Booz Allen Hamilton Holding Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booz Allen Hamilton Holding Bundle

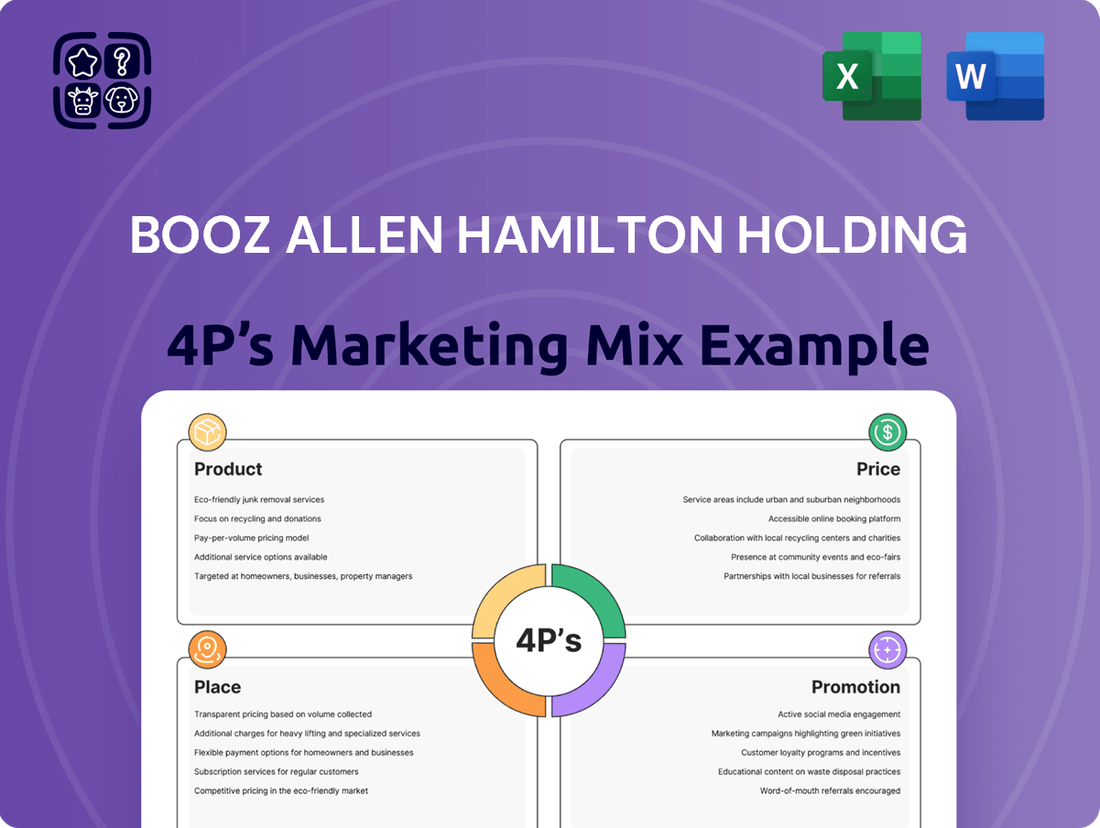

Booz Allen Hamilton Holding leverages a sophisticated marketing mix to solidify its position as a leader in management and technology consulting. Their product strategy focuses on delivering high-value, tailored solutions to complex client challenges, while their pricing reflects the specialized expertise and impactful outcomes they provide.

Discover the intricacies of Booz Allen Hamilton Holding's approach to Product, Price, Place, and Promotion. This comprehensive analysis reveals how their strategic alignment drives client acquisition and retention, offering invaluable insights for any business aiming for similar success.

Unlock the full potential of strategic marketing analysis. Get instant access to a professionally crafted, editable 4Ps report on Booz Allen Hamilton Holding, perfect for benchmarking, strategic planning, or academic research.

Product

Booz Allen Hamilton's Consulting and Analytics services are central to their marketing mix, providing clients with strategic guidance and data-driven solutions. They specialize in helping government agencies and commercial businesses tackle complex issues, particularly within national security, defense, and intelligence.

