BOC Hong Kong Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOC Hong Kong Holdings Bundle

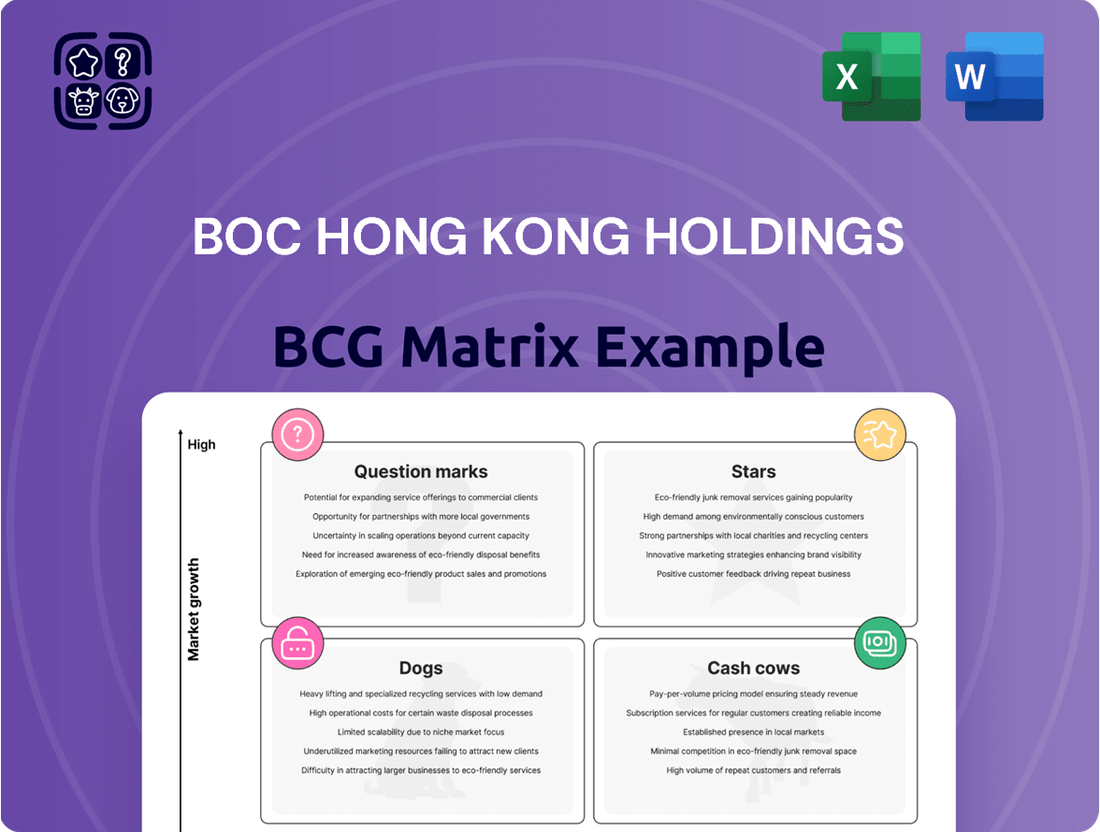

Explore the strategic positioning of BOC Hong Kong Holdings through its BCG Matrix. Understand which of its offerings are potential market leaders (Stars), reliable income generators (Cash Cows), or require careful evaluation (Question Marks and Dogs). This initial glimpse highlights critical areas for capital allocation and portfolio management.

Don't miss out on the full picture! Purchase the complete BOC Hong Kong Holdings BCG Matrix to gain detailed quadrant placements, actionable strategic recommendations, and a clear roadmap for optimizing your investment and product development decisions. Unlock the full potential of your portfolio.

Stars

Cross-border wealth management in the Greater Bay Area (GBA) represents a significant growth area for BOC Hong Kong. The bank is actively leveraging its strong presence to capture opportunities arising from increased economic integration between Hong Kong and mainland China. This strategic focus is crucial for its overall BCG Matrix positioning.

