Bloomin' Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomin' Brands Bundle

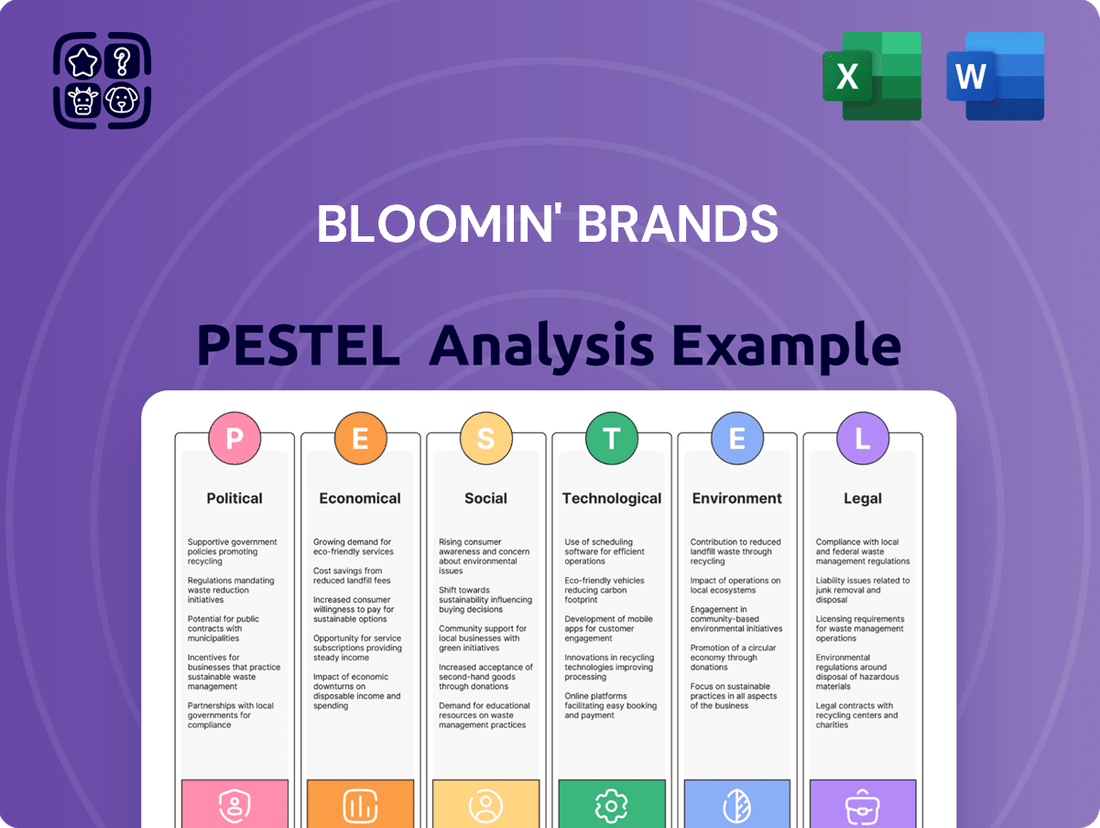

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Bloomin' Brands's future. From shifting consumer preferences to evolving labor laws, understanding these external factors is key to strategic success. Download our comprehensive PESTLE analysis to gain actionable intelligence and stay ahead of the curve.

Political factors

Government minimum wage policies are a significant political factor for Bloomin' Brands. For instance, California has seen its minimum wage rise to $16.00 per hour as of January 1, 2024, and further increases are anticipated. Similarly, Florida's minimum wage reached $13.00 per hour in September 2023, with a planned escalation to $15.00 by 2026.

These legislative changes directly impact the company's labor expenses, a substantial portion of operating costs for restaurant chains like Bloomin' Brands. Higher payrolls necessitate careful financial planning, potentially leading to adjustments in menu pricing or operational efficiencies to maintain profitability.

Bloomin' Brands, like all restaurant operators, must navigate evolving food safety and public health regulations. The U.S. Food and Drug Administration's Food Traceability Rule, for instance, mandates enhanced record-keeping to facilitate faster product recalls, a critical aspect for brands managing multiple supply chains. Failure to comply with these stringent health codes, covering everything from food handling to sanitation, can lead to significant legal penalties and damage to brand reputation.

Trade policies significantly impact Bloomin' Brands' global operations. For instance, changes in tariffs on imported goods, like beef sourced from Brazil, could directly increase operational costs and affect profit margins. In 2024, ongoing trade negotiations and potential protectionist measures in key markets could introduce volatility into Bloomin' Brands' supply chain, impacting everything from ingredient availability to final product pricing.

