BMC Software SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BMC Software Bundle

BMC Software, a leader in IT management solutions, possesses significant strengths in its established customer base and robust product portfolio, but faces challenges from intense market competition and evolving technological landscapes. Understanding these dynamics is crucial for any stakeholder looking to navigate the enterprise software sector.

Ready to dive deeper into BMC's strategic positioning? Purchase the complete SWOT analysis to uncover detailed insights into their competitive advantages, potential threats, and growth opportunities, empowering you to make informed decisions.

Strengths

BMC Software boasts a commanding presence in the enterprise IT sector, especially within IT operations management (ITOM), IT service management (ITSM), and automation. Its solutions are consistently lauded by industry analysts, cementing its status as a leader. This established market leadership is further underscored by BMC's impressive client roster, which includes 86% of the Forbes Global 50, demonstrating significant trust and deep integration within major global corporations.

BMC boasts a robust and forward-thinking product suite designed to tackle complex IT challenges. Key offerings like BMC Helix for AIOps, BMC Control-M for workload automation, and BMC Compuware for mainframe modernization provide end-to-end solutions. This comprehensive approach ensures they can meet a wide array of customer needs in critical IT management areas.

The company's commitment to innovation is evident in its sustained investment in research and development. Since 2020, BMC has launched more than 20 new and improved products, demonstrating a proactive strategy to stay ahead of technological advancements and evolving market demands.

BMC is a leader in embedding AI and automation into its enterprise solutions, a significant strength that directly addresses the growing demand for intelligent IT operations. This focus positions BMC favorably in a market increasingly driven by efficiency and predictive capabilities.

The company's commitment is evident in recent product updates. The May 2025 release of BMC Helix 25.2 introduced advanced agentic AI features, showcasing BMC's dedication to pushing the boundaries of AI integration. Furthermore, the 2024 launch of BMC AMI Assistant for mainframe developers highlights AI's role in modernizing legacy systems through enhanced code understanding and development workflows.

Strategic Business Model Transformation

BMC's strategic pivot to split into two distinct entities, BMC and BMC Helix, effective early 2025, is a significant strength. This separation is designed to enhance operational agility and enable a more targeted market approach. BMC will concentrate on mainframe optimization and automation, while BMC Helix will spearhead AI-driven service and operations management, allowing each to better serve its respective customer base.

This business model transformation is expected to unlock greater value by allowing each company to pursue specialized growth strategies. For instance, BMC Helix's focus on AI aligns with the growing demand for intelligent automation in IT service management, a market projected to see continued expansion through 2025 and beyond. This specialization can lead to more innovative product development and a stronger competitive position in their respective niches.

The split is anticipated to improve capital allocation efficiency, with each business unit able to invest more precisely in its core competencies and growth opportunities. This focused investment strategy is crucial for navigating the rapidly evolving technology landscape and maintaining a competitive edge. The move reflects a commitment to adapting the business structure to better meet market demands and shareholder expectations.

- Strategic Split: BMC is dividing into BMC and BMC Helix in early 2025 to foster agility and market focus.

- Specialized Focus: BMC will target mainframe optimization, while BMC Helix will lead in AI-driven service and operations management.

- Market Alignment: This transformation positions BMC Helix to capitalize on the increasing demand for AI in IT service management.

- Value Enhancement: The move aims to improve capital allocation and drive specialized growth for each entity.

Successful Transition to Subscription-Based Revenue

BMC Software has demonstrated considerable strength by successfully shifting its business model to prioritize subscription-based revenue. This strategic move is a significant accomplishment, as subscription sales now represent a substantial portion of their overall income, nearing 60% of total sales. This transition is a key driver for BMC's financial stability.

The move towards subscriptions is more than just a change in sales method; it's a fundamental improvement in revenue predictability. This means BMC can anticipate its income with greater accuracy, which is crucial for long-term planning and investment. The company's performance is expected to benefit from this more consistent financial inflow.

- Subscription Revenue Dominance: Subscription sales constitute nearly 60% of BMC Software's total revenue, highlighting a successful business model transformation.