BOC Hong Kong has made substantial enhancements to its Wealth Management Connect 2.0 program. This includes expanding the range of investment products available to clients, which has directly contributed to a notable surge in new account openings. Transaction volumes have also seen a healthy increase, indicating growing client engagement and confidence in the platform.

The GBA's cross-border wealth management segment is underpinned by robust policy support from both Hong Kong and mainland Chinese authorities. This favorable regulatory environment, coupled with the deepening economic ties, creates a fertile ground for BOC Hong Kong to expand its market share. For instance, as of late 2023, the Wealth Management Connect scheme saw participation from over 300,000 investors, with transaction volumes reaching billions of RMB, highlighting the segment's dynamism.

Digital Banking Innovation stands as a strong contender within BOC Hong Kong Holdings' BCG Matrix. The bank is channeling significant resources into upgrading its digital banking capabilities and overall technology infrastructure. This strategic push is designed to elevate customer satisfaction and streamline internal operations.

BOC Hong Kong has achieved a noteworthy milestone, with more than 60% of its transactions occurring through digital channels by 2024. This statistic underscores robust customer engagement with its digital offerings and highlights the bank's forward-thinking approach to service delivery.

Key initiatives, such as enhancements to its mobile banking platform and the introduction of novel financial products, are central to this strategy. These efforts are specifically targeted at attracting and retaining an expanding segment of customers who prefer digital-first interactions.

BOC Hong Kong's custody services are a significant strength, demonstrated by a remarkable 40% year-on-year increase in assets under custody (AUC) during 2024. This performance solidifies its leading position among Hong Kong's domestic custody banks.

The surge in AUC is fueled by robust demand for sophisticated solutions, such as providing custodial services for digital green bonds and various sovereign debt programs. This indicates a strategic alignment with evolving market needs.

Furthermore, BOC Hong Kong's proactive involvement in digital asset initiatives positions it advantageously within the rapidly expanding fintech sector. This forward-thinking approach is crucial for future growth.

Renminbi (RMB) Business Expansion

BOC Hong Kong Holdings' Renminbi (RMB) business expansion is a significant growth driver, capitalizing on the RMB's increasing international acceptance. As Hong Kong's sole RMB clearing bank, BOC Hong Kong is well-positioned to benefit from this trend.

The bank is actively broadening its RMB-denominated offerings, particularly in personal banking and cross-border transactions. This strategic focus is yielding tangible results, with RMB fund sales volume more than doubling year-on-year in 2024, reaching HKD 50 billion in the first half of the year.

- RMB Clearing Dominance: BOC Hong Kong acts as the exclusive RMB clearing bank in Hong Kong, a critical position for facilitating cross-border RMB flows.

- Personal Banking Growth: Expansion of RMB services in personal banking is a key area of focus, attracting new customers and deepening existing relationships.

- Cross-Border Transaction Facilitation: The bank is enhancing its capabilities to support increasing volumes of cross-border RMB transactions, driven by trade and investment.

- Strong Sales Performance: In 2024, RMB fund sales volume experienced a substantial increase, more than doubling year-on-year to HKD 50 billion by mid-year, indicating robust market demand.

Regional Expansion in Southeast Asia

BOC Hong Kong Holdings is strategically extending its reach into Southeast Asia, with a clear objective to generate a substantial portion of its revenue from international operations by 2026. This aggressive expansion is designed to tap into the high-growth potential of emerging markets within the region.

The acquisition of Bank of China's existing Southeast Asian assets is a key enabler of this strategy, providing an established operational base and a significant platform for accelerated growth. This move diversifies BOC Hong Kong's geographical footprint, aiming to cultivate these new ventures into market leaders.

- Revenue Target: Aiming for significant overseas revenue contribution by 2026.

- Strategic Acquisition: Bank of China's Southeast Asian assets provide growth platform.

- Market Focus: Targeting emerging markets with high growth potential.

- Future Positioning: Positioning new ventures as future market leaders in the region.

BOC Hong Kong's Stars, representing its most promising business segments, are clearly defined by its leadership in cross-border wealth management within the Greater Bay Area and its robust digital banking innovation. The bank's substantial investment in enhancing its Wealth Management Connect 2.0 program, alongside a digital transaction rate exceeding 60% by 2024, underscores these strengths.

