Bohai Leasing Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

Bohai Leasing Co. faces moderate threats from new entrants and substitutes, with significant bargaining power held by its buyers and suppliers within the leasing industry. The competitive rivalry among existing players is intense, demanding constant strategic adaptation.

The complete report reveals the real forces shaping Bohai Leasing Co.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global commercial aircraft manufacturing market is highly concentrated, with Boeing and Airbus holding a dominant duopoly. In 2023, these two giants accounted for over 90% of all commercial aircraft deliveries, leaving lessors like Bohai Leasing with very limited sourcing options. This scarcity of suppliers significantly strengthens their bargaining power, enabling them to dictate terms on pricing, customization, and delivery timelines.

For Bohai Leasing Co., the bargaining power of suppliers, particularly those providing specialized equipment, can be a significant factor. When acquiring high-end machinery or assets crucial for specific infrastructure projects, the market for manufacturers is often concentrated. This limited number of specialized providers means Bohai Leasing may face higher acquisition costs and less flexibility in negotiating lease terms for these essential assets.

Bohai Leasing Co. sources capital through a mix of private loans and publicly issued bonds, crucial for fleet expansion. For instance, in 2024, the company's ability to secure favorable terms on its debt offerings directly impacts its cost of acquiring new aircraft or other leased assets.

Changes in global interest rates, particularly those set by major central banks, significantly influence Bohai Leasing's financing costs. A rise in interest rates in 2024 would increase the expense of new borrowings and refinancing existing debt, potentially squeezing profit margins on leases.

The availability of capital from banks and institutional investors is a key determinant of Bohai Leasing's growth capacity. In 2024, a tightening credit market could limit access to funding, thereby restricting the company's ability to expand its fleet and pursue new leasing opportunities.

Technology and Maintenance Providers

Suppliers of specialized technology for fleet management and MRO services wield significant bargaining power over Bohai Leasing. Their advanced, often proprietary, solutions are critical for maintaining the operational integrity and safety of Bohai's leased aircraft. This reliance means Bohai Leasing must often accept supplier terms to ensure its fleet remains airworthy and competitive.

The specialized nature of these technology and maintenance providers creates a barrier to entry for new competitors, further consolidating their power. For instance, access to specific diagnostic software or unique repair techniques can only be obtained from a limited number of certified vendors. Bohai Leasing's dependence on these niche capabilities directly translates into higher costs and less flexibility in supplier negotiations.

- Specialized Technology: Providers of advanced fleet management software and diagnostic tools are few, giving them leverage.

- MRO Dependence: Bohai Leasing relies on specific MRO providers for critical maintenance, impacting operational uptime.

- High Switching Costs: Transitioning to new technology or MRO partners can involve substantial investment and retraining.

- Safety and Compliance: Adherence to stringent aviation regulations necessitates using certified and approved technology and service providers.

Regulatory and Certification Bodies

Regulatory and certification bodies, such as the Federal Aviation Administration (FAA) or the European Union Aviation Safety Agency (EASA), wield significant influence. While not direct suppliers of goods or services, their mandates for aircraft safety and airworthiness dictate the types of components and maintenance procedures that Bohai Leasing Co. must adhere to. For instance, in 2024, EASA continued to emphasize stringent environmental standards for new aircraft, impacting the types of engines and materials that manufacturers can offer, and by extension, influence the suppliers of these specialized inputs.

These regulatory requirements often necessitate the use of specific, certified materials or parts from approved manufacturers. This creates a situation where suppliers who hold the necessary certifications and can meet these rigorous standards gain leverage. Bohai Leasing Co., like other lessors, must source from these qualified entities, indirectly amplifying the bargaining power of these specialized suppliers.

- Mandated Standards: Aviation authorities set strict safety and performance benchmarks for aircraft and components.

- Certified Inputs: Compliance often requires specialized parts or services from suppliers with specific regulatory approvals.

- Supplier Leverage: The need for certified inputs enhances the negotiating power of these specialized suppliers.

- Indirect Influence: While not direct suppliers, regulators indirectly empower those who meet their stringent criteria.

