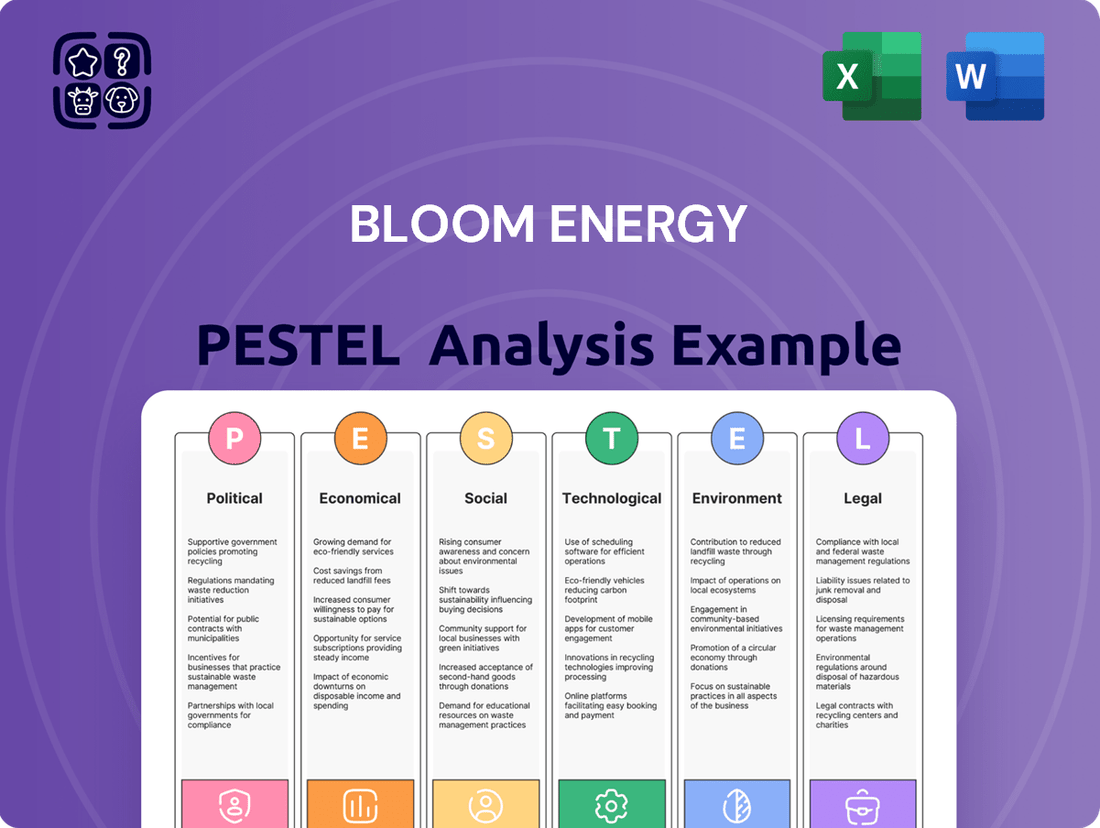

Bloom Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloom Energy Bundle

Unlock the critical external factors shaping Bloom Energy's trajectory with our comprehensive PESTLE analysis. From evolving government policies on clean energy to global economic shifts and technological advancements in fuel cells, understand the landscape. This analysis provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive advantage in understanding Bloom Energy's market dynamics.

Political factors

Government policies, especially tax credits and subsidies for clean energy, are crucial for Bloom Energy's success. These incentives make their fuel cell technology more competitive and affordable for customers.

The Inflation Reduction Act (IRA) in the United States, for example, provides extended and improved investment tax credits for fuel cells. This directly boosts the attractiveness of Bloom Energy's offerings.

These government programs can significantly lower the initial investment for clients, thereby accelerating the adoption of Bloom Energy's solutions and positively impacting the company's revenue and profitability.

Evolving energy policies and regulatory frameworks are pivotal for Bloom Energy. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers significant tax credits for clean energy technologies, including fuel cells, which directly benefits Bloom Energy's solid oxide electrolyzers and fuel cell products. This legislation aims to accelerate the transition to net-zero emissions, creating a more favorable market for distributed generation solutions.

Conversely, shifts in policy favoring traditional fossil fuels or introducing complex compliance burdens can pose challenges. While specific new regulations impacting Bloom Energy directly are still unfolding in late 2024 and early 2025, the general trend towards decarbonization is a positive indicator. However, any potential rollback of clean energy incentives or the imposition of new, costly permitting processes could increase operational expenses and affect market competitiveness.

