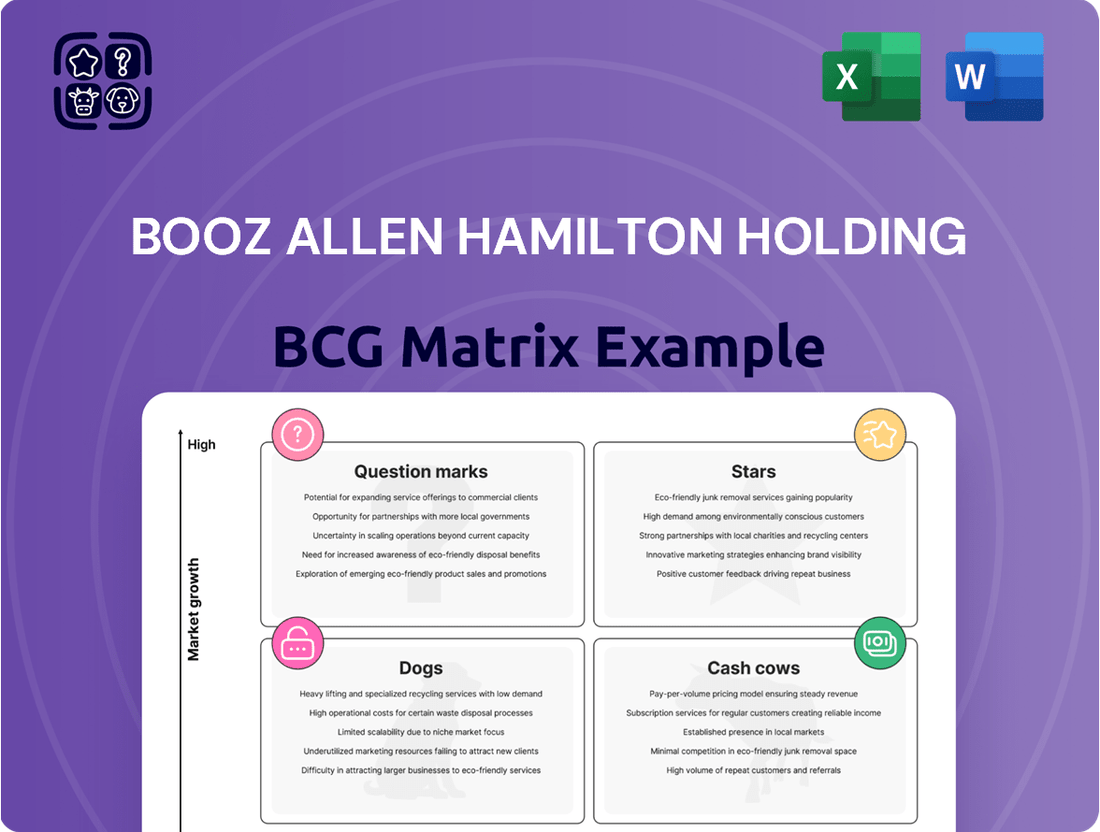

Booz Allen Hamilton Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booz Allen Hamilton Holding Bundle

Unlock the strategic potential of Booz Allen Hamilton's product portfolio with a glimpse into their BCG Matrix. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

Don't miss out on the critical insights needed to make informed investment and resource allocation decisions. Purchase the full BCG Matrix report to get a comprehensive breakdown of each quadrant, actionable recommendations, and a clear roadmap for optimizing Booz Allen Hamilton's market position.

Stars

Booz Allen Hamilton's cybersecurity solutions are a significant star in its business portfolio. The company is a dominant force in providing cybersecurity services to the U.S. federal government, with projected cyber revenue between $2.5 and $2.8 billion for fiscal year 2025. This segment accounts for nearly a quarter of Booz Allen's total anticipated revenue, highlighting its substantial market share in a critical and expanding sector.

With a robust team of over 8,000 cyber professionals engaged in nearly 300 ongoing projects, Booz Allen demonstrates a strong command of the cybersecurity market. Their strategic emphasis on advanced areas such as zero trust architecture and artificial intelligence for threat detection ensures they remain at the cutting edge of national security defense, solidifying their position as a leader.

