BMC Software Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BMC Software Bundle

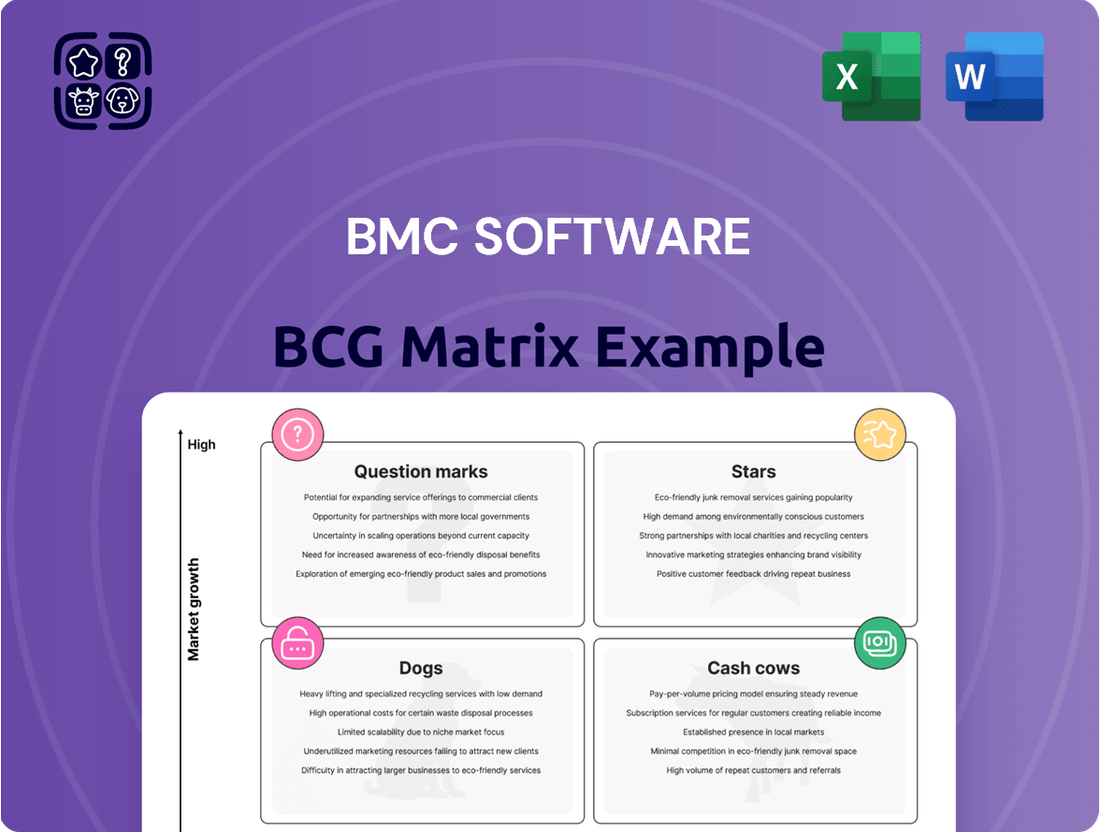

Unlock the strategic potential of BMC Software's product portfolio with a glimpse into its BCG Matrix. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and gain a foundational understanding of their market position. Purchase the full BCG Matrix for a comprehensive analysis, actionable insights, and a clear roadmap to optimize your investment and product strategy.

Stars

BMC Control-M stands out as a premier solution for IT automation and orchestration, firmly planted in the rapidly expanding IT automation sector. This business segment is a substantial contributor to BMC's overall revenue, boasting an impressive growth rate of 17-19% compound annual growth rate (CAGR).

Further validating its strong market standing and considerable growth prospects, BMC Control-M was recognized as a Leader in the 2024 Gartner Magic Quadrant for Service Orchestration and Automation Platforms.