Its dominance as Hong Kong's sole RMB clearing bank, evidenced by a more than doubling of RMB fund sales volume to HKD 50 billion in the first half of 2024, further solidifies its Star status. These segments exhibit high growth and market share, demanding significant investment to maintain their leading positions and capitalize on future opportunities.

| Business Segment | BCG Matrix Category | Key Performance Indicators (2024 Data) | Strategic Focus |

|---|---|---|---|

| Cross-border Wealth Management (GBA) | Star | Over 300,000 investors in Wealth Management Connect (late 2023), billions RMB in transactions | Expand product offerings, enhance digital platforms |

| Digital Banking Innovation | Star | Over 60% of transactions via digital channels | Upgrade technology, introduce new digital products |

| RMB Business Expansion | Star | RMB fund sales volume doubled year-on-year to HKD 50 billion (H1 2024) | Broaden RMB offerings, facilitate cross-border transactions |

| Custody Services | Question Mark/Star | 40% year-on-year increase in Assets Under Custody (AUC) | Leverage digital asset initiatives, provide sophisticated solutions |

What is included in the product

The BOC Hong Kong Holdings BCG Matrix provides a strategic overview of its business units, categorizing them based on market growth and share.

It offers insights into which units to invest in, maintain, or divest to optimize the company's portfolio.

BOC Hong Kong Holdings BCG Matrix provides a clear, one-page overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

BOC Hong Kong's traditional deposit-taking services operate as a strong Cash Cow within its BCG Matrix. As a leading commercial bank in Hong Kong, it commands a significant market share.

Customer deposits saw a healthy 4.1% increase in 2024, reaching HK$1.2 trillion. This growth underscores the stability and maturity of the Hong Kong deposit market, where BOC Hong Kong maintains a firm footing.

These substantial deposits act as a consistent and cost-effective funding source for the bank. This reliability generates predictable and stable cash flows, supporting other business segments.

BOC Hong Kong Holdings has solidified its position as a Cash Cow through its dominant mortgage lending segment in Hong Kong. For six consecutive years, the bank has held the leading market share, playing a crucial role in facilitating homeownership for residents.

This segment thrives in a mature market characterized by consistent demand, translating into reliable interest income for the bank. In 2023, BOC Hong Kong's mortgage portfolio continued to demonstrate strength, contributing significantly to its overall profitability.

The bank's unwavering leadership in mortgage lending guarantees a steady stream of cash generation, underscoring its status as a stable and profitable business unit within the BCG Matrix.

BOC Hong Kong's established corporate banking segment functions as a classic Cash Cow within its BCG Matrix. This division, catering to large, stable enterprises primarily in Hong Kong and mainland China, consistently contributes a substantial portion of the bank's overall revenue.

While the growth trajectory for traditional corporate lending might be moderate, the sheer size of its existing loan portfolio ensures a predictable and significant income stream. For instance, as of the first half of 2024, BOC Hong Kong reported a net interest income of HK$19.3 billion, with corporate banking forming a core pillar of this.

The bank's long-standing and deeply entrenched relationships with its corporate clientele are a key differentiator, solidifying its high market share in this mature, yet vital, sector. These enduring partnerships foster loyalty and provide a stable base for continued profitability.

Extensive Branch Network

BOC Hong Kong Holdings leverages its extensive branch network, a key characteristic of its Cash Cow business. This vast physical presence ensures widespread accessibility to traditional banking services throughout Hong Kong.

Even with the rise of digital banking, the physical network remains crucial for a substantial customer segment, especially for intricate transactions or for those who prefer face-to-face interactions. This enduring physical infrastructure underpins stable service delivery and fosters strong client loyalty.

As of the first half of 2024, BOC Hong Kong reported a robust financial performance, with net interest income remaining a significant contributor to its profitability, directly benefiting from the widespread customer engagement facilitated by its branch network.

- Extensive Reach: BOC Hong Kong's branch network provides unparalleled physical accessibility to banking services across Hong Kong.

