BOC Hong Kong Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOC Hong Kong Holdings Bundle

BOC Hong Kong Holdings operates within a dynamic banking sector, facing significant competitive pressures. The threat of new entrants is moderate, as regulatory hurdles and capital requirements create barriers, yet fintech innovations pose a challenge. Buyer power is substantial, with customers easily switching banks for better rates and services.

The intensity of rivalry among existing players is high, characterized by aggressive pricing and product differentiation strategies. Supplier power, primarily from technology providers and financial institutions, is relatively low due to the availability of multiple options.

However, the threat of substitutes, such as peer-to-peer lending platforms and digital payment solutions, is growing, forcing traditional banks to adapt. Understanding these forces is crucial for BOC Hong Kong Holdings's strategic planning.

The complete report reveals the real forces shaping BOC Hong Kong Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For BOC Hong Kong Holdings, the primary suppliers are those providing capital and specialized talent. The Hong Kong Monetary Authority (HKMA) and other regulatory bodies are critical, concentrated suppliers of essential licenses and regulatory frameworks, wielding significant influence over banking operations.

Access to liquidity through interbank lending and central bank facilities also represents a concentrated supply. In 2023, Hong Kong’s banking sector saw a total asset growth of 5.3%, reaching HK$25.3 trillion, highlighting the importance of stable capital flows managed under these regulatory umbrellas.

Individual and corporate depositors are the lifeblood of BOC Hong Kong Holdings, providing the critical raw material for its operations: funds. While no single depositor typically wields substantial influence, the sheer volume and diversity of its depositor base grant them a moderate collective bargaining power.

The ease of digital banking means depositors can readily shift their funds if they find more attractive rates or superior services elsewhere. For instance, in 2024, the average savings account interest rate across major Hong Kong banks hovered around 0.1% to 0.3%, creating a low barrier for depositors seeking marginal gains.

However, this power is somewhat tempered. Large corporate and institutional deposits, often characterized by more complex banking relationships and specific service needs, tend to be less mobile. These larger accounts are less susceptible to being swayed solely by minor interest rate differentials, providing a degree of stability.

BOC Hong Kong Holdings, like other banks, depends on skilled individuals in areas like IT, finance, and risk management, as well as technology providers offering critical software and cybersecurity. The push towards digital banking and the growing need for fintech specialists significantly boost the leverage of these suppliers, especially those offering specialized or proprietary solutions.

Limited Substitute Inputs

The bargaining power of suppliers for BOC Hong Kong Holdings is significantly influenced by the scarcity of direct substitutes for essential banking inputs. Key elements like regulatory approvals, substantial capital reserves, and specialized financial expertise are not easily replaced, inherently boosting the leverage of entities controlling these resources.

While technological advancements can streamline many banking operations, the fundamental need for human oversight in areas like risk management, compliance, and complex financial advisory means that skilled personnel remain a critical, irreplaceable input. This reliance on specialized talent and regulatory permissions grants considerable power to the suppliers of these crucial components.

- Regulatory Approvals: Obtaining and maintaining banking licenses is a complex and lengthy process, limiting the number of entities that can supply this essential input.

- Capital: While capital can be sourced from various markets, the sheer volume and specific regulatory requirements for banking capital create a concentrated supplier base. As of the first half of 2024, major banks like BOC Hong Kong continued to demonstrate robust capital adequacy ratios, reflecting the ongoing demand for substantial capital.

- Skilled Financial Talent: The demand for experienced professionals in areas such as compliance, risk management, and specialized financial services often outstrips supply, giving skilled individuals and specialized recruitment firms significant bargaining power.

Regulatory Influence on Supplier Power

The Hong Kong Monetary Authority (HKMA) significantly shapes supplier power by dictating crucial financial requirements for banks like BOC Hong Kong Holdings. For example, the HKMA's capital adequacy ratios and liquidity standards directly influence the cost and availability of funding for these institutions.

Stricter prudential standards, such as enhanced capital rules and Total Loss-Absorbing Capacity (TLAC) requirements, can compel banks to seek more capital. This, in turn, can bolster the bargaining power of capital providers, including equity investors and debt holders, as banks become more reliant on their investment.