Global geopolitical tensions, particularly those impacting traditional energy supplies, are increasingly driving demand for resilient, on-site power solutions. Nations are actively seeking to bolster energy security and reduce reliance on vulnerable centralized grids. This geopolitical landscape directly benefits Bloom Energy, whose fuel-flexible solid oxide electrolyzers and fuel cells offer a pathway to decentralized and reliable power generation.

Concerns over energy independence are a significant tailwind for Bloom Energy's business model. For instance, in 2024, many European nations continued to emphasize diversification of energy sources and strengthening domestic energy production capabilities in response to ongoing international energy market volatility. This strategic shift makes Bloom's technology, capable of running on various fuels including hydrogen and biogas, a more attractive proposition for securing critical infrastructure and data centers against potential supply chain disruptions.

Trade Policies and Tariffs

International trade policies, including tariffs on components or raw materials, directly impact Bloom Energy's supply chain costs and its ability to compete globally. For instance, changes in tariffs on specialized alloys or advanced manufacturing equipment could increase production expenses for their fuel cell systems. Managing these trade dynamics is crucial for Bloom Energy's international expansion strategies.

The imposition of tariffs can significantly alter the cost-effectiveness of deploying Bloom Energy's solutions in various international markets. For example, a 10% tariff on imported solar panel components, if Bloom Energy were to integrate them, would raise the overall project cost. This necessitates careful consideration of local sourcing versus international procurement, impacting Bloom Energy's competitive pricing.

- Tariff Impact: Tariffs on critical components like specialized metals for fuel cell stacks can increase Bloom Energy's cost of goods sold, potentially affecting profit margins and pricing competitiveness.

- Supply Chain Resilience: Trade policy shifts can disrupt established supply chains, forcing Bloom Energy to re-evaluate sourcing strategies and potentially invest in more localized manufacturing to mitigate risks.

- Market Access: Favorable trade agreements can open new markets for Bloom Energy's technology, while protectionist policies in key regions could create barriers to entry or increase operational costs.

Local and State Government Support

Support from local and state governments is a crucial political factor for Bloom Energy. Favorable permitting processes and zoning regulations can significantly speed up project deployment and reduce costs. For instance, in 2024, California continued to offer robust incentives for clean energy projects, including those utilizing fuel cell technology, which directly benefits Bloom Energy's market penetration in the state.

Specific regional incentives for clean energy or distributed power are also vital. These can include tax credits, grants, or streamlined approval pathways. For example, states like New York have been actively promoting distributed generation and energy storage solutions, creating a more conducive environment for Bloom Energy's fuel cell installations and potentially lowering their overall project expenses.

- Accelerated Deployment: Favorable local policies can reduce project timelines by months, leading to quicker revenue generation.

- Cost Reduction: Incentives and efficient permitting can lower the capital expenditure for Bloom Energy projects.

- Market Access: Supportive state and local governments often create demand for clean energy technologies, expanding Bloom Energy's addressable market.

Government incentives, such as the Inflation Reduction Act's investment tax credits for fuel cells, significantly enhance Bloom Energy's market competitiveness. These policies directly reduce upfront costs for customers, accelerating adoption and boosting revenue. Additionally, evolving energy policies globally are pushing for decarbonization, creating a favorable market for Bloom's distributed generation solutions.

Geopolitical shifts toward energy independence are a major advantage, driving demand for resilient, on-site power. Bloom's fuel-flexible technology addresses concerns about supply chain disruptions and energy security. However, international trade policies, including tariffs on components, can impact manufacturing costs and global competitiveness, requiring careful supply chain management.

| Political Factor | Impact on Bloom Energy | Example/Data (2024-2025) |

|---|---|---|

| Government Incentives (e.g., IRA Tax Credits) | Increases competitiveness, reduces customer costs, accelerates adoption. | IRA's 30% investment tax credit for fuel cells directly lowers project capital expenditure. |

| Energy Policy Trends (Decarbonization) | Creates favorable market conditions for clean energy solutions. | Global push for net-zero targets by 2050 drives demand for fuel cell technology. |

| Energy Security & Geopolitics | Boosts demand for resilient, on-site power generation. | European nations diversifying energy sources in 2024 increases interest in Bloom's fuel-flexible systems. |

| International Trade Policies (Tariffs) | Affects supply chain costs and global pricing. | Potential tariffs on specialized alloys could increase Bloom's cost of goods sold. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Bloom Energy across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key opportunities and threats derived from current market and regulatory dynamics.

