Bohai Leasing Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

Bohai Leasing Co. operates within a dynamic global environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to guide your decisions.

Gain a competitive edge by uncovering the technological advancements and legal frameworks impacting Bohai Leasing Co.'s operations, alongside critical environmental considerations. This ready-made PESTLE analysis delivers expert-level insights, perfect for investors and business strategists. Buy the full version to get the complete breakdown instantly and empower your market strategy.

Political factors

Government policies in China, Bohai Leasing's home base, are a major driver for its financial leasing business. For instance, the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) regularly update rules on capital adequacy and risk management for financial institutions, which directly affect leasing companies. These regulations can alter the cost of capital and the types of assets Bohai Leasing can finance.

Changes in China's regulatory landscape, such as the ongoing efforts to manage financial system risks and promote industry consolidation, directly shape Bohai Leasing's operational environment. New directives concerning asset management companies or the treatment of non-performing assets could influence Bohai Leasing's balance sheet and its ability to engage in certain types of transactions. For example, stricter rules on leveraged financing could limit expansion opportunities.

Furthermore, government support or limitations on key sectors, like the aviation industry or infrastructure development, significantly impact the demand for leasing services. In 2023, China's aviation sector continued its recovery, with domestic air traffic reaching pre-pandemic levels, which likely boosted demand for aircraft leasing. Conversely, any policy shifts impacting large-scale infrastructure projects could reduce opportunities for equipment leasing.

Global geopolitical stability is a significant factor for Bohai Leasing, particularly with its substantial aircraft and container leasing operations. Trade disputes and sanctions can directly impact cross-border leasing agreements and asset movement, as seen with ongoing trade tensions between major economies that could affect global shipping volumes and air travel demand. In 2024, the International Monetary Fund projected global growth to be around 3.2%, a figure sensitive to geopolitical shifts.

Government support through subsidies and tax incentives can significantly boost demand for leasing services, particularly in sectors like green energy. For instance, in 2024, many countries continued to offer tax credits for renewable energy projects, encouraging companies to lease solar panels or wind turbines rather than purchase them outright. This trend directly benefits leasing companies like Bohai Leasing by creating a steady stream of business for asset financing.

Conversely, shifts in government policy, such as the phasing out of subsidies for older technologies, can impact leasing portfolios. If incentives for, say, traditional manufacturing equipment are reduced in 2025, Bohai Leasing might see a slowdown in leasing demand for those specific assets, necessitating a strategic pivot towards more supported industries.

Political Stability in Operating Regions

The political stability of the countries where Bohai Leasing operates is a significant factor influencing its risk profile. For instance, in 2023, China, a primary operating region, maintained a generally stable political environment, though geopolitical tensions with Western nations continued to be a consideration for international trade and investment flows.

Unstable political landscapes can introduce considerable uncertainty, potentially leading to abrupt changes in regulations, disruptions to supply chains, or even the risk of asset seizure. This unpredictability directly affects Bohai Leasing’s ability to forecast revenues and manage its asset portfolio effectively.

Mitigating political risk involves continuous monitoring and strategic planning. Bohai Leasing likely engages in thorough due diligence and may employ risk management strategies such as political risk insurance or diversification of its operational base to counter potential adverse political events.

- Geopolitical Tensions: Ongoing trade disputes and diplomatic tensions, particularly between major economic blocs, can impact international leasing agreements and the movement of assets.

- Regulatory Shifts: Changes in government policies regarding foreign investment, taxation, or financial services in key operating markets can affect Bohai Leasing's profitability and operational flexibility.

- Regional Instability: While Bohai Leasing's core operations are in stable regions, any escalation of conflicts or political unrest in adjacent areas could indirectly influence market sentiment and economic conditions.

State-Owned Enterprise Influence

Bohai Leasing's operations are significantly impacted by the pervasive influence of state-owned enterprises (SOEs) and government directives within China. This relationship shapes its strategic decisions and financial accessibility, as government backing can be a double-edged sword, offering opportunities but also imposing constraints.

Government-backed initiatives, like the Belt and Road Initiative (BRI), can unlock new geographical markets for Bohai Leasing and potentially provide preferential financing. For instance, in 2023, China's state-owned banks continued to be major financiers of BRI projects, a trend expected to persist through 2025, directly benefiting companies like Bohai Leasing involved in international infrastructure and logistics.

- SOE Dominance: Chinese SOEs often receive preferential treatment in terms of capital access and regulatory support, creating a competitive landscape where private or partially private entities like Bohai Leasing must navigate carefully.

- BRI Opportunities: The BRI, a key government strategy, offers expansion avenues for Bohai Leasing in aviation and logistics, with significant investment planned through 2025, projected to reach trillions of dollars globally.

- Government Directives: Direct government intervention can influence pricing, route allocation, and strategic partnerships, impacting Bohai Leasing's operational autonomy and market positioning.