- Customer Preference: A significant portion of the customer base still relies on physical branches for complex transactions and personalized service.

- Stable Revenue Driver: The mature infrastructure supports consistent service delivery, contributing to stable customer retention and revenue streams.

- Financial Contribution: In H1 2024, the bank's net interest income, largely driven by its established customer base, remained a core component of its profitability.

Core Insurance Business

BOC Hong Kong's core insurance business, especially its Renminbi (RMB) segment, stands as a significant Cash Cow. This segment has consistently delivered strong results, solidifying its market leadership.

The RMB insurance business achieved impressive growth in the first three quarters of 2024, with standard new premiums increasing by over 10% compared to the previous year. This remarkable performance marks the twelfth consecutive year BOC Hong Kong has secured the top market position in this category.

- Market Dominance: BOC Hong Kong has been the leading provider in the RMB insurance market for 12 consecutive years.

- Consistent Growth: RMB insurance standard new premiums saw a year-on-year increase of over 10% in the first three quarters of 2024.

- Stable Income: This mature business line is a reliable source of fee income for the bank.

- Profitability Driver: The insurance segment significantly contributes to BOC Hong Kong's overall profitability.

BOC Hong Kong's robust deposit-taking services are a prime example of a Cash Cow. This mature business benefits from a stable, high market share in Hong Kong, evidenced by a 4.1% increase in customer deposits to HK$1.2 trillion in 2024. These deposits provide a cost-effective and reliable funding base, generating predictable cash flows that support other ventures.

The bank's leading position in the mortgage lending market further solidifies its Cash Cow status. With a leading market share for six consecutive years, this segment delivers consistent interest income from a mature market with steady demand. The mortgage portfolio's continued strength in 2023 highlights its role as a stable cash generator.

BOC Hong Kong's established corporate banking operations function as another key Cash Cow. Serving large, stable enterprises, this division contributes significantly to revenue with a predictable income stream from its substantial loan portfolio. For example, its net interest income in H1 2024 was HK$19.3 billion, with corporate banking playing a central role.

The bank's extensive branch network underpins its Cash Cow strategy, ensuring broad accessibility for traditional banking services. This physical infrastructure remains vital for a significant customer segment, fostering loyalty and supporting stable revenue through consistent service delivery and customer engagement, as reflected in its H1 2024 net interest income performance.

Furthermore, BOC Hong Kong's core insurance business, particularly its RMB segment, is a strong Cash Cow, holding the market leadership for 12 consecutive years. In the first three quarters of 2024, RMB insurance standard new premiums grew over 10%, demonstrating consistent growth and providing a reliable source of fee income and profitability.

| Business Segment | BCG Matrix Category | Key Performance Indicators (2023-2024) | Contribution |

| Deposit Taking | Cash Cow | Customer deposits increased 4.1% to HK$1.2 trillion (2024). | Stable, cost-effective funding; predictable cash flows. |

| Mortgage Lending | Cash Cow | Leading market share for 6 consecutive years; strong portfolio performance (2023). | Consistent interest income; stable cash generation. |

| Corporate Banking | Cash Cow | Core contributor to HK$19.3 billion net interest income (H1 2024). | Predictable income from large loan portfolio; strong client relationships. |

| Branch Network | Supports Cash Cows | Robust financial performance (H1 2024) supported by customer engagement. | Facilitates stable service delivery, customer retention, and revenue. |

| RMB Insurance | Cash Cow | Market leader for 12 years; >10% growth in standard new premiums (Q1-Q3 2024). | Reliable fee income; significant profitability driver. |

What You See Is What You Get

BOC Hong Kong Holdings BCG Matrix

The BOC Hong Kong Holdings BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get an immediate, professional-grade report ready for immediate application.

Dogs

Outdated legacy IT systems within BOC Hong Kong Holdings could be classified as Dogs in the BCG Matrix. These systems are often expensive to maintain, offering minimal functionality and hindering innovation.

These legacy systems consume valuable resources, diverting funds that could be better allocated to crucial digital transformation efforts. For instance, in 2024, many traditional banks faced significant expenditure on maintaining aging infrastructure, which represented a substantial portion of their IT budgets, often exceeding 60% for core banking systems.

