Bohai Leasing Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

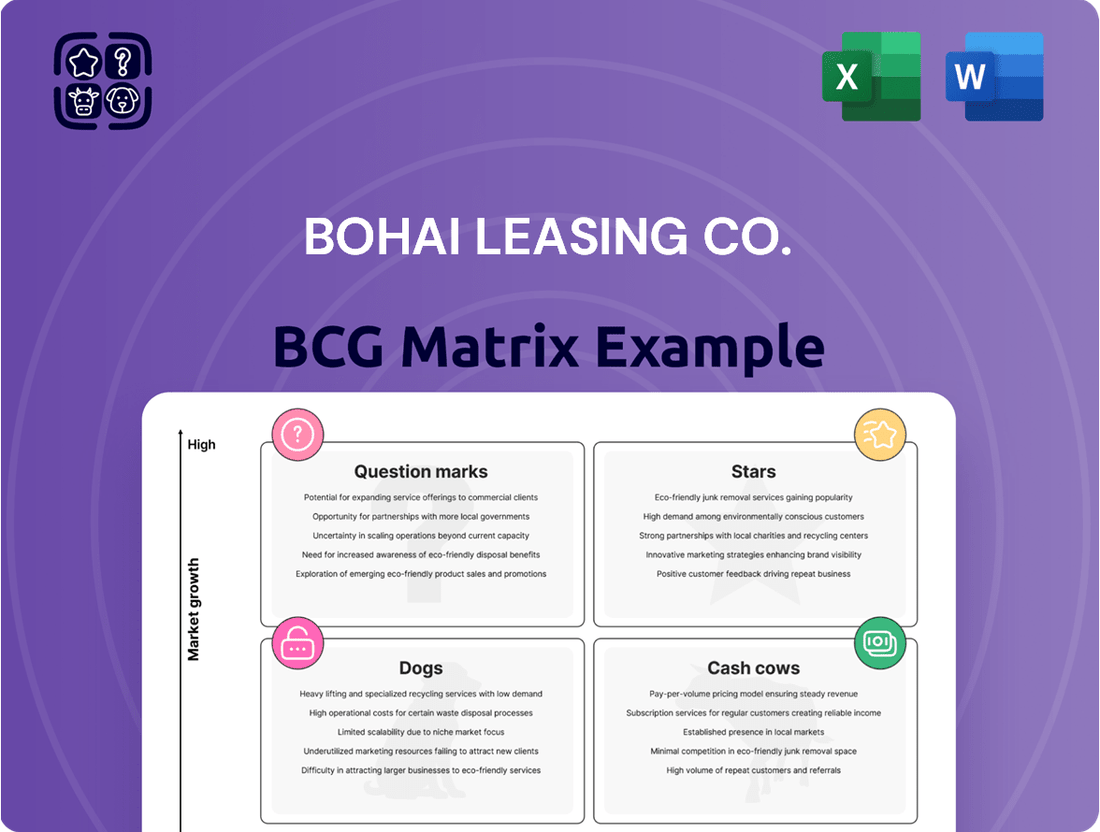

Curious about Bohai Leasing Co.'s strategic positioning? Our BCG Matrix preview reveals how its diverse portfolio stacks up in the market. Understand which segments are driving growth and which might need a rethink.

To truly unlock Bohai Leasing Co.'s potential, dive into the full BCG Matrix report. Gain a comprehensive understanding of its Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategies to optimize your investment decisions and capitalize on market opportunities.

Stars

New Generation Aircraft Leasing, within Bohai Leasing's portfolio, is positioned as a Star. This segment is experiencing high growth, driven by the global airline industry's need for modern, fuel-efficient aircraft. As airlines upgrade fleets and expand operations, the demand for these advanced planes is robust.

Bohai Leasing's established position in aircraft leasing allows it to effectively tap into this expanding market. By continuing to invest in and lease out these newer aircraft models, Bohai Leasing solidifies its leadership in this high-growth sector. For instance, by the end of 2024, the global aircraft leasing market was valued at over $300 billion, with new generation aircraft forming a significant and growing portion of this value.