Government policies in China heavily influence Bohai Leasing's operations, with regulators like the PBOC and CBIRC setting capital and risk management standards. These rules directly affect leasing costs and asset financing capabilities. For example, in 2024, China's focus on financial risk mitigation meant stricter oversight on leveraged financing, potentially limiting expansion for leasing firms.

Government support for key sectors, such as aviation, directly boosts demand for leasing services. In 2023, China's domestic air traffic recovery to pre-pandemic levels likely increased aircraft leasing needs. Conversely, policy shifts impacting infrastructure could reduce equipment leasing opportunities.

Global geopolitical stability is crucial for Bohai Leasing's international operations, especially in aircraft and container leasing. Trade disputes can disrupt cross-border agreements, impacting asset movement. The IMF projected global growth around 3.2% in 2024, a figure highly sensitive to geopolitical shifts.

What is included in the product

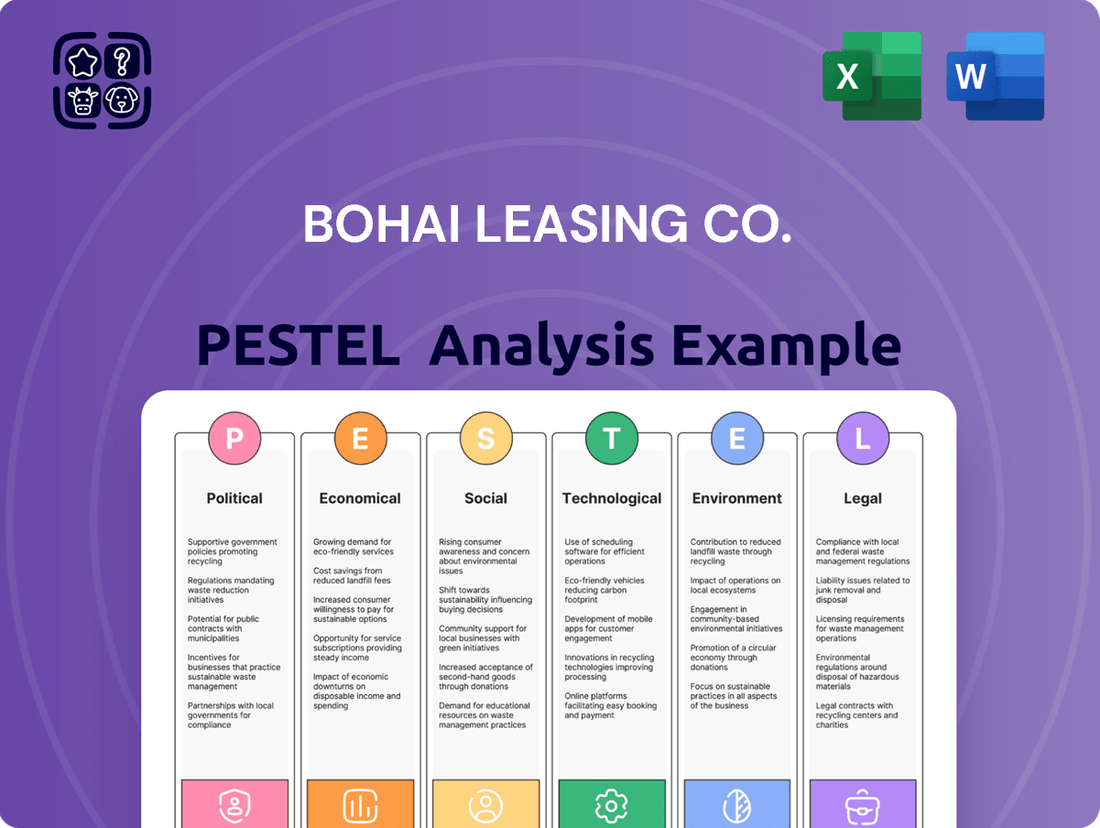

This PESTLE analysis of Bohai Leasing Co. provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations.

It offers actionable insights into how these external forces create both challenges and strategic advantages for the company.

The Bohai Leasing Co. PESTLE Analysis offers a clear, summarized version of external factors for easy referencing during meetings, relieving the pain point of information overload.

This analysis is easily shareable in a summary format, ideal for quick alignment across teams or departments, addressing the need for rapid communication and consensus building.

Economic factors

Changes in global interest rates significantly impact Bohai Leasing's financing costs and the profitability of its lease agreements. As a leasing company, it depends on borrowing to acquire assets for leasing. For instance, if the US Federal Reserve maintains its benchmark interest rate around 5.25%-5.50% throughout 2024 and into early 2025, Bohai Leasing's borrowing expenses will remain elevated, potentially squeezing its profit margins.

Rising interest rates directly increase Bohai Leasing's funding costs, which can lead to narrower profit margins or make leasing less appealing to customers. Conversely, declining rates can boost profitability and stimulate demand for leasing services. If central banks globally, including the People's Bank of China, begin a rate-cutting cycle in late 2024 or 2025, Bohai Leasing could see reduced funding costs and improved profitability.

