Bloomin' Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomin' Brands Bundle

Understanding Bloomin' Brands's competitive landscape through Porter's Five Forces reveals significant pressures from buyer bargaining power and the threat of substitutes within the casual dining sector. The intensity of rivalry among established brands and the influence of suppliers also play crucial roles in shaping their market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bloomin' Brands’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The restaurant industry, including Bloomin' Brands, depends on a wide array of suppliers for everything from fresh produce to specialized kitchen equipment. When a small number of suppliers control the market for essential items, their leverage grows significantly. For instance, if a particular type of specialty cheese or a unique spice blend is only available from one or two major producers, Bloomin' Brands has less room to negotiate prices, potentially driving up food costs.

Bloomin' Brands could encounter substantial switching costs when changing ingredient or equipment suppliers. These costs might include the expense of retraining kitchen staff on new preparation methods, redesigning menus to accommodate alternative ingredients, or purchasing entirely new specialized equipment, all of which can be quite disruptive to daily operations.

These elevated switching costs can significantly diminish Bloomin' Brands' bargaining leverage with its current suppliers. If the financial and operational burden of transitioning to a new supplier is greater than the potential savings from renegotiated terms, the company may be compelled to accept less favorable pricing or conditions from existing partners.

For instance, in 2024, the restaurant industry saw average food cost increases of around 5-10%, making supplier negotiations critical. A restaurant chain like Bloomin' Brands, with its extensive supply chain for items like Outback Steakhouse's signature bloomin' onion ingredients or Carrabba's Italian Grill's pasta, would face considerable costs if forced to switch suppliers for key components due to the need for new quality control measures and menu adjustments.

Suppliers might leverage their position by integrating forward into Bloomin' Brands' operations, essentially becoming competitors. This means a supplier could decide to open their own restaurant concepts or establish their own distribution networks, directly challenging Bloomin' Brands for market share and customer access.

While broadline food suppliers are less likely to pursue this strategy due to the complexity and capital required to run restaurant chains, specialized suppliers possessing strong brand recognition or unique, proprietary ingredients could find it a viable option. For instance, a premium pasta supplier with a cult following might consider opening its own Italian eatery.

This potential for forward integration by suppliers, even if not fully realized, increases their bargaining power. Bloomin' Brands must consider the risk that key suppliers could shift from partners to rivals, potentially impacting supply chain stability and cost structures. For example, in 2024, the restaurant industry saw increased consolidation among food distributors, which could empower some of these entities to explore more direct consumer engagement models.

Importance of Supplier's Input to Bloomin' Brands

The bargaining power of suppliers for Bloomin' Brands hinges significantly on how critical their products or services are to the company's core operations and brand identity. If a supplier provides a unique or high-quality ingredient that is central to a popular dish, their leverage increases substantially.

For instance, suppliers of premium beef for Outback Steakhouse or specialty seafood for Bonefish Grill possess greater bargaining power. This is especially true if these ingredients are difficult to source elsewhere or are a key differentiator for the restaurant chains. In 2024, Bloomin' Brands, like many in the casual dining sector, faced ongoing supply chain pressures, making reliable sourcing of quality ingredients paramount.

- Criticality of Inputs: Suppliers of specialized ingredients like prime cuts of beef or unique seafood varieties hold more power as these directly impact menu appeal and customer satisfaction.

- Supplier Concentration: If only a few suppliers can provide a necessary input, their bargaining power is amplified.

- Switching Costs: High costs associated with changing suppliers for essential ingredients can also empower existing suppliers.

- Brand Dependence: Suppliers whose products are integral to a restaurant's brand image, like specific spices or sauces, can exert more influence.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Bloomin' Brands' bargaining power with its suppliers. If Bloomin' Brands can easily switch to alternative suppliers for key ingredients like beef or produce, or if similar quality equipment is readily available from multiple vendors, the suppliers' ability to dictate terms diminishes. For instance, in 2024, the restaurant industry saw increased sourcing diversification for many ingredients, which generally pressured supplier pricing.

Conversely, reliance on unique or proprietary inputs grants suppliers greater leverage. If Bloomin' Brands requires a specific type of spice blend or a specialized piece of kitchen technology that only a few suppliers can provide, those suppliers hold more power. This can lead to higher costs or less favorable contract terms for Bloomin' Brands.

