Boeing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

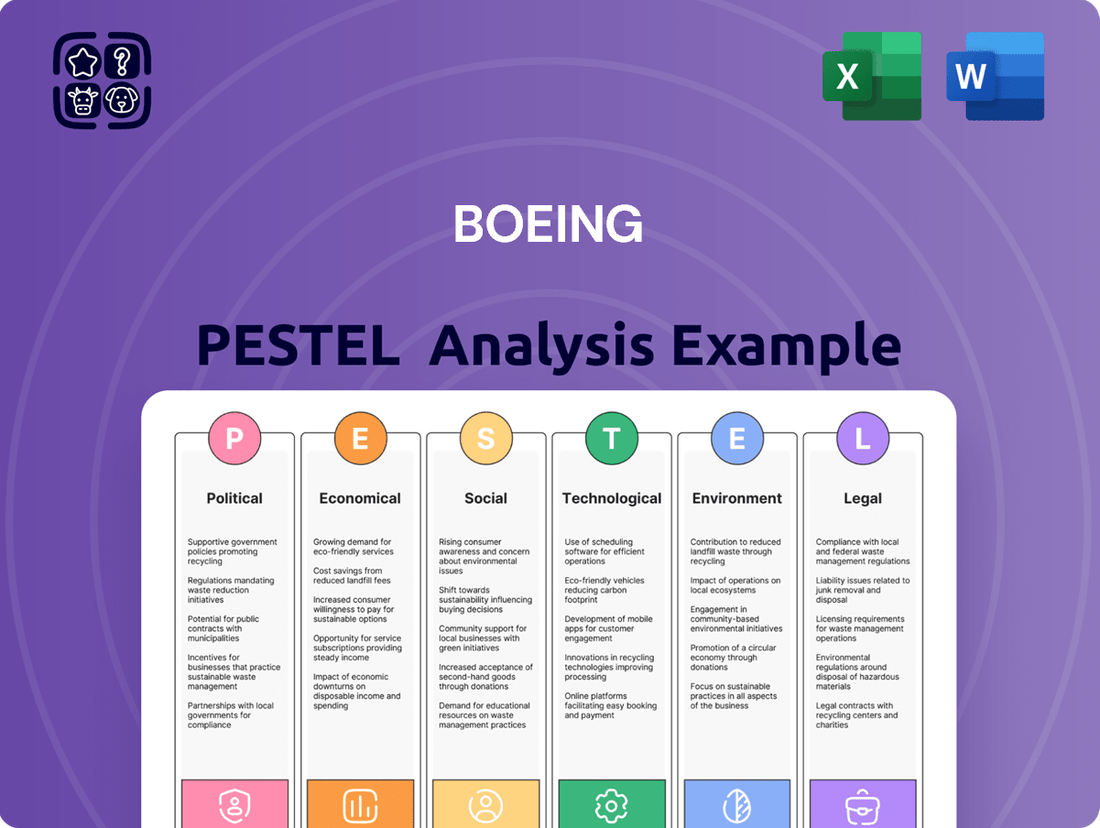

Unlock the intricate forces shaping Boeing's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are impacting this aerospace giant. This detailed report is your key to anticipating challenges and capitalizing on emerging opportunities in the global aviation market. Empower your strategic planning and investment decisions by gaining unparalleled clarity on Boeing's external environment. Download the full PESTLE analysis now and equip yourself with the actionable intelligence needed to stay ahead.

Political factors

Boeing's Defense, Space & Security (BDS) business is deeply intertwined with government contracts, making it highly susceptible to changes in national defense budgets and evolving geopolitical landscapes. For instance, increased global tensions in 2024 and projected into 2025 could spur greater defense investment, potentially boosting Boeing's order book.

Conversely, significant defense budget reductions, a recurring concern in many developed nations, would directly impact Boeing's revenue streams within the BDS segment. The company’s strategic focus on influencing policy is evident; its 2025 Advocacy Report highlights efforts tied to crucial legislation such as the National Defense Authorization Act, which directly shapes defense spending priorities.

International trade policies and tariffs are critical for Boeing's global business. For instance, the ongoing trade friction between the United States and China directly affects Boeing's costs for components and its access to the vast Chinese market. This can lead to higher prices for Boeing aircraft, potentially dampening demand from Chinese airlines.

Retaliatory tariffs imposed by other major economies, such as the European Union, can also add significant costs to Boeing's aircraft and spare parts. In 2023, the U.S. imposed tariffs on certain European goods, prompting concerns about potential reciprocal measures that could impact Boeing's competitiveness in the European market, a key region for aircraft sales.

Government aviation regulators wield significant influence over Boeing's operations, impacting everything from sales to production. Agencies like the U.S. Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) set the standards that Boeing must meet.

Following the January 2024 Alaska Airlines 737 MAX 9 incident, Boeing is under heightened scrutiny. This has led to production slowdowns and strict requirements for quality improvement plans, directly affecting manufacturing output.

Delays in regulatory certification for new aircraft models, such as the 737 MAX 7 and MAX 10, can create substantial challenges. These delays directly impact Boeing's ability to bring new products to market and meet customer delivery commitments.

