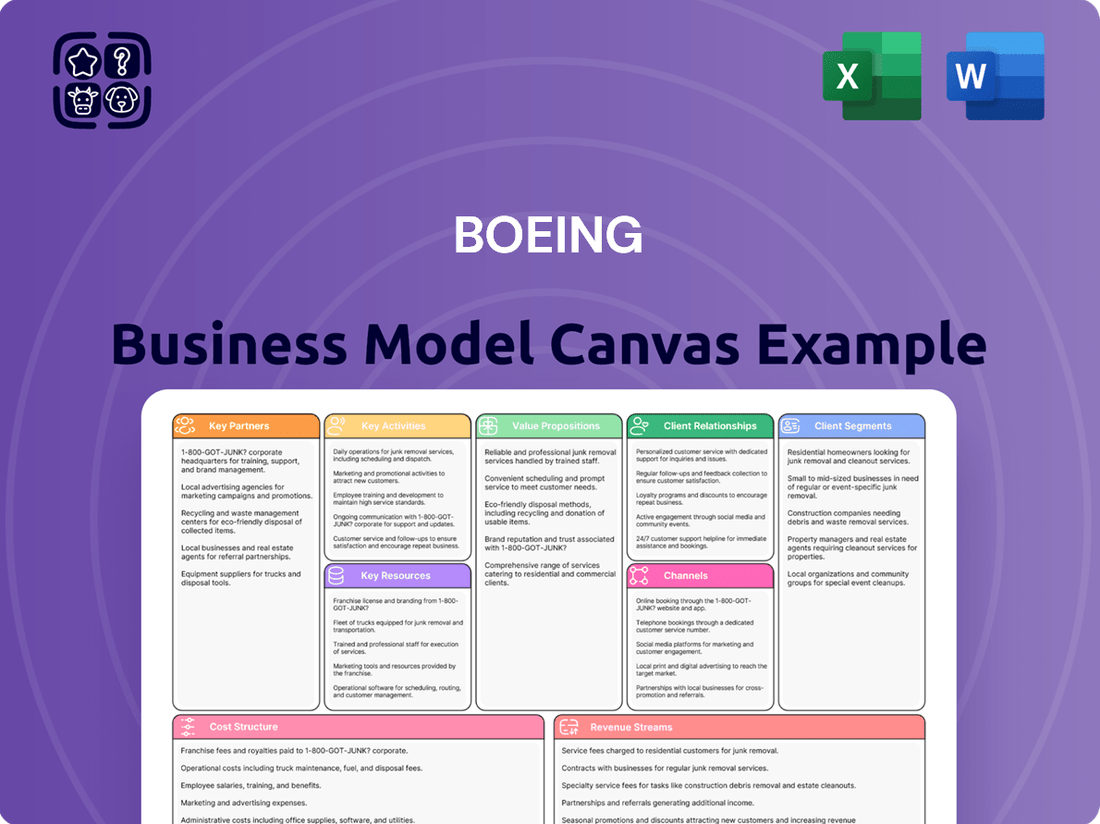

Boeing Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

Unlock the secrets behind Boeing's dominance in the aerospace industry with our comprehensive Business Model Canvas. This detailed analysis breaks down how Boeing creates, delivers, and captures value across its diverse operations. Discover their key partners, customer segments, and revenue streams to understand their enduring success.

Want to truly grasp Boeing’s strategic genius? Our full Business Model Canvas provides an in-depth look at their core activities, cost structure, and competitive advantages. This professionally crafted document is perfect for anyone seeking to learn from a global industry leader and apply those insights to their own ventures.

See how the pieces fit together in Boeing’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Boeing's business model thrives on a vast network of strategic suppliers, forming the backbone of its aircraft manufacturing. These partnerships are crucial for sourcing everything from advanced composite materials to complex avionics systems, ensuring a steady flow of essential components. For instance, in 2024, Boeing continued its deep integration with key players like Spirit AeroSystems for fuselage sections and GE Aerospace for engine systems, highlighting the critical nature of these relationships.

These collaborations go beyond mere procurement; they are vital for risk mitigation and quality assurance. By working closely with its suppliers, Boeing can better manage potential disruptions in the global supply chain and maintain rigorous quality standards for every part that goes into its aircraft. This strategic alignment allows for greater predictability in production schedules, a key factor in meeting delivery commitments to airlines worldwide.

Furthermore, Boeing actively engages its suppliers in the co-development of next-generation technologies and advanced materials. This collaborative innovation fosters progress in areas like sustainable aviation fuels and lighter, stronger airframe components. Such partnerships are essential for staying competitive and driving advancements in aerospace technology, as seen in ongoing joint research efforts targeting fuel efficiency improvements in future aircraft models.

Boeing's key partnerships with airline customers and operators are the bedrock of its commercial aviation business. These relationships are characterized by long-term contracts for new aircraft, a critical revenue stream, and extensive agreements for ongoing support, maintenance, and upgrades. For instance, in 2023, Boeing secured significant orders from carriers like United Airlines for 737 MAX aircraft, underscoring the importance of these deep-rooted connections.

These collaborations often extend to joint ventures or customized programs designed to meet specific airline fleet requirements and operational efficiencies. This co-development approach allows Boeing to gain invaluable insights into the evolving needs and challenges faced by its airline partners, such as optimizing fuel efficiency or integrating new technologies. Such partnerships are vital for fostering customer loyalty and securing substantial repeat business, which is essential for sustained growth.

Boeing's partnerships with government agencies and defense contractors are absolutely critical, forming the bedrock of its business. These entities, like the U.S. Department of Defense and NASA, are Boeing's largest customers, driving a substantial portion of its revenue through massive defense contracts and ambitious space exploration programs. For instance, in 2023, Boeing's defense segment generated over $30 billion in revenue, a testament to these deep-rooted relationships.

These collaborations often involve highly sensitive, classified projects that demand unwavering adherence to national security objectives and rigorous regulatory compliance. Boeing's ability to navigate these complex requirements is a key differentiator. The company invests heavily in research and development, working closely with these partners to pioneer advanced military aircraft, sophisticated defense systems, and cutting-edge space technologies.

Technology and Innovation Collaborators

Boeing actively cultivates partnerships with leading technology firms, prestigious research institutions, and innovative universities. These collaborations are instrumental in advancing the frontiers of aerospace engineering, pioneering breakthroughs in materials science, and developing sophisticated digital solutions. For instance, Boeing's ongoing work with universities in 2024 focuses on areas such as advanced aerodynamics and novel composite materials, aiming to reduce aircraft weight and improve fuel efficiency.

These strategic alliances are critical for the development of next-generation aircraft, enabling the integration of cutting-edge technologies and optimizing manufacturing processes. Furthermore, they facilitate the exploration of emerging capabilities, including the complex systems required for autonomous flight operations and the development of sustainable aviation fuels, a key focus area for the industry through 2025.

These crucial technology and innovation collaborations ensure that Boeing maintains its leadership position by consistently integrating the latest advancements into its products and services. In 2024, Boeing announced a significant investment in a consortium of universities researching advanced battery technologies for future electric aircraft, highlighting its commitment to sustainable innovation.