The bargaining power of suppliers for Bohai Leasing Co. is notably high, especially concerning aircraft manufacturers and providers of specialized aviation technology. This concentration of power stems from the limited number of global aircraft producers and the proprietary nature of critical maintenance and technology solutions. In 2023, Boeing and Airbus together delivered approximately 93% of all commercial aircraft, underscoring the limited options for lessors like Bohai. This scarcity directly translates into lessors having to accept supplier-dictated terms on pricing and delivery, impacting Bohai Leasing's acquisition costs and fleet expansion strategies.

Suppliers of specialized aviation technology and MRO services also exert significant influence due to the critical nature of their offerings for fleet airworthiness and operational efficiency. Bohai Leasing's reliance on these niche providers, often holding unique certifications or proprietary software, means they have limited alternatives. This dependence allows these suppliers to command higher prices and dictate terms, as switching costs are substantial, and regulatory compliance mandates the use of approved vendors.

| Supplier Type | Market Concentration | Bohai Leasing's Dependence | Impact on Bohai Leasing |

|---|---|---|---|

| Aircraft Manufacturers | Duopoly (Boeing, Airbus) | High (Limited sourcing options) | Higher acquisition costs, less negotiation flexibility on pricing and terms. |

| Specialized Technology Providers (e.g., Fleet Management Software) | Oligopoly/Niche providers | High (Proprietary solutions, critical for operations) | Increased costs for essential services, limited ability to negotiate terms. |

| MRO Services (for specialized components) | Concentrated with certified providers | High (Regulatory compliance, operational uptime) | Higher maintenance expenses, potential delays if key providers are unavailable. |

