BOC Hong Kong Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOC Hong Kong Holdings Bundle

Navigate the complex external forces shaping BOC Hong Kong Holdings with our comprehensive PESTLE analysis. Discover how evolving political landscapes, economic shifts, and technological advancements are creating both opportunities and challenges for the banking giant. This analysis is essential for anyone looking to understand BOC Hong Kong's strategic positioning and future trajectory. Gain a competitive edge by understanding these critical factors. Download the full PESTLE analysis now and unlock actionable intelligence to inform your investment or business decisions.

Political factors

Government policies and regulatory stability are paramount for BOC Hong Kong. The bank navigates a landscape shaped by Hong Kong's own financial regulations, as well as those emanating from mainland China, especially concerning capital flows and market access. For instance, the ongoing push to integrate Hong Kong further into the Greater Bay Area initiative, a key government policy, presents both opportunities and challenges for cross-border banking services.

The stability of these policies, particularly those affecting financial liberalization and the free movement of capital, directly influences BOC Hong Kong's strategic planning and potential for expansion. Changes in regulations regarding offshore RMB business, for example, can significantly impact the bank's profitability and market position.

Government efforts to reinforce Hong Kong's role as an international financial center and a crucial bridge to mainland China are vital. These initiatives, such as the expansion of Stock Connect and Bond Connect programs, directly benefit BOC Hong Kong by increasing transaction volumes and facilitating capital flows.

Geopolitical tensions, especially between China and Western nations, significantly shape investor sentiment and international trade, directly impacting Hong Kong's economic landscape and BOC Hong Kong's operations. For instance, in late 2023 and early 2024, heightened trade friction led to shifts in global supply chains, potentially affecting the volume of trade finance handled by the bank.

BOC Hong Kong, with its deep connections to mainland China, is particularly attuned to changes in cross-border relations. These shifts can influence its capacity to offer vital services like trade finance and cross-border wealth management, areas crucial to its revenue streams. The economic interdependence between Hong Kong and mainland China, reinforced by initiatives like the Greater Bay Area, presents a dual-edged sword of opportunity and inherent complexities for the bank's strategic planning.

The National Security Law, enacted in 2020, has significantly reshaped Hong Kong's political landscape, introducing a new regulatory environment for all businesses, including BOC Hong Kong. This law aims to bolster national security but has also prompted international scrutiny regarding Hong Kong's autonomy and adherence to the rule of law.

International perceptions of Hong Kong's political stability and legal framework are crucial for foreign investment and talent retention. A perceived shift in autonomy could deter overseas capital and skilled professionals, impacting the overall business ecosystem in which BOC Hong Kong operates.

BOC Hong Kong must diligently navigate the complexities of the National Security Law, ensuring full compliance with its provisions while simultaneously managing international stakeholder expectations and maintaining its position as a key financial institution in the region.

Financial Hub Status and Competition

Hong Kong's government actively champions its standing as a premier financial hub, yet faces significant competition, notably from Singapore. Policies focusing on fintech advancement and a supportive business climate are vital for maintaining this edge. For example, Hong Kong's Securities and Futures Commission (SFC) introduced new licensing requirements for virtual asset service providers in June 2023, aiming to bolster regulatory oversight and investor protection, a move intended to enhance its appeal in the digital asset space.

BOC Hong Kong Holdings plays a dual role, both benefiting from and actively contributing to Hong Kong's established financial infrastructure. The city's strategic location and robust legal framework continue to attract substantial foreign direct investment, with total foreign direct investment inflows reaching approximately $1.7 trillion USD in 2023, according to preliminary estimates.

Key government initiatives to bolster competitiveness include tax incentives for specific financial activities and streamlined processes for capital raising. These efforts are designed to attract and retain financial institutions and talent, ensuring Hong Kong remains a vibrant financial ecosystem. The Hong Kong Monetary Authority's (HKMA) initiatives, such as the FinTech Supervisory Sandbox and the Faster Payment System (FPS), illustrate a commitment to innovation and efficiency within the financial sector.

- Government Support: Hong Kong actively promotes its financial hub status through policy initiatives.

- Regional Competition: Singapore remains a key competitor, vying for regional financial market share.

- Fintech Focus: Policies are in place to attract and foster financial technology development.

- BOCHK's Role: The bank benefits from and contributes to Hong Kong's financial strength.

Regulatory Cooperation with Mainland China

BOC Hong Kong's deep ties to mainland China mean that regulatory cooperation between Hong Kong and mainland authorities is crucial. This alignment directly impacts its operational landscape and ability to serve its extensive client base.

Policies designed to boost financial integration, like the Wealth Management Connect scheme, are significant. For instance, in the first quarter of 2024, this scheme saw a notable increase in transaction volumes, demonstrating its potential to unlock new business opportunities for banks like BOC Hong Kong.

However, navigating potentially divergent regulatory frameworks presents ongoing challenges. BOC Hong Kong must remain agile to ensure compliance and manage the operational complexities that can arise from these differences.

- Regulatory Alignment: Harmonization of rules between Hong Kong and mainland China facilitates smoother cross-border financial services.

- Integration Schemes: Initiatives like Wealth Management Connect, which saw significant transaction growth in early 2024, open new revenue streams.

- Compliance Hurdles: Divergent regulations can increase compliance costs and operational complexity for BOC Hong Kong.

