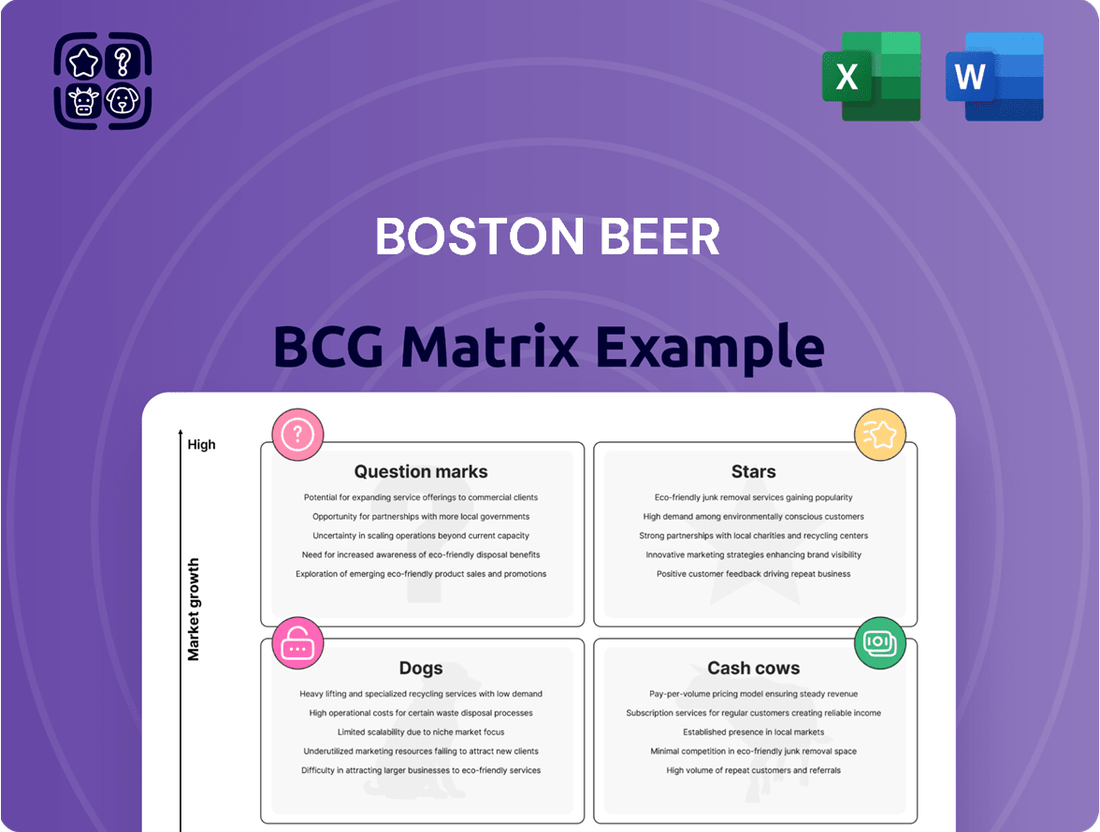

Boston Beer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Beer Bundle

Curious about the Boston Beer Company's product portfolio? Our BCG Matrix analysis reveals which brands are fueling growth (Stars), generating steady profits (Cash Cows), lagging behind (Dogs), or hold uncertain potential (Question Marks).

Don't miss out on the full strategic picture! Purchase the complete BCG Matrix report to unlock detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Boston Beer's market performance and investment decisions.

Stars

Twisted Tea remains a star performer for Boston Beer Company, holding a dominant position in the hard tea market. Its consistent year-over-year growth since 2001, even with rising competition, highlights its strong brand equity and appeal. In 2023, Twisted Tea shipments grew 11.5% year-over-year, contributing significantly to Boston Beer's overall volume.

Sun Cruiser, Boston Beer's vodka-based iced tea ready-to-drink (RTD) beverage, launched in late 2024. It has demonstrated robust initial performance, with plans for full national distribution by mid-2025. This product is a key growth driver, attracting new consumers to Boston Beer's offerings by tapping into the expanding RTD cocktail market.