Booz Allen Hamilton Holding is a leading player in the Artificial Intelligence (AI) for Government sector, positioning AI as a significant Star in its portfolio. The company's commitment is underscored by its status as the top provider of AI services to the U.S. government, with contract obligations surpassing $1.1 billion between fiscal years 2021 and 2023.

Further demonstrating this growth trajectory, Booz Allen's AI-related contract obligations saw an impressive year-over-year increase of over 30%, reaching approximately $800 million in fiscal year 2025. This expansion is strategically focused on key areas like Generative AI, Responsible AI, and Cyber AI, directly addressing the escalating investments and enterprise-wide adoption of AI by federal agencies.

Booz Allen Hamilton's defense business is a star performer, experiencing robust growth. In fiscal year 2024, this segment accelerated significantly, posting an impressive year-over-year increase of around 20%. This surge is directly linked to the company's strategic involvement in supporting geopolitical conflicts and modernizing existing defense systems.

The company is actively shaping future warfighting capabilities. A prime example of this is Booz Allen securing a substantial $2.6 billion SSMARTT task order, specifically aimed at Army modernization efforts. This highlights their critical role in advancing the military's technological edge.

This defense modernization and warfighting capabilities segment is characterized by enduring demand. Government investment in cutting-edge defense technologies remains consistently high, providing a strong foundation for continued expansion and success in this crucial sector.

Digital Transformation for National Security

Booz Allen Hamilton is a key player in enabling digital transformation for national security, focusing on secure, modern architectures. They facilitate the rapid integration of advanced technologies to boost mission effectiveness. In 2024, Booz Allen secured significant contracts, including a notable award from the U.S. Air Force for cloud computing services, underscoring their critical role in defense modernization.

- Secure Architectures: Booz Allen designs and implements secure digital frameworks to support the swift adoption of new technologies in defense and intelligence.

- Mission Enhancement: Their work involves modernizing legacy systems and integrating cutting-edge digital solutions to improve operational capabilities.

- Client Understanding: The company leverages its deep knowledge of national security requirements to manage complex technological transitions effectively.

- Market Position: Booz Allen's expertise in this high-demand sector solidifies its leading position, with their defense segment revenue showing consistent growth, reaching approximately $4.5 billion in fiscal year 2023.

Advanced Analytics and Data Science

Booz Allen Hamilton Holding's Advanced Analytics and Data Science segment is a significant driver of its growth, leveraging deep expertise in data science, engineering, and visualization to serve government clients. This segment is crucial for addressing complex challenges through the application of artificial intelligence and advanced analytical techniques.

The company actively partners with agencies like the CDC to build robust data analytics environments, demonstrating its practical application of these capabilities. In 2024, Booz Allen continued to emphasize its role in enabling data-driven decision-making across federal agencies, a trend that is only expected to accelerate.

- Market Position: Booz Allen is recognized for its market leadership in advanced analytics for government clients.

- Key Offerings: This includes AI application, data engineering, and advanced visualization services.

- Client Partnerships: Collaborations with agencies like the CDC highlight practical implementation of analytics solutions.

- Demand Drivers: The increasing need for data-driven decision-making across the federal sector fuels sustained high demand for these services.

Booz Allen Hamilton's cybersecurity and AI for Government segments are clear stars, demonstrating exceptional growth and market leadership. The defense business also shines, driven by modernization efforts and geopolitical demand. Advanced analytics further solidifies these star positions, with strong client partnerships and a focus on data-driven solutions.

| Business Segment | FY24 Growth (Approx.) | FY25 Projected Revenue (Cyber) | AI Contract Obligations (FY21-23) |

|---|---|---|---|

| Cybersecurity | N/A | $2.5B - $2.8B | N/A |

| AI for Government | N/A | N/A | >$1.1B |

| Defense | ~20% | N/A | N/A |

| Advanced Analytics | N/A | N/A | N/A |

What is included in the product

This BCG Matrix overview provides strategic insights for Booz Allen Hamilton's portfolio, highlighting units for investment, divestment, or maintenance.