What is included in the product

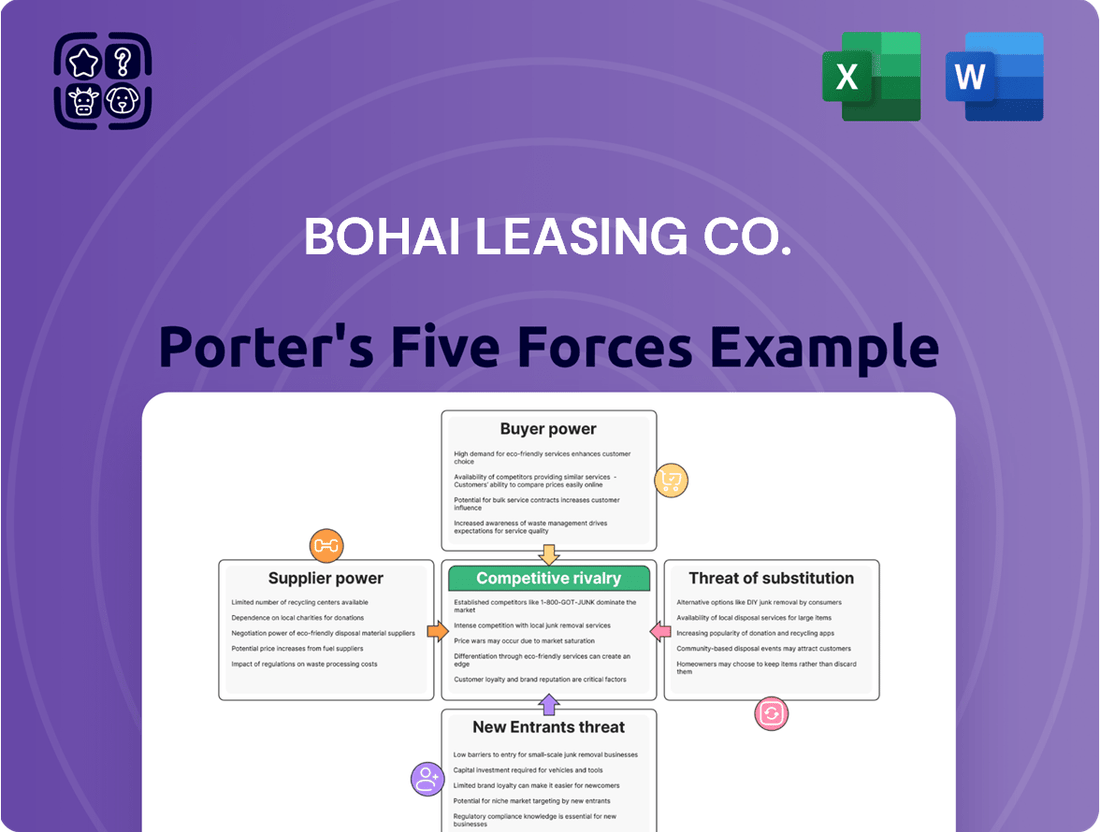

Tailored exclusively for Bohai Leasing Co., this analysis dissects the competitive forces impacting its leasing operations, including supplier and buyer power, threat of new entrants and substitutes, and the intensity of rivalry.

Bohai Leasing's Porter's Five Forces Analysis provides a streamlined, visual representation of competitive pressures, enabling rapid identification of key threats and opportunities without complex financial modeling.

Customers Bargaining Power

Bohai Leasing's diverse global customer base, spanning airlines for aircraft leasing and various businesses for container, infrastructure, and high-end equipment leasing, can somewhat dilute the bargaining power of any single customer segment. This broad reach across multiple industries means that a disruption or demand shift from one sector may not disproportionately impact Bohai Leasing's overall operations.

For airlines and large enterprises, the process of switching aircraft leasing providers is complex and costly. These switching costs, which can include re-negotiating contracts, retraining staff, and adapting operational procedures, significantly reduce the bargaining power of these lessees once a lease agreement is finalized. For instance, a major airline might incur millions in costs to transition its fleet to a new leasing partner, making them less likely to switch mid-contract.

Many of Bohai Leasing's aircraft lease agreements are structured as long-term contracts, often spanning several years. This contractual structure inherently limits the bargaining power of customers by reducing their ability to frequently renegotiate terms or switch lessors in the short term. For instance, a typical long-term aircraft lease might be for 10-12 years, providing Bohai Leasing with predictable revenue and diminishing immediate customer leverage.

Financial Sensitivity of Customers

The financial sensitivity of customers, particularly airlines, significantly impacts Bohai Leasing. Airlines operate on tight margins, making lease rates a critical factor in their profitability. For instance, in 2024, the global airline industry continued to navigate fluctuating fuel costs and intense competition, which directly translates to a keen focus on reducing operational expenses like aircraft leasing.

This heightened sensitivity empowers airlines to exert greater bargaining power. When there are numerous leasing options available, as often seen in a healthy market, airlines can leverage this to negotiate more favorable terms. This means Bohai Leasing must remain competitive on pricing to secure and retain clients.

- Customer Price Sensitivity: Airlines are highly attuned to lease rate fluctuations, directly impacting their cost structure and competitive pricing.

- Negotiation Leverage: In a market with abundant leasing choices, customers gain significant leverage to negotiate better lease agreements.

- Market Dynamics: The availability of alternative leasing providers in 2024 intensified the bargaining power of airlines looking for cost-effective solutions.

Availability of Leasing Options

The financial leasing market is quite crowded, with many companies offering comparable services. This abundance of choice means customers, particularly those looking to lease standard assets like shipping containers, possess significant bargaining power. They can leverage these options to secure more favorable lease terms and pricing.

For instance, in 2024, the global financial leasing market continued to demonstrate robust growth, with a significant portion of this activity involving standardized assets. This competitive landscape directly translates to customers having the upper hand in negotiations.

- Customer Choice: A wide array of leasing providers means customers aren't tied to a single option.

- Standardized Assets: Leasing common assets like containers offers less differentiation, increasing customer leverage.

- Negotiating Power: Customers can demand better rates and contract conditions due to market competition.