The Truly Unruly Mix Pack, an 8% ABV hard seltzer introduced in 2024, is a significant growth driver in the U.S. beer market, particularly within the higher alcohol content segment.

Boston Beer anticipates this product line will be a key contributor to its growth in 2025, reflecting strong consumer adoption and market potential.

This offering directly addresses a growing consumer preference for beverages with elevated alcohol content in the hard seltzer category.

Hard Mountain Dew

Hard Mountain Dew has demonstrated encouraging depletion trends in the latter half of 2024, building momentum from a smaller volume base. This positive performance suggests the product is gaining traction in the market.

The strategic rollout of Hard Mountain Dew Code Red in March 2025 is expected to further fuel growth, expanding the product's appeal and market penetration. This line extension is a key indicator of Boston Beer's commitment to this segment.

While establishing Hard Mountain Dew as a significant contributor to Boston Beer's overall volume mix is a long-term objective, its current growth trajectory in a competitive landscape highlights its potential as a Star in the BCG Matrix.

- Positive Depletion Trends: Hard Mountain Dew showed positive depletion trends in H2 2024.

- Line Extension: Hard Mountain Dew Code Red is set to launch in March 2025 to drive further growth.

- Growth Potential: The product's current growth trajectory indicates its potential as a Star despite being a multi-year effort.

- Market Dynamics: Performance in a dynamic market underscores its strategic importance.

Dogfish Head Grateful Dead Juicy Pale Ale (2025 Launch)

Dogfish Head Grateful Dead Juicy Pale Ale, slated for a Q1 2025 debut, is a strategic move by Boston Beer (SAM) to tap into the burgeoning craft beer market. This innovation aims to leverage the iconic Grateful Dead brand to attract a segment of consumers actively seeking distinctive, high-quality, and experience-driven beverages. The company anticipates this launch will bolster Dogfish Head's market presence and contribute to overall revenue growth in the competitive beverage landscape.

The national rollout of Dogfish Head Grateful Dead Juicy Pale Ale is backed by a comprehensive marketing strategy designed to maximize awareness and drive trial. This includes targeted media campaigns and localized promotional activities, underscoring Boston Beer's commitment to supporting new product introductions. The company's investment in these initiatives reflects confidence in the beer's potential to resonate with consumers and capture significant market share within the juicy pale ale category.

- Market Share Target: Aiming to capture 2-3% of the juicy pale ale segment within its first year.

- Projected Sales: Estimated to contribute $15-20 million in revenue in 2025.

- Brand Synergy: Leveraging the established Grateful Dead fanbase for cross-promotional opportunities.

- Distribution Reach: Targeting placement in over 5,000 retail locations nationwide by end of Q2 2025.

Twisted Tea continues its reign as a dominant force, showing 11.5% shipment growth in 2023. Sun Cruiser, a new vodka-based RTD, launched in late 2024 and is slated for national distribution by mid-2025, tapping into the growing RTD market. The Truly Unruly Mix Pack, a higher ABV hard seltzer introduced in 2024, is also a key growth driver, addressing consumer demand for elevated alcohol content.

Hard Mountain Dew is gaining traction, with positive depletion trends in the latter half of 2024, further supported by the planned March 2025 launch of Hard Mountain Dew Code Red. Dogfish Head Grateful Dead Juicy Pale Ale, launching in Q1 2025, aims to capture 2-3% of its segment and contribute $15-20 million in revenue for 2025, leveraging brand synergy and targeting 5,000 retail locations.

| Product | Category | 2023 Growth (if applicable) | Launch/Key Event | Projected 2025 Impact |

|---|---|---|---|---|

| Twisted Tea | Hard Tea | +11.5% shipments | Established | Continued market dominance |

| Sun Cruiser | Vodka RTD | N/A | Late 2024 | National distribution mid-2025, key growth driver |

| Truly Unruly Mix Pack | Hard Seltzer (8% ABV) | N/A | 2024 | Key growth driver in higher ABV segment |

| Hard Mountain Dew | Hard Soda | Positive depletion trends H2 2024 | Code Red launch March 2025 | Momentum building, potential Star |

| Dogfish Head Grateful Dead Juicy Pale Ale | Craft Beer | N/A | Q1 2025 | Target 2-3% segment share, $15-20M revenue |

What is included in the product

This BCG Matrix overview analyzes Boston Beer's portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth.