- Reduced Supplier Power: When Bloomin' Brands can easily find comparable ingredients or services from multiple sources, supplier influence is curtailed.

- Increased Supplier Power: Dependence on specialized or unique inputs strengthens the bargaining position of those specific suppliers.

- Impact on Costs: The availability of substitutes directly affects Bloomin' Brands' cost of goods sold and operational expenses.

- Strategic Sourcing: Bloomin' Brands' ability to identify and cultivate relationships with multiple suppliers for essential inputs is crucial for mitigating supplier power.

Bloomin' Brands faces significant supplier bargaining power when inputs are critical and difficult to substitute, particularly for signature items like Outback Steakhouse's prime beef or Carrabba's Italian Grill's specialty pasta. In 2024, the restaurant industry grappled with an average 8% increase in food costs, underscoring the impact of supplier leverage. High switching costs, including retraining and menu redesigns, further empower suppliers, making it challenging for Bloomin' Brands to negotiate favorable terms. The concentration of suppliers for unique ingredients also amplifies their power, directly affecting the company's cost of goods sold.

| Factor | Impact on Bloomin' Brands | 2024 Industry Context |

|---|---|---|

| Criticality of Inputs | High for signature ingredients (e.g., prime beef, specialty pasta) | Suppliers of key ingredients held strong negotiating positions due to demand. |

| Supplier Concentration | Elevated for unique or proprietary ingredients | Industry saw some consolidation, potentially increasing power for remaining suppliers. |

| Switching Costs | Significant for specialized equipment and ingredient retraining | Companies focused on supply chain stability, making switching more costly and risky. |

| Availability of Substitutes | Low for differentiated menu items | Diversification efforts were underway, but unique inputs remained a challenge. |

What is included in the product

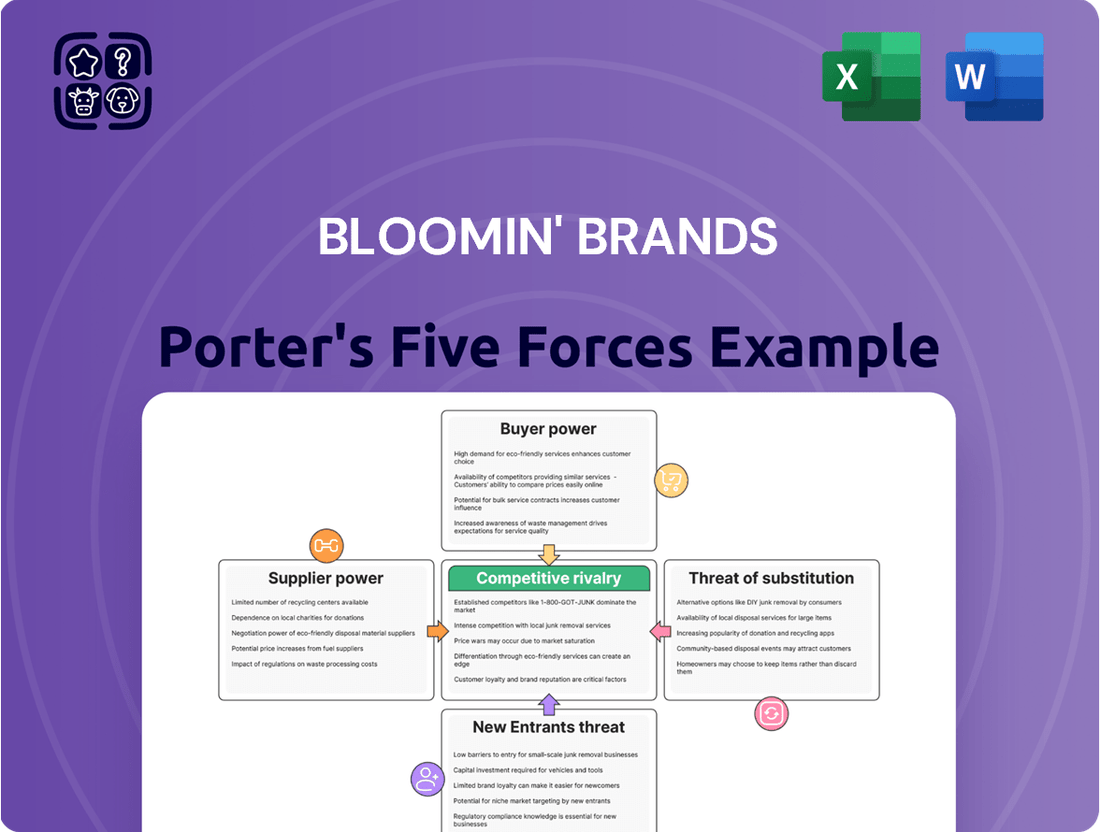

This analysis identifies the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the casual dining industry, specifically for Bloomin' Brands.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Bloomin' Brands' competitive landscape to alleviate decision-making paralysis.