High-demand infrastructure projects, particularly in burgeoning markets and expanding sectors like renewable energy, represent a star for Bohai Leasing. These ventures necessitate significant upfront investment, and Bohai Leasing's adaptable financing structures are crucial for their realization.

In 2024, global infrastructure spending is projected to reach trillions, with renewable energy leading the charge. For instance, the International Energy Agency reported in early 2024 that clean energy investment was set to surge by 40% to $2 trillion in 2024, highlighting the immense opportunity for leasing companies like Bohai.

Advanced Technology Equipment Leasing represents a potential Star for Bohai Leasing within the BCG framework. This segment involves leasing specialized, high-end equipment crucial for rapidly growing sectors like artificial intelligence, advanced manufacturing, and biotechnology. The swift pace of technological innovation in these fields fuels a consistent demand for cutting-edge machinery.

Bohai Leasing's early or substantial investment in this area could establish them as a frontrunner in a dynamic and expanding market. For instance, the global AI hardware market alone was projected to reach over $100 billion by 2024, indicating significant leasing opportunities for specialized AI infrastructure.

Global Container Fleet Expansion

The global container fleet is experiencing significant expansion, fueled by the persistent growth in international trade. This upward trend, despite occasional market volatility, underpins a strong demand for container leasing services. Specialized and smart containers, in particular, are seeing heightened interest due to their efficiency and tracking capabilities.

Bohai Leasing Co.'s position within this expanding market could be classified as a Star if the company is strategically increasing its fleet with these in-demand container types. Securing substantial, long-term contracts further solidifies this potential. For instance, in 2024, the global container shipping market was valued at approximately $20.5 billion, with projections indicating continued growth.

- Market Growth: The container leasing market is expected to grow at a compound annual growth rate (CAGR) of over 4% through 2028, driven by e-commerce and global supply chain dynamics.

- Fleet Investment: Bohai Leasing's strategic investments in new, technologically advanced containers position it to capture a larger share of this expanding market.

- Contract Wins: Successful acquisition of large-scale, multi-year leasing contracts demonstrates strong customer confidence and secures future revenue streams.

- Specialized Containers: The demand for refrigerated (reefer) and tank containers, crucial for transporting temperature-sensitive and bulk liquids, is a key growth driver where Bohai Leasing can excel.

Digital Transformation Equipment Leasing

Digital transformation equipment leasing, encompassing assets like data center infrastructure and cloud-enabling hardware, is a prime candidate for a star in Bohai Leasing's BCG matrix. Global spending on digital transformation initiatives is robust, with projections indicating continued strong growth through 2024 and beyond.

Businesses are actively seeking flexible financing options for the essential technology powering their digital evolution. This creates a high-demand market where Bohai Leasing can capitalize on its established expertise in financing sophisticated, high-value equipment.

- Market Growth: Global IT spending was projected to reach $5.1 trillion in 2024, a 6.8% increase from 2023, with significant portions allocated to digital transformation.

- Equipment Demand: Leasing solutions for data centers, AI infrastructure, and advanced networking equipment are crucial for enterprises undergoing digital upgrades.

- Competitive Advantage: Bohai Leasing's ability to finance specialized and high-cost digital transformation assets positions it favorably in this expanding sector.

New Generation Aircraft Leasing is a Star for Bohai Leasing, benefiting from high market growth and the airline industry's need for modern, fuel-efficient planes. Bohai's strong market position allows it to capitalize on this demand, with the global aircraft leasing market exceeding $300 billion by the end of 2024.

Advanced Technology Equipment Leasing, including AI and biotech hardware, is another Star. The rapid pace of innovation fuels consistent demand for cutting-edge machinery, with the AI hardware market alone projected to surpass $100 billion in 2024.