Taxation policies and incentives

Government taxation policies, such as corporate income tax rates and sales taxes, significantly affect Bloomin' Brands' bottom line and financial strategies. For instance, the U.S. federal corporate income tax rate was reduced from 35% to 21% in 2017, a change that would have positively impacted companies like Bloomin' Brands.

Shifts in these tax frameworks, or the implementation of new incentives for certain business activities, could sway the company's capital allocation and overall financial health. For example, tax credits for adopting sustainable practices or investing in employee training could encourage specific operational changes.

- Corporate Income Tax: Fluctuations in corporate tax rates directly influence net profits.

- Sales Tax: Changes in sales tax can impact consumer spending on dining out.

- Tax Incentives: Potential credits for sustainability or job creation could alter investment decisions.

- International Taxation: Differing tax laws in countries where Bloomin' Brands operates add complexity to financial planning.

Political stability and regulatory environment

Political stability is a cornerstone for Bloomin' Brands' operational predictability and long-term strategic planning. A consistent regulatory framework allows for more confident investment in new markets and menu development. For instance, in 2024, the U.S. political landscape saw ongoing debates around minimum wage laws, which directly impact labor costs for restaurant chains like Bloomin' Brands, potentially requiring adjustments to pricing or operational efficiency.

Shifts in government priorities or increased regulatory scrutiny within the food service sector can necessitate significant operational adjustments for Bloomin' Brands. This could include new food safety standards, marketing regulations, or even changes in international trade policies affecting supply chains. For example, in early 2025, there is anticipation of potential new labeling requirements for nutritional content in several key international markets where Bloomin' Brands operates, which would require substantial compliance efforts.

- Regulatory Uncertainty: Changes in food safety regulations or labor laws can increase operational costs and complexity for Bloomin' Brands.

- Government Support/Incentives: Political decisions regarding small business or restaurant industry support could offer opportunities or challenges.

- International Relations: Geopolitical stability and trade agreements directly influence Bloomin' Brands' global expansion and supply chain reliability.

- Consumer Protection Laws: Evolving laws around advertising and consumer rights can impact marketing strategies and brand perception.

Government policies on minimum wage and labor laws directly impact Bloomin' Brands' operating costs. For example, as of January 1, 2024, California's minimum wage reached $16.00 per hour, with further increases expected. These changes necessitate careful financial management and potential adjustments to pricing strategies to maintain profitability.

Evolving food safety and public health regulations, such as enhanced traceability rules, require Bloomin' Brands to maintain robust record-keeping and compliance. Non-adherence can lead to significant penalties and reputational damage, underscoring the importance of strict adherence to health codes.

Trade policies and international relations significantly influence Bloomin' Brands' global supply chain and operational costs. Tariffs on imported goods, for instance, can directly affect ingredient sourcing and profitability. Political stability in key markets also plays a crucial role in the company's expansion and strategic planning.

| Political Factor | Impact on Bloomin' Brands | Example Data (2024/2025) |

|---|---|---|

| Minimum Wage Laws | Increased labor costs, potential price adjustments | California minimum wage: $16.00/hour (Jan 2024); Florida minimum wage: $13.00/hour (Sep 2023), projected $15.00 by 2026 |

| Food Safety Regulations | Enhanced compliance and record-keeping requirements | FDA Food Traceability Rule implementation |

| Trade Policies & Tariffs | Supply chain costs, ingredient pricing volatility | Potential tariffs on imported beef from Brazil |

| Corporate Taxation | Net profit margins, capital allocation decisions | U.S. federal corporate income tax rate at 21% (since 2017) |

What is included in the product

This PESTLE analysis of Bloomin' Brands examines how political, economic, social, technological, environmental, and legal factors influence its restaurant operations and strategic decisions.

A concise PESTLE analysis for Bloomin' Brands offers a clear overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Consumer spending habits are a significant influence on casual dining, and Bloomin' Brands noted a 'choppy macro environment' in 2024, signaling increased price sensitivity among consumers. This trend impacted some brands, with Outback Steakhouse experiencing sales deceleration during the year, suggesting a discerning approach to dining out.

Despite these shifts, the overall appetite for restaurant meals persists, particularly for value-oriented options, indicating that affordability remains a key factor in driving demand for casual dining experiences.

Bloomin' Brands is grappling with substantial inflationary pressures impacting its core operational expenses. The cost of goods sold (COGS) and labor wages have seen notable increases, directly affecting profitability.