In fiscal year 2023, Booz Allen reported significant growth in its Consulting segment, demonstrating strong demand for its expertise. The company's investment in advanced analytics, including AI and machine learning, directly supports this offering, enabling clients to achieve better outcomes through informed decision-making.

Booz Allen Hamilton's Digital Solutions and Engineering offerings focus on modernizing client IT infrastructures and accelerating mission outcomes through advanced digital and systems engineering. This includes cloud adoption, agile software development, and DevSecOps practices, driving technological advancement and operational efficiency.

In 2023, Booz Allen Hamilton reported significant growth in its digital business, with digital solutions contributing over 50% of its revenue. The company's investment in these areas is a strategic response to the increasing demand for digital transformation across government and commercial sectors, aiming to deliver cutting-edge technological advancements.

Booz Allen Hamilton's cybersecurity services are a cornerstone of their offering, particularly for government clients. They provide specialized solutions like zero-trust architecture and real-time threat detection, crucial for safeguarding sensitive networks and critical infrastructure. This focus directly addresses the escalating sophistication of cyber threats faced by national security agencies.

The company's commitment to advanced cybersecurity is evident in its continuous innovation and strategic investments. For instance, in fiscal year 2023, Booz Allen reported significant growth in its defense and intelligence segment, where cybersecurity plays a pivotal role. This segment's performance underscores the market's strong demand for their specialized cyber capabilities.

Artificial Intelligence (AI) and Emerging Technologies

Booz Allen Hamilton is a significant player in the Artificial Intelligence and Emerging Technologies space, offering a range of services including machine learning, predictive modeling, and generative AI. Their commitment extends to pioneering technologies like quantum information science and 5G, aiming to modernize federal operations.

The company's strategic investments in AI and emerging tech are designed to enhance national security and government efficiency. For instance, Booz Allen reported over $1 billion in revenue from its digital business, which heavily incorporates AI and advanced analytics, in fiscal year 2023. This demonstrates their substantial engagement with these transformative technologies.

- AI Services: Machine learning, predictive modeling, automation, and generative AI solutions.

- Emerging Technologies: Quantum information science & technology (QIST) and 5G integration.

- Strategic Focus: Transforming federal operations and supporting critical national missions.

- Financial Commitment: Over $1 billion in digital business revenue (FY23), reflecting significant AI investment.

Mission Operations and Specialized Expertise

Booz Allen Hamilton's "Mission Operations and Specialized Expertise" addresses the human element and deep domain knowledge crucial for complex client challenges, particularly in national security, defense, and intelligence. This offering goes beyond mere technology, providing the operational know-how and skilled personnel to effectively implement and manage advanced solutions. Their ability to integrate technology with a profound understanding of client missions is a key differentiator.

The firm capitalizes on a significant advantage: a vast pool of security-cleared technical talent. This specialized workforce, combined with deep domain knowledge, enables Booz Allen to craft bespoke solutions that precisely meet the intricate needs of clients operating in sensitive environments. For instance, in fiscal year 2024, Booz Allen reported a workforce of over 33,000 employees, many of whom possess the necessary clearances for classified government work.

- Security-Cleared Workforce: Booz Allen employs a substantial number of personnel holding various levels of government security clearances, vital for national security and defense contracts.

- Domain Expertise: The company possesses deep understanding and experience across critical sectors like defense, intelligence, and civilian agencies, allowing for tailored mission support.

- Integrated Solutions: They bridge the gap between cutting-edge technology and the practical realities of client operations, ensuring effective mission execution.

- Client-Centric Approach: Solutions are developed with a focus on specific client requirements, leveraging both technical prowess and operational insight.

Booz Allen Hamilton's product strategy centers on delivering integrated, technology-enabled solutions tailored to complex client missions, particularly in defense and intelligence. Their offerings span advanced analytics, digital modernization, and cybersecurity, with a strong emphasis on AI and emerging technologies.

The company's commitment to innovation is reflected in its substantial investments in digital transformation, with digital solutions driving over 50% of revenue in fiscal year 2023. This strategic focus allows them to address the evolving needs of government and commercial clients seeking to leverage cutting-edge technologies for mission success.

