Bloom Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloom Energy Bundle

Bloom Energy's innovative fuel cell technology positions them at an exciting crossroads in the energy sector. Understanding their product portfolio through the lens of the BCG Matrix reveals a dynamic landscape of potential growth and established revenue streams.

This preview offers a glimpse into how Bloom Energy's offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market position. To truly unlock actionable strategies and gain a comprehensive view of their competitive advantage, dive deeper into the full BCG Matrix.

Purchase the complete BCG Matrix for a detailed quadrant-by-quadrant analysis, data-backed insights, and strategic recommendations that will empower your investment and product development decisions.

Stars

The escalating need for power in data centers, fueled by AI and cloud computing, positions Bloom Energy's Solid Oxide Fuel Cell (SOFC) systems as a key player. These on-site solutions offer a reliable and efficient alternative to traditional power grids.

Bloom Energy's market traction is evident through collaborations with industry giants like Oracle, American Electric Power (AEP), and Equinix. These partnerships underscore the growing acceptance and competitive strength of their SOFC technology in the data center space.

With over 400 MW of capacity deployed across data centers globally, Bloom Energy has secured a substantial market share. This impressive deployment figure highlights the company's capability to meet the immense power demands of this critical sector.

The distributed generation market is booming, with forecasts suggesting significant expansion in the coming years. Bloom Energy's fuel cell technology, providing on-site power, is perfectly positioned to meet the increasing demand for energy independence and enhanced grid reliability.

Bloom Energy's fuel cell systems are a prime example of innovative distributed generation. The global distributed generation market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2030, demonstrating robust growth. Bloom's technology directly taps into this trend by offering reliable, clean power solutions for businesses and communities seeking to reduce their reliance on traditional grid infrastructure.

Bloom Energy's fuel cell systems are a strong contender in the commercial and industrial (C&I) sector, catering to businesses needing dependable and cleaner energy. This market segment shows consistent demand, with companies prioritizing resilience and emission reduction. Bloom's established presence here translates to a significant market share.

In 2023, Bloom Energy reported that its Energy Server systems were deployed across over 700 customer sites, with a substantial portion serving C&I clients. These customers, ranging from data centers to manufacturing plants, benefit from the always-on power and reduced carbon footprint offered by Bloom's technology, solidifying its position in this lucrative market.

Multi-Fuel Capable Energy Servers

Bloom Energy's multi-fuel capable servers represent a significant strength, allowing them to operate on natural gas, biogas, and increasingly, hydrogen. This adaptability is crucial as the energy sector shifts, positioning Bloom to meet diverse customer demands and navigate evolving energy policies. Their fuel flexibility broadens market appeal and reach within distributed generation.

This technological advantage translates into tangible market benefits. For instance, Bloom Energy announced in late 2023 that its fuel cell technology can now achieve 100% hydrogen utilization, a critical milestone for decarbonization efforts. This capability allows them to serve a wider range of clients, from those committed to traditional fuels to those actively pursuing net-zero emissions goals.

- Fuel Versatility: Operates on natural gas, biogas, and hydrogen, offering adaptability in a changing energy market.

- Market Reach: Caters to diverse customer needs and evolving energy policies, securing a strong position in distributed generation.

- Decarbonization Alignment: Technology's ability to utilize 100% hydrogen (as demonstrated in late 2023) enhances appeal for environmentally conscious clients.

Strategic Partnerships and Large-Scale Deployments

Bloom Energy's strategic partnerships are a cornerstone of its growth, exemplified by a 1 GW framework agreement with American Electric Power (AEP). This collaboration, alongside its work with Oracle Cloud Infrastructure, highlights Bloom's capacity to manage and deliver massive deployment projects.

These substantial agreements serve as powerful endorsements of Bloom's technology, reinforcing its standing as a market leader. They also pave a clear route for sustained, accelerated growth and expansion within vital infrastructure segments.

Bloom Energy's expanding international presence further solidifies its robust market position.

- AEP Deal: A 1 GW framework agreement with American Electric Power demonstrates Bloom's ability to secure and execute large-scale energy projects.

- Oracle Collaboration: Partnership with Oracle Cloud Infrastructure showcases Bloom's technology integration for major infrastructure clients.