Bohai Leasing's customers, particularly airlines, exhibit high price sensitivity due to tight profit margins. In 2024, the airline industry’s focus on cost reduction meant lease rates were a critical negotiation point. This sensitivity, coupled with a competitive leasing market offering numerous alternatives, significantly amplifies customer bargaining power, allowing them to demand more favorable terms and pricing.

| Customer Segment | Price Sensitivity (2024 Context) | Bargaining Power Drivers | Impact on Bohai Leasing |

|---|---|---|---|

| Airlines | High; impacted by fuel costs and competition | Numerous leasing options, long-term contracts, high switching costs | Need for competitive pricing, potential for margin pressure |

| Businesses (Containers, etc.) | Moderate to High; dependent on asset type | Abundant providers for standardized assets, lower switching costs | Leverage for better rates on standard leases |

Same Document Delivered

Bohai Leasing Co. Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Bohai Leasing Co., detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry within the aviation and leasing industries. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides actionable insights into the strategic positioning and potential challenges faced by Bohai Leasing Co., offering a clear understanding of the market dynamics. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

The financial leasing market presents a fascinating paradox: while broad, it contains highly concentrated niches where competition is fierce. Segments like aircraft and container leasing are dominated by a select few powerful entities, creating intense rivalry.

Bohai Leasing strategically positions itself within these concentrated areas. Its ownership of Avolon, the world's second-largest aircraft lessor, and Seaco, the third-largest container lessor, places it directly against other major global players in these specific, high-stakes markets.

Bohai Leasing navigates a highly competitive landscape, facing off against other major international leasing firms. Its significant global footprint and operational scale present a formidable barrier to entry, demanding substantial capital investment and specialized knowledge to rival.

Companies like AerCap, with a fleet of over 1,000 aircraft and a portfolio valued in the tens of billions, exemplify the scale Bohai Leasing must contend with. In 2023, the global aviation leasing market was estimated to be worth over $100 billion, highlighting the immense scale of operations required to be a significant player.

Bohai Leasing's broad diversification across aircraft, containers, infrastructure, and high-end equipment leasing is a significant strength. This strategy allows them to absorb shocks in one sector by leveraging performance in others, effectively reducing overall risk. For instance, while the aviation sector might experience seasonal fluctuations, their container leasing business could provide a stable revenue stream.

Competitors focusing on a single niche, like only aircraft leasing, are more vulnerable to downturns specific to that industry. If a rival heavily relies on aircraft leasing, a drop in air travel demand, as seen during global travel disruptions, could severely impact their financial health. Bohai Leasing's diversified approach, in contrast, offers a more resilient business model.

In 2024, the global leasing market continued to show varied performance. The aircraft leasing sector, recovering from pandemic-related challenges, saw increased demand for newer, fuel-efficient aircraft, a segment Bohai Leasing is well-positioned to serve. Meanwhile, the container leasing market experienced price stabilization after significant volatility in prior years, demonstrating the benefits of a balanced portfolio.

Pricing and Service Innovation

Competitive rivalry within the aircraft leasing sector, particularly for companies like Bohai Leasing, is intense and often centers on pricing strategies and the continuous innovation of services. Lessors frequently engage in competitive pricing, offering flexible financing structures to secure lease agreements. This dynamic means that companies must constantly update their service portfolios to attract and keep customers, which can put pressure on profit margins.

The need for innovation extends to value-added services, such as customized maintenance programs, technical support, and fleet management solutions. For instance, in 2024, several major aircraft lessors announced new digital platforms aimed at enhancing customer experience and operational efficiency, directly competing on service quality. This constant push for differentiation means that lessors must invest heavily in technology and expertise.

- Pricing Wars: Competition often drives down lease rates, especially for popular aircraft models.

- Financing Flexibility: Offering tailored lease terms, including sale-and-leaseback options, is a key differentiator.

- Service Innovation: Value-added services like predictive maintenance and fleet advisory are crucial for retention.

- Market Share Focus: In 2024, lessors continued to vie for market share, sometimes at the expense of short-term profitability.

Impact of Economic Cycles and Geopolitical Factors

The leasing industry, including companies like Bohai Leasing, is inherently tied to the ebb and flow of global economic cycles. When economies contract, demand for leasing services often shrinks, leading to increased competition among lessors. This heightened rivalry can manifest as price wars or more aggressive marketing efforts as companies fight for a smaller pie.

