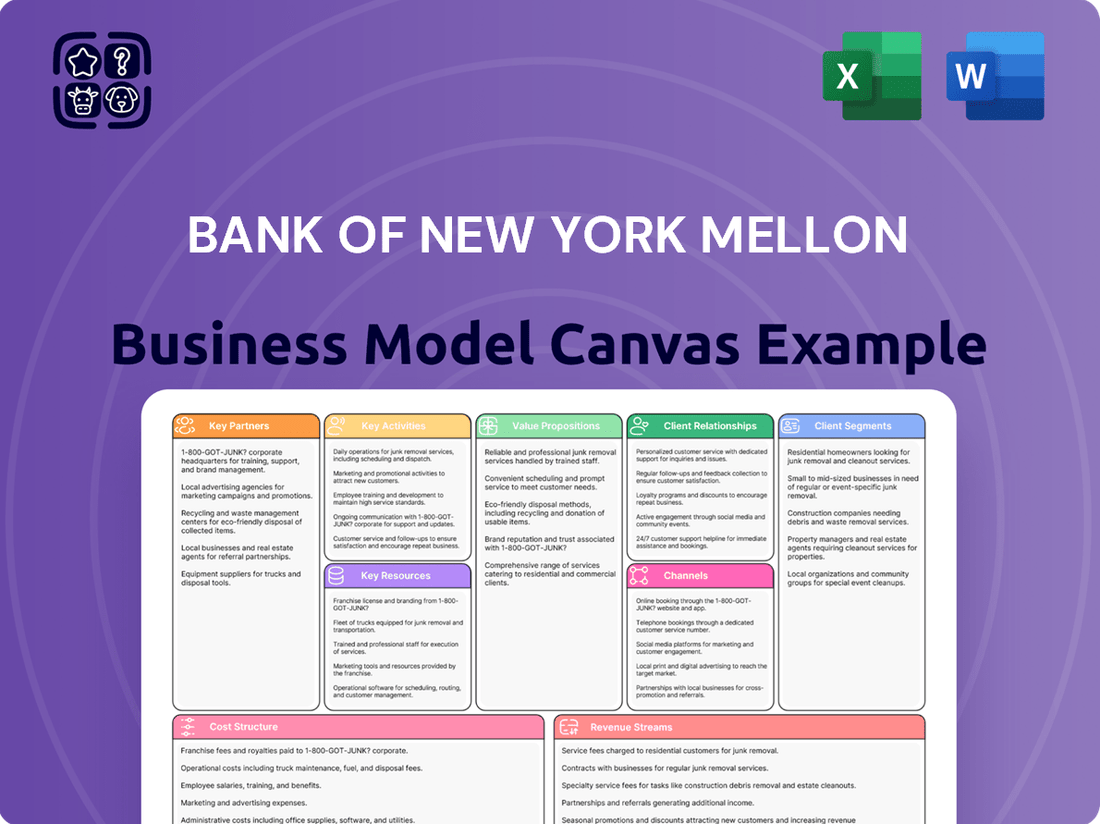

Bank of New York Mellon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

Unlock the strategic blueprint of Bank of New York Mellon with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver exceptional value propositions to diverse customer segments. This detailed analysis is crucial for anyone seeking to understand their competitive advantage.

Dive into the core of Bank of New York Mellon's success with our full Business Model Canvas. It meticulously outlines their revenue streams, cost structure, and key activities, offering invaluable insights into their operational efficiency and market dominance. Get the complete picture to inform your own strategic decisions.

Ready to dissect the winning formula of Bank of New York Mellon? Our downloadable Business Model Canvas provides a complete, section-by-section breakdown of their entire operation, from customer relationships to their unique value proposition. Download now to gain a competitive edge.

Partnerships

BNY Mellon actively collaborates with technology and fintech firms to bolster its digital offerings, focusing on advancements in AI for risk management and the burgeoning field of digital asset custody. These partnerships are vital for staying ahead in the fast-paced financial sector.

The strategic acquisition of Archer in late 2024 underscores BNY Mellon's commitment to enhancing its digital asset custody infrastructure through external innovation. Such moves are key to integrating cutting-edge solutions.

BNY Mellon's key partnerships with investment managers and fund companies are crucial to its business model. Collaborations with giants like BlackRock, Fidelity Investments, and Goldman Sachs Asset Management allow BNY Mellon to provide a broad spectrum of investment products and services. For instance, their work with these firms in areas like tokenized money market funds in 2024 expands their innovative offerings and client reach significantly.

BNY Mellon's key partnerships with financial market infrastructures like exchanges, clearinghouses, and central securities depositories are absolutely critical. These collaborations are the backbone of their asset servicing and securities services operations, ensuring that trades are settled efficiently and assets are held securely across the globe.

For instance, BNY Mellon's role as a custodian and administrator relies heavily on its integration with major stock exchanges and their clearing and settlement systems. In 2024, the sheer volume of transactions processed through these networks underscores the importance of these partnerships; for example, the Depository Trust & Clearing Corporation (DTCC), a key partner, reported processing trillions of dollars in securities transactions daily.

Strategic Alliances for Distribution

BNY Mellon actively cultivates strategic alliances to broaden the reach of its investment products and services. These partnerships are crucial for accessing new markets and client segments, thereby enhancing distribution capabilities.

A prime example is BNY Mellon's initiative to extend access to its US direct lending strategies. This expansion targets clients across the EMEA and APAC regions, leveraging its established global distribution infrastructure.

- Global Reach Expansion: BNY Mellon partners with entities worldwide to distribute its investment solutions, including specialized strategies like US direct lending.

- Market Penetration: These alliances enable BNY Mellon to tap into new geographical markets, such as EMEA and APAC, by utilizing partners' established networks and local expertise.

- Product Diversification Access: Clients in these expanded regions gain access to a wider array of BNY Mellon's investment products, fostering diversified portfolios.

- Revenue Growth Opportunities: By increasing distribution channels, BNY Mellon aims to drive significant revenue growth through broader client engagement and asset flows.