Government policies in Hong Kong, particularly those aimed at reinforcing its status as an international financial center and a gateway to mainland China, directly benefit BOC Hong Kong. Initiatives like the expansion of Stock Connect and Bond Connect programs, which saw increased participation in late 2023 and early 2024, boost transaction volumes and capital flows. The Hong Kong Monetary Authority's (HKMA) focus on fintech, exemplified by the Virtual Asset Service Providers licensing framework introduced in June 2023, aims to foster innovation and investor protection, enhancing the city's competitive edge against rivals like Singapore.

The bank's operations are also significantly influenced by the intricate relationship between Hong Kong and mainland China's regulatory environments. Policies promoting financial integration, such as the Wealth Management Connect scheme, which experienced notable transaction growth in the first quarter of 2024, create new avenues for BOC Hong Kong. However, navigating differing regulatory frameworks necessitates ongoing vigilance to ensure compliance and manage operational complexities.

Geopolitical shifts and trade tensions, particularly between China and Western nations, impact investor sentiment and international trade, influencing BOC Hong Kong's trade finance and cross-border wealth management services. The National Security Law, enacted in 2020, has introduced a new regulatory context, requiring careful adherence while balancing international stakeholder expectations. This evolving landscape underscores the need for BOC Hong Kong to remain adaptable to maintain its position.

| Policy Driver | Impact on BOC Hong Kong | Key Data/Event |

| Financial Hub Promotion | Increased transaction volumes, capital flows | Stock Connect & Bond Connect participation rose in late 2023/early 2024 |

| Fintech Regulation | Enhanced investor protection, competitive edge | HKMA's VASP licensing framework introduced June 2023 |

| Cross-border Integration | New revenue streams, operational complexity | Wealth Management Connect saw transaction growth Q1 2024 |

| Geopolitical Tensions | Impact on trade finance, wealth management | Heightened trade friction affected global supply chains late 2023/early 2024 |

What is included in the product

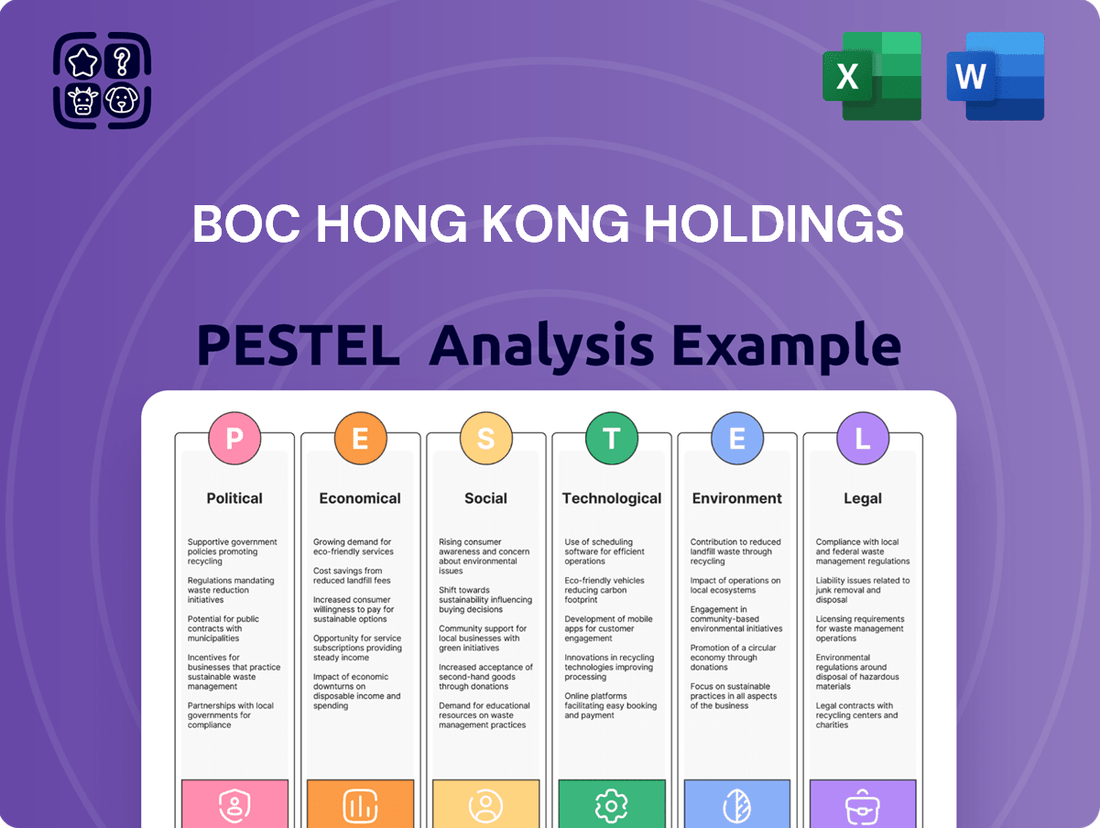

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting BOC Hong Kong Holdings, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges for the company in its operating environment.

This PESTLE analysis for BOC Hong Kong Holdings provides a clear, summarized version of complex external factors, alleviating the pain of sifting through lengthy reports for quick referencing during meetings or presentations.

