand visibility and contributing to revenue growth, as seen in 2023 performance.

Boston Beer Company's distribution network is built upon strong relationships with independent wholesalers and distributors. These partners are critical for ensuring their diverse portfolio, including Samuel Adams and Truly Hard Seltzer, reaches consumers effectively across various markets.

These collaborations extend beyond mere logistics, involving joint efforts in inventory management and supply chain efficiency. In 2023, the company's net revenue of $2.2 billion highlights the success of these channels in bringing products to market.

Boston Beer also prioritizes partnerships with raw material suppliers for ingredients like hops and malt. These collaborations are vital for maintaining product quality and managing costs, especially in light of fluctuating commodity prices. In 2023, the cost of goods sold was $1.2 billion, making efficient supplier relationships crucial for profitability.

Strategic co-manufacturing agreements, such as those amended in late 2024 with partners like Rauch North America Inc., provide essential production flexibility and scalability. This approach allows Boston Beer to meet demand efficiently without significant capital expenditure on additional owned facilities.

What is included in the product

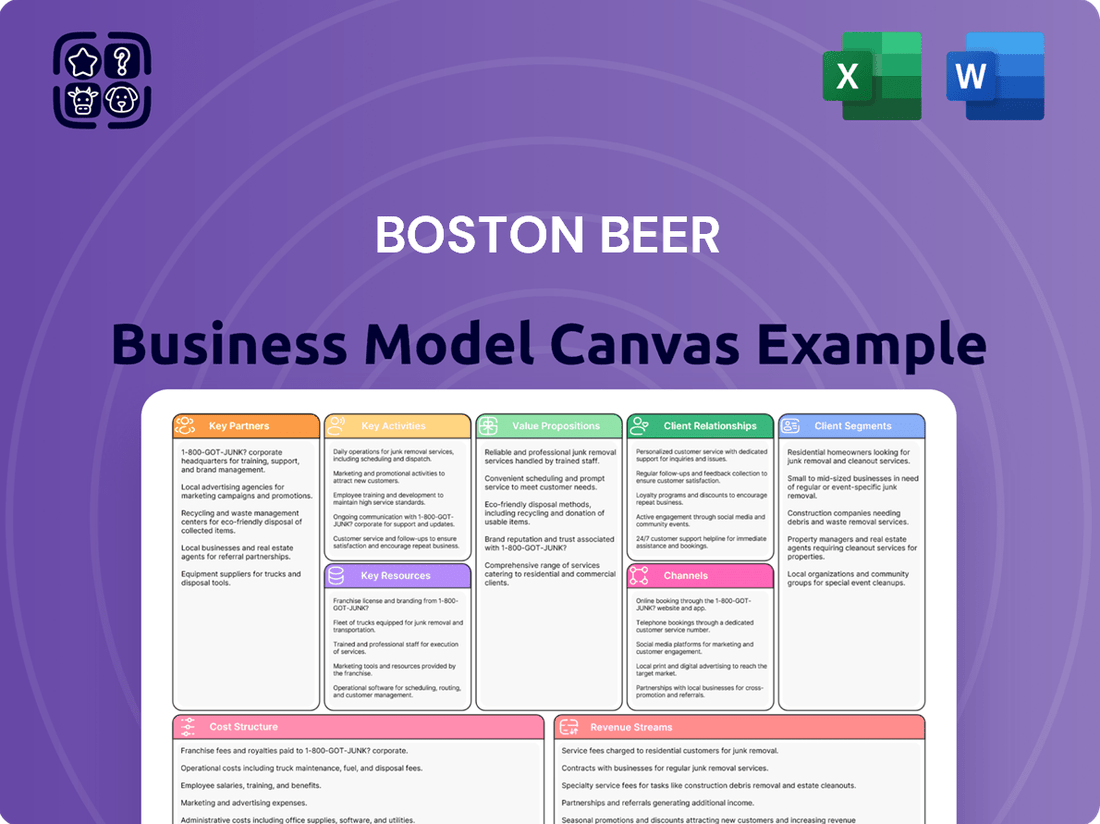

The Boston Beer Business Model Canvas focuses on crafting high-quality craft and specialty beers, targeting adult drinkers seeking unique and flavorful experiences through various distribution channels.

It details customer relationships, revenue streams, key resources, activities, and partnerships to support its brand-building and market expansion strategies.

The Boston Beer Business Model Canvas offers a clear, visual way to understand how the company addresses consumer desires for craft beer and hard seltzers, acting as a pain point reliever by simplifying complex market strategies.

Activities

Boston Beer Company's product development and innovation are central to its strategy. In 2024, they introduced Sun Cruiser, a vodka-based ready-to-drink beverage, alongside the Truly Unruly Mix Pack and Twisted Tea Extreme, demonstrating a commitment to expanding their portfolio and capturing new market segments.

This innovation drive continued with the launch of Samuel Adams American Light, targeting a broader consumer base. The company plans further expansion in 2025, venturing into spirits-based ready-to-drink options and exploring the potential of non-alcoholic and cannabis-infused beverages to stay ahead of market trends.

Boston Beer actively brews and produces its wide range of products, from craft beers to hard seltzers and ciders. This dual approach, utilizing both in-house breweries and external partners, allows for flexibility and scale.

The company consistently invests in its production capabilities. For instance, in 2023, Boston Beer reported capital expenditures of $142.5 million, a significant portion of which is directed towards enhancing brewery efficiencies and supporting new product innovations, aiming to lower processing costs and boost output.

Boston Beer Company's brand building and marketing are central to its business model. A significant portion of their efforts involves extensive advertising, promotional activities, and digital engagement to strengthen their portfolio of brands.