Bloom Energy's PESTLE analysis provides a clear roadmap for navigating complex market dynamics, acting as a pain point reliver by highlighting opportunities and mitigating risks.

This analysis serves as a valuable tool for business consultants, offering a structured approach to identifying and addressing external factors that impact Bloom Energy's strategy and client recommendations.

Economic factors

The cost-competitiveness of Bloom Energy's fuel cell systems is a critical economic factor. For instance, in 2024, the company continued to focus on reducing manufacturing costs through increased automation and supply chain optimization, aiming to bring their total installed cost per kilowatt closer to parity with traditional energy sources. This push is vital for wider adoption, especially as energy prices fluctuate.

Technological advancements directly impact this cost-competitiveness by improving the efficiency of their fuel cells, meaning more electricity is generated from the same amount of fuel. Higher efficiency translates to lower operating costs for customers over the lifetime of the system. Raw material costs, particularly for platinum group metals used in some fuel cell components, also play a significant role in the final price point.

Fluctuations in natural gas prices directly impact the operational costs for Bloom Energy customers, as it's a primary fuel source for their servers. For instance, in early 2024, natural gas prices saw significant swings, with Henry Hub prices trading in the $2.00-$3.00 per MMBtu range, affecting the overall cost-effectiveness of energy solutions.

While Bloom Energy's technology offers fuel flexibility, allowing for the use of biogas or hydrogen, sustained high natural gas prices could still challenge the economic appeal of their fuel cell systems. This fuel diversity, however, acts as a crucial hedge against the volatility inherent in fossil fuel markets.

Bloom Energy's fuel cell technology requires significant upfront capital, which can deter potential customers. To overcome this, the company leverages innovative financing models like Power Purchase Agreements (PPAs). These agreements allow customers to buy electricity generated by Bloom's systems at a fixed rate, shifting the capital burden from the customer to Bloom or its financing partners.

Partnerships with infrastructure capital providers are also crucial for Bloom Energy. These collaborations provide the necessary funding to deploy large-scale projects, making clean energy solutions more accessible. For instance, Bloom's 2023 financial reports indicated continued growth in its PPA backlog, demonstrating the effectiveness of these financing strategies in driving customer adoption and project pipelines.

Distributed Generation Market Growth

The distributed generation market is experiencing robust growth, creating a substantial economic avenue for Bloom Energy. This expansion is fueled by rising energy demands, the proliferation of electric vehicles, and a concerted push towards modernizing energy grids.

Bloom Energy is strategically positioned to leverage this market expansion, especially within the commercial and industrial segments. The global distributed generation market was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, reaching an estimated $350 billion.

- Increased electricity consumption: Global electricity consumption is expected to rise by over 50% by 2050, driving demand for diverse energy sources.

- EV adoption: The growing adoption of electric vehicles is a key driver, increasing the need for localized power generation to support charging infrastructure.

- Grid modernization: Investments in grid modernization and resilience are creating opportunities for distributed energy resources (DERs) like Bloom Energy's solutions.

- Commercial & Industrial (C&I) sector: The C&I sector represents a significant portion of the distributed generation market, with businesses seeking cost savings and energy independence.

Interest Rates and Access to Capital

Fluctuations in interest rates directly affect Bloom Energy's cost of capital and the attractiveness of its hydrogen fuel cell solutions for customers. For instance, a rising interest rate environment, as seen with the Federal Reserve's continued monetary tightening through 2023 and into early 2024, can increase the borrowing costs for Bloom Energy's projects, potentially impacting profitability and the payback periods for its customers. This makes securing favorable financing terms crucial for project viability.

Access to capital remains a cornerstone for Bloom Energy's aggressive growth strategy, particularly in scaling manufacturing and expanding its global reach. The company's ability to attract investment, evidenced by its successful equity offerings and strategic partnerships, is paramount for funding ongoing research and development into next-generation fuel cell technologies and hydrogen solutions. Investor confidence, often tied to macroeconomic stability and the company's financial performance, directly influences this access.

- Interest Rate Impact: Higher interest rates can increase the cost of financing for Bloom Energy's large-scale projects, potentially affecting customer adoption rates.

- Capital Needs: Bloom Energy requires substantial capital for R&D, manufacturing expansion, and market penetration, making consistent access to funding critical.