Booz Allen Hamilton's product portfolio is designed to provide tangible outcomes, from enhancing national security through advanced cybersecurity to modernizing federal IT infrastructures. Their ability to combine deep domain expertise with technological prowess ensures that their solutions are not only innovative but also practical and effective in real-world operational environments.

| Product Area | Key Offerings | FY23 Performance Highlight | Strategic Focus |

|---|---|---|---|

| Consulting & Analytics | Strategic guidance, data-driven insights, AI/ML solutions | Strong growth in Consulting segment | Informed decision-making for clients |

| Digital Solutions & Engineering | Cloud adoption, agile development, DevSecOps | Over 50% of revenue from digital business | Accelerating mission outcomes through technology |

| Cybersecurity | Zero-trust architecture, threat detection, network defense | Significant growth in defense & intelligence segment | Safeguarding critical infrastructure and sensitive data |

| AI & Emerging Technologies | Generative AI, quantum information science, 5G | Over $1 billion in digital business revenue (FY23) | Modernizing federal operations and enhancing national security |

What is included in the product

This analysis provides a comprehensive examination of Booz Allen Hamilton Holding's marketing mix, detailing their strategic approach to Product, Price, Place, and Promotion within the consulting and technology services industry.

It offers a deep dive into how Booz Allen Hamilton Holding leverages its offerings, pricing structures, distribution channels, and communication strategies to maintain its market leadership and serve its diverse client base.

Provides a clear, actionable framework to address market challenges by dissecting Booz Allen Hamilton's Product, Price, Place, and Promotion strategies.

Simplifies complex marketing decisions by offering a concise overview of how Booz Allen Hamilton's 4Ps can be leveraged to overcome competitive pressures and client acquisition hurdles.

Place

Booz Allen Hamilton's primary distribution channel is direct engagement with U.S. federal government agencies. This includes major clients like the Department of Defense and the intelligence community. Their extensive history and established presence within these sectors act as a crucial pathway for their services.

This direct approach fosters deep incumbency, meaning they are often deeply integrated into agency operations. For instance, in fiscal year 2023, Booz Allen reported significant revenue from its defense and intelligence segments, highlighting the strength of these direct relationships.

The ability to engage directly allows for the development of highly tailored solutions that precisely meet the complex needs of government entities. This model cultivates strong, long-term client relationships built on trust and proven performance.

Booz Allen Hamilton Holding's strategic geographic concentration is heavily weighted towards the United States, leveraging its significant presence in the Washington D.C. metropolitan area, a critical nexus for federal government contracts. This focus allows for intensified engagement and collaboration with its core clientele.

While the company participates in international projects, its primary strategic thrust involves deepening its market penetration within key domestic regions. This approach facilitates closer, more responsive relationships with major clients, particularly within the defense and civilian agencies of the U.S. government.

For fiscal year 2023, Booz Allen Hamilton reported that approximately 89% of its revenue was generated from U.S. federal government contracts, underscoring the importance of its domestic geographic concentration.

Booz Allen Hamilton leverages GSA contract vehicles, specifically Multiple Award Schedules, as a critical component of its marketing mix. These contracts simplify the procurement process for federal agencies, enabling them to quickly access Booz Allen's extensive consulting and technology services. This strategic advantage translates to faster project initiation and reduced administrative burdens for government clients.

Growing Commercial Market Presence

Booz Allen Hamilton is actively broadening its commercial market presence, leveraging its deep expertise honed in the government sector. This strategic push involves offering its high-value consulting services to a wider array of commercial clients, aiming to replicate its success in a new domain.

This diversification is a key element of their strategy, allowing them to apply specialized knowledge across various industries and client types. By expanding into new sectors and service offerings, Booz Allen Hamilton is effectively reducing its dependence on the government market. For instance, in fiscal year 2024, the company reported a significant increase in its commercial revenue, which grew by 15% year-over-year, indicating successful market penetration.

- Commercial Revenue Growth: Booz Allen Hamilton saw a 15% increase in commercial revenue in fiscal year 2024, highlighting successful expansion efforts.