- HKMA's Capital Adequacy Ratios: These ratios dictate the minimum capital a bank must hold relative to its risk-weighted assets, affecting their borrowing capacity and cost of capital.

- Liquidity Requirements: Mandated liquidity coverage ratios and net stable funding ratios influence a bank's ability to access short-term and long-term funding, impacting supplier relationships.

- TLAC Requirements: These regulations, aimed at ensuring banks can absorb losses in resolution, increase the demand for specific types of debt, potentially empowering those suppliers.

The bargaining power of suppliers for BOC Hong Kong Holdings is elevated due to the concentrated nature of essential inputs like regulatory approvals and specialized financial talent.

The Hong Kong Monetary Authority (HKMA) acts as a pivotal supplier, dictating capital adequacy and liquidity standards, which directly influence the cost and availability of funding for banks.

While depositors provide the bulk of funds, their collective power is moderate, especially as large institutional deposits offer more stability than readily mobile retail accounts.

The demand for skilled professionals in fintech and risk management, coupled with the limited availability of specialized technology providers, further amplifies supplier leverage.

| Supplier Type | Key Inputs | Bargaining Power Factor | Example Data/Impact (2024) |

|---|---|---|---|

| Regulators (HKMA) | Licenses, Regulatory Frameworks | High (Concentrated, Essential) | HKMA's Basel III reforms continue to shape capital requirements, influencing funding costs. |

| Capital Providers | Equity, Debt, Liquidity | Moderate to High (Volume Dependent) | Banks like BOC Hong Kong maintained strong capital adequacy ratios in H1 2024, reflecting ongoing capital demand. |

| Depositors | Funds | Moderate (Collective Power) | Savings rates around 0.1%-0.3% in 2024 show low switching costs for retail, but institutional deposits are stickier. |

| Skilled Talent/Tech | IT, Finance, Risk, Software | High (Specialized, Scarce) | Increased demand for cybersecurity and AI specialists in banking drives up talent acquisition costs. |