- Market Validation: These significant deals validate Bloom's fuel cell technology and its market leadership.

- Growth Trajectory: The partnerships provide a clear path for continued high growth and expansion in critical infrastructure sectors.

Bloom Energy's fuel cell technology, particularly its Solid Oxide Fuel Cell (SOFC) systems, positions it as a "Star" in the BCG matrix due to its high market share in a rapidly growing distributed generation sector. The company's ability to provide reliable, on-site power solutions, especially for data centers and the commercial and industrial (C&I) sector, demonstrates strong demand and growth potential.

Bloom Energy's fuel versatility, including its late 2023 achievement of 100% hydrogen utilization, further solidifies its "Star" status by aligning with decarbonization trends and broadening its market appeal. Significant partnerships, such as the 1 GW framework agreement with American Electric Power (AEP) and collaborations with Oracle, validate its technology and provide a clear path for continued expansion.

The company's substantial deployed capacity, exceeding 400 MW in data centers, and over 700 customer sites in 2023, indicate a dominant position in its target markets. This strong market presence, coupled with the robust growth of the distributed generation market, which was valued at approximately $200 billion in 2023 and projected to exceed $400 billion by 2030, clearly places Bloom Energy's core offerings in the "Star" quadrant.

| Category | Bloom Energy Offering | Market Growth | Market Share | BCG Quadrant |

|---|---|---|---|---|

| Distributed Generation | SOFC Systems | High (Projected >$400B by 2030 from ~$200B in 2023) | High (Significant deployments in data centers & C&I) | Star |

| Data Center Power | On-site SOFC Solutions | High (Driven by AI & Cloud Computing) | High (400+ MW deployed) | Star |

| C&I Energy Solutions | Reliable, Cleaner Power | Consistent Demand | High (700+ customer sites in 2023) | Star |