Geopolitical events and trade disruptions further exacerbate this sensitivity. For instance, disruptions in global supply chains or the imposition of tariffs can directly impact trade volumes, which are a key driver for many leasing sectors, such as aviation or shipping. In 2023, global trade experienced a slowdown, with the WTO forecasting a mere 0.8% growth in merchandise trade volume, down from 3.5% in 2022, highlighting the challenging environment lessors faced.

- Economic Downturns: Reduced business investment and consumer spending during recessions directly lower demand for leased assets, intensifying competition.

- Trade Disruptions: Events like the Red Sea shipping crisis in late 2023 and early 2024 led to increased shipping costs and rerouting, impacting the utilization and profitability of leased vessels.

- Geopolitical Instability: International conflicts can freeze or limit cross-border leasing activities, forcing companies to focus on domestic markets and increasing local competition.

- Currency Fluctuations: Significant shifts in exchange rates, often driven by geopolitical events, can impact the cost of leased assets and the profitability of international leasing operations.

Bohai Leasing operates in markets with intense rivalry, particularly in aircraft and container leasing, where a few dominant global players compete fiercely. Its strategic ownership of Avolon and Seaco places it directly against major international lessors like AerCap, which managed over 1,000 aircraft in 2023.

Competition often involves aggressive pricing, flexible financing structures, and a constant drive for service innovation, including digital platforms and advanced fleet management solutions. For instance, in 2024, lessors continued to prioritize market share, sometimes impacting short-term profitability, as seen in the global aviation leasing market valued at over $100 billion.

The intensity of this rivalry is amplified by economic cycles and geopolitical events. Downturns reduce demand, leading to price wars, while trade disruptions, like those affecting shipping in late 2023 and early 2024, increase operational costs and intensify competition within specific leasing segments.

| Competitor | Primary Market | Fleet Size (Approx.) | 2023 Revenue (Approx.) |

|---|---|---|---|

| AerCap | Aircraft | 1000+ Aircraft | $7.5 Billion |

| Seaco (Bohai Leasing Subsidiary) | Containers | ~2.7 Million TEU | N/A (Part of Bohai Leasing) |

| SMBC Aviation Capital | Aircraft | ~700 Aircraft | N/A (Private) |

SSubstitutes Threaten

Customers might choose to buy assets outright instead of leasing, particularly if they have the necessary funds or view long-term ownership as more economical. This direct purchase represents a significant substitute for leasing companies like Bohai Leasing.

For instance, in 2024, the global market for capital goods, which often involve assets that could be leased, saw continued robust demand. Companies with strong balance sheets may find direct acquisition more appealing, especially when interest rates on financing for purchases are favorable compared to lease rates.

Traditional bank loans and other forms of debt financing present a significant substitute for leasing services. Companies can directly borrow funds from financial institutions or issue corporate bonds to acquire assets, thereby circumventing the need for a leasing agreement. For instance, in 2024, the average interest rate for corporate bonds in the US hovered around 5% to 6%, making debt financing a potentially cost-effective alternative depending on market conditions and a company's creditworthiness.

The viability of this substitute is heavily influenced by prevailing interest rates and the overall ease of access to credit markets. When borrowing costs are low, businesses are more likely to opt for direct debt financing rather than leasing. This direct approach can offer greater ownership flexibility and potential tax advantages, depending on the specific financial structures employed.

The availability of used asset markets, particularly for containers and older aircraft, presents a significant threat to Bohai Leasing. Businesses can acquire pre-owned equipment at substantially lower costs compared to new leases, directly impacting Bohai Leasing's pricing power and market share. For instance, the secondary market for commercial aircraft is substantial, with many airlines opting for used planes to manage capital expenditure, as seen in the continued trading of Boeing 737-800s and Airbus A320ceos even as newer models emerge.

