Bloomin' Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomin' Brands Bundle

Unlock the strategic blueprint of Bloomin' Brands with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver unique value propositions across their diverse restaurant portfolio. This detailed analysis is perfect for anyone seeking to understand the mechanics of a successful multi-brand hospitality group.

Partnerships

Bloomin' Brands partners with strategic food and beverage suppliers to guarantee high-quality ingredients like prime steaks and fresh produce for its diverse brands. This ensures consistency and availability for customers. In 2024, the company continued to emphasize ethical sourcing and animal welfare within its supply chain, a key component of its brand promise.

Maintaining strong relationships with these key suppliers is vital for Bloomin' Brands to effectively manage fluctuating commodity costs and uphold stringent food safety standards across its restaurant portfolio. These partnerships are foundational to delivering the reliable dining experiences customers expect.

Bloomin' Brands relies heavily on technology and software providers to keep its restaurants running smoothly and to make dining more enjoyable for customers. This includes partnerships for their point-of-sale (POS) systems, which are crucial for processing orders and payments efficiently. For instance, in 2024, the company continued to leverage these systems to gather valuable sales data, informing inventory management and staffing decisions across its Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar locations.

The company also partners with online ordering and third-party delivery platforms, essential for reaching customers beyond the physical restaurant. These collaborations allow for seamless integration of digital orders into the kitchen workflow, a critical component in today's competitive dining landscape. In 2024, the expansion of these digital channels remained a key focus, aiming to capture a larger share of the off-premise dining market.

Furthermore, Bloomin' Brands collaborates with providers of in-restaurant technology, such as digital ordering tablets at tables. These tools can enhance the guest experience by offering self-service ordering and payment options, alongside gathering valuable feedback. The strategic adoption of such technologies in 2024 was aimed at both improving operational efficiency and directly boosting customer satisfaction metrics.

Bloomin' Brands actively collaborates with real estate developers and landlords. These relationships are crucial for securing prime locations for new restaurant openings, facilitating relocations, and undertaking necessary remodels of existing establishments.

The company is strategically focused on expanding its physical presence, with a notable emphasis on Outback Steakhouse. This expansion is complemented by ongoing investments in improving its existing assets to enhance customer traffic and boost sales performance.

These key partnerships are fundamental to Bloomin' Brands' overarching growth strategy and its commitment to optimizing its real estate portfolio, ultimately supporting increased revenue and market share.

Marketing and Advertising Agencies

Bloomin' Brands collaborates with marketing and advertising agencies to craft and implement comprehensive, multi-channel campaigns. These partnerships are crucial for amplifying brand awareness and directly influencing customer foot traffic to their various restaurant concepts.

The agency collaborations focus on a strategic mix of advertising channels. This includes leveraging traditional media like television alongside performance-driven digital marketing tactics to effectively promote new menu items, special promotions, and the overall dining experience offered by Bloomin' Brands.

These strategic marketing investments are a significant driver for improving sales performance and enhancing the overall perception of their brands. For instance, in 2024, Bloomin' Brands continued to allocate substantial resources towards advertising, aiming to capture a larger share of the competitive casual dining market.

- Brand Awareness: Agencies develop campaigns across TV, radio, and digital platforms to keep brands like Outback Steakhouse and Carrabba's Italian Grill top-of-mind.

- Customer Acquisition: Digital marketing efforts, including social media advertising and search engine marketing, are employed to drive online reservations and in-store visits.

- Promotional Support: Agencies help create compelling messaging for limited-time offers and menu innovations, directly impacting sales during promotional periods.

Franchise Partners

Bloomin' Brands leverages franchise partners for expansion, particularly in international markets and select domestic locations. This strategy enables wider market reach and a collaborative approach to growth, sharing the investment burden.

A significant move in 2024 involved Bloomin' Brands re-franchising a majority stake in its Brazil operations. This strategic decision is projected to generate ongoing royalty revenue streams, bolstering financial flexibility.

- International and Domestic Expansion: Franchisees operate restaurants under brands like Outback Steakhouse and Carrabba's Italian Grill in various global and some U.S. markets.

- Shared Investment and Growth: This model facilitates broader market penetration by pooling resources and risk with partners committed to brand development.

- Revenue Generation: The re-franchising of the Brazil operations in 2024 is expected to provide consistent royalty income, contributing to the company's financial performance.

Bloomin' Brands collaborates with technology providers for essential operational systems, including point-of-sale (POS) and online ordering platforms. In 2024, the company continued to integrate these technologies to enhance efficiency and customer experience across its brands.

Strategic partnerships with third-party delivery services are crucial for expanding reach and capturing off-premise sales. These collaborations allow for seamless order integration and wider customer access, a key focus in 2024 for increasing market share.

The company also engages with real estate developers for site selection and lease negotiations, vital for its expansion and remodel strategies. In 2024, this included a focus on optimizing the portfolio for brands like Outback Steakhouse.

Marketing and advertising agencies are key partners in developing and executing campaigns to boost brand awareness and drive customer traffic. These efforts, spanning digital and traditional media, were a significant investment in 2024 to enhance sales performance.

Franchise partners, particularly in international markets, are essential for growth and market penetration. Bloomin' Brands’ 2024 re-franchising of its Brazil operations exemplifies this strategy, aiming for royalty revenue and shared investment.

What is included in the product

This Business Model Canvas outlines Bloomin' Brands' strategy of operating a portfolio of casual dining restaurant concepts, focusing on delivering diverse culinary experiences and strong customer relationships through efficient operations and targeted marketing.

Bloomin' Brands' Business Model Canvas provides a clear, one-page snapshot of their restaurant operations, alleviating the pain of complex strategic planning.

It simplifies understanding Bloomin' Brands' multi-brand strategy, acting as a pain reliever by offering a digestible format for quick review and adaptation.

Activities

The fundamental activity revolves around the daily running of a vast collection of casual and fine dining establishments, such as Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar. This includes overseeing personnel, upholding service quality, and guaranteeing a uniform guest experience across every outlet.