In the first quarter of 2025, the company reported COGS inflation at around 1.5%, while labor inflation reached 3.7%. These escalating costs have contributed to a reduction in adjusted operating margins, requiring strategic adjustments to maintain financial health.

Consequently, Bloomin' Brands must focus on rigorous expense management and evaluate potential adjustments to menu pricing to offset these persistent inflationary headwinds.

The restaurant industry, especially casual dining, is incredibly competitive. Fast-casual concepts are really taking off, often seeing stronger sales and more customer visits than older, sit-down places. This means Bloomin' Brands has to work harder to stand out.

Bloomin' Brands operates in a crowded market, facing off against many different restaurant types. To keep customers coming back, they need to consistently provide good value and memorable dining experiences. This is key to succeeding when the market is already quite full.

Economic growth and employment rates

Robust economic growth and strong employment figures directly fuel consumer spending on dining out. When people feel secure in their jobs and have more disposable income, they are more likely to frequent restaurants like those operated by Bloomin' Brands. This trend is anticipated to continue, providing a favorable environment for the restaurant sector.

The U.S. restaurant industry is expected to be a significant job creator, with projections indicating it will employ close to 16 million people by 2025. This continued expansion in employment within the sector underscores a positive economic outlook and suggests sustained consumer capacity for discretionary spending on food services.

- Economic Growth Impact: Higher GDP growth generally correlates with increased consumer confidence and spending on non-essential services like dining out.

- Employment Outlook: The projected growth in restaurant jobs to nearly 16 million by 2025 signals a healthy labor market and consumer spending power.

- Disposable Income: A strong job market leads to higher disposable income, directly benefiting casual dining and full-service restaurant segments.

Interest rates and access to credit

Prevailing interest rates significantly impact Bloomin' Brands' financial flexibility. For instance, the Federal Reserve's benchmark interest rate, which influences broader borrowing costs, saw increases through 2023 and early 2024. This trend directly affects the cost of capital for potential expansion projects or refinancing existing debt.

Access to credit is also a critical factor. In 2024, lenders may adopt a more cautious approach to extending credit, especially for industries perceived as discretionary, like casual dining. This tighter credit environment could make it more challenging and expensive for Bloomin' Brands to secure the necessary funds for significant capital expenditures or to manage its debt obligations effectively.

- Federal Funds Rate: The Federal Reserve maintained a target range of 5.25%-5.50% as of early 2024, reflecting a restrictive monetary policy that increases borrowing costs.

- Corporate Bond Yields: Bloomin' Brands' ability to issue new debt or refinance existing debt is influenced by corporate bond yields, which have generally trended higher in the post-pandemic environment.

- Credit Availability: Banks and financial institutions may tighten lending standards in response to economic uncertainty, potentially limiting the ease with which Bloomin' Brands can access new credit lines.

Consumer spending habits are a significant influence on casual dining, and Bloomin' Brands noted a 'choppy macro environment' in 2024, signaling increased price sensitivity among consumers. This trend impacted some brands, with Outback Steakhouse experiencing sales deceleration during the year, suggesting a discerning approach to dining out.

Despite these shifts, the overall appetite for restaurant meals persists, particularly for value-oriented options, indicating that affordability remains a key factor in driving demand for casual dining experiences.

Bloomin' Brands is grappling with substantial inflationary pressures impacting its core operational expenses. The cost of goods sold (COGS) and labor wages have seen notable increases, directly affecting profitability.

In the first quarter of 2025, the company reported COGS inflation at around 1.5%, while labor inflation reached 3.7%. These escalating costs have contributed to a reduction in adjusted operating margins, requiring strategic adjustments to maintain financial health.

Consequently, Bloomin' Brands must focus on rigorous expense management and evaluate potential adjustments to menu pricing to offset these persistent inflationary headwinds.

The restaurant industry, especially casual dining, is incredibly competitive. Fast-casual concepts are really taking off, often seeing stronger sales and more customer visits than older, sit-down places. This means Bloomin' Brands has to work harder to stand out.

Bloomin' Brands operates in a crowded market, facing off against many different restaurant types. To keep customers coming back, they need to consistently provide good value and memorable dining experiences. This is key to succeeding when the market is already quite full.

Robust economic growth and strong employment figures directly fuel consumer spending on dining out. When people feel secure in their jobs and have more disposable income, they are more likely to frequent restaurants like those operated by Bloomin' Brands. This trend is anticipated to continue, providing a favorable environment for the restaurant sector.