- Investor Confidence: The company's ability to secure funding is heavily reliant on maintaining strong investor confidence, which is influenced by market conditions and its financial health.

- Financing Structures: Bloom Energy utilizes various financing mechanisms, including debt, equity, and strategic partnerships, to fund its operations and growth initiatives.

The cost-competitiveness of Bloom Energy's fuel cell systems is directly influenced by economic factors like raw material prices and the cost of natural gas, a primary fuel source. For instance, in early 2024, natural gas prices fluctuated around $2.00-$3.00 per MMBtu, impacting the operational cost-effectiveness for customers.

Bloom Energy's reliance on innovative financing models, such as Power Purchase Agreements (PPAs), is crucial for overcoming the high upfront capital costs of its technology. The company's PPA backlog growth, as noted in its 2023 reports, highlights the effectiveness of these strategies in making clean energy more accessible and driving adoption.

The expanding distributed generation market, valued at approximately $200 billion in 2023 and projected to reach $350 billion by 2030, presents a significant economic opportunity for Bloom Energy, particularly within the commercial and industrial sectors.

Interest rate fluctuations, a key economic consideration, directly impact Bloom Energy's cost of capital and the financial viability of its projects for customers. The Federal Reserve's monetary tightening through 2023 and into early 2024 has increased borrowing costs, underscoring the importance of favorable financing terms.

| Economic Factor | Impact on Bloom Energy | 2024/2025 Data/Trend |

| Natural Gas Prices | Affects operational cost-effectiveness for customers. | Traded in the $2.00-$3.00/MMBtu range in early 2024. |

| Capital Costs & Financing | High upfront costs necessitate PPAs and external funding. | Continued growth in PPA backlog reported in 2023; investor confidence key for capital access. |

| Distributed Generation Market Growth | Creates demand for Bloom's solutions. | Market valued at ~$200B in 2023, projected to reach ~$350B by 2030 (8% CAGR). |

| Interest Rates | Influences cost of capital and project payback periods. | Monetary tightening through 2023-early 2024 increased borrowing costs. |

Preview the Actual Deliverable

Bloom Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bloom Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a clear understanding of the external forces shaping Bloom Energy's strategic landscape.

Sociological factors

Societal concerns around grid stability and the increasing frequency of extreme weather events are fueling a significant rise in the demand for energy resilience. Businesses, particularly those reliant on continuous operations like data centers, are actively seeking solutions that guarantee uninterrupted power, a need Bloom Energy's on-site generation directly addresses.

This societal shift is translating into tangible market opportunities. For instance, the U.S. Department of Energy projected that by 2025, the demand for reliable power from critical infrastructure could surge, making resilient energy solutions a priority for national security and economic stability.

Societal pressure for businesses to operate responsibly is intensifying, with a significant focus on environmental sustainability. This trend directly influences customer demand, pushing commercial and industrial sectors towards cleaner energy alternatives.

Bloom Energy's fuel cell technology, which significantly lowers emissions and reduces water usage compared to traditional power generation, directly addresses these evolving corporate sustainability goals. For instance, Bloom Energy's solid oxide fuel cells can achieve up to 50% lower carbon emissions and use 20% less water than natural gas turbines, making them a compelling choice for companies aiming to enhance their environmental, social, and governance (ESG) profiles.

Public and corporate enthusiasm for clean energy, particularly fuel cell technology, significantly shapes market acceptance and Bloom Energy's brand reputation. Growing awareness of climate change and the tangible benefits of cleaner energy solutions, like reduced emissions, are driving this positive shift.

This enhanced perception translates directly into increased adoption and support for companies like Bloom Energy, aligning with their mission. For instance, in 2024, a significant majority of consumers expressed a willingness to pay more for products and services from companies committed to sustainability, a trend that directly benefits clean energy providers.

Workforce Development and Skills Gap

The burgeoning clean energy market, particularly fuel cell technology, demands a specialized and adequately trained workforce. This includes roles in advanced manufacturing, complex system installation, and ongoing maintenance. Bloom Energy, therefore, faces the critical task of bridging potential skills gaps to facilitate its growth and maintain operational excellence.

Addressing this challenge requires significant investment in workforce development initiatives. Companies like Bloom Energy are exploring partnerships with educational institutions and vocational training programs. For instance, the U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office is actively supporting training programs aimed at developing a skilled hydrogen workforce, with a focus on areas relevant to fuel cell deployment and operation.

- Skilled Labor Demand: The expansion of Bloom Energy's manufacturing facilities and project deployments directly correlates with an increased need for technicians, engineers, and project managers with expertise in fuel cell systems.