A key focus is on enhancing the execution at the restaurant level and boosting overall customer satisfaction. For instance, in the first quarter of 2024, Bloomin' Brands reported that comparable restaurant sales increased by 0.6% across its U.S. system, demonstrating efforts to refine operations.

Bloomin' Brands actively innovates its menus, introducing new dishes and refining existing ones to cater to diverse palates and maintain brand appeal. This includes simplifying offerings to focus on popular, high-satisfaction items, a strategy that can lead to improved operational efficiency and customer satisfaction.

The company frequently launches promotions and limited-time offers to drive traffic and create excitement, a key tactic in the competitive casual dining sector. For instance, in 2024, Bloomin' Brands continued to experiment with value-driven promotions across its brands to attract a wider customer base.

Bloomin' Brands actively manages its extensive supply chain, a vital function for maintaining the high quality and freshness of ingredients across its global restaurant portfolio, which numbered over 1,450 locations as of early 2024. This includes strategic sourcing of over $2 billion in food and beverage costs annually, ensuring cost-effectiveness and consistent supply.

Key activities involve meticulous inventory management and efficient logistics to support operations. The company places a significant emphasis on food safety protocols and ethical sourcing practices, aligning with its commitment to sustainability throughout its procurement processes.

Brand Marketing and Digital Engagement

Bloomin' Brands actively pursues brand marketing and digital engagement to attract and retain customers across its portfolio. This involves significant investment in national advertising campaigns and a strong focus on digital marketing strategies. For instance, in 2023, the company reported that digital sales represented a notable portion of their overall revenue, underscoring the importance of these efforts.

Leveraging loyalty programs is a cornerstone of their customer engagement strategy. Dine Rewards, for example, incentivizes repeat business and provides valuable data for personalized marketing. The company is committed to enhancing its digital presence and increasing its share of voice in the competitive restaurant landscape, aiming to drive traffic both online and in-store.

- National Campaigns: Broad reach advertising to build brand awareness.

- Digital Marketing: Targeted online efforts to reach specific customer segments.

- Loyalty Programs: Initiatives like Dine Rewards to foster customer retention.

- Digital Sales Growth: Investment in online platforms and marketing to boost digital transactions.

New Unit Development and Asset Management

Bloomin' Brands strategically expands by developing new restaurant units and enhancing its existing asset base. This includes opening new locations, relocating underperforming sites, and undertaking significant remodels of current restaurants to boost customer traffic and overall experience. For instance, in 2023, the company focused on optimizing its portfolio, which involved strategic closures of underperforming units alongside new openings and remodels.

The company's asset management approach is crucial for long-term growth and profitability. By investing in upgrades and new developments, Bloomin' Brands aims to revitalize its brand presence and attract more diners. This proactive management ensures that the portfolio remains competitive and aligned with evolving consumer preferences.

- Strategic expansion through new unit development and relocations.

- Remodeling existing restaurants to improve customer experience and traffic.

- Active asset management includes closing underperforming locations to optimize the portfolio.

- Focus on enhancing traffic trends and diner satisfaction through targeted investments.

Bloomin' Brands' key activities center on the operational excellence of its restaurant portfolio, encompassing daily management, quality control, and ensuring a consistent guest experience across brands like Outback Steakhouse and Bonefish Grill. The company also prioritizes menu innovation, introducing new items and refining existing ones to meet evolving consumer tastes, as seen in their focus on high-satisfaction items. Furthermore, aggressive marketing and digital engagement are critical, utilizing national campaigns, targeted online efforts, and loyalty programs like Dine Rewards to drive traffic and customer retention, with digital sales contributing significantly to overall revenue in 2023.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Restaurant Operations | Daily management, service quality, guest experience | 0.6% comparable sales increase (Q1 2024) |

| Menu Innovation | Developing new dishes, refining existing offerings | Focus on popular, high-satisfaction items |

| Marketing & Digital Engagement | Brand building, customer retention, digital sales | Continued investment in digital marketing, loyalty programs |

| Supply Chain & Procurement | Sourcing ingredients, inventory management, food safety | Managing over $2 billion in annual food/beverage costs |

| Strategic Expansion | New unit development, remodels, portfolio optimization | Optimizing portfolio through strategic closures and new openings/remodels |

