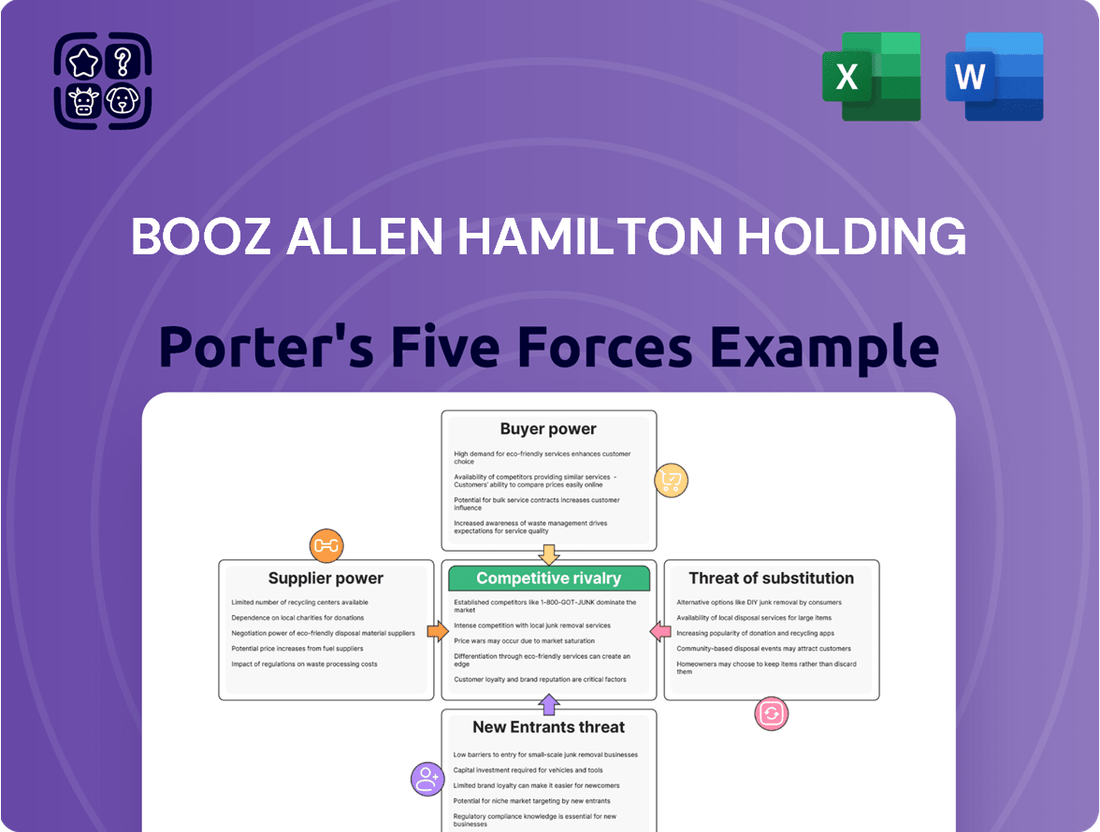

Booz Allen Hamilton Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booz Allen Hamilton Holding Bundle

Booz Allen Hamilton Holding operates within a complex consulting landscape, where the threat of new entrants is moderate due to high barriers like reputation and established client relationships, while buyer power is significant given the specialized nature of their services.

The complete report reveals the real forces shaping Booz Allen Hamilton Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers for Booz Allen Hamilton are its highly skilled employees, especially those with security clearances and expertise in AI, cybersecurity, and national security. The scarcity of this specialized talent, particularly in emerging tech fields, gives these workers considerable bargaining power.

This power directly influences Booz Allen's compensation and retention strategies, as the demand for these skills within government contracting is exceptionally high. For instance, in 2024, the cybersecurity talent gap remained a significant concern across industries, with reports indicating millions of unfilled positions globally.

Consequently, Booz Allen must offer competitive salaries and a strong work environment to attract and keep the best minds. The company's investment in talent development and its ability to secure clearances are critical factors in mitigating this supplier power.