- Investment in Training: Bloom Energy, alongside industry peers, is likely investing in internal training programs and apprenticeships to cultivate the necessary technical skills, ensuring a pipeline of qualified personnel.

- Addressing the Gap: Proactive strategies to upskill existing workers and attract new talent are essential to prevent a skills shortage from hindering the company's ambitious growth plans in the clean energy sector.

Community Engagement and Local Impact

Bloom Energy's on-site power generation solutions can significantly influence local communities. Considerations around land use for their fuel cell installations, potential noise levels, and the visual impact of these facilities are crucial for public acceptance. For instance, a successful project in a residential area requires careful planning to mitigate any aesthetic concerns and ensure minimal disruption.

Fostering strong community relationships through proactive and transparent communication is vital for Bloom Energy. This approach helps build trust and can smooth the path for project approvals and ongoing operations. By engaging with local stakeholders early and often, Bloom Energy can address concerns and highlight the benefits of their clean energy solutions, contributing to a positive local impact.

- Community Acceptance: Projects often require local permits and zoning approvals, making community buy-in essential for timely deployment.

- Local Economic Benefits: While not directly a sociological factor, the creation of local jobs during installation and maintenance can positively influence community perception.

- Environmental Perception: The visual and auditory impact of Bloom Energy's technology is a key factor in how communities perceive its integration into their neighborhoods.

- Stakeholder Dialogue: Open channels for dialogue with residents, local government, and community groups are critical for managing expectations and ensuring successful project outcomes.

Growing public awareness of climate change and the desire for energy independence are key sociological drivers. Consumers and businesses alike are increasingly prioritizing sustainability, directly boosting demand for Bloom Energy's cleaner power solutions. This trend is supported by data showing a significant portion of the population favors renewable energy sources, influencing corporate purchasing decisions.

The need for reliable power, especially in the face of extreme weather events, is a major societal concern. This drives demand for resilient, on-site energy generation, a core offering of Bloom Energy. For example, the increasing frequency of power outages in regions like Texas during winter storms highlights this critical need for dependable energy infrastructure.

Public perception of clean energy technologies, including fuel cells, is evolving positively. As more information becomes available about the benefits of reduced emissions and water conservation, public acceptance and support for companies like Bloom Energy are likely to grow. This is reflected in consumer surveys indicating a willingness to support environmentally conscious businesses.

Technological factors

Continuous innovation in solid oxide fuel cell (SOFC) technology is crucial for Bloom Energy's competitive advantage. Improvements in efficiency, durability, and fuel flexibility, such as utilizing hydrogen and biogas, are key. These advancements, driven by material science and manufacturing process enhancements, directly boost the value of Bloom Energy Servers.

The advancement and widespread adoption of green hydrogen production technologies are significant technological drivers for Bloom Energy. As the global push for decarbonization intensifies, the scaling of electrolyzer technology, like Bloom's, to produce hydrogen using renewable energy is crucial for the energy transition.

Bloom Energy's fuel cell technology, capable of operating on 100% hydrogen, places them at the forefront of the burgeoning hydrogen economy. This positions the company to capitalize on the increasing demand for clean energy solutions as nations build out hydrogen infrastructure and explore its diverse applications.

The burgeoning demand for AI and cloud computing is a major tailwind for Bloom Energy. These digital technologies, particularly data centers, are incredibly power-hungry, creating a substantial market for Bloom's on-site energy solutions. For instance, the global AI market was valued at approximately $136.77 billion in 2022 and is projected to grow significantly, with data centers being a primary consumer of this computing power.

Bloom Energy's fuel cell technology is well-suited to meet these demands by providing reliable, high-density power directly where it's needed. This on-site generation capability is crucial for data centers facing increasing electricity costs and the need for uninterrupted operations. Furthermore, Bloom can leverage AI itself to optimize its own operational efficiency and predictive maintenance, enhancing the value proposition for its customers.

Energy Storage and Microgrid Solutions

Technological progress in energy storage, especially advanced battery technologies, is significantly boosting the viability and adaptability of localized power generation. This evolution is crucial for creating more robust and flexible energy systems.

Bloom Energy's product suite, which includes sophisticated microgrids capable of independent operation, directly capitalizes on this technological shift. These integrated systems offer a more complete power solution, reducing reliance on traditional grid infrastructure and improving energy security for users.

