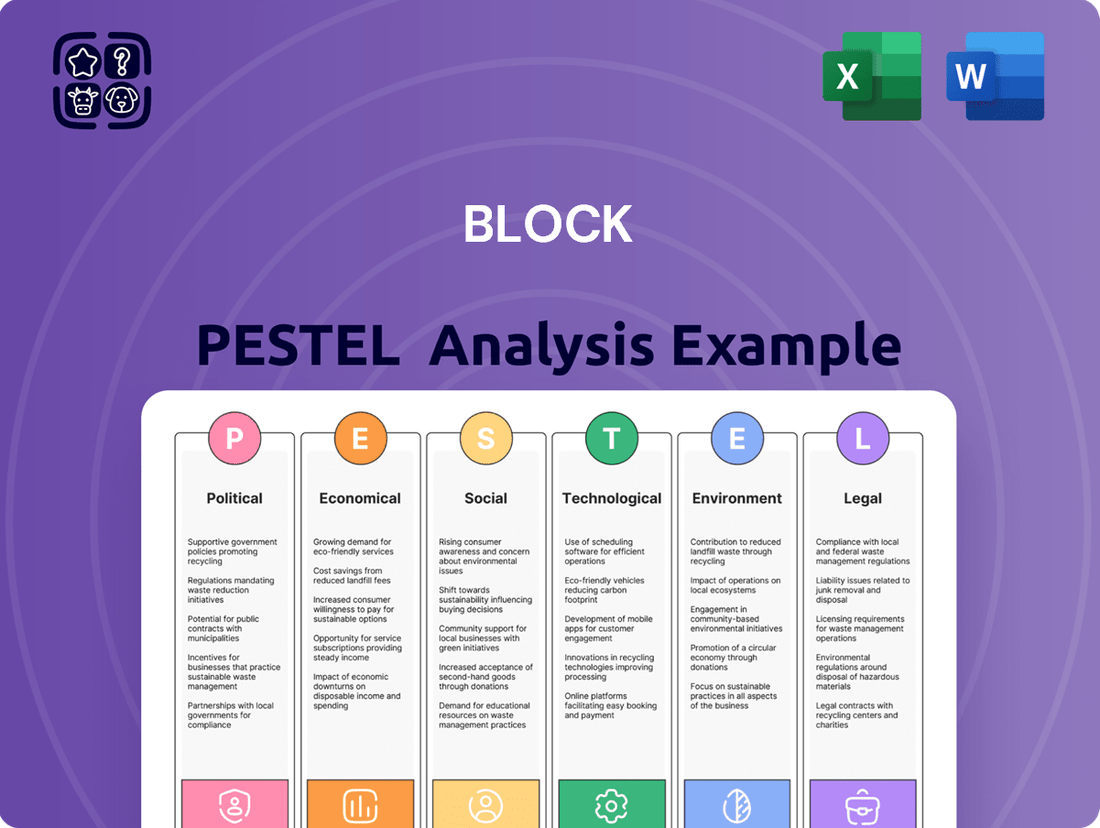

Block PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

Unlock the forces shaping Block's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and growth. Equip yourself with critical insights to navigate market complexities and make informed strategic decisions. Download the full analysis now to gain a competitive edge.

Political factors

Government policies and regulatory frameworks concerning financial technology companies significantly impact Block, Inc.'s operations. Changes in licensing requirements, consumer protection laws, or data handling regulations directly affect Square's payment processing and Cash App's financial services.

For instance, in 2024, the U.S. Securities and Exchange Commission (SEC) continued its focus on digital assets and payment platforms, potentially introducing new compliance burdens for fintech firms like Block. Increased regulatory scrutiny in 2025 could lead to higher compliance costs or limitations on service offerings, impacting Block's revenue streams and strategic expansion plans.

Government approaches to cryptocurrency are a major political consideration for Block. With Block's substantial Bitcoin investment via Spiral and its blockchain projects through TBD, regulatory shifts directly impact their business. For instance, the U.S. Securities and Exchange Commission's ongoing scrutiny of digital assets and stablecoins, as seen in enforcement actions throughout 2023 and early 2024, creates an environment of uncertainty that could affect the growth and operational freedom of these ventures.