The U.S. restaurant industry is expected to be a significant job creator, with projections indicating it will employ close to 16 million people by 2025. This continued expansion in employment within the sector underscores a positive economic outlook and suggests sustained consumer capacity for discretionary spending on food services.

- Economic Growth Impact: Higher GDP growth generally correlates with increased consumer confidence and spending on non-essential services like dining out.

- Employment Outlook: The projected growth in restaurant jobs to nearly 16 million by 2025 signals a healthy labor market and consumer spending power.

- Disposable Income: A strong job market leads to higher disposable income, directly benefiting casual dining and full-service restaurant segments.

Prevailing interest rates significantly impact Bloomin' Brands' financial flexibility. For instance, the Federal Reserve's benchmark interest rate, which influences broader borrowing costs, saw increases through 2023 and early 2024. This trend directly affects the cost of capital for potential expansion projects or refinancing existing debt.

Access to credit is also a critical factor. In 2024, lenders may adopt a more cautious approach to extending credit, especially for industries perceived as discretionary, like casual dining. This tighter credit environment could make it more challenging and expensive for Bloomin' Brands to secure the necessary funds for significant capital expenditures or to manage its debt obligations effectively.

- Federal Funds Rate: The Federal Reserve maintained a target range of 5.25%-5.50% as of early 2024, reflecting a restrictive monetary policy that increases borrowing costs.

- Corporate Bond Yields: Bloomin' Brands' ability to issue new debt or refinance existing debt is influenced by corporate bond yields, which have generally trended higher in the post-pandemic environment.

- Credit Availability: Banks and financial institutions may tighten lending standards in response to economic uncertainty, potentially limiting the ease with which Bloomin' Brands can access new credit lines.

| Economic Factor | 2024/2025 Data Point | Impact on Bloomin' Brands |

|---|---|---|

| Consumer Spending | 'Choppy macro environment' in 2024; increased price sensitivity. | Sales deceleration for some brands (e.g., Outback Steakhouse); demand for value-oriented options. |

| Inflation (COGS) | ~1.5% in Q1 2025 | Increased operational expenses, impacting profitability. |

| Inflation (Labor) | ~3.7% in Q1 2025 | Increased operational expenses, impacting profitability. |

| Employment Growth | Projected ~16 million jobs in U.S. restaurant industry by 2025. | Positive indicator for consumer spending power and sector health. |

| Interest Rates | Federal Funds Rate target 5.25%-5.50% (early 2024). | Higher cost of capital for debt and expansion; potential credit tightening. |

What You See Is What You Get

Bloomin' Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bloomin' Brands delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumers are increasingly prioritizing convenience, value, and distinctive dining experiences. This shift is evident in the growing demand for off-premise options like takeout, drive-thru, and delivery, which have significantly expanded their market share since the pandemic. For instance, by the end of 2023, off-premise sales represented over 60% of total restaurant revenue for many establishments, a substantial increase from pre-2020 levels.

Bloomin' Brands needs to strategically adapt its operations to align with these evolving consumer desires. This includes optimizing menu offerings for ease of ordering and consumption outside the traditional dining room, alongside strengthening its infrastructure for efficient and reliable off-premises service. The company's investment in digital ordering platforms and expanded delivery partnerships in 2024 aims to address this critical trend.

Consumers are increasingly prioritizing health and wellness, leading to a surge in demand for healthier menu choices, including plant-based and allergen-friendly options. This trend is evident across the food service industry, with many establishments actively adapting their offerings to cater to these evolving preferences.

In response, Bloomin' Brands, like many in the sector, is likely innovating its menus to include more mindful selections. Transparency regarding ingredients and sourcing is also becoming a key differentiator, as customers seek to understand what they are consuming. For example, a 2024 survey indicated that over 60% of diners consider nutritional information when choosing a restaurant, highlighting the direct impact of health consciousness on dining decisions.

Consumers are increasingly scrutinizing restaurants for their environmental and social impact, favoring those with transparent commitments to sustainability. This includes a strong preference for businesses that actively reduce food waste, source ingredients responsibly, and uphold ethical labor standards. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for products from sustainable brands, a trend directly impacting the restaurant industry.

Bloomin' Brands has publicly emphasized its dedication to these principles, aligning with this evolving consumer sentiment. Their initiatives, such as reducing single-use plastics and supporting sustainable agriculture, resonate with a growing segment of the market that views these practices as crucial factors in their dining choices. This focus on ethical consumption is becoming a significant differentiator in the competitive restaurant landscape.