What is included in the product

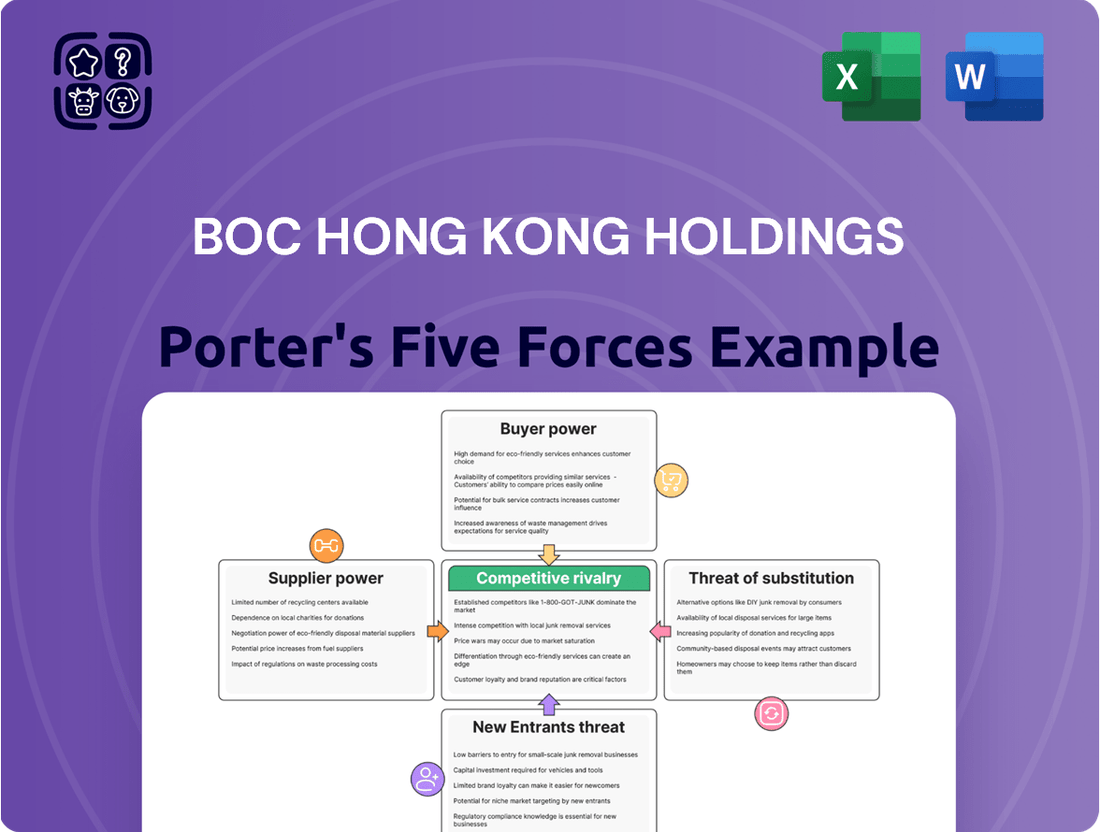

This analysis of BOC Hong Kong Holdings' Porter's Five Forces examines the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes in the Hong Kong banking sector.

BOC Hong Kong Holdings' Porter's Five Forces Analysis provides a clear, one-sheet summary of competitive pressures, enabling swift strategic adjustments.

Customers Bargaining Power

Historically, customers faced considerable effort when switching banks. This involved the tedious process of transferring direct debits, updating standing orders, and potentially re-establishing credit histories, which collectively imposed moderate switching costs. These costs acted as a significant deterrent, thereby limiting the bargaining power of customers.

However, the financial landscape is rapidly evolving. Digitalization and the advent of open banking have begun to dismantle these traditional barriers. For instance, by 2024, many challenger banks and fintech platforms offer seamless account switching services, significantly reducing the time and effort required. This trend is increasingly empowering customers by lowering the costs and complexities associated with changing their banking provider.

Customers, particularly in the retail and small-to-medium enterprise (SME) sectors, are increasingly focused on price and are more comfortable using digital channels. This trend is amplified by the widespread availability of online tools that enable easy comparison of banking products, from interest rates to service fees.

The ability for customers to quickly compare offerings means they have more leverage to negotiate better terms. For instance, in 2024, the average interest rate spread for personal loans in Hong Kong remained competitive, reflecting this customer power to seek out the best deals.

Mobile banking apps, now used by a significant portion of the banking population, further empower customers by providing instant access to information and facilitating switching between providers. This digital access directly translates into heightened bargaining power for consumers seeking optimal value.

BOC Hong Kong Holdings (BOCHK) caters to a wide array of customers, from individual savers to major corporations and institutional investors. This diversity means the bargaining power of customers isn't uniform across the board.

Large corporate clients and institutional investors, due to their significant transaction volumes and sophisticated financial requirements, wield considerable bargaining power. They can often negotiate more favorable terms, such as preferential interest rates or tailored service packages, directly impacting BOCHK's profitability. For instance, in 2023, corporate banking revenue for BOCHK was a substantial contributor to its overall performance, highlighting the importance of these relationships.

Conversely, the vast majority of BOCHK's customer base consists of individual retail customers. While individually their transaction volumes are small, their collective presence is significant. However, their individual bargaining power is limited, often relying on standardized product offerings and publicly available rate sheets.

Availability of Multiple Banking Options

Hong Kong's banking landscape is incredibly dense and competitive, featuring a multitude of local and international banks, alongside restricted and deposit-taking entities. This saturation means customers, whether individuals or businesses, have a wealth of options at their fingertips. As of early 2024, the Hong Kong Monetary Authority (HKMA) reported over 200 licensed banks operating in the territory, underscoring the intense competition.

The presence of numerous banking providers, including newer virtual banks that often offer competitive rates and digital convenience, significantly amplifies customer bargaining power. This wide selection empowers customers to shop around for the best terms, fees, and services, forcing banks like BOC Hong Kong to offer more attractive propositions to retain and attract business.

- High Market Saturation: Hong Kong boasts a mature banking sector with over 200 licensed banks, increasing customer choice.

- Virtual Bank Competition: The emergence of virtual banks introduces new competitive pressures, often focusing on lower fees and enhanced digital services.

- Customer Mobility: Customers can easily switch providers to secure more favorable interest rates, lower transaction fees, or superior digital banking experiences.