Booz Allen Hamilton Holding's reliance on technology and software vendors, particularly for advanced AI, cloud, and cybersecurity solutions, presents a significant factor in supplier bargaining power. The critical nature of these specialized offerings, coupled with potentially high switching costs for integrated platforms, allows key vendors to exert considerable influence. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the demand and value of these foundational technologies.

Booz Allen Hamilton's reliance on specialized data and analytics providers can grant these suppliers significant bargaining power. If Booz Allen needs proprietary datasets or advanced analytical software that few others offer, these providers can command higher prices or dictate terms. For instance, in 2024, the global big data and analytics market was valued at over $270 billion, indicating a robust demand for such services, which can embolden key suppliers.

Subcontractors and Partners

Booz Allen Hamilton Holding relies on a diverse ecosystem of subcontractors and strategic partners, often smaller, specialized firms, to deliver on its complex government and commercial contracts. This network is crucial for accessing niche expertise and meeting set-aside requirements, as seen in the US federal contracting landscape where small businesses play a significant role. For instance, in fiscal year 2023, the U.S. government awarded approximately $150 billion in prime contracts to small businesses, highlighting their importance.

The bargaining power of these subcontractors and partners stems from their specialized knowledge or certifications that are difficult to replicate. When Booz Allen requires highly specific technical skills or access to particular government programs that favor small or disadvantaged businesses, these entities can exert influence over pricing and delivery schedules. This is particularly true for subcontractors holding critical security clearances or possessing proprietary technology essential for contract performance.

- Specialized Expertise: Subcontractors with unique, hard-to-find technical skills or certifications can command higher prices.

- Government Mandates: Requirements for utilizing small or disadvantaged businesses can increase the bargaining power of eligible partners.

- Dependency: Booz Allen's reliance on specific partners for critical contract components can shift negotiation leverage.

- Market Concentration: A limited pool of qualified subcontractors for a particular service strengthens their position.

Research and Development Institutions

Research and development institutions, particularly those at the forefront of innovation, can exert significant bargaining power over Booz Allen Hamilton. This power is amplified when Booz Allen needs to license or acquire novel technologies or intellectual property to enhance its service offerings, especially in rapidly evolving fields like artificial intelligence.

Booz Allen's strategic emphasis on integrating advanced technologies means that specialized R&D partners, such as leading universities or private research labs, hold leverage. For instance, if a university's computer science department develops a breakthrough in AI-driven analytics, they can command favorable terms for licensing that technology to consulting firms like Booz Allen.

The bargaining power of these R&D suppliers is further underscored by the competitive landscape for cutting-edge research. Booz Allen competes with other major players in the defense, technology, and consulting sectors for access to these innovations. In 2024, the demand for AI talent and proprietary algorithms remained exceptionally high, driving up the cost and exclusivity of such research outputs.

- High Demand for AI Expertise: The global market for AI services was projected to reach over $200 billion in 2024, intensifying competition for specialized R&D.

- Intellectual Property Value: Patents and proprietary research from leading institutions represent valuable assets that can significantly differentiate consulting services.

- Strategic Partnerships: Booz Allen often forms deep collaborations with academic institutions, granting these suppliers considerable influence over the terms of engagement and technology transfer.

Booz Allen Hamilton Holding's bargaining power of suppliers is significantly influenced by its reliance on highly skilled personnel, particularly those with security clearances and expertise in AI, cybersecurity, and national security. The scarcity of this specialized talent, especially in emerging tech fields, grants these workers considerable leverage over compensation and retention strategies. For example, in 2024, the cybersecurity talent gap continued to be a major issue across industries, with millions of unfilled positions globally, directly impacting Booz Allen's need to offer competitive packages.

The company also depends on technology and software vendors for advanced AI, cloud, and cybersecurity solutions. The critical nature of these offerings and potentially high switching costs for integrated platforms empower key vendors. The global AI market's projected growth to over $200 billion in 2024 underscores the value and demand for these foundational technologies, giving suppliers significant influence.

Furthermore, specialized data and analytics providers can hold substantial bargaining power if Booz Allen requires proprietary datasets or advanced analytical software that few others offer. The robust demand in the over $270 billion big data and analytics market in 2024 emboldens these key suppliers to dictate terms or command higher prices.