Economic factors

The interest rate environment is a critical factor for BOC Hong Kong Holdings. Changes in global and local rates directly influence the bank's net interest margin, affecting its profitability. For instance, the Hong Kong Monetary Authority (HKMA) typically aligns its monetary policy with the US Federal Reserve, meaning shifts in US interest rates often translate to Hong Kong. As of early 2024, the Federal Reserve has maintained a relatively high interest rate environment, which has generally supported higher net interest margins for banks like BOC Hong Kong.

However, this environment also presents challenges. Rising interest rates can increase the cost of funding for BOC Hong Kong, as it pays more on deposits and borrowed funds. Simultaneously, while lending rates may also increase, the potential for borrowers to struggle with higher repayment burdens can lead to increased credit risk. For example, a sustained period of elevated rates could see a rise in non-performing loans within the bank's portfolio, impacting asset quality.

Economic growth in both Hong Kong and mainland China directly fuels BOC Hong Kong's operations. When these economies expand robustly, BOC Hong Kong typically sees a surge in demand for its core services like deposits, loans, and wealth management. For instance, China's GDP grew by 5.2% in 2023, and Hong Kong's economy rebounded with an estimated 3.2% growth in the same year, indicating a positive environment for financial institutions.

Conversely, any economic deceleration in these key markets presents challenges. A slowdown, perhaps driven by issues in the property sector or shifts in international trade, can dampen business activity and potentially increase the risk of loan defaults for BOC Hong Kong. For example, concerns over China's property market stability in late 2023 and early 2024 have been closely watched for their potential ripple effects on the broader financial sector.

Inflationary pressures in Hong Kong can significantly impact BOC Hong Kong Holdings by increasing operating costs for the bank, such as salaries and technology investments. These pressures also influence consumer spending patterns, potentially altering the demand for various financial products like mortgages and personal loans.

For instance, Hong Kong's Consumer Price Index (CPI) saw a modest increase, with the Composite CPI at 2.7% in April 2024, up from 1.7% in March 2024, indicating persistent inflationary forces. This environment necessitates careful management of the bank's balance sheet and product pricing to ensure profitability.

Conversely, deflationary trends, though less prevalent recently, could lead to a decrease in asset values, impacting the collateral for loans and potentially reducing loan demand as consumers and businesses postpone spending. Such a scenario would challenge BOC Hong Kong's asset quality and overall loan portfolio performance.

BOC Hong Kong must therefore strategically adapt its financial product offerings and risk management practices to navigate both inflationary and potential deflationary economic conditions, aiming to maintain healthy profit margins and robust asset quality throughout these price cycles.

Currency Stability and Exchange Rates

Currency stability is a cornerstone for BOC Hong Kong Holdings. Its Hong Kong Dollar (HKD) remains firmly pegged to the US Dollar, a relationship that has provided a predictable financial environment. This peg, currently around 7.75-7.85 HKD to 1 USD, is crucial for managing cross-border financial flows, especially given BOC Hong Kong's significant business dealings with mainland China and the growing influence of the Renminbi (RMB).

Fluctuations in exchange rates directly affect the bank's financial health. For instance, if the RMB weakens against the USD, BOC Hong Kong's RMB-denominated assets and liabilities will translate to fewer HKD or USD when reported. This impacts the valuation of its balance sheet and the profitability of its international transactions. The bank must actively manage these foreign exchange exposures to safeguard its earnings.

In 2024, the RMB has experienced periods of volatility against the USD, influenced by global economic conditions and China's domestic policies. For BOC Hong Kong, this means constant vigilance in its treasury operations. Effective management of these currency risks is paramount for maintaining profitability and investor confidence.

- HKD Peg Stability: The Hong Kong Dollar's long-standing peg to the US Dollar provides a bedrock of stability for BOC Hong Kong's operations.

- Renminbi Exposure: Given BOC Hong Kong's extensive cross-border business, the Renminbi's exchange rate movements are a key factor influencing profitability.

- Asset and Liability Valuation: Exchange rate shifts directly impact the value of foreign currency holdings and obligations on the bank's books.

- Transaction Profitability: Cross-border trade and investment activities are sensitive to currency swings, affecting BOC Hong Kong's transaction income.

Capital Market Performance and Investor Sentiment

The performance of Hong Kong's capital markets, encompassing both equities and fixed income, significantly influences BOC Hong Kong's wealth management and investment banking divisions. In 2024, the Hang Seng Index experienced volatility, with a notable downturn in the first half of the year impacting investor confidence.

Positive investor sentiment and robust market activity directly translate into higher fee income for BOC Hong Kong, particularly from its wealth management products and brokerage services. For instance, during periods of market upswing, such as the recovery seen in late 2023, fee and commission income from these areas saw a marked increase.

Conversely, market downturns, like the challenges faced in early 2024, can lead to a contraction in client activity and a reduction in assets under management, directly affecting profitability. The Hong Kong bond market also plays a role, with interest rate movements influencing investment banking deal flow and the attractiveness of fixed-income products offered by BOC Hong Kong.

- Hang Seng Index performance: Experienced a decline of approximately 10% in the first half of 2024, before showing signs of recovery.

- Wealth Management Contributions: Fee and commission income from wealth management and brokerage services represented a significant portion of BOC Hong Kong's revenue in 2023, contributing over 30% of total income.

- Investor Sentiment Indicator: Consumer Confidence Index for Hong Kong showed a dip in Q1 2024, reflecting cautious sentiment towards investment.