Customers Bargaining Power

Customers in the casual dining sector, where Bloomin' Brands operates with brands like Outback Steakhouse and Carrabba's Italian Grill, often exhibit significant price sensitivity. This is particularly true in the current economic climate, marked by persistent inflation. For instance, the U.S. Consumer Price Index (CPI) for all urban consumers saw a 3.4% increase in the twelve months ending April 2024, impacting household budgets and dining out decisions.

Bloomin' Brands has acknowledged this price sensitivity by implementing value-oriented promotions, such as their popular Aussie 3 Course meal. This strategy aims to attract and retain customers by offering perceived good value, a crucial factor when consumers are watching their spending more closely.

When customers are highly sensitive to price, their willingness to switch to competitors offering more attractive price points increases. This directly amplifies their bargaining power, as restaurants must compete not only on quality and experience but also on affordability to maintain market share.

Customers possess considerable bargaining power because they have a vast array of dining alternatives. Beyond Bloomin' Brands' specific restaurants, consumers can choose from other casual dining establishments, fast-casual eateries, quick-service options, or opt to prepare meals at home. This wide availability of substitutes means customers are not tied to any single provider, significantly amplifying their ability to negotiate or seek better value elsewhere.

Customers today possess significant bargaining power due to unprecedented access to information. Online reviews, readily available menus, and transparent pricing across various platforms empower diners to meticulously compare Bloomin' Brands' offerings with competitors. This ease of access allows them to make informed decisions based on perceived value, food quality, and overall dining experience, directly influencing their willingness to patronize a particular establishment.

Low Switching Costs for Customers

The ease with which a customer can switch from a Bloomin' Brands restaurant to a competitor significantly bolsters their bargaining power. This transition typically involves minimal effort, often just the decision to visit a different establishment.

This lack of friction in switching empowers customers, allowing them to readily shift their patronage if they encounter dissatisfaction with pricing, food quality, or the overall dining experience. For instance, in 2024, the casual dining sector saw continued competition with numerous brands vying for customer attention, making it simple for diners to explore alternatives.

- Low Switching Costs: Customers face minimal barriers when choosing between Bloomin' Brands and other dining options.

- Customer Empowerment: The ability to easily switch gives customers leverage to demand better value and experience.

- Competitive Landscape: In 2024, the restaurant industry remained highly competitive, reinforcing the power of customers with many choices.

Customer Loyalty Programs

Bloomin' Brands' loyalty programs, such as Dine Rewards, aim to foster customer retention. While these programs don't directly increase a customer's ability to negotiate lower prices, their success in keeping customers engaged can lessen the overall impact of customer bargaining power.

By building a loyal customer base, Bloomin' Brands can reduce the propensity for customers to switch to competitors, even when faced with compelling offers. This loyalty acts as a buffer against aggressive price demands from customers.

- Customer Retention: Loyalty programs are designed to encourage repeat business and reduce customer churn.

- Mitigating Switching Behavior: Effective programs make it less likely for customers to be swayed by competitor promotions.

- Brand Affinity: Successful loyalty initiatives can cultivate a stronger emotional connection with the brand, further solidifying customer loyalty.

Customers hold significant bargaining power within the casual dining sector due to a multitude of readily available alternatives. This allows them to easily switch to competitors if Bloomin' Brands' pricing or offerings are not perceived as favorable. For example, in 2024, the restaurant industry continued to experience intense competition, with numerous brands actively vying for consumer attention.

The ease of switching means customers can effectively leverage their choices to seek better value, impacting Bloomin' Brands' pricing strategies and profit margins. This dynamic is further amplified by the increasing transparency of pricing and promotions across various online platforms, empowering diners with extensive comparative data.