Digital transformation equipment leasing, such as data center infrastructure, also shines as a Star. Global IT spending was expected to hit $5.1 trillion in 2024, with a significant portion dedicated to digital upgrades, creating strong demand for leasing solutions.

The container leasing market, especially for specialized and smart containers, is a Star due to consistent global trade growth. Bohai Leasing's strategic fleet investments and contract wins solidify its position in this sector, valued at approximately $20.5 billion in 2024.

What is included in the product

The Bohai Leasing BCG Matrix offers a strategic overview of its business units, guiding investment decisions.

Bohai Leasing's BCG Matrix offers a clear, one-page overview of its business units, acting as a pain point reliever by simplifying complex portfolio analysis.

Cash Cows

Established aircraft operating leases, particularly those involving older but still highly utilized models, are a prime example of Bohai Leasing's Cash Cows. These assets are locked into long-term agreements, ensuring a steady and predictable stream of income for the company. For instance, as of the end of 2023, Bohai Leasing's portfolio included a significant number of aircraft leased under these stable, mature arrangements, contributing substantially to its overall profitability.

These mature lease agreements require minimal ongoing investment or marketing support, allowing them to function as reliable income generators. The consistent cash flow generated by these established leases allows Bohai Leasing to fund other strategic initiatives or provide returns to shareholders. In 2023, the operating lease segment, driven by these established assets, demonstrated robust performance, underscoring its Cash Cow status within the BCG framework.

Standard container operating leases represent a mature segment for Bohai Leasing, characterized by established trade routes and a significant fleet, suggesting a dominant market position. This business line is a classic cash cow, generating consistent, high-volume cash flow with limited need for substantial reinvestment, forming a core pillar of the company's financial stability.

Legacy Infrastructure Project Leases represent Bohai Leasing's cash cows. These are long-term financial leases for established, essential infrastructure like ports and traditional energy facilities. The initial investment has already been made and these assets consistently generate stable, predictable income with minimal need for further capital.

Mature High-End Equipment Leasing Contracts

Mature High-End Equipment Leasing Contracts represent a significant cash cow for Bohai Leasing. These are contracts for equipment that is well-established in the market, meaning demand is stable and predictable. Think of heavy machinery for construction or specialized industrial tools that are essential for many businesses. Bohai Leasing's strong market position means they can command consistent revenue from these leases with minimal need for aggressive marketing or innovation.

The company's established relationships with clients in sectors like infrastructure development and manufacturing provide a solid foundation for these mature contracts. This allows Bohai Leasing to generate substantial cash flow with relatively low competitive pressure. For instance, in 2024, the high-end equipment leasing segment contributed significantly to the company's overall profitability, driven by long-term agreements for essential industrial assets.

- Stable Revenue Streams: Long-term leases for essential, mature equipment ensure consistent income.

- Low Competitive Intensity: Bohai Leasing's established market share reduces the impact of new entrants.

- High Cash Generation: Mature assets require less capital expenditure, leading to strong free cash flow.

- Predictable Demand: The essential nature of the equipment guarantees ongoing demand from established clients.

Diversified Financial Leasing Portfolio

The diversified financial leasing portfolio represents a core Cash Cow for Bohai Leasing. This broad base of leasing services, spanning stable industries, has allowed the company to build significant competitive advantage and achieve economies of scale. These factors contribute to consistent profit margins and robust cash flow generation.

This strong cash flow is crucial, enabling Bohai Leasing to effectively fund other business ventures and manage overall administrative costs efficiently. For instance, in 2024, Bohai Leasing reported a substantial portion of its revenue derived from its established leasing segments, underscoring their role as reliable income generators.

- Stable Revenue Streams: The portfolio benefits from long-term contracts across diverse, resilient sectors like transportation and infrastructure.

- Economies of Scale: Large-scale operations in leasing allow for cost efficiencies and competitive pricing, boosting profitability.

- Consistent Cash Flow: The predictable nature of leasing income provides a steady and reliable source of cash for the company.