Booz Allen's subcontractor network, often comprised of smaller, specialized firms crucial for accessing niche expertise and meeting government set-aside requirements, also represents a significant supplier group. In fiscal year 2023, U.S. government prime contracts awarded to small businesses totaled approximately $150 billion, highlighting their importance and potential leverage.

| Supplier Type | Key Leverage Factors | Impact on Booz Allen | 2024 Market Context |

| Skilled Personnel (AI, Cyber, National Security) | Scarcity of specialized talent, high demand | Increased compensation and retention costs | Millions of unfilled cybersecurity positions globally |

| Technology & Software Vendors (AI, Cloud, Cyber) | Critical nature of offerings, high switching costs | Potential for higher pricing and dictated terms | Global AI market projected over $200 billion |

| Data & Analytics Providers | Proprietary datasets, unique analytical software | Higher pricing, dictated terms | Global big data & analytics market over $270 billion |

| Subcontractors & Small Businesses | Niche expertise, government program access | Influence on pricing and delivery schedules | ~$150 billion in US federal prime contracts to small businesses (FY23) |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Booz Allen Hamilton Holding, while also evaluating control held by suppliers and buyers and their influence on pricing and profitability.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Booz Allen Hamilton's reliance on U.S. government agencies for nearly all of its revenue, around 98%, grants these entities immense bargaining power. As a dominant buyer, the government can dictate terms and conditions, significantly influencing Booz Allen's profitability and contract structures.

Booz Allen Hamilton, like many government contractors, faces significant pressure from U.S. government budgetary constraints. Agencies are actively seeking ways to reduce spending, which translates into a heightened demand for cost-efficiency and demonstrable results from consulting firms. This environment forces companies like Booz Allen to offer more competitive pricing and focus on delivering tangible outcomes to secure and retain contracts.

Government procurement regulations and policies significantly shape the bargaining power of customers, particularly for firms like Booz Allen Hamilton. For instance, evolving policies emphasizing small business set-asides can directly impact contract opportunities for larger prime contractors, forcing them to collaborate or cede portions of work. In 2024, the U.S. government continued to prioritize small business participation in federal contracting, with agencies striving to meet congressionally mandated goals.

These regulations often dictate specific certifications, compliance standards, and contractual terms, granting the government considerable leverage. For example, new cybersecurity compliance standards, such as those mandated by the Cybersecurity Maturity Model Certification (CMMC) program, require extensive investment and adherence, giving government agencies the ability to select vendors that meet these stringent requirements. This empowers the government as a buyer by setting clear operational and security benchmarks.

Internal Capabilities and Insourcing

Government agencies increasingly build internal capacity for tasks previously outsourced. For instance, in 2024, the US federal government continued initiatives to bolster in-house cybersecurity expertise, potentially reducing reliance on external IT consulting firms for certain projects. This trend directly impacts firms like Booz Allen Hamilton Holding by creating a more competitive landscape where clients can leverage their own resources.

The insourcing of routine or standardized services by government clients directly translates to diminished demand for external consulting. This shift empowers customers, as they have more options and can negotiate from a stronger position. For example, if a government department can handle its own data analytics for routine reporting, it lessens the need for a consultant, thereby increasing the client's bargaining power.

- Insourcing Trend: Government agencies are expanding internal capabilities, particularly in areas like data analytics and IT support.

- Reduced Reliance: This expansion lessens the dependency on external consulting firms for specific, often recurring, tasks.

- Impact on Demand: A decrease in the need for specialized external services directly affects the revenue streams of consulting companies.

- Increased Client Power: When clients can perform tasks internally, their ability to negotiate terms and pricing with external providers is significantly enhanced.

Switching Costs (Low for Customer, High for Booz Allen)

While government agencies might encounter some administrative hurdles when switching to a new contractor, these are often secondary to the pursuit of better cost-efficiency or enhanced performance. In 2023, Booz Allen Hamilton reported revenue of $9.3 billion, highlighting the significant scale of their operations and the potential impact of losing even a few key contracts.

For a firm like Booz Allen, the departure of a substantial government client can significantly disrupt its revenue streams and future project pipeline, often referred to as its backlog. This reality underscores why customer retention is a paramount concern for the company, as demonstrated by their consistent focus on client satisfaction and contract renewal rates.