The global energy storage market is projected for substantial growth. For instance, by 2030, the market is expected to reach hundreds of billions of dollars, driven by falling battery costs and increasing demand for grid stability. Bloom Energy's microgrid solutions are positioned to benefit from this expansion.

- Advancements in battery chemistry, such as solid-state batteries, promise higher energy density and faster charging times, further enhancing microgrid capabilities.

- The integration of artificial intelligence and machine learning into microgrid management systems optimizes energy distribution and storage utilization, improving overall efficiency.

- Bloom Energy's fuel cell technology, when coupled with advanced storage, creates highly resilient microgrids that can provide reliable power even during extended grid outages.

Manufacturing Scale and Automation

Bloom Energy's ability to scale its manufacturing and integrate automation is directly impacting its cost structure and ability to fulfill growing orders. In 2023, the company continued to emphasize its "Manufacturing Optimization Program," which aims to drive down the cost of its fuel cell systems. This focus on automation is critical for achieving economies of scale, a key factor for improving profitability in the competitive clean energy sector.

Technological advancements in fuel cell manufacturing are a significant driver for Bloom Energy. The company has been investing in advanced techniques to enhance production efficiency and reduce per-unit costs. For instance, their continued efforts in automating assembly lines and improving material utilization are designed to make their solid oxide fuel cells more cost-competitive. This technological imperative is essential for meeting the increasing demand for their energy solutions and achieving long-term financial success.

Key aspects of Bloom Energy's manufacturing technology and scale include:

- Manufacturing Cost Reduction: Bloom Energy's focus on automation and advanced manufacturing techniques is aimed at reducing the cost of its fuel cell systems, a critical factor for market penetration.

- Economies of Scale: Increasing production volume through enhanced automation is essential for achieving economies of scale, which directly impacts profitability and competitiveness.

- Demand Fulfillment: The company's investment in manufacturing capacity and efficiency is crucial for meeting the growing demand for its clean energy solutions from diverse customer segments.

Bloom Energy's technological edge in solid oxide fuel cells (SOFCs) is paramount. Continued innovation in efficiency, durability, and fuel flexibility, including hydrogen and biogas, directly enhances their Bloom Energy Servers' value. Material science and manufacturing process improvements are key to this competitive advantage.

Legal factors

Bloom Energy operates within a stringent environmental regulatory framework, encompassing emissions standards, waste management protocols, and site cleanup requirements. Staying compliant with these often-changing rules is essential to prevent costly legal battles, operational interruptions, and financial penalties. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to refine air quality standards, impacting industrial operations.

The company's core technology, fuel cells, offers a distinct advantage by enabling its clients to achieve their own sustainability objectives and reduce their environmental footprint. This alignment with customer environmental goals is a significant market driver. Bloom Energy's commitment to cleaner energy solutions directly addresses the growing demand for compliance with global climate agreements and national environmental policies.

Permitting and interconnection laws are critical for Bloom Energy's project development. For instance, in 2024, the U.S. Department of Energy highlighted that lengthy permitting processes can add significant delays and costs to renewable energy projects, impacting their economic viability. Clear, standardized interconnection rules, like those being refined by FERC (Federal Energy Regulatory Commission) in their Notice of Proposed Rulemaking, are essential for Bloom Energy to connect its fuel cell systems to the grid efficiently and predictably.

Shifting tax legislation, especially concerning clean energy tax credits and deductions, directly affects Bloom Energy's financial performance and its customer base. For instance, the Inflation Reduction Act of 2022 extended and enhanced clean energy tax credits, including those applicable to fuel cell technology, making Bloom's offerings more economically viable.

The eligibility of fuel cell technology for specific tax credits, such as Section 48E (Investment Tax Credit for Clean Energy Projects), plays a crucial role in the financial appeal of Bloom Energy's solutions. This credit can significantly reduce the upfront cost for customers, thereby driving demand and improving Bloom's competitive positioning in the market.

Intellectual Property Rights

Intellectual property rights are paramount for Bloom Energy, safeguarding its innovative solid oxide fuel cell technology. The company holds numerous patents, a critical asset for maintaining its competitive edge in the clean energy sector. For instance, as of early 2024, Bloom Energy's patent portfolio includes hundreds of granted patents and pending applications globally, covering various aspects of its core technology.

Legal challenges concerning intellectual property could significantly impact Bloom Energy. Such disputes can drain financial resources and potentially slow down its pace of innovation and market expansion. Protecting these assets is therefore a continuous legal and strategic priority for the company.