For 2025, the company intends to ramp up advertising spending. This increased investment is earmarked for key brands such as Twisted Tea and Samuel Adams, alongside the introduction of new offerings like Sun Cruiser. Marketing strategies for established brands, including Truly Hard Seltzer, are also slated for a refresh.

These marketing initiatives encompass substantial media investments across various platforms, complemented by targeted local marketing efforts. This multi-faceted approach aims to enhance brand visibility and consumer connection, driving sales and market share.

Distribution and Sales Management

Boston Beer's distribution and sales management is a critical function, heavily reliant on navigating the established three-tier system in the United States. This involves actively managing relationships with a network of independent wholesalers who are responsible for delivering products to retailers. The company's sales force plays a vital role in securing shelf space and promoting its brands within this competitive landscape.

Optimizing the flow of goods through this network is paramount. This includes ensuring efficient delivery schedules and carefully managing distributor inventory levels to prevent stockouts or excess. Boston Beer also prioritizes expanding the physical availability of its diverse portfolio, from its flagship Sam Adams beers to its Truly Hard Seltzer and other craft brands, across a wide range of retail outlets.

- Distribution Network Management: Boston Beer operates within the U.S. three-tier alcohol distribution system, requiring close collaboration with independent wholesalers to ensure product reaches retailers effectively.

- Sales Force Engagement: A dedicated sales team actively works to gain market share and prominent shelf placement for its brands, including Sam Adams, Truly, and Twisted Tea, in a competitive beverage market.

- Inventory Optimization: The company focuses on managing inventory levels at the distributor level to ensure product availability while minimizing waste and obsolescence.

- Physical Availability Expansion: A key objective is to broaden the physical reach of its products, making them accessible to a wider consumer base across various retail channels.

Supply Chain Optimization

Boston Beer is focused on refining its supply chain, which includes scrutinizing supplier agreements and streamlining the acquisition of raw materials and packaging. This strategic approach is designed to lower expenses, boost gross profit margins, and allow for greater adaptability in production as market conditions shift.

In late 2024, the company demonstrated its commitment to supply chain agility by making a substantial payment to a third-party supplier. This investment was specifically aimed at securing enhanced flexibility within their operations.

- Supplier Contract Review: Boston Beer is actively assessing and renegotiating terms with its suppliers to achieve more favorable pricing and service levels.

- Procurement Optimization: Efforts are underway to improve the efficiency and cost-effectiveness of sourcing raw materials and packaging components.

- Inventory Management Enhancement: The company is implementing strategies to better manage inventory levels, reducing holding costs and minimizing waste.

- Strategic Supplier Payments: A significant payment in late 2024 to a third-party supplier highlights a direct investment in securing greater operational flexibility.

Boston Beer's key activities revolve around product innovation, brewing and production, brand building, and distribution management. They actively develop new products, as seen with the 2024 launches of Sun Cruiser and Truly Unruly Mix Pack, and plan further expansion into spirits-based RTDs and non-alcoholic options for 2025. Their production involves both in-house breweries and external partners, supported by significant capital expenditures, with $142.5 million invested in 2023 for efficiency improvements.

Brand building includes substantial advertising and promotional spending, with plans to increase investment in 2025 for key brands like Twisted Tea and Samuel Adams. Distribution relies on managing relationships within the U.S. three-tier system and optimizing product flow through independent wholesalers to ensure broad retail availability.

| Key Activity | Description | 2024/2025 Focus |

| Product Innovation & Development | Creating new beverages across beer, hard seltzer, cider, and exploring spirits-based RTDs. | Launched Sun Cruiser, Truly Unruly Mix Pack, Twisted Tea Extreme; planning spirits-based RTDs and non-alcoholic options. |

| Brewing & Production | Manufacturing a diverse product portfolio using in-house and partner facilities. | Continued investment in production capabilities; $142.5 million capital expenditures in 2023. |

| Brand Building & Marketing | Advertising, promotions, and digital engagement to strengthen brand presence. | Increased advertising spending planned for 2025 on key brands and new launches. |

| Distribution & Sales Management | Navigating the three-tier system and managing wholesaler relationships. | Focus on expanding physical availability and optimizing inventory flow. |

Delivered as Displayed

Business Model Canvas

The Boston Beer Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct view of the complete, professionally structured analysis. Once your order is processed, you will gain full access to this identical file, ready for immediate use and customization.

Resources

Boston Beer Company's strong brand portfolio is a cornerstone of its business model. This diverse collection includes highly recognizable names such as Samuel Adams, Twisted Tea, Truly Hard Seltzer, Angry Orchard, and Sun Cruiser. These established brands are critical for maintaining market presence and responding to evolving consumer tastes across the alcoholic beverage spectrum.

The strength of these brands allows Boston Beer to cater to a wide range of consumer preferences, from traditional craft beer drinkers to those seeking alternative alcoholic options. For example, Twisted Tea has demonstrated impressive growth, contributing significantly to the company's revenue and market share in the ready-to-drink segment.

Boston Beer Company strategically operates and maintains several of its own breweries, notably its flagship locations in Boston, Massachusetts, and Cincinnati, Ohio. These facilities are not just production hubs but are vital for pioneering new product development and ensuring stringent quality control across its diverse portfolio.

The company's commitment to innovation and operational excellence is evident in its ongoing capital investments aimed at enhancing efficiency and expanding production capabilities at its owned breweries. This focus allows Boston Beer to better control its product quality and respond to evolving market demands.