- Key Collaborations: Partnerships with universities like MIT and Stanford for materials research.

- Innovation Focus: Driving advancements in autonomous systems and sustainable aviation technologies.

- Strategic Impact: Ensuring access to cutting-edge research and talent for future product development.

- Industry Trend: Increased investment in university research to accelerate technological adoption, with a significant portion of aerospace R&D budgets allocated to such partnerships in 2024.

Maintenance, Repair, and Overhaul (MRO) Providers

Boeing’s global services are significantly amplified by its key partnerships with authorized Maintenance, Repair, and Overhaul (MRO) providers and service centers. These collaborations are vital for extending Boeing's aftermarket support network, ensuring customers worldwide receive prompt and expert aircraft maintenance. In 2024, the aerospace MRO market was valued at approximately $90 billion, highlighting the scale of this crucial sector.

These partnerships allow Boeing to offer comprehensive support, improving aircraft uptime and operational efficiency for its airline customers. By leveraging the expertise and geographical reach of MRO partners, Boeing broadens its service offerings, making them accessible in more regions. This distributed model is critical for supporting Boeing’s vast fleet, which in 2024 comprised over 10,000 active aircraft.

- Global Reach: MRO partners enable Boeing to provide localized support, crucial for airlines operating diverse international routes.

- Enhanced Uptime: Collaboration ensures faster turnaround times for maintenance and repairs, maximizing aircraft availability.

- Expertise Access: Authorized partners provide specialized skills and access to genuine Boeing parts and tooling.

- Market Expansion: These relationships help Boeing penetrate new markets and strengthen its presence in existing ones through a wider service footprint.

Boeing’s strategic alliances with major airlines are fundamental, often involving long-term aircraft purchase agreements and extensive aftermarket support contracts. These customer relationships are vital for revenue generation and market intelligence, influencing future product development. For example, in 2023, Boeing secured substantial orders from carriers like United Airlines for its 737 MAX family, demonstrating the enduring importance of these partnerships.

These deep-rooted customer ties frequently lead to customized programs and joint ventures, allowing Boeing to tailor solutions to specific airline needs and operational requirements. This collaborative approach ensures customer loyalty and drives repeat business, which is essential for sustained growth in the competitive aviation sector.

Boeing’s network of key suppliers is the bedrock of its manufacturing operations, providing critical components from advanced materials to complex avionics. These partnerships are essential for maintaining production flow and ensuring quality, with companies like Spirit AeroSystems and GE Aerospace being integral. In 2024, Boeing continued to emphasize supply chain resilience, working closely with these partners to mitigate disruptions and uphold rigorous quality standards.

These supplier relationships extend to collaborative innovation, driving advancements in areas such as sustainable aviation technologies and new materials. By engaging suppliers in co-development, Boeing fosters progress and maintains a competitive edge in aerospace engineering.

Boeing's partnerships with government entities, particularly the U.S. Department of Defense and NASA, are crucial for its defense and space segments. These government contracts represent a significant portion of Boeing's revenue, with the defense sector alone generating over $30 billion in 2023. These relationships necessitate strict adherence to national security protocols and regulatory compliance.

These collaborations also involve joint research and development efforts to pioneer advanced military aircraft, sophisticated defense systems, and cutting-edge space technologies. This close working relationship ensures Boeing remains at the forefront of aerospace innovation for national security and exploration.

Boeing actively partners with leading technology firms, research institutions, and universities to advance aerospace engineering and develop innovative solutions. In 2024, collaborations with universities focused on areas like advanced aerodynamics and novel composite materials to enhance fuel efficiency. These alliances are critical for integrating cutting-edge technologies and optimizing manufacturing processes for next-generation aircraft.

These partnerships are instrumental in exploring emerging capabilities, including autonomous flight systems and sustainable aviation fuels, ensuring Boeing maintains its technological leadership. For instance, in 2024, Boeing invested in a university consortium researching advanced battery technologies for future electric aircraft, underscoring its commitment to sustainable innovation.

| Partner Type | Key Activities | Examples/Data Points |

|---|---|---|

| Airlines | Aircraft sales, aftermarket support, customized programs | United Airlines orders for 737 MAX (2023); ~10,000+ active Boeing aircraft globally (2024) |

| Suppliers | Component manufacturing, materials sourcing, co-development | Spirit AeroSystems (fuselage), GE Aerospace (engines); emphasis on supply chain resilience (2024) |

| Government Agencies & Defense Contractors | Defense contracts, space programs, R&D collaboration | U.S. Department of Defense, NASA; Defense segment revenue >$30 billion (2023) |

| Technology Firms & Academia | R&D, materials science, digital solutions, sustainable tech | University research on aerodynamics, composites, battery tech (2024) |

What is included in the product

A structured framework detailing Boeing's approach to delivering aircraft and services, encompassing its vast customer base, diverse distribution channels, and unique value propositions.

The Boeing Business Model Canvas acts as a pain point reliever by offering a structured framework to identify and address inefficiencies in complex aerospace operations.

It streamlines the visualization of critical business elements, helping to pinpoint and resolve operational bottlenecks or strategic misalignments.

Activities

Aircraft Design and Engineering is fundamental to Boeing's business, encompassing the creation of commercial airplanes, defense systems, and space exploration vehicles. This involves intricate work in aerodynamics, structural integrity, and the integration of complex systems to ensure safety and performance, all while adhering to stringent global aviation standards.

Boeing's commitment to innovation is evident in its substantial investment in research and development, crucial for pushing the boundaries of aerospace technology. For instance, in 2023, Boeing reported R&D expenses of approximately $3.7 billion, underscoring its dedication to designing next-generation aircraft and systems.

This core activity relies heavily on a highly skilled engineering workforce, who are instrumental in developing solutions that meet diverse customer needs and evolving market demands. Continuous development of new aircraft programs and ongoing improvements to existing models are key to maintaining Boeing's competitive edge in the aerospace sector.

Boeing's core activities revolve around the intricate manufacturing of aircraft components and the comprehensive assembly of its diverse product lines, including commercial jets, defense systems, and space exploration vehicles. This demands mastery of high-precision engineering and sophisticated production workflows.

Managing extensive production lines, integrating cutting-edge automation, and upholding rigorous quality assurance are paramount. For instance, in 2024, Boeing continued its efforts to ramp up 737 MAX production, targeting a rate of 50 aircraft per month, a significant undertaking requiring meticulous execution of these key activities.

The efficiency of these manufacturing and assembly processes directly impacts Boeing's ability to meet crucial delivery timelines and maintain competitive cost structures. Delays in production, as seen with past challenges in the 787 Dreamliner program, can have substantial financial and reputational consequences, underscoring the critical nature of these operations.

Boeing's sales and marketing teams actively engage global customers, including major airlines, defense departments, and space exploration organizations, to secure significant aircraft and defense system orders. These efforts involve intricate negotiations and product demonstrations, crucial for maintaining their substantial order backlog, which stood at $462 billion at the end of 2023, reflecting ongoing demand for their aviation solutions.

The company's marketing strategy emphasizes innovation, safety, and lifecycle support, aiming to highlight the long-term value of its offerings. This focus is essential for winning competitive bids and fostering loyalty among its diverse customer base, which spans over 150 countries.