Global and national data privacy laws, like Europe's GDPR and California's CCPA, significantly shape how Block, Inc. manages customer information across its various services. These regulations require substantial investment in robust security, transparent data handling, and ongoing compliance efforts. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, highlighting the financial risk of non-compliance.

Antitrust Scrutiny and Market Competition

Antitrust scrutiny is a growing concern for major financial technology players like Block. Regulatory bodies globally are examining large companies for monopolistic behavior, and Block's significant market share through Square and Cash App could draw attention. This oversight is designed to foster a more competitive financial services landscape.

Potential antitrust actions could include investigations into Block's practices, limitations on future mergers and acquisitions, or mandates for operational changes. For instance, in 2023, the European Commission continued its investigations into various tech giants regarding competition concerns, setting a precedent for increased regulatory oversight in the digital economy.

- Increased regulatory focus on fintech market concentration.

- Potential for investigations into Block's market dominance by antitrust authorities.

- Risk of restrictions on M&A activity impacting Block's growth strategy.

- Need for Block to adapt business practices to comply with fair competition regulations.

International Trade and Cross-Border Policies

Block's global operations are significantly influenced by international trade policies and cross-border regulations. For instance, tariffs on imported hardware components, such as those used in Square point-of-sale devices, can directly impact production costs and, consequently, pricing strategies. The World Trade Organization (WTO) reported that global trade growth was projected to be 2.6% in 2024, a slight uptick from 0.9% in 2023, indicating a potentially more favorable environment for international expansion, but also highlighting the ongoing sensitivity to trade dynamics.

Cross-border data flow regulations, often referred to as data localization laws, pose another critical challenge. These rules dictate where and how customer data must be stored and processed, affecting the efficiency and cost of Block's international payment processing services. For example, the European Union's General Data Protection Regulation (GDPR) has set a precedent for stringent data privacy rules that many countries are now emulating, requiring significant investment in compliance infrastructure.

- Tariffs: Increased tariffs on electronic components could raise the cost of Square hardware by an estimated 5-10% in affected markets.

- Data Localization: Compliance with varying data localization laws may necessitate building new data centers or partnering with local providers, adding an estimated 3-7% to operational expenses in regions with strict regulations.

- Trade Disputes: Geopolitical tensions can disrupt supply chains, leading to potential delays in hardware delivery and increased shipping costs, impacting revenue by an estimated 1-2% if prolonged.

Government policies and regulatory frameworks, particularly concerning fintech and digital assets, are pivotal for Block, Inc. Increased scrutiny from bodies like the U.S. SEC on payment platforms and cryptocurrencies in 2024 and 2025 could introduce compliance costs and operational limitations.

Block's significant Bitcoin holdings and blockchain initiatives through TBD are directly influenced by evolving global stances on digital currencies. For example, the U.S. Treasury's continued focus on stablecoin regulation in 2024 presents both opportunities and challenges for Block's crypto-related ventures.

Data privacy laws, such as GDPR and CCPA, necessitate substantial investment in security and compliance, with potential fines for non-compliance being significant. Antitrust concerns also loom, with potential investigations into Block's market share potentially impacting M&A activity and business practices.

What is included in the product

The Block PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the Block across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the Block's operating landscape.

Provides a clear, actionable framework that helps identify and mitigate potential external threats, thereby reducing anxiety and uncertainty in strategic decision-making.

Economic factors

Inflation and interest rates are key economic factors that significantly influence Block's operations. For instance, in the first quarter of 2024, the US inflation rate stood at 3.5%, a slight increase from the previous year, impacting consumer spending power.

Rising interest rates, like the Federal Reserve's benchmark rate which has remained elevated through early 2024, can increase Block's borrowing costs. This could affect its investments in growth initiatives and potentially make its financial products less attractive to users compared to traditional savings accounts.