Alternative Transportation or Logistics Models

The threat of substitutes for Bohai Leasing Co. in the container leasing segment is influenced by evolving transportation and logistics models. For shorter hauls, a growing preference for intermodal solutions that integrate rail and road transport can bypass the need for standalone container leasing.

Furthermore, major shipping lines are increasingly offering comprehensive, end-to-end logistics services. This vertical integration means they might manage their container fleets internally or through dedicated subsidiaries, thereby diminishing reliance on third-party lessors like Bohai Leasing. For instance, in 2024, several global carriers announced expansions of their integrated logistics platforms, aiming to capture a larger share of the supply chain value.

- Shifting demand towards intermodal transport for regional distribution.

- Vertical integration by shipping lines reducing reliance on external leasing.

- Growth in asset-light logistics providers potentially impacting traditional leasing models.

Technological Advancements and Obsolescence

Rapid technological advancements pose a significant threat to Bohai Leasing's business model. As new technologies emerge, existing leased equipment can quickly become outdated. For instance, in the aviation sector, the introduction of more fuel-efficient aircraft, like the Boeing 737 MAX or Airbus A320neo families, can make older models less attractive to airlines, potentially leading them to seek newer, technologically superior aircraft rather than continuing leases on older fleets. This can increase the appeal of direct purchases or leases from manufacturers offering cutting-edge solutions.

This trend can pressure Bohai Leasing to constantly update its asset portfolio to remain competitive. Customers might opt for purchasing newer, more advanced equipment directly from manufacturers or explore alternative leasing providers that offer the latest innovations. For example, the rapid evolution of digital technologies in the IT leasing sector means that hardware can become obsolete within a few years, pushing clients to upgrade more frequently.

The threat of substitutes is amplified by the decreasing cost and increasing accessibility of advanced technologies. Consider the telecommunications industry, where 5G technology is rapidly being adopted, making older 4G infrastructure less desirable. Airlines, for example, are increasingly looking at the total cost of ownership, including fuel efficiency and technological capabilities, when making fleet decisions. In 2023, the global aviation industry saw significant investment in next-generation aircraft, with orders for fuel-efficient models continuing to rise, highlighting this shift.

- Technological Obsolescence: Leased assets, particularly in sectors like aviation and IT, face rapid depreciation due to technological advancements.

- Customer Preference Shift: Customers may favor purchasing or leasing newer, more efficient equipment directly from manufacturers or competitors offering advanced solutions.

- Increased Competition: The availability of cutting-edge technology at competitive prices from alternative sources intensifies the threat of substitutes for Bohai Leasing.

- Impact on Asset Value: The speed of technological change directly impacts the residual value and leaseability of Bohai Leasing's asset portfolio.

Customers can bypass leasing entirely by purchasing assets outright, especially if they have capital or find ownership more economical long-term. In 2024, the capital goods market showed strong demand, making direct acquisition appealing for companies with robust balance sheets, particularly when favorable financing rates for purchases are available compared to lease rates.

Debt financing, like bank loans or corporate bonds, serves as a direct substitute for leasing. Companies can fund asset acquisition through borrowing, avoiding lease agreements. For context, in 2024, U.S. corporate bond interest rates averaged around 5% to 6%, offering a potentially cost-effective alternative depending on creditworthiness and market conditions.

The availability of used assets, especially in sectors like aircraft and containers, poses a threat. Businesses can acquire pre-owned equipment at lower costs than new leases, impacting Bohai Leasing's pricing. For instance, the secondary market for aircraft like the Boeing 737-800 and Airbus A320ceo remains active, with airlines often choosing used planes for cost management.

Entrants Threaten

The sheer scale of capital needed to enter the financial leasing market, particularly for high-value assets like aircraft and heavy machinery, presents a formidable hurdle. For instance, acquiring even a single new wide-body aircraft can easily exceed $300 million in 2024, demanding extensive financing and robust credit lines that new players often lack.

The financial leasing sector is heavily regulated, with varying licensing requirements across different countries. For instance, in China, where Bohai Leasing operates, leasing companies must adhere to strict capital adequacy ratios and operational guidelines set by bodies like the China Banking and Insurance Regulatory Commission (CBIRC). Navigating these complex legal landscapes and obtaining the necessary approvals presents a significant barrier for potential new entrants, requiring substantial investment in legal expertise and compliance infrastructure.