Global economic growth significantly influences Bohai Leasing's demand. In 2024, projections suggest a moderate but potentially uneven global expansion, with the IMF forecasting 3.2% growth for the year. This generally positive outlook supports capital expenditure by businesses, which translates to increased demand for leasing services like aircraft and equipment, benefiting Bohai Leasing.

However, recession risks remain a concern. Persistent inflation and geopolitical tensions could dampen global investment and consumer spending. Should a significant downturn materialize in late 2024 or 2025, Bohai Leasing could face reduced new leasing agreements, a rise in customer defaults, and challenges in remarketing repossessed assets, impacting its financial performance.

Currency exchange rate volatility is a major economic concern for Bohai Leasing due to its extensive international operations. Fluctuations between the Chinese Yuan (CNY) and currencies like the US Dollar (USD) directly affect the reported value of its global assets and the cost of its foreign-denominated debt. For instance, if the USD strengthens significantly against the CNY, Bohai Leasing's USD-denominated assets would appear more valuable in Yuan terms, but its USD debt would also become more expensive to service.

In 2024, the CNY experienced periods of weakness against the USD, with the USD/CNY rate trading around 7.25 for much of the year. This trend can impact Bohai Leasing's profitability by increasing the Yuan cost of its dollar-denominated revenues and financial liabilities. Effective currency hedging strategies are therefore essential to protect its financial performance from these unpredictable economic shifts.

Industry-Specific Capital Expenditure Trends

Capital expenditure trends in sectors critical to Bohai Leasing, such as aviation, shipping, and infrastructure, directly shape its leasing volumes. For instance, airlines' decisions to expand fleets, driven by anticipated passenger growth, translate into increased demand for aircraft leasing. In 2024, the International Air Transport Association (IATA) projected global air cargo revenue to reach $137.4 billion, signaling continued investment in air transport capacity.

Similarly, the shipping industry's capital investment in new vessels and containers, influenced by global trade dynamics, impacts Bohai Leasing's opportunities in that segment. The International Maritime Organization's (IMO) regulations on emissions are also prompting significant fleet renewal, creating leasing demand. Infrastructure development, often fueled by government stimulus packages, further drives the need for leasing of heavy equipment and specialized assets.

- Aviation: IATA forecasts a global net profit for airlines of $46.4 billion in 2024, suggesting a positive outlook for fleet expansion and leasing.

- Shipping: Global container throughput is expected to grow, with projections indicating continued investment in fleet modernization to meet demand and regulatory requirements.

- Infrastructure: Major economies are implementing substantial infrastructure spending plans, with the US alone allocating significant funds through the Infrastructure Investment and Jobs Act, creating leasing opportunities for construction equipment.

Availability of Credit and Liquidity

The availability and cost of credit are crucial for Bohai Leasing's operations, directly impacting its ability to finance asset purchases. For instance, in early 2024, global interest rates remained elevated, reflecting ongoing efforts to curb inflation, which would naturally increase the cost of borrowing for companies like Bohai Leasing.

A contraction in credit markets or a general tightening of liquidity can significantly hinder Bohai Leasing's growth trajectory. This makes securing necessary funding more difficult and expensive, potentially affecting its competitive edge.

Bohai Leasing's access to a variety of funding channels is a key economic factor.

- Credit Availability: In 2024, global credit markets experienced varied conditions, with some regions seeing increased lending while others faced tighter conditions due to central bank policies.

- Cost of Capital: The benchmark lending rates, such as the Loan Prime Rate (LPR) in China, influenced borrowing costs for Bohai Leasing throughout 2024.

- Liquidity Levels: Overall market liquidity, influenced by quantitative easing or tightening measures by major central banks, directly affects the ease and cost of Bohai Leasing accessing funds.

- Funding Diversification: Bohai Leasing's strategy to access diverse funding sources, including bank loans, bond issuances, and potentially securitization, is vital for mitigating risks associated with any single market's liquidity.

Economic factors significantly shape Bohai Leasing's operational landscape, influencing everything from financing costs to demand for its services. Fluctuations in global interest rates, for example, directly impact borrowing expenses; if rates remain elevated around 5.25%-5.50% as seen in the US during 2024, Bohai Leasing faces higher funding costs. Conversely, anticipated rate cuts in late 2024 or 2025 by central banks could improve profitability by reducing these costs. Global economic growth, projected at 3.2% by the IMF for 2024, generally supports capital expenditure and thus demand for leasing, though recessionary risks could dampen this. Currency volatility, particularly the USD/CNY rate which hovered around 7.25 in 2024, adds another layer of complexity, affecting asset valuation and debt servicing costs for Bohai Leasing's international operations.

| Economic Factor | 2024/2025 Outlook | Impact on Bohai Leasing |

|---|---|---|

| Global Interest Rates | Elevated, potential for cuts late 2024/2025 | Higher financing costs, potential margin squeeze or improvement |

| Global Economic Growth | Moderate growth (IMF 3.2% for 2024), recession risks | Supports demand, but downturns can reduce leasing and increase defaults |

| Currency Exchange Rates (USD/CNY) | Volatile, USD strength observed (around 7.25 in 2024) | Affects asset valuation and cost of foreign debt/revenue |

| Capital Expenditure (Aviation, Shipping, Infrastructure) | Positive outlook (e.g., IATA airline profits $46.4bn in 2024) | Drives demand for aircraft, vessels, and equipment leasing |

| Credit Availability & Cost | Varied global conditions, elevated costs early 2024 | Impacts ability to finance asset purchases; tighter credit hinders growth |

Same Document Delivered

Bohai Leasing Co. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bohai Leasing Co. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll gain a thorough understanding of the external forces shaping the leasing industry.