- Bond Market Activity: Primary bond issuance in Hong Kong saw a 15% year-on-year increase in 2023, indicating underlying investor demand for fixed income.

Interest rate shifts directly impact BOC Hong Kong's net interest margin and funding costs. As of early 2024, elevated US rates, often mirrored by the HKMA, supported margins but also increased borrowing expenses. For instance, a sustained high-rate environment could strain borrowers, potentially increasing non-performing loans.

Economic growth in Hong Kong and mainland China is vital for BOC Hong Kong's business volume. China's 5.2% GDP growth in 2023 and Hong Kong's 3.2% rebound provided a favorable backdrop, boosting demand for banking services. However, economic slowdowns, such as those linked to China's property sector concerns in late 2023/early 2024, pose risks.

Inflationary pressures, evidenced by Hong Kong's CPI rising to 2.7% in April 2024, increase BOC Hong Kong's operating costs and affect consumer spending on financial products. Conversely, deflation could devalue assets and reduce loan demand, impacting asset quality.

The HKD's peg to the USD at 7.75-7.85 provides stability, but RMB volatility, observed in 2024, directly affects BOC Hong Kong's cross-border transaction profitability and balance sheet valuation.

Hong Kong's capital markets performance is key for BOC Hong Kong's wealth and investment banking arms. The Hang Seng Index's volatility in early 2024, with a notable decline, impacted investor sentiment and fee income. Wealth management contributed over 30% of BOC Hong Kong's 2023 income.

| Economic Factor | Key Metric/Trend (2023-2024) | Impact on BOC Hong Kong | Data Point Example |

|---|---|---|---|

| Interest Rates | Elevated Global & HK Rates | Supports Net Interest Margin, Increases Funding Costs | US Federal Funds Rate maintained high in early 2024 |

| Economic Growth | China GDP: 5.2% (2023), HK GDP: 3.2% (2023) | Drives Demand for Banking Services, Increases Credit Risk during Slowdowns | China property sector concerns in late 2023/early 2024 |

| Inflation | HK CPI: 2.7% (April 2024) | Increases Operating Costs, Influences Consumer Spending | CPI rose from 1.7% in March 2024 |

| Currency Exchange Rates | HKD Pegged to USD (7.75-7.85) | Provides Stability, RMB Volatility Impacts Cross-Border Profitability | RMB experienced volatility against USD in 2024 |

| Capital Markets | Hang Seng Index Volatility | Affects Wealth Management Fees, Investor Sentiment | Hang Seng Index declined ~10% in H1 2024 |

Preview the Actual Deliverable

BOC Hong Kong Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for BOC Hong Kong Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination of how these external forces shape BOC Hong Kong's operational landscape and strategic decisions. You can trust that the insights and structure you see in this preview are precisely what you'll be working with.

Sociological factors

Hong Kong’s aging population, with over 1.3 million people aged 65 and above as of mid-2024, presents a dual-edged sword for BOC Hong Kong. This demographic trend is expected to fuel demand for financial products catering to retirement, wealth preservation, and specialized insurance, potentially boosting fee-based income streams.

However, the increasing proportion of the elderly could also strain the labor force and dampen overall economic vitality. This shift might temper the growth of traditional lending and transactional banking services, requiring BOC Hong Kong to adapt its service offerings and operational models to an evolving customer base.

Consumers in Hong Kong are rapidly shifting towards digital financial solutions. By the end of 2024, it’s estimated that over 70% of banking transactions in Hong Kong are conducted digitally, with mobile banking usage surging. This trend necessitates that BOC Hong Kong significantly enhances its digital offerings, focusing on intuitive mobile applications and seamless online platforms to cater to this evolving demand.

Despite the digital surge, a substantial segment of Hong Kong's population, particularly older demographics, still prefers the tangible experience of physical branches and direct human interaction for financial advice. A 2025 survey indicated that 45% of customers aged 55 and above still visit branches at least once a month for services. Therefore, BOC Hong Kong must adopt a hybrid strategy, integrating robust digital channels with accessible and well-staffed physical locations to serve its diverse customer base effectively.

The increasing wealth in Hong Kong and mainland China is a significant sociological driver, boosting demand for advanced wealth management solutions and expert financial advice. BOC Hong Kong must effectively serve a wide range of clients, from ultra-high-net-worth individuals to the burgeoning mass affluent segment.

In 2023, Hong Kong's total wealth reached an estimated US$2.7 trillion, with a notable portion held by affluent individuals seeking professional management. Simultaneously, efforts to elevate financial literacy are crucial, as a more informed populace is more likely to engage with and benefit from intricate financial instruments and services offered by institutions like BOC Hong Kong.

Social Values and ESG Consciousness

Societal values are shifting, with a pronounced increase in awareness and demand for Environmental, Social, and Governance (ESG) principles in corporate operations. This trend is particularly evident among consumers, especially younger demographics, who are actively seeking out sustainable investment options and financial institutions that exhibit robust corporate social responsibility. For BOC Hong Kong, aligning with these evolving values is not just a matter of compliance but a strategic imperative.