- Customer Switching Costs: Generally low for government agencies, primarily administrative.

- Booz Allen's Vulnerability: High impact of contract loss on revenue and backlog.

- 2023 Revenue: $9.3 billion for Booz Allen Hamilton, indicating the stakes involved.

- Strategic Imperative: Customer retention is a critical priority for Booz Allen.

The U.S. government's substantial reliance on Booz Allen Hamilton Holding, accounting for approximately 98% of its revenue, positions it as a dominant buyer with immense bargaining power. This allows the government to dictate terms, influence pricing, and demand cost-efficiency, as seen in 2024 with continued budgetary constraints pushing for greater value. The insourcing trend, where agencies build internal capacity for tasks like data analytics, further amplifies this power by reducing reliance on external consultants and enhancing negotiation leverage.

| Customer | Revenue Share (Approx.) | Key Bargaining Factors | 2024 Trend Impact |

|---|---|---|---|

| U.S. Government | 98% | Budgetary Constraints, Procurement Regulations, Insourcing Initiatives | Increased Demand for Cost-Efficiency, Reduced Reliance on External Services |

Same Document Delivered

Booz Allen Hamilton Holding Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces Analysis for Booz Allen Hamilton Holding, detailing the competitive landscape and strategic implications within the consulting industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, offering no placeholders or sample content. This allows you to gain immediate insight into the forces shaping Booz Allen Hamilton's market position and competitive advantage.

Rivalry Among Competitors

The management and technology consulting landscape, especially within the government sector, presents a dual nature: it's quite fragmented with numerous participants, yet it's also experiencing a notable trend of consolidation via mergers and acquisitions.

This evolving market structure means Booz Allen Hamilton contends with a broad spectrum of competitors, ranging from expansive, multi-faceted consulting giants to niche, specialized boutique firms.

For instance, the U.S. federal government consulting market alone was valued at approximately $150 billion in 2023, showcasing the sheer scale and the multitude of entities vying for contracts.

This ongoing consolidation, driven by firms seeking to expand capabilities or market share, intensifies competitive pressures as the industry matures.

Booz Allen Hamilton operates in a highly competitive arena, facing rivals ranging from large defense contractors like Lockheed Martin and Northrop Grumman, which possess their own consulting capabilities, to specialized government consulting firms and major commercial consulting players such as Accenture and Deloitte that also target public sector contracts. This multifaceted competition demands constant adaptation and a clear value proposition.

The intense competition in high-growth sectors like AI and cybersecurity significantly fuels rivalry. Many companies are aggressively pursuing contracts in these profitable markets, increasing the pressure on established players like Booz Allen Hamilton.

Booz Allen Hamilton's established leadership in AI and cybersecurity, particularly its role as a key provider to the U.S. government, offers a distinct competitive edge. For instance, in fiscal year 2023, the company reported significant revenue growth in its defense and intelligence segments, which heavily leverage these technologies.

To maintain its advantage, Booz Allen must consistently invest in research and development and foster innovation. This ongoing commitment is crucial to staying ahead of emerging threats and technological advancements in these rapidly evolving fields.

Price Sensitivity and Value Proposition

Government clients, particularly within the defense and civilian sectors, often operate under strict budgetary controls, making price sensitivity a persistent challenge for Booz Allen Hamilton. This means that while expertise is crucial, the ability to deliver that expertise cost-effectively is paramount in securing new business and retaining existing contracts. For instance, in fiscal year 2023, federal agencies continued to scrutinize spending, leading to competitive bidding processes where price often played a significant role in contract awards.

Booz Allen's strategy to counter this involves articulating a robust value proposition that extends far beyond the initial price tag. They emphasize their proven track record of delivering complex solutions, their deep domain knowledge across various government functions, and their commitment to achieving measurable, impactful outcomes for their clients. This focus on tangible results helps justify their pricing by highlighting the long-term benefits and return on investment for the government.

- Federal Budgetary Constraints: Government agencies consistently face pressure to optimize spending, directly impacting contract negotiations and pricing expectations.