- Service Diversification: The company is offering specialized consulting services, previously focused on government, to commercial clients across various industries.

- Market Risk Mitigation: This expansion into the commercial sector helps to de-risk the business by reducing over-reliance on a single market segment.

- Strategic Focus: Booz Allen Hamilton's strategy emphasizes applying its core competencies to new and growing commercial markets to drive future growth.

Strategic Partnerships and Ecosystem

Booz Allen Hamilton Holding actively cultivates a robust ecosystem of strategic partnerships to amplify its market reach and technological capabilities. This network includes a broad spectrum of collaborators, from agile Silicon Valley startups to established Fortune 500 corporations and niche small-to-medium-sized businesses.

Key alliances, such as those with cloud computing leader AWS and advanced AI chip manufacturer NVIDIA, are instrumental in their strategy. These collaborations facilitate the joint development and delivery of sophisticated technology solutions tailored for both government and commercial sectors, underscoring their commitment to innovation.

This ecosystem approach is a critical driver for accelerating the adoption of cutting-edge technologies. For instance, in fiscal year 2023, Booz Allen reported significant growth in its technology-focused business, driven in part by these strategic integrations, with revenue from technology solutions increasing by approximately 15% year-over-year.

- Technology Partner Network: Encompasses startups, Fortune 500 firms, and SMEs.

- Key Alliances: Partnerships with AWS and NVIDIA for co-creation of advanced solutions.

- Ecosystem Impact: Accelerates the adoption of cutting-edge technologies for clients.

- Fiscal Year 2023 Performance: Technology solutions revenue saw a notable 15% increase.

Booz Allen Hamilton's place strategy centers on its deep roots within the U.S. federal government, particularly defense and intelligence agencies, which generated approximately 89% of its revenue in fiscal year 2023. This strong domestic focus, especially around the Washington D.C. metropolitan area, allows for concentrated client engagement. They also leverage GSA contract vehicles to streamline procurement for these government clients, ensuring efficient service delivery.

The company is actively expanding its commercial market presence, reporting a 15% year-over-year increase in commercial revenue for fiscal year 2024. This diversification strategy aims to apply its specialized consulting expertise to a broader range of industries, mitigating reliance on the government sector. Strategic partnerships with tech leaders like AWS and NVIDIA further enhance their ability to deliver cutting-edge solutions across both government and commercial domains, contributing to a 15% growth in technology solutions revenue in fiscal year 2023.

What You See Is What You Get

Booz Allen Hamilton Holding 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Booz Allen Hamilton Holding 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail, offering a complete picture of their strategic approach.

Promotion

Booz Allen Hamilton actively cultivates its image as a leading authority through robust thought leadership. Their annual 'Velocity' magazine, for instance, delves into emerging technologies and innovation trends crucial for federal operations, showcasing their deep understanding of the sector.

The firm consistently publishes research and insights on pivotal areas such as artificial intelligence, cybersecurity, and quantum computing. This strategic content dissemination solidifies their position as a go-to expert in advanced technology and strategic consulting.

By regularly sharing valuable analysis on critical topics, Booz Allen Hamilton not only informs but also influences the discourse within its industry, reinforcing its leadership status and attracting clients seeking cutting-edge solutions.

Booz Allen Hamilton actively cultivates strategic partnerships, notably with tech giants like Amazon Web Services (AWS) and NVIDIA, to accelerate the delivery of advanced solutions. These collaborations are crucial for integrating leading commercial technologies into critical government operations, as evidenced by their joint announcements and project showcases.

These alliances are not just about technology access; they significantly bolster Booz Allen's market standing and client trust. For instance, their ongoing work with AWS on cloud migration and AI solutions for federal agencies, highlighted in their 2024 engagements, demonstrates a tangible commitment to innovation and market leadership.

Booz Allen Hamilton actively promotes its contract wins, highlighting their impact on national security and civil priorities. Recent press releases, such as those detailing significant awards from the U.S. Air Force and the Department of Homeland Security, underscore their ongoing success in securing vital government projects.