Industry Associations and Regulatory Bodies

BNY Mellon actively engages with key industry associations and regulatory bodies to navigate the complex financial landscape. This collaboration ensures they remain informed about evolving regulations and can advocate for sound market practices. For instance, their participation in industry working groups helps shape discussions around digital assets and evolving payment systems, crucial for their 2024 strategic positioning.

Their involvement allows BNY Mellon to contribute to the development of industry best practices, fostering a more stable and efficient financial ecosystem. This proactive stance is essential for managing risks and identifying opportunities in areas like sustainable finance and technological innovation. In 2024, regulatory scrutiny on areas like data privacy and cybersecurity remains high, making these partnerships indispensable.

- Industry Leadership: BNY Mellon's participation in groups like The Clearing House and the Securities Industry and Financial Markets Association (SIFMA) allows them to influence policy and promote innovation.

- Regulatory Compliance: Staying ahead of regulatory changes from bodies like the SEC, Federal Reserve, and international counterparts is critical for BNY Mellon's global operations.

- Advocacy for Innovation: Engagement with regulators on emerging technologies, such as distributed ledger technology, helps shape frameworks that support responsible adoption.

- Market Stability: Through these partnerships, BNY Mellon contributes to discussions that enhance market resilience and investor protection, a key focus in 2024.

BNY Mellon's key partnerships extend to technology providers and fintech innovators, crucial for enhancing its digital capabilities and exploring emerging areas like digital asset custody. The acquisition of Archer in late 2024 exemplifies this strategy, integrating advanced solutions into its infrastructure.

Collaborations with major asset managers and investment firms, such as BlackRock and Fidelity, are foundational, enabling BNY Mellon to offer a wide array of investment products and services, including innovative offerings like tokenized money market funds in 2024.

Partnerships with financial market infrastructures, including exchanges and clearinghouses like the DTCC, are vital for secure and efficient asset servicing and settlement, processing trillions in transactions daily.

BNY Mellon also actively engages with industry associations and regulatory bodies to shape market practices and ensure compliance, particularly in evolving areas like digital assets and data privacy throughout 2024.

What is included in the product

This Business Model Canvas for Bank of New York Mellon (BNY Mellon) outlines its core operations as a financial services powerhouse, focusing on its institutional client base and the diverse services it offers, from custody and fund administration to investment management.

It provides a structured overview of BNY Mellon's value propositions, customer relationships, key activities, and revenue streams, offering insights into its strategy for navigating the complex financial landscape.

The Bank of New York Mellon's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its complex operations, simplifying understanding and strategic alignment for stakeholders.

It streamlines the identification of key value propositions and customer segments, alleviating the pain of navigating intricate financial services through a digestible and actionable framework.

Activities

Asset servicing and custody are fundamental to BNY Mellon's operations, encompassing the safekeeping of trillions of dollars in assets for institutional clients worldwide. This core activity includes essential functions like fund accounting and transfer agency services, ensuring meticulous record-keeping and efficient transaction processing.

In 2023, BNY Mellon reported approximately $45.7 trillion in assets under custody and administration, highlighting the immense scale of its servicing operations. These services are crucial for maintaining client trust and facilitating smooth global investment flows.

BNY Mellon's Investment Management segment is a core pillar, actively managing a diverse array of investment strategies and products. This encompasses equities, fixed income, and alternative investments, catering to both institutional and individual clients. They focus on developing and distributing tailored investment solutions to meet specific client objectives and market demands.

BNY Mellon's Corporate Trust and Treasury Services are vital for managing complex financial transactions. They act as trustees for corporate debt and equity, ensuring terms are met, and serve as paying agents for interest and principal payments. In 2024, the company continues to be a cornerstone for issuers and investors alike in these critical functions.

Treasury Services offer corporations and financial institutions essential tools for managing their cash flow. This includes facilitating payments, executing foreign exchange transactions, and providing liquidity management solutions. These services are fundamental to the day-to-day operations of businesses globally, supporting their financial health and strategic objectives.

Technological Innovation and Platform Development

BNY Mellon heavily invests in its technology infrastructure, aiming to modernize its platforms and incorporate cutting-edge solutions. A key focus is the integration of artificial intelligence to streamline operations and improve client interactions. This technological push is crucial for developing new digital offerings, such as the tokenization of assets, which represents a significant shift in financial asset management.

The company's '1BNY' strategy underscores its commitment to creating seamless, integrated experiences for its clients by leveraging these advanced technologies. This approach is designed to consolidate services and provide a unified platform for a wide range of financial needs. In 2024, BNY Mellon continued to prioritize digital transformation, with significant capital allocation towards these initiatives.

- AI Integration: Enhancing operational efficiency and client service through AI-powered solutions.

- Platform Modernization: Investing in the transformation of core technology platforms for greater agility.

- Digital Solutions: Developing new offerings like asset tokenization to meet evolving market demands.

- '1BNY' Strategy: Focusing on integrated client solutions for a unified experience.

Risk Management and Regulatory Compliance

BNY Mellon’s risk management and regulatory compliance activities are fundamental to its operations, encompassing credit, market, and operational risks. These efforts are crucial for maintaining the stability of the financial system and the trust placed in the institution. For instance, in 2023, BNY Mellon reported a strong capital position, with its Common Equity Tier 1 (CET1) ratio standing at 15.7%, well above regulatory minimums, underscoring its robust risk absorption capacity.

Adherence to a complex web of global financial regulations is a core function. This ensures the integrity of its services and protects its clients and the broader market. The company actively invests in technology and personnel to stay ahead of evolving regulatory landscapes, a necessity in an industry where compliance failures can have significant financial and reputational consequences.

- Credit Risk Management: BNY Mellon rigorously assesses and manages the risk of loss arising from borrowers failing to meet their contractual obligations.

- Market Risk Management: The institution actively monitors and controls exposures to fluctuations in market prices, interest rates, and foreign exchange rates.

- Operational Risk Management: BNY Mellon implements controls to mitigate risks arising from inadequate or failed internal processes, people, and systems, or from external events.