- Patent Portfolio: Bloom Energy actively defends and expands its patent portfolio to protect its core solid oxide fuel cell technology.

- Competitive Advantage: Strong IP rights are essential for maintaining Bloom Energy's market position and technological leadership.

- Legal Risks: Potential litigation over patents poses a risk, requiring significant investment in legal defense and potentially impacting operational focus.

- Innovation Protection: Safeguarding its innovations ensures Bloom Energy can continue to invest in research and development without immediate replication by competitors.

Contract Law and Project Financing Agreements

Bloom Energy's reliance on complex power purchase agreements (PPAs) and intricate financing partnerships underscores the critical role of contract law. These agreements are the bedrock for managing risk, securing project capital, and clearly delineating obligations for all stakeholders in their energy solution deployments.

The structure and enforceability of these PPAs are paramount. For instance, in 2023, Bloom Energy announced a significant expansion of its PPA portfolio, highlighting the need for robust legal frameworks to govern these long-term revenue streams and operational commitments.

Well-drafted financing agreements are also crucial. They ensure that Bloom Energy can secure the necessary capital for its projects, often involving multiple financial institutions and investors, each with specific legal requirements and risk appetites.

- PPA Enforceability: Legal certainty in PPAs is vital for attracting investors and ensuring predictable revenue for Bloom Energy.

- Financing Structure: Contract law dictates the terms of debt and equity financing, directly impacting project viability and Bloom Energy's capital structure.

- Risk Mitigation: Clear contractual clauses for performance, maintenance, and termination are essential for managing operational and financial risks.

- Regulatory Compliance: Contracts must align with evolving energy regulations, ensuring legal standing and market access.

Bloom Energy navigates a complex web of environmental regulations, including emissions standards and waste management. Compliance is key to avoiding penalties and operational disruptions, especially as agencies like the EPA refine air quality standards in 2024. The company's fuel cell technology aids clients in meeting sustainability goals, aligning with global climate agreements.

Permitting and interconnection laws significantly impact project timelines and costs. The U.S. Department of Energy noted in 2024 that lengthy permitting can delay renewable energy projects. Standardized rules from bodies like FERC are crucial for efficient grid connection.

Tax legislation, particularly clean energy credits, directly influences Bloom Energy's financial attractiveness. The Inflation Reduction Act of 2022, for example, extended credits for fuel cell technology, boosting its economic viability. Eligibility for credits like Section 48E is a major driver of customer adoption.

Intellectual property is vital for Bloom Energy, protecting its solid oxide fuel cell innovations. The company held hundreds of patents and applications globally as of early 2024. Protecting this IP is crucial to maintaining its competitive edge and preventing replication by rivals.

Environmental factors

The global push to combat climate change and meet ambitious decarbonization targets is a significant environmental factor influencing Bloom Energy. Their fuel cell technology provides a cleaner power source, directly supporting the widespread efforts by nations and businesses to cut greenhouse gas emissions.

Bloom Energy's solutions align with a growing demand for low-carbon energy, as evidenced by the increasing number of countries setting net-zero targets. For instance, by the end of 2023, over 140 countries had committed to net-zero emissions, creating a substantial market opportunity for technologies like Bloom's.

Bloom Energy's fuel cell technology offers a significant advantage by producing virtually no air pollutants like sulfur dioxide or nitrogen oxides. This is particularly relevant as many regions, including California and parts of Europe, are tightening regulations on emissions to combat smog and improve public health. For instance, the U.S. Environmental Protection Agency (EPA) sets National Ambient Air Quality Standards (NAAQS) for criteria pollutants, and Bloom Energy's process aligns well with meeting these stringent requirements.

Bloom Energy's fuel cell technology offers a distinct advantage in areas grappling with water scarcity, as its systems require virtually no water for operation. This stark contrast to traditional power generation, which can be highly water-intensive, positions Bloom Energy as a provider of sustainable solutions.

The global water crisis is intensifying; by 2025, an estimated 1.8 billion people will be living in countries with absolute water scarcity, according to the World Health Organization. This makes Bloom Energy's water-efficient technology particularly attractive for businesses and municipalities prioritizing environmental stewardship and operational resilience.

Renewable Energy Integration

The growing reliance on intermittent renewable energy sources like solar and wind necessitates dependable, readily available power. Bloom Energy's adaptable fuel systems are well-suited to address this by supplying consistent baseload power or acting as a stabilizing element, thereby fostering a stronger and more sustainable energy landscape.