- Revenue Predictability: This shift to subscriptions provides a more stable and predictable revenue stream, reducing financial volatility.

- Sustained Growth Foundation: The predictable income from subscriptions is expected to fuel sustained growth and enhance overall financial performance for the company.

BMC's market leadership, particularly in ITOM and ITSM, is a significant strength, with 86% of the Forbes Global 50 relying on their solutions. Their comprehensive product suite, including BMC Helix and Control-M, addresses complex IT needs, further bolstered by over 20 new and improved products launched since 2020, demonstrating a commitment to innovation.

The company's strategic split into BMC and BMC Helix in early 2025 is a key strength, allowing for specialized focus on mainframe optimization and AI-driven IT management, respectively. This move is designed to enhance agility and capitalize on market trends, particularly the growing demand for AI in IT service management, expected to drive specialized growth and improve capital allocation efficiency.

BMC has successfully transitioned to a subscription-based revenue model, with subscriptions now accounting for nearly 60% of total sales. This shift significantly improves revenue predictability, providing a stable foundation for sustained growth and enhancing overall financial performance.

What is included in the product

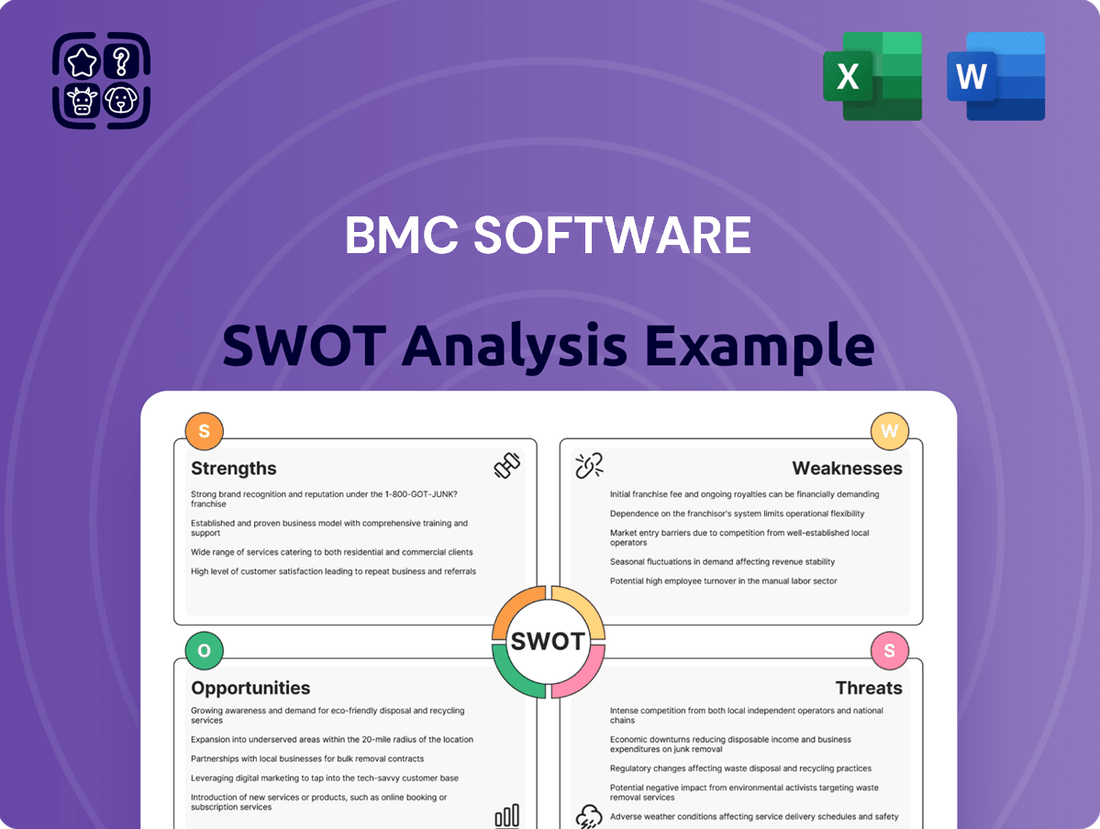

This SWOT analysis provides a comprehensive look at BMC Software's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear visual representation of BMC's strategic landscape, simplifying complex internal and external factors for focused action.