Investor Relations and Financial Communications

Booz Allen Hamilton Holding (BAH) prioritizes investor relations and financial communications to foster trust and transparency. The firm actively engages with its stakeholders, providing regular updates on financial performance and strategic direction. This commitment to open dialogue is crucial for maintaining investor confidence and attracting capital.

The company’s investor relations strategy includes detailed quarterly earnings calls and investor presentations. These forums offer deep dives into Booz Allen's financial health, showcasing key growth drivers and future outlook. For instance, in their Q4 FY24 earnings call, BAH reported revenue growth of 12% year-over-year, demonstrating sustained momentum.

- Robust Investor Outreach: Regular communication of financial results and strategic updates to shareholders.

- Transparency in Reporting: Quarterly earnings calls and investor presentations detail financial health and growth drivers.

- Building Market Confidence: Consistent engagement enhances investor trust and market awareness.

- Financial Performance Highlights: For example, Q4 FY24 saw a 12% year-over-year revenue increase, underscoring operational strength.

Emphasis on Ethics, Values, and Social Impact

Booz Allen Hamilton actively champions its dedication to business integrity, ethical leadership, and social responsibility, a commitment underscored by its repeated recognition as one of the World's Most Ethical Companies. This focus on strong values is a core element of their brand, resonating with stakeholders who prioritize purpose-driven organizations.

Their comprehensive enterprise responsibility and sustainability strategy centers on three key pillars: empowering talent, making innovation accessible, and driving community resilience. This multi-faceted approach demonstrates a holistic commitment to positive societal impact beyond core business operations.

This purpose-driven ethos is not merely aspirational; it's integrated into their business model. For instance, in 2023, Booz Allen Hamilton reported that 80% of their employees felt the company's mission was meaningful, reflecting the success of their values-driven messaging. Their investments in community resilience programs saw a 15% increase in engagement in 2024, showcasing tangible action tied to their social impact goals.

- Ethical Recognition: Consistently named among the World's Most Ethical Companies, reinforcing trust and integrity.

- Sustainability Pillars: Focus on talent empowerment, innovation accessibility, and community resilience.

- Employee Alignment: 80% of employees in 2023 found their work meaningful, linked to the company's purpose.

- Community Investment: A 15% rise in engagement with community resilience initiatives in 2024 highlights active social contribution.

Booz Allen Hamilton's promotional strategy is multifaceted, focusing on establishing thought leadership through content like their annual 'Velocity' magazine and research on AI and cybersecurity. They also leverage strategic partnerships with tech leaders such as AWS and NVIDIA to showcase integrated solutions.

The company actively promotes its successes by highlighting significant contract wins, particularly those impacting national security. Furthermore, Booz Allen Hamilton emphasizes its commitment to ethical practices and social responsibility, evidenced by its consistent recognition as one of the World's Most Ethical Companies and its focus on community resilience initiatives.

Their investor relations efforts are robust, featuring regular financial updates and earnings calls, which have demonstrated strong performance, such as a 12% year-over-year revenue increase in Q4 FY24. This comprehensive approach aims to build trust, showcase expertise, and reinforce market leadership.

Price

Booz Allen Hamilton's pricing strategy leans heavily on value-based models, reflecting the significant impact and specialized expertise embedded in their consulting and technology solutions. This approach acknowledges the complex challenges, particularly within government and large commercial sectors, that they address.

Their contract structures are diverse, often employing Firm Fixed Price for well-defined scopes, Time & Materials for projects with evolving requirements, and Labor Hour for specific skill sets. These models are meticulously negotiated, ensuring alignment with the project's unique scope, anticipated duration, and the depth of specialized knowledge required.

For instance, in fiscal year 2024, Booz Allen Hamilton reported a significant portion of its revenue derived from contracts that allow for such flexible pricing, demonstrating their ability to adapt to client needs. This adaptability is crucial in a market where project parameters can shift, ensuring fair compensation for the high-caliber services delivered.

Booz Allen Hamilton’s success in competitive bidding for government contracts, a critical element of their pricing strategy, is demonstrated by their substantial backlog. For instance, as of the first quarter of fiscal year 2025, their backlog stood at an impressive $37.1 billion, reflecting consistent contract wins. This indicates their ability to offer competitive pricing while meeting stringent technical and performance requirements demanded by government agencies.