A clear BCG Matrix visualizes Boston Beer's portfolio, easing the pain of resource allocation by identifying Stars and Cash Cows for growth.

Cash Cows

Samuel Adams Boston Lager, as Boston Beer Company's flagship product, boasts a significant legacy and widespread recognition. Despite a general slowdown in the traditional craft beer segment, this iconic brand continues to be a cornerstone of the company's offerings, providing essential stability to its overall portfolio.

The brand's enduring appeal is bolstered by its well-established distribution network and a dedicated customer following. This allows Samuel Adams Boston Lager to generate consistent cash flow, requiring comparatively modest investments for continued growth, a characteristic hallmark of a cash cow.

Angry Orchard Hard Cider is a prime example of a Cash Cow for Boston Beer. It dominates the hard cider market, a segment that, while not experiencing explosive growth, offers dependable and substantial revenue streams. This brand consistently generates significant cash flow due to its established market leadership and high brand recognition within the cider category.

Truly Hard Seltzer's core offerings, especially its sleek can variety packs, remain a vital revenue stream for Boston Beer. Despite a broader market slowdown in hard seltzers, these established products maintain a notable market share.

In 2023, Boston Beer Company reported net revenue of $2.2 billion, with its "Other" products, which include Truly, accounting for a significant portion. While the hard seltzer category faced headwinds, Truly's efficient production and smart pricing strategies ensure its continued role as a cash cow.

Established Beyond Beer Portfolio

Boston Beer's established 'Beyond Beer' portfolio, which includes a variety of flavored malt beverages and hard ciders, serves as a significant cash cow. This segment accounted for approximately 85% of the company's total volume in 2024, demonstrating its foundational role in generating stable revenue streams.

As the second-largest supplier within the 'Beyond Beer' category, Boston Beer commands a substantial 21% market share. This strong market position underscores the consistent demand and profitability derived from these mature product lines, allowing the company to fund investments in other areas of its business.

- Established 'Beyond Beer' portfolio drives significant volume.

- Accounts for roughly 85% of Boston Beer's 2024 volume.

- Holds a 21% market share in the 'Beyond Beer' segment.

- Provides stable and predictable revenue streams.

Efficient Production and Distribution Network

Boston Beer's commitment to operational excellence is a cornerstone of its Cash Cow strategy. The company has made significant capital investments in its production facilities, aiming to enhance brewery efficiencies. For instance, planned capital expenditures for 2024 and 2025 are heavily weighted towards optimizing manufacturing processes, which directly translates into improved gross margins and robust cash flow generation from its established brands.

A highly effective distribution network is crucial for maintaining the profitability of Boston Beer's Cash Cows. The company relies on a strong partnership with independent wholesalers throughout the United States and in key international markets. This established system ensures that its popular, mature brands are widely available to consumers, driving consistent sales and reinforcing their Cash Cow status.

- Brewery Efficiency Investments: Capital expenditures in 2024 and planned for 2025 focus on optimizing production, boosting gross margins.

- Supply Chain Optimization: Streamlining operations enhances cash flow from mature product lines.

- Extensive Distribution Network: Partnerships with independent U.S. and international wholesalers ensure broad market reach.

- Product Availability: Consistent availability of mature brands supports sustained sales and profitability.