Sociological factors

The growing trend of asset-light business models, where companies prioritize leasing over ownership, directly benefits Bohai Leasing. This shift, evident across industries, means more businesses are seeking flexible leasing solutions to manage capital and operations efficiently. For instance, the global operating lease market is projected to see robust growth, with estimates suggesting a compound annual growth rate (CAGR) of over 7% between 2024 and 2029, indicating a substantial market opportunity.

Entrepreneurship is also on the rise, with new ventures frequently opting for leasing to conserve startup capital. This surge in new businesses creates a consistent demand for Bohai Leasing's financial and operating lease products. In 2024, the number of new business registrations in key global markets continued to climb, with some regions reporting year-over-year increases of 5-10% in new business formations, underscoring the expanding client base for leasing services.

Bohai Leasing is well-positioned to capitalize on these evolving dynamics by developing and offering tailored leasing packages. These can range from traditional financial leases for long-term asset acquisition to more agile operating leases that accommodate changing business needs and technological advancements. The company's ability to adapt its service portfolio to support this entrepreneurial spirit and the demand for flexible asset utilization is key to its continued success.

Global workforce demographics are shifting, with many developed nations facing an aging population. This trend, coupled with a growing demand for specialized technical skills in sectors Bohai Leasing supports, like aviation and advanced manufacturing, influences asset financing needs. For instance, a shortage of experienced aircraft mechanics in the US, projected to intensify, could drive airlines to invest in newer, more automated aircraft, increasing demand for leasing of such assets.

The availability and cost of skilled labor directly impact the demand for the high-end equipment and infrastructure Bohai Leasing finances. As automation becomes more prevalent due to labor shortages or the need for greater efficiency, companies may lease more sophisticated machinery. In 2024, the global skills gap in advanced manufacturing was estimated to affect over 40% of manufacturers, potentially boosting leasing of automated solutions.

Human capital trends also shape Bohai Leasing's internal operations. The need for finance professionals with expertise in cross-border leasing, risk management, and understanding of emerging technologies is paramount. As of early 2025, the financial services sector continues to seek talent proficient in data analytics and ESG (Environmental, Social, and Governance) compliance, impacting the company's ability to innovate and manage its portfolio effectively.

Consumer travel patterns significantly influence the aviation and tourism sectors, key markets for aircraft leasing companies like Bohai Leasing. For instance, a 2024 report by the International Air Transport Association (IATA) indicated a strong post-pandemic rebound in air travel, with global passenger traffic expected to reach 4.7 billion in 2024, nearing pre-pandemic levels and highlighting sustained demand for fleet expansion.

Increased demand for both business and leisure air travel directly translates into greater opportunities for aircraft lessors, as airlines seek to grow or refresh their fleets. This trend is supported by projections suggesting continued growth in international tourist arrivals, with the UN World Tourism Organization (UNWTO) forecasting a return to 2019 levels by late 2024 or early 2025.

However, evolving consumer preferences, such as growing environmental consciousness, could impact air travel demand. While currently not a dominant factor, a significant shift towards more sustainable travel options or a rise in fuel costs could eventually lead airlines to reconsider fleet expansion plans, potentially affecting lessors.

Urbanization and Infrastructure Needs

The accelerating pace of urbanization globally, especially in emerging markets, is a significant driver for infrastructure development. This trend directly translates into a robust demand for new transportation systems, energy grids, and essential public services. For instance, by the end of 2023, over 65% of the world's population was projected to live in urban areas, a figure expected to climb to nearly 70% by 2050, according to UN data. This demographic shift necessitates massive investments in infrastructure.

Bohai Leasing is strategically positioned to benefit from this urban expansion. By focusing on infrastructure leasing, the company can provide crucial financial solutions for major projects that underpin the growth of cities and their economies. This includes financing for everything from airport expansions to renewable energy installations, directly supporting the needs of burgeoning urban centers and their populations.

Key areas where Bohai Leasing can leverage urbanization trends include:

- Transportation Infrastructure: Financing for high-speed rail, urban transit systems, and airport upgrades to manage increased passenger and freight volumes.

- Energy Infrastructure: Providing capital for power generation facilities, including renewable energy projects like solar and wind farms, to meet the escalating energy demands of urban areas.