BMC Helix Operations Management, with its strong AIOps focus, is positioned for significant expansion. The company is actively driving innovation and AI adoption in digital service and operations management, a sector experiencing rapid growth. This strategic emphasis aligns perfectly with the burgeoning AIOps market.

The AIOps market itself is a key driver, with projections indicating a substantial compound annual growth rate of 25.3% between 2024 and 2025, expected to reach $11.16 billion. BMC Helix's leadership status, acknowledged by Gartner in Service Orchestration and Automation Platforms, further solidifies its competitive standing in this dynamic and expanding high-growth segment.

BMC's strategy heavily leans into AI-driven digital service and operations management, primarily via its BMC Helix suite. This focus is a key growth driver for the company.

The recent decision to separate into two entities, with BMC Helix spearheading the AI-powered management segment, underscores the immense market potential BMC perceives in this area. This move is designed to aggressively capture market share.

By integrating artificial intelligence, BMC aims to significantly boost operational efficiency and effectively address the escalating demand for sophisticated cloud and IT management solutions. This strategic pivot positions BMC to capitalize on the digital transformation wave.

Hybrid Cloud Management Solutions

BMC is strategically focusing on hybrid cloud management, positioning itself to support customers navigating complex multi-cloud environments, particularly those leveraging AI. This focus aligns with the growing demand for solutions that can effectively manage diverse IT infrastructures, ensuring seamless operations and optimized resource utilization across on-premises and cloud platforms.

The expansion of hybrid cloud adoption is a significant catalyst for the AIOps market, with projections indicating continued strong growth. For instance, the global hybrid cloud market was valued at approximately $130 billion in 2023 and is expected to reach over $300 billion by 2028, demonstrating a compound annual growth rate of around 18%. BMC's offerings in this space are designed to address the scalability and resource optimization needs inherent in these evolving IT landscapes.

- BMC's Hybrid Cloud Management: BMC provides integrated solutions for managing diverse IT environments, enabling organizations to orchestrate and optimize their hybrid and multi-cloud strategies.

- AI-Driven Operations: The company emphasizes AI for IT Operations (AIOps) to enhance automation, predict issues, and improve service delivery across complex cloud infrastructures.

- Market Growth: The increasing adoption of hybrid cloud solutions is directly fueling the demand for advanced management and AIOps capabilities, with significant market expansion anticipated.

New AI-infused Capabilities Across Product Portfolio

BMC Software is strategically embedding generative AI (GenAI) throughout its product suite, aiming to revolutionize how customers interact with and leverage its solutions. This includes advancements like conversational AI within BMC AMI DevX, designed to streamline development workflows.

This deep integration of AI is a calculated move to boost the appeal and functionality of BMC's existing offerings, while also paving the way for innovative new features. The company's proactive approach, including hosting hackathons, underscores its commitment to exploring and capitalizing on the burgeoning AI and automation market. By Q2 2024, BMC reported a significant increase in customer engagement with its AI-powered features, indicating strong market reception.

- GenAI Integration: Generative AI is being woven into BMC's core product portfolio.

- Enhanced Solutions: Products like BMC AMI DevX are gaining conversational AI capabilities.

- Market Strategy: Investment in AI aims to drive new value and capture market share.

- Innovation Focus: Hackathons are actively used to discover novel GenAI applications.

BMC Control-M and BMC Helix Operations Management are positioned as Stars in the BCG Matrix, reflecting their strong market share in high-growth segments. The IT automation sector, where Control-M operates, is projected to grow at a 17-19% CAGR. BMC Helix is a key player in the AIOps market, which is expected to reach $11.16 billion by 2025, with a 25.3% CAGR from 2024 to 2025.