To effectively meet fluctuating consumer demand and broaden its market reach, Boston Beer also utilizes a network of third-party production facilities. This flexible approach allows the company to scale production without the immediate need for further significant investment in owned infrastructure, ensuring agility in a dynamic beverage market.

Boston Beer's extensive distribution network, built upon a three-tier system, is a cornerstone of its business. This model leverages independent wholesalers, a critical resource for ensuring its diverse portfolio, from Samuel Adams to Truly Hard Seltzer, reaches consumers across the United States and in numerous international markets. This established infrastructure is vital for product availability, a significant competitive edge in the beverage industry.

In 2023, Boston Beer Company reported net revenue of $2.2 billion, underscoring the scale and reach facilitated by its distribution capabilities. This vast network allows the company to effectively place its products in thousands of retail locations, from large supermarket chains to smaller independent stores, ensuring broad market penetration and consumer access.

Skilled Workforce and Sales Force

Boston Beer's skilled workforce is a cornerstone of its business model, particularly its extensive sales force. In 2024, the company maintained a robust sales organization exceeding 475 individuals. This large, well-trained team is crucial for effectively reaching and servicing distributors and retailers across its markets, ensuring strong brand presence and product availability.

Beyond sales, the company relies on its technical expertise. World-class brewers are at the heart of product development and quality control, while a dedicated innovation team continuously works on new and responsive beverage offerings. This blend of brewing mastery and forward-thinking development is key to meeting evolving consumer tastes.

The collective leadership and employee expertise across all departments are vital assets. This human capital drives strategic decision-making, operational efficiency, and the overall ability to adapt and thrive in the competitive beverage industry.

- Extensive Sales Network: Over 475 trained professionals facilitate effective distribution and retail relationships.

- Brewing and Innovation Prowess: World-class brewers and an innovation team ensure high-quality, consumer-centric products.

- Expert Leadership and Employee Base: The collective knowledge and experience of the workforce are critical for strategic execution.

Financial Capital and Cash Flow

Boston Beer's financial capital is a cornerstone of its business model, providing the fuel for strategic growth and operational excellence. A robust cash position, coupled with a debt-free structure, grants the company considerable financial flexibility. This allows for substantial investments in key areas like brand development, which is crucial for maintaining market share in the competitive beverage industry. For instance, in the second quarter of 2025, Boston Beer reported a healthy cash balance of $212.4 million, with no outstanding debt.

This strong financial footing directly translates into the ability to pursue ambitious product innovation and enhance its supply chain infrastructure. These investments are vital for ensuring product quality and efficient distribution. Furthermore, the company's financial strength supports disciplined capital allocation strategies.

- Strong Cash Position: $212.4 million in cash as of Q2 2025.

- Debt-Free Operations: No outstanding debt provides significant financial flexibility.

- Investment Capacity: Enables substantial spending on brand building and product innovation.

- Shareholder Returns: Allows for share repurchase programs, indicating efficient capital management and future growth potential.

Boston Beer's Key Resources are its strong brand portfolio, including Samuel Adams and Truly Hard Seltzer, its network of owned and third-party breweries, an extensive distribution system, and its skilled workforce, particularly its sales team. Financial capital, characterized by a debt-free status and a healthy cash reserve, also underpins its operations and growth initiatives.

| Resource | Description | Key Data Point (2024/2025) |

|---|---|---|

| Brand Portfolio | Iconic brands like Samuel Adams, Truly, Twisted Tea. | Drives market presence and revenue. |

| Production Facilities | Owned breweries (Boston, Cincinnati) and third-party partners. | Ensures quality control and flexible production scaling. |

| Distribution Network | Three-tier system leveraging independent wholesalers. | Facilitated $2.2 billion in net revenue in 2023. |

| Human Capital | Sales force (>475 in 2024), brewers, innovation team. | Crucial for market reach, product quality, and new development. |

| Financial Capital | Debt-free with strong cash reserves. | $212.4 million cash balance as of Q2 2025. |

Value Propositions

Boston Beer Company distinguishes itself with a broad and high-caliber selection of alcoholic drinks. This includes not only its renowned craft beers but also a growing presence in hard ciders, hard seltzers, and ready-to-drink spirits, effectively reaching a wider consumer base with diverse preferences and consumption occasions.

This strategic diversification is key to their success, enabling them to adapt to shifting market trends, particularly the significant rise in demand for products categorized as 'Beyond Beer.' For instance, in the first quarter of 2024, Boston Beer reported net revenue of $477.6 million, with their Samuel Adams brand showing resilience and their Truly hard seltzer brand continuing to innovate within the competitive seltzer market.

Boston Beer consistently innovates, launching products that align with evolving consumer tastes. For instance, their successful introduction of hard seltzers, like Truly, capitalized on a significant market trend, and more recently, the Sun Cruiser brand has tapped into the growing demand for flavored alcoholic beverages. This agility in product development keeps them competitive.

Their ability to create entirely new beverage categories, such as the hard seltzer market, showcases a deep understanding of consumer desires and market potential. This strategic foresight allows them to not only respond to trends but also to shape them, as seen with the substantial growth experienced in the flavored malt beverage segment.

Boston Beer Company’s value proposition is significantly bolstered by its strong brand recognition and the deep trust consumers place in its offerings. Well-established names like Samuel Adams, Twisted Tea, and Truly have cultivated decades of loyalty, creating a powerful competitive edge.

This robust brand equity translates directly into consumer acceptance and encourages repeat purchases across their diverse portfolio. For instance, Twisted Tea boasts a substantial organic social media following, demonstrating its strong connection with its customer base.