- Regulatory Compliance: The firm dedicates substantial resources to ensuring full compliance with all applicable laws, regulations, and supervisory expectations across its global operations.

BNY Mellon's key activities revolve around providing essential financial infrastructure and services to a global client base. These include safeguarding trillions in assets, managing complex corporate transactions, and facilitating global payments and liquidity. The company also actively manages investment portfolios and is heavily invested in modernizing its technology to offer innovative digital solutions.

| Key Activity | Description | 2023/2024 Data/Focus |

| Asset Servicing & Custody | Safekeeping and administration of client assets, fund accounting, transfer agency. | $45.7 trillion in assets under custody and administration (2023). |

| Investment Management | Actively managing diverse investment strategies across equities, fixed income, and alternatives. | Focus on developing tailored solutions for institutional and individual clients. |

| Corporate Trust & Treasury Services | Managing debt and equity transactions, facilitating payments, FX, and liquidity management. | Cornerstone for issuers and investors, supporting global business operations. |

| Technology & Digital Transformation | Modernizing platforms, integrating AI, developing digital offerings like asset tokenization. | Prioritizing digital transformation with significant capital allocation in 2024. |

| Risk Management & Compliance | Mitigating credit, market, and operational risks; ensuring adherence to global regulations. | CET1 ratio of 15.7% (2023), demonstrating robust risk absorption. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for The Bank of New York Mellon you see here is the actual document you will receive upon purchase. This preview offers a direct glimpse into the comprehensive structure and content, ensuring you know exactly what to expect. Upon completing your transaction, you'll gain full access to this same detailed analysis, ready for your strategic use.

Resources

BNY Mellon's financial capital is a cornerstone of its business model, evidenced by its substantial assets under custody and administration, which reached $45.5 trillion as of the first quarter of 2024. This immense scale allows the bank to serve a global client base and manage complex financial operations.

The company maintains strong liquidity, a critical factor for a financial institution. As of year-end 2023, BNY Mellon reported a Liquidity Coverage Ratio (LCR) well above regulatory requirements, demonstrating its capacity to meet short-term obligations even in stressed market conditions.

This robust financial foundation, characterized by a strong balance sheet and significant capital reserves, empowers BNY Mellon to absorb market volatility and invest in its technological infrastructure and service offerings, thereby supporting its diverse revenue streams and client relationships.

Bank of New York Mellon (BNY Mellon) heavily relies on advanced technology platforms and infrastructure to power its operations and deliver services. This includes a strategic platforms operating model designed for efficiency and scalability.

The company actively integrates artificial intelligence, exemplified by its Eliza platform, to enhance client interactions and streamline processes. These technological investments are fundamental to BNY Mellon's ongoing digital transformation efforts and maintaining a competitive edge in the financial services industry.

In 2023, BNY Mellon reported significant investments in technology and operations, underscoring its commitment to innovation. For instance, their focus on digital solutions is crucial for managing the increasing volume and complexity of global financial transactions, a trend that continued to accelerate into 2024.

BNY Mellon's global network, spanning over 100 markets, is a critical asset, enabling it to cater to a vast international clientele. This expansive operational footprint underpins its core investment and asset servicing operations.

In 2023, BNY Mellon reported that its global network facilitated the servicing of assets under custody and administration totaling $45.4 trillion, highlighting the sheer scale of its international reach.

Human Capital and Expertise

Bank of New York Mellon (BNY Mellon) relies heavily on its human capital and expertise, a cornerstone of its business model. This includes a vast pool of highly skilled financial professionals, cutting-edge technologists, and seasoned risk management experts. Their collective knowledge is indispensable for BNY Mellon to effectively deliver complex financial services, manage intricate global operations, and drive the development of innovative solutions in a rapidly evolving market.

The firm's commitment to nurturing this talent is evident. As of the first quarter of 2024, BNY Mellon employed approximately 50,000 individuals globally, with a significant portion dedicated to client-facing roles and technology development. This workforce is crucial for maintaining the trust and operational integrity required in the financial services industry, directly impacting the quality and breadth of services offered.

- Skilled Workforce: BNY Mellon's approximately 50,000 employees as of Q1 2024 are a critical asset, encompassing deep expertise in financial markets, technology, and compliance.

- Expertise in Financial Services: The collective knowledge of their professionals enables the delivery of a wide range of services, from asset servicing and wealth management to payments and digital assets.

- Innovation and Technology: Technologists within BNY Mellon are vital for developing and implementing advanced platforms, supporting digital transformation and enhancing operational efficiency.

- Risk Management Prowess: Experienced risk management professionals are essential for navigating complex regulatory environments and safeguarding client assets, a key differentiator for the institution.

Brand Reputation and Client Trust

BNY Mellon's brand reputation, forged over more than 240 years, is a cornerstone of its business model, fostering deep client trust. This enduring credibility acts as a powerful intangible asset, crucial for attracting and retaining its core clientele of institutional investors and high-net-worth individuals.

The company's long history translates into a perception of stability and reliability, differentiating it in a competitive financial landscape. This trust is not merely anecdotal; it underpins BNY Mellon's ability to manage trillions of dollars in assets.

- 240+ Years of Operation: Demonstrates a long-term commitment and resilience.

- Deep Client Trust: Essential for attracting and retaining institutional and high-net-worth clients.

- Intangible Asset: Brand reputation contributes significantly to market valuation and competitive advantage.

- Asset Under Custody/Administration: As of the first quarter of 2024, BNY Mellon reported approximately $45.5 trillion in assets under custody and administration, reflecting the trust placed in the institution.

BNY Mellon's intellectual property, including its proprietary technology platforms and data analytics capabilities, represents a significant key resource. These assets enable the company to offer specialized financial solutions and maintain operational efficiency.

The firm's robust data analytics infrastructure, continuously enhanced through investments in AI and machine learning, allows for sophisticated client insights and risk assessment, differentiating its service offerings in the market.