- Demand for Better Terms: This environment allows customers to negotiate for better loan rates or deposit yields, directly impacting bank profitability.

Impact of Fintech and Digital Banks

The proliferation of fintech and digital banks has dramatically amplified customer bargaining power against established institutions like BOC Hong Kong. These disruptors frequently present superior digital experiences, reduced fee structures, and niche product offerings, directly challenging traditional banks to enhance their value proposition to prevent customer attrition.

For instance, by mid-2024, many neobanks and digital-first platforms were already boasting significantly lower operating costs per customer compared to incumbent banks, allowing them to pass these savings onto consumers through reduced fees for services like international transfers or account maintenance. This competitive pressure forces BOC Hong Kong and similar banks to rethink their pricing strategies and service delivery models.

- Increased Customer Choice: Fintech innovations provide consumers with a wider array of banking and financial service providers, diminishing reliance on any single institution.

- Price Sensitivity: Digital banks often compete on price, offering lower fees and more competitive interest rates, which directly influences customer decisions.

- Demand for Digital Convenience: Customers increasingly expect seamless, user-friendly digital interfaces and 24/7 access, a standard set by many fintech players.

- Focus on Niche Markets: Specialized fintechs cater to specific customer needs (e.g., remittances, wealth management for millennials) with tailored solutions that traditional banks must emulate or acquire.

The bargaining power of customers towards BOC Hong Kong Holdings is elevated due to Hong Kong's highly competitive and saturated banking market, where over 200 licensed banks offer abundant choices. This intense competition, further fueled by digital and virtual banks introducing lower fees and superior digital experiences, compels established players like BOCHK to offer more attractive terms and services to retain clients.

Customers, especially retail and SME segments, are increasingly price-sensitive and adept at utilizing digital tools for comparing banking products, directly influencing their ability to negotiate better rates. For instance, the competitive personal loan interest rate spread observed in Hong Kong during 2024 reflects this amplified customer leverage.

While large corporate clients and institutional investors hold significant sway due to their substantial transaction volumes, the collective power of numerous individual retail customers, empowered by digital accessibility and a wide array of options, also exerts considerable pressure on banks to maintain competitive pricing and service quality.

| Factor | Description | Impact on BOCHK |

| Market Saturation | Over 200 licensed banks in Hong Kong | Increases customer choice, reduces loyalty |

| Digital/Virtual Banks | Offer lower fees and better digital services | Forces competitive pricing and service innovation |

| Customer Price Sensitivity | Customers actively compare rates and fees | Pressures margins, requires competitive offerings |

| Ease of Switching | Reduced effort to change banking providers | Heightens customer leverage, increases potential attrition |

What You See Is What You Get

BOC Hong Kong Holdings Porter's Five Forces Analysis

This preview displays the exact BOC Hong Kong Holdings Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive assessment of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the banking sector. This document is fully formatted and ready for your immediate use, providing a detailed breakdown of each force and its implications for BOC Hong Kong Holdings. No placeholders or samples, just the complete, professionally written analysis you need.

Rivalry Among Competitors

The Hong Kong banking sector is a mature and highly concentrated landscape, with a few dominant players like BOC Hong Kong, HSBC, and Standard Chartered holding significant market share. This consolidation naturally fuels intense competitive rivalry as these large institutions vie for customers and profitability across all banking services.

BOC Hong Kong, for instance, reported a net interest income of HK$31.8 billion in 2023, highlighting the substantial revenue streams these major banks generate. The battle for deposits and loans is fierce, leading to aggressive pricing strategies and innovative product offerings as each bank seeks to capture a larger piece of the pie.

BOC Hong Kong Holdings faces intense competition, not just from established commercial banks, but also from a rising tide of virtual banks and innovative fintech companies. This dynamic environment means rivalry is fierce as each entity strives to carve out its unique market position and attract specific customer segments. For instance, as of early 2024, Hong Kong has seen significant growth in its virtual banking sector, with players like MOX Bank and WeLab Bank actively competing for digital-first customers by offering streamlined services and attractive digital interfaces.

