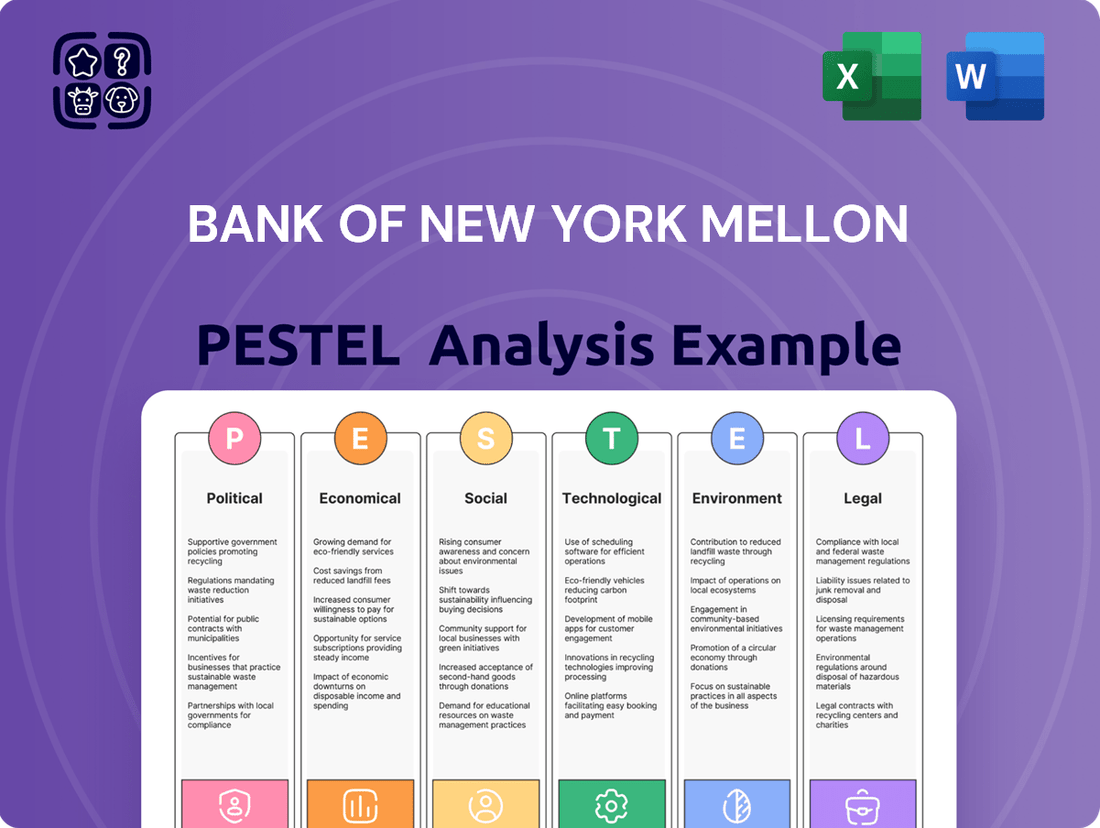

Bank of New York Mellon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

Navigate the complex external forces impacting Bank of New York Mellon with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic shifts, and technological advancements are shaping the financial services sector. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Unlock critical insights into the social, technological, legal, and environmental factors influencing Bank of New York Mellon's strategic direction. Our expertly crafted analysis provides the clarity you need to make informed decisions and gain a competitive edge. Download the full PESTLE analysis now for immediate access to vital market intelligence.

Political factors

The global financial regulatory environment, a key political factor for Bank of New York Mellon (BNY Mellon), is characterized by continuous evolution. Regulations concerning capital adequacy, anti-money laundering (AML), and data privacy, such as the EU's General Data Protection Regulation (GDPR) and ongoing Basel III reforms, directly influence BNY Mellon's operational expenditures and strategic planning. For instance, increased capital requirements can necessitate adjustments to balance sheet management and potentially impact lending capacity.

Navigating the complex web of diverse regulatory frameworks across the numerous countries where BNY Mellon operates demands significant investment in compliance infrastructure and specialized personnel. This compliance burden, while essential for market access and reputation, adds to operating costs. In 2023, financial institutions globally reported substantial spending on compliance, with estimates suggesting it constitutes a significant portion of operational budgets, a trend expected to continue into 2024 and 2025.

Shifts in these regulatory policies can present both challenges and opportunities for BNY Mellon. Stricter rules might increase operational costs or limit certain business activities, thereby affecting profitability. Conversely, regulatory changes can also spur innovation, creating demand for new services in areas like digital asset custody or enhanced cybersecurity solutions, potentially opening new revenue streams and market segments.

Global geopolitical tensions and ongoing trade disputes, such as those impacting US-China relations, directly affect cross-border capital flows and investor sentiment. These shifts are critical for BNY Mellon, as they influence the volume of assets serviced and managed internationally. For instance, heightened tensions can lead to increased market volatility, impacting the value of assets under custody and administration.