A clear, visual BCG Matrix analysis helps leadership quickly identify and address underperforming business units.

This tool simplifies complex portfolio management, offering actionable insights for strategic resource allocation.

Cash Cows

Booz Allen Hamilton's core government consulting services represent a significant cash cow for the company. With a remarkable 98% of its 2024 revenue stemming from federal contracts, this segment showcases deep incumbency and established relationships within the U.S. government landscape.

This high reliance on government work, within a mature but stable market, ensures a predictable and consistent revenue stream. The firm's proven ability to secure and execute long-term contracts solidifies its position as a reliable generator of cash, benefiting from consistent demand and a strong market share.

Booz Allen Hamilton's legacy IT systems modernization efforts are a prime example of a cash cow business. The company secured a significant 7-year, $419 million contract with the National Science Foundation, highlighting its deep involvement in updating and maintaining crucial federal IT infrastructure.

While the IT modernization market might not experience explosive growth, the constant requirement to maintain and upgrade existing critical systems ensures a reliable and predictable revenue stream. This steady demand provides a stable foundation for consistent cash flow.

Booz Allen's sustained presence and expertise in these long-standing IT modernization projects give it a durable competitive advantage. This positions the company to generate consistent cash generation over the long term.

Booz Allen Hamilton's Intelligence Sector Support is a classic Cash Cow within its BCG Matrix. This segment accounted for 17% of the company's revenue in 2024, highlighting its significant contribution.

While the intelligence sector might not see the explosive growth of newer technologies, it offers consistent, high-value contracts. This stability stems from the continuous and essential nature of intelligence operations, providing a reliable revenue stream for Booz Allen.

The company's established expertise and the stringent security clearances required for this work create formidable barriers to entry for competitors. This entrenched position solidifies the Intelligence Sector Support as a mature, profitable, and dependable business for Booz Allen.

Human Capital and Strategic Operations Consulting

Booz Allen Hamilton's Human Capital and Strategic Operations Consulting services function as cash cows within their BCG matrix. These offerings are a cornerstone of their business, addressing fundamental client needs, particularly within the government sector, a market Booz Allen has served for decades. The firm's deep expertise and established methodologies in these areas ensure a steady revenue stream and healthy profitability, even if they aren't the most cutting-edge technological solutions.

The company’s long-standing presence means they possess deeply ingrained client relationships and a strong brand reputation, fostering consistent demand. For instance, in fiscal year 2023, Booz Allen reported significant revenue from its consulting services, highlighting the enduring strength of these foundational offerings. This consistent performance allows the company to generate substantial cash flow, which can then be reinvested into more dynamic growth areas.

- Mature Market Dominance: Booz Allen leverages its extensive history and established frameworks in human capital and strategic operations consulting, ensuring a stable and predictable demand from clients seeking efficiency improvements.

- Consistent Revenue Generation: These services, while not always technology-focused, represent a core competency that consistently contributes to Booz Allen's top-line revenue, underpinning its financial stability.

- Robust Profit Margins: The firm's established reputation and expertise in these foundational areas allow for strong profit margins, making them reliable cash cows that support broader business investments.

- Foundation for Growth: The consistent cash flow generated by these services provides the financial flexibility to invest in and develop newer, potentially higher-growth areas of the business.

Established Defense Programs and Engineering Services

Booz Allen Hamilton's established defense programs and engineering services, particularly in C4ISR, are key drivers of its stable revenue. These long-term engagements, often involving ongoing support and upgrades, represent a mature market where the company holds a strong, established position.

In fiscal year 2024, Booz Allen reported significant revenue from its defense sector, underscoring the reliability of these established programs. The company's deep expertise and long-standing relationships within these areas provide a predictable and substantial income stream.

- Defense Sector Contribution: Booz Allen's defense segment consistently forms a large portion of its overall revenue, demonstrating the stability of its established programs.

- Engineering Services: Specialized engineering services for defense clients, including maintenance and incremental upgrades, ensure a steady demand and revenue flow.

- Market Maturity: The nature of these programs aligns with a mature market, characterized by sustained support rather than rapid technological shifts, benefiting Booz Allen's predictable revenue model.