Influence of social media and digital engagement

Social media platforms are now central to how consumers decide where to dine. Platforms like Instagram and TikTok heavily influence dining choices, with user-generated content and influencer reviews often driving traffic. Bloomin' Brands, like many in the restaurant industry, actively uses these channels for marketing.

Digital engagement extends beyond marketing to direct customer interaction and personalized offers. Restaurants are increasingly using data analytics from digital interactions to tailor promotions, aiming to enhance customer loyalty and spending. This data-driven approach is becoming essential for competitive differentiation in the casual dining sector.

- Consumer Decision-Making: Studies in 2024 indicate that over 60% of consumers check online reviews and social media before choosing a restaurant.

- Marketing Strategies: Bloomin' Brands utilizes targeted social media campaigns and loyalty programs that collect diner data for personalized offers, a trend that intensified in 2024.

- Digital Presence: Investment in digital platforms for ordering, reservations, and feedback is crucial, with many casual dining chains reporting significant growth in digital sales channels throughout 2024.

- Influencer Impact: Restaurant partnerships with social media influencers continue to be a key strategy for reaching younger demographics, a trend projected to grow in 2025.

Changing workforce demographics and expectations

The restaurant industry, including companies like Bloomin' Brands, is experiencing a significant shift towards a younger and more diverse workforce. This demographic trend means a higher proportion of employees are teenagers and young adults, bringing with them evolving expectations.

Adapting to these expectations is paramount for attracting and keeping talent. For instance, in 2024, the fast-food industry saw continued debate and some action around minimum wage increases, reflecting the demand for fair compensation. A positive and supportive work environment, coupled with competitive pay, becomes a key differentiator in a tight labor market where employee turnover can be high.

- Younger Workforce: The average age of restaurant employees continues to trend downwards, with a notable increase in the participation of those aged 16-24.

- Diversity & Inclusion: The workforce is becoming increasingly diverse across various demographics, necessitating inclusive hiring and management practices.

- Wage Expectations: Minimum wage discussions and actual increases in several states and cities in 2024 highlight the growing pressure for higher compensation in entry-level roles.

- Work Environment: Beyond wages, younger workers often prioritize a positive company culture, opportunities for growth, and a healthy work-life balance.

Consumer preferences are increasingly shaped by social media, with platforms like TikTok and Instagram heavily influencing dining choices. In 2024, over 60% of consumers reported checking online reviews and social media before selecting a restaurant, making digital engagement critical for brands like Bloomin' Brands.

The workforce is also evolving, with a younger demographic entering the restaurant industry. This trend, coupled with increased diversity, requires companies to adapt management styles and compensation, as evidenced by ongoing discussions and some implementation of higher minimum wages in 2024.

Ethical consumption is gaining traction, with consumers favoring restaurants demonstrating commitments to sustainability and responsible sourcing. A 2024 report indicated that 60% of consumers would pay more for products from sustainable brands, pushing companies like Bloomin' Brands to highlight their environmental and social initiatives.

| Sociological Factor | 2024 Data Point | Implication for Bloomin' Brands |

|---|---|---|

| Social Media Influence | 60%+ consumers check online reviews before dining | Enhanced digital marketing and online reputation management are crucial. |

| Workforce Demographics | Increased participation of 16-24 year olds | Focus on attractive work environments, fair wages, and growth opportunities. |

| Ethical Consumerism | 60% consumers willing to pay more for sustainable brands | Transparency in sourcing and sustainability practices can be a competitive advantage. |

Technological factors

The restaurant sector's digital evolution has surged, with online ordering, mobile apps, and contactless payments becoming commonplace. Bloomin' Brands is actively integrating technologies like Ziosk for tableside payments, aiming to streamline service and improve customer satisfaction by cutting down wait times and simplifying the payment process.

Bloomin' Brands is navigating a landscape where automation and AI are becoming standard in the restaurant industry. These technologies are crucial for streamlining everything from inventory management to menu optimization, directly impacting efficiency and customer engagement.

The adoption rate is significant, with a notable one-third of restaurant operators already implementing AI. Projections for 2025 indicate a continued surge in integration, with plans focusing on automating online orders, improving front-of-house guest experiences, and enhancing back-of-house operational control.

Bloomin' Brands is increasingly leveraging enhanced data analytics to gain deeper business insights. This technology allows them to meticulously track sales trends, understand intricate customer behavior patterns, and monitor resource utilization across their diverse restaurant portfolio. For instance, by analyzing point-of-sale data and loyalty program information, they can identify popular menu items in specific regions, enabling more targeted promotions and inventory management. This data-driven approach is crucial for optimizing operational efficiency and ultimately boosting profitability.