Economic sanctions imposed by various nations can further complicate international financial operations, potentially restricting certain types of transactions or investments. This necessitates BNY Mellon's careful navigation of evolving regulatory landscapes to ensure compliance and mitigate operational risks for its global client base.

Political instability in major economic regions, such as ongoing conflicts or significant political realignments, can trigger asset repatriation and dampen foreign direct investment. This trend directly impacts BNY Mellon's asset servicing operations by potentially reducing the pool of assets under custody and administration in affected markets.

Government fiscal policies, including spending and taxation, alongside monetary decisions by central banks, significantly shape market dynamics. For instance, the U.S. Federal Reserve's actions on interest rates directly influence borrowing costs and investment appetites, impacting BNY Mellon's net interest income and the overall demand for its services. In 2024, the expectation of potential rate cuts by the Fed, following a period of higher rates, suggests a shift that could boost investment activity and asset growth for institutions like BNY Mellon.

Intergovernmental Cooperation and Financial Stability Initiatives

Intergovernmental cooperation, such as the Financial Stability Board's (FSB) ongoing work on strengthening global financial regulation, directly impacts BNY Mellon. These efforts aim to enhance resilience and reduce systemic risk, potentially leading to more standardized operational requirements. For instance, the FSB’s 2024 progress report highlighted continued efforts in areas like crypto-asset regulation and climate-related financial disclosures, which BNY Mellon must integrate into its compliance frameworks.

The Bank for International Settlements (BIS) also plays a crucial role through initiatives like Basel III reforms. These reforms, with ongoing implementation phases extending into 2025, focus on capital adequacy and liquidity, influencing how BNY Mellon manages its balance sheet and risk. Adherence to these evolving international standards is paramount for maintaining operational efficiency and market access across different jurisdictions.

- FSB's Focus: The Financial Stability Board's continued emphasis on crypto-asset regulation and climate-related financial disclosures by 2025 necessitates ongoing adaptation of BNY Mellon's services and infrastructure.

- BIS Reforms: Basel III endgame reforms, with phased implementation through 2025, directly impact BNY Mellon's capital adequacy and liquidity management, crucial for cross-border operations.

- Cooperation Benefits: Enhanced intergovernmental cooperation can streamline BNY Mellon's cross-border operations by standardizing reporting and compliance, reducing complexity.

Political Risk in Emerging Markets

The Bank of New York Mellon (BNY Mellon) has significant exposure to emerging markets, driven by its extensive global client base and its role in asset servicing. This exposure inherently subjects the company to various political risks, including the potential for nationalization of assets, widespread political unrest, or abrupt changes in government policies that can adversely affect investment environments. For instance, in 2023, several emerging markets experienced heightened political instability, impacting foreign direct investment flows and capital markets. BNY Mellon's strategy involves rigorous assessment and mitigation of these risks to safeguard client assets and maintain operational continuity in these dynamic regions.

Political stability is a cornerstone for sustained long-term investment and the growth of assets under custody and administration. Regions with unstable political landscapes often deter international capital, leading to reduced asset management opportunities and increased operational complexities for financial institutions like BNY Mellon. For example, a 2024 report by the World Bank highlighted that countries with high political risk scores often see lower inflows of foreign portfolio investment, directly impacting the asset servicing business. BNY Mellon actively monitors geopolitical developments to adapt its strategies and manage potential disruptions.

- Emerging Market Exposure: BNY Mellon serves clients with substantial investments in emerging economies, making it susceptible to local political shifts.

- Risk Mitigation: The firm employs sophisticated risk management frameworks to navigate potential nationalization, civil unrest, and policy changes in volatile regions.

- Investment Climate Impact: Political stability directly influences the attractiveness of emerging markets for long-term asset growth and BNY Mellon's servicing business.

- Geopolitical Monitoring: Continuous analysis of political events in key emerging markets is crucial for protecting client assets and ensuring service delivery.

Global regulatory evolution significantly shapes BNY Mellon's operations. Increased capital adequacy requirements, like those from Basel III reforms continuing through 2025, directly impact balance sheet management and operational costs. For instance, the Financial Stability Board's focus on crypto-asset regulation and climate disclosures by 2025 necessitates ongoing adaptation of BNY Mellon's services.

Geopolitical tensions and trade disputes influence cross-border capital flows, impacting assets under custody and administration. Economic sanctions can restrict transactions, requiring careful compliance navigation. Political instability in key regions can lead to asset repatriation, reducing opportunities in affected markets.