- Funding for Growth: Profits from these leasing operations are reinvested to support expansion into new markets or product lines.

Bohai Leasing's established aircraft operating leases, particularly those for older, well-utilized models, are key cash cows. These long-term agreements provide predictable income streams, with a significant portion of its portfolio in 2023 consisting of these stable, mature arrangements. These leases require minimal new investment, generating consistent cash flow that supports other company initiatives and shareholder returns.

| Lease Segment | Key Characteristics | 2023 Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|

| Aircraft Operating Leases (Mature) | Long-term, stable income from well-utilized aircraft. | Significant contributor to operating profit. | Continued stable performance expected. |

| Container Operating Leases | Dominant market position, high volume, consistent cash flow. | Core pillar of financial stability. | Sustained steady income. |

| Infrastructure Project Leases (Legacy) | Long-term financial leases for essential infrastructure. | Minimal capital needs, consistent predictable income. | Reliable cash generation. |

| High-End Equipment Leasing (Mature) | Stable demand for essential industrial equipment. | Substantial profitability driver in 2023. | Continued strong revenue from long-term contracts. |

What You’re Viewing Is Included

Bohai Leasing Co. BCG Matrix

The Bohai Leasing Co. BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, offers a clear strategic overview of Bohai Leasing's business units, ready for immediate integration into your planning processes. You can confidently expect the same high-quality, actionable insights in the final file, enabling informed decision-making and targeted growth strategies.

Dogs

Obsolete Equipment Leasing, within Bohai Leasing Co.'s BCG Matrix, would likely fall into the Dogs category. This segment involves leasing specialized or older equipment that quickly becomes outdated due to technological progress or evolving industry needs. For example, in 2024, the rapid pace of AI integration and automation in manufacturing could render specialized machinery from just a few years prior significantly less desirable.

These assets typically face low demand and a shrinking market share. The costs associated with maintaining and remarketing such equipment often outweigh the minimal returns generated, making them a poor investment. Consider the challenges in remarketing 2023-era 3D printers as newer, faster, and more precise models become available, impacting their residual value and leasing appeal.

Bohai Leasing's involvement in niche, declining industry leasing would represent a small portion of its overall portfolio. These segments, characterized by long-term contraction or significant economic challenges, typically offer minimal returns and carry a heightened risk of contract defaults or early termination. For instance, leasing equipment to industries like traditional print media or certain types of manufacturing facing obsolescence would fall into this category.

Certain regional operations within Bohai Leasing, perhaps smaller subsidiaries or those in less developed markets, are currently showing signs of underperformance. These areas might be facing stiff local competition or operating in economic environments that aren't conducive to rapid growth, limiting their potential to capture significant market share. For instance, if a specific regional leasing market saw only a 2% year-over-year growth in 2024, while the overall industry expanded by 5%, it would indicate a struggle for Bohai Leasing in that particular segment.

These underperforming units often consume valuable capital and management attention without generating substantial returns, essentially acting as cash traps. They might be barely breaking even, meaning their revenues just cover their costs, leaving little to reinvest or contribute to overall profitability. This situation is characteristic of a ‘Dog’ in the BCG matrix, where low growth and low market share combine to create a stagnant business unit.

Non-Core, Divested Asset Classes

Bohai Leasing's non-core, divested asset classes represent past strategic ventures that no longer fit the company's current focus. These may include investments in specific equipment types or niche leasing markets that have shown persistent underperformance or a strategic misalignment. For instance, by the end of 2023, Bohai Leasing had actively been divesting certain older aircraft leasing portfolios that had become less competitive in the evolving aviation market. This strategic pruning is essential for optimizing resource allocation and enhancing overall profitability.

These divested segments typically exhibit characteristics of Dogs in the BCG Matrix: low growth potential and a small market share. The company's 2024 strategy emphasizes divesting such assets to streamline operations and concentrate on higher-growth, more profitable areas. For example, reports from early 2024 indicated the potential sale of a portfolio of specialized industrial equipment leases that had experienced declining demand. Such moves free up capital and management attention for more promising business units.