Research and Development (R&D)

Boeing's Research and Development (R&D) is a cornerstone of its operations, involving substantial and ongoing investment in the future of aerospace. This commitment fuels the exploration of cutting-edge technologies, novel materials, and advanced systems crucial for staying ahead in the industry. For instance, in 2023, Boeing reported R&D expenses of $3.7 billion, reflecting a significant dedication to innovation.

The company's R&D efforts are strategically directed towards several key areas. These include the development of sustainable aviation solutions, such as eco-friendly fuels and more efficient aircraft designs, alongside advancements in propulsion systems. Furthermore, Boeing is heavily invested in digital manufacturing techniques and the creation of next-generation defense capabilities, ensuring its product portfolio remains relevant and competitive.

- Focus on Sustainable Aviation: Boeing is actively researching and developing technologies to reduce the environmental impact of flight, including advancements in sustainable aviation fuels and more efficient engine technologies.

- Digital Transformation in Manufacturing: Significant R&D is dedicated to integrating digital tools and processes into manufacturing, aiming for increased efficiency, quality, and speed in production.

- Next-Generation Defense Systems: The company continues to invest in developing advanced defense platforms and systems, incorporating AI, advanced sensors, and new weapon technologies.

- Materials Science Innovation: Boeing invests in researching and implementing new lightweight, strong, and sustainable materials to improve aircraft performance and reduce operational costs.

Global Services and Support

Boeing's Global Services and Support is a vital component of its business model, focusing on keeping its aircraft flying reliably. This involves offering a wide array of aftermarket services. These include everything from routine maintenance and significant modifications to comprehensive pilot and technician training. They also manage the distribution of spare parts and provide advanced digital solutions designed to enhance operational efficiency.

These services are essential for maintaining the operational readiness and extending the useful life of Boeing's vast global fleet. By ensuring customers can keep their aircraft in the air, Boeing solidifies its long-term relationships. In 2023, Boeing's Defense, Space & Security segment, which heavily relies on these support services, generated over $28 billion in revenue, demonstrating the significant financial contribution of this area. The Services segment as a whole is projected to continue its growth trajectory, targeting a $1 trillion market opportunity by 2030.

- Aircraft Maintenance and Modifications: Ensuring aircraft airworthiness and upgrades.

- Training Solutions: Providing flight, maintenance, and technical training for crews and technicians.

- Parts Distribution: Managing a global network for the supply of genuine Boeing parts.

- Digital Solutions: Offering data analytics, performance management, and predictive maintenance tools.

Boeing's sales and marketing are crucial for securing orders from airlines and defense entities worldwide. This involves extensive customer engagement, product demonstrations, and competitive bid processes. The company's substantial order backlog, which reached $462 billion by the end of 2023, highlights the effectiveness of these activities in driving future revenue.

Delivered as Displayed

Business Model Canvas

The Boeing Business Model Canvas preview you are viewing is the precise document that will be delivered to you upon purchase. This is not a generic template or a simplified example; it represents the actual, comprehensive analysis you will receive. Once your order is complete, you'll gain full access to this same, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Boeing's extensive intellectual property, particularly its patent portfolio covering aircraft designs, advanced manufacturing techniques, and cutting-edge aerospace technologies, serves as a cornerstone of its competitive edge. This protected knowledge capital is fundamental to Boeing's sustained innovation and the distinctiveness of its products, ensuring its market leadership.

In 2024, Boeing continued to invest heavily in research and development, a significant portion of which fuels the expansion of its intellectual property assets. While specific patent counts fluctuate, the company consistently ranks among the top patent filers in the aerospace sector, underscoring its commitment to technological advancement and safeguarding its innovations.

Boeing's advanced manufacturing facilities, a cornerstone of its business model, encompass a vast global network of state-of-the-art plants and assembly lines. These are not just buildings; they are highly specialized environments equipped with precision machinery essential for producing complex aerospace products. For instance, in 2024, Boeing continued its significant investments in its Renton, Washington facility, a key site for 737 production, ensuring cutting-edge capabilities.

The sheer scale and technological sophistication of Boeing's equipment are vital. This includes advanced automation, robotics, and digital manufacturing tools that enable the high-precision, large-scale production required in the aerospace industry. The efficiency and capacity of these facilities are directly linked to Boeing's ability to meet global demand, a critical factor given the long lead times in aircraft manufacturing.

Continuous investment in upgrades and maintenance is a non-negotiable aspect of these resources. In 2024, Boeing allocated substantial capital expenditures towards modernizing its production lines across various sites, including those for the 787 Dreamliner in South Carolina. This ensures that its manufacturing processes remain at the forefront of technological advancement and meet stringent quality and safety standards.

The operational capacity of these facilities is a direct determinant of production output. Boeing's ability to ramp up or adjust production rates for its commercial aircraft, such as the 737 MAX and 787 families, hinges on the readiness and efficiency of its manufacturing infrastructure. For example, efforts to increase 737 MAX production rates in 2024 are heavily reliant on the throughput and technological readiness of its associated facilities.

Boeing's highly skilled workforce is a critical asset, encompassing aerospace engineers, seasoned technicians, and expert production staff. This specialized talent pool is essential for the intricate design, manufacturing, and integration of Boeing's advanced aircraft and defense systems. For instance, in 2023, Boeing employed approximately 249,000 people globally, a significant portion of whom possess specialized engineering and technical skills vital for innovation and quality.

The expertise of these individuals in areas like aerodynamics, materials science, and complex systems integration directly fuels Boeing's ability to develop and deliver cutting-edge products. Their proficiency is non-negotiable for maintaining Boeing's competitive edge in a technologically demanding industry. In 2024, continued investment in training programs, such as those focused on advanced manufacturing techniques and digital engineering, remains a top priority to ensure this workforce stays at the forefront of aerospace innovation.

Financial Capital and Funding Access

Boeing requires substantial financial capital to fuel its extensive research and development, manage its vast manufacturing operations, and ensure timely supplier payments. This financial muscle is critical for long-term project financing in the high-stakes aerospace sector.

Access to diverse funding sources is paramount. Boeing leverages capital markets, secures substantial credit lines, and benefits from government funding for specific defense and aerospace programs. In 2024, Boeing's financial strategy continued to focus on robust capital allocation, balancing investment in new technologies with shareholder returns, a testament to its ongoing need for significant financial resources.

- Research & Development Funding: Significant investment is channeled into developing next-generation aircraft and aerospace technologies.

- Manufacturing Operations: Capital is allocated to maintain and upgrade extensive manufacturing facilities and supply chains.

- Access to Capital Markets: Boeing regularly accesses debt and equity markets to raise funds. For instance, in 2024, the company actively managed its debt portfolio to ensure favorable financing costs.

- Government Contracts and Support: Major defense contracts and potential government support for critical aerospace initiatives provide a stable financial foundation.

Global Supply Chain Network

Boeing’s global supply chain network is an indispensable asset, a vast web connecting thousands of suppliers worldwide. This intricate structure is fundamental to ensuring that the myriad components and raw materials needed for aircraft manufacturing reach production lines precisely when required. The efficiency and reliability of this network directly impact Boeing’s ability to meet production schedules and fulfill customer orders, underscoring its critical role in operational success.