- Utilities and Public Services: Supporting the development of water treatment plants, telecommunications networks, and waste management systems essential for sustainable urban living.

Societal Acceptance of Leasing vs. Ownership

Societal and corporate attitudes towards leasing versus outright ownership significantly shape the market for asset financing. As leasing gains traction as a strategic financial tool, Bohai Leasing's potential market expands. For instance, in 2024, the global operating lease market was projected to reach over $700 billion, indicating a growing preference for flexible asset acquisition models.

Businesses are increasingly recognizing leasing not just as a cost-saving measure but as a way to enhance operational agility and manage capital more effectively. This shift in perception is crucial for Bohai Leasing, as greater acceptance translates directly into increased demand for its services. Case studies demonstrating successful leasing strategies, particularly in sectors like aviation and transportation where Bohai Leasing is active, can further solidify this trend.

- Growing acceptance of leasing: Businesses worldwide are increasingly viewing leasing as a strategic financial tool rather than just a rental agreement.

- Financial and operational benefits: Leasing offers advantages like improved cash flow, reduced upfront capital expenditure, and easier asset upgrades, making it attractive.

- Market penetration for Bohai Leasing: The broader the societal acceptance of leasing, the larger the addressable market for Bohai Leasing's diverse asset leasing solutions.

- Education and case studies: Highlighting successful leasing implementations, especially in key Bohai Leasing sectors like aviation and equipment, can accelerate this acceptance.

Societal attitudes towards asset utilization are shifting, with a growing preference for leasing over outright ownership. This trend is amplified by the increasing recognition of leasing as a strategic financial tool, offering flexibility and capital efficiency. For example, by early 2025, the global market for operating leases was estimated to be valued at over $750 billion, showcasing a significant move towards this model.

The emphasis on environmental, social, and governance (ESG) factors is also influencing business decisions, including asset acquisition. Companies are increasingly seeking leasing partners who can demonstrate strong ESG credentials and offer sustainable asset solutions. This societal push for sustainability aligns with Bohai Leasing's potential to offer greener fleet options, such as newer, more fuel-efficient aircraft, which is a growing consideration for airlines.

Furthermore, the general perception of leasing as a viable and often superior alternative to purchasing assets is solidifying across various industries. This evolving mindset, driven by successful case studies and the clear financial benefits, directly expands the addressable market for Bohai Leasing's comprehensive suite of leasing services. The widespread adoption of leasing for everything from vehicles to specialized industrial equipment underscores this societal shift.

Technological factors

The financial services industry is undergoing a significant digital transformation, impacting Bohai Leasing's ability to operate efficiently and connect with customers. By adopting advanced digital tools for tasks like credit evaluation, managing agreements, and serving clients, Bohai Leasing can make its operations smoother, cut expenses, and improve the overall customer journey.

Staying competitive means Bohai Leasing must actively integrate fintech advancements. For instance, in 2024, global fintech investment reached an estimated $150 billion, highlighting the sector's rapid growth and the importance of adopting these technologies to keep pace with market trends.

Technological progress in aircraft and containers directly shapes Bohai Leasing's asset portfolio. For instance, the push for more fuel-efficient aircraft, like the Boeing 737 MAX which entered service in 2017 with improved fuel economy, influences fleet demand. Similarly, the integration of IoT in smart containers, allowing for real-time tracking and condition monitoring, is becoming a significant factor in asset financing.

The pace of innovation can also impact lease structures. Rapid advancements might lead to shorter lease terms for cutting-edge equipment to mitigate the risk of obsolescence. For example, the increasing demand for advanced, lighter materials in aircraft manufacturing could accelerate the depreciation of older models, prompting lessors to adjust their strategies for asset lifecycle management.

Big data analytics and AI are transforming risk management for Bohai Leasing. By analyzing vast datasets, the company can refine credit scoring models, potentially reducing defaults. For instance, advancements in AI credit scoring in the financial sector have shown improved accuracy in predicting borrower behavior, with some models achieving over 90% accuracy in identifying high-risk loans.

Furthermore, AI can predict maintenance needs for leased assets, such as aircraft or vehicles, minimizing downtime and operational costs. Predictive maintenance in the aviation industry, for example, has been reported to reduce unscheduled maintenance by up to 15%, directly impacting asset utilization and profitability.

These technological capabilities enable Bohai Leasing to identify emerging market trends and optimize its asset portfolio. By leveraging AI for market trend analysis, the company can make more agile and informed decisions, ensuring its leased assets remain in high demand and contribute to overall portfolio performance optimization.

Cybersecurity Threats and Data Protection

As financial transactions and sensitive client data increasingly move to digital platforms, cybersecurity threats become a paramount technological concern for Bohai Leasing. The company must invest robustly in cybersecurity measures to protect its systems, financial data, and client information from breaches and attacks. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

Compliance with evolving data protection regulations, such as GDPR and similar frameworks in China, is also crucial. These regulations aim to safeguard personal information and maintain customer trust. Failure to comply can result in substantial fines; for example, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Key technological considerations for Bohai Leasing include:

- Investment in advanced threat detection and prevention systems: This includes AI-powered security analytics and regular penetration testing to identify vulnerabilities.