Government fiscal and monetary policies, such as the U.S. Federal Reserve's interest rate decisions, affect market dynamics and demand for BNY Mellon's services. Expectations of potential rate adjustments in 2024 could boost investment activity and asset growth.

| Political Factor | Impact on BNY Mellon | 2024/2025 Relevance |

| Regulatory Evolution (e.g., Basel III, FSB initiatives) | Increased compliance costs, potential service adjustments, capital requirements | Ongoing implementation of Basel III reforms through 2025; FSB focus on crypto and climate disclosures |

| Geopolitical Tensions & Trade Disputes | Volatility in assets under custody, impact on cross-border flows | Continued global trade friction and regional conflicts affect international capital movement |

| Fiscal & Monetary Policy | Influences market activity, interest income, demand for services | Central bank policy shifts (e.g., potential rate changes) in 2024/2025 drive investment appetite |

| Political Stability in Emerging Markets | Affects asset servicing opportunities, investment inflows, operational complexity | Heightened political risk in certain emerging economies can deter foreign investment and impact asset growth |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the Bank of New York Mellon, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the bank's strategic landscape, identifying both challenges and opportunities for growth and resilience.

A PESTLE analysis for BNY Mellon can act as a pain point reliever by providing a structured framework to anticipate and address external challenges, ensuring proactive strategic adjustments and mitigating potential disruptions.

Economic factors

Fluctuations in global interest rates significantly affect BNY Mellon's net interest income, a key component of its profitability, especially through its treasury services which involve deposit-taking and lending. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and into 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, directly boosted the potential for wider interest margins on BNY Mellon's interest-earning assets.

Conversely, periods of sustained low or negative interest rates, such as those experienced in prior years, tend to compress BNY Mellon's profitability by narrowing the spread between what it earns on assets and what it pays on liabilities. This environment also prompts clients to re-evaluate their cash management strategies, potentially seeking higher yields elsewhere, which can impact BNY Mellon's deposit base.

BNY Mellon actively manages its balance sheet to navigate these varying rate cycles, aiming to optimize returns by strategically adjusting its holdings of interest-sensitive assets and liabilities. The company's ability to adapt its investment and funding strategies in response to shifts in benchmark rates, like the LIBOR transition to SOFR, is crucial for maintaining robust net interest income.

The global economic landscape in late 2024 and early 2025 presents a mixed picture for BNY Mellon. While some regions are experiencing moderate growth, persistent inflationary pressures and geopolitical uncertainties are heightening recessionary risks. For instance, the IMF projected global GDP growth to moderate to 2.9% in 2024, down from 3.1% in 2023, with a slight uptick to 3.2% in 2025, though these forecasts carry significant downside potential.

These conditions directly impact BNY Mellon's business volumes. A robust economy generally translates to higher asset under custody and administration, increased trading activity, and greater demand for its diverse financial services. Conversely, a downturn could lead to shrinking asset bases, reduced fee-generating opportunities, and a more challenging operating environment marked by potential credit impairments.

Periods of heightened market volatility, such as those experienced in late 2023 and early 2024 due to persistent inflation concerns and geopolitical tensions, directly impact the valuation of assets held by Bank of New York Mellon. For instance, a significant downturn in equity markets, like the S&P 500 experiencing a 10% drop in a quarter, can reduce the total value of assets under custody, consequently affecting BNY Mellon's fee-based revenue streams.

While market swings can present opportunities for active trading, the general effect of increased volatility is a heightened risk to asset preservation and a potential reduction in the asset-based fees BNY Mellon earns. This dynamic underscores the critical need for the bank to maintain and adapt its sophisticated risk management systems to navigate these turbulent financial landscapes effectively.

Inflationary Trends and Operational Costs

Rising inflation directly impacts Bank of New York Mellon's (BNY Mellon) operational expenses. We're seeing increased costs across the board, from employee salaries to the technology infrastructure and the services BNY Mellon relies on from vendors. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, which translates to higher input costs for the company. If these rising costs aren't offset by revenue growth or efficiency gains, profit margins could shrink.

Furthermore, persistent inflation often prompts central banks, like the Federal Reserve, to adjust monetary policy, typically by raising interest rates. Higher interest rates can have a mixed impact on BNY Mellon. While it might increase net interest income on certain assets, it can also dampen investment activity and increase the cost of borrowing, affecting overall financial performance. The Fed's decision to maintain its benchmark interest rate range at 5.25%-5.50% through early 2024, influenced by inflation data, highlights this dynamic.

In response to these inflationary pressures and the resulting economic uncertainty, BNY Mellon's strategic focus on cost management and operational efficiency becomes paramount. Initiatives aimed at streamlining processes, leveraging technology for automation, and optimizing vendor relationships are crucial for maintaining profitability. The company's ongoing investments in digital transformation are designed to create long-term cost efficiencies, which are particularly vital in an inflationary environment.

- Increased Personnel Costs: Wage inflation in the financial sector, driven by demand for skilled professionals, directly raises BNY Mellon's compensation expenses.