- Emphasis on Cost-Efficiency: A core requirement for winning government contracts involves demonstrating a clear path to cost savings or efficient resource utilization.

- Value Proposition Differentiation: Booz Allen Hamilton leverages its extensive experience, specialized expertise, and history of successful project delivery to stand out in competitive bids.

- Outcome-Based Solutions: The firm's ability to deliver measurable, impactful results is a key selling point that justifies its premium on price.

Talent Acquisition and Retention

The competition for highly skilled and cleared personnel in the government contracting sector is intense. Booz Allen Hamilton, like its peers, faces significant rivalry in attracting and retaining top talent, as human capital is a critical asset. This drives up labor costs and necessitates continuous investment in employee development and engagement.

In 2024, the demand for cybersecurity experts, data scientists, and AI specialists within government agencies remained exceptionally high. Booz Allen Hamilton's success hinges on its capacity to offer compelling career progression, competitive compensation packages, and a robust organizational culture. For instance, the company reported a significant increase in its workforce in recent years, underscoring the ongoing need to acquire and keep skilled professionals.

- Talent Scarcity: Key skill sets like advanced analytics and secure cloud migration are in short supply, intensifying competition.

- Retention Challenges: High demand means employees are frequently approached with competing offers, requiring proactive retention strategies.

- Compensation Wars: Firms often engage in bidding wars for specialized talent, impacting overall project profitability.

- Clearing Requirements: The rigorous and time-consuming security clearance process acts as both a barrier to entry and a retention factor.

Booz Allen Hamilton faces intense rivalry from a broad spectrum of competitors, including large defense contractors, specialized government consultancies, and major commercial players also targeting the public sector. This competition is particularly fierce in high-growth areas like AI and cybersecurity, where numerous firms aggressively pursue lucrative contracts.

The market's fragmentation, coupled with ongoing consolidation, means Booz Allen must constantly differentiate itself through innovation and a strong value proposition to secure and retain business.

SSubstitutes Threaten

Government agencies are increasingly building in-house capabilities, particularly in areas like IT modernization and data analytics. For instance, the U.S. Department of Defense's internal software development initiatives aim to reduce reliance on external contractors. This trend represents a direct substitute for consulting services that Booz Allen Hamilton provides, as agencies can choose to insource these functions.

The burgeoning freelance and gig economy, amplified by online platforms, presents a significant threat of substitution for traditional consulting services like those offered by Booz Allen Hamilton. These platforms enable clients to directly source specialized expertise for specific projects, bypassing the need for comprehensive, long-term engagements with established firms. This trend allows businesses to tap into a global talent pool, often at a more competitive price point.

In 2024, the global gig economy was projected to reach a substantial size, with some estimates suggesting it could account for a significant portion of the workforce. For instance, reports indicated that platforms like Upwork and Fiverr saw increased user activity, facilitating millions of freelance engagements. This accessibility to on-demand talent means clients can find niche skills without the overhead associated with hiring full-time consultants, directly impacting the demand for broader consulting packages.

The rise of sophisticated technology presents a significant threat of substitutes for Booz Allen Hamilton. Off-the-shelf software, advanced AI analytics, and automation platforms are increasingly capable of handling tasks previously requiring human consulting expertise. For instance, in 2024, the global market for AI in consulting services was projected to reach tens of billions of dollars, indicating a substantial availability of these technological substitutes.

Commercial Software and SaaS Offerings

The rise of commercial software and SaaS solutions presents a significant threat of substitutes for Booz Allen Hamilton. For many common government IT needs and business processes, agencies can now turn to readily available, often more cost-effective off-the-shelf or cloud-based software rather than engaging consulting firms for bespoke development or implementation services. This trend can diminish the demand for traditional IT consulting and systems integration work.

This shift is driven by several factors:

- Increased Affordability: Many SaaS solutions offer subscription-based pricing that can be more predictable and lower upfront than custom development projects. For instance, the global SaaS market was projected to reach over $300 billion in 2024, indicating widespread adoption and a growing range of available solutions.

- Faster Deployment: Commercial software and SaaS platforms can often be implemented much more quickly than custom-built solutions, allowing agencies to address urgent needs with less lead time.