Widespread Availability and Accessibility

Boston Beer Company leverages its robust three-tier distribution network to make its diverse portfolio, including Samuel Adams and Truly Hard Seltzer, readily available across the United States and in numerous international markets. This widespread availability is a cornerstone of its business model, ensuring consumers can easily find their preferred brands in a multitude of retail locations and on-premise establishments.

The company's commitment to accessibility means consumers encounter Boston Beer products in a wide array of channels, from grocery stores and convenience stores to bars and restaurants. This broad reach significantly enhances customer convenience and supports consistent sales volume. For instance, in 2023, Boston Beer's net revenue reached $2.2 billion, underscoring the success of its expansive distribution strategy.

- Extensive Distribution Network: Boston Beer's products are distributed through a well-established three-tier system, ensuring broad market penetration.

- Retail and On-Premise Presence: The company's beverages are accessible in a wide variety of retail outlets and hospitality venues.

- Market Reach: Products are available throughout the United States and in significant international markets, broadening consumer access.

Authenticity and Craft Heritage

Boston Beer's Samuel Adams brand centers its value proposition on authenticity and a deep craft heritage. This resonates with consumers who prioritize genuine quality and a connection to brewing tradition, setting it apart from mass-market beers.

The commitment to time-honored brewing techniques, including practices like traditional lagering, forms a core part of this appeal. For instance, Samuel Adams was among the pioneers in reintroducing certain historical brewing methods to the American craft beer scene.

- Heritage Brewing: Emphasizes a rich history and traditional brewing processes.

- Authenticity: Appeals to consumers seeking genuine, high-quality craft beverages.

- Craftsmanship: Highlights the dedication to artisanal methods and a story behind the beer.

- Differentiation: Sets Samuel Adams apart from mass-produced alternatives through its unique brewing philosophy.

Boston Beer Company's value proposition is built on offering a diverse and high-quality portfolio of alcoholic beverages. This includes not only its flagship craft beers but also a significant expansion into hard ciders, hard seltzers, and ready-to-drink spirits, catering to a broad spectrum of consumer preferences and occasions.

This diversification strategy has proven effective in capturing the growing market for 'Beyond Beer' products. In Q1 2024, the company reported net revenue of $477.6 million, with its Truly hard seltzer brand continuing to be a key player in the competitive seltzer market.

The company's ability to innovate and adapt to evolving consumer tastes is a core strength. For example, the successful launch of Truly hard seltzers tapped into a major market trend, and more recently, brands like Sun Cruiser are addressing the demand for flavored alcoholic beverages, demonstrating agility in product development.

Boston Beer Company's strong brand equity, exemplified by trusted names like Samuel Adams, Twisted Tea, and Truly, fosters deep consumer loyalty and repeat purchases. This brand recognition provides a significant competitive advantage in the marketplace.

Their extensive three-tier distribution network ensures broad availability of their products across the United States and internationally. This accessibility, from grocery stores to bars, underpins consistent sales volumes, as evidenced by their 2023 net revenue of $2.2 billion.

| Brand Family | Key Value Proposition | Supporting Data/Fact |

| Craft Beer (e.g., Samuel Adams) | Authenticity, heritage, and traditional brewing craftsmanship. | Pioneered reintroduction of historical brewing methods in the US craft beer scene. |

| Hard Seltzer (e.g., Truly) | Innovation, market trend capitalization, and broad appeal. | Key player in the competitive seltzer market, contributing to significant revenue. |

| Hard Cider & RTD Spirits (e.g., Twisted Tea) | Product diversification, catering to evolving consumer preferences beyond beer. | Twisted Tea demonstrates strong organic social media engagement, indicating brand connection. |

Customer Relationships

Boston Beer cultivates deep brand loyalty through unwavering product quality and compelling marketing, exemplified by Samuel Adams and Twisted Tea. These brands actively foster community, utilizing social media and local events to create strong connections and encourage brand advocacy.

Twisted Tea, in particular, demonstrates this with its substantial organic social media following, highlighting the effectiveness of their community-building efforts in driving engagement and loyalty.

Boston Beer increasingly leverages digital advertising and social media platforms to foster direct consumer engagement. This strategy allows for real-time interaction, enabling the company to gather valuable feedback on existing products and generate buzz for new releases. For instance, in 2024, their social media campaigns often feature user-generated content and interactive polls, driving a sense of community and brand loyalty.

Boston Beer actively cultivates customer relationships through engaging promotional programs and experiential marketing. These initiatives, which include product sampling and active participation in key events, aim to create direct, positive interactions with consumers.

Strategic partnerships, such as their collaboration with AEG Presents for music festivals, are central to this strategy. These collaborations allow consumers to experience Boston Beer's brands in vibrant, social settings, fostering memorable moments and strengthening brand loyalty.

In 2024, Boston Beer continued to leverage these experiential activations to connect with a broad audience, underscoring the importance of creating engaging brand experiences beyond traditional advertising to build lasting customer affinity.

Consumer Feedback Integration

Boston Beer actively incorporates consumer feedback into its product innovation and marketing. This commitment to listening ensures their beverages align with changing consumer tastes, fostering continued customer loyalty. For instance, in 2024, the company continued to monitor social media sentiment and sales data to refine its seasonal offerings and explore new flavor profiles, a practice that has historically driven successful product launches.

This iterative process allows Boston Beer to adapt its portfolio, ensuring that both new and established products resonate with the market. By integrating direct consumer input, they maintain a competitive edge and enhance overall customer satisfaction. Their focus on consumer-responsive beverages is a cornerstone of their strategy.