BOC Hong Kong's proactive engagement with ESG can significantly bolster its brand image and attract a growing segment of socially conscious customers. For instance, the bank has been actively involved in promoting green finance. In 2023, BOC Hong Kong issued its first green bond, raising HKD 5 billion to fund eligible green projects, demonstrating a tangible commitment to environmental sustainability. This move is in line with the increasing investor preference for sustainable assets, with global sustainable investment assets projected to reach $50 trillion by 2025, according to estimates from various financial bodies.

- Growing Demand for ESG: Consumers, particularly millennials and Gen Z, are increasingly prioritizing brands and financial services that demonstrate strong ESG performance.

- Sustainable Investment Growth: The market for sustainable investments is expanding rapidly, with an estimated $50 trillion in assets by 2025, indicating a clear financial incentive for ESG integration.

- Brand Reputation Enhancement: By highlighting its ESG initiatives, such as green bond issuance and community support programs, BOC Hong Kong can strengthen its brand loyalty and attract socially aware clientele.

- Customer Acquisition: Banks demonstrating a clear commitment to social responsibility often see improved customer acquisition and retention rates, especially among younger, values-driven consumers.

Urbanization and Lifestyle Changes

Hong Kong and the Greater Bay Area continue to experience significant urbanization, leading to a dynamic shift in lifestyle expectations and, consequently, banking needs. This urban sprawl necessitates financial institutions to adapt to the demands of a populace prioritizing speed and ease in their financial interactions.

The inherently fast-paced urban environment fuels a strong demand for instant and mobile financial services. Customers expect seamless digital access to manage their finances anytime, anywhere, reflecting a broader trend in consumer behavior across major metropolitan areas globally. For example, in 2024, mobile banking adoption in Hong Kong continued its upward trajectory, with a significant percentage of transactions conducted via smartphones.

To maintain relevance and competitiveness, BOC Hong Kong must proactively align its product development and service accessibility with these evolving urban living trends. This means investing in and enhancing digital platforms, offering user-friendly mobile applications, and ensuring quick, responsive customer support channels that cater to the modern, on-the-go lifestyle.

- Urbanization Trends: Continued migration to urban centers in the Greater Bay Area fuels demand for accessible financial services.

- Digital Adoption: The prevalence of smartphones in Hong Kong supports a strong preference for mobile banking solutions.

- Service Expectations: Urban dwellers expect 24/7 access and instant transaction capabilities from their banks.

- BOC Hong Kong's Strategy: Aligning product offerings with these lifestyle changes is crucial for customer retention and acquisition.

Hong Kong's demographic shifts, particularly its aging population and increasing digital savviness, are reshaping banking needs. While an aging populace, exceeding 1.3 million individuals aged 65+ by mid-2024, drives demand for retirement and wealth management services, it also highlights the need for accessible, human-centric support. Simultaneously, the rapid adoption of digital financial solutions, with over 70% of transactions expected to be digital by end-2024, necessitates enhanced mobile platforms and online services for BOC Hong Kong to cater to a diverse customer base.

Societal values are also evolving, with a growing emphasis on Environmental, Social, and Governance (ESG) principles. BOC Hong Kong's commitment to ESG, exemplified by its 2023 green bond issuance of HKD 5 billion, aligns with increasing consumer and investor preference for sustainable finance, a market projected to reach $50 trillion by 2025.

Urbanization within Hong Kong and the Greater Bay Area fuels demand for swift, convenient financial services. The prevalence of mobile banking, with a significant portion of transactions conducted via smartphones in 2024, underscores the need for BOC Hong Kong to prioritize user-friendly digital platforms and responsive customer support channels to meet the expectations of the modern, on-the-go urban dweller.

| Sociological Factor | Trend | Impact on BOC Hong Kong | Data Point |

| Aging Population | Increasing proportion of elderly | Demand for retirement/wealth products; potential strain on labor force | Over 1.3 million people aged 65+ (mid-2024) |

| Digitalization | Shift to digital transactions | Need for enhanced mobile/online platforms | >70% of transactions digital (est. end-2024) |

| ESG Awareness | Growing demand for sustainable practices | Opportunity to enhance brand reputation and attract conscious consumers | HKD 5 billion green bond issued (2023) |

| Urbanization | Concentration in urban centers | Increased demand for instant, mobile financial services | High smartphone transaction volume (2024) |

Technological factors

The banking industry's ongoing digital transformation is a significant technological driver. BOC Hong Kong needs to consistently upgrade its digital offerings, from mobile banking applications to online services, ensuring a smooth customer experience across all touchpoints.

Customer preference for digital channels continues to grow, making it essential for BOC Hong Kong to maintain a strong, user-friendly digital infrastructure to remain competitive. For instance, by the end of 2024, it's projected that over 80% of banking transactions in Hong Kong will be conducted digitally, highlighting the urgency for continuous investment in these areas.

FinTech innovation is significantly reshaping the financial landscape in Hong Kong, with virtual banks and agile startups rapidly emerging. This surge intensifies competition for established players like BOC Hong Kong.

BOC Hong Kong faces a critical juncture: either directly compete with these nimble FinTechs or forge strategic collaborations to leverage their innovative capabilities. This dynamic is forcing the bank to explore new service offerings and optimize existing operations.

Key areas experiencing profound FinTech disruption include digital payment solutions, online lending platforms, and the burgeoning wealth technology sector. For instance, Hong Kong's digital payment market saw a substantial increase in users, with over 10 million active users registered for various electronic payment services by late 2023, highlighting the rapid adoption of new technologies.