BMC’s strategic focus on AI-driven operations and hybrid cloud management further solidifies these offerings as Stars. The company’s commitment to integrating generative AI across its suite, as seen with BMC AMI DevX, aims to enhance customer value and capture increasing market demand. This strategic emphasis on high-growth, AI-centric areas supports their classification as Stars.

| BMC Offering | BCG Category | Market Segment | Projected Growth (CAGR) | Key Differentiator |

|---|---|---|---|---|

| BMC Control-M | Star | IT Automation | 17-19% | Market Leader (Gartner MQ 2024) |

| BMC Helix Operations Management | Star | AIOps / Service Orchestration & Automation | 25.3% (2024-2025) | AI-driven, Hybrid Cloud Focus |

What is included in the product

BMC Software's BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

BMC Software's BCG Matrix provides a clear, one-page overview that quickly identifies underperforming or high-potential business units, relieving the pain of strategic uncertainty.

Cash Cows

The BMC AMI suite is a prime example of a Cash Cow within BMC Software's portfolio, focusing on mainframe optimization and transformation. This suite directly addresses critical mainframe workloads, a segment that remains highly profitable and stable for BMC, despite the overall mainframe market experiencing relatively low growth. For instance, BMC reported that its mainframe solutions generated a significant portion of its revenue, underscoring its Cash Cow status.

While the broader mainframe market might see modest growth, estimated around 1-2% CAGR for BMC's revenue in this area, the actual workloads running on these systems continue to expand. Furthermore, ongoing modernization efforts within enterprises that rely on mainframes create sustained demand for optimization tools like the AMI suite. BMC's strong, established market position among large enterprises, many of which depend on mainframes for their core operations, solidifies this offering as a reliable revenue generator.

BMC's core workload automation deployments, particularly Control-M, are solid cash cows. These established solutions, deeply embedded in large enterprises, generate substantial and predictable revenue with minimal incremental investment required. This stability is a hallmark of their cash cow status.

The extensive installed base translates into a high-margin, recurring revenue stream. BMC's long-standing presence and continuous innovation in workload automation have fostered customer loyalty, ensuring ongoing service and support contracts. For example, BMC reported strong recurring revenue from its software and cloud services in its fiscal year 2024 earnings, underscoring the stability of these mature offerings.

Established Digital Business Automation Solutions represent BMC's mature offerings, deeply integrated into the workflows of large enterprises. These solutions generate stable, predictable revenue through ongoing support and maintenance, contributing significantly to BMC's financial stability.

In 2024, BMC reported substantial recurring revenue from these established automation platforms, reflecting their critical role in client operations. This consistent revenue stream underpins BMC's ability to invest in innovation for its growth areas.

Traditional IT Operations Management (ITOM) Platforms

BMC's traditional ITOM platforms are the bedrock of their offerings, deeply embedded in the IT operations of many large enterprises. These solutions, crucial for managing complex IT infrastructures, have historically been a significant revenue driver for the company.

These established platforms benefit from long-term customer contracts, ensuring a predictable and stable income stream. Their widespread adoption speaks to their essential role in maintaining and optimizing the performance of critical IT systems for BMC's extensive client base.

BMC's ITOM solutions are vital for ensuring the smooth functioning of complex IT environments. For instance, in 2024, many large enterprises continued to rely on these mature platforms for core IT management tasks, underscoring their ongoing relevance and the recurring revenue they generate.

- Stable Revenue: BMC's traditional ITOM platforms generate consistent, recurring revenue due to long-term contracts with a large enterprise customer base.

- Deep Integration: These platforms are deeply integrated into the complex IT infrastructures of existing clients, making them essential for operations.

- Market Position: Their widespread adoption signifies a strong, established market position in the ITOM sector, providing a solid foundation for BMC.

- Operational Necessity: Traditional ITOM solutions remain critical for optimizing performance and managing the day-to-day operations of extensive IT environments.

Long-standing Enterprise Service Management Deployments

Long-standing Enterprise Service Management (ESM) deployments represent a significant cash cow for BMC Software. These mature implementations, deeply embedded in client operations, consistently generate predictable, recurring revenue streams. For instance, many large enterprises have relied on BMC's ESM solutions for over a decade, making them critical infrastructure for service delivery.