Managing this complex global network involves significant coordination and strategic oversight. In 2024, Boeing continued to navigate the challenges inherent in such a widespread operation, focusing on resilience and agility. The company relies on this network to source everything from specialized alloys to sophisticated electronic systems, demonstrating its vital contribution to the final product.

The effective management of Boeing's supply chain is not merely about logistics; it’s a core competency for mitigating risks, such as geopolitical instability or material shortages. By fostering strong relationships with suppliers and implementing robust quality control measures, Boeing aims to maintain the integrity and flow of its operations. For instance, in 2024, efforts were intensified to diversify sourcing and enhance visibility across multiple tiers of suppliers to preempt potential disruptions.

- Global Reach: Boeing collaborates with over 12,500 suppliers globally, a testament to the extensive nature of its supply chain network.

- Component Integration: The network facilitates the assembly of complex aircraft, requiring seamless integration of hundreds of thousands of individual parts.

- Risk Mitigation: In 2024, Boeing emphasized supply chain resilience, investing in technologies and partnerships to better anticipate and address potential disruptions.

- Timeliness and Efficiency: The network's primary function is to ensure the timely delivery of materials, directly impacting production throughput and cost management.

Boeing's intellectual property is a critical resource, safeguarding its technological advancements and market position. This includes a vast patent portfolio covering innovative aircraft designs and manufacturing processes. In 2024, the company continued its substantial investment in research and development, further solidifying its intellectual capital and ensuring its continued leadership in aerospace innovation.

Value Propositions

Boeing's commitment to cutting-edge aerospace technology means customers gain access to innovations like the fuel-efficient 737 MAX, featuring advanced aerodynamic designs and new engine technology that can reduce fuel burn by up to 14% compared to older models. This focus on innovation translates to superior performance, with aircraft boasting enhanced reliability and operational efficiency, often exceeding industry standards and providing a competitive edge for airlines.

Boeing's proven reliability and safety standards are a cornerstone of its value proposition. This commitment is built on decades of rigorous testing and extensive operational experience across both commercial and defense sectors. This deep-rooted focus instills significant confidence in airlines, governments, and passengers, ensuring dependable operations and minimizing inherent risks.

For instance, Boeing's commercial airplanes have consistently demonstrated high dispatch reliability rates, often exceeding 99%. This statistic is crucial for airlines, directly impacting their operational efficiency and profitability. The company’s dedication to safety is not just a talking point; it’s a critical differentiator in a highly competitive market, underpinning customer trust and long-term partnerships.

Boeing's commitment to comprehensive global support and services is a cornerstone of its business model, ensuring customers receive unparalleled assistance throughout the aircraft lifecycle. This encompasses vital services like maintenance, the provision of spare parts, and specialized technical training, all designed to keep fleets operational and mission-ready. In 2024, Boeing continued to bolster its digital solutions, offering advanced analytics and predictive maintenance tools that significantly enhance efficiency and reduce downtime for operators worldwide.

This dedication to full lifecycle support directly translates into maximized aircraft uptime, a critical factor for airline profitability and operational continuity. By streamlining maintenance processes and providing readily available parts, Boeing minimizes complexities for its global customer base. This focus on customer success fosters deep-seated loyalty and creates robust, recurring revenue streams, demonstrating the strategic value of these support services.

Customization and Mission-Specific Solutions

Boeing’s value proposition centers on delivering highly customized and mission-specific solutions, particularly for its defense, space, and select commercial clients. This adaptability allows them to meet unique operational needs and strategic goals, a critical factor in securing government contracts. For instance, the U.S. Air Force’s KC-46 Pegasus tanker program, a derivative of Boeing’s 767, showcases this customization, with modifications to meet stringent military refueling requirements.

This tailored approach ensures that Boeing's products are not just manufactured but optimized for their intended, often demanding, applications. This deep level of configuration provides significant value by directly addressing customer-specific challenges and enhancing performance in specialized environments. Such bespoke offerings are key to maintaining strong relationships and a competitive edge in niche markets.

- Tailored Defense Systems: Boeing designs and builds aircraft like the F-15EX Eagle II, configured with advanced avionics and weaponry to meet specific U.S. Air Force mission profiles.

- Spacecraft Customization: For NASA’s Starliner program, Boeing developed a crew capsule with specific life support and docking systems to meet ISS mission requirements.

- Commercial Adaptations: While less extreme, even commercial aircraft can be customized with cabin configurations and performance enhancements for specific airline needs.

- Mission Optimization: This focus on customization ensures that each platform is precisely engineered for its operational environment, maximizing effectiveness and efficiency.

Economic Efficiency and Operational Performance

Boeing's commitment to economic efficiency is central to its value proposition, translating into tangible benefits for its customers. The company designs aircraft with advanced fuel-saving technologies, directly impacting airlines' operating expenses. For instance, the 787 Dreamliner offers up to 20% better fuel efficiency compared to previous generation aircraft, a significant cost advantage in today's market. This focus on reducing fuel burn, coupled with lower maintenance needs and high dispatch reliability, enhances overall operational performance.

This enhanced operational performance directly fuels the profitability of commercial airline customers. Lower operating costs mean airlines can offer more competitive fares or achieve higher margins on their routes. For government and defense clients, this translates into greater cost-effectiveness for their missions, ensuring resources are utilized efficiently. Boeing's dedication to these factors underscores the long-term financial advantages of partnering with them.

- Fuel Efficiency: Boeing aircraft are engineered to minimize fuel consumption, a critical factor in reducing operating costs for airlines.

- Reduced Maintenance: Innovative design and materials contribute to lower and less frequent maintenance requirements, saving airlines time and money.

- High Dispatch Reliability: Ensuring aircraft are available for flights as scheduled minimizes disruptions and associated financial losses for operators.

- Lower Operating Costs: The combination of fuel efficiency, reduced maintenance, and reliability leads to a demonstrably lower cost per seat-mile for airlines.

Boeing's value proposition centers on delivering cutting-edge aerospace technology and proven reliability, ensuring customers benefit from innovations like fuel-efficient aircraft and exceptional safety standards. This commitment translates to superior performance, enhanced operational efficiency, and significant cost savings for airlines and defense clients alike.

The company provides comprehensive global support, offering maintenance, spare parts, and advanced digital solutions to maximize aircraft uptime. Furthermore, Boeing excels in delivering customized, mission-specific solutions, particularly for defense and space sectors, ensuring optimal performance in demanding applications.