BNY Mellon's intellectual capital is further bolstered by its research and development efforts, focused on areas such as digital assets and sustainable finance, positioning it for future growth and innovation.

| Key Resource | Description | Supporting Data (as of Q1 2024 unless otherwise noted) |

|---|---|---|

| Intellectual Property | Proprietary technology, data analytics, R&D | Focus on AI and machine learning for client insights; ongoing development in digital assets and sustainable finance. |

| Technology Platforms | Advanced infrastructure for operations and service delivery | Strategic platforms operating model for efficiency and scalability; AI-driven Eliza platform for client interaction. |

| Global Network | Operational presence in over 100 markets | Facilitated servicing of $45.5 trillion in assets under custody and administration in Q1 2024. |

| Human Capital | Skilled workforce of financial professionals and technologists | Approximately 50,000 employees globally, with significant expertise in financial markets, technology, and risk management. |

| Brand Reputation | Over 240 years of operational history and client trust | Underpins ability to manage $45.5 trillion in assets; fosters deep trust with institutional and high-net-worth clients. |

Value Propositions

BNY Mellon provides a comprehensive suite of asset management and servicing solutions, enabling clients to efficiently and securely manage, service, and invest their financial assets. This integrated approach simplifies complex financial operations for institutional clients, covering everything from investment management to custody and fund administration.

In 2024, BNY Mellon continued to solidify its position as a leading provider of these services, managing trillions in assets under custody and administration. The company reported significant growth in its investment services segment, reflecting the increasing demand for sophisticated asset servicing capabilities in a dynamic global market.

BNY Mellon's global reach is a significant value proposition, granting clients access to over 100 markets worldwide. This extensive network is crucial for facilitating complex cross-border transactions and investment strategies, making it a key differentiator for international businesses and investors.

In 2024, BNY Mellon continued to leverage this global infrastructure, supporting trillions in assets under custody and administration across diverse geographies. This vast operational footprint enables clients to navigate international financial landscapes with greater ease and efficiency, unlocking opportunities in emerging and developed markets alike.

BNY Mellon is heavily invested in technological innovation, offering clients advanced digital platforms. These include AI-driven insights and robust digital asset capabilities, designed to boost efficiency and transparency. This strategic focus aims to unlock new financial frontiers and significantly improve the overall client experience.

In 2024, BNY Mellon continued to prioritize digital transformation, with significant investments in areas like artificial intelligence and blockchain technology. For instance, their early 2024 report highlighted a substantial uptick in the usage of their digital asset custody services, reflecting growing client adoption and confidence in these emerging financial technologies.

Risk Management and Regulatory Expertise

BNY Mellon's value proposition centers on its extensive risk management frameworks and profound regulatory expertise, offering clients unparalleled confidence and security. This deep understanding of compliance helps clients navigate the intricate global financial landscape, safeguarding their assets and operations.

The firm's commitment to regulatory adherence is a cornerstone of its client relationships. For instance, in 2023, BNY Mellon reported significant investments in its compliance and risk management infrastructure to meet evolving global standards. This proactive approach ensures clients can operate with reduced exposure to regulatory penalties and operational disruptions.

- Robust Risk Management: BNY Mellon employs sophisticated tools and methodologies to identify, assess, and mitigate a wide array of financial risks, from market volatility to operational failures.

- Regulatory Navigation: The institution possesses deep knowledge of international and domestic financial regulations, enabling clients to maintain compliance and avoid costly breaches.

- Client Asset Protection: A primary focus is the safeguarding of client assets through stringent controls and adherence to best-in-class security protocols.

- Operational Resilience: BNY Mellon invests heavily in technology and processes to ensure the continuity and integrity of its services, even in challenging market conditions.

Tailored and Integrated Client Solutions

Bank of New York Mellon (BNY Mellon) is focusing on delivering tailored and integrated client solutions through its '1BNY' strategy. This approach aims to consolidate its offerings, ensuring clients receive cohesive services that meet their unique requirements.

The company's new commercial coverage model is designed to foster deeper relationships by understanding and addressing the specific needs of various client segments. This client-centric focus is crucial for identifying cross-selling opportunities and enhancing overall client value.

For instance, in 2024, BNY Mellon continued to invest in technology and data analytics to better segment its client base and personalize its service delivery. This allows them to proactively offer solutions rather than simply reacting to client requests.

- Customized Solutions: BNY Mellon leverages its broad capabilities to create bespoke financial solutions for institutional clients, including asset servicing, investment management, and data analytics.

- Integrated Approach: The '1BNY' initiative ensures that different business lines collaborate seamlessly to provide a unified client experience, breaking down internal silos.

- Enhanced Client Relationships: By understanding specific client needs, BNY Mellon aims to become a more strategic partner, leading to increased client retention and loyalty.

- Cross-Selling Opportunities: The integrated model facilitates identifying and capitalizing on opportunities to offer additional services to existing clients, driving revenue growth.

BNY Mellon's value proposition centers on providing clients with seamless, integrated financial solutions that simplify complex operations. This includes a full spectrum of asset management and servicing, from investment management to custody and fund administration, all designed for institutional clients.

In 2024, BNY Mellon managed trillions in assets under custody and administration, underscoring its scale and the trust placed in its comprehensive service offerings. The company's investment services segment saw notable growth, highlighting the increasing demand for advanced asset servicing capabilities in the global financial market.

BNY Mellon offers clients access to over 100 markets, a critical advantage for international transactions and investment strategies. This extensive global network facilitates cross-border activities, making it a key differentiator for businesses operating on a global scale.

The firm's commitment to technological innovation, including AI-driven insights and digital asset capabilities, enhances efficiency and transparency. These advancements aim to improve client experience and unlock new opportunities in the evolving financial landscape.

BNY Mellon's robust risk management and regulatory expertise provide clients with security and confidence. Their deep understanding of compliance helps clients navigate complex global regulations, safeguarding assets and operations.