Boston Beer's established 'Beyond Beer' portfolio, encompassing hard ciders and flavored malt beverages, functions as its primary Cash Cow. This segment is critical, representing approximately 85% of the company's total volume in 2024 and securing a robust 21% market share within its category. These mature product lines deliver consistent, predictable revenue streams, enabling investment in newer ventures.

| Brand/Category | BCG Matrix Status | Key Characteristics | 2024 Volume Share (Est.) | Market Share (Category) |

|---|---|---|---|---|

| Samuel Adams Boston Lager | Cash Cow | Flagship, stable revenue, established distribution | N/A | N/A |

| Angry Orchard Hard Cider | Cash Cow | Market leader, dependable revenue, high recognition | N/A | N/A |

| Truly Hard Seltzer (Core) | Cash Cow | Vital revenue stream, maintains market share despite category slowdown | N/A | N/A |

| 'Beyond Beer' Portfolio (Overall) | Cash Cow | Dominant volume contributor, stable cash flow, funds growth initiatives | 85% | 21% |

What You See Is What You Get

Boston Beer BCG Matrix

The Boston Beer BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase, offering a clear, professional analysis of their product portfolio. This comprehensive document is ready for immediate use in strategic planning, containing no watermarks or demo content, just the expert-backed insights you need. You're seeing the final, unedited version, ensuring you get precisely the strategic clarity required to understand Boston Beer's market position and potential. Once purchased, this analysis-ready file will be instantly downloadable for your business planning or client presentations.

Dogs

The traditional craft beer segment, exemplified by Samuel Adams' core offerings, has faced headwinds. In 2023, the U.S. craft beer market saw a dollar sales decline, with some reports indicating a drop of over 4% for the segment. This reflects a broader trend where consumer tastes are evolving, moving towards newer styles and brands.

Within this context, Samuel Adams' traditional portfolio has experienced significant contraction. For instance, Samuel Adams Boston Lager, a flagship product, saw its dollar sales decrease by approximately 15% in the year leading up to mid-2024. This sharp decline underscores the low growth nature of this category and the challenges of maintaining market share.

The declining growth rate and sales figures for traditional craft beers mean this segment needs strategic oversight. Boston Beer Company, the maker of Samuel Adams, must carefully manage these assets to prevent them from becoming a substantial drain on resources, especially as consumer preferences increasingly favor alternative beverage options and newer craft beer innovations.

While the Truly brand overall has strong growth potential, certain individual flavors and package configurations within its hard seltzer lineup are facing headwinds. For instance, some of the more niche or older flavor profiles might be experiencing declining sales as consumer preferences evolve. This trend is particularly noticeable as the broader hard seltzer market matures.

The overall hard seltzer market, which saw explosive growth in prior years, is now showing signs of saturation and even contraction in certain segments. This intensified competition means that even established brands like Truly can see specific offerings lose market share. In 2023, the U.S. hard seltzer market volume saw a notable decrease compared to the previous year, with some reports indicating a decline of over 10% in certain categories.

These underperforming Truly products, characterized by diminishing sales and market relevance, could be classified as Dogs in the Boston Beer Company's BCG matrix. This classification signals a need for a strategic review. Boston Beer might consider discontinuing these specific SKUs or investing heavily in their repositioning and marketing to revive their performance, aiming to cut losses and reallocate resources to more promising ventures.

Boston Beer Company's smaller, niche craft beer offerings might be categorized as Dogs within the BCG Matrix. The craft beer market, particularly for smaller brands, has faced significant contraction and intense competition. Many smaller breweries have closed, indicating a challenging environment for products lacking strong differentiation or widespread consumer appeal.

These niche products likely contribute little to overall revenue and cash flow, potentially consuming valuable resources without generating adequate returns. For instance, in 2023, the U.S. craft beer market saw a slowdown, with many smaller players struggling to maintain growth amidst rising costs and shifting consumer preferences, a trend expected to continue into 2024.

Older, Less Popular Seasonal or Limited-Release Beers

Older, less popular seasonal or limited-release beers might be categorized as Dogs in Boston Beer's BCG Matrix. These offerings, despite their initial appeal, may not have sustained demand or market share, leading to inefficient resource allocation. For instance, a seasonal brew that saw a decline in sales from its launch year could represent this category.

Such beers often carry production and distribution expenses without generating enough revenue to offset these costs. Boston Beer's strategic emphasis on 'fewer things better' in its innovation pipeline suggests a deliberate shift away from these lower-impact product lines. This approach aims to concentrate resources on more promising and popular offerings.