Boeing's focus on economic efficiency, through technologies like advanced fuel-saving designs and reduced maintenance needs, directly enhances customer profitability and mission cost-effectiveness.

| Value Proposition | Key Features | Customer Benefit |

|---|---|---|

| Technological Innovation | Fuel-efficient aircraft (e.g., 737 MAX, 787 Dreamliner) | Reduced operating costs, enhanced performance |

| Reliability and Safety | High dispatch reliability (>99%), rigorous testing | Minimized risks, operational continuity, customer confidence |

| Global Support & Services | Lifecycle support, digital solutions, predictive maintenance | Maximized uptime, reduced downtime, operational efficiency |

| Customized Solutions | Tailored defense systems (e.g., F-15EX), spacecraft customization (Starliner) | Mission-specific optimization, competitive edge in niche markets |

| Economic Efficiency | Fuel savings (e.g., 20% on 787), lower maintenance | Increased profitability, cost-effectiveness for operations |

Customer Relationships

Boeing’s customer relationships are solidified through dedicated account management and sales teams. These teams cultivate enduring, personalized connections with crucial clients like major airlines and government entities, ensuring a high level of service and understanding of unique requirements.

These specialized teams act as the primary point of contact, facilitating intricate sales processes and providing continuous support. This direct engagement allows Boeing to deeply understand and respond to customer needs, fostering loyalty and repeat business.

In 2024, Boeing continued to emphasize these relationships, which are vital for securing large, multi-year aircraft orders. For instance, the company’s strong ties with carriers like United Airlines and Delta Air Lines are instrumental in their order book, reflecting the success of this high-touch approach.

Boeing's customer relationships are heavily solidified through long-term contractual agreements, particularly for aircraft orders. For instance, in 2024, major airlines continued to place substantial orders, often spanning multiple years and aircraft types, demonstrating a deep commitment beyond a single transaction. These contracts are not just about delivery schedules; they encompass support and maintenance packages, ensuring ongoing engagement.

These extended partnerships are built on continuous dialogue and collaborative planning. Boeing works closely with its airline and defense customers to forecast future needs, optimize fleet management, and develop tailored solutions. This approach, exemplified by ongoing discussions with major carriers regarding next-generation aircraft configurations throughout 2024, fosters a sense of shared destiny and mutual benefit.

The stability provided by these multi-year agreements is a cornerstone of Boeing's business model. For 2024, the backlog of aircraft orders, valued at hundreds of billions of dollars, underscores the predictability these contracts offer. This predictability aids in production planning, resource allocation, and financial forecasting for both Boeing and its customers.

Boeing offers extensive technical support, including pilot and maintenance training, to help customers maximize their aircraft's performance. This commitment extends to knowledge transfer, ensuring clients gain the expertise to operate and maintain their fleets efficiently. In 2024, Boeing continued its focus on these areas, recognizing their critical role in fostering long-term customer relationships and operational success.

These support and training initiatives are designed to build customer capability and foster deep trust, solidifying Boeing's position as a dependable partner throughout the aircraft lifecycle. By enhancing the operational independence of its clients through robust knowledge transfer, Boeing creates a more resilient and self-sufficient customer base.

Customer Feedback Integration and Improvement Cycles

Boeing places a strong emphasis on customer feedback, actively incorporating it into its product development and ongoing service improvements. This dedication to listening to its clients ensures that new aircraft and services are designed to meet the evolving needs of the aviation industry.

For instance, in 2024, Boeing continued its robust engagement with airlines through various channels, including user conferences and direct technical discussions. This feedback loop is crucial for refining existing models and shaping the next generation of aircraft, like the 777X, which has seen extensive input from launch customers regarding cabin design and operational efficiency.

- Customer Input Channels: Boeing utilizes customer advisory boards, operational performance reviews, and direct feedback mechanisms from pilots and maintenance crews.

- Product Enhancement: Feedback on the 787 Dreamliner, for example, has led to software updates and configuration adjustments aimed at improving fuel efficiency and passenger comfort.

- Service Improvement: Customer insights also drive enhancements in Boeing's Global Services offerings, focusing on predictive maintenance and optimized fleet management solutions.

- Market Responsiveness: This iterative process allows Boeing to remain responsive to market demands and maintain its competitive edge by delivering tailored solutions.

Strategic Partnerships for Fleet Planning and Modernization

Boeing cultivates deep relationships through strategic partnerships focused on fleet planning and modernization with airlines and defense clients. These collaborations are crucial for customers to optimize their aircraft assets and adapt to evolving operational demands. For instance, in 2024, Boeing continued its work with major carriers on long-term fleet renewal programs, which can span over a decade and involve billions in aircraft orders and services.

These partnerships go beyond simple sales, offering integrated solutions for technology upgrades and lifecycle support. This strategic alignment ensures customers can effectively manage their investments and prepare for future market shifts. Such relationships foster a shared vision, for example, in developing sustainable aviation solutions, a key focus area for many airlines in 2024.

- Fleet Planning: Assisting clients in forecasting future fleet needs and acquisition strategies.

- Modernization: Implementing upgrades for existing aircraft to enhance efficiency and capability.

- Technology Integration: Incorporating new technologies for improved performance and passenger experience.

- Lifecycle Support: Providing ongoing services and maintenance to maximize asset value.

Boeing's customer relationships are built on dedicated account management and long-term contracts, ensuring personalized service and repeat business. In 2024, these deep ties with airlines like United and Delta were crucial for securing significant multi-year orders. The company also prioritizes customer feedback, incorporating it into product development to meet evolving industry needs, as seen with the 777X's cabin design input.

| Aspect | Description | 2024 Relevance |

|---|---|---|

| Dedicated Account Management | Personalized support for key clients like airlines and governments. | Fosters loyalty and understanding of unique client needs. |

| Long-Term Contracts | Multi-year agreements for aircraft orders, including support and maintenance. | Provides order book stability and predictable revenue streams. |

| Customer Feedback Integration | Active incorporation of client input into product development and service enhancements. | Ensures products and services align with market demands and future needs. |

| Strategic Partnerships | Collaborations on fleet planning and modernization with airlines and defense clients. | Helps customers optimize assets and adapt to evolving operational requirements. |

Channels

Boeing relies heavily on its dedicated direct sales force and a robust network of global sales offices. This approach allows them to directly connect with key customers like commercial airlines and government agencies across the globe, fostering strong, personal relationships. This direct engagement is crucial for navigating complex contract negotiations and tailoring solutions to specific customer needs.

In 2024, Boeing's direct sales model enables them to manage the intricate sales cycles for their large commercial aircraft and defense programs. This direct channel ensures that their sales teams possess deep product knowledge and can provide expert guidance throughout the procurement process, a necessity when dealing with multi-billion dollar deals.

For its defense, space, and security segments, Boeing's primary engagement channel is government procurement, which involves responding to formal tenders and direct negotiations with defense ministries and space agencies worldwide.

This channel is characterized by stringent regulatory compliance, competitive bidding processes, and extended sales cycles, often spanning several years from initial request for proposal to contract award.

In 2024, the global defense market was projected to reach over $2.2 trillion, with government contracts forming the bedrock of major aerospace and defense manufacturers like Boeing.

Navigating these formal, highly specialized channels requires significant investment in proposal development, lobbying, and maintaining strong relationships with government stakeholders to secure substantial, long-term contracts.

Boeing strategically exhibits at key global aerospace events like the Paris Air Show and Farnborough Airshow, vital for direct customer interaction and showcasing advanced aircraft. In 2024, these shows continue to be critical for forging new sales agreements and strengthening existing relationships within the aviation ecosystem.