The company's '1BNY' strategy focuses on delivering tailored, integrated solutions by consolidating offerings and fostering collaboration across business lines. This client-centric approach aims to build deeper relationships and provide cohesive services that meet unique client needs.

| Value Proposition | Description | 2024 Data/Impact |

| Integrated Asset Servicing | Comprehensive suite of services simplifying financial operations for institutional clients. | Manages trillions in assets under custody and administration, with growth in investment services. |

| Global Market Access | Facilitates complex cross-border transactions through access to over 100 markets. | Supports trillions in assets across diverse geographies, enabling clients to navigate international markets. |

| Technological Innovation | Advanced digital platforms, AI insights, and digital asset capabilities for efficiency and transparency. | Significant investments in AI and blockchain; increased usage of digital asset custody services. |

| Risk Management & Regulatory Expertise | Sophisticated frameworks and deep compliance knowledge to protect assets and ensure operational integrity. | Investments in compliance infrastructure to meet evolving global standards, ensuring client operational resilience. |

| Tailored Client Solutions | '1BNY' strategy to provide cohesive, customized services based on specific client needs. | Focus on data analytics for client segmentation and personalized service delivery, enhancing client relationships. |

Customer Relationships

BNY Mellon prioritizes personalized client engagement through dedicated account managers and specialized service teams. This strategy is crucial for understanding and addressing the unique, often complex, needs of their institutional clientele, fostering deep, enduring partnerships.

BNY Mellon prioritizes regular and detailed communication, ensuring clients are always in the loop regarding their assets and market shifts. This proactive approach fosters trust and transparency.

Comprehensive reporting is a key element, providing clients with clear insights into performance and strategic updates. For instance, in 2024, BNY Mellon continued to invest in digital reporting platforms to enhance client experience and data accessibility.

Bank of New York Mellon (BNY Mellon) emphasizes an advisory and consultative approach, moving beyond simple transactions to forge deeper client partnerships. This involves actively listening to clients' strategic goals and then crafting bespoke solutions and valuable insights.

In 2024, BNY Mellon continued to invest in its client advisory services, aiming to enhance client retention and attract new business by demonstrating tangible value. This strategic focus is crucial in a competitive landscape where clients increasingly seek partners who understand their long-term vision and can offer proactive guidance.

Digital Engagement Platforms

BNY Mellon enhances client relationships through robust digital engagement platforms, offering self-service capabilities and real-time data access. These platforms streamline workflows and provide clients with greater control. For instance, in 2024, BNY Mellon continued to invest in its digital infrastructure, aiming to improve user experience and efficiency across its client base.

- Wove Platform: BNY Mellon's Wove platform provides clients with advanced analytics and portfolio management tools, fostering deeper engagement through data-driven insights.

- LiquidityDirect: This platform offers clients efficient management of their liquidity and treasury needs, enabling real-time transaction processing and reporting.

- Client Self-Service: Digital tools empower clients to manage accounts, access reports, and initiate transactions independently, reducing reliance on direct human interaction for routine tasks.

- Data Accessibility: Enhanced digital access to real-time performance data and market insights allows clients to make more informed and timely decisions.

Industry Events and Networking

BNY Mellon actively hosts and participates in key industry events and forums. For instance, their INSITE conference serves as a crucial platform for direct client engagement, community building, and invaluable feedback collection.

- Client Engagement: INSITE provides a direct channel to connect with a broad client base, fostering deeper understanding and trust.

- Feedback Mechanism: The event allows BNY Mellon to gather real-time insights into client needs and market trends.

- Opportunity Identification: Discussions and interactions at these events help uncover new business opportunities and areas for innovation.

- Community Building: Participating in and hosting forums strengthens BNY Mellon's position within the financial services community.

BNY Mellon's customer relationships are built on a foundation of personalized service, proactive communication, and robust digital tools. They act as strategic partners, offering advisory services and bespoke solutions to meet the complex needs of their institutional clients. This approach is reinforced by investments in digital platforms and industry events, ensuring clients receive timely information and tailored support.

In 2024, BNY Mellon continued to enhance its client advisory services and digital infrastructure. For example, the firm reported significant growth in assets under custody and administration, reaching $47.6 trillion by the end of the first quarter of 2024, underscoring the trust and reliance clients place on their services. This growth is a direct reflection of their commitment to deepening client partnerships through value-added engagement and efficient digital solutions.

| Relationship Aspect | BNY Mellon Approach | Client Benefit |

|---|---|---|

| Personalization | Dedicated account managers and specialized teams | Tailored solutions addressing unique client needs |

| Communication | Regular, detailed updates and proactive market insights | Enhanced trust and transparency, informed decision-making |

| Digital Engagement | Advanced platforms like Wove and LiquidityDirect, self-service options | Streamlined workflows, real-time data access, greater control |

| Advisory Services | Consultative approach, understanding strategic goals | Bespoke solutions, valuable insights, long-term partnership |

Channels

BNY Mellon leverages a specialized direct sales force and dedicated relationship managers to connect with its institutional and high-net-worth clientele. This personal approach is fundamental for navigating the intricacies of their financial service offerings, fostering trust and understanding.

These relationship managers act as the primary point of contact, ensuring clients receive tailored solutions and expert guidance. This direct engagement is vital for complex products and services where personalized attention is paramount to client retention and satisfaction.

As of the first quarter of 2024, BNY Mellon reported total assets under custody and administration of $45.2 trillion, underscoring the scale of its client base and the importance of these direct relationships in managing such vast portfolios.

Bank of New York Mellon (BNY Mellon) leverages a robust suite of online platforms and digital portals to serve its diverse client base. These include specialized offerings like LiquidityDirect, which provides clients with streamlined access to liquidity management tools and transaction execution. This digital infrastructure is crucial for enhancing operational efficiency and client accessibility in today's fast-paced financial environment.

The company is also actively developing and integrating newer platforms, such as Wove, to further modernize client interactions and service delivery. In 2024, BNY Mellon continued to invest heavily in its digital capabilities, recognizing that these portals are key channels for client engagement, reporting, and the seamless execution of financial transactions, ultimately driving client retention and satisfaction.

BNY Mellon actively cultivates strategic partnerships with other financial institutions, including banks and asset managers, to expand its service offerings and client access. For instance, in 2024, the company continued to deepen its collaborations within the traditional financial ecosystem, aiming to streamline cross-border payments and enhance custody services.