Consider a scenario where a craft beer released for a specific holiday season in 2023, which had moderate success, is reintroduced in 2024 but experiences a significant drop in sales, perhaps by 30% compared to its initial run. This decline, coupled with ongoing inventory and marketing costs, would position it as a potential Dog.

- Declining Sales: Beers that fail to maintain sales momentum after their initial release period.

- High Costs, Low Returns: Products that incur significant production and distribution costs but yield minimal profit.

- Strategic Divestment: Companies may choose to discontinue or reduce investment in these underperforming products to focus on more profitable ventures.

- Innovation Focus: A shift towards prioritizing resources for new, high-potential product development over legacy, low-performing seasonal items.

Discontinued or Phased-Out Products

Products Boston Beer has recently discontinued or is phasing out would be considered Dogs in the BCG Matrix. These items typically exhibit low market share and low growth potential, prompting the company to stop production or reduce their visibility. This strategic move allows Boston Beer to reallocate resources to more promising ventures.

For instance, while specific product discontinuations aren't always publicly detailed, a company like Boston Beer might phase out niche seasonal beers or experimental flavors that failed to gain traction. In 2023, the company continued to manage its portfolio, focusing on core brands like Samuel Adams and Truly Hard Seltzer, while evaluating the performance of its broader offerings.

- Low Market Share: Products in the Dog category have a minimal presence in their respective markets.

- Low Growth: These items are not experiencing significant expansion in demand or sales.

- Resource Reallocation: Discontinuing Dogs frees up capital and management attention for more profitable areas.

- Portfolio Optimization: Removing underperformers strengthens the overall product mix and strategic focus.

Products identified as Dogs in Boston Beer's BCG matrix are those with low market share and low growth potential, often characterized by declining sales and high costs relative to returns. Boston Beer has strategically focused on optimizing its portfolio, which involves phasing out or reducing investment in underperforming items to reallocate resources to more promising ventures.

For example, certain niche craft beer offerings or less popular seasonal releases that fail to gain traction or sustain demand would fall into this category. The company's emphasis on a streamlined innovation pipeline suggests a move away from numerous low-impact product lines toward those with demonstrated or high potential consumer appeal.

These Dogs represent an opportunity for divestment or significant repositioning to prevent them from becoming a drain on company resources. By identifying and managing these products, Boston Beer aims to improve overall operational efficiency and financial performance.

The company's approach to portfolio management, especially in the challenging craft beer segment where many smaller brands struggled in 2023 and into 2024, necessitates a clear-eyed view of which products are contributing positively versus those that are not.

Question Marks

Boston Beer is actively pursuing innovation within its Truly brand, with the Truly Unruly Lemonade Mix Pack slated for a Q1 2025 release. This move indicates a continued effort to expand the Truly portfolio and capture evolving consumer preferences in the hard seltzer category.

While Truly Unruly has demonstrated promising initial performance, other new Truly innovations face an uncertain future. Their market adoption and share growth remain to be fully assessed within the highly competitive and dynamic hard seltzer landscape. These newer offerings necessitate substantial marketing investment to achieve meaningful traction and mitigate the risk of becoming underperforming "Dogs" in the BCG matrix.

Beyond the Grateful Dead collaboration, Dogfish Head has explored other innovations like the "SuperEights" variety pack, featuring eight different beers. These new product introductions in the crowded craft beer market, which saw a 0.5% volume decline in 2023 according to the Brewers Association, face intense competition and require rapid market penetration to prove their value.

The success of these Dogfish Head innovations hinges on their ability to capture consumer attention amidst a landscape where craft beer sales have become increasingly challenging. For instance, Boston Beer Company's overall depletions for its Samuel Adams brand saw a 7% decrease in the first quarter of 2024, highlighting the broader industry headwinds that Dogfish Head innovations must overcome to justify continued investment and resources.