What is included in the product

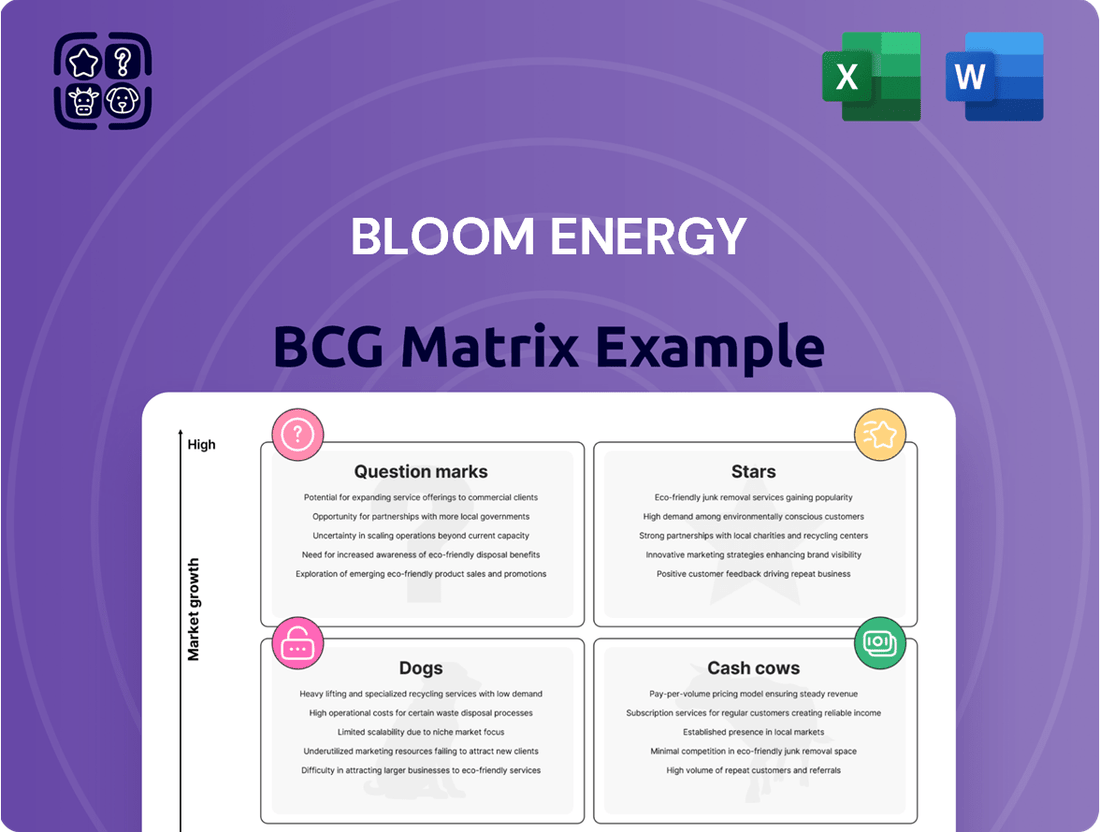

This BCG Matrix overview analyzes Bloom Energy's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth potential.

The Bloom Energy BCG Matrix provides a clear, visual roadmap, relieving the pain of strategic uncertainty by pinpointing where to invest or divest.

Cash Cows

Bloom Energy's robust installed base, exceeding 1.5 gigawatts across over 1,200 global sites, represents a significant competitive advantage. This foundation is further strengthened by long-term service agreements that generate a predictable and recurring revenue stream.

These service contracts are crucial, offering stable cash flow that is vital for reinvestment. As of the first quarter of 2024, Bloom Energy reported that its service revenue grew by 15% year-over-year, demonstrating the increasing contribution of this segment.

Bloom Energy Servers provide essential, dependable power to its established industrial clientele, often forming a critical component of their ongoing operations. These mature installations, marked by consistent energy usage and existing agreements, yield steady revenue streams with reduced spending on marketing and deployment incentives.

In 2023, Bloom Energy reported that its distributed generation solutions, which include its fuel cell technology, served a significant portion of its customer base, highlighting the reliability and value proposition for these long-term industrial partners. The predictability of these revenue streams, coupled with the established nature of the client relationships, positions this segment as a core cash generator for the company.

Bloom Energy's mature natural gas fuel cell deployments are firmly in the Cash Cow quadrant. These systems leverage existing natural gas infrastructure, providing a reliable and profitable revenue stream for the company. In 2023, Bloom Energy reported that its fuel cell solutions generated approximately 97% of their revenue from natural gas, underscoring the maturity and dominance of this technology for the company.

These established natural gas fuel cells offer a competitive advantage and healthy profit margins, meaning they don't require substantial new investment for growth. Bloom Energy can therefore allocate less capital towards promoting these proven systems, allowing them to continue generating significant and consistent cash flow to support other areas of the business.

Base Load Power for Critical Infrastructure

Base Load Power for Critical Infrastructure is a significant cash cow for Bloom Energy. This segment focuses on providing uninterrupted, reliable electricity to essential facilities like hospitals and data centers, where consistent uptime is non-negotiable.

These deployments typically secure long-term contracts, ensuring a steady stream of high-margin revenue. The critical nature of these services means that power supply is a paramount concern, allowing for premium pricing and stable cash generation.

- Reliability is Key: Critical infrastructure demands 24/7 power, making Bloom Energy's fuel-flexible solutions highly valuable.

- Stable Revenue: Long-term contracts with essential services provide predictable and consistent cash flow.

- High Margins: The non-negotiable need for uptime supports premium pricing and healthy profit margins.

- Market Demand: In 2023, data centers alone accounted for approximately 1.3% of global electricity consumption, highlighting the substantial market for reliable power solutions.

Revenue from Long-Term Lease and PPA Structures

Bloom Energy's strategic use of long-term lease and Power Purchase Agreement (PPA) structures transforms significant customer capital outlays into manageable, predictable operational expenses. This approach is a cornerstone of their Cash Cow strategy.

These flexible financing arrangements provide Bloom Energy with a steady, reliable stream of revenue over extended periods, directly from the systems they deploy. This significantly de-emphasizes the need for immediate, large upfront sales, creating a more consistent and sustainable income flow.

- Stable Revenue: PPAs and leases ensure predictable, long-term cash flows, bolstering financial stability.

- Reduced Sales Cycles: Converts large upfront costs for customers into predictable monthly payments, potentially shortening sales cycles.