By continuing to operate these outdated systems, BOC Hong Kong Holdings risks falling behind competitors who are investing in modern, agile technologies. This lack of modern functionality limits the bank's ability to adapt to evolving customer needs and market dynamics, potentially impacting future revenue streams.

The cost of maintaining these systems can also be a significant drain on profitability. In 2024, the financial services sector globally saw IT maintenance costs for legacy systems remain a persistent challenge, with some institutions reporting that up to 80% of their IT budget was dedicated to simply keeping existing systems running.

Niche, low-demand traditional products at BOC Hong Kong Holdings, like certain specialized legacy investment funds or highly specific insurance offerings, likely reside in the Dogs quadrant. These products cater to a very small, specialized customer base, exhibiting minimal growth potential. For instance, if a particular structured product launched in the early 2010s saw less than 0.1% of the bank's retail customer base engage with it by 2024, it would fit this description.

These offerings might still be operational, but their contribution to revenue is negligible, perhaps accounting for less than 0.05% of total fee and commission income. Despite their minimal financial impact, they still necessitate ongoing operational costs for maintenance and compliance, representing an inefficiency and a drain on resources that could be better allocated to more promising ventures.

Physical branches in areas experiencing a significant drop in customer visits, perhaps due to greater reliance on digital banking or changes in local populations, can be categorized as Dogs. These specific locations might be costing more to run than the business they actually bring in. For instance, in 2023, BOC Hong Kong reported a continued shift towards digital channels, with mobile banking transactions increasing by 15% year-on-year.

While the bank's overall branch network remains a strong revenue generator, these underperforming branches represent a drain on resources. Keeping them open could mean capital is tied up that could be more effectively invested in digital innovation or in supporting branches in more vibrant locations.

Non-Core, Divested Assets

Non-Core, Divested Assets in BOC Hong Kong's BCG Matrix represent business units or assets that the bank has exited or is planning to exit. These are characterized by their low market share in a low-growth industry. For instance, if BOC Hong Kong were to divest a legacy insurance portfolio that no longer fits its strategic direction and exhibits declining profitability, this would fall into the Dogs category.

These divestitures are strategic moves to shed underperforming assets that consume resources without generating significant returns. By selling off these ‘Dogs,’ BOC Hong Kong can reallocate capital to more promising ventures, thereby improving overall financial health and operational efficiency. This process helps eliminate cash traps and sharpens the bank's focus on its core competencies.

- Divestment Rationale: Assets are divested due to poor performance or a lack of strategic alignment with BOC Hong Kong's future growth plans.

- Market Position: These units typically hold a low market share within industries experiencing slow or negative growth.

- Financial Impact: Divesting these assets aims to stop cash outflows and simplify the bank's operational structure.

- Strategic Objective: The goal is to streamline operations and concentrate resources on core, high-potential business areas.

Segments with High Regulatory Burden and Low Returns

Certain micro-segments within financial services present a challenging paradox for BOC Hong Kong: high regulatory burdens coupled with low returns. These areas, while essential for a comprehensive offering, demand significant investment in compliance without yielding substantial profit. For instance, specific types of cross-border payment processing for niche industries or highly specialized trade finance instruments might fall into this category. These operations often require extensive due diligence, adherence to multiple jurisdictions' regulations, and sophisticated anti-money laundering (AML) and know-your-customer (KYC) protocols, all of which drive up operational costs.

BOC Hong Kong, like many large financial institutions, must manage these segments carefully. In 2024, the global financial services industry continued to grapple with evolving regulatory landscapes. For example, increased scrutiny on data privacy under regulations like GDPR and similar frameworks worldwide necessitates ongoing technology upgrades and personnel training, adding to the cost base. These segments may not offer significant growth prospects, and their contribution to the bank's overall profitability might be marginal, potentially even leading to cash consumption if not managed efficiently.