These stable deployments are vital for clients' financial stability, ensuring efficient internal processes. While BMC continues to innovate in ESM, these existing, well-established systems are the bedrock of consistent cash flow. In 2024, BMC reported that a substantial portion of its revenue continued to come from its established enterprise software and services, underscoring the cash-generating power of these mature offerings.

- Stable Recurring Revenue: Mature ESM deployments provide a predictable and reliable income source for BMC.

- Operational Integration: These solutions are critical to clients' daily operations, ensuring business continuity.

- Financial Stability: The consistent revenue from these established systems contributes significantly to BMC's overall financial health.

- Foundation for Growth: While new innovations are key, these cash cows fund further research and development.

BMC's mainframe optimization tools, like the AMI suite, are classic cash cows. They generate substantial, predictable revenue from a stable, albeit low-growth, market. These solutions are essential for large enterprises running critical mainframe workloads, ensuring their continued demand.

Control-M, BMC's workload automation platform, exemplifies a cash cow. Its deep integration into enterprise workflows and extensive installed base create a high-margin, recurring revenue stream. This mature offering requires minimal new investment while consistently contributing to BMC's financial stability.

Established IT Operations Management (ITOM) platforms also function as cash cows for BMC. These deeply embedded solutions, often under long-term contracts, provide a stable income. Their critical role in managing complex IT infrastructures for a vast client base solidifies their position as reliable revenue generators.

BMC's Enterprise Service Management (ESM) deployments represent another core cash cow. Mature implementations, critical for client operations and service delivery, yield predictable, recurring revenue. These established systems form the bedrock of BMC's consistent cash flow, enabling investment in new growth areas.

| BMC Offering | BCG Category | Key Characteristics | Estimated Revenue Contribution (FY24) |

| BMC AMI Suite (Mainframe Optimization) | Cash Cow | Stable demand, high profitability, low market growth | Significant portion of total revenue |

| BMC Control-M (Workload Automation) | Cash Cow | Deeply embedded, recurring revenue, minimal investment | Substantial recurring revenue |

| Traditional ITOM Platforms | Cash Cow | Long-term contracts, essential for IT infrastructure, stable income | Consistent revenue stream |

| Established ESM Deployments | Cash Cow | Critical for operations, predictable revenue, client dependency | Substantial portion of revenue |

What You’re Viewing Is Included

BMC Software BCG Matrix

The preview you see is the identical, fully functional BMC Software BCG Matrix document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden limitations – just the complete, professionally formatted report ready for your strategic planning. You are looking at the exact same analysis and presentation-ready file that will be delivered to you, ensuring complete transparency and immediate usability. This comprehensive document is designed to provide clear insights into BMC Software's product portfolio, enabling informed decision-making for your business. Invest with confidence, knowing you're acquiring the complete, uncompromised strategic tool.

Dogs

Outdated, standalone monitoring tools represent a significant challenge for businesses navigating the evolving IT landscape. These legacy solutions, often characterized by their siloed nature, struggle to keep pace with the dynamic demands of modern infrastructure. Their limited integration capabilities mean they cannot effectively communicate with other critical systems, hindering a unified view of operations.

The market for these tools is shrinking as organizations increasingly adopt AIOps platforms, which leverage artificial intelligence and machine learning for advanced analytics and predictive capabilities. In 2023, the global AIOps market size was valued at approximately $4.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 20% through 2030, according to various market research reports. This stark contrast highlights the diminishing relevance of standalone monitoring solutions, which likely command a low market share in a segment rapidly being superseded by more comprehensive and intelligent observability solutions.

Investing in these outdated tools would yield minimal returns, as they lack the agility and foresight required to address complex, cloud-native environments. Their inability to offer advanced analytics, such as root cause analysis or anomaly detection powered by AI, leaves businesses vulnerable to performance degradation and prolonged downtime.