- Consumer Feedback Loop: Boston Beer utilizes surveys, social media monitoring, and direct engagement to gather insights on product performance and preferences.

- Product Development: Feedback directly influences decisions on new flavor introductions, packaging updates, and ingredient sourcing.

- Marketing Refinement: Consumer input helps shape advertising campaigns and promotional strategies to better connect with target audiences.

- Market Responsiveness: This approach allows Boston Beer to quickly adapt to market trends and evolving consumer demands in the dynamic beverage industry.

Retailer and Wholesaler Support

Boston Beer's relationships with its wholesaler and retailer partners are foundational, directly influencing how consumers experience its brands. The company focuses on robust sales support, efficient inventory management, and providing effective promotional materials to ensure its products are readily available and appealing on shelves.

These efforts are critical for maintaining product visibility and accessibility, ultimately shaping the end-consumer's purchasing journey. For instance, Boston Beer's commitment to its distribution network helps guarantee that products like Samuel Adams and Truly Hard Seltzer reach consumers in optimal condition and are prominently featured in retail environments.

- Sales Support: Boston Beer provides its wholesaler and retailer partners with dedicated sales teams and resources to effectively market and sell its products.

- Inventory Management: Efficiently managing inventory across the supply chain ensures product availability and minimizes stockouts, enhancing the customer experience.

- Promotional Materials: The company equips partners with point-of-sale displays, advertising collateral, and promotional programs to drive consumer engagement and sales.

Boston Beer cultivates strong customer relationships through a multi-faceted approach, blending direct consumer engagement with robust support for its retail and wholesaler partners. This dual strategy ensures brand visibility and fosters loyalty across all touchpoints.

The company actively listens to consumers, using feedback to refine products and marketing, as seen in 2024's adjustments to seasonal offerings based on social media sentiment. Experiential marketing, like festival sponsorships, creates memorable brand interactions, further solidifying customer connections.

Boston Beer's success also hinges on its partnerships with wholesalers and retailers, providing them with sales support and promotional tools. This ensures their popular brands, such as Samuel Adams and Twisted Tea, are readily available and attractively presented to consumers.

| Customer Relationship Strategy | Key Tactics | 2024 Focus/Examples |

|---|---|---|

| Direct Consumer Engagement | Social Media Interaction, Experiential Marketing, Consumer Feedback Integration | User-generated content campaigns, music festival partnerships (e.g., AEG Presents), refining seasonal flavors based on social listening. |

| Wholesaler & Retailer Partnerships | Sales Support, Inventory Management, Promotional Materials | Ensuring product availability and optimal shelf presentation for brands like Samuel Adams and Truly Hard Seltzer. |

Channels

Independent wholesale distributors are the bedrock of Boston Beer Company's go-to-market strategy. This three-tier system means Boston Beer sells its products to these independent entities, who then handle the crucial task of getting Samuel Adams, Truly, and other brands onto shelves and taps across the nation and beyond. This network is vital for their extensive market penetration.

In 2023, Boston Beer Company's net revenue was approximately $2.05 billion, a testament to the effectiveness of their distribution channels. These independent wholesalers are the conduits that allow Boston Beer to reach a vast array of on-premise and off-premise accounts, ensuring their diverse portfolio is accessible to consumers.

Boston Beer's products reach consumers through an extensive network of off-premise retailers, encompassing grocery stores, convenience stores, and liquor stores. This broad distribution is vital for making their popular brands, such as Twisted Tea and Truly Hard Seltzer, accessible to a wide customer base.

Gaining prominent shelf space and prime cold box placement within these retail environments is a key strategy. For instance, in 2023, the U.S. beer market saw continued growth in the hard seltzer and flavored malt beverage categories, where Truly and Twisted Tea are major players, underscoring the importance of visibility in these competitive retail channels.

Boston Beer's products are readily available in on-premise locations like bars and restaurants, offering direct consumer interaction and brand immersion. This channel is crucial for experiencing their craft beverages firsthand.

Strategic alliances, such as the one with AEG Presents, significantly boost Boston Beer's visibility within live music venues and festivals, reaching consumers in entertainment-rich environments.

In 2024, Boston Beer continued to leverage these on-premise channels to drive trial and build brand loyalty, a strategy that has historically proven effective for craft beverage brands seeking to connect with consumers in social settings.

E-commerce Platforms

Boston Beer actively engages with e-commerce platforms, acknowledging their increasing significance in the beverage alcohol sector. This strategic focus allows them to tap into a growing consumer preference for online purchasing, offering greater convenience and broader accessibility.

The company understands that securing prominent placement on these digital shelves is crucial for visibility and sales conversion. As online sales for alcoholic beverages continue to climb, e-commerce channels are becoming essential for market reach, complementing traditional distribution networks.

In 2023, the U.S. e-commerce market for alcohol reached an estimated $6 billion, with projections indicating continued growth. Boston Beer's participation in this channel directly addresses evolving consumer behavior, where convenience and digital access are paramount.

- E-commerce Platform Presence: Boston Beer leverages major online retailers and specialized alcohol delivery services to offer its portfolio.

- Market Reach Expansion: These platforms extend Boston Beer's geographical reach, allowing consumers in various locations to access their products.

- Consumer Convenience: The ability to purchase and receive beverages directly at home or a designated pickup point aligns with modern consumer demand for ease of use.

- Sales Growth Driver: E-commerce represents a significant and growing revenue stream, contributing to overall sales performance.

Company-Owned Taprooms and Breweries

Company-owned taprooms and breweries act as vital direct-to-consumer touchpoints for Boston Beer Company, complementing its primary wholesale operations. These venues offer immersive brand experiences, allowing consumers to sample new products and purchase exclusive merchandise, thereby fostering deeper brand engagement.