Weaknesses

While BMC strives for user-friendly interfaces, some users find configuring BMC Helix ITSM challenging, requiring specialized training. This complexity can extend implementation timelines and create a steeper learning curve, potentially raising initial client operational expenses.

While BMC Helix ITSM boasts robust functionality, a portion of customer feedback points to its user interface being perceived as dated. This sentiment, particularly concerning the search capabilities, could potentially hinder user experience and adoption rates when contrasted with contemporary, more intuitive market alternatives.

Some BMC Software customers have voiced concerns regarding the responsiveness and effectiveness of their initial customer support interactions. Reports indicate that users sometimes struggle to get adequate assistance or find timely resolutions, with the first tier of support being described as potentially lacking in expertise and slow to escalate complex issues to specialized teams.

This can understandably lead to significant frustration for clients, particularly when dealing with intricate technical challenges that require deep product knowledge. Such experiences can negatively impact overall customer satisfaction and potentially hinder the perceived value of BMC's offerings, especially in a competitive market where prompt and competent support is a key differentiator.

Intense Competition in the Enterprise Software Market

BMC faces a fiercely competitive landscape in enterprise software, contending with giants like ServiceNow, Atlassian, Microsoft, and SolarWinds, alongside agile newcomers. This intense rivalry directly impacts pricing power and necessitates accelerated innovation to defend market share. For instance, the IT service management (ITSM) market, a key area for BMC, saw significant growth in 2024, with analysts projecting it to reach over $20 billion globally by 2025, highlighting the high stakes and crowded nature of the space.

The constant need to invest in research and development to keep pace with evolving customer demands and emerging technologies presents a significant challenge. Competitors are consistently launching new features and solutions, forcing BMC to allocate substantial resources to maintain its product relevance and competitive edge. This pressure is evident as many of BMC's competitors have reported strong double-digit revenue growth in their cloud-based offerings throughout 2024, underscoring the rapid pace of technological advancement and market adoption.

- Intense Rivalry: BMC must constantly innovate against established and emerging enterprise software vendors.

- Pricing Pressure: High competition limits BMC's ability to command premium pricing for its solutions.

- Market Share Defense: Maintaining and growing market share requires substantial and continuous investment in product development and marketing.

- Innovation Demands: Keeping pace with rapid technological shifts and competitor advancements is a critical and costly undertaking.

Risk Associated with Strategic Corporate Split

While BMC Software's 2023 strategic split into two entities, BMC and BMC Helix, was designed to foster focused growth, it introduced inherent weaknesses. The transition itself created operational complexities, demanding careful navigation to ensure seamless integration and ongoing service delivery for customers. For instance, during the separation, maintaining consistent customer support across both newly formed businesses required significant resource allocation and process refinement.

A key challenge lies in clearly articulating the distinct value propositions of BMC and BMC Helix to a diverse customer base. Without precise communication, existing clients might experience uncertainty regarding product roadmaps and support structures, potentially impacting retention. This was evident in the initial post-split period where some analysts noted a need for clearer messaging on how each entity would address specific market needs, particularly in the hybrid cloud management space.

The period of transition also posed a risk of temporary disruption. For example, the integration of IT systems and the alignment of sales and marketing efforts for two separate entities could have led to minor service interruptions or a lag in new product introductions. This uncertainty could have provided competitors an opening to capture market share if not managed proactively.

- Operational Complexity: The split necessitated the disentanglement of shared resources and systems, potentially leading to inefficiencies during the transition phase.

- Value Proposition Clarity: Communicating the distinct benefits of each new company to customers and the market required a robust and clear strategy to avoid confusion.

- Customer Uncertainty: The restructuring could have created apprehension among existing clients regarding future product development, support, and pricing models.