The challenge lies in identifying these specific operations within BOC Hong Kong's vast portfolio. These are not necessarily unprofitable ventures but rather those where the investment in compliance and operational overhead significantly eats into the revenue generated. Think of highly regulated, low-margin services that lack a strong competitive differentiator for BOC Hong Kong. Such segments might be essential for client relationships or market presence but represent areas where the bank does not possess a distinct advantage to command higher pricing or achieve economies of scale that offset regulatory costs.

- High Compliance Costs: Segments requiring extensive adherence to AML, KYC, and data privacy regulations contribute to elevated operational expenditures.

- Low Revenue Generation: These operations typically generate modest revenues due to their niche nature or competitive pricing pressures.

- Limited Growth Potential: The inherent nature of these segments often restricts significant expansion or market share gains.

- Potential Cash Burn: Without strategic focus or efficiency improvements, these units can consume resources without providing adequate returns.

Within BOC Hong Kong Holdings' portfolio, "Dogs" represent products or services with low market share and low growth prospects. These are often legacy IT systems, niche financial products with limited demand, or physical branches in declining areas. For example, in 2024, many banks, including BOC Hong Kong, continued to face challenges with aging IT infrastructure, which consumed significant portions of their budgets without offering competitive advantages.

These underperforming assets, such as certain specialized legacy investment funds or physical branches with consistently low customer traffic, generate minimal revenue while still incurring operational and maintenance costs. By 2023, BOC Hong Kong observed a 15% year-on-year increase in mobile banking transactions, highlighting a clear shift away from traditional branch usage for many customers.

Effectively, these "Dogs" are cash traps that divert resources from more promising growth areas. The strategic imperative is to identify and divest or minimize these assets to reallocate capital towards digital transformation and higher-return ventures, thereby improving overall financial health and operational efficiency.

| Category | Description | Market Share | Growth Rate | BOC Hong Kong Example (Illustrative) |

| Dogs | Low market share, low growth | Low | Low | Legacy IT systems, underutilized branches, niche legacy products |

| IT Systems | Outdated infrastructure | N/A | N/A | Core banking systems requiring high maintenance costs (often >60% of IT budget in 2024 for similar institutions) |

| Products | Low demand, specialized offerings | < 0.1% customer engagement | Declining | Certain structured products launched pre-2015 with minimal uptake by 2024 |

| Branches | Declining customer footfall | N/A | Negative | Branches in areas with significant population shifts or digital channel preference |

Question Marks

Emerging Fintech Ventures represent the bank's early-stage investments in innovative financial technologies, often characterized by high growth potential but unproven market traction. These ventures, which could include experimental blockchain applications or AI-driven advisory tools, are positioned in rapidly expanding markets. For instance, BOC Hong Kong Holdings has been actively exploring partnerships in areas like digital payments and wealth management technology, reflecting a commitment to these nascent sectors.

These early-stage initiatives require significant capital infusion to foster development and achieve scalability, much like the bank’s ongoing investments in digital transformation projects aimed at enhancing customer experience and operational efficiency. While detailed financial figures for individual early-stage ventures are often proprietary, the broader fintech sector saw substantial global investment throughout 2024, with venture capital flowing into areas like regtech and embedded finance, signaling investor confidence in future growth.

BOC Hong Kong's new green finance offerings, like specialized green deposits and sustainability-linked loans, are entering a market experiencing rapid expansion fueled by increasing Environmental, Social, and Governance (ESG) awareness. These innovative products are designed to meet growing investor and corporate demand for environmentally responsible financial solutions.

While BOC Hong Kong is actively investing in developing these new green finance products, its current market share in these specific segments may still be nascent when compared to more established players or its own traditional banking services. This reflects the early stage of development for these specialized offerings within the bank's portfolio.

The bank is dedicating significant resources to marketing and further product development to ensure these green finance solutions gain substantial market traction and adoption. For example, as of early 2024, the global sustainable finance market was projected to reach trillions of dollars, indicating the immense potential for growth in this sector.

BOC Hong Kong's expansion into specific ASEAN sub-segments, like digital banking services for SMEs in Vietnam or wealth management for high-net-worth individuals in the Philippines, would position them as Stars or Question Marks within the BCG Matrix. These are often high-growth areas where their current market share is nascent. For instance, while Southeast Asia’s digital banking market is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 20% in the coming years, BOC Hong Kong's penetration in these specific niches might still be relatively low.