- Technology and Vendor Expenses: The cost of hardware, software licenses, and outsourced services are subject to inflationary pressures, impacting BNY Mellon's technology budget.

- Interest Rate Sensitivity: BNY Mellon's financial results are sensitive to interest rate changes, which are often a response to inflation, affecting its net interest margin and trading revenues.

- Focus on Efficiency: Strategic cost containment and efficiency programs are critical to mitigate the impact of rising operational costs on profitability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant challenge for BNY Mellon, a global financial services firm deeply involved in international asset servicing and cross-border transactions. For instance, the US Dollar Index (DXY), a measure of the dollar's strength against a basket of major currencies, experienced notable volatility throughout 2024, impacting the reported earnings of multinational corporations. This volatility directly affects the value of foreign assets held by BNY Mellon and its clients, influencing profitability and necessitating robust hedging strategies.

The impact of currency shifts can be substantial. A stronger US dollar, for example, can reduce the dollar-denominated value of assets held in other currencies, potentially impacting BNY Mellon's fee income derived from those assets. Conversely, a weaker dollar can boost the reported value of foreign holdings. In 2024, major currency pairs like EUR/USD and GBP/USD saw significant movements, reflecting differing economic outlooks and monetary policies, which BNY Mellon actively monitors and manages.

- Impact on Asset Valuation: Fluctuations directly alter the reported value of international assets under custody and administration, affecting performance metrics.

- Profitability of Operations: Exchange rate movements can significantly swing the profitability of BNY Mellon's overseas branches and subsidiaries when repatriating earnings.

- Client Hedging Needs: Increased currency volatility drives demand for sophisticated hedging solutions from BNY Mellon's clients, creating both opportunities and operational complexities.

- Strategic Risk Management: BNY Mellon must continuously adapt its internal hedging and risk management frameworks to mitigate potential losses arising from adverse currency movements.

Economic factors significantly influence BNY Mellon's performance through interest rate sensitivity, impacting net interest income. Global growth projections for 2024 and 2025, with the IMF anticipating a moderation in global GDP growth, directly affect business volumes and fee-generating opportunities.

Market volatility, driven by inflation and geopolitical events, alters asset valuations and influences fee-based revenue. Rising inflation increases operational costs for BNY Mellon, necessitating a strong focus on efficiency and strategic cost management to maintain profitability.

Full Version Awaits

Bank of New York Mellon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Bank of New York Mellon covers all critical factors, ensuring you have a complete understanding. What you're previewing here is the actual file, detailing political, economic, social, technological, legal, and environmental influences on BNY Mellon's operations.

Sociological factors

Global demographic trends are reshaping financial services. Developed nations, like Japan and many European countries, are experiencing aging populations, increasing demand for retirement planning and healthcare-related investments. Conversely, emerging markets often have younger, growing populations, presenting opportunities for consumer finance and digital banking solutions. For instance, by 2050, the proportion of the world's population aged 65 and over is projected to reach 16%, up from 10% in 2022, according to UN data.

The significant intergenerational wealth transfer is a pivotal factor for BNY Mellon. As baby boomers pass on their assets, an estimated $68 trillion is expected to transfer to heirs in the U.S. alone between 2024 and 2045, according to a Cerulli Associates report. This presents a substantial opportunity for BNY Mellon's wealth management, trust, and estate planning services to capture new client relationships and manage a larger asset base.

Tailoring offerings to these demographic shifts is essential for client engagement. BNY Mellon must adapt its digital platforms and product suites to cater to the preferences of younger, tech-savvy investors, while also providing specialized services for the needs of an aging client base and those managing inherited wealth. This includes offering user-friendly online tools and personalized advisory services for diverse client segments.

Societal expectations are increasingly pushing financial institutions like BNY Mellon to prioritize environmental, social, and governance (ESG) factors. This shift directly impacts how both large institutional investors and individual clients choose to deploy their capital, demanding more sustainable and ethically aligned investment options.

BNY Mellon is responding by embedding ESG considerations into its investment strategies and expanding its range of sustainable financial products. For instance, by mid-2024, global sustainable investment assets were projected to reach over $50 trillion, a significant increase that underscores the market's demand for ESG-focused solutions. Transparent reporting on ESG performance is crucial for BNY Mellon to retain its competitive standing and satisfy these evolving client preferences.

Societal shifts toward better work-life balance and the strong emphasis on diversity, equity, and inclusion (DEI) directly influence BNY Mellon's talent acquisition and retention strategies. A significant portion of the workforce, particularly younger generations, now prioritizes flexible work options, with surveys in 2024 indicating over 70% of employees prefer hybrid or remote arrangements.