Supply chain management technologies

Technological advancements in supply chain management are critical for companies like Bloomin' Brands. Robust traceability systems and smart inventory management software are key to minimizing waste and controlling food costs. For instance, in 2024, the food industry is increasingly investing in AI-powered demand forecasting to optimize stock levels, reducing spoilage by an estimated 10-15%.

These technologies provide real-time visibility across the entire supply chain, from farm to fork. This allows for rapid identification and resolution of potential issues, ensuring food safety compliance and maintaining product quality. By 2025, the adoption of blockchain technology for food traceability is expected to grow significantly, enhancing transparency and consumer trust.

Key technological factors impacting Bloomin' Brands' supply chain include:

- Real-time inventory tracking: Utilizing IoT sensors and advanced analytics to monitor stock levels, reducing overstocking and stockouts.

- AI-driven demand forecasting: Employing machine learning algorithms to predict consumer demand more accurately, optimizing procurement and reducing waste.

- Blockchain for traceability: Implementing distributed ledger technology to enhance transparency and track products from origin to sale, ensuring safety and authenticity.

- Automated warehouse management: Leveraging robotics and automated systems to improve efficiency and accuracy in distribution centers.

Customer relationship management (CRM) and loyalty programs

Technological advancements are revolutionizing how Bloomin' Brands interacts with its customers. Sophisticated Customer Relationship Management (CRM) systems and data analytics allow for highly personalized marketing campaigns and loyalty programs. By leveraging Point-of-Sale (POS) data, restaurants can craft tailored offers and promotions designed to resonate with individual customer preferences. This data-driven approach is proving highly effective in fostering customer loyalty and driving repeat business.

Loyalty programs, powered by these technological tools, are a key driver of customer engagement. Members of these programs typically exhibit higher visit frequencies and increased spending compared to non-members. For instance, a significant portion of repeat customers in the casual dining sector are often enrolled in loyalty programs, demonstrating their value in building a consistent customer base. Bloomin' Brands' investment in these technologies directly supports its strategy to enhance customer lifetime value.

- Personalized Offers: CRM systems analyze purchase history to deliver targeted promotions, increasing offer relevance.

- Loyalty Program Impact: Loyalty members often spend 15-20% more per visit and visit 2-3 times more frequently.

- Data-Driven Marketing: POS data integration allows for dynamic adjustments to marketing strategies based on real-time customer behavior.

- Enhanced Engagement: Technology facilitates a deeper connection with customers, fostering brand advocacy and repeat patronage.

Bloomin' Brands is enhancing operational efficiency through technology adoption, with AI integration in restaurants projected to reach 50% by 2025, up from 33% in 2024. This includes AI for order automation and guest experience improvements. The company's focus on data analytics, particularly from POS systems and loyalty programs, allows for precise sales trend analysis and customer behavior insights, driving targeted promotions and optimizing inventory. These technological investments are crucial for staying competitive in a rapidly digitizing industry.

| Technology Area | 2024 Status/Trend | 2025 Projection/Impact | Bloomin' Brands Relevance |

|---|---|---|---|

| AI in Restaurants | 33% adoption by operators | 50% adoption projected | Streamlining orders, guest experience |

| Contactless Payments | Widespread adoption | Continued growth and integration | Improving service speed |

| Data Analytics (POS/Loyalty) | Key for personalization | Deeper insights, hyper-personalization | Targeted marketing, loyalty building |

| Supply Chain Tech (AI Forecasting) | 10-15% waste reduction potential | Increased transparency (Blockchain) | Cost control, food safety |

Legal factors

Bloomin' Brands faces significant legal hurdles with minimum wage and labor law compliance. For instance, in 2024, several states, including California and New York, continued to implement phased minimum wage increases, impacting restaurant operators like Bloomin' Brands. These legal shifts necessitate constant adjustments to payroll and benefits to remain compliant, directly affecting operational expenses.

Bloomin' Brands must rigorously follow federal, state, and local food safety laws. This means sticking to health codes for how food is handled, stored, and prepared, and keeping everything clean. For instance, compliance with the FDA Food Traceability Rule, implemented in January 2026, is crucial for tracking food products to prevent outbreaks and ensure consumer safety.

Bloomin' Brands must strictly adhere to Occupational Safety and Health Administration (OSHA) regulations to maintain a secure workplace. This includes robust hazard communication, comprehensive employee safety training, and diligent incident reporting, such as the prevention of heat-related illnesses, which saw over 3,000 cases reported to OSHA in 2023 alone.