- Revenue Stability: The company's entrenched position and specialized talent in these defense areas contribute to a consistent and reliable generation of income.

Booz Allen Hamilton's core government consulting services, particularly in areas like IT modernization and intelligence sector support, function as significant cash cows. These segments benefit from long-term contracts and deep incumbency, ensuring a predictable and stable revenue stream. For instance, 98% of its 2024 revenue came from federal contracts, highlighting this strong foundation.

The company's established defense programs and engineering services also represent mature markets where Booz Allen holds a strong position. These long-term engagements, such as C4ISR support, provide a consistent and substantial income. In fiscal year 2024, the defense sector was a major revenue contributor, underscoring the reliability of these established programs.

Human Capital and Strategic Operations Consulting are further examples of cash cows, addressing fundamental client needs with established methodologies. The firm's deep expertise and strong client relationships in these areas foster consistent demand, contributing to healthy profit margins and providing financial flexibility for investments in growth areas.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Core Government Consulting (IT Modernization, Intelligence Support) | Cash Cow | Long-term contracts, deep incumbency, stable demand, high barriers to entry | Significant portion of total revenue (e.g., 98% from federal contracts) |

| Defense Programs & Engineering Services (C4ISR) | Cash Cow | Mature market, established position, ongoing support and upgrades, predictable income | Major contributor to overall revenue |

| Human Capital & Strategic Operations Consulting | Cash Cow | Fundamental client needs, established methodologies, strong client relationships, consistent demand | Cornerstone of business, steady revenue stream |

Preview = Final Product

Booz Allen Hamilton Holding BCG Matrix

The Booz Allen Hamilton Holding BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic tool. You can confidently use this preview to understand the depth of analysis and presentation quality contained within the complete report, which will be immediately accessible after your transaction. This ensures transparency and guarantees that the purchased document is precisely what you've evaluated, allowing for immediate application in your business planning.

Dogs

Booz Allen Hamilton's global commercial cyber consulting segment experienced a notable 22% revenue decline in the third quarter of fiscal year 2024. This downturn was attributed to strategic divestitures and a softening market, positioning this business unit in a less advantageous spot within the BCG matrix.

The company's commercial cyber offerings, while still present, demonstrate a lower market share and operate within a slower growth trajectory when contrasted with their dominant federal cyber business. This suggests the commercial cyber consulting arm likely falls into the 'Dog' category, characterized by low growth and low market share.

Booz Allen's strategic reallocation of resources and focus towards the more lucrative federal sector, which boasts higher growth and market share, further solidifies the assessment of their global commercial cyber consulting as a 'Dog' in their portfolio.

Booz Allen Hamilton Holding has strategically divested certain business units, a move that directly impacted its global commercial sector revenue. This action is consistent with the BCG matrix philosophy of divesting 'Dogs' – those business units with low market share and low growth potential. For instance, in fiscal year 2023, Booz Allen reported a decrease in its commercial revenue, partly attributed to these portfolio adjustments.

Non-Strategic Legacy IT Projects, in the context of Booz Allen Hamilton's strategic portfolio, represent engagements that, while perhaps once vital, now offer limited future growth or competitive advantage. These could be older IT modernization efforts with low margins, consuming valuable resources that could be better allocated to more dynamic, high-impact initiatives. For instance, if a significant portion of Booz Allen's IT modernization revenue in 2024 came from maintaining outdated systems rather than developing cutting-edge solutions, these legacy projects would be candidates for the question mark quadrant.

Commoditized IT Support Services

Commoditized IT support services represent a category where Booz Allen Hamilton Holding would likely be positioned as a 'Dog' in the BCG matrix. These are areas of IT support that have become highly standardized, leading to limited opportunities for differentiation and fierce competition based primarily on price. For instance, basic help desk functions or routine hardware maintenance fall into this segment. While Booz Allen's overall strategy focuses on high-value, specialized solutions, any residual presence in these lower-margin, less innovative IT support areas would be considered a Dog.