- Customer Adoption: Makes Bloom's technology more accessible to a wider customer base by lowering the initial financial barrier.

- Financial Resilience: This model provides a strong foundation for sustained profitability and operational efficiency.

Bloom Energy's established natural gas fuel cell deployments are firmly positioned as Cash Cows. These systems benefit from existing natural gas infrastructure, generating a consistent and profitable revenue stream. In 2023, these solutions accounted for approximately 97% of Bloom Energy's revenue, demonstrating their maturity and market dominance.

These mature natural gas fuel cells offer a competitive edge and healthy profit margins, minimizing the need for substantial new investment. Bloom Energy can therefore allocate less capital to promote these proven systems, allowing them to consistently generate significant cash flow to support other business areas.

Base Load Power for Critical Infrastructure represents a significant cash cow for Bloom Energy, providing uninterrupted, reliable electricity to essential facilities. These deployments typically involve long-term contracts, ensuring a steady stream of high-margin revenue due to the paramount importance of consistent uptime.

Bloom Energy's strategic use of long-term lease and Power Purchase Agreement (PPA) structures transforms customer capital outlays into predictable operational expenses, a cornerstone of their Cash Cow strategy. These financing arrangements provide a steady, reliable revenue stream over extended periods, reducing the reliance on immediate, large upfront sales.

| Segment | Key Characteristics | Revenue Contribution (2023 Est.) | Growth Potential | Investment Need |

| Natural Gas Fuel Cells (Existing Deployments) | Mature technology, reliable, established infrastructure | ~97% | Low | Low |

| Base Load Power for Critical Infrastructure | Uninterrupted power, high uptime, essential services | Significant, but specific percentage not publicly detailed | Moderate | Low |

Preview = Final Product

Bloom Energy BCG Matrix

The Bloom Energy BCG Matrix preview you're examining is the identical, fully formatted document you'll receive after purchase, offering a clear strategic overview without any watermarks or demo content. This comprehensive report, designed for professional use, provides actionable insights into Bloom Energy's product portfolio based on market share and growth rates. What you see is precisely what you'll download, ready for immediate integration into your business planning or competitive analysis. You're previewing the actual BCG Matrix file that will be yours upon purchase, unlocking a professionally designed, analysis-ready asset for your strategic decision-making.

Dogs

Older fuel cell models from Bloom Energy, perhaps those with lower energy efficiency or higher manufacturing costs, could be classified as Dogs in the BCG matrix. These legacy systems might face intense competition from newer, more cost-effective technologies, both internal and external, leading to a shrinking market presence. For instance, if an older Bloom Box model achieved only 40% electrical efficiency compared to current offerings exceeding 60%, it would likely struggle to attract new customers.

These underperforming solutions often represent a drain on resources, potentially becoming cash traps rather than cash generators. Bloom Energy might be investing in maintaining or servicing these older units without seeing significant returns, diverting capital from more promising growth areas. In 2024, for example, the cost of maintaining a decade-old fuel cell system might outweigh the revenue it produces, especially if replacement parts become scarce or expensive.

Geographies with limited market penetration for Bloom Energy, potentially categorized as 'dogs' in a BCG matrix analysis, might include certain emerging markets where establishing a foothold has proven difficult. These areas could present challenges such as intense local competition from established energy providers, regulatory hurdles that hinder the adoption of new technologies, or a lack of the necessary infrastructure to support Bloom's fuel cell systems. For instance, while Bloom has explored opportunities in regions like parts of Asia and South America, the pace of adoption may not have met initial expectations due to these factors.

Bloom Energy's strategic repositioning likely involved divesting or de-emphasizing ventures that didn't align with its core solid oxide fuel cell (SOFC) technology. These could have been experimental projects or early-stage business lines that, while potentially innovative, didn't exhibit strong market growth or a clear path to scalable commercialization. For instance, if Bloom Energy explored tangential energy storage solutions or niche applications for its technology that didn't gain traction, these would fit the 'dog' category.

High-Cost, Low-Volume Custom Projects

High-Cost, Low-Volume Custom Projects in Bloom Energy's context are akin to the 'Dogs' in the BCG matrix. These are highly specialized fuel cell installations, often requiring extensive customization for unique client needs. Think of a bespoke system designed for a very specific industrial application where mass production isn't feasible.