Banks are locked in an intense rivalry, with digital transformation emerging as the primary battleground. This means significant investments are being poured into artificial intelligence and other cutting-edge technologies. The goal is to create a superior customer experience, streamline operations, and launch novel financial products. For instance, in 2024, major banks globally continued to allocate substantial portions of their IT budgets to digital initiatives, with some reporting over 50% of their technology spend focused on these areas. This constant innovation aims to capture and hold onto market share, making it a crucial element of competition.

Geopolitical and Macroeconomic Influences

The banking sector in Hong Kong and mainland China is navigating a complex landscape shaped by global economic headwinds, escalating geopolitical tensions, and significant downturns in the property market. These external pressures directly influence loan demand and the quality of bank assets, intensifying rivalry as institutions compete for a more constrained and challenging business environment.

These macroeconomic and geopolitical factors create a more aggressive competitive dynamic. For instance, in 2024, many banks are likely to focus on fee-based income streams and cost efficiencies to offset potential declines in net interest margins due to fluctuating interest rate environments and slower credit growth. The impact of these global trends means that banks must be exceptionally agile.

- Economic Headwinds: Persistent inflation and potential recessions in major economies can dampen international trade and investment flows, impacting Hong Kong's role as a financial hub and the cross-border business of banks.

- Geopolitical Tensions: Strained relations between major global powers can lead to increased regulatory scrutiny, trade restrictions, and a reluctance for foreign investment, affecting the operational environment for banks in both Hong Kong and mainland China.

- Property Market Downturns: Significant corrections in the property sector, a key driver of economic activity and lending in both regions, directly impact banks through potential increases in non-performing loans and reduced mortgage demand. For example, concerns about developer defaults in mainland China's property sector have been a recurring theme impacting investor sentiment and bank risk assessments throughout 2024.

Regulatory Landscape and Cross-Border Opportunities

While regulations are essential for financial stability, they also significantly influence the competitive dynamics within the banking sector. For BOC Hong Kong Holdings (BOCHK), navigating this regulatory terrain is crucial. Its established presence in mainland China and its designation as an RMB clearing bank offer a distinct advantage in facilitating cross-border transactions.

This strong position, particularly within the Greater Bay Area (GBA), intensifies rivalry for the significant financial flows occurring in this rapidly developing economic zone. Other financial institutions are actively seeking to capture a larger share of this lucrative cross-border business, leading to increased competition for BOCHK.

- Regulatory Frameworks Shape Competition: Banking regulations, while promoting stability, create specific operating environments that can favor or challenge incumbents like BOCHK.

- RMB Clearing Advantage: BOCHK's role as an RMB clearing bank provides a unique competitive edge in handling yuan-denominated transactions, a key driver of cross-border activity.

- Greater Bay Area Focus: The GBA is a focal point for cross-border financial services, intensifying competition among banks vying for market share in this high-growth region.

- Intensified Rivalry for Cross-Border Flows: The lucrative nature of cross-border capital and trade flows in the GBA means that BOCHK faces heightened competition from both domestic and international financial players.

The competitive rivalry within Hong Kong's banking sector is exceptionally high, driven by a mature market dominated by a few large players and an influx of digital disruptors. BOC Hong Kong faces intense pressure from both traditional banks and agile virtual banks, all vying for customer loyalty and market share. This dynamic pushes institutions to innovate rapidly, particularly in digital offerings and customer experience, to stay ahead.

In 2023, BOC Hong Kong's net interest income reached HK$31.8 billion, underscoring the significant financial stakes involved. The ongoing digital transformation across the industry means banks are heavily investing in technologies like AI, with global IT spending on digital initiatives often exceeding 50% of tech budgets in 2024. This relentless pursuit of technological advancement is a key battleground in the fight for dominance.

Furthermore, external factors like global economic uncertainty and the downturn in the property market, particularly evident with developer defaults in mainland China throughout 2024, exacerbate the competitive landscape. Banks must navigate these challenges by focusing on efficiency and diversified income streams, intensifying the rivalry as they seek to secure their positions in a more constrained environment.

| Key Competitor | Primary Competitive Tactics | 2023 Performance Indicator (Illustrative) |

| HSBC | Digital banking expansion, wealth management services | Net profit before tax: HK$12.0 billion |

| Standard Chartered | Corporate banking focus, GBA opportunities | Operating income: HK$13.9 billion |

| Virtual Banks (e.g., MOX, WeLab) | Low fees, user-friendly mobile apps, niche products | Rapid customer acquisition (specific figures often proprietary) |

SSubstitutes Threaten

Fintech companies are increasingly offering alternatives to traditional banking services, directly impacting BOC Hong Kong Holdings. These digital disruptors provide services like peer-to-peer lending, digital payment platforms, and online wealth management through robo-advisors. For instance, the global fintech market was valued at approximately USD 11.2 trillion in 2023 and is projected to grow significantly, indicating a substantial shift in consumer preference towards these new financial solutions.