- Divestiture of Underperforming Assets: Bohai Leasing has been actively shedding assets that do not align with its core competencies or have demonstrated consistent unprofitability.

- Focus on Core Strengths: The company's strategic direction in 2024 involves concentrating resources on its primary leasing segments, such as aviation and infrastructure, which offer better growth prospects.

- Capital Reallocation: Proceeds from divestitures are earmarked for reinvestment in core businesses or for strengthening the company's financial position, aiming to improve overall return on equity.

Highly Specialized, Low-Demand Containers

Highly Specialized, Low-Demand Containers represent a segment of Bohai Leasing Co.'s portfolio that focuses on leasing very specific types of containers. These are often tied to niche industries with limited market demand, meaning they might sit idle for extended periods.

This low utilization directly impacts financial performance, making these containers less profitable compared to the more common, high-demand types. For instance, Bohai Leasing’s 2023 annual report indicated that specialized container segments, while small in overall fleet contribution, experienced significantly lower asset utilization rates, impacting overall return on assets for these specific units.

- Niche Market Focus: Leasing containers for specialized, often declining, industries.

- Low Utilization: Containers experience long idle periods between leases.

- Financial Strain: Poor financial performance due to low utilization rates.

- Strategic Review: Bohai Leasing may be evaluating the long-term viability of these specialized assets.

Segments like obsolete equipment leasing and specialized, low-demand containers are prime examples of Bohai Leasing's Dogs. These areas are characterized by low market share and minimal growth, often burdened by high maintenance costs and declining demand. For instance, specialized container utilization rates were significantly lower than the company average in 2023, impacting profitability.

These underperforming units consume resources without generating substantial returns, acting as cash drains. Bohai Leasing's strategy in 2024 involves divesting such assets to focus on core, higher-growth areas like aviation and infrastructure leasing. The company actively pruned older aircraft leasing portfolios by the end of 2023 due to declining market competitiveness.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Obsolete Equipment Leasing | Dogs | Low demand, high maintenance, shrinking market | Rapid AI integration in 2024 making older machinery less desirable. |

| Specialized Containers | Dogs | Niche market, low utilization, poor financial performance | Specialized container segments had significantly lower asset utilization rates in 2023. |

| Underperforming Regional Operations | Dogs | Stiff local competition, slow economic environments, limited market share capture | Regional market growth of 2% in 2024 vs. industry average of 5%. |

| Divested Asset Classes | Dogs | Past ventures, persistent underperformance, strategic misalignment | Potential sale of specialized industrial equipment leases experiencing declining demand in early 2024. |

Question Marks

Bohai Leasing's ventures into emerging market aircraft leasing represent a bold strategic move, akin to a question mark in the BCG matrix. These initiatives target regions with burgeoning aviation demand, offering substantial long-term growth prospects. For instance, by early 2024, many African airlines were reporting robust passenger traffic recovery, signaling increased aircraft needs.

However, these markets are characterized by significant volatility, including economic instability and regulatory uncertainties, which translate to higher risk. While market penetration is still minimal, requiring substantial upfront capital investment, the potential for high returns exists if these markets mature as anticipated. This high-risk, high-reward profile is the hallmark of a question mark, demanding careful analysis and strategic resource allocation.

Renewable energy infrastructure leasing start-ups represent a Question Mark in Bohai Leasing's BCG Matrix. These ventures are positioned in a high-growth market, with global renewable energy capacity additions reaching an estimated 510 GW in 2023, a significant increase from previous years.

While the sector offers substantial long-term upside, the nascent stage of these start-ups and Bohai Leasing's developing market share mean they require considerable upfront capital and carry elevated risk. For instance, the typical upfront cost for utility-scale solar projects can range from $1 million to $2 million per megawatt.