Established players like Bohai Leasing benefit from deeply entrenched relationships with a diverse client base, built over years of consistent service and demonstrable reliability. For instance, in 2024, Bohai Leasing reported a robust fleet utilization rate, underscoring its strong client partnerships.

New entrants face a significant hurdle in replicating this established trust and client loyalty. They would need to invest heavily in marketing and sales to build a comparable reputation and attract customers away from proven providers, a process that historically takes considerable time and financial resources.

Access to Diverse Asset Portfolios

Bohai Leasing's extensive and varied asset portfolio, spanning aircraft, shipping containers, and infrastructure, presents a significant barrier for potential new entrants. This diversification allows Bohai to offer a comprehensive suite of financial solutions and leverage cross-selling opportunities that a newcomer, likely needing to focus on a niche initially, would struggle to match.

For instance, in 2024, Bohai Leasing's consolidated assets reached approximately $50 billion, a scale that requires substantial capital investment to replicate. New competitors would face the daunting task of building a similarly broad asset base, which is time-consuming and capital-intensive.

- Diversified Asset Base: Bohai Leasing's holdings across multiple asset classes (aircraft, containers, infrastructure) create a strong competitive moat.

- Capital Intensity: New entrants require massive capital to match Bohai's breadth of asset ownership, limiting their ability to compete across the board.

- Cross-Selling Synergies: Bohai leverages its diverse portfolio to offer integrated financial services, a capability difficult for specialized new firms to replicate.

- Market Reach Limitation: Initial specialization by new entrants restricts their immediate market penetration and ability to capture a significant share of the leasing market.

Economies of Scale and Operational Efficiency

The threat of new entrants for Bohai Leasing is significantly mitigated by substantial economies of scale. Established players like Bohai Leasing leverage their massive fleet sizes to negotiate better terms on aircraft acquisition and financing, driving down per-unit costs. For instance, in 2024, major lessors often secure bulk discounts on new aircraft orders, a significant advantage unavailable to smaller, emerging companies.

Achieving operational efficiency comparable to Bohai Leasing would require immense upfront capital investment and time to build a comparable fleet and customer base. This makes it challenging for new entrants to compete on price and service quality. The sheer operational complexity of managing a global fleet, including maintenance, regulatory compliance, and remarketing, also presents a high barrier.

- Economies of Scale in Purchasing: Large lessors benefit from bulk discounts on new aircraft, reducing acquisition costs per unit.

- Financing Advantages: Established companies can secure more favorable financing terms due to their size and creditworthiness.

- Operational Efficiencies: High fleet utilization and optimized management practices lead to lower operating expenses for large lessors.

The threat of new entrants is considerably low for Bohai Leasing due to the immense capital requirements and stringent regulatory environment. New companies would need billions to compete, a barrier few can overcome. Established relationships and brand reputation also solidify Bohai's position, making it difficult for newcomers to gain traction.

The high cost of acquiring assets, like aircraft costing over $300 million in 2024, coupled with complex licensing and compliance in markets like China, deters potential competitors. Furthermore, Bohai's diversified asset base and economies of scale in purchasing and financing provide significant cost advantages that are challenging to replicate.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | Massive investment needed for asset acquisition and operations. | New wide-body aircraft exceed $300 million. |

| Regulatory Hurdles | Complex licensing and compliance across jurisdictions. | China's CBIRC mandates strict capital adequacy ratios. |

| Economies of Scale | Lower per-unit costs due to large-scale operations and purchasing power. | Bulk discounts on aircraft orders for major lessors. |

| Established Relationships | Existing client loyalty and trust built over time. | Bohai's strong fleet utilization indicates robust client partnerships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bohai Leasing Co. is built upon comprehensive data from annual reports, industry-specific market research, and official regulatory filings. This blend of sources allows for a robust assessment of competitive intensity and strategic positioning.