These commoditized services typically exhibit low growth prospects and a low relative market share for Booz Allen unless they are strategically bundled with more advanced, differentiated offerings. The firm’s stated commitment to areas like artificial intelligence, cyber, and digital transformation underscores a deliberate pivot away from purely commoditized IT support. In 2023, Booz Allen reported significant growth in its technology and engineering segments, indicating a strategic de-emphasis on lower-value IT services.

- Low Market Growth: The market for basic IT support is mature and offers limited expansion potential.

- Low Relative Market Share: Booz Allen's competitive advantage is diminished in highly commoditized IT support areas.

- Strategic Focus Shift: The company prioritizes higher-margin, specialized technology and consulting services.

- Example: Basic IT help desk operations or standard network maintenance are examples of commoditized services.

Underperforming Civil Business Segments

Booz Allen Hamilton's civil business experienced headwinds in Q1 FY26, marked by a sluggish government procurement landscape and widespread cost-saving initiatives. This led the company to undertake proactive restructuring efforts within this sector.

Certain segments within Booz Allen's civil business, characterized by a low market share or diminishing demand, are likely candidates for strategic review. These areas, if demonstrating poor performance, could be classified as Dogs in a BCG matrix context, necessitating restructuring or potential divestment to optimize resource allocation.

- Civil Sector Challenges: Q1 FY26 saw Booz Allen's civil business grappling with a weak government procurement environment and cost-saving measures.

- Restructuring Initiatives: Proactive restructuring was implemented to address these growth challenges within the civil sector.

- Underperforming Segments: Specific civil business segments with low market share or declining demand are identified as potential Dogs.

- Strategic Actions: These underperforming segments may require restructuring or consideration for exit to improve overall portfolio performance.

Booz Allen Hamilton's global commercial cyber consulting segment, experiencing a 22% revenue decline in Q3 FY24 due to divestitures and market softening, likely represents a 'Dog' in their BCG matrix. This unit exhibits low market share and slower growth compared to their dominant federal cyber business, indicating a strategic pivot towards higher-growth federal opportunities.

Commoditized IT support services also fall into the 'Dog' category for Booz Allen, characterized by standardization and price-based competition. The firm's focus on AI, cyber, and digital transformation underscores a deliberate move away from these lower-margin, less innovative IT areas, as evidenced by significant growth in technology and engineering segments in 2023.

Within Booz Allen's civil business, segments with low market share or diminishing demand, exacerbated by a sluggish government procurement landscape in Q1 FY26, are also considered 'Dogs'. These areas are undergoing restructuring or potential divestment to optimize resource allocation and improve overall portfolio performance.

Booz Allen Hamilton's strategic divestitures, such as those impacting its commercial sector revenue in FY23, align with the BCG matrix approach of shedding 'Dog' units. This proactive portfolio management aims to enhance the company's overall competitive position and financial returns.

Question Marks

Booz Allen Hamilton is strategically investing in agentic AI, a frontier in artificial intelligence where systems can autonomously pursue goals. This focus aligns with their commitment to high-growth technology sectors, aiming to position themselves at the forefront of this evolving market.

While the potential market for agentic AI is substantial, the current market share for these advanced applications is still in its nascent stages of development. Booz Allen's substantial resource allocation reflects a long-term vision to establish a dominant presence in this emerging field, anticipating significant future demand and technological advancements.

Booz Allen Hamilton is positioning its quantum computing solutions as a future Star within its BCG matrix. The company is making substantial investments in this high-growth, emerging technology sector, both internally and through strategic ventures like SEEQC. This focus acknowledges quantum computing's potential to revolutionize defense and critical infrastructure sectors.

While Booz Allen is actively building its capabilities in quantum computing, it has not yet achieved a dominant market share. Significant capital expenditure is necessary to move this technology from its current experimental phase to a market-leading position. The company's commitment signals a strategic bet on quantum's long-term disruptive power.

Booz Allen Hamilton is strategically focusing on space missions and digital battlespace technologies, recognizing them as significant growth avenues. These sectors are experiencing rapid expansion due to evolving national security requirements, with market share for new offerings still being defined.