Full Document Unlocks After Purchase

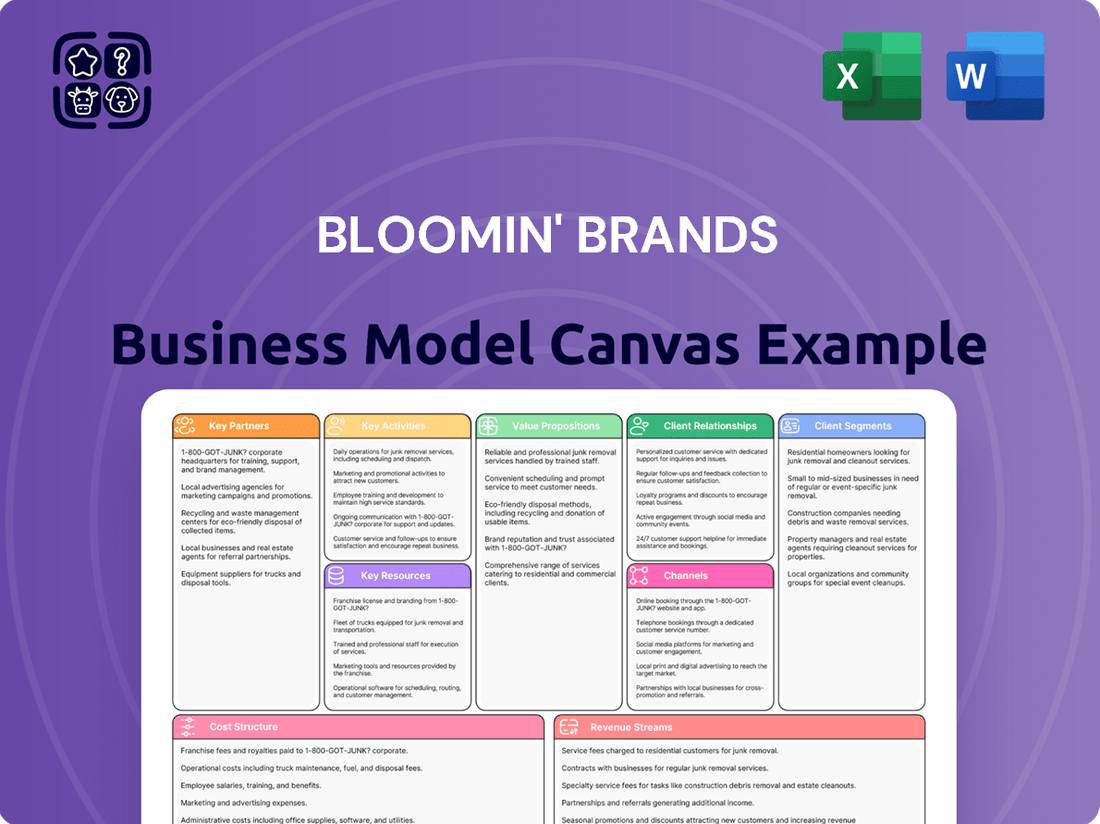

Business Model Canvas

This preview offers a direct glimpse into the Bloomin' Brands Business Model Canvas, showcasing the exact structure and content you will receive upon purchase. You are not viewing a sample; this is a live snapshot from the comprehensive document that will be delivered to you. Once your order is complete, you'll gain full access to this same professionally formatted Business Model Canvas, ready for immediate use.

Resources

Bloomin' Brands' most valuable intangible assets are its established restaurant brands: Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar. These brands drive significant customer loyalty and command premium pricing, contributing to the company's market presence.

The intellectual property associated with these brands, including proprietary recipes and standardized operational procedures, is crucial for maintaining consistent quality and customer experience across all locations. This IP protects their unique offerings and competitive advantage.

In 2024, Bloomin' Brands continued to leverage its strong brand portfolio. For instance, Outback Steakhouse, a cornerstone of the company, consistently ranks among the top casual dining steakhouse chains in the United States, reflecting the enduring appeal of its brand and its well-protected intellectual property.

Bloomin' Brands' physical restaurant locations are a cornerstone of its business, representing the primary interface with customers. As of the first quarter of 2024, the company operated approximately 1,480 locations globally, a testament to its extensive physical footprint.

These real estate assets, whether owned outright or leased, are vital operational resources. The strategic acquisition, development, and maintenance of these sites, including significant investments in remodels and new store openings, directly impact customer experience and brand presence.

The management of this real estate portfolio is a key strategic consideration. For instance, in 2023, Bloomin' Brands invested over $150 million in capital expenditures, a significant portion of which was allocated to restaurant development and remodels, underscoring the importance of these physical locations.

Bloomin' Brands' skilled workforce, encompassing culinary teams, restaurant managers, and front-of-house staff, is a cornerstone of its operations. This human capital is directly responsible for upholding the consistent quality of food, service, and hospitality across its diverse restaurant portfolio, ensuring a memorable dining experience for every guest.

The company actively cultivates an environment that fosters inclusivity and empowers its employees. This focus on team member development is crucial for maintaining the high standards that define the Bloomin' Brands dining experience, contributing to customer satisfaction and loyalty.

In 2024, Bloomin' Brands continued to invest in its people, recognizing that their expertise is a key differentiator. While specific workforce numbers fluctuate, the company's commitment to training and development aims to ensure that its teams possess the culinary and service skills necessary to excel in a competitive market.

Supply Chain and Distribution Network

Bloomin' Brands relies heavily on its established supply chain and distribution network, which includes strong ties with key food and beverage distributors and producers. This network is vital for ensuring that all restaurant locations consistently receive high-quality ingredients on time. For instance, in 2023, the company managed a vast network to support its portfolio of brands like Outback Steakhouse and Bonefish Grill, underscoring the operational backbone this provides.

The emphasis on ethical sourcing and stringent food safety protocols further elevates the importance of this resource. Bloomin' Brands' commitment to these principles means their supply chain isn't just about logistics; it's about maintaining brand trust and product integrity. This focus is critical in an industry where consumer confidence in food quality and origin is paramount.

Key aspects of Bloomin' Brands' supply chain and distribution network include:

- Supplier Relationships: Cultivating and maintaining partnerships with reliable food and beverage suppliers ensures consistent access to necessary ingredients.

- Logistics and Warehousing: An efficient system for warehousing and transporting goods to numerous restaurant locations across different regions.

- Quality Control: Implementing rigorous checks to guarantee the freshness, safety, and quality of all delivered products.

- Ethical Sourcing Practices: Adhering to standards for responsible sourcing, which can include fair labor practices and sustainable agriculture.

Technology Infrastructure and Data

Bloomin' Brands invests significantly in its technology infrastructure, viewing it as a critical resource for modern restaurant operations. This includes upgrading point-of-sale (POS) systems across its brands to streamline transactions and improve efficiency. For instance, the company has been implementing new POS systems to enhance the customer experience and provide better data capture.

Digital ordering platforms and customer relationship management (CRM) tools are also central to their strategy. These technologies allow for direct engagement with customers, personalized marketing efforts, and loyalty program management. By leveraging CRM, Bloomin' Brands aims to build stronger customer relationships and drive repeat business.

Data analytics capabilities are increasingly important, enabling the company to gain insights into customer behavior, operational performance, and market trends. This data-driven approach informs strategic decisions, from menu optimization to marketing campaign effectiveness. The adoption of tools like Ziosk, which offers interactive table-side ordering and payment, exemplifies this commitment to leveraging technology for improved service and data collection.