Bloomin' Brands' loyalty programs, like Dine Rewards, aim to counter this by fostering customer retention and reducing the likelihood of customers switching. However, the fundamental power of choice remains a key factor influencing customer behavior and their ability to negotiate value.

| Factor | Impact on Bloomin' Brands | 2024 Relevance |

|---|---|---|

| Availability of Substitutes | High customer bargaining power | Intense competition among casual dining and other food service options. |

| Price Sensitivity | Customers demand value for money | Inflationary pressures in 2024 continued to make consumers budget-conscious. |

| Information Accessibility | Customers compare options easily | Online reviews and price comparison tools are widely used. |

| Switching Costs | Minimal for customers | Customers can easily shift dining choices with little effort. |

Same Document Delivered

Bloomin' Brands Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Bloomin' Brands Porter's Five Forces Analysis you see here details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This professionally written analysis is fully formatted and ready for your immediate use.

Rivalry Among Competitors

Bloomin' Brands operates in a highly competitive restaurant landscape, especially within the casual dining sector. The industry is characterized by its fragmentation, featuring numerous national chains, regional players, and independent establishments all vying for customer attention. This sheer volume and variety of competitors directly fuel intense rivalry.

In 2024, the casual dining segment continues to see significant competition. For instance, Bloomin' Brands, which operates brands like Outback Steakhouse and Carrabba's Italian Grill, faces off against giants such as Darden Restaurants (Olive Garden, LongHorn Steakhouse) and Brinker International (Chili's, Maggiano's Little Italy). Beyond these major players, a vast number of smaller chains and local eateries also contribute to the crowded marketplace, offering diverse cuisines and price points.

The U.S. restaurant industry is expected to see modest growth in 2024 and 2025. While segments like fast-casual and quick-service are growing more rapidly, casual dining, where Bloomin' Brands operates, is projected for more moderate expansion.

This slower growth within casual dining means that companies are more intensely competing for market share. With a less expansive market, the drive to attract and retain customers becomes even more critical, increasing the pressure on established players.

Bloomin' Brands actively works to set its restaurants apart. Outback Steakhouse focuses on Australian-themed casual dining, Carrabba's Italian Grill offers authentic Italian cuisine, Bonefish Grill specializes in seafood, and Fleming's Prime Steakhouse & Wine Bar provides a premium steakhouse experience. This multi-brand strategy aims to capture different customer segments.

Despite these efforts, the casual dining sector often faces challenges in achieving significant product differentiation. Many competitors offer similar menus and dining atmospheres, forcing them to compete more intensely on factors like pricing, promotional deals, and customer service quality. This can lead to a more aggressive competitive landscape for Bloomin' Brands.

High Fixed Costs and Perishable Products

The restaurant sector, including companies like Bloomin' Brands, is characterized by substantial fixed costs. These include expenses for prime real estate, kitchen equipment, and a consistent workforce, all of which must be paid regardless of sales volume. This financial structure inherently pushes businesses to operate at high capacity to spread these costs.

Compounding this pressure is the perishable nature of food inventory. Restaurants must sell their products before they spoil, creating an urgent need to drive sales. This can lead to a cycle of aggressive pricing and promotional activities as competitors vie for customer attention and try to minimize waste, thereby intensifying competitive rivalry.

- High Fixed Costs: Bloomin' Brands, like others in the industry, faces significant overheads such as rent for its numerous locations and investments in kitchen infrastructure.

- Perishable Inventory: The need to sell food before it spoils necessitates constant sales efforts and can lead to markdowns or promotions.

- Intensified Rivalry: These factors combined often result in price wars and aggressive marketing campaigns among casual dining chains.

- 2024 Impact: In 2024, many restaurant chains reported increased food costs, further squeezing margins and potentially leading to more aggressive sales tactics to cover operational expenses.

Exit Barriers

Bloomin' Brands, like many in the casual dining sector, faces significant exit barriers. These can trap less successful competitors in the market, even when profitability is low. This situation often fuels intense price competition, as these companies try to stay afloat, impacting overall industry margins.

High exit barriers for Bloomin' Brands and its competitors can include:

- Specialized Assets: Restaurant locations, kitchen equipment, and brand-specific technology represent significant investments that are difficult to liquidate or repurpose, making it costly to exit.