The convenience, lower transaction fees, and often more tailored experiences offered by fintech substitutes present a significant challenge. For example, digital payment platforms processed trillions of dollars globally in 2023, capturing market share from traditional card and banking services. This growing adoption means customers have readily available alternatives for many core banking functions, intensifying the threat of substitution for BOC Hong Kong.

The rise of digital wallets and instant payment systems presents a significant threat of substitution for traditional banking services, including those offered by BOC Hong Kong Holdings. Hong Kong's Faster Payment System (FPS), launched in 2018, allows for real-time, 24/7 fund transfers between different banks and stored value facilities, directly bypassing traditional bank channels for many everyday transactions. By mid-2024, FPS reported over 1.7 billion transactions, demonstrating its widespread adoption and the increasing willingness of consumers and businesses to use these alternative payment methods. This shift reduces reliance on bank-issued credit cards and direct debit services, offering a convenient and often lower-cost alternative.

For corporate clients, the threat of substitutes to traditional bank lending, like that offered by BOC Hong Kong Holdings, is significant. Alternative financing avenues such as private equity, crowdfunding, and direct lending from non-bank financial institutions provide viable options, especially for startups and small to medium-sized enterprises (SMEs) that may face stricter criteria from conventional banks.

This trend is amplified by the growing maturity of alternative lending markets. For instance, the global private debt market was projected to reach $1.5 trillion by the end of 2024, demonstrating a substantial pool of capital outside traditional banking channels. This offers businesses more flexibility and potentially faster access to funds, directly challenging the market share of established banks.

Cryptocurrencies and Decentralized Finance (DeFi)

While still developing and facing regulatory scrutiny in Hong Kong, cryptocurrencies and decentralized finance (DeFi) present emerging threats. These technologies offer alternative avenues for services like lending, borrowing, and asset management, potentially disintermediating traditional banks. For instance, by mid-2024, the total value locked in DeFi protocols globally reached over $100 billion, demonstrating significant user adoption and capital flow outside conventional systems.

- Growing DeFi Adoption: The total value locked (TVL) in DeFi reached approximately $105 billion by June 2024, indicating a substantial shift of assets and activities away from traditional financial institutions.

- Alternative Lending and Borrowing: DeFi platforms allow users to lend and borrow assets directly, often with more competitive rates than traditional banks, attracting a growing user base.

- Asset Management Innovations: Decentralized autonomous organizations (DAOs) and yield farming protocols offer new ways to manage and grow assets, providing substitutes for wealth management services.

- Regulatory Landscape: While evolving, the regulatory environment in Hong Kong for cryptocurrencies and DeFi remains a key factor influencing the pace and impact of these substitutes on traditional banking.

Insurance and Wealth Management Platforms

The threat of substitutes for BOC Hong Kong's insurance and wealth management platforms is significant. Customers increasingly have access to a wide array of non-bank providers for these services. This includes independent financial advisors, specialized online wealth management platforms, and direct insurers who can often offer competitive pricing and tailored solutions.

These specialized players pose a direct challenge to BOC Hong Kong's diversified business segments. For instance, robo-advisors and fintech companies are rapidly gaining market share in wealth management, offering automated investment solutions that appeal to a growing segment of the population. In the insurance sector, direct-to-consumer online insurers are streamlining the application and claims process, often at a lower cost.

Consider the growth of digital wealth management. By the end of 2023, global assets under management in robo-advisory services were projected to reach over $3 trillion, demonstrating a clear shift in consumer preference towards these accessible and often lower-fee alternatives. Similarly, the insurtech sector saw significant investment and growth in 2023, with many startups focusing on niche markets and digital-first customer experiences.