Collaborations with fintech firms are a critical channel for BNY Mellon to integrate innovative technologies and reach new market segments. In 2024, BNY Mellon announced several new fintech partnerships focused on areas like digital asset servicing and data analytics, reflecting a commitment to leveraging cutting-edge solutions to meet evolving client needs.

Engaging with advisory networks and consultants allows BNY Mellon to gain deeper market insights and connect with prospective clients seeking specialized financial solutions. These alliances are instrumental in building trust and demonstrating the value of BNY Mellon's comprehensive suite of services across wealth management and institutional investment.

Investor Relations and Public Communications

Investor Relations and Public Communications are crucial for Bank of New York Mellon (BNY Mellon) to convey its financial health and strategic direction. These channels ensure transparency and build trust with a diverse stakeholder base, from individual investors to institutional clients and the broader financial community.

Key channels include BNY Mellon's official website, which hosts a dedicated investor relations portal. This portal provides access to essential documents like annual reports, quarterly earnings releases, and SEC filings. For example, in their 2024 investor communications, BNY Mellon highlighted their ongoing digital transformation efforts and their commitment to enhancing shareholder value.

Earnings calls are another vital platform. These events, often featuring senior management, offer detailed insights into the company's performance, strategy, and outlook. BNY Mellon's 2024 earnings calls consistently emphasized their focus on growing fee-generating businesses and managing expenses effectively, aiming to deliver sustainable returns.

- Official Company Websites: Provide comprehensive financial data, regulatory filings, and corporate news.

- Investor Relations Portals: Centralized hubs for reports, presentations, and webcast archives.

- Annual Reports: Detailed overviews of the company's financial performance, strategy, and governance for the fiscal year.

- Earnings Calls: Live or recorded sessions where management discusses financial results and answers analyst questions.

Industry Conferences and Events

BNY Mellon actively participates in and hosts key industry conferences, such as Sibos and the annual SIFMA conference. These events are crucial for demonstrating thought leadership and showcasing innovative solutions in areas like digital assets and sustainable finance. In 2024, BNY Mellon executives were prominent speakers at numerous financial technology and investment management forums, highlighting their strategic direction.

These engagements serve as vital networking opportunities, allowing BNY Mellon to connect directly with existing and potential clients, as well as industry influencers. By presenting at these gatherings, the company gains valuable insights into market trends and client needs, which informs product development and service enhancements. For instance, BNY Mellon's presence at the 2024 Global Financial Summit facilitated discussions around evolving regulatory landscapes.

- Showcasing Expertise: BNY Mellon leverages these events to present research and insights on critical industry topics, reinforcing its position as a trusted advisor.

- Networking: Direct interaction with clients and prospects at conferences helps build and strengthen relationships, leading to new business opportunities.

- New Offering Introduction: Industry events provide a prime platform for launching and promoting new products and services, such as their expanded custody solutions for digital assets.

- Market Intelligence: Participation offers a valuable channel for gathering real-time feedback and understanding emerging client demands and competitive pressures.

BNY Mellon utilizes a multi-faceted channel strategy encompassing direct client engagement, digital platforms, strategic partnerships, and industry presence. This approach ensures broad reach and tailored service delivery to a diverse global client base, from institutional investors to high-net-worth individuals.

Direct sales forces and relationship managers are key for complex needs, while digital portals like LiquidityDirect and Wove enhance accessibility and efficiency. Partnerships with fintechs and traditional institutions expand service capabilities and market penetration.

Industry conferences and investor relations communications further solidify BNY Mellon's market position, facilitating thought leadership, networking, and the dissemination of crucial financial and strategic information. This integrated channel strategy is vital for client acquisition, retention, and overall business growth.

Customer Segments

Bank of New York Mellon (BNY Mellon) serves a diverse array of institutional clients, including massive public retirement funds, powerful sovereign wealth funds, substantial endowments, vital foundations, and significant corporate pension plans. These entities manage trillions of dollars in assets, making them cornerstone clients for any financial institution.

These sophisticated clients demand highly specialized services, such as comprehensive asset servicing, secure custody of assets, and tailored investment management solutions. For instance, BNY Mellon's custody assets under custody and administration reached $47.0 trillion as of the first quarter of 2024, highlighting the scale of services provided to these institutional players.

BNY Mellon's financial institution segment is a cornerstone of its operations, serving a diverse clientele including other banks, broker-dealers, investment managers, and insurance companies. These institutions rely on BNY Mellon for critical services that underpin their daily financial activities.

Key services provided to this segment include robust asset servicing, ensuring the efficient management and administration of trillions in assets. Furthermore, BNY Mellon facilitates seamless clearance and settlement processes for securities transactions, a vital function for market liquidity and stability. In 2023, BNY Mellon reported total assets under custody and administration of $45.4 trillion, highlighting the scale of its services to financial institutions.

The company also offers sophisticated collateral management solutions, crucial for risk mitigation and regulatory compliance in today's complex financial landscape. Additionally, treasury and payment solutions are provided, enabling financial institutions to manage their cash flows and execute transactions efficiently. These offerings are essential for the operational resilience and strategic growth of BNY Mellon's institutional clients.

Large corporations are a cornerstone customer segment for BNY Mellon. They utilize the firm's extensive corporate trust services for managing complex financial transactions, including debt issuance and collateral management. In 2024, BNY Mellon continued to be a vital partner for these entities, facilitating trillions in assets under custody and administration, reflecting their critical role in global finance.

Treasury solutions are another key offering for corporations, helping them manage cash flow, payments, and liquidity efficiently. BNY Mellon's global reach and sophisticated technology empower these businesses to navigate international markets and optimize their financial operations. The firm's commitment to innovation in treasury management ensures corporations can adapt to evolving economic landscapes.

High-Net-Worth Individuals and Family Offices

BNY Mellon's wealth management division directly serves high-net-worth individuals and family offices, providing tailored investment management, comprehensive wealth planning, and specialized private banking solutions. This segment benefits from personalized strategies designed to preserve and grow substantial assets.