- Long-Term Leases: Many restaurant chains operate under leases that extend for several years. Breaking these leases can incur substantial penalties, forcing companies to continue operating even in unfavorable conditions. For instance, in 2023, many restaurant companies were still managing leases signed pre-pandemic, impacting their flexibility.

- Employee Severance and Contractual Obligations: Closing multiple locations can lead to significant costs associated with severance packages and fulfilling existing contracts with suppliers or service providers.

- Brand Reputation and Goodwill: A sudden closure of multiple outlets can damage the brand's reputation, making it harder to recover any residual value from assets or future ventures.

The competitive rivalry within the casual dining sector, where Bloomin' Brands operates, is notably intense. This is driven by a fragmented market with numerous players, including national giants and local establishments, all vying for customer dollars. In 2024, Bloomin' Brands, with its portfolio of brands like Outback Steakhouse, faces direct competition from major restaurant groups such as Darden Restaurants and Brinker International, alongside a multitude of smaller operators.

The casual dining segment is projected for moderate growth in 2024 and 2025, which intensifies the battle for market share. This environment often leads to aggressive pricing and promotional strategies as companies strive to attract and retain customers amidst similar offerings. The industry's structure, characterized by high fixed costs and perishable inventory, further fuels this rivalry, pushing businesses to maximize sales and minimize waste through competitive tactics.

Exit barriers within the casual dining industry are substantial, trapping less profitable competitors and contributing to ongoing price pressures. Factors like specialized assets, long-term leases, and contractual obligations make it costly for underperforming companies to leave the market, thereby sustaining a crowded and highly competitive landscape for Bloomin' Brands.

| Competitor Group | Key Brands | Estimated 2024 Market Share (Casual Dining - US) |

|---|---|---|

| Bloomin' Brands | Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, Fleming's | ~3-4% |

| Darden Restaurants | Olive Garden, LongHorn Steakhouse, Capital Grille | ~8-10% |

| Brinker International | Chili's Grill & Bar, Maggiano's Little Italy | ~4-5% |

| Other Major Chains (e.g., Texas Roadhouse, Cheesecake Factory) | Various | ~15-20% (combined) |

SSubstitutes Threaten

The threat of in-home dining and meal kits as substitutes for restaurants like Bloomin' Brands is growing. As restaurant prices climb, consumers are increasingly looking for more economical options, with home-prepared meals becoming a more attractive alternative. This trend was evident in 2023, where inflation continued to put pressure on household budgets, making dining out a less frequent discretionary expense for many.

The convenience factor is also a significant driver. The proliferation of meal kit services and the availability of high-quality, ready-to-eat meals from grocery stores further reduce the perceived effort and time commitment compared to traditional restaurant dining. For instance, the U.S. meal kit delivery market was valued at approximately $7.6 billion in 2023 and is projected to continue its growth trajectory, indicating a sustained consumer preference for these convenient at-home options.

Bloomin' Brands' casual dining restaurants, like Outback Steakhouse and Carrabba's Italian Grill, contend with a significant threat from quick-service restaurants (QSRs) and fast-casual dining. These alternatives are increasingly capturing market share by offering speed, affordability, and a growing emphasis on quality and personalized options. For instance, the fast-casual segment in the U.S. saw substantial growth, with brands like Chipotle and Panera Bread consistently reporting strong sales figures, indicating a consumer shift towards convenient yet elevated dining experiences.

The threat of substitutes in the casual dining space is significant, with chains like Texas Roadhouse and Chili's offering very similar experiences and cuisines. These direct competitors provide consumers with easy alternatives, making switching between brands a common occurrence based on factors like current promotions, convenient locations, or simply where customers perceive better value. For instance, in 2024, the casual dining segment continued to see intense competition, with many chains actively engaging in price-based promotions and loyalty programs to retain customers amidst this substitutability.

Entertainment and Experiential Alternatives

Consumers have a wide array of choices for their discretionary spending, extending far beyond just dining out. These entertainment and experiential alternatives, such as attending live events, traveling, or engaging in other leisure pursuits, directly compete for the same disposable income that might otherwise be allocated to a meal at a restaurant.

For a premium dining establishment like Fleming's Prime Steakhouse & Wine Bar, these alternatives represent a significant competitive force. When consumers decide to spend their leisure budget, a concert or a weekend getaway can easily take precedence over a high-end dining experience.