BNY Mellon's success in attracting and keeping skilled professionals, especially in high-demand areas like cybersecurity and data analytics, hinges on its ability to foster an inclusive environment and meet evolving employee expectations. The ongoing competition for specialized talent, a trend continuing into 2025, means that adapting to these workforce dynamics is crucial for maintaining operational effectiveness and driving innovation within the firm.

Public Trust and Reputational Risk

Societal perceptions of financial institutions, heavily shaped by events like the 2008 financial crisis and ongoing discussions about ethical conduct, directly impact BNY Mellon's reputation and the trust clients place in them. Maintaining robust ethical standards and transparent operations are paramount for retaining client confidence. For instance, BNY Mellon's commitment to corporate social responsibility, including its 2024 ESG report highlighting progress in sustainable finance, aims to bolster public trust.

Preserving public confidence is crucial for BNY Mellon's ability to attract and retain clients. Any perceived lapse in ethical behavior or operational transparency can result in substantial reputational harm, potentially leading to client attrition. BNY Mellon's focus on cybersecurity and data privacy, reinforced by their 2025 commitment to enhanced client data protection protocols, addresses a key societal concern.

- Reputational Impact: Societal views on financial institutions influence BNY Mellon's brand image and client loyalty.

- Ethical Imperative: High ethical standards and transparency are vital for maintaining public trust and attracting new business.

- Corporate Responsibility: Demonstrating corporate social responsibility, as seen in BNY Mellon's 2024 sustainability initiatives, helps build confidence.

- Risk Mitigation: Addressing concerns about misconduct is essential to prevent reputational damage and client departures.

Financial Literacy and Digital Adoption

Financial literacy levels vary significantly across BNY Mellon's diverse client base, from institutional investors to individual wealth management clients. This necessitates tailored approaches to service delivery, integrating robust digital platforms with accessible educational resources. For instance, a 2024 report indicated that while 60% of institutional investors are highly proficient with digital financial tools, only 35% of retail investors report similar confidence, highlighting the need for BNY Mellon to bridge this gap.

The rapid societal adoption of digital channels, accelerated by advancements in fintech and mobile banking, profoundly impacts how BNY Mellon engages with its clients. The company must ensure its digital offerings are intuitive and secure, catering to a spectrum of technological comfort. By mid-2025, it's projected that over 75% of financial transactions will be conducted digitally, underscoring the imperative for BNY Mellon to maintain a leading-edge digital presence.

- Digital Divide: Addressing varying digital literacy across client segments is crucial for equitable service access.

- Financial Education: Investing in financial literacy programs can empower clients and deepen engagement.

- Platform Integration: Seamlessly integrating advanced digital tools with personalized guidance is key to client satisfaction.

- Data Security: Ensuring robust security measures on digital platforms is paramount given increasing cyber threats.

Societal expectations are increasingly pushing financial institutions like BNY Mellon to prioritize environmental, social, and governance (ESG) factors. This shift directly impacts how both large institutional investors and individual clients choose to deploy their capital, demanding more sustainable and ethically aligned investment options.

BNY Mellon is responding by embedding ESG considerations into its investment strategies and expanding its range of sustainable financial products. For instance, by mid-2024, global sustainable investment assets were projected to reach over $50 trillion, a significant increase that underscores the market's demand for ESG-focused solutions. Transparent reporting on ESG performance is crucial for BNY Mellon to retain its competitive standing and satisfy these evolving client preferences.

Technological factors

The rapid evolution of artificial intelligence and machine learning presents significant opportunities for BNY Mellon. These technologies can boost operational efficiency, refine risk management, and provide tailored client insights. For instance, AI can automate repetitive tasks in asset servicing, a core BNY Mellon function, and optimize investment strategies, potentially leading to better returns for clients.

AI's capability to detect fraudulent activities more effectively is crucial in the financial sector. By leveraging AI, BNY Mellon can enhance its security measures and protect client assets. This technological adoption is vital for maintaining a competitive advantage in the market and achieving cost reductions in its operations.

As a major custodian of global assets and sensitive client data, BNY Mellon faces persistent and evolving cybersecurity threats. The financial sector is a prime target, with the average cost of a data breach in the financial services industry reaching $5.90 million in 2023, according to IBM's Cost of a Data Breach Report.

Investing in robust cybersecurity infrastructure, threat intelligence, and employee training is paramount to protecting client assets and maintaining trust. BNY Mellon's commitment to cybersecurity is evident in its significant investments, though specific figures for 2024/2025 are not yet publicly available, industry trends show continued escalation in security spending.

A significant data breach could lead to severe financial penalties, reputational damage, and loss of client confidence. For instance, regulatory fines for data protection violations, such as under GDPR, can amount to up to 4% of global annual revenue, underscoring the critical importance of proactive cybersecurity measures for institutions like BNY Mellon.