These expos are instrumental for Boeing's lead generation, allowing direct engagement with airlines, defense ministries, and other potential buyers. They provide a concentrated period for market analysis and competitive intelligence gathering, crucial for staying ahead in the dynamic aerospace industry.

Announcements of new aircraft programs, technological advancements, and strategic partnerships often occur at these high-profile events, generating significant media attention and industry interest. For instance, a major order placed at a 2024 show can significantly impact Boeing's order backlog and future revenue projections.

Participation in industry trade shows reinforces Boeing's brand visibility and commitment to innovation, fostering trust and credibility among its diverse customer base. These events are a concentrated opportunity for market engagement, directly impacting sales pipelines and brand perception.

Customer Support Centers and Field Service Representatives

Post-sale, Boeing leverages a global network of customer support centers and field service representatives. These teams offer crucial technical assistance, manage spare parts ordering, and provide maintenance guidance, ensuring customers receive timely support throughout their aircraft's operational life. This proactive engagement is fundamental to fostering strong customer relationships and driving satisfaction.

Boeing's commitment to post-sale support is reflected in its substantial investment in these channels. For instance, in 2024, the company continued to invest in training and infrastructure for its field service teams, aiming to enhance response times and the quality of technical advice provided to airlines. This focus directly impacts customer retention and the ongoing operational efficiency of their fleet.

- Global Reach: Boeing maintains customer support centers and field service representatives in key aviation hubs worldwide.

- Lifecycle Support: Services extend from initial technical assistance to ongoing maintenance and operational guidance.

- Customer Retention: High-quality support is a critical factor in ensuring repeat business and long-term partnerships.

- Operational Efficiency: Direct support helps airlines minimize downtime and maximize the performance of their Boeing aircraft.

Online Portals and Digital Platforms for Services

Boeing is significantly expanding its digital footprint through online portals and dedicated platforms. These channels streamline access to critical services for its global customer base. For instance, customers can now readily order spare parts, access extensive technical documentation, and engage with comprehensive training modules all through user-friendly digital interfaces.

These digital avenues are designed to boost operational efficiency and empower customers with self-service capabilities. Beyond just transactional functions, these platforms are increasingly offering advanced data analytics services, providing valuable insights crucial for effective fleet management and predictive maintenance. This shift reflects a commitment to modernizing customer engagement and service delivery.

- Digital Parts Ordering: Customers can access a vast catalog of genuine Boeing parts, reducing lead times and improving inventory accuracy.

- Technical Documentation Hubs: Comprehensive manuals, service bulletins, and repair instructions are available 24/7, facilitating quicker troubleshooting and maintenance.

- Online Training Resources: Boeing offers a growing library of digital training modules for flight crews and maintenance personnel, enhancing skill development and compliance.

- Data Analytics Services: Platforms provide customers with insights into aircraft performance, operational efficiency, and maintenance trends to optimize fleet utilization.

Boeing utilizes a multi-faceted channel strategy, focusing on direct sales for large aircraft and defense contracts, leveraging global sales offices and personal relationships. Its defense business heavily relies on government procurement channels, demanding rigorous compliance and long sales cycles.

Trade shows like the Paris Air Show and Farnborough Airshow remain vital for direct customer engagement, lead generation, and market intelligence, especially in 2024. Post-sale, a robust network of customer support centers and field service representatives ensures ongoing technical assistance and maintenance guidance.

Boeing is increasingly investing in digital channels, offering online portals for parts ordering, technical documentation, and training, enhancing customer efficiency and self-service capabilities.

| Channel Type | Primary Focus | Key Activities | 2024 Relevance/Data |

|---|---|---|---|

| Direct Sales Force | Commercial Airlines, Government Agencies | Complex negotiations, tailored solutions, relationship building | Crucial for multi-billion dollar aircraft and defense deals. |

| Government Procurement | Defense Ministries, Space Agencies | Responding to tenders, direct negotiations, regulatory compliance | Defense market projected over $2.2 trillion in 2024; contracts are foundational. |

| Aerospace Trade Shows | Aviation Ecosystem | Customer interaction, showcasing products, lead generation, market analysis | Critical for sales agreements and relationship strengthening in 2024. |

| Post-Sale Support | Existing Customers | Technical assistance, spare parts, maintenance guidance | Investment in training and infrastructure to enhance response times. |

| Digital Platforms | Global Customer Base | Online ordering, technical docs, training, data analytics | Streamlining access to services and offering advanced fleet management insights. |

Customer Segments

Commercial airlines, both for carrying passengers and cargo, are a cornerstone customer segment for Boeing. This includes giants like Delta Air Lines and Emirates, alongside smaller regional players and dedicated cargo carriers such as FedEx and UPS. These companies are keenly focused on acquiring aircraft that offer superior fuel efficiency, such as Boeing's 737 MAX and 787 Dreamliner families, to manage operational expenses. Reliability and the ability to transport significant passenger or freight volumes are also paramount. For instance, in 2024, airlines continued to grapple with fluctuating fuel prices, making fuel-efficient models even more attractive for fleet modernization programs.

Boeing's government defense departments and militaries segment targets national defense ministries and armed forces globally. These entities purchase Boeing's advanced military aircraft, helicopters, satellites, and sophisticated defense systems. In 2024, defense spending worldwide continues to be a significant driver for this customer base, with major nations prioritizing modernization and strategic advantage.

The core needs of this segment revolve around national security objectives, the acquisition of cutting-edge strategic capabilities, and meeting demanding operational requirements. These needs often translate into the procurement of platforms like fighter jets, transport aircraft, and surveillance systems to maintain a technological edge.

Transactions within this segment are characterized by long-term, high-value contracts. These agreements are heavily influenced by government regulations, procurement processes, and complex political considerations, often involving extensive negotiation and oversight.

Boeing's space segment caters to a demanding clientele, including major national and international space agencies like NASA and the European Space Agency, alongside commercial satellite operators. These entities rely on Boeing for critical launch services, advanced satellite platforms, and essential components supporting everything from groundbreaking scientific research to vital communication networks and national security initiatives.

The needs of space agencies and satellite operators are exceptionally high, demanding technologies that are not only specialized but also possess unwavering reliability and represent the absolute cutting edge of space innovation. For instance, the Artemis program, which Boeing is a key partner in, requires unparalleled precision for missions to the Moon and beyond, underscoring the paramount importance of reliability in this sector.

In 2024, the global space economy was projected to reach over $600 billion, with government and commercial satellite operations forming a significant portion of this growth. Boeing's ability to deliver on precision and reliability is directly tied to its success in capturing a share of this expanding market, where even minor failures can have catastrophic consequences and immense financial implications.

Private and Business Jet Operators

Boeing serves a distinct niche by providing customized business and private jet variants of its commercial aircraft. This segment, while smaller than its commercial airline customer base, includes high-net-worth individuals, corporations, and charter companies. These clients prioritize luxury, extended range, exceptional comfort, and highly personalized configurations. Discretion and the ability to deliver tailored solutions are paramount for success in this market.

The demand for bespoke aviation experiences fuels this segment. For example, Boeing's BBJ (Boeing Business Jet) family offers a platform for extensive customization, allowing clients to design interiors that reflect their specific needs and preferences. This can range from opulent suites and conference rooms to advanced entertainment systems. The global market for business jets, including those based on commercial airliners, continues to show resilience, driven by the desire for efficient and private travel.