Lobbying and Political Influence

Boeing dedicates significant resources to lobbying and political advocacy, aiming to shape policies favorable to the aerospace and defense sectors. By participating in groups like the Aerospace Industries Association (AIA), Boeing influences discussions on crucial issues such as federal funding for research and development. In 2023 alone, the aerospace and defense industry, including Boeing, collectively spent over $100 million on lobbying efforts in the United States, highlighting the substantial investment in influencing policy decisions.

Through its involvement with organizations such as the Business Roundtable, Boeing advocates for advancements in technology and solutions addressing supply chain challenges. This collaborative approach allows Boeing to amplify its voice on critical matters impacting its operations and the broader industry landscape. For instance, in 2024, the AIA reported that its members, including Boeing, actively pushed for legislation supporting domestic aerospace manufacturing and innovation.

- Lobbying Expenditures: Boeing's political action committee (PAC) and corporate lobbying expenditures are substantial, reflecting a commitment to influencing legislation and regulatory frameworks.

- Industry Association Memberships: Membership in key industry groups like the AIA and Business Roundtable provides Boeing with a platform to collectively advocate for its interests and the health of the aerospace sector.

- Policy Focus Areas: Key advocacy points include securing federal investments in R&D, fostering technological innovation, and addressing critical workforce and supply chain vulnerabilities.

- Government Contracts: Boeing’s substantial reliance on government contracts, particularly from the U.S. Department of Defense, underscores the importance of maintaining positive political relationships.

Market Access and Diplomatic Relations

Boeing's commercial success hinges on its ability to access global markets, especially rapidly growing economies. In 2024, emerging markets in Asia, such as China and India, continue to be the primary drivers of new aircraft demand, with projections indicating they will account for over 70% of future growth. Strong diplomatic ties and favorable trade agreements are instrumental in securing these vital orders and fostering strategic partnerships. For instance, the ongoing trade discussions between the US and China in 2024 directly impact Boeing's order book and market positioning.

Strained political relationships or trade disputes can significantly hinder Boeing's market penetration. A shift towards protectionist policies or geopolitical tensions can result in lost market share as countries increasingly favor domestic aerospace manufacturers. This dynamic was evident in 2023 and continues to be a concern in 2024, with some nations actively promoting their own aviation industries to reduce reliance on foreign suppliers.

Government policies and defense spending directly influence Boeing's business, especially its Defense, Space & Security division. Increased geopolitical tensions in 2024 and projections into 2025 suggest a potential rise in defense budgets, which could benefit Boeing. However, budget cuts remain a persistent risk.

International trade policies and tariffs significantly impact Boeing's global operations and costs. Trade friction, such as between the US and China, affects component expenses and market access, potentially increasing aircraft prices. Retaliatory tariffs from regions like the EU can also hurt competitiveness.

Regulatory oversight from bodies like the FAA and EASA is crucial. Following the January 2024 incident, Boeing faces heightened scrutiny, leading to production adjustments and stricter quality control, impacting output and certification timelines for new models like the 737 MAX 7 and 10.

Boeing actively engages in lobbying, spending substantial sums to influence legislation and secure federal R&D funding. In 2023, the aerospace industry's lobbying efforts exceeded $100 million, with Boeing playing a key role in advocating for domestic manufacturing and innovation.

| Factor | Impact on Boeing | 2024/2025 Data/Trend |

|---|---|---|

| Defense Budgets | Directly affects BDS revenue; increased spending is beneficial. | Global tensions may lead to higher defense investments in 2024-2025. |

| Trade Policies & Tariffs | Impacts component costs, market access, and aircraft pricing. | Ongoing US-China trade friction continues to influence market access and pricing. |

| Regulatory Scrutiny | Affects production, quality control, and new aircraft certification. | Post-January 2024 incident, heightened FAA/EASA oversight is impacting 737 MAX production and certification. |

| Lobbying & Advocacy | Shapes favorable legislation, R&D funding, and industry support. | Aerospace industry lobbying exceeded $100M in 2023; focus on domestic manufacturing innovation in 2024. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Boeing across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive view of the forces shaping its industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear snapshot of external factors impacting Boeing.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, legal, and environmental influences.

Economic factors

Global economic growth, measured by GDP, is a primary driver for air travel demand. When economies are expanding, businesses and individuals have more disposable income and a greater need for transportation, directly benefiting airlines and aircraft manufacturers like Boeing.

Boeing’s own projections highlight this connection, forecasting a robust 4.2% annual growth in passenger traffic through 2044. This growth rate is expected to outpace global GDP and more than double the overall volume of air travel, indicating a strong future for the industry.

A strong global economic environment encourages airlines to invest in expanding their fleets and upgrading older, less fuel-efficient planes. This investment cycle is crucial for Boeing’s order books and production schedules, as airlines look to capitalize on increased travel demand.

Inflation and ongoing supply chain issues significantly impact Boeing's operational costs. Rising prices for critical materials like aluminum and titanium, coupled with labor cost increases, directly affect the bottom line. For instance, in 2024, Boeing reported that higher input costs and supply chain constraints contributed to production challenges, impacting their ability to meet delivery targets.