This integration is critical as the global renewable energy capacity continues to expand. For instance, BloombergNEF reported that global investment in the energy transition reached $1.1 trillion in 2023, a record high, with renewables and storage accounting for a significant portion. Bloom Energy's technology can directly benefit from this trend by offering a solution that bridges the gap left by the variable nature of these sources.

- Grid Stability: Bloom Energy's fuel cells provide dispatchable power, ensuring grid reliability when renewable output fluctuates.

- Renewable Complementarity: Their systems can operate on biogas or natural gas, supporting renewable energy integration by offering a flexible power source.

- Decarbonization Goals: By enabling higher renewable penetration, Bloom Energy contributes to meeting ambitious decarbonization targets set by governments and corporations worldwide.

Waste-to-Energy and Biogas Utilization

Bloom Energy's fuel cell technology can process a variety of biogas feedstocks, including landfill gas and agricultural waste, through an integrated cleanup system. This allows for the conversion of waste materials into electricity, aligning with circular economy principles. For instance, the company has been involved in projects utilizing landfill gas, a significant source of methane emissions, to generate clean power.

This waste-to-energy capability offers a distinct environmental advantage by reducing reliance on fossil fuels and providing a sustainable energy source. The ability to manage and convert organic waste streams into usable energy is crucial for decarbonization efforts. In 2024, the global biogas market was valued at approximately $20.7 billion and is projected to grow significantly, indicating a strong demand for such solutions.

- Biogas Feedstock Flexibility: Bloom Energy's systems can utilize diverse organic waste streams, turning a disposal problem into an energy asset.

- Circular Economy Integration: The technology supports closed-loop systems, recovering value from waste and reducing landfill burdens.

- Fossil Fuel Displacement: By generating power from biogas, Bloom Energy contributes to reducing the demand for natural gas and other fossil fuels.

- Environmental Impact: This process helps mitigate greenhouse gas emissions, particularly methane from organic decomposition, and improves air quality compared to traditional waste management.

The global drive towards decarbonization, with over 140 countries aiming for net-zero emissions by late 2023, directly benefits Bloom Energy by creating a substantial market for its clean energy solutions. Their fuel cell technology significantly reduces air pollutants, aligning with increasingly stringent environmental regulations in regions like California and Europe, which focus on improving air quality.

Bloom Energy's water-efficient systems are particularly advantageous given the intensifying global water crisis, where 1.8 billion people were projected to face absolute water scarcity by 2025. Furthermore, their technology complements the growing reliance on intermittent renewables like solar and wind, offering stable baseload power, a critical need as global renewable energy investment hit a record $1.1 trillion in 2023.

Bloom Energy's ability to convert organic waste, such as landfill gas, into electricity supports circular economy principles and reduces greenhouse gas emissions. The biogas market, valued at approximately $20.7 billion in 2024, highlights the strong demand for such waste-to-energy solutions, offering a sustainable alternative to fossil fuels.

| Environmental Factor | Description | Impact on Bloom Energy | Relevant Data/Trends (2023-2025) |

|---|---|---|---|

| Climate Change & Decarbonization | Global efforts to reduce greenhouse gas emissions and combat climate change. | Creates significant market demand for Bloom Energy's low-emission power generation. | Over 140 countries committed to net-zero emissions by late 2023. Global investment in energy transition reached $1.1 trillion in 2023. |

| Air Quality Regulations | Stricter government standards on air pollutants. | Positions Bloom Energy's virtually emission-free technology as a compliant and preferred solution. | Regions like California and Europe are tightening emission standards for power generation. |

| Water Scarcity | Increasing global concern over freshwater availability. | Highlights the advantage of Bloom Energy's water-efficient fuel cell systems compared to water-intensive traditional power plants. | An estimated 1.8 billion people faced absolute water scarcity by 2025. |

| Renewable Energy Integration | Need for reliable power to complement intermittent renewable sources. | Bloom Energy's fuel cells offer dispatchable and stable power, enhancing grid reliability and supporting higher renewable penetration. | Renewable energy capacity continues to expand globally, increasing the need for grid balancing solutions. |

| Waste Management & Circular Economy | Converting waste materials into valuable resources. | Enables Bloom Energy to utilize biogas and landfill gas, turning waste into clean energy and aligning with circular economy goals. | The global biogas market was valued at ~$20.7 billion in 2024, with strong growth projections. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bloom Energy is built on a foundation of official government reports, leading industry publications, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.