By 2024, it's anticipated that FinTech will continue to drive demand for more seamless, personalized, and efficient customer experiences, pushing traditional banks to accelerate their digital transformation efforts or risk losing market share.

Artificial intelligence and big data analytics are fundamentally reshaping how banks operate. BOC Hong Kong can harness these advancements to offer more personalized customer experiences and execute more effective marketing campaigns. Furthermore, these technologies are crucial for enhancing risk management protocols and bolstering fraud detection capabilities.

By integrating AI and big data, BOC Hong Kong can unlock deeper understanding of its customer base, streamline internal processes through automation, and ultimately make more informed and agile business decisions. This strategic adoption is key to staying competitive in the evolving financial landscape.

The Hong Kong Monetary Authority (HKMA) is actively supporting the integration of AI within the banking sector. Initiatives such as the GenA.I. Sandbox are designed to encourage and facilitate the adoption of AI technologies, providing a controlled environment for testing and development, which BOC Hong Kong can certainly benefit from.

Cybersecurity Threats and Data Protection

The increasing digitalization of banking services, including those offered by BOC Hong Kong, significantly amplifies the risk of cyberattacks and data breaches. Protecting sensitive customer information and maintaining the integrity of financial systems are paramount. BOC Hong Kong must therefore make substantial and ongoing investments in sophisticated cybersecurity technologies and protocols to safeguard its operations and reputation.

In 2024, the financial sector globally saw a marked increase in sophisticated cyber threats. For instance, a report by IBM in March 2024 indicated that the average cost of a data breach reached $4.73 million globally. Hong Kong's financial regulators are also tightening their grip, with the Hong Kong Monetary Authority (HKMA) consistently updating its guidelines on cyber resilience. This includes rigorous stress testing and mandatory reporting of security incidents, putting pressure on institutions like BOC Hong Kong to maintain robust defenses.

- Escalating Cyber Threats: As digital channels become primary for transactions, the attack surface for cybercriminals expands, necessitating constant vigilance and advanced threat detection capabilities.

- Data Protection Imperative: BOC Hong Kong must adhere to strict data privacy regulations, such as Hong Kong's Personal Data (Privacy) Ordinance, which carries significant penalties for non-compliance in the event of a breach.

- Investment in Cybersecurity: Continuous investment in areas like AI-driven threat intelligence, multi-factor authentication, and employee training is crucial to mitigate evolving cyber risks.

- Regulatory Scrutiny: Increased oversight from bodies like the HKMA means banks must demonstrate proactive and effective cyber resilience frameworks, including incident response and recovery plans.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) offer significant potential to transform BOC Hong Kong's operations. These technologies can streamline cross-border payments, making them faster and cheaper, and enhance the security and transparency of trade finance processes. Furthermore, DLT facilitates asset tokenization, opening new avenues for financial product development and liquidity management.

While widespread adoption is still developing, BOC Hong Kong should actively explore and pilot these innovations. This aligns with the Hong Kong Monetary Authority's (HKMA) forward-looking approach, including initiatives like the Ensemble project, which aims to foster innovation in the financial sector. By integrating DLT, BOC Hong Kong can boost operational efficiency and fortify its security posture.

- Enhanced Efficiency: DLT can reduce settlement times for cross-border transactions, potentially cutting them from days to minutes.

- Increased Transparency: Shared ledgers provide an immutable record, improving auditability and reducing fraud in trade finance.

- New Revenue Streams: Asset tokenization can unlock liquidity for previously illiquid assets, creating new investment opportunities.

- Regulatory Alignment: Proactive exploration of DLT supports BOC Hong Kong's compliance with evolving digital finance regulations and HKMA initiatives.

Technological advancements are fundamentally reshaping the banking sector, necessitating continuous adaptation for BOC Hong Kong. The rapid rise of FinTechs and the increasing demand for digital banking services, with over 80% of transactions expected to be digital in Hong Kong by end-2024, highlight the need for robust online platforms and mobile applications. Furthermore, the integration of AI and big data analytics presents opportunities for enhanced customer personalization and improved risk management, supported by initiatives like the HKMA's GenA.I. Sandbox.

Legal factors

BOC Hong Kong (Holdings) operates under the watchful eye of the Hong Kong Monetary Authority (HKMA), adhering to a robust framework of banking regulations and prudential standards. These regulations are designed to ensure the stability and integrity of the financial system.

Key requirements encompass capital adequacy ratios, with the HKMA closely monitoring banks to maintain strong buffers against potential losses. For instance, by the end of 2024, major banks in Hong Kong are expected to continue meeting Basel III requirements, which set minimum capital levels to absorb unexpected losses. Liquidity is also paramount, with strict rules governing the amount of high-quality liquid assets banks must hold to manage short-term funding needs, especially in times of stress.

Furthermore, BOC Hong Kong must implement comprehensive risk management systems to identify, measure, monitor, and control various risks, including credit, market, and operational risks. Sound corporate governance practices are also mandated, ensuring accountability and transparency in the bank's operations. Staying compliant with these dynamic regulations, which are continuously updated to reflect global best practices and emerging risks, is not just a legal obligation but a critical factor in maintaining customer confidence and avoiding significant penalties.