These economic headwinds have translated into tangible production delays. Bottlenecks in the supply of essential components have forced Boeing to slow down assembly lines for key programs such as the 737 MAX and the 787 Dreamliner. This not only delays revenue recognition but also incurs additional costs associated with managing extended production schedules and supplier backlogs.

Exchange rates play a crucial role in Boeing's financial performance, given its extensive international operations. Fluctuations in currency values directly affect the cost of its aircraft for overseas customers. For instance, in early 2024, the U.S. dollar experienced some strengthening against major currencies, which could make Boeing's planes, priced in dollars, less attractive to buyers in Europe or Asia.

A robust U.S. dollar can create a significant headwind for Boeing's export sales. When the dollar is strong, a foreign airline needs more of its local currency to purchase a Boeing aircraft. This increased cost can lead to deferred orders or a shift towards competitors who may offer pricing in local currencies or have lower overheads. Boeing's reliance on international markets, which typically represent over 70% of its revenue, makes it particularly vulnerable to these currency movements.

Conversely, a weaker dollar can boost Boeing's international competitiveness and profitability. It makes American-made aircraft more affordable for foreign buyers, potentially stimulating demand and increasing order backlogs. This also positively impacts the company's reported earnings when foreign currency revenues are translated back into dollars. For example, during periods of dollar weakness in 2023, Boeing reported improved international sales figures.

Managing currency risk is therefore a key strategic imperative for Boeing. The company employs hedging strategies, such as forward contracts and options, to mitigate the impact of adverse currency movements on its revenue and costs. These financial instruments aim to lock in exchange rates for future transactions, providing a degree of certainty in an otherwise volatile global market.

Interest Rates and Capital Expenditure

Interest rates play a crucial role in Boeing's capital expenditure environment by directly influencing airlines' ability to finance new aircraft purchases. Higher interest rates translate to increased borrowing costs for airlines, potentially making the acquisition of new planes less attractive and leading to deferred or canceled orders. For instance, as of mid-2024, central banks have maintained relatively elevated interest rates to combat inflation, which directly impacts the cost of capital for airline fleet modernization programs.

The Federal Reserve's benchmark interest rate, for example, remained in a range of 5.25%-5.50% throughout much of 2024, a significant increase from prior years. This elevated cost of borrowing can put pressure on airlines' profitability, forcing them to re-evaluate their capital expenditure plans. Such a scenario could lead to a slowdown in demand for Boeing's commercial aircraft, impacting the company's order book and revenue forecasts.

Furthermore, the cost of capital for Boeing itself is also affected by prevailing interest rates. This can influence the company's own investment decisions in research and development, manufacturing capacity, and new technologies.

- Increased Financing Costs: Higher interest rates in 2024 directly raise the cost of loans for airlines seeking to purchase new Boeing aircraft.

- Deferred Fleet Modernization: Elevated borrowing costs can prompt airlines to postpone or scale back plans for fleet upgrades, reducing demand for new planes.

- Impact on Boeing's Revenue: A slowdown in airline capital expenditure due to interest rate sensitivity can negatively affect Boeing's sales projections and order backlog.

- Boeing's Own Capital Allocation: Interest rate levels also influence Boeing's cost of capital, impacting its strategic investments in R&D and production.

Labor Market and Wage Pressures

The availability and cost of skilled labor are critical to Boeing's operational efficiency and production expenses. In 2024, the company navigated rising labor expenses stemming from new wage agreements.

Furthermore, a significant machinist strike in 2024 directly impacted production, leading to temporary shutdowns and exacerbating existing delivery delays. These labor market dynamics have tangible financial consequences.

- Increased Wage Pressures: Boeing has seen its labor costs rise due to negotiated wage increases in 2024, impacting its cost structure.

- Production Disruptions: A notable machinist strike in 2024 caused work stoppages, affecting output and contributing to broader delivery challenges.

- Impact on Financials: These labor issues have directly contributed to financial losses and further delayed aircraft deliveries, a key performance indicator for the company.

Global economic growth remains a key indicator for aircraft demand, with projections suggesting continued expansion in air travel. Boeing anticipates a 4.2% annual growth in passenger traffic through 2044, underscoring the industry's reliance on a healthy global economy to drive fleet expansion and modernization by airlines.

However, inflationary pressures and persistent supply chain disruptions significantly impact Boeing's operational costs. Rising prices for materials like aluminum and titanium, coupled with increased labor expenses, directly affect profitability and production timelines, as evidenced by production slowdowns on programs like the 737 MAX and 787 Dreamliner in 2024.

Fluctuating exchange rates also pose a challenge, particularly the strengthening U.S. dollar in early 2024, which makes Boeing's dollar-denominated aircraft more expensive for international buyers, potentially impacting its substantial export revenue. Conversely, a weaker dollar historically boosts international competitiveness and translates to improved sales figures.