- Consumer Spending Shift: In 2024, the U.S. Bureau of Economic Analysis reported that personal consumption expenditures on recreation services saw a notable increase, indicating a strong consumer appetite for experiences.

- Competition for Wallet Share: While not direct food competitors, activities like theme park admissions or sporting event tickets vie for the same dollars consumers allocate to dining out, particularly in the upscale segment.

- Impact on Premium Dining: For brands like Fleming's, the allure of unique experiences can draw spending away from traditional fine dining, forcing them to emphasize value and memorable occasions.

Dietary Trends and Health Consciousness

The increasing consumer focus on health-conscious, plant-based, and sustainably sourced food presents a significant threat of substitutes for Bloomin' Brands. If the company's menu and sourcing practices don't align with these evolving preferences, consumers may opt for alternatives. For instance, a 2024 report indicated that over 30% of consumers are actively seeking plant-based options more frequently than in previous years, a trend that could divert customers from traditional casual dining establishments.

Restaurants that successfully integrate these dietary shifts, offering diverse plant-based entrees or emphasizing transparent, sustainable sourcing, can capture market share. This creates a competitive pressure for Bloomin' Brands to innovate its offerings. For example, a competitor might introduce a highly successful vegan menu that directly appeals to this growing demographic, thereby reducing the demand for Bloomin' Brands' core products.

- Growing Demand for Plant-Based Options: Consumer surveys in 2024 consistently show an upward trend in plant-based eating, with a significant portion of the population reducing or eliminating meat consumption.

- Emphasis on Sustainable and Ethical Sourcing: A growing segment of diners prioritizes restaurants that demonstrate commitment to environmental sustainability and ethical treatment of animals, viewing these as key differentiators.

- Health and Wellness Focus: The broader health and wellness movement encourages consumers to choose foods perceived as healthier, which can include fresh, unprocessed, and nutrient-dense options often found outside traditional casual dining.

- Availability of Diverse Substitutes: The market now offers a wide array of substitutes, from fast-casual eateries with specialized healthy menus to meal kit services and even home cooking with readily available plant-based ingredients, all competing for consumer dining dollars.

The threat of substitutes for Bloomin' Brands is multifaceted, encompassing everything from home dining to alternative leisure activities. Consumers are increasingly seeking value and convenience, leading them to consider options beyond traditional casual dining. This is particularly true as economic pressures, like inflation seen through 2023, make discretionary spending on dining out a more considered choice.

The rise of meal kit services and enhanced grocery store offerings further strengthens the substitute threat by providing convenient and often more affordable alternatives to restaurant meals. For example, the U.S. meal kit market was valued at approximately $7.6 billion in 2023, demonstrating a clear consumer preference for these at-home solutions.

Beyond food preparation, other leisure activities compete for consumer dollars. Experiences like concerts or travel can easily divert spending that might otherwise go to a premium dining experience. In 2024, personal consumption expenditures on recreation services saw a notable increase, highlighting this trend of prioritizing experiences.

Furthermore, evolving consumer preferences for health-conscious and plant-based options present a growing substitute threat. A 2024 report indicated over 30% of consumers are seeking plant-based options more frequently, a shift that could impact casual dining if menus don't adapt.

Entrants Threaten

Launching and running a restaurant chain, particularly one with diverse brands like Bloomin' Brands, demands substantial financial backing. This includes significant outlays for prime real estate, essential kitchen equipment, initial stock of ingredients, and extensive marketing campaigns to build brand recognition.

These considerable capital needs create a substantial hurdle for aspiring competitors looking to enter the market. For instance, establishing just one full-service restaurant can easily cost upwards of $500,000 to $1 million, and for a chain, this multiplies exponentially.

Bloomin' Brands enjoys significant brand recognition and customer loyalty, cultivated over years through its popular chains like Outback Steakhouse and Carrabba's Italian Grill. This established goodwill presents a considerable barrier for newcomers. For instance, in 2023, Bloomin' Brands reported total revenue of $4.2 billion, a testament to its strong market presence and customer base.

Established restaurant companies like Bloomin' Brands have cultivated deep-rooted relationships with suppliers and built robust distribution networks over years of operation. This existing infrastructure makes it challenging for newcomers to gain access to the same quality ingredients or efficient delivery systems. For instance, in 2024, major food distributors often prioritize volume and established credit lines, which new entrants may not yet possess.