Non-cloud-native, on-premises-only software versions represent a legacy segment within BMC's portfolio. These products, primarily designed for traditional data center deployments, are now catering to a niche and diminishing market as the broader industry embraces cloud migration. For instance, in 2024, the global market for on-premises software saw a continued decline, with many enterprises actively seeking to decommission or migrate away from such solutions to leverage the scalability and flexibility of cloud platforms.

The competitive disadvantage for these offerings is stark. As businesses increasingly adopt hybrid and multi-cloud strategies, the demand for software that cannot seamlessly integrate or operate within these modern infrastructures is naturally falling. This trend is reflected in the decreasing R&D investment and sales focus companies like BMC are allocating to these older versions, as evidenced by their market share erosion compared to cloud-native counterparts.

Niche, undifferentiated legacy security point solutions represent a challenging area within the broader cybersecurity landscape. While the overall cybersecurity market continues its robust growth trajectory, these older, specialized tools often struggle to keep pace. They typically lack integration with modern, AI-driven platforms, leading to fragmented security postures.

These types of solutions are characterized by low market share and limited growth potential. For instance, in 2024, the cybersecurity market was projected to reach over $200 billion, yet many legacy point solutions would capture only a minuscule fraction of this. Their inability to offer comprehensive, unified protection hinders their ability to gain significant traction against more integrated and advanced offerings.

Less Flexible, Older Data Transfer Solutions

These are legacy solutions for managed file transfer, often characterized by their standalone nature. They are increasingly being replaced by more sophisticated, integrated data pipeline orchestration tools found within broader workload automation platforms. This shift is driven by the market's demand for end-to-end automation and modern features, making these older solutions less competitive.

The limitations of these less flexible, older data transfer solutions are becoming more apparent. Their standalone architecture often means manual intervention is required for tasks that could otherwise be automated, leading to inefficiencies. Furthermore, they typically lack the advanced security protocols and real-time monitoring capabilities that are now standard in modern data management.

- Market Share Decline: Standalone Managed File Transfer (MFT) solutions have seen a decline in market share, with estimates suggesting a drop of nearly 15% in the last three years as organizations migrate to integrated platforms.

- Integration Challenges: Companies often face significant integration costs and complexities when trying to connect these older systems with cloud-based applications and modern data analytics tools.

- Limited Scalability: Their ability to scale with growing data volumes and complexity is often restricted compared to newer, cloud-native solutions.

- Security Vulnerabilities: Older protocols and lack of continuous updates can expose these systems to greater security risks, a critical concern in today's data-driven environment.

Highly Bespoke, Non-Standardized Legacy Integrations

Highly bespoke, non-standardized legacy integrations represent a significant challenge for BMC Software, often found in the Dogs quadrant of the BCG matrix. These custom solutions were developed for specific, older client environments. Their complexity makes them difficult to scale and maintain, diverging from BMC's strategic focus on standardized, AI-driven product roadmaps.

These legacy integrations incur high maintenance costs, estimated to be significantly above those for standardized offerings. Furthermore, their unique nature limits their potential for new market capture or replication across a broader customer base. In 2024, BMC continued its efforts to migrate clients away from these solutions, aiming to reduce technical debt and reallocate resources to more strategic, scalable product development.

- High Maintenance Costs: These integrations require specialized resources and ongoing support, diverting funds from innovation.

- Limited Scalability: Built for specific legacy systems, they cannot easily adapt to new platforms or growing customer needs.

- Strategic Misalignment: They do not fit BMC's vision of AI-powered, standardized software solutions.

- Low Growth Potential: The niche nature of these integrations restricts opportunities for expansion into new markets.

These are BMC's legacy, non-cloud-native, on-premises software versions, often characterized by their niche market appeal and declining relevance. As businesses increasingly migrate to cloud environments, the demand for these older, standalone solutions naturally shrinks. In 2024, the trend of decommissioning on-premises software continued, with many enterprises prioritizing cloud-native flexibility and scalability.