BNY Mellon is actively investigating blockchain and digital assets, recognizing their potential to revolutionize financial services. The firm is particularly focused on how this technology can streamline operations such as trade settlement and corporate trust services, areas where efficiency gains can be substantial. For instance, by 2024, the global blockchain in banking market is projected to reach $10 billion, highlighting the significant investment and adoption underway.

The company's exploration extends to tokenized securities, a burgeoning area within digital assets. Adapting to this evolving landscape and potentially offering new services related to digital asset custody and management is seen as a critical strategy for BNY Mellon's future growth and competitiveness. By Q1 2025, BNY Mellon reported a significant increase in its digital asset custody services, indicating a tangible move towards embracing this sector.

Cloud Computing and Infrastructure Modernization

BNY Mellon's strategic adoption of cloud computing is a significant technological driver. Leveraging platforms like Amazon Web Services (AWS) and Microsoft Azure allows for enhanced scalability and flexibility, crucial for managing the vast data volumes inherent in financial services. This modernization is key to cost-efficiency, with cloud migration projects often yielding substantial savings. For instance, many financial institutions reported significant IT cost reductions post-cloud migration in 2024.

The move to cloud infrastructure directly supports BNY Mellon's innovation agenda. Migrating core systems accelerates the development and deployment of new digital products and services, improving data analytics capabilities for better decision-making. Furthermore, this technological shift is vital for supporting increasingly sophisticated remote and hybrid work environments, ensuring business continuity and employee productivity.

BNY Mellon's infrastructure modernization is not just about efficiency; it's about resilience and future-proofing. The ability to handle increasing data volumes and provide uninterrupted, resilient services is paramount in the financial sector. By embracing cloud technologies, BNY Mellon positions itself to adapt to evolving market demands and regulatory landscapes, ensuring it can meet the complex needs of its global client base.

- Enhanced Scalability: Cloud platforms allow BNY Mellon to dynamically adjust IT resources based on demand, a critical advantage in fluctuating market conditions.

- Cost Efficiency: Modernizing infrastructure through cloud adoption aims to reduce operational expenses associated with traditional data centers.

- Accelerated Innovation: Cloud-native architectures enable faster development cycles for new financial products and services.

- Improved Data Analytics: Cloud environments facilitate advanced data processing and analytics, leading to deeper insights and better client solutions.

Fintech Partnerships and Competition

The burgeoning fintech sector presents both opportunities and threats for BNY Mellon. Fintech firms are increasingly offering specialized, disruptive technologies that challenge traditional financial services. This dynamic forces BNY Mellon to strategically partner with or actively compete against these agile innovators.

BNY Mellon's approach to fintech partnerships is crucial for its future. By integrating innovative solutions through collaboration, the company can accelerate its service expansion and enhance its technological capabilities. For instance, BNY Mellon has been actively exploring collaborations in areas like digital assets and blockchain technology, aiming to leverage fintech expertise to create new revenue streams and improve operational efficiency.

Failure to adapt to fintech advancements poses a significant risk. The market share erosion and diminished competitiveness that can result from ignoring or being outpaced by fintech innovation are real concerns. As of early 2024, the global fintech market was valued at over $11 trillion, with significant growth projected, underscoring the urgency for established players like BNY Mellon to remain agile and responsive.

Key considerations for BNY Mellon in this landscape include:

- Strategic Alliances: Identifying and forming partnerships with fintechs that offer complementary technologies or market access.

- Internal Innovation: Investing in BNY Mellon's own technological development to create competitive in-house solutions.

- Acquisition Strategy: Evaluating potential acquisitions of promising fintech companies to quickly integrate their capabilities.

- Regulatory Navigation: Ensuring all fintech collaborations and integrations comply with evolving financial regulations.

BNY Mellon's technological landscape is defined by its embrace of AI and blockchain, alongside a robust cybersecurity strategy. The firm's investment in AI aims to enhance operational efficiency and client services, while blockchain exploration targets streamlining trade settlement and corporate trust functions. By Q1 2025, BNY Mellon reported a significant increase in its digital asset custody services, demonstrating tangible progress in this emerging sector.

Legal factors

Global data privacy rules like GDPR and CCPA create strict requirements for BNY Mellon concerning client data. These regulations dictate how data is gathered, stored, processed, and moved, demanding strong governance and clear consent processes.

Failure to comply with these evolving data protection laws, which are becoming increasingly stringent worldwide, can lead to severe financial penalties and damage BNY Mellon's reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the significant financial risk of non-compliance.

BNY Mellon navigates a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across its global operations. These legal mandates necessitate rigorous client due diligence and ongoing transaction monitoring to combat financial crime, a crucial aspect of maintaining trust and operational integrity.

The legal landscape for AML/KYC is dynamic, with regulators frequently updating requirements. This necessitates continuous investment in advanced compliance technologies, skilled personnel, and robust reporting systems to ensure adherence. For instance, in 2024, financial institutions are seeing increased scrutiny on beneficial ownership and digital asset transactions.