BMC's competitive positioning is challenged by a crowded enterprise software market, with rivals like ServiceNow and Microsoft actively innovating. This intense rivalry, particularly in the ITSM sector projected to exceed $20 billion globally by 2025, puts pressure on BMC's pricing power and necessitates continuous, significant investment in research and development to maintain product relevance and market share.

The recent strategic split into BMC and BMC Helix, while aimed at focused growth, introduced operational complexities and the challenge of clearly articulating distinct value propositions. This transition period risked customer uncertainty regarding future roadmaps and support, potentially creating opportunities for competitors if not managed with precision.

User experience is another area of concern, with some customers finding BMC Helix ITSM configuration challenging, requiring specialized training and potentially increasing initial operational costs. Additionally, feedback suggests that the user interface, particularly search functionalities, is perceived as dated compared to more modern alternatives, which could impact adoption rates.

Customer support has also been a point of contention, with reports of initial interactions lacking responsiveness and expertise, leading to delays in resolving complex technical issues. This can negatively impact customer satisfaction and the perceived value of BMC's offerings in a market where prompt, knowledgeable support is a key differentiator.

Preview the Actual Deliverable

BMC Software SWOT Analysis

This is the same BMC Software SWOT analysis document included in your download. The full content is unlocked after payment, giving you a comprehensive understanding of their strategic position.

You’re viewing a live preview of the actual BMC Software SWOT analysis file. The complete version, detailing their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

The file shown below is not a sample—it’s the real BMC Software SWOT analysis you'll download post-purchase, in full detail. This allows for immediate strategic planning.

Opportunities

The enterprise software sector is booming, largely fueled by a strong push towards AI and hyperautomation. BMC is well-positioned to capitalize on this trend.

By 2025, AI and machine learning are anticipated to be embedded in a remarkable 90% of enterprise applications. Furthermore, the market for software that enables hyperautomation is forecast to approach $600 billion by the same year, highlighting substantial expansion opportunities for BMC's AI-centric solutions.

The enterprise software market is seeing a massive shift towards cloud and hybrid IT, with organizations actively migrating workloads. BMC is well-positioned to benefit from this trend, as evidenced by its continued investment in cloud-first solutions and hybrid IT management capabilities. For instance, BMC's BMC AMI Cloud offering directly addresses the need for scalable and cost-efficient data management in these evolving environments, particularly for mainframe data.

The enterprise application software market is poised for significant expansion, with projections indicating an increase of USD 146.5 billion between 2024 and 2029, growing at a compound annual growth rate of 7.9%. This substantial market growth presents a prime opportunity for BMC to broaden its customer base and capture a greater market share.

Furthermore, the global IT Service Management (ITSM) software market is expected to reach $15.4 billion by 2029. This upward trend in ITSM adoption underscores the increasing reliance on efficient IT operations and service delivery, areas where BMC's solutions are well-positioned to excel.

Strategic Acquisitions to Enhance Portfolio and Capabilities

BMC has a proven track record of growth through strategic acquisitions. For instance, the acquisition of Netreo in April 2024 bolstered its capabilities in observability and AIOps, while the April 2023 acquisition of Model9 expanded its mainframe data migration and cloud integration services. These moves highlight BMC's commitment to inorganic growth by integrating cutting-edge technologies and expanding its service offerings.

Continuing this strategy of targeted acquisitions presents a significant opportunity for BMC. By acquiring companies with complementary technologies or established market positions, BMC can accelerate its product development, enter new market segments, and enhance its overall competitive standing. This approach allows for quicker integration of advanced solutions, such as AI-driven automation and enhanced cloud management tools, to meet evolving customer demands.

- Acquisition of Netreo (April 2024): Strengthened observability and AIOps capabilities.

- Acquisition of Model9 (April 2023): Enhanced mainframe data migration and cloud integration.

- Future Acquisitions: Potential to integrate AI, cloud, and cybersecurity technologies.

- Market Expansion: Opportunity to gain market share in emerging technology segments.

Leveraging Generative AI for Enhanced Product Functionality

BMC's strategic integration of generative AI across its extensive product suite offers a compelling avenue for growth. By enabling customers to incorporate their proprietary large language models and data sources, BMC is fostering a more personalized and powerful user experience.