- Point-of-Sale (POS) Systems: Investments in modern POS systems to enhance transaction speed and data accuracy.

- Digital Ordering Platforms: Development and integration of online and mobile ordering capabilities to meet evolving consumer preferences.

- Customer Relationship Management (CRM): Utilization of CRM tools to personalize customer interactions and build loyalty.

- Data Analytics: Deployment of analytics to derive actionable insights from operational and customer data, informing strategic planning.

Bloomin' Brands' key resources are its powerful restaurant brands, extensive physical locations, dedicated workforce, robust supply chain, and advanced technology infrastructure. These elements collectively enable the company to deliver consistent dining experiences and maintain its competitive edge in the casual dining sector.

Value Propositions

Bloomin' Brands provides a spectrum of dining atmospheres, from the relaxed vibe of Outback Steakhouse to the sophisticated setting of Fleming's Prime Steakhouse & Wine Bar. This variety extends to Carrabba's Italian Grill and Bonefish Grill, offering Italian and seafood specialties respectively, ensuring a fit for diverse customer tastes and occasions.

Bloomin' Brands' core value proposition centers on delivering high-quality food and beverages. This means a strong focus on fresh ingredients, with notable examples like USDA Prime steaks and meticulously prepared seafood. They aim to consistently provide well-executed dishes that satisfy customer palates.

Beyond taste, the company prioritizes responsible sourcing. This commitment extends to ensuring food safety, adhering to ethical practices in ingredient procurement, and upholding standards for animal welfare. These principles are integral to building trust and delivering on their quality promise.

To maintain customer interest and loyalty, Bloomin' Brands actively engages in continuous menu innovation. This proactive approach ensures their offerings stay relevant, exciting, and aligned with evolving consumer preferences for taste and overall quality. For instance, in 2024, they continued to refine their menus across brands like Outback Steakhouse and Bonefish Grill, introducing new seasonal items and updating core favorites.

Guests can anticipate a reliable and enjoyable dining experience, as Bloomin' Brands strives for consistent service and hospitality across its portfolio. This commitment ensures a familiar and welcoming atmosphere, regardless of the specific restaurant visited.

Bloomin' Brands actively works to enhance customer satisfaction, evidenced by their ongoing focus on improving service consistency. This dedication aims to foster a comfortable and inviting environment, encouraging repeat visits.

In 2024, Bloomin' Brands continued to invest in training and operational standards to uphold this promise of consistent quality. For instance, their Outback Steakhouse brand, a significant contributor to their overall revenue, consistently aims for high marks in guest feedback related to service interactions.

Convenience and Accessibility

Bloomin' Brands ensures customers can easily enjoy their meals through a widespread network of physical restaurants. This accessibility extends to convenient online ordering and partnerships with third-party delivery services, making off-premises dining a key component of their strategy. In 2023, off-premises sales represented a substantial portion of their revenue, highlighting the importance of this channel.

The company further enhances convenience with options like gift cards, offering flexibility for customers. This multi-faceted approach to accessibility caters to diverse customer preferences, ensuring Bloomin' Brands is a readily available dining choice.

- Extensive Physical Footprint: Bloomin' Brands operates thousands of restaurants across various brands, providing widespread physical access to its dining experiences.

- Digital Ordering Platforms: Robust online ordering systems and mobile apps streamline the process for customers to place orders for pickup or delivery.

- Third-Party Delivery Integration: Partnerships with major delivery platforms expand reach and offer customers additional convenient channels to receive their meals.

- Gift Card Flexibility: The availability of gift cards provides a convenient payment and gifting option, further enhancing customer accessibility.

Value-for-Money Options

Bloomin' Brands focuses on delivering strong value for money across its portfolio. This strategy is crucial for attracting and keeping customers, especially given the current economic climate. For instance, in 2024, the company continued to emphasize promotions like three-course meals at brands such as Outback Steakhouse.

These value-driven offers are designed to provide a satisfying dining experience without breaking the bank. By balancing quality ingredients and preparation with accessible pricing, Bloomin' Brands aims to be a go-to choice for value-conscious consumers.

- Abundant Everyday Value: Initiatives like these are key to appealing to a broad customer base.

- Promotional Three-Course Meals: These bundles offer a complete dining experience at an attractive price point.

- Competitive Pricing: Maintaining accessible price points is vital in a challenging market.

- Customer Retention: Value propositions are a primary driver for repeat business.

Bloomin' Brands offers a diverse range of dining experiences, from casual to upscale, catering to various preferences and occasions. Their commitment to high-quality food, emphasizing fresh ingredients like USDA Prime steaks and expertly prepared seafood, forms a cornerstone of their appeal. This dedication to quality is further reinforced by responsible sourcing practices, including food safety and animal welfare.

The company actively engages in menu innovation, keeping offerings fresh and aligned with consumer trends, as seen with new seasonal items introduced in 2024 across brands like Outback Steakhouse. Coupled with a focus on consistent service and hospitality, these elements aim to ensure a reliable and enjoyable dining experience for all guests, fostering customer loyalty.

Accessibility is a key value, with a widespread network of physical locations complemented by convenient online ordering and third-party delivery partnerships, a strategy that proved significant with substantial off-premises sales in 2023. Furthermore, Bloomin' Brands emphasizes strong value for money, utilizing promotions like three-course meals, particularly at Outback Steakhouse, to attract and retain customers in the current economic climate.

| Brand | Primary Cuisine | 2024 Key Focus Areas |

|---|---|---|

| Outback Steakhouse | Steakhouse | Value promotions, service consistency |

| Carrabba's Italian Grill | Italian | Menu innovation, ingredient quality |

| Bonefish Grill | Seafood | Seasonal offerings, guest experience |

| Fleming's Prime Steakhouse & Wine Bar | Steakhouse/Fine Dining | Upscale atmosphere, premium ingredients |

Customer Relationships

Bloomin' Brands cultivates loyalty by prioritizing personalized in-restaurant service. Their staff are trained to offer attentive care, aiming to make each dining experience memorable and cater to individual guest preferences. This focus on quality interactions is key to building lasting customer relationships.