Elevated interest rates, with the Federal Reserve's benchmark rate holding between 5.25%-5.50% through much of 2024, increase financing costs for airlines. This can lead to deferred fleet modernization plans, directly affecting demand for new aircraft and influencing Boeing's own capital allocation for research and development.

Labor dynamics, including increased wage pressures and disruptions like the 2024 machinist strike, directly impact Boeing's production efficiency and financial performance. These factors have contributed to rising labor expenses and exacerbated existing delivery delays.

| Economic Factor | Impact on Boeing | Data/Trend (2024-2025) |

| Global GDP Growth | Drives air travel demand, influencing aircraft orders. | Projected 4.2% annual passenger traffic growth through 2044. |

| Inflation & Supply Chains | Increases operational costs (materials, labor), causes production delays. | Higher input costs and constraints reported impacting 2024 deliveries. |

| Exchange Rates (USD Strength) | Makes aircraft more expensive for international buyers, reducing export competitiveness. | Strengthening USD in early 2024 posed a headwind for international sales. |

| Interest Rates | Increases airline financing costs, potentially slowing fleet modernization and new aircraft demand. | Fed rate 5.25%-5.50% throughout much of 2024, raising borrowing costs. |

| Labor Costs & Availability | Affects production expenses and efficiency; disruptions impact output. | Increased wage pressures and a 2024 machinist strike affected production. |

Same Document Delivered

Boeing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed Boeing PESTLE analysis offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the aerospace giant.

Understand the external forces shaping Boeing's strategies, from global trade agreements to emerging market demands.

This ready-to-use analysis provides actionable insights for strategic planning and competitive advantage.

Sociological factors

Consumer preferences for air travel have largely recovered, with spending on flights now mirroring pre-pandemic patterns as a portion of disposable income. This resurgence is particularly evident in the strong demand for budget-friendly and shorter routes, a trend amplified in emerging markets.

This robust demand for accessible air travel is directly influencing the market, indicating that single-aisle aircraft will continue to be the primary driver of fleet expansion in the coming years. For instance, IATA reported a significant increase in passenger traffic in early 2024, with many of these journeys being shorter, domestic flights.

Public perception of aircraft safety has taken a significant hit following the 737 MAX accidents and the January 2024 Alaska Airlines door plug incident. These events have directly eroded trust, making safety a paramount concern for travelers and airlines alike.

Rebuilding this trust hinges on Boeing demonstrating an unwavering commitment to rigorous quality control and enhanced safety protocols. This commitment is vital for restoring customer confidence and safeguarding the company's brand reputation in a highly competitive market.

For instance, following the 737 MAX grounding, Boeing's order backlog saw cancellations and delays, impacting its financial performance and market standing. The ongoing scrutiny emphasizes that tangible improvements in manufacturing and oversight are essential for regaining public and customer faith.

Societal expectations increasingly demand that large corporations like Boeing prioritize workforce diversity and inclusion. This isn't just about fairness; it's a strategic imperative for attracting and retaining top talent in a competitive global market. Companies that embrace diverse perspectives often see enhanced innovation and better problem-solving capabilities.

Boeing’s 2024 Sustainability and Social Impact Report indicates tangible progress, noting an increase in the percentage of racial and ethnic minorities within its U.S. workforce. Similarly, the report details efforts to boost the representation of women across its global operations. These figures underscore a commitment to building a more representative workforce.

Creating an inclusive environment where all employees feel valued and respected is crucial. This fosters a sense of belonging, which directly impacts employee morale, engagement, and ultimately, retention rates. A diverse and inclusive culture can also improve a company's reputation, making it a more attractive employer and business partner.

Urbanization and Travel Demographics

Global urbanization continues to reshape travel patterns, with a significant portion of the world's population now residing in urban centers. This trend, coupled with the expanding middle class in emerging economies, directly fuels a surge in demand for air travel. These demographic shifts are critical for understanding future aviation needs.

Looking ahead, emerging markets are poised to become dominant forces in aviation. Projections indicate that by 2044, these regions will represent over half of the global commercial aircraft fleet. This substantial growth necessitates considerable investment in new aircraft to support expanding airline routes and passenger capacity.

- Urbanization: Over 60% of the world's population is expected to live in urban areas by 2030, increasing the pool of potential air travelers.

- Middle-Class Growth: The global middle class is projected to reach 5.3 billion people by 2030, with a substantial portion residing in Asia and Africa, driving discretionary spending on travel.

- Fleet Demand: Emerging markets are expected to account for more than 50% of the global commercial fleet by 2044, highlighting the need for aircraft manufacturers like Boeing to adapt production and offerings.

Social Media and Reputation Management

Social media's pervasive influence means that even a single safety incident, like the January 2024 Alaska Airlines 737 MAX door plug incident, can trigger a cascade of negative public sentiment. Boeing faced intense scrutiny across platforms, with millions of posts and comments shaping its public image. This rapid dissemination of information underscores the critical need for proactive reputation management and transparent communication to mitigate damage and foster trust among passengers, regulators, and investors.