Government Regulations and Licensing

The restaurant sector, including companies like Bloomin' Brands, faces a significant hurdle from government regulations and licensing requirements. These can range from strict health and safety codes, like those enforced by the FDA, to labor laws and specific liquor licensing, all of which demand substantial compliance efforts and investment. Navigating this intricate web of rules adds considerable cost and complexity for any new player aiming to enter the market, thereby acting as a deterrent.

For instance, in 2024, the ongoing scrutiny of food safety standards and evolving labor regulations, such as minimum wage adjustments in various states, continue to shape the operational landscape. New entrants must not only secure the necessary permits and licenses, which can be a lengthy and expensive process, but also build robust systems to ensure continuous compliance across all facets of their business. This regulatory burden effectively raises the barrier to entry, making it more challenging for nascent competitors to establish themselves against established entities like Bloomin' Brands.

- Health and Safety Regulations: Compliance with food safety standards, hygiene protocols, and building codes.

- Labor Laws: Adherence to minimum wage, overtime, and employee benefit mandates.

- Licensing Requirements: Obtaining permits for operations, alcohol service, and signage.

- Environmental Regulations: Meeting standards for waste disposal and energy consumption.

Experience and Operational Know-how

The threat of new entrants for Bloomin' Brands is significantly influenced by the experience and operational know-how required to succeed in the casual dining sector. Successfully navigating multiple restaurant concepts, complex supply chains, extensive marketing efforts, and the management of a large workforce demands substantial industry expertise. New players, especially those lacking a proven track record in restaurant operations, face a considerable learning curve and elevated business risks.

For instance, in 2024, the restaurant industry continues to be characterized by high failure rates for new establishments. Studies indicate that a significant percentage of new restaurants close within their first year of operation, underscoring the difficulty of establishing a sustainable business model without deep operational understanding. Bloomin' Brands, with its established infrastructure and decades of experience across brands like Outback Steakhouse and Carrabba's Italian Grill, benefits from a considerable barrier to entry for newcomers.

- Significant Capital Investment: New entrants need substantial capital not only for initial setup but also for ongoing operational costs, marketing, and adapting to evolving consumer preferences.

- Brand Recognition and Loyalty: Building brand awareness and customer loyalty takes years and considerable marketing expenditure, a hurdle that Bloomin' Brands has already overcome.

- Supply Chain Management: Establishing reliable and cost-effective supply chains for diverse menu items across multiple locations is a complex operational challenge that experienced companies have mastered.

- Talent Acquisition and Retention: Attracting and retaining skilled management and service staff in the competitive hospitality sector requires robust HR practices and a strong employer brand, areas where established players have an advantage.

The threat of new entrants for Bloomin' Brands is moderate, primarily due to the significant capital required to establish a new restaurant chain. Beyond initial setup costs, which can easily exceed $1 million per location in 2024, new entrants must also contend with the substantial marketing investments needed to build brand recognition against established players like Bloomin' Brands, which reported $4.2 billion in revenue in 2023.

Existing supply chain relationships and operational expertise also act as deterrents. Newcomers struggle to match the economies of scale and supplier leverage that companies like Bloomin' Brands have developed over years, making it harder to secure favorable pricing and efficient distribution in 2024. Furthermore, navigating complex regulations, from food safety to labor laws, adds considerable cost and time, favoring established entities with proven compliance systems.

| Barrier to Entry | Impact on New Entrants | Bloomin' Brands Advantage |

|---|---|---|

| Capital Requirements | High (e.g., $500k-$1M+ per full-service restaurant) | Established financial resources and access to capital markets. |

| Brand Recognition & Loyalty | Low (requires significant marketing spend) | Strong brand equity from chains like Outback Steakhouse. |

| Supply Chain & Distribution | Challenging (supplier relationships, volume discounts) | Existing, robust, and cost-effective supply chain infrastructure. |

| Operational Expertise | High (navigating complex operations, high failure rates) | Decades of experience across multiple brands and markets. |

| Regulatory Compliance | Costly and time-consuming (licenses, health, labor laws) | Established systems for meeting and maintaining compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bloomin' Brands leverages data from SEC filings, investor relations reports, and industry-specific market research from firms like IBISWorld. This combination provides a comprehensive view of competitive dynamics, supplier power, and buyer influence within the casual dining sector.