The company's commitment is underscored by its recent acquisition of PAR Government Systems Corp., a move specifically targeting the digital battlespace technologies segment. This acquisition, completed in 2024, signals Booz Allen's intent to bolster its capabilities and market presence in this critical area.

Post-Quantum Cryptography

Booz Allen Hamilton is actively developing post-quantum cryptography solutions, recognizing the significant threat that quantum computers pose to current encryption standards. This strategic focus aligns with the company’s role in the BCG Matrix, likely positioning it within the Stars or Question Marks category due to the high-growth potential and nascent market adoption.

The company is prototyping quantum-resistant technologies specifically for defense and critical infrastructure sectors. This forward-looking investment acknowledges that while the market is still in its early stages, the demand for future-proof security is inevitable. Booz Allen’s commitment here is a clear bet on the evolving landscape of cybersecurity needs.

- Market Growth: The global post-quantum cryptography market is projected to grow significantly, with some estimates suggesting it could reach billions of dollars by the late 2020s. For instance, reports from 2024 indicate a compound annual growth rate (CAGR) exceeding 25%.

- Early Adoption: Despite the high growth potential, widespread adoption is still in its infancy. Many organizations are in the testing and pilot phases, awaiting standardization and clearer implementation roadmaps.

- Investment Rationale: Booz Allen’s investment is driven by the anticipation of future security mandates and the need for robust encryption against advanced computational threats, positioning them to capture market share as the sector matures.

- Strategic Positioning: This initiative places Booz Allen at the forefront of a critical technological shift, aiming to establish a dominant position in a market where competitive advantages are still being defined.

New Venture Capital Investments

Booz Allen Hamilton Holding has strategically increased its venture capital commitment to $300 million, signaling a significant push to bolster its influence and capabilities within the venture capital ecosystem. This substantial investment is aimed at fostering innovation and securing early-stage access to cutting-edge technologies and disruptive business models.

Investments in promising startups such as Corsha, a cybersecurity firm, and ConductorAI, focused on generative AI solutions, exemplify Booz Allen's targeted approach. These ventures are chosen for their high growth potential and their alignment with emerging technological trends that could reshape industries.

While these new ventures represent exciting opportunities, their ultimate market success and the extent of their future market share remain uncertain. This inherent unpredictability places them squarely in the 'Question Marks' category of the BCG matrix, requiring careful monitoring and strategic decision-making regarding further investment or divestment.

- Increased VC Commitment: Booz Allen's venture capital allocation has risen to $300 million.

- Targeted Startups: Investments include Corsha (cybersecurity) and ConductorAI (generative AI).

- BCG Classification: These high-potential but uncertain ventures are classified as Question Marks.

- Strategic Importance: These investments aim to enhance capabilities and influence in emerging tech sectors.

Booz Allen Hamilton's investments in emerging technologies like agentic AI, quantum computing, and post-quantum cryptography, along with its venture capital activities, place many of these initiatives within the Question Marks category of the BCG matrix. These are areas with high growth potential but currently low market share and uncertain future outcomes, necessitating careful strategic evaluation.

The company's $300 million venture capital commitment, including stakes in cybersecurity firm Corsha and generative AI specialist ConductorAI, exemplifies this strategy. These ventures, while promising, are in early stages, making their market penetration and eventual dominance speculative, thus fitting the Question Mark profile.

Similarly, the nascent markets for agentic AI and quantum computing, despite significant investment and anticipated future demand, represent areas where Booz Allen is building capabilities but has yet to establish a dominant market share. This aligns with the characteristics of Question Marks, requiring ongoing assessment of their trajectory towards becoming Stars.

| Initiative | BCG Category | Rationale |

| Agentic AI | Question Mark | High growth potential, nascent market share, significant investment in future capabilities. |

| Quantum Computing | Question Mark | Emerging technology with transformative potential, requiring substantial capital for market leadership, currently low market share. |

| Post-Quantum Cryptography | Question Mark | High growth projected due to security threats, but adoption is early stage; Booz Allen is building capabilities for future mandates. |

| Venture Capital Investments (e.g., Corsha, ConductorAI) | Question Mark | High potential startups with uncertain market success and future market share; strategic bets on emerging tech trends. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.