The speed at which social media amplifies concerns is a significant challenge. For Boeing, negative narratives surrounding quality control, such as those amplified after the 2023 incidents, can spread globally within hours, impacting stock price and customer confidence. Managing this online discourse requires sophisticated strategies, including real-time monitoring and swift, honest responses to address public anxieties and demonstrate commitment to safety improvements.

- Rapid Information Dissemination: Safety or quality issues can go viral on platforms like X (formerly Twitter) and Facebook, reaching millions instantly.

- Public Perception Impact: Negative social media trends can significantly shape public opinion, affecting brand loyalty and consumer choice.

- Reputation Rebuilding: Transparent communication and demonstrable actions are essential to counter negative narratives and restore trust following incidents.

- Investor Sentiment: Social media sentiment analysis is increasingly used by investors to gauge public reaction to company events, influencing investment decisions.

Public perception of aviation safety is a critical sociological factor, significantly impacted by recent incidents like the January 2024 Alaska Airlines 737 MAX door plug failure. This event, along with the earlier 737 MAX accidents, has eroded consumer trust, making safety the paramount concern for both passengers and airlines. Boeing's ability to rebuild this trust relies heavily on demonstrating enhanced quality control and transparent communication.

Societal expectations for corporate responsibility are also evolving, with a growing emphasis on diversity and inclusion within the workforce. Boeing's 2024 Sustainability and Social Impact Report highlights efforts to increase the representation of racial and ethnic minorities and women, recognizing that a diverse workforce fosters innovation and talent retention.

The pervasive influence of social media amplifies public sentiment, as seen with the rapid spread of negative narratives following safety concerns. Boeing must actively manage its online reputation through transparent communication and demonstrable improvements to counter negative perceptions and maintain customer and investor confidence.

Technological factors

Boeing's competitive edge is deeply rooted in its relentless pursuit of advancements in aerospace engineering. This includes breakthroughs in aircraft design, the utilization of cutting-edge materials, and sophisticated avionics systems. The company's commitment to staying at the forefront of technological development is evident in its substantial investments in next-generation aircraft and associated technologies. These efforts are specifically aimed at enhancing fuel efficiency, boosting overall performance, and ensuring the highest standards of safety.

A prime example of this technological drive is the ongoing development of the 777X. This program showcases Boeing's dedication to pushing the boundaries of what's possible in commercial aviation. For instance, the 777X incorporates advanced composite materials, such as carbon fiber wings, contributing to a significant reduction in weight and a corresponding improvement in fuel economy. The aircraft also features next-generation engines, like the GE9X, which are designed for superior efficiency and reduced emissions. These engineering feats are crucial for maintaining market leadership in an increasingly competitive global landscape.

Technological progress in aviation is rapidly advancing, with a strong emphasis on sustainability. Innovations in sustainable aviation fuels (SAF), electric propulsion systems, and aerodynamic aircraft designs are paramount for minimizing the industry's environmental impact. Boeing, for instance, has set a goal for all its aircraft to be compatible with 100% SAF by 2030, demonstrating a significant investment in these crucial decarbonization technologies and carbon removal partnerships.

Boeing is significantly increasing its investment in advanced manufacturing technologies like robotics, 3D printing, and AI-powered automation. This strategic push aims to enhance production efficiency, elevate aircraft quality, and drive down manufacturing costs. For instance, Boeing's commitment to digital manufacturing is expected to streamline assembly processes, leading to greater precision and faster production cycles.

Digital Integration and Cybersecurity

The relentless march of digital integration within Boeing's operations, from the initial design phases to manufacturing and ongoing services, introduces significant cybersecurity vulnerabilities. Protecting proprietary designs, critical operational systems, and sensitive customer data is paramount. Boeing's commitment to robust cybersecurity is essential to safeguard its advanced technological offerings against an evolving threat landscape.

In 2024, the aerospace industry, including Boeing, faces escalating cyber threats targeting intellectual property and operational continuity. For instance, the US Department of Homeland Security reported a 71% increase in reported cyber incidents across critical infrastructure sectors in 2023, a trend expected to persist. Boeing's ongoing investments are therefore crucial to maintain the integrity and security of its digital infrastructure and products.

Boeing's strategic response includes continuous upgrades to its cybersecurity frameworks and proactive threat intelligence. This ensures the protection of sensitive flight data, manufacturing processes, and customer information. The company's focus on advanced encryption and secure network architecture is a direct answer to the heightened digital risks.

- Digital Integration Challenges: Increasing reliance on digital platforms for design, production, and service necessitates strong cybersecurity.

- Cybersecurity Investment: Boeing must allocate significant resources to protect intellectual property, operational systems, and sensitive data.

- Threat Landscape: The aerospace sector is a prime target for cyberattacks, requiring constant vigilance and adaptation.

- Data Integrity: Ensuring the security and integrity of data is critical for flight safety and operational efficiency.

Research and Development Investment

Consistent and significant investment in research and development (R&D) is crucial for Boeing to sustain its competitive advantage in the aerospace industry. This commitment fuels innovation and ensures the company remains a leader in developing advanced aviation technologies. In 2024, Boeing allocated approximately $3.3 billion to R&D, demonstrating a strong focus on creating next-generation aircraft and systems.