Bloomin' Brands' Dine Rewards program is a cornerstone of its customer relationship strategy, designed to foster loyalty through a points-based system and exclusive benefits. This initiative encourages repeat business across its diverse restaurant portfolio, including Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar.

By offering tangible rewards and special perks, the program incentivizes customers to choose Bloomin' Brands locations for their dining experiences. This direct engagement also provides valuable data, allowing the company to gain deeper insights into customer preferences and dining habits, which can inform future marketing and operational decisions.

Bloomin' Brands leverages digital channels for robust customer engagement. Their online ordering platforms and in-restaurant Ziosk tablets are key to this strategy, streamlining service and gathering immediate customer feedback. This approach allows for quick issue resolution and continuous improvement of the dining experience.

In 2024, Bloomin' Brands continued to emphasize these digital touchpoints. For instance, their investment in technology aims to enhance the convenience of online ordering, a segment that saw significant growth across the restaurant industry. The Ziosk tablets specifically provide a direct line for customers to rate their meals and service, offering valuable real-time data that informs operational adjustments.

Targeted Marketing and Promotions

Bloomin' Brands actively engages customers through tailored marketing and promotions, frequently featuring new menu additions, limited-time offers, and seasonal celebrations. These efforts aim to draw in new patrons and keep existing ones returning, driving both visits and sales.

The company’s multi-channel advertising approach, which includes digital, social media, and traditional advertising, is optimized using customer data analytics to ensure strong return on investment. For instance, in 2023, Bloomin' Brands reported significant marketing expenditures aimed at driving traffic and sales across its brands.

- Targeted Campaigns: Promotions often highlight specific menu items or value propositions relevant to different customer segments.

- Seasonal Events: Leveraging holidays and seasonal themes to create special menus and promotions.

- Digital Engagement: Utilizing social media and email marketing to communicate offers and news directly to customers.

- Data-Driven Optimization: Employing analytics to measure campaign effectiveness and refine future marketing strategies.

Catering and Private Event Services

Bloomin' Brands cultivates strong customer relationships by offering specialized catering and private event services. This approach directly targets customer segments seeking unique dining experiences for gatherings and celebrations, moving beyond the typical walk-in traffic.

These services allow for customized menus and atmospheres, transforming the restaurant space or bringing the brand's offerings directly to clients. This flexibility caters to a wide range of occasions, from corporate functions to intimate personal parties, fostering deeper engagement.

In 2024, Bloomin' Brands continued to leverage these channels to broaden its market presence and create memorable touchpoints. For instance, Outback Steakhouse's catering options provide a convenient way for businesses to host events, while Carrabba's Italian Grill offers private dining rooms for more exclusive gatherings.

- Catering Services: Extends brand reach to corporate and private functions, offering curated menus.

- Private Events: Utilizes restaurant spaces for exclusive celebrations, providing customized experiences.

- Customer Engagement: Creates memorable, off-premise dining interactions beyond daily operations.

- Revenue Diversification: Taps into the lucrative events market, complementing dine-in sales.

Bloomin' Brands' customer relationship strategy is multifaceted, blending personalized service with robust loyalty programs and digital engagement. The Dine Rewards program, for example, incentivizes repeat visits by offering points and exclusive perks across its brands like Outback Steakhouse and Bonefish Grill. This direct customer interaction, amplified through digital channels and tailored promotions, aims to foster lasting loyalty and gather valuable data for continuous improvement.

| Customer Relationship Strategy Element | Description | 2024 Focus/Data Point |

|---|---|---|

| Loyalty Programs | Dine Rewards program incentivizes repeat business with points and exclusive benefits. | Continued emphasis on program growth and member engagement. |

| Personalized Service | Staff training focuses on attentive care and catering to individual guest preferences. | Ongoing investment in staff training to enhance in-restaurant experience. |

| Digital Engagement | Online ordering, Ziosk tablets for feedback, and targeted digital marketing. | Enhancement of digital platforms for convenience and direct customer feedback collection. |

| Targeted Marketing | Promotions, seasonal events, and multi-channel advertising informed by data analytics. | Optimization of marketing spend based on data analytics for improved ROI. |

Channels

Bloomin' Brands' core channel remains its vast network of physical restaurants. These locations, housing brands like Outback Steakhouse and Carrabba's Italian Grill, are the primary touchpoints for customer engagement and sales. As of the first quarter of 2024, the company operated 1,455 total company-owned and franchised locations globally, underscoring the significance of this physical presence.

Bloomin' Brands utilizes its owned websites and mobile apps for direct online ordering, enhancing convenience for takeout customers. This first-party approach gives them more command over the customer journey and valuable data insights.

This direct channel is crucial for supporting the significant expansion of their off-premises dining operations. In the first quarter of 2024, Bloomin' Brands reported that off-premises sales represented approximately 25% of total sales, a trend they aim to further capitalize on through these proprietary platforms.

Bloomin' Brands leverages third-party delivery services to extend its market reach and meet the growing consumer preference for dining at home. These partnerships are crucial for capturing off-premises sales and attracting customers who prioritize convenience. In 2023, Bloomin' Brands reported that off-premises dining, which includes delivery and takeout, represented approximately 60% of their total U.S. sales, underscoring the significance of these channels.

Gift Card Sales

Gift cards, available in both physical and e-gift formats, are a key revenue stream for Bloomin' Brands, acting as both a customer acquisition and retention tool. Their flexibility, redeemable across all Bloomin' Brands locations, enhances their appeal to gift-givers and recipients alike, contributing to consistent cash flow.

Bloomin' Brands actively promotes gift card sales as a way to drive incremental revenue and encourage repeat visits. This strategy is particularly effective during holiday seasons and for special occasions.