- Robust data encryption and access controls: Ensuring that all sensitive data is encrypted both in transit and at rest, with strict protocols for data access.

- Employee training and awareness programs: Educating staff on cybersecurity best practices to mitigate human error, a common cause of breaches.

- Adherence to data privacy regulations: Implementing comprehensive policies and procedures to comply with all relevant national and international data protection laws.

Blockchain for Asset Tracking and Transparency

Blockchain technology is showing significant promise for improving asset tracking and verifying ownership, which could fundamentally change the leasing sector. This innovation offers a way to record transactions with greater transparency.

By implementing blockchain, Bohai Leasing could boost the efficiency of managing valuable assets like aircraft and shipping containers. This would also bolster the security and traceability of its entire asset portfolio, potentially cutting down on fraudulent activities.

The potential benefits are substantial. For instance, a study by Deloitte in 2023 highlighted that blockchain could reduce administrative costs in supply chain management by up to 30% through enhanced transparency and automation. For Bohai Leasing, this translates to more secure and verifiable asset management.

Bohai Leasing should consider initiating pilot programs and forming strategic partnerships within the blockchain space. Such initiatives could provide a competitive edge and future-proof its operations against evolving industry standards and technological advancements.

- Enhanced Efficiency: Blockchain can streamline processes, reducing manual checks and paperwork for asset tracking.

- Fraud Reduction: Immutable transaction records make it harder to falsify ownership or asset history.

- Improved Traceability: A transparent ledger allows for clear visibility of an asset's lifecycle and ownership changes.

Technological advancements are reshaping how Bohai Leasing operates, from digitalizing customer interactions to enhancing asset management. The company must embrace fintech, big data, AI, and blockchain to remain competitive and efficient. For instance, global fintech investment neared $150 billion in 2024, underscoring the sector's rapid growth and the necessity for Bohai Leasing to adopt these innovations.

AI and big data analytics are crucial for refining risk management, with AI credit scoring showing over 90% accuracy in identifying high-risk loans. Predictive maintenance, a key AI application, can reduce unscheduled aircraft maintenance by up to 15%, directly boosting asset utilization. These technologies enable Bohai Leasing to identify market trends and optimize its asset portfolio for sustained demand and performance.

Cybersecurity is a paramount concern, given the projected $10.5 trillion annual cost of cybercrime by 2025. Bohai Leasing must invest in advanced threat detection, data encryption, and employee training to protect sensitive data and comply with regulations like GDPR, where fines can reach 4% of global annual turnover.

Blockchain technology offers enhanced transparency and security for asset tracking and ownership verification. Deloitte projected that blockchain could cut supply chain administrative costs by up to 30% by 2023 through automation. Implementing blockchain could significantly improve Bohai Leasing's asset management efficiency and reduce fraud.

Legal factors

Bohai Leasing's global operations necessitate strict adherence to a complex web of international leasing laws and conventions. The Cape Town Convention on International Interests in Mobile Equipment, for instance, significantly shapes how Bohai Leasing manages its aircraft leasing portfolio by standardizing cross-border transactions and collateral enforcement. Failure to comply can lead to substantial legal risks and operational disruptions.

Bohai Leasing operates within a stringent global financial regulatory landscape, necessitating robust compliance with anti-money laundering (AML) and know-your-customer (KYC) mandates. Failure to adhere to these, alongside capital adequacy requirements across its diverse operational territories, can result in substantial penalties and operational disruptions. For instance, in 2023, global financial institutions faced billions in AML fines, underscoring the financial and reputational risks of non-compliance.

The dynamic nature of financial regulations means Bohai Leasing must continuously adapt its compliance strategies. Anticipating and integrating new rules, such as those related to digital asset oversight or enhanced data privacy, is crucial for sustained operational integrity and market access.

Bohai Leasing's operations heavily rely on strong contract law and effective enforcement. This ensures that leasing agreements are legally binding and that the company can recover assets or outstanding payments if a lessee defaults, which is crucial for managing financial risk.

In 2024, the global legal landscape continues to present complexities for international leasing. For instance, differences in bankruptcy laws and asset repossession procedures across jurisdictions, such as those between the EU and emerging markets, necessitate specialized legal counsel to navigate effectively. This legal variability directly impacts Bohai Leasing's ability to secure its assets and enforce contractual obligations consistently worldwide.

Tax Laws and Incentives

Changes in corporate tax laws, such as adjustments to depreciation schedules and the introduction of new tax credits, directly influence Bohai Leasing's bottom line and market standing. For instance, if a country revises its tax code to allow for accelerated depreciation on aircraft, this could significantly reduce Bohai Leasing's taxable income in the short term, enhancing its profitability and potentially allowing for more competitive pricing on leases.