BOC Hong Kong must contend with the fact that customers are not limited to traditional banking channels for financial planning and protection. The ability of substitute providers to innovate and cater to specific customer needs, often with greater agility than large incumbent institutions, presents a continuous challenge. This necessitates a strong focus on customer experience, digital innovation, and competitive product offerings to retain market share.

- Digital Wealth Management Growth: Global assets in robo-advisory services are expected to exceed $3 trillion by the end of 2023.

- Insurtech Investment: The insurtech sector experienced substantial investment in 2023, driving innovation in insurance product delivery.

- Non-Bank Competition: Independent financial advisors and online platforms offer specialized wealth management and insurance solutions.

- Customer Preferences: Consumers increasingly seek accessible, lower-fee, and digitally-enabled financial services.

The threat of substitutes for BOC Hong Kong's core banking services is substantial, driven by the rapid evolution of fintech and digital payment systems. The Hong Kong's Faster Payment System (FPS) has seen immense adoption, facilitating billions of transactions directly between users and bypassing traditional bank channels for everyday payments. By mid-2024, FPS processed over 1.7 billion transactions, underscoring the shift towards readily available, lower-cost digital alternatives for consumers and businesses alike.

Beyond payments, alternative lending platforms and decentralized finance (DeFi) pose increasing threats. The global private debt market's projected growth to $1.5 trillion by the end of 2024 highlights businesses' willingness to seek funding outside traditional banking. Furthermore, the total value locked in DeFi protocols surpassed $100 billion by mid-2024, indicating a growing segment of financial activity, including lending and asset management, operating independently of incumbent institutions.

| Substitute Area | Key Substitutes | 2023/2024 Data Point | Impact on BOC Hong Kong |

|---|---|---|---|

| Payments | Fintech Payment Platforms, Digital Wallets, FPS | FPS processed >1.7 billion transactions by mid-2024 | Reduced reliance on traditional bank payment rails |

| Lending | Private Equity, Crowdfunding, Direct Lending, DeFi Lending | Global private debt market projected to reach $1.5 trillion by end of 2024 | Competition for corporate and SME financing |

| Wealth Management | Robo-advisors, Independent Financial Advisors | Global robo-advisory assets projected to exceed $3 trillion by end of 2023 | Erosion of market share in investment services |

| Decentralized Finance (DeFi) | DeFi Lending, Borrowing, Asset Management Protocols | Total value locked in DeFi protocols >$100 billion by mid-2024 | Emerging threat to traditional intermediation roles |

Entrants Threaten

The banking sector in Hong Kong is exceptionally well-regulated, with the Hong Kong Monetary Authority (HKMA) setting rigorous capital requirements, demanding detailed licensing processes, and enforcing strict compliance standards. These substantial regulatory barriers make market entry a challenging and expensive undertaking for potential new participants.

Adding to this, the HKMA has publicly stated its view that the current number of virtual banking licenses issued is considered optimal, effectively capping the influx of new digital-only banks into the competitive landscape.

Establishing a commercial bank, particularly one aiming for the scale and reach of BOC Hong Kong, necessitates immense capital investment. This includes building and maintaining physical branches, implementing robust technological infrastructure for digital banking, and covering initial operational expenses. For instance, in 2023, major banks globally continued to report significant capital expenditure, with investments in digital transformation alone often running into billions of dollars, creating a formidable barrier for new players.

Established banks like BOC Hong Kong Holdings benefit immensely from decades of built-up brand recognition and deep-rooted customer trust. This loyalty, cultivated over many years, creates a significant hurdle for any potential new entrant aiming to capture market share. New players must invest heavily in marketing and dedicate substantial time to even begin building a comparable level of confidence with consumers.

Economies of Scale and Network Effects

The threat of new entrants for BOC Hong Kong Holdings is significantly mitigated by the powerful advantages enjoyed by incumbents, particularly economies of scale and network effects. Existing large banks, including BOC Hong Kong, operate with substantial scale across their operations, from back-office processing to sophisticated technology investments and broad marketing campaigns. This allows them to spread fixed costs over a larger volume of transactions, leading to lower per-unit costs.