BOC Hong Kong Holdings operates within a stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) legal landscape, designed to align with global best practices. This framework necessitates rigorous adherence to customer due diligence procedures, ongoing transaction monitoring, and timely reporting of any suspicious activities.

In 2023, Hong Kong's Joint Financial Intelligence Unit (FIU) processed a significant volume of suspicious transaction reports, underscoring the active regulatory environment. Failure to comply with these AML/CTF obligations can result in severe penalties, including substantial financial fines and irreparable damage to the bank's reputation.

BOC Hong Kong, like all financial institutions, navigates a complex web of data privacy laws. Hong Kong's Personal Data (Privacy) Ordinance (PDPO) is a key piece of legislation requiring stringent adherence to how customer information is collected, processed, and stored. Failure to comply can result in significant penalties. This extends to regulations governing cross-border data transfers, a crucial aspect for a bank operating internationally.

Consumer Protection Laws

Consumer protection laws are a critical element for BOC Hong Kong Holdings. Regulations focusing on fair lending, transparency in product disclosures, and robust complaint handling directly shape how the bank interacts with its customers. For instance, adherence to the Personal Data (Privacy) Ordinance in Hong Kong ensures sensitive customer information is handled with care, a key aspect of consumer trust.

Compliance with these legal frameworks is not just about avoiding penalties; it's fundamental to building and maintaining customer confidence. A strong track record in consumer protection can differentiate BOC Hong Kong in a competitive market. In 2024, the Hong Kong Monetary Authority (HKMA) continued to emphasize consumer protection, issuing guidance on areas like digital banking security and fair treatment of customers.

- Fair Lending Practices: Laws preventing discrimination in credit decisions are paramount, ensuring equitable access to financial products.

- Disclosure Requirements: Mandates for clear and comprehensive information on fees, interest rates, and terms build transparency.

- Complaint Resolution: Established mechanisms for addressing customer grievances are vital for maintaining satisfaction and trust.

- Data Privacy: Strict adherence to data protection regulations safeguards customer information against misuse.

Cross-Border Legal Frameworks

BOC Hong Kong (BOCHK) operates within a complex web of cross-border legal frameworks, particularly given its deep ties with mainland China. Navigating differing regulations between Hong Kong and the mainland poses significant challenges, impacting areas like capital movement and investment product sales. For instance, the SAFE (State Administration of Foreign Exchange) regulations in China govern cross-border capital flows, directly affecting BOCHK's ability to move funds and offer certain services to its clients.

The legal landscape for financial institutions like BOCHK is constantly evolving. Changes in regulations concerning anti-money laundering (AML) and know-your-customer (KYC) requirements across jurisdictions necessitate continuous adaptation. In 2024, Hong Kong's Securities and Futures Commission (SFC) continued to emphasize robust compliance measures for financial products sold to both retail and professional investors, with cross-border offerings facing heightened scrutiny.

- Cross-Jurisdictional Compliance: BOCHK must adhere to both Hong Kong's legal system and the evolving regulatory environment in mainland China.

- Capital Flow Regulations: Managing cross-border capital flows is subject to stringent controls, impacting BOCHK's treasury operations and international business.

- Dispute Resolution: Resolving legal disputes that arise from cross-border transactions requires understanding and navigating different legal and arbitration frameworks.

- Product Distribution Laws: The sale and distribution of investment products across borders are governed by distinct licensing and disclosure requirements in each jurisdiction.

BOC Hong Kong Holdings faces significant legal obligations concerning anti-money laundering (AML) and counter-terrorist financing (CTF). Adherence to Hong Kong's AMLO and updated guidelines from the Joint Financial Intelligence Unit (FIU) is critical. Failure to implement robust due diligence, transaction monitoring, and reporting mechanisms can lead to severe penalties, impacting the bank’s financial standing and reputation.

Data privacy is governed by Hong Kong's Personal Data (Privacy) Ordinance (PDPO), which mandates strict controls over the collection, processing, and storage of customer information. For 2024, the focus remains on secure data handling, especially with increased digital transactions. Cross-border data transfer regulations also add complexity, requiring careful navigation to ensure compliance with international standards and avoid breaches.

Consumer protection laws are integral to BOC Hong Kong's operations, emphasizing fair lending and transparent product disclosures. The Hong Kong Monetary Authority (HKMA) actively promotes these principles, with recent guidance in 2024 reinforcing the need for clear communication on fees and terms. Effective complaint resolution processes are also legally mandated to maintain customer trust and satisfaction.

Environmental factors

Climate change presents significant physical risks, such as extreme weather events like typhoons, which could damage BOC Hong Kong's physical assets and disrupt operations. Transition risks are also crucial, stemming from policy shifts and technological advancements aimed at a low-carbon economy, potentially impacting the value of assets financed by the bank.

BOC Hong Kong must proactively assess and manage these climate-related risks across its business, including its extensive lending portfolios. This involves understanding how climate change might affect borrowers' ability to repay loans.

Alignment with the Hong Kong Monetary Authority's (HKMA) climate risk stress tests and governance guidelines is essential for BOC Hong Kong. For instance, the HKMA's 2024 climate risk stress test for larger banks will provide crucial insights into potential impacts and required resilience measures.

In 2024, the banking sector, including BOC Hong Kong, is increasingly focusing on integrating climate risk into their enterprise-wide risk management frameworks, as mandated by regulatory bodies to ensure long-term financial stability.