The ready-to-drink (RTD) alcoholic beverage market is experiencing robust growth, with spirit-based RTDs showing particularly strong momentum. Boston Beer's Sun Cruiser is an example of this trend, and any future spirit-based RTD offerings would likely target this expanding segment.

These new products face a competitive landscape, requiring significant marketing and distribution investments to gain traction against established players and new entrants. The market is dynamic, with consumer preferences rapidly evolving in the RTD space.

Potential Future Category Expansions (e.g., non-alcoholic options)

Boston Beer might look into expanding into new areas like the rapidly growing non-alcoholic beer and ready-to-drink (RTD) beverage markets. These segments show significant growth potential, but Boston Beer's entry would position them as Question Marks in the BCG matrix.

This classification stems from the expectation of low initial market share in these new ventures, necessitating substantial investment to build a competitive foothold. Success hinges on Boston Beer's ability to develop compelling products and execute effective market penetration strategies.

- Non-alcoholic beer market growth: The global non-alcoholic beer market was valued at approximately $25.3 billion in 2023 and is projected to reach $45.7 billion by 2030, growing at a CAGR of 8.8%.

- RTD beverage market expansion: The RTD cocktail market alone is expected to reach $55.2 billion by 2027, indicating a strong consumer shift towards convenient, pre-mixed alcoholic beverages.

- Investment requirements: Entering these competitive spaces will require significant capital for brand building, distribution, and product innovation, mirroring the typical investment needs for Question Mark products.

Experimental or Limited-Trial Products

Boston Beer Company actively experiments with new beverages, aiming to build a robust innovation pipeline. These experimental or limited-trial products are inherently uncertain.

They represent early-stage ventures with unproven consumer demand and minimal market penetration. For instance, Boston Beer has historically launched various hard seltzers and flavored malt beverages in limited markets before wider rollouts.

The company must meticulously track their performance to determine future investment.

- Nascent Stage: These products are in their infancy, often with limited distribution and marketing.

- Unproven Market Acceptance: Consumer reaction is still being gauzed, making future sales volume unpredictable.

- Low Initial Market Share: By definition, these are new entrants with a negligible share of the relevant beverage market.

- Strategic Decision Point: Performance data dictates whether to scale up or phase out these experimental offerings.

Boston Beer's ventures into new beverage categories like non-alcoholic beer and spirit-based ready-to-drink (RTD) cocktails position them as Question Marks. These markets, while experiencing significant growth, represent new territory for the company with uncertain initial market share.

The company must invest heavily in these areas to build brand awareness and distribution, similar to the typical investment required for Question Mark products. Success will depend on their ability to innovate and capture consumer interest in dynamic and competitive segments.

The non-alcoholic beer market is projected to grow substantially, with a global valuation of approximately $25.3 billion in 2023, and the RTD cocktail market is also expanding rapidly. These growth trends present opportunities, but also necessitate significant capital for market entry and penetration.

Boston Beer's experimental or limited-trial products, such as past limited releases of hard seltzers, also fall into the Question Mark category. These are early-stage ventures with unproven consumer demand and low initial market share, requiring careful performance tracking to guide future investment decisions.

| Category | Market Growth Potential | Boston Beer's Position | Key Considerations |

|---|---|---|---|

| Non-alcoholic Beer | Global market valued at $25.3B in 2023, projected to reach $45.7B by 2030 (8.8% CAGR). | Question Mark (new entrant, low initial share) | Requires significant marketing and distribution investment; brand building is crucial. |

| Spirit-Based RTDs | Rapidly growing segment, with RTD cocktails alone expected to reach $55.2B by 2027. | Question Mark (potential new offerings, uncertain market adoption) | Intense competition from established and new players; consumer preference shifts are rapid. |

| Experimental Products | N/A (product-specific) | Question Mark (nascent stage, unproven demand) | Performance data dictates future investment; requires strategic decision-making on scaling or phasing out. |

BCG Matrix Data Sources

Our Boston Beer BCG Matrix is built on a foundation of verified market intelligence, integrating financial statements, industry growth forecasts, and competitor analysis to provide strategic clarity.