Key considerations for Boeing in serving this segment include:

- Customization and Bespoke Interiors: Offering unparalleled levels of personalization in cabin design and amenities to meet individual client specifications.

- Range and Performance: Ensuring aircraft meet demanding range requirements for intercontinental travel, often with enhanced performance capabilities.

- After-Sales Support and Service: Providing dedicated support, maintenance, and upgrade services tailored to the unique operational needs of private and business jet operators.

- Discretion and Confidentiality: Maintaining a high level of privacy throughout the sales, customization, and delivery process, which is critical for this client base.

Aircraft Leasing Companies

Aircraft leasing companies represent a crucial customer segment for Boeing. These entities, such as AerCap and Avolon, purchase aircraft directly from Boeing and then lease them to a vast network of airlines worldwide. This model allows airlines to access modern fleets without the substantial upfront capital commitment, offering flexibility in fleet management. For instance, in 2024, AerCap, the world's largest aircraft lessor, continued to be a major customer, with its portfolio including thousands of Boeing aircraft. Their purchasing decisions are heavily swayed by the projected residual value of the aircraft, the prevailing market demand for leased assets, and the availability of favorable financing arrangements.

The leasing sector's health directly impacts Boeing's order book. The ability of these lessors to secure financing and manage their asset portfolios effectively is paramount. In 2024, as global air travel continued its recovery and expansion, demand for leased aircraft remained robust, benefiting lessors and, by extension, Boeing. Key influences on their purchasing strategy include:

- Asset Value: Lessors focus on aircraft types with strong resale values and high demand from airlines.

- Market Demand: The leasing companies' outlook on future airline capacity needs drives their order volumes.

- Financing Terms: Access to competitive financing is essential for lessors to manage their capital expenditures and offer attractive lease rates.

Boeing's customer segments are diverse, encompassing commercial airlines seeking fuel-efficient aircraft like the 737 MAX and 787 Dreamliner, and government defense departments prioritizing advanced military capabilities. The space sector relies on Boeing for critical launch services and satellites, while high-net-worth individuals and corporations opt for customized business jets. Aircraft leasing companies, such as AerCap, act as intermediaries, purchasing Boeing aircraft to lease to airlines globally, driven by asset value and market demand.

Cost Structure

Boeing dedicates a significant portion of its budget to research and development, fueling innovation across its commercial and defense sectors. For instance, in 2023, Boeing reported R&D expenses of approximately $3.8 billion, reflecting a commitment to developing next-generation aircraft and advanced defense technologies.

These crucial investments cover everything from initial concept design and intricate engineering to rigorous prototyping, extensive testing, and the complex certification processes required to bring new aerospace products to market safely and efficiently.

This ongoing R&D expenditure is not just about new products; it's a strategic, long-term investment aimed at maintaining Boeing's technological leadership and ensuring its competitive positioning in the rapidly evolving aerospace industry.

Boeing's manufacturing and production expenses are substantial, forming the bedrock of its operational costs. These include the procurement of raw materials like aluminum and titanium, along with thousands of specialized components sourced from a global supply chain. The assembly of these parts, from initial fuselage construction to final aircraft integration, requires significant investment in labor, machinery, and factory infrastructure, including substantial factory overheads.

Quality control and assurance are paramount, adding to production costs through rigorous testing and inspection at every stage. Furthermore, the ongoing investment in tooling, and particularly the considerable expense of retooling facilities for new aircraft models like the 777X or for enhancing production efficiency of existing lines, directly impacts this cost category. For instance, the development and production ramp-up of the 787 Dreamliner saw significant cost overruns, highlighting the sensitivity of these expenses.

In 2023, Boeing reported cost of sales for its commercial airplanes segment was $59.7 billion. This figure encapsulates a large portion of these manufacturing and production outlays. Efficiently managing these multifaceted costs is absolutely critical for Boeing to maintain healthy profit margins and remain competitive in the aerospace industry.

Boeing's supply chain and logistics represent a substantial cost center, involving the procurement of components from thousands of global suppliers. These costs are directly impacted by fluctuating commodity prices, such as aluminum and titanium, and the intricate coordination required for a worldwide network. In 2024, Boeing continued to navigate these complexities, with logistics and procurement forming a significant portion of its Cost of Goods Sold.

Labor and Personnel Costs

Boeing's cost structure is heavily influenced by its labor and personnel expenses, reflecting the highly skilled and labor-intensive nature of aircraft manufacturing. These costs encompass salaries, wages, comprehensive benefits packages, and ongoing training for a vast workforce of engineers, production specialists, technicians, and administrative personnel. The need for specialized expertise across design, engineering, manufacturing, and support functions makes workforce management a critical factor in controlling overall operational expenses.

In 2024, Boeing continued to navigate the complexities of its workforce, which is fundamental to its operational capacity and product quality. Given the advanced technological requirements and stringent safety standards in the aerospace industry, the investment in human capital remains substantial. Effective management of these labor costs directly impacts Boeing's profitability and its ability to remain competitive in the global market.

- Significant Investment in Skilled Workforce: Boeing employs hundreds of thousands of individuals globally, with a large portion comprising highly skilled engineers and manufacturing technicians critical for complex aircraft production.

- Ongoing Training and Development: To maintain its technological edge and safety standards, Boeing invests heavily in continuous training and development programs for its employees.

- Impact of Labor on Production Costs: Labor represents a substantial portion of the manufacturing cost for each aircraft, influencing pricing and profit margins.

- Workforce Management Strategies: Strategies focused on efficient staffing, productivity improvements, and talent retention are vital for managing these significant personnel costs.

Sales, Marketing, and Administrative Expenses (SG&A)

Sales, Marketing, and Administrative Expenses (SG&A) are a crucial component of Boeing's cost structure, encompassing a wide array of operational necessities. These include the significant investments made in sales and marketing to secure new orders and maintain customer relationships. General and administrative costs, covering everything from corporate functions to IT infrastructure, are also substantial, ensuring the smooth running of a global enterprise.

In 2024, Boeing's SG&A expenses reflect the ongoing efforts to support its vast production and delivery schedules, as well as compliance with stringent aviation regulations. These costs are essential for customer acquisition and retention in a highly competitive aerospace market. For instance, a portion of these expenses goes towards the sales teams interacting with airlines and defense agencies worldwide, negotiating complex contracts.

Efficient management of SG&A is paramount for Boeing's financial health. Keeping these costs in check directly impacts profitability and the ability to invest in future research and development. The company must balance the need for robust sales and administrative support with cost optimization strategies.

- Global Sales Force: Maintaining a network of sales professionals across key markets to secure aircraft orders.

- Marketing and Branding: Investments in advertising, trade shows, and promotional activities to enhance brand visibility and attract customers.

- Corporate Overhead: Costs associated with executive management, finance, human resources, and legal departments supporting global operations.

- IT Infrastructure: Expenses for maintaining and upgrading the technology systems that underpin all business functions, from design to delivery.