These locations are crucial for building brand loyalty and establishing a direct dialogue with customers, providing valuable feedback for product development. For instance, Dogfish Head, a prominent brand within Boston Beer's portfolio, operates its own taprooms, reinforcing this strategy.

In 2024, Boston Beer Company continued to leverage its taproom presence to drive brand affinity and explore new product introductions. While specific financial breakdowns for taproom revenue are not always granularly reported, these locations contribute to overall brand equity and can offer higher margins on direct sales compared to wholesale.

The strategic importance of these physical spaces is evident in their ability to:

- Showcase the full brand portfolio and new releases.

- Gather direct consumer feedback and insights.

- Create unique, memorable brand experiences.

- Drive incremental sales and profit.

Boston Beer Company's distribution strategy hinges on independent wholesale distributors, who are essential for getting their products to market. This network ensures broad availability across both on-premise and off-premise locations. In 2023, the company achieved net revenue of approximately $2.05 billion, highlighting the effectiveness of these established channels in reaching a diverse consumer base.

The company also leverages e-commerce platforms to tap into growing consumer demand for convenient purchasing options. This digital presence extends their market reach and complements traditional distribution. In 2023, the U.S. alcohol e-commerce market was valued at an estimated $6 billion, underscoring the channel's increasing importance.

Company-owned taprooms and breweries serve as direct-to-consumer touchpoints, fostering brand loyalty and providing immersive experiences. These locations are crucial for gathering customer feedback and driving trial of new products, as exemplified by Dogfish Head's taproom operations.

| Channel Type | Key Function | 2023 Relevance/Data Point |

|---|---|---|

| Independent Wholesalers | Nationwide product distribution | Enabled $2.05 billion net revenue |

| Off-Premise Retailers | Consumer accessibility (grocery, liquor stores) | Crucial for brands like Truly and Twisted Tea in growing categories |

| On-Premise Locations | Direct consumer interaction (bars, restaurants) | Key for brand trial and social engagement in 2024 |

| E-commerce Platforms | Online sales and delivery convenience | Addresses evolving consumer behavior in a $6 billion market (2023) |

| Taprooms/Breweries | Direct-to-consumer engagement, brand experience | Fosters loyalty and product feedback, supports new releases |

Customer Segments

Craft Beer Enthusiasts are a core group for Boston Beer, valuing the distinct flavors and brewing traditions of brands like Samuel Adams. They actively seek out unique taste profiles and appreciate the narrative behind the beer, often influencing purchasing decisions based on brand heritage and perceived authenticity.

Boston Beer's customer base includes a significant and expanding group of hard seltzer and ready-to-drink (RTD) consumers. This segment, drawn to brands like Truly and Twisted Tea, values convenience, refreshing taste profiles, and the availability of new and varied flavors.

These consumers are actively participating in the 'Beyond Beer' market, which is a strategic priority for the company. Data from 2024 indicates continued strong performance in the RTD category, with consumers showing a clear preference for options that offer both novelty and a higher alcohol by volume (ABV) without sacrificing refreshment.

Flavor-Seeking Drinkers are a key customer segment for Boston Beer, particularly drawn to their flavored malt beverages and ciders like Twisted Tea and Angry Orchard. These consumers actively seek out new and exciting tastes, often preferring sweet or fruity profiles for casual social gatherings and celebrations.

The appeal of variety is paramount for this group, and they readily experiment with different flavor profiles. Twisted Tea, for instance, has demonstrated remarkable growth, indicating its broad appeal within this segment, resonating with a wide demographic looking for enjoyable and accessible alcoholic options.

Social Drinkers and Event-Goers

Social drinkers and event-goers represent a significant customer segment for Boston Beer, particularly those who consume alcoholic beverages at concerts, festivals, and other gatherings. In 2024, the live events industry continued its robust recovery, with major music festivals and sporting events drawing millions of attendees, creating prime opportunities for brand engagement. Boston Beer actively targets this demographic through strategic partnerships with live entertainment providers, such as AEG Presents, ensuring their products are available and visible at these high-traffic venues.

These collaborations go beyond mere product placement, aiming to create branded experiences that resonate with consumers during moments of enjoyment and celebration. For instance, in 2024, Boston Beer ran several successful on-site activations at popular music festivals, offering sampling opportunities and unique brand interactions that directly linked their products with positive event memories. This approach is particularly effective as it captures consumers when they are most receptive to trying new beverages and forming brand loyalties.

- Targeting Event Enthusiasts: Consumers who enjoy alcoholic beverages in social settings, including concerts, festivals, and other events, form a key segment.

- Strategic Partnerships: Collaborations with live entertainment providers like AEG Presents are crucial for reaching these individuals.

- On-Site Brand Experiences: Boston Beer focuses on offering branded experiences and product availability at relevant venues to capture consumers during moments of enjoyment.

- Industry Growth: The live events sector’s continued expansion in 2024 provided a fertile ground for these engagement strategies.

Health-Conscious Consumers

The health-conscious consumer segment represents a significant and growing opportunity for Boston Beer. This group actively seeks alcoholic beverages that align with wellness trends, such as lower calorie counts or reduced sugar content. For instance, the continued popularity of hard seltzers, like Truly, directly appeals to this demographic's preference for lighter options. Boston Beer's investment in innovation within this space, including exploring non-alcoholic beverages, positions them well to capture this expanding market share.