- Scalability and Flexibility: Modern SaaS offerings are designed for scalability, allowing government agencies to adjust their usage based on demand without significant infrastructure changes, a feature that can be costly to replicate with custom solutions.

Non-Consulting Professional Services

Other professional service providers, like law firms, accounting firms, and engineering companies, are increasingly broadening their service portfolios. These firms might start offering strategic advisory or technical services that directly compete with Booz Allen Hamilton's core consulting business. For instance, a major accounting firm could launch a dedicated strategy consulting arm, directly challenging Booz Allen's market share in that segment.

This encroachment from adjacent industries represents a significant threat of substitutes for Booz Allen. As these established players leverage their existing client relationships and brand recognition, they can present a compelling alternative for clients seeking specialized consulting. The ability of these firms to offer integrated services, combining legal or accounting expertise with strategic advice, further enhances their substitutability.

For example, in 2024, many large accounting firms, such as Deloitte and PwC, continued to report substantial growth in their consulting divisions, with revenues from advisory services forming a significant portion of their overall earnings. This trend indicates a direct competitive pressure on traditional management and technology consulting firms like Booz Allen, as clients may opt for a single, broader service provider.

- Increased Competition: Adjacent professional service firms expanding into strategic advisory.

- Client Leverage: Established relationships and brand recognition of substitutes.

- Integrated Offerings: Combined legal/accounting and strategic advice as a substitute.

- Market Trends: Significant growth in consulting arms of major accounting firms in 2024.

The increasing capability of off-the-shelf software and advanced AI analytics presents a significant threat of substitution for Booz Allen Hamilton. These technologies can now perform tasks previously requiring human consultants, such as data analysis and process automation.

In 2024, the global market for AI in consulting services was projected to reach tens of billions of dollars, highlighting the growing availability and adoption of these technological substitutes. This trend allows clients to leverage AI-powered solutions directly, potentially reducing their reliance on external consulting expertise for specific functions.

The rise of commercial Software as a Service (SaaS) solutions also offers a compelling alternative. Many SaaS platforms provide cost-effective, readily deployable solutions for common business and government IT needs, bypassing the need for custom development or implementation services from consulting firms.

The global SaaS market was projected to exceed $300 billion in 2024, demonstrating the widespread availability and affordability of these alternative solutions. This accessibility means clients can often achieve their objectives more quickly and at a lower cost by utilizing existing commercial software rather than engaging consultants for bespoke projects.

Entrants Threaten

The threat of new entrants for Booz Allen Hamilton is significantly low due to the inherent complexities within the government contracting sector. These include rigorous compliance with federal regulations, the necessity for extensive security clearances for personnel, and navigating intricate, often lengthy, government procurement processes. These substantial hurdles naturally deter many potential competitors from entering the market.

New companies entering the government contracting space, particularly in areas like advanced analytics or cybersecurity, find it incredibly difficult to overcome the need for highly specialized technical skills and proven track records. Booz Allen Hamilton, for instance, benefits from its deep bench of experts in fields such as artificial intelligence and national security, which are critical for winning government bids.

Furthermore, obtaining the necessary security clearances and demonstrating a history of successful, complex project execution are significant hurdles. Booz Allen's established reputation and extensive portfolio of past performance act as a powerful barrier, making it challenging for nascent firms to compete effectively for lucrative government contracts, especially those awarded in 2024.

Launching a consulting firm that can rival Booz Allen Hamilton's extensive reach and diverse service offerings demands significant upfront capital. This includes substantial investments in cutting-edge technology, robust infrastructure, and continuous workforce upskilling, creating a formidable financial barrier for emerging players.

For instance, in 2024, the average initial investment for a technology-focused consulting startup can easily run into millions of dollars, covering software licenses, secure data storage, and advanced analytics platforms. This high entry cost effectively deters many smaller entities from attempting to compete directly with established giants like Booz Allen, thereby lowering the immediate threat of new entrants.

Brand Reputation and Client Relationships

Booz Allen Hamilton's formidable brand reputation, cultivated over decades of service, presents a significant barrier to new entrants. This reputation is intrinsically linked to deeply entrenched relationships with key government agencies, fostering a level of trust that is exceptionally difficult for newcomers to establish.