Furthermore, these established players benefit immensely from network effects. BOC Hong Kong, for instance, leverages its extensive customer base and deeply integrated systems, such as its widespread ATM network and proprietary payment platforms. These interconnected systems create a virtuous cycle where more users attract more services, which in turn attracts even more users, making it exceedingly difficult for newcomers to achieve comparable reach and cost-competitiveness.

Consider the digital banking landscape. While new digital banks emerge, they often struggle to replicate the sheer scale of physical and digital infrastructure that established banks like BOC Hong Kong have built over decades. For example, as of late 2023, BOC Hong Kong reported over HKD 3.1 trillion in total assets, a testament to its scale. New entrants would need massive capital investment and time to build a comparable customer base and technological backbone to effectively challenge established players.

- Economies of Scale: Large banks like BOC Hong Kong can achieve lower operating costs per transaction due to their size, covering technology development, compliance, and marketing across a vast customer base.

- Network Effects: BOC Hong Kong benefits from its extensive customer relationships and integrated payment systems, making it more convenient and cost-effective for existing customers and deterring new entrants who lack this interconnectedness.

- Customer Loyalty: The established trust and brand recognition associated with large banks create customer stickiness, requiring new entrants to offer significantly superior value propositions to attract and retain customers.

Fintech Innovation as a Double-Edged Sword

Fintech innovations present a mixed bag for new entrants into the banking sector. While some niche fintech services might see reduced entry barriers due to digital platforms, establishing a full-service commercial bank still demands substantial investment. For instance, building the necessary robust cybersecurity infrastructure to protect customer data and financial transactions can be a significant hurdle. In 2024, the average cost for a financial institution to recover from a data breach was estimated to be around $5.5 million, a figure that can deter smaller, less capitalized new players.

Furthermore, the complex web of regulatory compliance, especially concerning anti-money laundering (AML) and know-your-customer (KYC) procedures, adds another layer of cost and complexity. New entrants must navigate these requirements meticulously, which often necessitates significant legal and operational expenditures. The General Data Protection Regulation (GDPR) and similar data privacy laws globally also impose stringent requirements, demanding sophisticated data management systems.

- Cybersecurity Investments: New entrants face substantial costs in developing and maintaining advanced cybersecurity defenses, with global spending on cybersecurity expected to reach $268 billion in 2024.

- Regulatory Compliance Burden: Adhering to banking regulations like AML and KYC requires significant upfront investment in technology and personnel, often exceeding millions of dollars annually.

- Data Infrastructure Costs: Establishing scalable and secure data infrastructure for banking operations, including cloud services and data analytics, represents a major capital expenditure for new players.

- Talent Acquisition: Attracting specialized talent in areas like AI, blockchain, and cybersecurity is crucial but expensive, as demand for these skills outstrips supply in the financial industry.

The threat of new entrants for BOC Hong Kong Holdings is considerably low, primarily due to the substantial capital requirements and stringent regulatory environment in Hong Kong's banking sector. These hurdles, coupled with the immense brand loyalty and economies of scale enjoyed by incumbents, create a formidable barrier for any new player aiming to enter the market.

The Hong Kong Monetary Authority's (HKMA) licensing process and capital demands are significant deterrents. For instance, in 2024, the ongoing investment in digital transformation for established banks continues, with billions allocated globally, a sum difficult for newcomers to match. Furthermore, BOC Hong Kong's vast customer base and integrated network, including its extensive ATM presence, amplify network effects, making it challenging for new entrants to achieve comparable reach and cost-efficiency.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment needed for licensing, technology, and operations. | Significant financial barrier, requiring substantial funding. |

| Regulatory Hurdles | Rigorous compliance, AML, and KYC standards set by HKMA. | Increased costs and complexity in market entry. |

| Economies of Scale | Lower per-unit costs for established banks due to large operational volume. | New entrants struggle to compete on price and efficiency. |

| Brand Loyalty & Trust | Decades of built-up customer confidence and recognition. | New entrants need extensive marketing and time to build similar trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BOC Hong Kong Holdings is built upon data from the company's annual reports, investor presentations, and disclosures filed with the Hong Kong Stock Exchange. We also integrate information from reputable financial news outlets and industry-specific publications that cover the banking sector in Hong Kong and China.