This segment is particularly drawn to products that offer a perceived healthier alternative to traditional beers or spirits. Boston Beer's product development, especially in the hard seltzer category, directly addresses this demand. In 2023, the hard seltzer market continued to be a substantial contributor to the beverage alcohol industry, with brands like Truly maintaining a strong presence, indicating sustained consumer interest in these lighter, often fruit-flavored options.

- Growing Demand for Lighter Options: Consumers are increasingly prioritizing lower-calorie and lower-sugar alcoholic beverages.

- Truly Hard Seltzer Appeal: Brands like Truly directly cater to this health-conscious segment, offering a popular alternative to traditional beer.

- Innovation in Non-Alcoholic Beverages: Boston Beer's exploration of non-alcoholic options further taps into the wellness trend, broadening their appeal to this demographic.

Boston Beer serves a diverse customer base, from dedicated craft beer aficionados who appreciate brands like Samuel Adams to a growing segment embracing hard seltzers and ready-to-drink (RTD) options such as Truly and Twisted Tea. These latter consumers prioritize convenience, varied flavors, and the expanding 'Beyond Beer' market, with 2024 data showing continued strong performance in RTDs. The company also targets flavor-seekers who enjoy ciders like Angry Orchard, valuing novelty and accessible, enjoyable alcoholic choices.

A significant customer group includes social drinkers and event-goers, who are present at concerts, festivals, and sporting events. Boston Beer leverages partnerships with live entertainment providers, like AEG Presents, to reach these individuals, enhancing brand visibility and engagement at high-traffic venues. In 2024, the robust recovery of the live events industry provided ample opportunities for these on-site activations, linking brands with positive consumer experiences.

Furthermore, Boston Beer caters to the health-conscious consumer, who seeks lower-calorie and reduced-sugar alcoholic beverages. The enduring popularity of hard seltzers, exemplified by Truly, directly addresses this trend. Boston Beer's strategic focus on innovation within this space, including potential non-alcoholic offerings, positions them to capture a larger share of this expanding market, as 2023 data indicated the hard seltzer market remained a substantial contributor to the beverage alcohol industry.

Cost Structure

The Cost of Goods Sold (COGS) for Boston Beer is a significant expense, encompassing raw materials like malt and hops, packaging materials, and the direct labor and overhead tied to their brewing and production processes. For instance, in 2023, the company reported Cost of Goods Sold of $1.22 billion, a notable increase from $1.04 billion in 2022, reflecting these substantial production expenses.

Managing COGS is crucial for Boston Beer's profitability. The company actively works to mitigate impacts from fluctuating commodity prices and enhance brewery efficiencies. These efforts are directly aimed at improving their gross margin performance, which in 2023 stood at 43.8%.

Boston Beer Company allocates substantial resources to advertising, promotion, and selling expenses to cultivate its diverse portfolio of brands. In 2024, these expenditures are crucial for building brand awareness and driving consumer demand across its craft beer, hard seltzer, and other beverage segments.

These costs encompass investments in a wide array of marketing channels, including traditional advertising like television and print, alongside robust digital media campaigns. Furthermore, the company supports a significant sales force through salaries and benefits, essential for market penetration and relationship management with distributors and retailers.

Looking ahead to 2025, Boston Beer Company anticipates an increase in these operational costs. This strategic decision is driven by the objective to further strengthen its existing brands and effectively support the introduction of new products, which will likely have a direct impact on the company's short-term profitability.

Boston Beer's cost structure includes significant expenses for distributing its products through the three-tier system, covering shipping to distributors and retailers. These costs are essential for getting their beverages to market.

The company actively works to optimize its distribution network to lower freight and warehousing expenses. This focus on supply chain efficiency is vital for maintaining profitability, as demonstrated by their efforts to reduce these operational costs.

For instance, in 2024, Boston Beer continued to invest in logistics and supply chain improvements, aiming to translate these efficiencies into lower per-unit freight costs. Such optimizations are key to managing the inherent complexities of beverage distribution.

General and Administrative Expenses

General and Administrative (G&A) expenses at Boston Beer encompass a range of corporate overhead costs. These include salaries and benefits for their administrative teams, fees paid to outside professionals, and various indirect taxes. The company actively tracks these expenditures.

In 2023, Boston Beer reported G&A expenses of $237.8 million. This figure saw a notable increase compared to $203.1 million in 2022, partly influenced by costs associated with their CEO transition. Additionally, lower incentive compensation payouts in 2023 helped to offset some of these increases.

- Corporate Overhead: Salaries, benefits for administrative staff, and office operating costs.

- Professional Fees: Legal, accounting, and consulting services.

- Indirect Taxes: Taxes not directly tied to production or sales, like property taxes.

- Impact of Special Items: Costs such as CEO transition expenses and impairment charges, like the $15.3 million impairment charge recorded for the Dogfish Head brand in Q3 2023, can significantly influence G&A figures.

Capital Expenditures and Brewery Investments

Boston Beer's cost structure includes significant capital expenditures, particularly for its breweries. These investments are crucial for expanding production capacity, enhancing operational efficiency, and fostering new product development.

In 2024, the company projected capital expenditures to be in the range of $90 million to $110 million. This significant outlay underscores Boston Beer's strategic focus on bolstering its manufacturing infrastructure and supporting its long-term growth ambitions.

The company's commitment to investing in its brewery network is a key component of its strategy to meet growing demand and maintain product quality.

- Brewery Investments: Funds allocated for company-owned breweries.

- Capacity Expansion: Building out facilities to meet increased demand.

- Efficiency Improvements: Upgrading technology and processes to reduce costs.

- Product Innovation: Supporting the development and production of new beverages.