- Revenue Generation: Gift cards provide upfront cash for Bloomin' Brands, improving working capital.

- Customer Acquisition: Recipients of gift cards are often new customers introduced to the brand.

- Customer Retention: Gift cards encourage repeat visits from existing customers.

- Brand Visibility: The broad redemption options across brands like Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar increase brand exposure.

Catering and Event Sales

Bloomin' Brands leverages dedicated sales channels for its catering and private event bookings. These channels are strategically designed to capture opportunities beyond walk-in traffic, focusing on corporate clients, large group gatherings, and individuals organizing special occasions.

This approach allows for the creation of tailored menus and unique dining experiences, effectively expanding the company's sales footprint. By catering to these specific market segments, Bloomin' Brands addresses a broader range of customer needs and preferences, driving incremental revenue streams.

- Target Audience: Corporate clients, large groups, individuals planning special occasions.

- Service Offering: Customized menus and unique event experiences.

- Sales Expansion: Extends reach beyond individual restaurant visits.

- Revenue Diversification: Supports diverse customer needs and occasions.

Bloomin' Brands' channels are a mix of direct and indirect touchpoints designed to reach a broad customer base. Physical restaurants remain central, complemented by digital platforms for online ordering and engagement.

Third-party delivery services are crucial for extending reach, especially given the significant portion of off-premises sales. In 2023, off-premises dining accounted for roughly 60% of total U.S. sales for Bloomin' Brands, highlighting the importance of these partnerships.

Gift cards, both physical and digital, serve as a vital revenue stream and customer engagement tool, redeemable across all their brands. Dedicated sales efforts also target catering and private events, broadening their service offerings beyond dine-in experiences.

| Channel Type | Description | Key Data/Impact |

|---|---|---|

| Physical Restaurants | Company-owned and franchised locations | 1,455 total locations globally (Q1 2024) |

| Owned Websites/Apps | Direct online ordering | Supports significant off-premises growth (approx. 25% of total sales in Q1 2024) |

| Third-Party Delivery | Extended market reach for off-premises dining | Crucial for capturing convenience-driven sales |

| Gift Cards | Physical and e-gift formats | Revenue generation and customer acquisition/retention tool |

| Catering/Private Events | Dedicated sales for special occasions and groups | Expands sales footprint beyond walk-in traffic |

Customer Segments

Casual diners seeking value are a cornerstone for Bloomin' Brands, particularly at Outback Steakhouse and Carrabba's Italian Grill. This group, often families and individuals, prioritizes a relaxed atmosphere and dependable, well-loved flavors without breaking the bank. They seek good quality at accessible prices, making these restaurants a go-to for regular meals or informal get-togethers.

Bloomin' Brands' strategy to offer abundant everyday value directly appeals to this significant segment. For instance, in 2024, Outback Steakhouse continued to feature popular promotions like the "Steak & Unlimited Shrimp" to attract and retain these price-conscious customers. This focus ensures consistent traffic and reinforces brand loyalty among those who value a satisfying meal at a reasonable cost.

Bonefish Grill targets individuals who appreciate a sophisticated yet relaxed dining atmosphere, with a particular fondness for fresh seafood. This customer base seeks an elevated casual dining experience, enjoying vibrant settings without the formality of fine dining.

In 2024, Bloomin' Brands, the parent company of Bonefish Grill, continued to focus on menu innovation to cater to these upscale casual and seafood enthusiasts. This includes introducing new dishes and refining existing ones to ensure a high-quality, appealing offering that aligns with evolving consumer tastes for fresh, well-prepared seafood.

Fleming's Prime Steakhouse & Wine Bar targets an affluent clientele who desire a luxurious dining experience, focusing on premium steaks and a curated wine list. This segment often chooses Fleming's for significant celebrations, important business engagements, or memorable events, placing a high value on exceptional service and an elegant ambiance.

In 2024, Fleming's continues to be recognized for its commitment to quality, with customer feedback frequently highlighting the superior taste of its steaks and the breadth of its wine offerings. For instance, in the first quarter of 2024, Fleming's reported a comparable same-store sales increase of 4.5%, indicating strong customer demand from this discerning segment.

Convenience-Oriented Customers (Off-Premises)

The convenience-oriented customer segment, often choosing off-premises dining, represents a significant and growing portion of Bloomin' Brands' business. These individuals and families value their time and opt for the ease of takeout or delivery to enjoy restaurant meals at home.

Bloomin' Brands' substantial off-premises sales, which have seen consistent growth, underscore the critical importance of catering to this customer base. For instance, in 2023, off-premises sales constituted a substantial part of their overall revenue, reflecting a strong consumer preference for off-premise options.

- Growing Demand: This segment actively seeks convenient dining solutions, driving demand for takeout and delivery services.

- Lifestyle Alignment: Busy lifestyles make off-premises dining an attractive option for enjoying quality meals without the need to dine in.

- Sales Impact: Bloomin' Brands' significant off-premises sales figures highlight the financial importance of this customer group.

- Strategic Focus: The company's continued investment in digital ordering platforms and efficient off-premises operations directly addresses the needs of these convenience-focused customers.

Corporate and Group Event Organizers

Corporate and group event organizers represent a key customer segment for Bloomin' Brands, particularly for upscale concepts like Fleming's Prime Steakhouse & Wine Bar. These organizers are looking for venues that offer a premium experience, private spaces, and comprehensive event services to host functions ranging from holiday parties to important client dinners.

Fleming's actively courts this market by offering private dining rooms and customizable menus designed to impress. In 2024, the demand for in-person corporate events saw a significant rebound, with many companies allocating budgets for team-building and client appreciation events. For instance, reports from event industry surveys in late 2023 and early 2024 indicated that over 70% of businesses planned to increase their spending on corporate events compared to the previous year.

- Demand for Premium Venues: Corporate clients prioritize locations offering a sophisticated ambiance and high-quality service for events.