Tax incentives specifically designed for the aviation leasing sector or for investments in certain geographic regions can be a powerful driver of demand. Conversely, an increase in corporate tax rates or the removal of beneficial leasing incentives could compress profit margins and make Bohai Leasing's services less attractive compared to alternatives. Navigating the complexities of both domestic and international tax regulations is therefore crucial for optimizing financial outcomes.

As of early 2024, many jurisdictions are reviewing their tax policies. For example, ongoing discussions around global minimum corporate tax rates could impact international leasing operations. Furthermore, specific incentives for green aviation technologies, which may emerge in 2025, could create new opportunities or necessitate adjustments in Bohai Leasing's fleet strategy and financial planning.

- Impact of Corporate Tax Rate Changes: A hypothetical 1% increase in corporate tax rates could reduce net income by millions, depending on Bohai Leasing's taxable income base in affected regions.

- Depreciation Rule Benefits: Accelerated depreciation on a new aircraft could save Bohai Leasing tens of millions in taxes over its useful life, improving cash flow.

- Incentive-Driven Demand: Tax holidays or reduced VAT on aircraft leases in emerging markets can spur significant new leasing contracts, boosting revenue.

- International Tax Compliance: The cost of ensuring compliance with diverse tax regimes globally represents a significant operational expense for multinational leasing companies.

Data Privacy and Protection Regulations

Bohai Leasing must navigate a complex web of data privacy and protection regulations as it handles increasing amounts of client information. Laws like China's Personal Information Protection Law (PIPL) and potentially GDPR, if operations involve EU citizens, mandate strict compliance. Failure to secure client data can lead to significant legal penalties and damage to reputation.

Key compliance areas include:

- Secure Data Handling: Implementing robust protocols for the collection, processing, and storage of personal and corporate data.

- Cross-Border Data Transfers: Adhering to regulations governing the transfer of data outside of China, especially if dealing with international clients.

- Client Consent and Rights: Ensuring clear consent mechanisms are in place and respecting individuals' rights regarding their data.

- Breach Notification: Establishing procedures for promptly notifying authorities and affected individuals in the event of a data breach.

In 2023, China's PIPL continued to shape how companies like Bohai Leasing manage data, emphasizing consent and purpose limitation. The global trend towards stronger data protection, exemplified by GDPR's extraterritorial reach, underscores the need for proactive compliance strategies to mitigate risks and maintain client trust.

Legal frameworks governing international leasing are paramount for Bohai Leasing, with the Cape Town Convention setting global standards for mobile equipment. Navigating differing bankruptcy laws and asset repossession procedures across jurisdictions, such as between the EU and emerging markets in 2024, requires specialized legal expertise to ensure consistent contract enforcement and asset security.

Environmental factors

Increasingly stringent carbon emission regulations are a key environmental challenge for the aviation sector, directly impacting lessors like Bohai Leasing. The International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) aims to stabilize net global aviation carbon emissions from 2021 onwards. This global framework encourages airlines to reduce their carbon footprint, which translates into a growing demand for fuel-efficient aircraft.

This shift towards greener fleets pressures airlines to retire older, less efficient aircraft sooner, potentially impacting the residual values of older models within Bohai Leasing's portfolio. For instance, the average fuel efficiency of new aircraft entering service in 2024 is significantly higher than models from a decade ago, a trend expected to accelerate. Bohai Leasing must therefore strategically adapt its fleet acquisition and management strategies to align with these evolving environmental mandates and market preferences.

The global sustainable finance market is experiencing significant growth, with ESG assets projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. This surge directly impacts companies like Bohai Leasing, as investors increasingly scrutinize environmental, social, and governance factors when allocating capital. A strong ESG performance can unlock access to this expanding pool of funds.

Financial institutions are also aligning their lending and investment strategies with sustainability goals. For instance, many banks are implementing policies that favor green financing and penalize carbon-intensive industries. Bohai Leasing's commitment to sustainable practices, such as reducing its carbon footprint in fleet operations, can therefore lead to more favorable financing terms and a lower cost of capital.

Furthermore, investor preference for ESG-compliant companies is not just about capital access; it's also about long-term value creation and risk mitigation. Companies demonstrating robust ESG management, including transparent reporting on environmental impact and social responsibility, often exhibit greater resilience and are perceived as less risky. This enhanced reputation can attract a wider range of investors, including those focused on impact investing, thereby bolstering Bohai Leasing's market standing.

Growing concerns over resource scarcity are increasingly influencing how companies like Bohai Leasing manage their assets. The global push for a circular economy, emphasizing repair, reuse, and recycling, directly impacts the lifecycle management of leased equipment and containers.

This trend means Bohai Leasing will likely see a greater focus on refurbishing and repurposing high-end assets at the end of their lease terms. For instance, the International Maritime Organization's (IMO) 2023 regulations on reducing sulfur oxide emissions from ships could necessitate earlier upgrades or replacements of older vessel components, driving demand for refurbishment services.