This substantial R&D expenditure directly impacts Boeing's ability to introduce groundbreaking products and maintain market leadership. The investment allows for the exploration of new materials, propulsion systems, and digital technologies, positioning Boeing to meet evolving customer demands and regulatory requirements. Furthermore, it supports the development of more fuel-efficient and sustainable aircraft, a key trend shaping the future of air travel.

- $3.3 billion allocated to R&D in 2024.

- Focus areas include advanced materials, propulsion, and digital technologies.

- Goal is to maintain competitive edge and market leadership.

- Supports development of next-generation, sustainable aircraft.

Technological factors heavily influence Boeing's operations, driving innovation in aircraft design, materials, and propulsion systems. Significant investment in R&D, such as the $3.3 billion allocated in 2024, fuels advancements in areas like sustainable aviation fuels and digital manufacturing, aiming to enhance efficiency and reduce environmental impact.

The company is integrating advanced manufacturing technologies like 3D printing and robotics to improve production quality and cost-effectiveness. This technological push is crucial for maintaining a competitive edge in the global aerospace market, especially with the development of programs like the 777X which features advanced composite materials and next-generation engines.

However, increased digital integration introduces cybersecurity risks, requiring substantial investment to protect proprietary data and operational systems. The escalating threat landscape, with a reported 71% increase in cyber incidents across critical infrastructure in 2023, underscores the need for Boeing's continuous cybersecurity framework upgrades.

Legal factors

Boeing operates under rigorous aviation safety regulations overseen by bodies like the Federal Aviation Administration (FAA) and international equivalents. These regulations are paramount for aircraft manufacturing and operation, impacting design, production, and maintenance processes. Compliance is not optional; it's a fundamental requirement for market access and operational continuity.

Recent events, including the 737 MAX incidents and the Alaska Airlines incident in early 2024, have intensified this regulatory environment. The FAA imposed production limits on Boeing in January 2024, capping 737 production at 380 aircraft per year, a direct consequence of quality control concerns. These events have triggered extensive investigations and increased demands for enhanced quality management systems across Boeing's operations.

Failure to adhere to these stringent safety standards can lead to severe repercussions. These include substantial financial penalties, lengthy investigations that disrupt production and delivery schedules, and potentially the grounding of entire aircraft fleets, as was seen with the 737 MAX. Such non-compliance directly impacts Boeing's financial performance and its reputation within the industry.

Boeing's operations are heavily influenced by product liability laws, particularly given the critical safety nature of its aircraft. Accidents or identified manufacturing defects can trigger a wave of costly lawsuits, significantly impacting its financial health and public image.

The tragic 737 MAX accidents brought this risk into sharp focus, leading to extensive litigation and a deferred prosecution agreement with the U.S. Justice Department. Boeing's admission to breaching this agreement in 2024 underscores the ongoing legal scrutiny it faces.

These legal battles can result in substantial financial penalties, including substantial settlements and fines. For instance, in 2024, Boeing agreed to a $1.6 billion settlement with victims' families and airlines related to the 737 MAX crashes, adding to its financial burden.

Beyond direct financial costs, these lawsuits inflict considerable reputational damage, eroding customer trust and potentially affecting future sales and partnerships. Navigating these complex legal landscapes is a critical ongoing challenge for Boeing's strategic planning.

Boeing's extensive international operations necessitate strict adherence to a multifaceted landscape of global trade regulations. This includes navigating export controls and sanctions imposed by various nations, which can significantly affect market access and sales potential. For instance, in 2023, the U.S. Department of Commerce continued to enforce export controls on advanced technologies, impacting the aerospace sector's ability to supply certain components to specific regions.

Geopolitical shifts frequently translate into new trade restrictions, directly influencing Boeing's ability to sell aircraft and services to affected countries. These sanctions can disrupt supply chains and limit revenue streams, as seen with ongoing global political realignments that have historically led to market access challenges for major aerospace manufacturers in certain territories.

Maintaining compliance with these international legal frameworks is paramount for Boeing to avert severe legal penalties, including hefty fines and potential loss of operating licenses. Furthermore, a strong track record of legal compliance is crucial for preserving and fostering robust business relationships with international partners and governments, ensuring continued global market participation.

Intellectual Property Rights

Protecting its vast intellectual property (IP) is a major legal focus for Boeing. This includes safeguarding its cutting-edge aircraft designs, intricate manufacturing techniques, and unique proprietary technologies. Boeing's IP portfolio is a cornerstone of its competitive edge in the aerospace industry, valued in the billions and crucial for maintaining market leadership.

Navigating global patent laws, trademark regulations, and trade secret protections is essential to prevent infringement. In 2024, Boeing continued to actively pursue patents, with filings often exceeding hundreds annually, demonstrating its commitment to innovation and IP defense. Failure to adequately protect this IP could lead to significant financial losses and a diminished market position.

- Patent Protection: Boeing actively patents new aerospace technologies, securing rights for innovations in areas like advanced materials and propulsion systems.