- Customization is Key: Organizers require flexible menu options and the ability to tailor the dining experience to their specific event goals.

- Event Support Services: Professional coordination and dedicated staff are crucial for ensuring seamless execution of corporate functions.

- Holiday Party Focus: Fleming's, in particular, leverages the holiday season as a prime period for booking corporate parties, a trend that continued strongly into the 2024 holiday season.

Bloomin' Brands serves a diverse customer base, from casual diners seeking value at Outback Steakhouse to affluent patrons enjoying premium experiences at Fleming's Prime Steakhouse & Wine Bar. The company also caters to seafood enthusiasts at Bonefish Grill and those prioritizing convenience through off-premises dining. Corporate event organizers also represent a significant segment, particularly for the upscale brands.

The company's strategy in 2024 reflects a commitment to meeting the varied needs of these segments. For instance, Outback Steakhouse's continued promotions like Unlimited Shrimp aim to attract value-conscious families, while Fleming's focuses on premium offerings and private dining to capture the corporate and celebration market. Bonefish Grill, meanwhile, emphasizes menu innovation to appeal to seafood lovers.

The convenience-oriented customer, opting for takeout and delivery, remains a crucial focus, with Bloomin' Brands leveraging digital platforms to enhance this experience. This segment's growing importance is evident in the consistent rise of off-premises sales, which formed a substantial revenue stream in 2023 and continued to be a key growth driver into 2024.

| Restaurant Concept | Primary Customer Segment | 2024 Focus/Data Point |

|---|---|---|

| Outback Steakhouse | Casual diners seeking value | Continued promotions like Steak & Unlimited Shrimp to drive traffic. |

| Carrabba's Italian Grill | Casual diners seeking value | Emphasis on dependable, well-loved flavors and accessible pricing. |

| Bonefish Grill | Upscale casual, seafood enthusiasts | Menu innovation with new and refined seafood dishes. |

| Fleming's Prime Steakhouse & Wine Bar | Affluent clientele, corporate events | Premium steaks, curated wine list, private dining; 4.5% comparable same-store sales increase in Q1 2024. |

| Off-Premises Dining | Convenience-oriented customers | Investment in digital ordering and efficient operations; significant revenue contribution in 2023. |

Cost Structure

Food and beverage costs, often referred to as the Cost of Goods Sold (COGS), represent a substantial element within Bloomin' Brands' cost structure. This category primarily encompasses the expense of acquiring all the raw ingredients needed for their diverse menu, from prime cuts of meat and fresh seafood to vibrant produce and a wide array of beverages.

These procurement costs are particularly sensitive to fluctuations in commodity prices. For instance, in 2024, ongoing inflationary pressures on agricultural products and global supply chain disruptions continued to exert upward pressure on the cost of many key ingredients. This volatility directly impacts the restaurant-level operating margins, as higher input costs can squeeze profitability if not effectively managed.

To counteract these pressures, Bloomin' Brands actively pursues strategies focused on enhancing supply chain efficiency and optimizing its menu offerings. By forging strong relationships with suppliers and exploring innovative sourcing methods, they aim to secure favorable pricing. Furthermore, menu engineering, which involves analyzing the profitability and popularity of dishes, allows them to strategically adjust offerings to mitigate the impact of rising ingredient costs and maintain healthy margins.

Labor costs, encompassing wages, salaries, benefits, and other compensation for Bloomin' Brands' extensive workforce across its restaurants and corporate offices, represent a significant component of its cost structure. In 2024, the company, like many in the industry, faced ongoing labor inflation, a persistent challenge impacting profitability.

To mitigate these rising expenses, Bloomin' Brands actively pursues operational efficiencies and strategic adjustments to staffing levels. This focus on optimizing labor utilization is crucial for managing costs while maintaining service quality.

Occupancy and operating costs represent a significant portion of Bloomin' Brands' expenses, encompassing rent, utilities, and ongoing maintenance for its extensive network of over 1,000 restaurant locations. These costs are crucial for the day-to-day functioning and upkeep of each establishment.

In 2023, Bloomin' Brands reported total operating costs of $3.8 billion. The company actively manages these expenses through strategic decisions like restaurant closures and remodels, aiming to optimize its real estate footprint and shed costs tied to underperforming locations.

Marketing and Advertising Expenses

Bloomin' Brands allocates significant resources to marketing and advertising to build brand awareness and attract customers to its restaurant concepts. These expenses are a crucial part of their cost structure, directly influencing sales volume and market share. The company focuses on optimizing these investments, particularly through digital channels, to ensure a strong return on investment.

For 2024, Bloomin' Brands has indicated plans to increase its marketing expenditure. This strategic move is designed to further bolster brand visibility and drive customer traffic, especially as they navigate a competitive casual dining landscape. The company aims to achieve greater effectiveness by employing a strategic mix of advertising approaches.

- Marketing and advertising are key drivers of customer acquisition and revenue for Bloomin' Brands.

- The company is prioritizing digital marketing tactics for efficiency and reach.

- Bloomin' Brands intends to boost its marketing spend in 2024 to enhance brand promotion.

General and Administrative (G&A) and Technology Costs

General and Administrative (G&A) and Technology Costs encompass corporate overhead and essential administrative functions. These include expenses related to executive management, finance, human resources, and legal departments. For Bloomin' Brands, these costs are critical for supporting the overall business operations and brand management.

Bloomin' Brands has been actively managing its G&A expenses. In 2023, the company reported G&A expenses of $323.5 million. Recent restructuring initiatives, including corporate job cuts, are designed to streamline these operations and align the cost structure with the company's current operational scale, aiming for improved efficiency.

Ongoing investments in technology infrastructure are also a significant component. These expenditures are vital for enhancing operational efficiency, supporting digital transformation efforts, and driving future growth. For instance, technology investments can range from point-of-sale system upgrades to data analytics platforms that improve customer insights and marketing effectiveness.

- Corporate Overhead: Costs associated with central management and support functions.