Consumer protection and privacy laws

Bloomin' Brands navigates a complex landscape of consumer protection laws, mandating transparency in areas like menu labeling and nutritional information. For instance, the U.S. Food and Drug Administration's (FDA) menu labeling rule requires chain restaurants to display calorie counts. Accuracy in advertising is also paramount, preventing misleading claims about food quality or promotions.

Furthermore, data privacy regulations significantly impact Bloomin' Brands' operations, particularly concerning customer loyalty programs and digital transactions. In 2024, with the increasing volume of personal data collected, compliance with laws such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), is critical. These laws grant consumers rights over their data, requiring robust security measures and clear consent mechanisms for data usage. Failure to comply can result in substantial fines, as seen with penalties levied against other companies for data breaches and privacy violations.

- Menu Labeling Compliance: Adherence to FDA regulations for calorie and nutritional information display.

- Advertising Accuracy: Ensuring all marketing claims are truthful and not deceptive.

- Data Privacy Regulations: Strict adherence to laws like CCPA/CPRA for customer data handling.

- Customer Data Security: Implementing robust security protocols for loyalty programs and digital transactions.

Licensing, permits, and zoning regulations

Operating a vast restaurant chain like Bloomin' Brands necessitates navigating a dense regulatory landscape. This includes securing numerous licenses and permits at federal, state, and local government levels. These cover everything from general business operation permits to specific health department approvals and liquor licenses for alcohol sales, all of which are critical for day-to-day functioning.

Maintaining ongoing compliance with these varied regulations, alongside strict adherence to local zoning laws for each of its numerous restaurant sites, is a significant operational challenge. For instance, in 2024, the National Restaurant Association reported that compliance costs for small restaurants could range from $5,000 to $15,000 annually, a figure that scales considerably for a large enterprise like Bloomin' Brands with hundreds of locations.

- Federal Licenses: While fewer, these can impact food sourcing and safety standards.

- State Licenses: Crucial for business registration, sales tax, and alcohol permits.

- Local Permits: Essential for health inspections, building codes, and zoning compliance.

- Zoning Regulations: Dictate where restaurants can operate and what hours they can serve.

Bloomin' Brands must also contend with evolving employment laws, including those pertaining to independent contractors versus employees. The classification of workers directly impacts labor costs, benefits, and legal liabilities. For example, the ongoing debate and legal challenges surrounding gig economy worker classification in 2024 continue to create uncertainty for businesses relying on flexible staffing models.

Antitrust laws are also a consideration, particularly if Bloomin' Brands engages in mergers, acquisitions, or dominant market practices. Ensuring fair competition and avoiding monopolistic behavior is crucial to prevent regulatory scrutiny and potential penalties. While not a primary daily concern, significant strategic moves would necessitate legal review under these frameworks.

The company must also comply with accessibility laws, such as the Americans with Disabilities Act (ADA), ensuring its physical locations and digital platforms are accessible to individuals with disabilities. This includes requirements for ramps, accessible restrooms, and website design, with ongoing legal interpretations and enforcement actions in 2024 highlighting the importance of proactive compliance.

Bloomin' Brands' legal obligations extend to intellectual property protection, safeguarding its brands, recipes, and operational processes. This involves trademarking, copyrighting, and potentially patenting unique aspects of its business to prevent infringement by competitors.

Environmental factors

Bloomin' Brands is increasingly prioritizing environmental sustainability, with a significant focus on waste management and food waste reduction across its restaurant portfolio. This commitment reflects a growing consumer demand for eco-friendly practices within the dining industry.

The company's efforts align with a wider industry movement towards minimizing environmental footprints. Restaurants are adopting innovative approaches like 'nose-to-tail' and 'root-to-stem' culinary techniques to maximize ingredient utilization and reduce disposal.

For instance, the National Restaurant Association reported in 2024 that over 70% of consumers are more likely to choose a restaurant that demonstrates a commitment to sustainability. This trend underscores the financial incentive for companies like Bloomin' Brands to invest in robust waste reduction programs.

Consumers and the industry are increasingly focused on sourcing ingredients sustainably and ethically. Bloomin' Brands is responding by enhancing its policies to safeguard forests, and it's transparent about the percentage of beef it sources from Brazil, with a goal of achieving deforestation-free sourcing.

The company is also committed to using cage-free eggs and promoting sustainable seafood practices. This aligns with broader market trends where environmental, social, and governance (ESG) considerations are becoming critical for brand reputation and consumer loyalty.