- Trademark Enforcement: Safeguarding its brand name and logos globally is vital to prevent counterfeit products and maintain brand integrity.

- Trade Secret Management: Critical manufacturing processes and sensitive technological data are protected through stringent internal policies and legal agreements.

- Global IP Strategy: Boeing operates under a complex web of international IP laws, requiring constant legal vigilance and strategic enforcement across multiple jurisdictions.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Boeing, as it operates in an industry with very few major players. As one of only two global commercial aircraft manufacturers, alongside Airbus, Boeing faces significant scrutiny to ensure fair market practices. These regulations are designed to prevent monopolies and foster a competitive environment, impacting how Boeing approaches market strategies and potential mergers or acquisitions. Failure to comply can lead to substantial legal challenges and financial penalties, as seen in past investigations into market dominance.

The U.S. Department of Justice and the European Commission are key bodies that monitor Boeing's activities. For instance, in 2024, ongoing investigations into potential anti-competitive behavior in the aerospace supply chain continue to shape regulatory oversight. Boeing's market share, which consistently hovers around 50% for new commercial aircraft orders globally, necessitates careful adherence to these laws to avoid accusations of monopolistic practices and maintain its operational freedom. This regulatory landscape means that any significant expansion or consolidation efforts must undergo rigorous antitrust review.

- Market Share Scrutiny: Boeing's duopoly status with Airbus means its market share, often around 50% of global commercial aircraft deliveries, is closely watched by regulators.

- Merger and Acquisition Oversight: Regulatory bodies like the U.S. DOJ and the European Commission scrutinize any potential mergers or acquisitions by Boeing to prevent market concentration.

- Regulatory Compliance Costs: Boeing incurs costs associated with ensuring compliance with antitrust laws, including legal fees and internal review processes, which were estimated to be in the hundreds of millions of dollars annually in recent years.

- Impact on Strategy: Antitrust concerns directly influence Boeing's strategic decisions, limiting certain partnership opportunities and acquisition targets to avoid regulatory challenges.

Boeing's legal landscape is heavily shaped by stringent aviation safety regulations, particularly from the FAA. The early 2024 Alaska Airlines incident led to FAA imposing production limits, capping 737 output at 380 annually, reflecting heightened quality control demands and ongoing investigations.

Product liability laws pose a significant risk, with the 737 MAX crashes resulting in extensive litigation. In 2024, Boeing agreed to a $1.6 billion settlement with victims' families and airlines, underscoring the financial and reputational impact of safety failures.

Global trade regulations and export controls significantly impact Boeing's international sales. In 2023, continued enforcement of U.S. export controls on advanced technologies affected aerospace supply chains, necessitating constant legal vigilance across jurisdictions.

Antitrust laws are critical given Boeing's duopoly with Airbus. Its market share, around 50% of global commercial aircraft orders, faces scrutiny from bodies like the U.S. DOJ and European Commission, influencing strategic decisions and limiting expansion opportunities to avoid regulatory challenges.

| Legal Factor | Description | Recent Impact/Data (2023-2024) |

| Safety Regulations | Compliance with aviation safety standards (FAA, EASA). | FAA production limit on 737s (380/year) imposed Jan 2024 post-Alaska Airlines incident. |

| Product Liability | Risk from aircraft defects and accidents. | $1.6 billion settlement in 2024 for 737 MAX crashes. |

| International Trade Laws | Adherence to export controls, sanctions, and global trade agreements. | Continued enforcement of U.S. export controls on aerospace tech in 2023. |

| Antitrust & Competition | Ensuring fair market practices in a duopoly market. | Ongoing scrutiny of market share (approx. 50%) by U.S. DOJ and European Commission. |

Environmental factors

The aviation industry faces intense pressure regarding its carbon footprint, making climate change a critical environmental consideration. Boeing is actively investing in developing more fuel-efficient aircraft and promoting the use of Sustainable Aviation Fuels (SAF) to align with ambitious industry goals. These targets include an annual emissions reduction of 2% and achieving net-zero emissions by 2050, a significant undertaking for global aviation.

Boeing is making significant strides in Sustainable Aviation Fuel (SAF), with a bold goal for its aircraft to run on 100% SAF by 2030. This commitment isn't just aspirational; it involves concrete actions like forging partnerships to boost SAF production and availability. For instance, in 2023, the industry produced an estimated 700 million gallons of SAF globally, a figure projected to grow substantially in the coming years, driven by such initiatives.

The company is also leading by example, purchasing SAF blends for its own operations. This proactive approach demonstrates a tangible shift towards greener aviation practices. Boeing's investment and advocacy are crucial in driving the wider adoption of SAF, which is seen as a key pathway to decarbonizing air travel. The International Air Transport Association (IATA) has set a target for the aviation industry to achieve net-zero carbon emissions by 2050, with SAF playing a vital role.

Boeing's commitment to resource efficiency is central to its environmental strategy, focusing on reducing energy, water, and waste across its global manufacturing operations. This means actively seeking ways to operate more leanly, from how much electricity its factories use to how much water is consumed.