- Administrative Functions: Expenses for finance, HR, legal, and other back-office operations.

- Technology Investments: Spending on IT infrastructure, software, and digital initiatives to support operations and growth.

- Cost Optimization: Initiatives like restructuring and job cuts to improve efficiency and align costs with business size.

Bloomin' Brands' cost structure is heavily influenced by food and beverage procurement, labor, and occupancy expenses. In 2024, inflationary pressures continued to impact ingredient costs, while labor inflation remained a significant challenge. The company actively manages these through supply chain optimization, menu engineering, and operational efficiencies.

Occupancy and operating costs, including rent and utilities for over 1,000 locations, are substantial. Bloomin' Brands strategically addresses these by optimizing its real estate footprint, sometimes through restaurant closures or remodels. Marketing and technology investments are also key, with a planned increase in marketing spend for 2024 to boost brand visibility.

| Cost Category | 2023 Data (Millions) | 2024 Focus |

|---|---|---|

| Food & Beverage (COGS) | N/A (Variable) | Managing commodity price volatility, supply chain efficiency |

| Labor | N/A (Variable) | Addressing labor inflation, optimizing staffing |

| Occupancy & Operating | Part of $3.8B Total Operating Costs | Real estate optimization, cost reduction via remodels/closures |

| Marketing & Advertising | N/A (Variable) | Increased spend planned for 2024, focus on digital |

| G&A | $323.5 | Streamlining operations, cost reduction through restructuring |

| Technology | N/A (Investment) | Enhancing efficiency, digital transformation |

Revenue Streams

The core of Bloomin' Brands' income is generated from customers enjoying meals and drinks within their restaurants. This covers all their brands, like Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar. The company actively aims to increase sales from diners at their existing locations.

Off-premises sales, encompassing both takeout and third-party delivery, represent a substantial and expanding revenue source for Bloomin' Brands. This segment has seen remarkable growth, more than doubling since 2019, underscoring its importance to the company's strategy.

This focus on off-premises dining directly addresses evolving consumer preferences for convenience and significantly broadens the accessibility of their brands. The company has actively invested in digital platforms and operational efficiencies to capitalize on this trend.

Gift card sales represent another important revenue stream for Bloomin' Brands. These cards can be used across their entire restaurant portfolio, offering flexibility to customers. This not only brings in immediate cash but also acts as a powerful tool for future customer engagement and revenue recognition when the cards are eventually redeemed.

Catering and Private Event Revenue

Bloomin' Brands generates revenue through catering services and the hosting of private events, such as corporate functions and personal celebrations. This diversifies income beyond traditional dine-in experiences, enabling the company to cater to larger groups and capitalize on event-specific spending. Fleming's Prime Steakhouse & Wine Bar, for instance, is noted for its robust private dining facilities.

This segment allows the brands to tap into a market seeking exclusive dining experiences, often with higher per-person spending compared to regular restaurant patronage. For example, in 2024, many high-end restaurants saw increased demand for private event bookings as corporate events and social gatherings returned with greater frequency.

- Catering Sales: Revenue generated from providing food and beverage services for off-site or on-site events.

- Private Event Hosting: Income derived from booking dedicated spaces within restaurants for exclusive use by parties.

- Corporate Functions: Revenue from business-related events like meetings, conferences, and holiday parties.

- Special Celebrations: Earnings from hosting personal milestones such as birthdays, anniversaries, and wedding receptions.

Franchise Fees and Royalties

Bloomin' Brands generates significant revenue from its franchised locations, primarily through initial franchise fees and recurring royalty payments. These royalties are typically calculated as a percentage of the franchisee's gross sales, providing a consistent income stream for the company.

The strategic re-franchising of its Brazil operations in 2023, for instance, is a clear indicator of this revenue model's importance. This move not only streamlined operations but also secured ongoing royalty revenue, demonstrating a commitment to this growth strategy.

- Franchise Fees: Initial lump-sum payments made by franchisees to secure the rights to operate a Bloomin' Brands restaurant.

- Royalty Payments: Ongoing fees, usually a percentage of gross sales, paid by franchisees to Bloomin' Brands for brand usage and support.

- International Focus: A significant portion of franchise fee and royalty revenue is derived from international markets, where franchising is a key expansion strategy.

- Strategic Re-franchising: The sale of company-owned stores to franchisees to generate upfront fees and establish long-term royalty streams, as seen with the Brazil divestiture.

Beyond dine-in and off-premises orders, Bloomin' Brands also generates revenue through the sale of gift cards, which can be used across their diverse restaurant portfolio. This provides immediate cash flow and encourages future visits, acting as a valuable customer engagement tool.

The company also leverages its brands for catering and private event hosting, offering tailored experiences for corporate functions and personal celebrations. This diversifies income and allows for higher per-patron spending, with brands like Fleming's noted for their private dining capabilities.

Franchising remains a key revenue driver, with initial fees and ongoing royalty payments from international operators contributing significantly. The strategic re-franchising of its Brazil operations in 2023 exemplifies this model, securing consistent royalty streams.

| Revenue Stream | Description | Example/Notes |

|---|---|---|

| Dine-In Sales | Revenue from customers eating in restaurants. | Core business for Outback, Carrabba's, Bonefish, Fleming's. |

| Off-Premises Sales | Revenue from takeout and third-party delivery. | More than doubled since 2019, showing strong growth. |

| Gift Cards | Revenue from the sale of gift cards. | Encourages future customer visits and provides upfront cash. |

| Catering & Events | Revenue from off-site catering and private event hosting. | Includes corporate events and personal celebrations; Fleming's offers private dining. |

| Franchise Fees & Royalties | Revenue from initial franchise fees and ongoing royalty payments. | Key for international expansion; Brazil re-franchising in 2023 secured ongoing royalties. |

Business Model Canvas Data Sources

The Bloomin' Brands Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive analysis reports. These diverse data streams provide a comprehensive view of operational performance and market positioning.