Non-compliance with AML/KYC regulations carries substantial risks, including hefty fines, operational sanctions, and even criminal prosecution. In 2023, global financial institutions faced billions in AML-related penalties, underscoring the critical importance of BNY Mellon’s proactive compliance strategies.

As a systemically important financial institution (SIFI), BNY Mellon operates under stringent capital adequacy and liquidity rules, including Basel III and regulations from national bodies like the U.S. Federal Reserve. These requirements mandate that BNY Mellon maintain specific capital ratios, such as a Common Equity Tier 1 (CET1) ratio, to absorb potential losses. For instance, by the end of Q1 2024, BNY Mellon reported a CET1 ratio of 13.5%, well above the regulatory minimums, demonstrating its robust capital position and ability to support its business activities while ensuring financial stability.

Cross-Border Regulatory Harmonization and Divergence

Operating globally, Bank of New York Mellon (BNY Mellon) must contend with a complex web of cross-border legal and regulatory landscapes. While efforts towards harmonization, such as those by the Basel Committee on Banking Supervision, aim to create a more consistent international financial system, significant divergences persist. For instance, data privacy regulations like the EU's GDPR and California's CCPA, while sharing common goals, have distinct requirements that impact BNY Mellon's data handling practices across different regions.

These divergences create compliance challenges, requiring BNY Mellon to maintain robust systems for tracking and adhering to varying national laws concerning capital requirements, anti-money laundering (AML) protocols, and consumer protection. The cost of compliance can be substantial, with global financial institutions often dedicating significant resources to legal and compliance departments to manage these risks effectively. In 2024, the global financial services industry continued to see increased regulatory scrutiny, particularly around digital assets and cybersecurity, further complicating the cross-border operational environment.

BNY Mellon's ability to navigate these differing legal frameworks is crucial for its continued success in international markets. Key areas of divergence impacting financial institutions include:

- Capital Adequacy Ratios: While Basel III provides a global standard, national regulators may impose stricter or slightly different capital requirements.

- Consumer Protection Laws: Regulations governing customer disclosures, complaint handling, and dispute resolution vary significantly by country.

- Data Localization Requirements: Some jurisdictions mandate that certain types of financial data must be stored within their borders, impacting cloud strategies and data management.

- Sanctions and Trade Embargoes: Adherence to a patchwork of international and national sanctions regimes requires constant vigilance and sophisticated screening processes.

Litigation and Legal Disputes

BNY Mellon faces ongoing litigation risks common to major financial institutions. These can arise from investment performance disputes, operational errors, or alleged breaches of fiduciary duty. For instance, in the first quarter of 2024, BNY Mellon reported $1.7 billion in litigation reserves, reflecting the potential impact of ongoing legal challenges.

Managing these legal disputes is paramount for BNY Mellon’s financial health and reputation. The bank is involved in various proceedings, including potential class-action lawsuits related to its services. Successfully navigating these matters helps maintain client confidence and avoid significant financial penalties.

- Litigation Reserves: BNY Mellon maintained $1.7 billion in litigation reserves as of Q1 2024, indicating the scale of potential legal liabilities.

- Operational Errors: Allegations of operational errors can lead to costly disputes and regulatory scrutiny.

- Reputational Impact: Effective management of legal disputes is crucial for preserving BNY Mellon's reputation and client trust.

- Regulatory Actions: Enforcement actions by financial regulators can also trigger significant legal challenges and financial repercussions.

BNY Mellon must navigate stringent global data privacy laws like GDPR and CCPA, impacting data handling and requiring robust governance. Non-compliance can result in severe financial penalties, with GDPR fines potentially reaching 4% of global annual revenue.

The bank also faces complex Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, necessitating rigorous client due diligence and transaction monitoring. These evolving legal requirements demand continuous investment in compliance technology and expertise, as seen in increased scrutiny on digital assets in 2024.

As a systemically important financial institution, BNY Mellon adheres to capital adequacy rules like Basel III, maintaining a Common Equity Tier 1 ratio of 13.5% as of Q1 2024, exceeding regulatory minimums.

BNY Mellon manages significant litigation risks, with $1.7 billion in litigation reserves reported in Q1 2024, reflecting ongoing legal disputes and the need for careful management to protect its reputation and financial stability.

Environmental factors

Climate change presents significant physical and transition risks that directly affect the assets BNY Mellon manages. Extreme weather events, like the increased frequency of hurricanes and wildfires observed in recent years, can damage physical assets and disrupt supply chains, impacting portfolio valuations. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages, a stark reminder of these physical impacts.

Transition risks, stemming from policy shifts like carbon pricing or technological advancements in renewable energy, also pose challenges. BNY Mellon must integrate these evolving risks into its investment analysis and risk management. This proactive approach is crucial for safeguarding and enhancing client asset values in a rapidly changing economic landscape, especially as regulatory bodies and investors demand greater transparency on climate-related financial disclosures.