BOC Hong Kong Holdings, like many financial institutions, faces mounting pressure from regulators, investors, and the public to bolster its Environmental, Social, and Governance (ESG) disclosures and embrace sustainable business practices. This trend is particularly pronounced in 2024 and 2025, with increasing expectations for transparency and tangible action on climate-related risks and social impact. For instance, the Hong Kong Monetary Authority (HKMA) has been progressively enhancing its ESG guidelines for banks, pushing for more robust climate risk management frameworks and consistent reporting. This necessitates BOC Hong Kong to embed ESG considerations deeply into its core business strategy, risk management processes, and public reporting, moving beyond mere financial metrics to demonstrate a genuine commitment to long-term sustainability.

Hong Kong is making significant strides in green finance. The Hong Kong government and the Hong Kong Monetary Authority (HKMA) are actively championing sustainable finance. This includes encouraging the issuance of green bonds and developing comprehensive green taxonomies to guide investments.

These initiatives present a clear pathway for BOC Hong Kong. The bank can tap into opportunities for green lending, allowing it to finance environmentally friendly projects. Furthermore, BOC Hong Kong can issue its own sustainable bonds, attracting investors keen on ESG principles.

The bank is also well-positioned to offer a range of green investment products. This allows customers to align their portfolios with sustainable objectives. By participating in these burgeoning green finance markets, BOC Hong Kong can contribute to and profit from the expanding green economy.

In 2023, Hong Kong's green bond market saw substantial growth, with issuance reaching approximately US$28 billion, a significant increase from previous years. This trend is expected to continue, with projections indicating further expansion in 2024 and beyond, driven by regulatory support and investor demand.

Sustainable Banking Practices and Operations

Beyond offering green finance products, banks like BOC Hong Kong are increasingly scrutinized for their internal operational sustainability. This includes tangible efforts to shrink their carbon footprint, streamline energy usage, and implement robust waste management protocols. These initiatives directly impact the bank's environmental performance and, consequently, its public image.

BOC Hong Kong's commitment to operational sustainability is a key component of its environmental strategy. In 2023, the bank reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions. Furthermore, significant investments were made in upgrading building infrastructure to enhance energy efficiency across its branches and offices.

Specific initiatives undertaken by BOC Hong Kong include:

- Energy Efficiency Upgrades: Installation of LED lighting and smart building management systems in key facilities, aiming for a 15% reduction in electricity consumption by 2025.

- Waste Reduction Programs: Implementation of enhanced recycling programs and a reduction in paper usage through digital transformation efforts, targeting a 20% decrease in paper consumption.

- Sustainable Procurement: Prioritizing suppliers with strong environmental track records and sourcing eco-friendly office supplies.

- Employee Engagement: Promoting environmental awareness and sustainable behaviors among staff through training and internal campaigns.

Regulatory Focus on Environmental Impact

Regulators, such as the Hong Kong Monetary Authority (HKMA), are significantly enhancing their oversight of environmental impact within the financial sector. They are actively integrating climate risk management into their supervisory frameworks, expecting institutions like BOC Hong Kong to embed these considerations into their fundamental business operations and strategies.

This intensified regulatory scrutiny mandates that banks establish clear net-zero targets and diligently monitor their financed emissions. For instance, the HKMA's supervisory review process in 2024 placed a greater emphasis on banks' climate-related financial disclosures and their progress towards decarbonization goals, directly influencing strategic planning and operational adjustments.

Consequently, BOC Hong Kong, like its peers, is compelled to proactively manage its environmental footprint. This includes developing robust strategies to mitigate climate-related risks and actively contributing to broader national and international climate objectives, such as those outlined in Hong Kong's Climate Action Plan 2025.

- HKMA's 2024 supervisory review emphasized climate risk integration.

- Net-zero targets and financed emissions monitoring are key regulatory expectations.

- Climate Action Plan 2025 sets the broader environmental agenda for Hong Kong.

- Banks are expected to demonstrate proactive management of their environmental impact.

Environmental factors significantly influence BOC Hong Kong's operations, driven by climate change risks and the growing green finance sector. The bank must navigate physical and transition risks, as highlighted by the HKMA's 2024 climate risk stress tests, to ensure resilience. Hong Kong's commitment to green finance, evidenced by a US$28 billion green bond market in 2023, presents opportunities for BOC Hong Kong in green lending and sustainable product offerings, aligning with the Climate Action Plan 2025.

| Environmental Factor | Impact on BOC Hong Kong | Key Data/Initiative |

|---|---|---|

| Climate Change Risks | Physical damage to assets, disruption of operations, loan portfolio impact | HKMA's 2024 climate risk stress tests |

| Green Finance Growth | Opportunities in green lending, sustainable bonds, and investment products | Hong Kong green bond market: ~US$28 billion in 2023 |

| Regulatory Expectations | Increased focus on ESG disclosures, net-zero targets, and financed emissions | HKMA's enhanced ESG guidelines and 2024 supervisory review |

| Operational Sustainability | Need to reduce carbon footprint and improve energy efficiency | Targeting 15% electricity consumption reduction by 2025; Scope 1 & 2 emission reductions in 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for BOC Hong Kong Holdings is grounded in data from official government publications in Hong Kong and mainland China, reports from international financial institutions like the IMF and World Bank, and reputable market research firms specializing in the financial sector.