Bloomin' Brands is actively working to lower its environmental footprint, recognizing the impact of energy use and emissions. The company has committed to reducing its direct greenhouse gas emissions (Scopes 1 and 2) by 46.2% by the year 2030, using 2019 as its baseline. This ambitious target is part of a broader strategy to achieve net-zero emissions by 2050.

To reach these goals, Bloomin' Brands is focusing on enhancing operational efficiency and improving the energy performance of its supply chain. Key initiatives include upgrading to more energy-efficient technologies, such as widespread adoption of LED lighting across its restaurant locations and investing in newer, more efficient kitchen equipment. These changes aim to directly decrease the energy consumed per unit of operation.

Water conservation efforts

Bloomin' Brands is actively pursuing water conservation initiatives across its restaurant operations, aiming to enhance water efficiency and protect natural resources. This commitment is underscored by a comprehensive water risk assessment conducted in 2024.

The company also focuses on collaborating with its supply chain to foster better water management practices. Notably, a significant portion of Bloomin' Brands' land-based protein suppliers have implemented water reduction measures, reflecting a broader industry trend towards sustainable water use.

- 2024 Water Risk Assessment: Bloomin' Brands completed a thorough assessment to identify and address water-related risks within its operations and supply chain.

- Supplier Collaboration: The company actively partners with suppliers to encourage and implement effective water management strategies.

- Supplier Water Reduction: A substantial percentage of land-based protein suppliers have established and are executing water reduction programs.

Sustainable packaging innovation

Bloomin' Brands is actively pursuing sustainable packaging innovations for all its services, including to-go, catering, and dine-in. This focus is a direct response to growing environmental concerns and a significant shift in consumer demand for eco-friendly options.

The company is exploring materials like biodegradable containers and recyclable plastics. This strategic move aligns with broader industry trends where companies are increasingly adopting greener supply chain practices to reduce their environmental footprint.

By 2024, the global market for sustainable packaging was projected to reach over $400 billion, highlighting the immense economic and consumer-driven push towards these solutions. Bloomin' Brands' commitment to this area is therefore crucial for maintaining brand reputation and market competitiveness.

- Consumer Demand: A 2023 Nielsen report indicated that 73% of consumers globally are willing to change their purchasing habits to reduce environmental impact.

- Regulatory Push: Many regions are implementing stricter regulations on single-use plastics and waste management, encouraging businesses to adopt sustainable alternatives.

- Cost Savings: While initial investment might be higher, innovations in reusable and recyclable materials can lead to long-term cost reductions in waste disposal and material sourcing.

- Brand Image: Companies demonstrating strong environmental stewardship, including through packaging, often experience enhanced brand loyalty and a positive public image.

Bloomin' Brands is actively working to lower its environmental footprint, recognizing the impact of energy use and emissions. The company has committed to reducing its direct greenhouse gas emissions (Scopes 1 and 2) by 46.2% by the year 2030, using 2019 as its baseline. This ambitious target is part of a broader strategy to achieve net-zero emissions by 2050.

To reach these goals, Bloomin' Brands is focusing on enhancing operational efficiency and improving the energy performance of its supply chain. Key initiatives include upgrading to more energy-efficient technologies, such as widespread adoption of LED lighting across its restaurant locations and investing in newer, more efficient kitchen equipment. These changes aim to directly decrease the energy consumed per unit of operation.

Bloomin' Brands is actively pursuing water conservation initiatives across its restaurant operations, aiming to enhance water efficiency and protect natural resources. This commitment is underscored by a comprehensive water risk assessment conducted in 2024.

| Environmental Factor | Bloomin' Brands' Initiatives | Data/Targets |

| Greenhouse Gas Emissions | Reducing Scopes 1 & 2 emissions | 46.2% reduction by 2030 (vs. 2019 baseline) |

| Energy Efficiency | LED lighting, efficient kitchen equipment | Ongoing upgrades across locations |

| Water Conservation | Water risk assessment, supplier collaboration | Water reduction measures by protein suppliers |

| Waste Management | Food waste reduction, sustainable packaging | Exploring biodegradable and recyclable materials |

| Sustainable Sourcing | Deforestation-free beef, cage-free eggs, sustainable seafood | Transparency on Brazilian beef sourcing |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bloomin' Brands is built on a foundation of publicly available data from government agencies, reputable financial news outlets, and industry-specific market research reports. We synthesize information on economic indicators, regulatory changes, technological advancements, and social trends to provide a comprehensive overview.