These projects carry significant upfront engineering costs and lack the economies of scale associated with more standardized offerings. Their one-off nature means they don't easily lend themselves to repeatable manufacturing processes or widespread market deployment. For instance, a custom-designed fuel cell for a niche research facility might fall into this category.

While they can satisfy particular customer demands, their limited market share and profitability due to their singular nature place them firmly in the 'Dog' quadrant. This means they consume resources without generating substantial returns or growth potential for Bloom Energy.

- Limited Scalability: Projects are bespoke, hindering mass production and cost reduction.

- High Upfront Investment: Significant engineering and customization costs are incurred per project.

- Low Market Share: Niche applications mean few repeat customers or broad market adoption.

- Profitability Challenges: High costs and low volume make sustained profitability difficult.

Unsuccessful Carbon Capture Applications

While Bloom Energy's core solid oxide fuel cell technology shows promise, specific applications in carbon capture might be considered 'dogs' if they haven't reached commercial success. These ventures would drain resources without yielding significant market share or growth.

For instance, if Bloom Energy explored partnerships or developed specialized units for capturing CO2 from industrial flue gas that didn't gain traction, these efforts would fall into the dog category. The high cost of early-stage carbon capture technology and regulatory hurdles can make commercialization challenging.

- Limited Commercial Adoption: If Bloom Energy's carbon capture solutions have seen very few real-world deployments or pilot projects that failed to scale, it indicates a lack of market acceptance.

- Resource Drain: Investments in R&D and infrastructure for unproven carbon capture applications that don't generate revenue represent a drain on the company's resources.

- Low Market Share: In the competitive landscape of energy solutions, if Bloom's carbon capture offerings hold a negligible market share, it signifies a weak position.

Bloom Energy's older, less efficient fuel cell models, or those with higher production costs, would be classified as Dogs. These legacy systems face stiff competition, leading to a reduced market presence. For example, older Bloom Box models with 40% efficiency would struggle against newer ones exceeding 60%.

These underperformers can become cash drains, diverting capital from more promising areas. In 2024, maintaining aging fuel cell systems might cost more than the revenue they generate, especially if parts are scarce.

Emerging markets with low adoption rates for Bloom Energy's technology could also be considered Dogs. Challenges like local competition, regulatory hurdles, and infrastructure gaps can hinder growth, as seen in some Asian and South American markets where adoption hasn't met initial expectations.

Bloom Energy may have strategically divested from tangential energy storage or niche applications that didn't achieve commercial traction, fitting the 'dog' profile. These ventures, while potentially innovative, lacked strong market growth or a clear path to scalability.

| Category | Bloom Energy Example | Market Status | Strategic Implication |

| Legacy Products | Older Bloom Box models (e.g., 40% efficiency) | Low market share, high competition | Consider phasing out or upgrading |

| Underperforming Markets | Certain emerging markets with slow adoption | Limited penetration, regulatory hurdles | Re-evaluate market entry strategy or divest |

| Non-Core Ventures | Unsuccessful niche applications or early-stage projects | Low revenue, high R&D costs | Focus on core SOFC technology |

Question Marks

The market for green hydrogen production is booming, with projections showing significant expansion driven by the urgent need for decarbonization. Bloom Energy's electrolyzer technology is a key player in this rapidly evolving sector.

While Bloom Energy's electrolyzer is technologically advanced and strategically vital for their future, it's still in the early phases of widespread commercial adoption. This means it requires considerable investment to capture a larger slice of this high-growth market and ramp up manufacturing capabilities.

Bloom Energy's collaboration with Chart Industries to embed carbon capture technology into its fuel cells positions it within a burgeoning, high-potential market. This strategic move targets the delivery of ultra-low carbon electricity solutions, especially for sectors with substantial energy demands.

While this integrated approach offers a promising path to near zero-carbon power, the market for such solutions is still in its nascent stages. Bloom's current market penetration in this specific carbon capture integration is minimal, necessitating considerable capital outlay to foster future expansion and market share.