New firms would find it challenging to replicate Booz Allen's institutional knowledge and the established rapport with decision-makers within these critical government sectors. This makes securing high-value, long-term contracts a substantial hurdle for any potential competitor. For instance, in fiscal year 2023, Booz Allen Hamilton reported total revenue of $9.3 billion, with a significant portion derived from its long-standing government contracts, underscoring the value of these established relationships.

- Established Trust: Decades of consistent performance and reliability have built deep trust with government clients.

- Institutional Knowledge: Understanding agency needs, processes, and culture is a competitive advantage new entrants lack.

- Contractual Inertia: Existing long-term contracts create a sticky customer base, making switching costs high for agencies.

- Reputational Capital: Booz Allen's brand signifies quality and security, which is paramount for sensitive government work.

Niche Market Entry and Consolidation

While Booz Allen Hamilton operates in a broad consulting space where establishing a direct, comprehensive competitor is challenging, new entrants can emerge in highly specialized niches. For instance, in areas like advanced AI implementation or quantum computing advisory services, smaller, agile firms might offer focused expertise. These specialized entrants may find initial traction, but their long-term viability often leads to consolidation.

Booz Allen, along with other major consulting firms, actively monitors and acquires these niche players. This strategy allows them to integrate specialized capabilities, expand their service offerings, and reduce potential future competition. For example, in 2023, the consulting industry saw significant M&A activity, with firms acquiring specialized technology and data analytics practices, reflecting this trend of niche market consolidation.

- Niche Specialization: New entrants often target specific, high-growth areas within consulting, such as cybersecurity for critical infrastructure or advanced data analytics for defense applications.

- Acquisition as a Strategy: Larger, established firms like Booz Allen frequently acquire these specialized firms to absorb their expertise and client base, thereby consolidating the market.

- Market Consolidation: This pattern of acquisition limits the long-term threat of new, independent niche competitors, as they are often absorbed into larger entities.

The threat of new entrants for Booz Allen Hamilton remains low, primarily due to the substantial barriers to entry in the government consulting sector. These include high capital requirements for technology and talent, stringent security clearance processes, and the need for a proven track record with government agencies. For instance, in 2024, the average initial investment for a tech-focused consulting startup can easily exceed several million dollars, covering essential infrastructure and software.

Booz Allen's established reputation and deep institutional knowledge, built over decades, create a significant competitive advantage. New firms struggle to replicate the trust and relationships Booz Allen has cultivated with key government clients, which are crucial for securing long-term contracts. This established trust is a key reason why, in fiscal year 2023, Booz Allen Hamilton reported a revenue of $9.3 billion, largely driven by these enduring partnerships.

While niche players may emerge in specialized areas like advanced AI or quantum computing advisory, these firms are often acquired by larger entities like Booz Allen. This market consolidation, evident in the significant M&A activity seen in 2023 within the consulting industry, further limits the long-term threat from independent new entrants.

| Barrier Type | Description | Impact on New Entrants | Example for Booz Allen |

|---|---|---|---|

| Capital Requirements | High investment needed for technology, infrastructure, and skilled personnel. | Deters smaller firms with limited funding. | In 2024, tech consulting startups require millions for secure data platforms and advanced analytics. |

| Government Regulations & Security Clearances | Rigorous compliance and personnel security vetting are mandatory. | Time-consuming and costly process for new companies. | Obtaining necessary clearances for sensitive government projects is a lengthy undertaking. |

| Brand Reputation & Trust | Established track record and deep client relationships foster loyalty. | New entrants lack the credibility to compete for high-value contracts. | Booz Allen's fiscal year 2023 revenue of $9.3 billion highlights the value of its long-standing government partnerships. |

| Niche Specialization & Consolidation | Emergence of specialized firms, often acquired by larger players. | Limits the long-term independent threat of niche competitors. | 2023 saw significant M&A in consulting, with firms acquiring specialized AI and data analytics practices. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Booz Allen Hamilton Holding is built upon a foundation of publicly available information, including the company's annual reports (10-K filings), investor presentations, and press releases. We also incorporate insights from reputable industry analysis firms and market intelligence reports to capture the broader competitive landscape and emerging trends.