This capability directly translates into enhanced automation, smarter predictive analytics for improved decision-making, and a superior overall customer engagement. For instance, in 2024, the AI market is projected to reach $196.6 billion, highlighting the significant demand for such advanced functionalities.

- Adaptive Automation: Generative AI allows BMC's solutions to learn and adapt to unique customer workflows, streamlining complex processes.

- Data-Driven Insights: Customers can leverage their own data with AI to unlock deeper, more actionable insights for strategic planning.

- Personalized Experiences: The ability to integrate custom LLMs means end-users receive more relevant and tailored interactions with BMC software.

The enterprise software market is expanding rapidly, with a projected increase of USD 146.5 billion between 2024 and 2029, at a 7.9% CAGR. BMC is well-positioned to capture a larger share of this growth. The increasing adoption of AI and hyperautomation, with AI expected in 90% of enterprise applications by 2025 and the hyperautomation market nearing $600 billion, presents significant opportunities for BMC's AI-centric solutions.

BMC's strategic acquisitions, such as Netreo in April 2024 and Model9 in April 2023, have bolstered its capabilities in observability, AIOps, and mainframe data management. This inorganic growth strategy allows BMC to quickly integrate new technologies and expand its offerings, tapping into evolving customer demands for AI, cloud, and cybersecurity solutions.

The company's integration of generative AI across its product suite is a key growth driver. By allowing customers to use their own large language models and data, BMC enhances automation, provides smarter analytics, and creates more personalized user experiences, capitalizing on the AI market projected to reach $196.6 billion in 2024.

| Opportunity Area | Market Projection | BMC Relevance |

| Enterprise Software Market Growth | USD 146.5 billion increase (2024-2029), 7.9% CAGR | Broadens customer base and market share potential. |

| AI & Hyperautomation Adoption | AI in 90% of enterprise apps by 2025; Hyperautomation market near $600 billion (2025) | Leverages BMC's AI-centric solutions for advanced automation. |

| Strategic Acquisitions | Acquired Netreo (April 2024), Model9 (April 2023) | Enhances capabilities in observability, AIOps, and cloud integration. |

| Generative AI Integration | AI market $196.6 billion (2024) | Drives personalized experiences and enhanced automation for customers. |

Threats

BMC Software operates in a highly competitive landscape, facing significant pressure from major software vendors such as ServiceNow, Atlassian, Microsoft, and Broadcom. These competitors are also making substantial investments in developing and enhancing their IT management and automation solutions, directly challenging BMC's market position.

The aggressive product development and marketing by these rivals could lead to BMC experiencing a reduction in its market share. Furthermore, this intensified competition may force BMC to adjust its pricing strategies, potentially impacting its profit margins and revenue growth.

The relentless march of technology, especially in areas like AI and automation, presents a significant threat. BMC must constantly adapt and integrate these advancements to stay ahead. For instance, the global AI market was projected to reach $196.65 billion in 2023 and is expected to grow substantially, highlighting the speed of innovation BMC must match.

Failure to keep pace with these rapid technological shifts, or being outmaneuvered by nimble startups leveraging new tech, could seriously erode BMC's market standing. This continuous need for innovation requires substantial R&D investment, which can strain resources if not managed effectively.

As BMC Software increasingly relies on cloud environments for its solutions, safeguarding customer data and ensuring privacy are paramount. The threat of data breaches, amplified by the growing sophistication of cyberattacks, poses a significant risk. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, a figure that underscores the potential financial fallout for BMC.

Compliance with a patchwork of evolving data privacy regulations, such as GDPR and CCPA, presents another substantial challenge. Failure to adhere to these complex legal frameworks can result in hefty fines and erode customer trust. In 2023, regulatory fines related to data privacy violations saw a notable increase, highlighting the heightened scrutiny faced by technology companies operating in the cloud.