For instance, in 2024, BNY Mellon Wealth Management reported managing significant assets for these clients, reflecting a strong demand for their expertise in navigating complex financial landscapes. Their offerings often include sophisticated estate planning, philanthropic advisory, and access to alternative investments.

- Personalized Investment Management: Customized portfolios aligned with individual risk tolerance and financial goals.

- Wealth Planning: Holistic approach encompassing tax efficiency, estate planning, and intergenerational wealth transfer.

- Private Banking: Exclusive banking services, credit solutions, and liquidity management.

Governments and Public Sector Entities

BNY Mellon plays a crucial role in supporting governments and public sector entities by facilitating the funding of vital local projects. This includes providing essential financial services to central banks and various local authorities, underscoring its deep integration within the public finance ecosystem.

The institution's involvement extends to managing significant assets for public sector clients. For instance, as of the first quarter of 2024, BNY Mellon reported total assets under custody and administration of $47.3 trillion, a portion of which directly serves governmental and public sector needs, enabling critical infrastructure development and public service provision.

- Public Finance Support: BNY Mellon assists governments in issuing and managing municipal bonds and other debt instruments to fund infrastructure, education, and healthcare projects.

- Central Bank Services: The company provides custody, clearing, and settlement services for central banks globally, ensuring the smooth operation of national financial systems.

- Local Authority Partnerships: BNY Mellon partners with local governments to manage public funds, pension liabilities, and investment portfolios, optimizing their financial resources.

- Economic Development: By facilitating capital flows for public projects, BNY Mellon contributes to economic growth and job creation within communities.

BNY Mellon's customer segments are primarily institutional, encompassing large corporations, financial institutions, governments, and high-net-worth individuals. These clients rely on BNY Mellon for a broad spectrum of services, from asset servicing and custody to investment management and treasury solutions. The scale of these relationships is immense, with BNY Mellon holding trillions in assets under custody and administration for these diverse groups.

| Customer Segment | Key Services Offered | 2024 Data/Relevance |

|---|---|---|

| Institutional Clients (Retirement Funds, Endowments, Foundations, Sovereign Wealth Funds) | Asset Servicing, Custody, Investment Management | Assets under custody and administration reached $47.0 trillion as of Q1 2024. |

| Financial Institutions (Banks, Broker-Dealers, Investment Managers) | Asset Servicing, Clearance & Settlement, Collateral Management, Treasury & Payment Solutions | Total assets under custody and administration were $45.4 trillion in 2023. |

| Large Corporations | Corporate Trust Services, Debt Issuance Management, Treasury Solutions | Continued to be a vital partner in 2024, facilitating trillions in assets under custody and administration. |

| High-Net-Worth Individuals & Family Offices | Wealth Management, Investment Management, Wealth Planning, Private Banking | Significant assets managed in 2024, with demand for personalized strategies. |

| Governments & Public Sector Entities | Public Finance Support, Central Bank Services, Local Authority Partnerships | Facilitated funding for local projects; assets under custody and administration included public sector needs in Q1 2024. |

Cost Structure

Bank of New York Mellon (BNY Mellon) dedicates significant resources to its technology and innovation segment, recognizing its crucial role in maintaining a competitive edge. These investments are essential for developing, maintaining, and enhancing sophisticated technological infrastructures. For instance, in 2023, BNY Mellon reported technology and development expenses of $2.7 billion, reflecting a commitment to areas like artificial intelligence, robust cybersecurity measures, and comprehensive digital transformation projects.

Personnel and compensation expenses represent a significant cost for The Bank of New York Mellon (BNY Mellon). As a global financial services leader, the company employs a vast workforce of highly skilled professionals across various critical functions, from technology and operations to client service and investment management. These costs encompass salaries, wages, bonuses, and comprehensive benefits packages designed to attract and retain top talent in a competitive industry.

In 2024, BNY Mellon's commitment to its personnel is reflected in its operating expenses. For instance, during the first quarter of 2024, the company reported total compensation and benefits expenses of approximately $2.1 billion. This figure underscores the substantial investment made in its human capital, which is essential for delivering complex financial services and maintaining its market position.

Operational and administrative expenses are a significant component of The Bank of New York Mellon's cost structure, encompassing the day-to-day running of its extensive global operations. These costs include essential elements like maintaining office spaces worldwide, covering utilities, and engaging professional services such as legal and consulting firms. In 2023, BNY Mellon reported non-interest expenses of $12.6 billion, a substantial portion of which is attributable to these overheads.

Compliance and Regulatory Costs

BNY Mellon faces significant expenses in maintaining compliance with the complex web of financial regulations. These costs are essential for operating legally and managing associated risks.

In 2023, BNY Mellon reported that its total operating expenses were $15.6 billion. A notable portion of this is allocated to compliance, legal, and risk management functions, reflecting the demanding regulatory landscape of the banking sector.

- Regulatory Compliance: Costs associated with adhering to rules from bodies like the SEC, Federal Reserve, and international regulators.

- Legal Services: Expenses for legal counsel, contract reviews, and litigation defense.

- Risk Management: Investment in systems and personnel to identify, assess, and mitigate financial, operational, and compliance risks.

Marketing and Sales Expenses

Marketing and sales expenses are a significant component of The Bank of New York Mellon's (BNY Mellon) cost structure, directly impacting client acquisition and retention. These costs encompass a broad range of activities aimed at building and maintaining relationships with a diverse client base, from institutional investors to corporations.

BNY Mellon invests in comprehensive marketing campaigns to enhance brand visibility and attract new clients. Furthermore, substantial resources are allocated to its sales force, covering compensation, training, and the infrastructure needed for effective client engagement. These efforts are crucial for securing and expanding business across its various service lines, including investment servicing, investment management, and markets and wealth services.

- Client Acquisition Costs: BNY Mellon incurs costs related to attracting new clients, such as advertising, digital marketing, and participation in industry events.

- Relationship Management: Expenses for dedicated relationship managers who nurture existing client ties and identify opportunities for cross-selling services are a key cost driver.