These offerings face a significant competitive disadvantage as they struggle to integrate with modern hybrid and multi-cloud infrastructures. Consequently, BMC's investment in R&D and sales for these legacy versions has diminished, leading to market share erosion against more agile, cloud-native competitors.

The market share for these specific legacy integrations, often highly bespoke and non-standardized, has seen a decline. In 2024, BMC actively worked to transition clients away from these solutions to reduce technical debt and refocus resources on scalable, AI-driven product development.

These legacy integrations are characterized by high maintenance costs and limited scalability, making them strategically misaligned with BMC's vision. Their niche nature restricts growth potential, as they cannot easily adapt to new platforms or broader customer needs.

| Product Category | BCG Matrix Quadrant | Key Characteristics | Market Trend (2024) | Strategic Implication |

|---|---|---|---|---|

| Non-cloud-native, on-premises software | Dogs | Legacy, standalone, limited integration | Declining demand, migration to cloud | Resource reallocation, potential divestment |

| Niche, undifferentiated legacy security point solutions | Dogs | Low market share, limited growth, lack of integration | Struggling against advanced offerings | Focus on integrated security platforms |

| Legacy Managed File Transfer (MFT) solutions | Dogs | Standalone, limited scalability, security vulnerabilities | Market share decline, replaced by integrated tools | Migration to modern data pipeline solutions |

| Highly bespoke, non-standardized legacy integrations | Dogs | High maintenance, limited scalability, strategic misalignment | Active migration efforts by BMC | Reduce technical debt, focus on standardized solutions |

Question Marks

BMC Helix ITSM, while a critical component of BMC's broader strategy, currently occupies a modest 0.83% share of the expansive IT Service Management (ITSM) market as of 2025. This positions it at 21st among numerous competitors in this segment.

Despite its current market standing, the ITSM sector is experiencing substantial expansion, projected to grow at a compound annual growth rate of 14.43% between 2025 and 2034. This robust growth trajectory presents a significant opportunity for BMC Helix ITSM to capture a larger slice of the market.

BMC is making substantial investments in weaving generative AI throughout its product suite, with new applications and features powered by GenAI currently in their nascent market adoption phase. These innovative solutions are poised to capitalize on the burgeoning AI market, though their current market penetration is minimal, necessitating considerable investment to secure a leading position.

BMC Software's strategy for expansion into new emerging geographic markets aligns with the characteristics of a 'Question Mark' in the BCG Matrix. These markets present significant growth potential for cloud and IT management solutions, driven by increasing digital transformation efforts. For instance, in 2024, many emerging economies in Southeast Asia and Africa have shown robust GDP growth, signaling a fertile ground for new technology adoption.

However, BMC's initial market share in these nascent regions is expected to be low. This is typical for companies entering unfamiliar territories where brand recognition and established customer relationships are limited. Building a presence requires substantial investment in sales, marketing, and local support infrastructure, which can take time to yield significant returns and market penetration.

The objective in these 'Question Mark' markets is to invest strategically to gain market share and eventually transition these ventures into 'Stars'. BMC's focus on cloud-native solutions and automation is particularly relevant as emerging markets leapfrog traditional IT infrastructure. By 2024, the global cloud market, especially in developing regions, was projected to see double-digit growth, offering BMC a compelling opportunity to capture a larger piece of this expanding pie.

Advanced Observability Solutions

Advanced observability solutions, while sharing roots with AIOps, represent a distinct evolution. These offerings move beyond traditional monitoring by integrating telemetry data from diverse sources – logs, metrics, and traces – to provide a holistic view of system performance and user experience. BMC's investment in this space is strategic, aiming to capture a growing market segment that demands deeper insights into complex, distributed environments.