Talent Shortage in Specialized IT Fields

The IT sector, especially in niche areas like mainframe operations and cutting-edge AI development, is experiencing a significant talent deficit. This scarcity directly impacts BMC's capacity to innovate, deploy, and maintain its sophisticated software solutions. For instance, a 2024 report indicated that globally, there were over 10 million unfilled IT positions, with a disproportionate number in cybersecurity and AI, critical areas for BMC's portfolio.

This talent gap can hinder BMC's product roadmap execution and its ability to provide timely, expert support to its clientele. Furthermore, it affects BMC's customers, potentially limiting their ability to leverage BMC's advanced capabilities, which could slow down product adoption and lead to user frustration.

- Talent Gap Impact: Difficulty in developing and supporting specialized IT solutions.

- Customer Adoption Risk: Potential for slower uptake and dissatisfaction due to customer inability to fully utilize complex products.

- Market Trend: Over 10 million unfilled IT roles globally in 2024, with high demand in AI and mainframe skills.

Economic Downturns and Reduced IT Spending

Global economic uncertainties, particularly those observed into 2024 and projected for 2025, present a significant threat through reduced enterprise IT spending. This slowdown directly impacts BMC's revenue streams and growth forecasts, as organizations tighten budgets. For instance, a projected global GDP slowdown in 2024, estimated by the IMF to be around 3.2%, could translate into lower IT investment across industries.

While BMC's solutions are designed to enhance efficiency and cut costs, which are attractive during economic downturns, a widespread market contraction can still limit overall demand. This means even with compelling value propositions, the total addressable market for BMC's offerings may shrink, posing a challenge to sales targets and market share expansion efforts in the near term.

- Reduced IT Budgets: Forecasts for 2024 and 2025 indicate a potential contraction in IT spending by 1-3% in some sectors due to economic headwinds, impacting BMC's sales pipeline.

- Delayed Projects: Enterprises facing economic uncertainty may postpone or cancel IT modernization and software upgrade projects, directly affecting BMC's project-based revenue.

- Increased Price Sensitivity: Customers are likely to become more price-sensitive, demanding deeper discounts and potentially impacting BMC's profit margins.

Intense competition from major players like ServiceNow and Microsoft, coupled with rapid technological advancements in AI and automation, poses a significant threat to BMC's market position. Failure to innovate quickly or integrate these new technologies could lead to market share erosion and reduced profitability, especially as the global AI market continues its substantial growth trajectory.

Data breaches and evolving privacy regulations present substantial risks, with the average cost of a data breach reaching $4.45 million in 2024. Navigating complex compliance frameworks like GDPR and CCPA is crucial to avoid hefty fines and maintain customer trust, a challenge amplified by increasing regulatory scrutiny.

A critical talent shortage in specialized IT fields, particularly AI and mainframe operations, hinders BMC's ability to develop and support its sophisticated solutions. With over 10 million unfilled IT roles globally in 2024, this gap can slow product roadmaps and impact customer adoption, potentially leading to dissatisfaction.

Global economic uncertainties, including a projected 3.2% global GDP slowdown in 2024, could reduce enterprise IT spending. This economic headwind may lead to delayed projects and increased price sensitivity among customers, impacting BMC's revenue and profit margins despite the inherent cost-saving benefits of its offerings.

| Threat Category | Specific Challenge | Impact on BMC | Relevant Data Point |

|---|---|---|---|

| Competition | Aggressive innovation by rivals | Market share erosion, pricing pressure | Global AI market projected for substantial growth beyond $196.65 billion in 2023 |

| Technology | Keeping pace with AI/automation | Risk of obsolescence, R&D strain | AI market growth highlights rapid innovation pace |

| Cybersecurity & Compliance | Data breaches, privacy regulations | Financial penalties, loss of trust | Average cost of data breach: $4.45 million (2024) |

| Talent Acquisition | Shortage of skilled IT professionals | Hindered product development, support issues | Over 10 million unfilled IT roles globally (2024) |

| Economic Factors | Reduced IT budgets, price sensitivity | Lower revenue, margin pressure | Projected global GDP slowdown of ~3.2% (2024) |

SWOT Analysis Data Sources

This BMC Software SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence reports, and expert commentary from industry analysts to ensure a robust and accurate strategic overview.