- Sales Force Compensation: This includes salaries, commissions, and bonuses for the sales teams responsible for generating revenue.

- Brand Building and Engagement: Investments in public relations, content marketing, and client-specific events contribute to brand loyalty and market presence.

BNY Mellon's cost structure is heavily influenced by its substantial investments in technology and its large, skilled workforce. Personnel costs, including salaries and benefits for its global team, are a primary expense, as demonstrated by the $2.1 billion in compensation and benefits reported in Q1 2024. Additionally, the bank allocates significant funds to operational and administrative overheads, encompassing everything from office maintenance to legal and consulting services, with total non-interest expenses reaching $12.6 billion in 2023.

| Expense Category | 2023 (in billions USD) | Q1 2024 (in billions USD) |

|---|---|---|

| Technology & Development | $2.7 | N/A (Specific Q1 data not provided) |

| Personnel & Compensation | N/A (Included in total operating expenses) | $2.1 (Q1 2024) |

| Total Non-Interest Expenses | $12.6 | N/A (Specific Q1 data not provided) |

| Total Operating Expenses | $15.6 | N/A (Specific Q1 data not provided) |

Revenue Streams

Fee revenue from investment services is a cornerstone for Bank of New York Mellon (BNY Mellon). This income is primarily generated through fees for asset servicing, custody, fund administration, and corporate trust services. These fees are directly linked to the substantial volume and value of assets BNY Mellon holds under custody and administration.

As of the first quarter of 2024, BNY Mellon reported significant fee revenue, with its Investment Services segment playing a crucial role. The company's Assets Under Custody and Administration (AUC/A) reached an impressive $45.7 trillion in Q1 2024, underscoring the scale of its operations and the revenue potential derived from these services.

Net Interest Income (NII) is a core revenue generator for Bank of New York Mellon (BNY Mellon). It’s the profit a bank makes from lending money and receiving interest, minus the interest it pays out on deposits and borrowings. For instance, in the first quarter of 2024, BNY Mellon reported NII of $1.04 billion, a slight decrease from the previous quarter, reflecting the dynamic interest rate environment.

This revenue stream is highly sensitive to changes in interest rates, as well as the bank's ability to manage its balance sheet effectively. A larger proportion of lower-cost deposits relative to interest-earning assets can boost NII. BNY Mellon’s focus on managing its deposit base and investment portfolio plays a crucial role in optimizing this vital revenue stream.

Investment management fees form a core revenue stream for BNY Mellon, primarily generated from managing client investment portfolios. These fees are typically structured as a percentage of the total assets under management (AUM), meaning as BNY Mellon's clients' investments grow, so does this revenue source.

In the first quarter of 2024, BNY Mellon reported investment management fees of $1.1 billion. This reflects the substantial scale of assets they oversee and the consistent demand for their portfolio management expertise across various asset classes.

Foreign Exchange and Trading Revenue

Bank of New York Mellon (BNY Mellon) generates revenue through foreign exchange (FX) transactions and various trading activities. These services are offered to clients, and the firm also engages in trading for its own portfolio. Market volatility plays a significant role in the volume and profitability of these revenue streams.

- Foreign Exchange Revenue: BNY Mellon facilitates FX transactions for clients, earning fees and spreads on currency trades.

- Trading Revenue: This includes income from the firm's proprietary trading activities and commissions earned from executing trades on behalf of clients across various asset classes.

- Impact of Volatility: Increased market volatility can lead to higher trading volumes and potentially greater revenue from FX and trading, though it also introduces higher risk.

- 2024 Data Insight: For the first quarter of 2024, BNY Mellon reported total revenue of $4.36 billion, with trading and foreign exchange activities contributing significantly to this figure, reflecting ongoing client activity and market dynamics.

Clearing and Collateral Management Fees

Clearing and collateral management fees are a significant revenue driver for BNY Mellon. These fees stem from facilitating the settlement of securities trades and ensuring that parties involved in financial transactions have sufficient collateral to cover potential risks. In 2023, BNY Mellon reported substantial revenue from its Pershing segment, which includes clearing services, and its Markets segment, which encompasses collateral management. For instance, their Asset Servicing business, which handles collateral, generated billions in revenue.

- Securities Clearing: BNY Mellon earns fees for processing and settling trades across various asset classes, ensuring timely delivery of securities and cash.

- Collateral Management: Fees are generated from managing and optimizing collateral for clients, particularly in derivatives and securities lending, to meet regulatory and counterparty requirements.

- Transaction Volume: Revenue in this area is directly tied to the volume and value of securities transactions processed and the amount of collateral managed.

BNY Mellon's revenue streams are diverse, encompassing fees from investment services, net interest income, investment management, foreign exchange and trading, and clearing and collateral management. These segments collectively form the backbone of its financial performance.

In the first quarter of 2024, BNY Mellon reported total revenue of $4.36 billion, with its fee-based businesses, particularly asset servicing and investment management, showing resilience. The company's substantial Assets Under Custody and Administration (AUC/A) of $45.7 trillion in Q1 2024 highlight the scale of its fee-generating operations.

| Revenue Stream | Description | Q1 2024 Highlight |

|---|---|---|

| Fee Revenue (Investment Services) | Fees for asset servicing, custody, fund administration, corporate trust. | AUC/A reached $45.7 trillion. |

| Net Interest Income (NII) | Profit from lending minus interest paid on deposits/borrowings. | Reported $1.04 billion in Q1 2024. |

| Investment Management Fees | Percentage of assets under management (AUM). | Generated $1.1 billion in Q1 2024. |

| FX & Trading Revenue | Fees/spreads from currency transactions and proprietary trading. | Contributed significantly to total Q1 2024 revenue. |

| Clearing & Collateral Management | Fees for trade settlement and collateral optimization. | Billions generated from Asset Servicing and Pershing. |

Business Model Canvas Data Sources

The Bank of New York Mellon's Business Model Canvas is informed by a blend of internal financial reporting, extensive market research on global financial services, and strategic analysis of industry trends and competitive landscapes. These diverse data sources ensure a comprehensive and accurate representation of the bank's operations and strategic direction.