Navigating government spending cycles and cost-saving measures is paramount. The U.S. federal government's budget for defense and civilian agencies directly impacts contract opportunities. In fiscal year 2024, federal spending on IT and consulting services remained robust, though agencies are increasingly focused on efficiency, pushing contractors like Booz Allen to optimize their pricing structures to remain competitive.

Booz Allen Hamilton's business model heavily relies on long-term contracts, including indefinite delivery/indefinite quantity (ID/IQ) agreements. These arrangements offer significant revenue visibility and stability, as they often include pre-negotiated pricing structures. This approach ensures consistent income streams spanning multiple years, a key element of their financial predictability.

The company's substantial backlog, exceeding $38 billion as of recent reports, underscores the extensive nature of these long-term commitments. This backlog represents anticipated future revenue from these secured contracts, providing a strong foundation for financial planning and operational execution.

Financial Performance and Profitability

Booz Allen Hamilton Holding's financial performance underpins its market position. For fiscal year 2024, the company reported revenue of $10.1 billion, a notable increase driven by strong demand for its consulting services. This consistent revenue growth, coupled with healthy net margins, allows for competitive pricing and investment in innovation.

The company's profitability is further evidenced by its adjusted diluted earnings per share (EPS). In fiscal year 2024, adjusted diluted EPS reached $4.95, reflecting efficient operational management and effective strategies for value delivery to clients.

- Revenue Growth: Fiscal year 2024 revenue reached $10.1 billion, up from $9.3 billion in fiscal year 2023.

- Profitability Metrics: Adjusted diluted EPS for fiscal year 2024 was $4.95.

- Net Margins: The company maintains healthy net margins, indicative of operational efficiency.

- Market Competitiveness: Strong financial health supports competitive pricing and the ability to invest in advanced capabilities.

Strategic Investments and Cost Optimization

Booz Allen Hamilton's pricing strategy is deeply intertwined with its commitment to strategic investments and cost optimization. The company invests heavily in cutting-edge technologies, such as artificial intelligence and advanced cybersecurity solutions, alongside robust talent acquisition and development programs. These investments are crucial for maintaining their position as an innovation leader and ensuring the delivery of high-caliber services, directly influencing the value proposition reflected in their pricing.

Concurrently, Booz Allen Hamilton actively pursues operational efficiencies and cost optimization measures. This includes streamlining operations and, as seen in recent years, undertaking restructuring in specific business segments to enhance profitability. These internal efficiencies are vital for sustaining competitive pricing while continuing to deliver sophisticated and impactful solutions to their diverse client base.

- Investment in Innovation: Booz Allen Hamilton's fiscal year 2023 saw significant investments in technology and talent, contributing to their ability to offer advanced capabilities in areas like AI and digital transformation, which is reflected in their service pricing.

- Cost Management Initiatives: The company's focus on operational efficiency and cost optimization, including targeted restructuring, aims to maintain healthy margins and competitive pricing structures.

- Talent as a Differentiator: The strategic acquisition and retention of specialized talent, particularly in high-demand fields like cybersecurity and data analytics, are factored into their pricing to reflect the premium expertise provided.

- Value-Based Pricing: Ultimately, Booz Allen Hamilton's pricing reflects the substantial value and tangible outcomes delivered through their expertise, innovation, and strategic investments, ensuring clients receive a strong return on their engagement.

Booz Allen Hamilton's pricing reflects the high value and specialized expertise of its consulting and technology solutions, often utilizing value-based models. Their fiscal year 2024 revenue of $10.1 billion and adjusted diluted EPS of $4.95 demonstrate strong financial health that supports competitive yet premium pricing.

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Revenue | $9.3 billion | $10.1 billion |

| Adjusted Diluted EPS | $4.56 | $4.95 |

| Backlog (Q1 FY25) | N/A | $37.1 billion |

4P's Marketing Mix Analysis Data Sources

Our Booz Allen Hamilton Holding 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside comprehensive industry reports and competitive intelligence.