To align with these circular economy principles, Bohai Leasing may need to forge new partnerships or develop internal strategies for responsible asset disposal and refurbishment. This could involve collaborating with specialized repair firms or investing in facilities capable of extending the useful life of their leased fleet.

Climate Change and Physical Risks to Assets

Climate change presents tangible threats to Bohai Leasing's physical assets. Extreme weather events, such as intensified typhoons or floods, pose a direct risk to its fleet of aircraft and shipping containers. For instance, the increasing frequency of severe weather in key shipping lanes could lead to asset damage or prolonged operational disruptions, impacting delivery schedules and increasing maintenance costs.

The potential for rising sea levels also introduces long-term risks to port infrastructure where Bohai Leasing's assets are often stored or transported. This could necessitate costly upgrades or relocation of assets. Furthermore, the heightened risk of natural disasters can translate into higher insurance premiums for Bohai Leasing, directly affecting operational expenses and potentially leading to asset write-downs if damage is severe and uninsurable.

- Increased Insurance Costs: Global insured losses from natural catastrophes reached an estimated $130 billion in 2023, a significant increase from previous years, indicating a trend that could affect Bohai Leasing's insurance outlays.

- Supply Chain Disruptions: The World Economic Forum's 2024 Global Risks Report highlights climate action failure and extreme weather as top long-term global risks, suggesting a continued vulnerability of global supply chains, which Bohai Leasing relies on.

- Asset Impairment: In 2024, several major shipping ports experienced disruptions due to extreme weather, leading to temporary asset idleness and potential devaluation for leasing companies with assets situated in affected areas.

Environmental Impact of Infrastructure Development

As a financier, Bohai Leasing is indirectly tied to the environmental footprint of infrastructure projects. Increasingly stringent environmental regulations, like those seen in China's efforts to curb pollution, can lead to project delays or increased costs for developers. For instance, in 2024, new regulations in several Asian nations mandated more rigorous environmental impact assessments for large-scale construction, potentially affecting project timelines and financing requirements.

Public scrutiny over ecological preservation is also a growing factor. Projects that raise concerns about biodiversity loss or carbon emissions may encounter significant opposition, impacting their viability and, consequently, Bohai Leasing's investment exposure. The push for green building standards, driven by global climate agreements, means that projects not adhering to these principles may face financing challenges or reduced market appeal.

Supporting infrastructure that prioritizes environmental sustainability is becoming crucial. This not only contributes to broader sustainability objectives but also bolsters Bohai Leasing's corporate reputation. Companies demonstrating a commitment to green finance, such as investing in renewable energy infrastructure or projects with low carbon footprints, are increasingly favored by investors and regulators alike, as evidenced by the growing global green bond market, which reached an estimated $1.5 trillion in 2024.

Key considerations for Bohai Leasing include:

- Regulatory Compliance: Ensuring financed projects meet evolving environmental standards and permitting requirements.

- Public Perception: Assessing potential public opposition to projects based on environmental concerns.

- Sustainability Alignment: Prioritizing investments in projects that align with global climate goals and promote eco-friendly practices.

- Green Finance Trends: Monitoring the growth and demand for green financial products and sustainable infrastructure investments.

Environmental factors significantly shape Bohai Leasing's operational landscape, driven by a global shift towards sustainability and stricter regulations. The aviation sector's increasing focus on fuel efficiency, spurred by initiatives like CORSIA, directly influences fleet demand, potentially impacting the residual values of older aircraft in Bohai Leasing's portfolio.

The burgeoning sustainable finance market, projected to reach $50 trillion by 2025, offers both opportunities and challenges, with investors scrutinizing ESG performance. Bohai Leasing's commitment to environmental responsibility can unlock access to this capital and lead to more favorable financing terms.

Resource scarcity and the circular economy principles are also influencing asset management, pushing for repair and reuse strategies. Furthermore, climate change presents physical risks to assets through extreme weather events, potentially increasing insurance costs and causing supply chain disruptions, as highlighted by a 2023 insured loss figure of $130 billion from natural catastrophes.

| Environmental Factor | Impact on Bohai Leasing | Supporting Data/Trend |

| Carbon Emission Regulations (CORSIA) | Demand for fuel-efficient aircraft; pressure on residual values of older models. | Average fuel efficiency of new aircraft in 2024 significantly higher than a decade ago. |

| Sustainable Finance Growth | Access to capital; investor scrutiny on ESG. | ESG assets projected to reach $50 trillion by 2025 (Bloomberg Intelligence). |

| Circular Economy Principles | Focus on asset refurbishment and reuse. | IMO 2023 regulations on sulfur oxide emissions may necessitate earlier vessel component upgrades. |

| Extreme Weather Events | Asset damage, operational disruptions, increased insurance costs. | Global insured losses from natural catastrophes estimated at $130 billion in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bohai Leasing Co. is grounded in data from official Chinese government agencies, international financial institutions like the IMF and World Bank, and reputable aviation industry reports. We integrate insights from regulatory updates, economic forecasts, and market research to provide a comprehensive view.