To thrive in these niche markets, substantial investment in localized technology, marketing, and talent is crucial. BOC Hong Kong would need to outmaneuver established local players and potentially other international banks entering the same space. Success here hinges on developing tailored product offerings that meet the unique demands of these segments, such as specific loan products for Vietnamese SMEs or Sharia-compliant investment options for certain Muslim-majority markets in ASEAN.

The bank’s strategy in these areas would require aggressive market penetration, potentially through partnerships or acquisitions, to quickly gain traction. The potential return is high due to the rapid growth of these emerging markets, but the risk is also considerable given the competitive landscape and the need for significant upfront capital. For example, in 2024, many fintech firms were reporting substantial funding rounds to capture these exact opportunities, indicating the competitive intensity.

Specialized Digital-Only Products for Underserved Segments

BOC Hong Kong Holdings could explore developing specialized digital-only products for underserved segments, such as gig economy workers or micro-SMEs. These segments are increasingly digital-savvy but may have lower current penetration for BOC Hong Kong. For instance, a digital platform offering tailored lending or payment solutions for freelancers could tap into this growing market. This strategy requires significant investment in user acquisition and continuous product refinement to build a strong user base and achieve economies of scale.

In 2024, the digital banking landscape saw continued growth in services catering to niche markets. For example, the fintech sector has seen significant traction in providing financial tools for micro-enterprises, with some platforms reporting over 30% year-over-year user growth in this segment. BOC Hong Kong could leverage this trend by creating:

- Targeted digital wallets and payment solutions for freelance platforms.

- Simplified digital loan application processes for micro-SMEs with faster approval times.

- Personalized financial management tools and advice accessible via mobile app.

- Partnerships with gig economy platforms to offer integrated financial services.

Digital Assets and Web3 Initiatives

BOC Hong Kong Holdings' ventures into digital assets and Web3 represent a nascent but potentially high-growth area, fitting the profile of a Question Mark in the BCG matrix. The bank is exploring distributed ledger technology and potential stablecoin initiatives, signaling a move into innovative financial services. As of early 2024, the digital asset market, while volatile, continues to attract significant investment, with the global crypto market capitalization fluctuating but consistently in the trillions. BOC Hong Kong's current market share in these experimental sectors is understandably small, reflecting the early stage of adoption and the bank's cautious approach.

Transitioning these initiatives from Question Marks to Stars will demand substantial investment in research, development, and robust risk management frameworks. The inherent volatility and regulatory uncertainty surrounding digital assets pose significant challenges. For instance, regulatory clarity on stablecoins, a key area of interest, is still evolving globally. BOC Hong Kong's strategic focus must be on building a strong foundation, understanding the competitive landscape, and managing the inherent risks to unlock the long-term potential of Web3 technologies.

- Market Potential: The global digital asset market is projected to grow significantly, with estimates varying but generally pointing towards substantial expansion in the coming years.

- Current Share: BOC Hong Kong's presence in the digital asset and Web3 space is in its infancy, indicating a low current market share.

- Investment Required: Significant capital expenditure is necessary for technological development, talent acquisition, and compliance in this rapidly evolving field.

- Risk Management: Robust strategies are crucial to navigate the regulatory, technological, and market risks associated with digital assets and Web3.

BOC Hong Kong's ventures into emerging markets, such as specific ASEAN sub-segments or niche digital products for underserved groups, represent potential Question Marks. These areas offer high growth but currently have a low market share for the bank. Significant investment is needed to compete effectively and build traction. For example, the digital banking market in Southeast Asia is experiencing rapid growth, with projections indicating over 20% compound annual growth rates. However, BOC Hong Kong's penetration in these specific niches might still be limited, requiring substantial capital for localized technology and marketing efforts to capture market share.

BCG Matrix Data Sources

Our BCG Matrix for BOC Hong Kong Holdings leverages official annual reports, detailed market share data, and industry growth forecasts to accurately position each business unit.