Bloom Energy's international expansion into new markets, beyond established ones like South Korea, falls into the question mark category of the BCG matrix. These ventures are characterized by high growth potential, reflecting the global demand for clean energy solutions, but currently represent a small fraction of Bloom's total revenue. For instance, Bloom Energy announced in 2024 its intention to explore opportunities in the Australian market, a region with significant renewable energy targets.

Fuel Cell Solutions for Maritime and Aviation

Bloom Energy is actively exploring fuel cell applications in the maritime and aviation sectors, targeting significant decarbonization opportunities. These industries represent high-growth potential, but Bloom's current market share is minimal, necessitating extensive research, development, and regulatory approvals.

The maritime industry, for instance, is under increasing pressure to reduce emissions, with the International Maritime Organization (IMO) setting ambitious targets. By 2030, the IMO aims to reduce total annual greenhouse gas emissions from international shipping by at least 50% compared to 2008 levels. Fuel cells offer a promising pathway to achieve these goals, potentially powering vessels with zero or near-zero emissions.

- Market Potential: The global maritime fuel cell market is projected to reach billions of dollars in the coming years, driven by environmental regulations and the demand for cleaner shipping solutions.

- Development Challenges: Significant investment in R&D is required to adapt fuel cell technology for the demanding conditions of maritime and aviation environments, including space constraints, vibration, and safety certifications.

- Competitive Landscape: While Bloom Energy is a key player, other companies are also developing fuel cell solutions for these sectors, creating a dynamic and competitive market.

- Bloom's Strategy: Bloom's focus on innovation and strategic partnerships is crucial for establishing a foothold and scaling its offerings in these emerging markets.

Advanced Microgrid and Energy-as-a-Service Offerings

Bloom Energy's advanced microgrid and Energy-as-a-Service (EaaS) offerings represent a burgeoning segment. While their core fuel cell technology is robust, the full-fledged EaaS model, which bundles energy supply, management, and maintenance into a service contract, is an area where they are actively cultivating market presence.

This strategic focus aligns with a significant market trend. The global microgrid market was valued at approximately $29.7 billion in 2023 and is projected to reach $73.3 billion by 2030, demonstrating a compound annual growth rate of 13.7%. This expansion is driven by the escalating need for energy security, particularly in the face of grid instability and extreme weather events.

- High Growth Potential: The EaaS model caters to the increasing demand for predictable energy costs and enhanced operational uptime, especially for critical infrastructure and industrial facilities.

- Investment Requirements: Developing sophisticated microgrid solutions and robust EaaS frameworks demands substantial capital for infrastructure, software development, and customer acquisition.

- Market Positioning: Bloom's ability to integrate its efficient fuel cell technology into these advanced service models positions it to capture a share of this expanding market, offering a differentiated value proposition.

- Resilience and Decentralization: These offerings directly address the growing need for decentralized power generation and the resilience it provides against traditional grid failures, a key driver for adoption in 2024 and beyond.

Question Marks in Bloom Energy's portfolio represent areas with high growth potential but currently low market share. These are typically new ventures or emerging markets where significant investment is needed to build market presence and scale operations. The success of these ventures hinges on their ability to gain traction and eventually transition into Stars.

Bloom Energy's electrolyzer technology for green hydrogen production and its expansion into new international markets, like Australia announced in 2024, fall into this category. Similarly, exploring fuel cell applications in the maritime and aviation sectors, despite their high growth potential, are considered Question Marks due to Bloom's minimal current market share and the extensive R&D and regulatory hurdles involved.

The Energy-as-a-Service (EaaS) model, which integrates microgrid solutions with Bloom's fuel cells, also represents a Question Mark. While the global microgrid market is expanding rapidly, with projections showing significant growth, Bloom's market penetration in the EaaS segment is still developing, requiring substantial capital for infrastructure and customer acquisition.

These Question Mark areas demand strategic investment and careful market development. The global maritime fuel cell market, for instance, is expected to reach billions, but Bloom needs to overcome significant development challenges and a competitive landscape to establish a strong foothold.

BCG Matrix Data Sources

Our Bloom Energy BCG Matrix is built on robust data, incorporating financial statements, industry growth forecasts, and competitive market analysis for strategic decision-making.