In 2023, Boeing reported achieving a 15% reduction in greenhouse gas emissions intensity compared to a 2017 baseline, a testament to its investments in energy-efficient infrastructure and renewable energy procurement. The company aims for further improvements, targeting an additional 25% reduction in emissions intensity by 2025.

Waste management is also a significant focus, with Boeing implementing programs to divert materials from landfills through recycling and reuse initiatives. For instance, in 2023, over 70% of manufacturing waste was diverted from landfills, a figure the company plans to increase.

Noise Pollution Regulations

Noise pollution from aircraft is a major issue for areas surrounding airports, and regulations are becoming more stringent. Boeing, as a leading aircraft manufacturer, must invest in developing quieter engine technologies and improving aerodynamic designs to comply with these evolving standards. This focus on noise reduction directly impacts research and development budgets and the overall cost of aircraft production.

Meeting these environmental challenges presents both risks and opportunities for Boeing. Stricter regulations can drive innovation, leading to more efficient and environmentally friendly aircraft that could become a competitive advantage. For instance, the development of the Boeing 777X incorporated advanced engine nacelles and wing designs aimed at reducing noise footprints, reflecting an ongoing effort to address these concerns.

Future noise pollution regulations are expected to continue tightening globally. For example, the International Civil Aviation Organization (ICAO) Committee on Aviation Environmental Protection (CAEP) regularly reviews and updates noise standards. Boeing's ability to adapt its product line to meet or exceed these future requirements will be critical for its long-term market access and reputation. The company's ongoing commitment to sustainability, including noise reduction, is a key element of its forward-looking strategy.

- Stricter Noise Standards: Governments worldwide are implementing and enforcing more rigorous noise regulations for commercial aircraft.

- Technological Investment: Boeing must allocate significant resources to research and development for quieter engines and improved aerodynamic efficiency.

- Operational Impact: Aircraft noise affects airport curfews, flight path restrictions, and community relations, influencing operational flexibility.

- Market Competitiveness: Aircraft that meet or exceed noise standards can offer a competitive edge and potentially lower operating costs for airlines.

Environmental Reporting and Transparency

Stakeholders, including investors and customers, are increasingly demanding greater transparency regarding environmental impact, pushing companies like Boeing to provide detailed reporting. Boeing's commitment to this is exemplified by its annual Sustainability and Social Impact Report, which serves as a key platform for communicating progress and future goals. This report details efforts to reduce greenhouse gas emissions and increase the use of renewable energy sources, showcasing a dedication to accountability in its environmental stewardship.

In 2023, Boeing reported a 12% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2017 baseline, with a target of net-zero carbon emissions by 2050. The company also aims to source 100% of its electricity from renewable sources by 2030. These initiatives are crucial for maintaining stakeholder trust and navigating evolving regulatory landscapes.

- Greenhouse Gas Emission Reduction: Boeing reported a 12% reduction in Scope 1 and 2 emissions against its 2017 baseline as of 2023.

- Renewable Energy Sourcing: The company is working towards sourcing 100% of its electricity from renewable sources by 2030.

- Sustainability Reporting: The annual Sustainability and Social Impact Report details progress on environmental goals, including emissions and energy initiatives.

- Stakeholder Expectations: There is growing pressure from investors, customers, and regulators for enhanced environmental transparency and performance.

Boeing is heavily focused on reducing its environmental impact, particularly concerning carbon emissions and noise pollution. The company is investing significantly in Sustainable Aviation Fuels (SAF), aiming for its aircraft to operate on 100% SAF by 2030, a move supported by industry-wide goals like achieving net-zero emissions by 2050. Boeing's 2023 report showed a 12% reduction in Scope 1 and 2 greenhouse gas emissions from a 2017 baseline, with a target to further reduce emissions intensity by 25% by 2025.

Resource efficiency is another key environmental pillar, with Boeing working to lower energy, water, and waste in its manufacturing processes. Over 70% of manufacturing waste was diverted from landfills in 2023, part of an ongoing effort to increase this figure. Stricter noise regulations are also a major consideration, prompting investment in quieter engine technologies and aerodynamic designs, such as those seen in the Boeing 777X, to meet evolving global standards set by bodies like ICAO.

| Environmental Focus | Boeing's Action/Target | Key Data Point (2023 unless noted) |

|---|---|---|

| Sustainable Aviation Fuel (SAF) | Goal: 100% SAF by 2030 | Global SAF production ~700 million gallons |

| Greenhouse Gas Emissions | Target: Net-zero by 2050 | 12% reduction in Scope 1 & 2 vs. 2017 baseline |

| Renewable Energy | Target: 100% renewable electricity by 2030 | |

| Waste Management | Increase landfill diversion rates | >70% of manufacturing waste diverted |

| Noise Pollution | Invest in quieter technologies | 777X features advanced noise-reducing designs |

PESTLE Analysis Data Sources

Our Boeing PESTLE Analysis is meticulously crafted using data from leading aviation industry bodies, global economic indicators, government regulatory databases, and reputable market research firms. This comprehensive approach ensures that political, economic, social, technological, legal, and environmental factors are assessed with robust, fact-based insights.