This area is characterized by rapid innovation and intense competition, with many players vying for market share. BMC is positioning itself to address the increasing need for proactive issue detection and faster root cause analysis, especially as digital transformation accelerates. The market for observability platforms is projected for significant growth, with some estimates suggesting it could reach tens of billions of dollars by the mid-2020s, driven by the complexity of cloud-native applications and the demand for seamless digital experiences.

- Distinct from AIOps: Focuses on comprehensive data integration (logs, metrics, traces) for deeper insights, not just automated IT operations.

- High-Growth Market: Observability platforms are experiencing substantial market expansion, with strong projected growth rates in the coming years.

- Competitive Landscape: BMC faces a dynamic market with established and emerging vendors, making market dominance a future objective.

- Strategic Investment: BMC's focus on advanced observability aims to capture new customer segments and address evolving IT complexity.

Specialized Solutions for New Cloud Platforms/Technologies

As new cloud platforms and technologies, such as advanced serverless architectures and specialized AI/ML infrastructure, gain traction, BMC Software is strategically positioning itself to develop tailored solutions. These specialized offerings are designed to address the unique operational and management challenges presented by these high-growth, emerging sub-markets. For instance, BMC's focus on observability and automation for Kubernetes-native applications reflects this strategy.

These initiatives represent BMC's investment in future growth areas, acknowledging that establishing a dominant market share will necessitate substantial capital and sustained effort to compete effectively with both established players and agile newcomers. The company's commitment to innovation in these nascent cloud segments is crucial for its long-term competitive standing.

BMC's approach to these new cloud platforms can be viewed through the lens of a BCG Matrix, where these specialized solutions would likely fall into the "Question Marks" category. This signifies their placement in high-growth markets with currently low market share, demanding significant investment to capture potential future gains.

- Emerging Cloud Technologies: BMC is investing in solutions for platforms like serverless computing and specialized AI/ML cloud infrastructure, areas experiencing rapid expansion.

- High-Growth Potential: These new cloud segments represent significant growth opportunities, but also require substantial upfront investment.

- Competitive Landscape: BMC faces the challenge of competing against both established vendors and emerging startups in these dynamic markets.

- Strategic Investment: The development of specialized solutions for these platforms is a strategic move to build future market share and revenue streams.

BMC's strategic expansion into new geographic markets and its development of specialized solutions for emerging cloud technologies both exemplify the 'Question Mark' quadrant of the BCG Matrix. These areas represent high-growth potential but currently low market share, necessitating significant investment to build a competitive position.

In 2024, emerging markets in regions like Southeast Asia and Africa demonstrated robust GDP growth, indicating fertile ground for technology adoption. Similarly, the global cloud market, particularly in developing economies, was projected for substantial double-digit growth, offering BMC opportunities to increase its market penetration.

BMC's investments in generative AI and advanced observability solutions are also positioned within this 'Question Mark' framework. While these nascent areas are experiencing rapid innovation and market expansion, BMC's current market share is minimal, requiring considerable capital to secure a leading role.

| BCG Category | BMC Focus Area | Market Growth | BMC Market Share (Est. 2025) | Investment Strategy |

|---|---|---|---|---|

| Question Mark | Emerging Geographic Markets | High (e.g., 10%+ GDP growth in some regions in 2024) | Low | Strategic investment in sales, marketing, and local support. |

| Question Mark | New Cloud Platforms (Serverless, AI/ML Infrastructure) | Very High (e.g., Cloud market growth projected double-digit in developing regions in 2024) | Low | Develop tailored, specialized solutions; significant R&D. |

| Question Mark | Generative AI Applications | Extremely High (Nascent market adoption phase) | Minimal | Weaving GenAI throughout product suite; significant investment needed. |

| Question Mark | Advanced Observability Solutions | High (Projected tens of billions of dollars by mid-2020s) | Low | Integrate diverse telemetry data; capture complex environment needs. |

BCG Matrix Data Sources

Our BMC Software BCG Matrix is built upon comprehensive market intelligence, integrating financial performance data, industry growth forecasts, and competitive landscape analysis.