Boston Beer's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which reached $1.22 billion in 2023, up from $1.04 billion in 2022, reflecting raw materials, packaging, and production labor. Significant investments in advertising and promotion, totaling hundreds of millions annually, are essential for brand building and driving sales across their diverse beverage portfolio.

Distribution costs, encompassing shipping and warehousing, are also a major expense, with ongoing efforts in 2024 to optimize logistics for lower per-unit freight costs. General and Administrative (G&A) expenses, including corporate overhead and professional fees, were $237.8 million in 2023, showing an increase from $203.1 million in 2022. Capital expenditures for brewery improvements and capacity expansion are also substantial, with projected spending of $90 million to $110 million in 2024.

| Cost Category | 2023 ($ millions) | 2024 Projection ($ millions) |

| Cost of Goods Sold (COGS) | 1,220.0 | N/A |

| Advertising & Promotion | N/A (Significant) | N/A (Significant) |

| Distribution Costs | N/A (Significant) | N/A (Ongoing Optimization) |

| General & Administrative (G&A) | 237.8 | N/A |

| Capital Expenditures | N/A | 90-110 |

Revenue Streams

Revenue streams for Boston Beer Company are primarily driven by the sales of its diverse beer products. The flagship Samuel Adams brand continues to be a significant contributor, with sales channeled through wholesalers to reach retailers and end consumers.

Despite a mature and sometimes challenging traditional beer market, Samuel Adams maintains its position as a foundational element of the company's revenue generation. In 2024, Boston Beer reported net revenue of $2.25 billion, with its Samuel Adams and other heritage brands forming a substantial part of this figure.

Sales of hard seltzers represent a significant revenue stream for Boston Beer, with Truly Hard Seltzer holding a prominent position in the market. Despite a maturing seltzer landscape, Truly remains a top-tier brand and a key driver of the company's Beyond Beer portfolio. In 2023, Boston Beer reported that Truly generated over $900 million in net revenue, underscoring its importance.

Revenue is also generated from hard cider sales, with Angry Orchard being the flagship brand. This product line diversifies Boston Beer's offerings, catering to consumers interested in alcoholic beverages beyond traditional beer. In 2024, Angry Orchard continued its growth trajectory, securing increased shelf space and appealing to a broader market.

Sales of Flavored Malt Beverages (FMBs) and RTDs

The sale of flavored malt beverages (FMBs) and ready-to-drink (RTD) spirits-based beverages forms a core revenue stream for Boston Beer. The Twisted Tea brand, a significant player in the FMB market, continues to demonstrate robust growth, solidifying its position as a key contributor. This segment is crucial for the company's overall financial performance.

Boston Beer is strategically expanding its RTD offerings to capture evolving consumer tastes. Newer products, such as the spirits-based Sun Cruiser, are designed to appeal to a growing demand for convenient, pre-mixed alcoholic beverages. This diversification within the beverage category is a key element of their revenue strategy.

- Twisted Tea's Dominance: As of early 2024, Twisted Tea has become a powerhouse, outselling Truly by a significant margin. It is now 1.9 times larger than Truly in measured off-premise sales channels, highlighting its substantial market penetration and revenue-generating capability.

- RTD Growth Potential: The company is actively investing in and promoting its RTD portfolio, including spirits-based options like Sun Cruiser, to capitalize on the accelerating consumer shift towards convenient, ready-to-drink alcoholic beverages.

- Brand Strength: The sustained success of Twisted Tea underscores the strength of Boston Beer's brand portfolio and its ability to identify and capitalize on emerging beverage trends.

International Sales and Other Revenue

Boston Beer Company does generate revenue from international sales, though its primary focus remains the United States. In 2023, international sales represented a smaller portion of the company's overall revenue compared to its domestic performance, but it's an area with potential for growth.

Beyond direct product sales, other revenue streams can contribute. These might include revenue from licensing agreements where its brands are used by other companies, or direct-to-consumer sales from its taprooms and breweries. However, the vast majority of its revenue is still derived from the wholesale distribution of its beverages.

Price increases are also a recognized method for boosting revenue. For instance, Boston Beer has implemented price adjustments on its products over time to account for inflation and maintain profit margins. These adjustments directly impact the revenue generated per unit sold.

- International Sales: While the U.S. is the main market, Boston Beer does pursue international sales, contributing to its overall revenue.

- Other Revenue Streams: Potential includes licensing agreements and direct-to-consumer sales via taprooms.

- Wholesale Dominance: The core revenue generation remains through wholesale distribution networks.

- Price Adjustments: The company utilizes price increases as a strategy to enhance revenue.

Boston Beer's revenue streams are robust, driven by a diversified portfolio. The company's core brands, Samuel Adams, Truly Hard Seltzer, and Twisted Tea, are significant revenue generators. In 2024, the company reported net revenue of $2.25 billion, with these brands forming the backbone of its financial performance.

| Brand | Primary Category | 2023 Net Revenue (Approx.) |

| Samuel Adams | Beer | Significant contributor, part of $2.25B total net revenue in 2024 |

| Truly | Hard Seltzer | Over $900 million |

| Twisted Tea | Flavored Malt Beverage (FMB) | Outselling Truly, 1.9x larger in measured off-premise sales (early 2024) |

| Angry Orchard | Hard Cider | Continued growth in 2024 |

| Sun Cruiser | Spirits-Based RTD | Growing segment, part of RTD portfolio expansion |

Business Model Canvas Data Sources

The Boston Beer Business Model Canvas is informed by a blend of internal financial statements, sales data, and operational metrics. This data is supplemented by external market research reports, competitor analysis, and consumer trend studies to ensure a comprehensive view.