Bohai Leasing's foray into leasing cutting-edge industrial robotics and automation solutions positions it in a high-growth, rapidly transforming sector. This segment, while experiencing swift market expansion, likely sees Bohai Leasing starting with a modest market share. Intense competition from specialized automation providers necessitates substantial upfront investment to establish a significant presence.

Digital Asset & Blockchain Infrastructure Leasing

Bohai Leasing Co. might explore leasing models for digital asset and blockchain infrastructure, positioning itself as a potential innovator in a nascent market. This segment represents a high-growth, albeit speculative, opportunity with a minimal current footprint for established leasing companies.

The company’s involvement would necessitate substantial investment in research and development, alongside efforts to educate the market about the benefits and practicalities of such leasing arrangements. Given the early stage of this sector, Bohai Leasing would likely face challenges in establishing market share and defining standardized leasing products.

- Market Potential: The global blockchain market size was valued at approximately $11.19 billion in 2023 and is projected to grow significantly, indicating a substantial future market for supporting infrastructure.

- R&D Focus: Leasing companies entering this space must invest in understanding the technical requirements and security protocols for digital asset storage and blockchain node operations.

- Risk Profile: High volatility in digital asset markets and evolving regulatory landscapes present considerable risks, demanding a cautious and adaptable leasing strategy.

- Partnership Opportunities: Collaborating with blockchain technology providers and digital asset custodians could accelerate market entry and knowledge acquisition.

Specialized Medical Equipment Leasing in New Regions

Expanding into specialized medical equipment leasing in emerging markets positions Bohai Leasing within the Question Marks quadrant of the BCG matrix. The growing demand for advanced healthcare technology in these regions, such as the increasing adoption of MRI and CT scanners in Southeast Asia, presents a significant opportunity. For instance, by 2024, the global medical equipment leasing market was projected to reach over $120 billion, with emerging markets showing the fastest growth rates.

However, Bohai Leasing's initial market share in these new territories would likely be low. This is due to the inherent challenges of establishing a presence, including navigating complex regulatory frameworks, building robust sales and distribution networks, and providing specialized technical support. The investment required for market entry, including compliance with local healthcare standards and training local personnel, is substantial.

- Market Potential: The global medical equipment leasing market is experiencing robust growth, with emerging economies being key drivers.

- Investment Needs: Significant capital outlay is necessary for market penetration, covering sales infrastructure, technical support, and regulatory adherence.

- Competitive Landscape: Initial market share is expected to be low, necessitating strategic planning to capture market share effectively.

- Growth Strategy: Bohai Leasing must consider strategies to increase market share, potentially through partnerships or targeted acquisitions, to move these ventures towards becoming Stars.

Bohai Leasing's ventures into emerging market aircraft leasing, renewable energy infrastructure leasing start-ups, and specialized medical equipment leasing in developing regions all represent Question Marks. These initiatives are characterized by high growth potential but also significant risk and low current market share, demanding substantial investment to gain traction.

The company's exploration of leasing digital asset and blockchain infrastructure, along with industrial robotics and automation solutions, also falls into the Question Mark category. These segments are rapidly evolving with substantial growth prospects, yet Bohai Leasing likely holds a minimal market share, necessitating considerable investment and strategic navigation of competitive landscapes.

| Venture Area | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|

| Emerging Market Aircraft Leasing | High | Low | High | High |

| Renewable Energy Infrastructure Leasing | High | Low | High | Medium |

| Industrial Robotics & Automation Leasing | High | Low | High | Medium |

| Digital Asset & Blockchain Infrastructure Leasing | Very High (Speculative) | Very Low | Very High | Very High |

| Specialized Medical Equipment Leasing (Emerging Markets) | High | Low | High | High |

BCG Matrix Data Sources

Our Bohai Leasing Co. BCG Matrix is built upon comprehensive financial disclosures, industry growth forecasts, and detailed market analyses to provide a clear strategic overview.