Boeing's cost structure is dominated by manufacturing and production expenses, encompassing raw materials, components, labor, and factory overhead. These costs are directly tied to the complex process of building aircraft, with significant investments in tooling and retooling for new models. In 2023, Boeing's cost of sales for commercial airplanes alone was $59.7 billion, underscoring the magnitude of these outlays.

Research and development represent another substantial cost, critical for maintaining technological leadership. In 2023, R&D expenses reached approximately $3.8 billion, funding innovation in both commercial and defense sectors. These investments cover design, engineering, testing, and certification for next-generation aerospace products.

Labor and personnel expenses are also a major component, reflecting the highly skilled workforce required for aerospace manufacturing. These costs include salaries, benefits, and extensive training for engineers and technicians. Managing this significant investment in human capital is vital for operational efficiency and product quality.

Sales, Marketing, and Administrative (SG&A) expenses support global operations, customer relationships, and regulatory compliance. These costs are essential for securing orders and maintaining brand presence in a competitive market, with ongoing efforts to optimize these expenditures for financial health.

| Cost Category | 2023 Data (Approximate) | Key Components |

| Manufacturing & Production | $59.7 Billion (Commercial Airplanes Cost of Sales) | Raw materials, components, labor, factory overhead, tooling |

| Research & Development | $3.8 Billion | Design, engineering, prototyping, testing, certification |

| Labor & Personnel | Significant Portion of Production Costs | Salaries, wages, benefits, training for skilled workforce |

| Sales, Marketing & Administrative (SG&A) | Substantial Operational Necessity | Sales force, marketing, corporate overhead, IT infrastructure |

Revenue Streams

Boeing's primary revenue source is the sale of commercial aircraft. These are a mix of passenger jets and cargo planes sold to airlines and leasing companies globally. In 2024, Boeing continued to focus on delivering its key commercial programs, aiming to increase production rates to meet sustained demand.

These aircraft sales represent significant, high-value transactions, frequently involving substantial orders and intricate financing structures. For instance, a single wide-body jet can cost hundreds of millions of dollars. Revenue recognition typically occurs only after the aircraft has been delivered to the customer.

Boeing's defense, space, and security segment represents a significant and stable revenue engine, primarily fueled by extensive contracts with government entities. These agreements cover a wide array of sophisticated products, including advanced military aircraft like the F-15EX and F/A-18 Super Hornet, formidable weapon systems, crucial satellites for communication and surveillance, and vital cybersecurity solutions. This segment is a bedrock of Boeing's financial stability, often involving multi-year commitments with phased payments tied to project milestones, ensuring a predictable income flow.

For 2024, Boeing reported strong performance in its Defense, Space & Security segment, with revenues reaching approximately $25.0 billion. This segment's backlog remains robust, standing at an impressive $59.1 billion as of the end of 2024, underscoring the long-term nature and stability of these governmental contracts. Many of these projects are classified, adding a layer of strategic importance and exclusivity to Boeing's offerings in this critical sector.

Boeing's Global Services segment is a crucial revenue generator, offering a wide array of offerings like aircraft maintenance, repair, overhaul (MRO), spare parts, and digital solutions to airlines worldwide. This segment ensures the operational readiness of Boeing's vast installed base of aircraft, contributing substantial recurring revenue that complements new aircraft sales.

In 2023, Boeing's Defense, Space & Security segment, which includes global services, reported revenue of $33.6 billion. The company has been strategically investing in expanding its services capabilities, aiming to capture a larger share of the aftermarket support market. This focus is expected to drive continued growth in this segment.

The aftermarket services market is projected to grow significantly, driven by the increasing global aircraft fleet and the need for efficient maintenance and operational solutions. Boeing's commitment to digital transformation within its services offerings, such as predictive maintenance and data analytics, further enhances its value proposition to customers and strengthens this revenue stream.

Aircraft Modifications and Upgrades

Boeing generates revenue by offering modifications and upgrades to existing aircraft fleets, a crucial service for airlines wanting to enhance performance or adapt to new needs. This includes services like cabin reconfigurations, which can improve passenger experience and capacity, and avionics upgrades that bring older planes up to current technological standards.

These upgrades are vital for extending an aircraft's operational lifespan and ensuring compliance with evolving regulations. For instance, structural enhancements can address wear and tear, delaying the need for costly new aircraft purchases. In 2023, Boeing's Commercial Airplanes segment, which encompasses many of these services, saw significant revenue contributions, reflecting the ongoing demand for fleet modernization. While specific revenue figures for modifications alone are not broken out, the aftermarket services division, which includes these offerings, is a substantial part of Boeing's overall financial picture.

- Fleet Modernization: Revenue from updating existing aircraft with new technologies and configurations.

- Performance Enhancement: Income generated by improving aircraft fuel efficiency, range, or payload capacity.

- Lifespan Extension: Revenue from structural repairs and upgrades that prolong an aircraft's service life.

- Regulatory Compliance: Income from modifications necessary to meet new aviation standards and mandates.

Government Research and Development Grants/Contracts

Boeing secures significant revenue through government research and development grants and contracts, particularly for advanced technology projects and defense initiatives. These agreements fund the creation of groundbreaking technologies with potential for both military and commercial use, bolstering Boeing's innovation pipeline.

For instance, in 2024, Boeing continued to be a major recipient of U.S. Department of Defense contracts, a substantial portion of which is allocated to research and development. These funds are critical for advancing areas like next-generation aircraft, autonomous systems, and cybersecurity solutions.

- Defense R&D Contracts: Boeing consistently receives substantial funding for research into advanced military aviation technologies, including next-generation fighter jets and drone capabilities.

- NASA Partnerships: Grants and contracts from NASA support Boeing's role in space exploration, contributing to the development of spacecraft and related technologies.

- Dual-Use Technology Development: Government funding often drives innovation in technologies that offer both defense applications and potential commercial spin-offs, such as advanced materials and propulsion systems.

Boeing's diverse revenue streams are built upon the sale of aircraft, both commercial and defense-related, alongside a robust global services segment. These revenue streams are further diversified by modifications, upgrades, and government research and development contracts. This multi-faceted approach provides financial stability and fuels continuous innovation.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Commercial Aircraft Sales | Sale of passenger and cargo jets to airlines and leasing companies. | Focus on increasing production rates to meet sustained demand. |

| Defense, Space & Security | Sales of military aircraft, weapon systems, satellites, and cybersecurity solutions to governments. | Revenue: ~$25.0 billion; Backlog: $59.1 billion. |

| Global Services | Aftermarket support including maintenance, repair, overhaul (MRO), spare parts, and digital solutions. | Crucial for operational readiness; complements new aircraft sales. |

| Modifications & Upgrades | Enhancing existing aircraft fleets for performance, passenger experience, or regulatory compliance. | Vital for extending aircraft lifespan; a substantial part of aftermarket services. |

| R&D Grants & Contracts | Funding for advanced technology and defense projects, particularly from government entities. | Critical for advancing next-generation aircraft and autonomous systems. |

Business Model Canvas Data Sources

The Boeing Business Model Canvas is informed by extensive market research, internal operational data, and detailed financial reports. These sources provide a comprehensive view of customer needs, competitive landscapes, and cost structures.