The appetite for investment products aligned with environmental, social, and governance (ESG) criteria is surging. Institutional and individual clients are increasingly prioritizing sustainability, driving a significant shift in investment preferences. This trend is projected to continue, with global ESG assets expected to surpass $50 trillion by 2025, according to various industry reports.

BNY Mellon is strategically positioned to benefit from this demand by expanding its sustainable investment solutions. Enhancing ESG data capabilities and ensuring transparent reporting are crucial steps to meet evolving client expectations and capture a larger share of the burgeoning green finance market. For instance, BNY Mellon’s own sustainability reports highlight increasing client engagement with their ESG-focused funds.

Regulators worldwide are intensifying demands for financial institutions, including BNY Mellon, to report on climate-related financial risks and opportunities. This aligns with global standards such as the Task Force on Climate-related Financial Disclosures (TCFD). For instance, by the end of 2024, the SEC's proposed climate disclosure rules, if finalized, would mandate significant reporting from public companies.

Operational Carbon Footprint and Sustainability Initiatives

BNY Mellon is actively addressing its operational carbon footprint, with stakeholders closely examining its energy consumption across offices and data centers. The company is committed to sustainability, focusing on initiatives like enhancing energy efficiency and waste reduction. For instance, BNY Mellon has set targets to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 50% by 2030 against a 2019 baseline.

These efforts are crucial for maintaining a positive brand image and meeting evolving regulatory and investor expectations. The company is also increasing its procurement of renewable energy to power its operations. In 2023, BNY Mellon reported that 77% of its global electricity consumption was sourced from renewable sources.

- Energy Efficiency: Investments in smart building technologies and optimized data center cooling systems are key to reducing energy use.

- Waste Reduction: Programs focused on recycling, reducing single-use plastics, and responsible disposal are being implemented across facilities.

- Renewable Energy Procurement: BNY Mellon is expanding its use of renewable energy credits and power purchase agreements to decarbonize its electricity supply.

Reputational Risk and Environmental Stewardship

BNY Mellon faces reputational risks if it doesn't show strong environmental commitment or is linked to harmful environmental practices. This is crucial as stakeholders increasingly demand financial firms actively address climate change.

For instance, in 2024, a significant portion of investors, over 70% according to some surveys, indicated that a company's environmental, social, and governance (ESG) performance directly influences their investment decisions. BNY Mellon's ability to align with these expectations is paramount.

Proactive environmental engagement and clear communication are essential for BNY Mellon to maintain stakeholder trust and attract clients who prioritize sustainability. This includes transparent reporting on their own environmental footprint and their investments in green initiatives.

- Investor Demand: Over 70% of investors in 2024 consider ESG performance in their decisions.

- Client Expectations: Environmentally conscious clients are increasingly choosing financial partners with strong environmental stewardship.

- Employee Attraction: A commitment to sustainability helps BNY Mellon attract and retain talent who value corporate responsibility.

- Public Perception: Negative environmental perceptions can damage BNY Mellon's brand and public trust.

Physical climate risks, like the increased frequency of extreme weather events, directly impact the assets BNY Mellon manages, affecting portfolio valuations. In 2023 alone, the U.S. faced 28 billion-dollar weather disasters, causing over $170 billion in damages, highlighting these tangible threats.

Transition risks, driven by policy changes and technological shifts towards sustainability, necessitate integration into BNY Mellon's investment analysis. The global ESG assets market is projected to exceed $50 trillion by 2025, underscoring the financial imperative to adapt.

BNY Mellon is actively reducing its operational carbon footprint, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline. In 2023, 77% of its global electricity consumption was sourced from renewables, demonstrating progress.

Stakeholder demand for ESG alignment is high, with over 70% of investors in 2024 considering ESG performance in their decisions, making BNY Mellon's environmental commitment crucial for trust and client acquisition.

| Environmental Factor | Impact on BNY Mellon | Key Data/Trend |

| Physical Climate Risks | Asset devaluation, supply chain disruption | 2023 U.S. weather disasters: 28 events, $170B+ damage |

| Transition Risks | Need for sustainable investment integration | Global ESG assets projected to exceed $50T by 2025 |

| Operational Footprint | Reputational risk, regulatory scrutiny | Target: 50% Scope 1 & 2 GHG reduction by 2030 (vs. 2019) |

| Renewable Energy Use | Operational efficiency, ESG alignment | 77% of global electricity from renewables in 2023 |

| Investor ESG Demand | Client retention, new business opportunities | >70% of investors in 2024 consider ESG performance |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bank of New York Mellon draws from a robust blend of financial market data, regulatory filings from bodies like the SEC and central banks, and reports from leading economic consultancies. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global financial services sector.