Block's financial performance is closely tied to the overall health of the economy, which naturally cycles through periods of growth and recession. When the economy is expanding, businesses generally see increased sales, leading to higher payment processing volumes for Block. Conversely, during economic slowdowns or recessions, small businesses, a core customer base for Block, often face reduced sales and can even go out of business. This directly impacts Block's revenue from payment processing.

Consumer spending, a key driver for Block's Cash App, also fluctuates with economic cycles. In times of economic hardship, consumers tend to cut back on discretionary spending, which can lead to fewer transactions on Cash App. This reduction in activity affects the transaction fees Block earns and also impacts the adoption and usage of its investing features within the app. For instance, during the initial phases of the COVID-19 pandemic in 2020, many economies experienced sharp contractions, which would have likely pressured transaction volumes across payment platforms.

Looking ahead to 2024 and 2025, economic forecasts suggest a mixed environment. While some regions anticipate moderate growth, others may face slower expansion or potential headwinds. For example, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, with a slight uptick in 2025, though regional variations are significant. This economic backdrop means Block needs to be adaptable, as different markets will experience varying impacts on small business activity and consumer spending habits.

Consumer spending habits are undergoing a significant transformation, with a growing emphasis on digital and contactless transactions. This shift directly impacts Block, as it aligns with the company's core business model. For instance, in Q1 2024, Block reported a 25% year-over-year increase in Cash App total net revenue, reaching $1.73 billion, demonstrating the direct benefit of consumers embracing digital financial tools.

A strong economy generally translates to increased consumer spending, which in turn drives more transactions through Block's platforms. As of May 2024, the U.S. personal consumption expenditures saw a notable increase, indicating robust economic activity. This environment is particularly beneficial for Block's point-of-sale systems and its Cash App services, as more people engage in financial exchanges.

The ongoing adoption of digital financial tools is a critical economic factor for Block's sustained growth. In 2023, global digital payment transaction volumes were projected to exceed $10 trillion, a figure expected to continue its upward trajectory. This trend directly fuels the demand for Block's integrated ecosystem, from its seller services to its peer-to-peer payment solutions.

Unemployment Rates and Small Business Formation

Unemployment rates significantly shape the landscape for small business formation, a key component for companies like Block. When unemployment is low, more individuals have disposable income, leading to increased consumer spending which benefits small businesses and, by extension, Block's payment processing and financial services.

For instance, in the United States, the unemployment rate hovered around 3.9% in early 2024, a relatively low figure that generally supports consumer confidence and entrepreneurial activity. This environment is conducive to new ventures starting up, as potential founders might feel more secure leaving established employment or have better access to capital.

Conversely, periods of high unemployment can stifle small business creation. This occurred during economic downturns, where reduced consumer demand and tighter credit conditions made it harder for new businesses to launch and survive. This directly affects Block's transaction volumes and the adoption of its various financial tools.

- Low Unemployment: Typically correlates with higher consumer spending and a more favorable environment for new business startups.

- High Unemployment: Can lead to decreased consumer demand and reduced entrepreneurial activity, negatively impacting transaction volumes.

- 2024 US Unemployment: Averaged around 3.9%, indicating a generally supportive economic climate for small businesses.

- Impact on Block: Directly influences transaction volumes and the growth of its ecosystem, which relies on a healthy base of small businesses and active consumers.

Competitive Landscape in Fintech

The fintech sector is intensely competitive, forcing Block to navigate significant economic pressures. Traditional financial institutions are increasingly adopting digital strategies, while a surge of agile fintech startups constantly introduces novel solutions. This dynamic environment directly impacts Block’s pricing power and necessitates substantial investment in research and development.

For instance, in 2024, the global fintech market was valued at over $2.5 trillion, with projections indicating continued robust growth. This intense competition means Block faces constant pressure to innovate and acquire customers efficiently. Block's Q1 2025 earnings report highlighted increased marketing spend as a key factor in maintaining user acquisition amidst this crowded landscape.

- Intense Competition: The fintech market is characterized by a high number of players, including established banks, payment processors like PayPal and Stripe, and numerous emerging startups.

- Pricing Pressures: To attract and retain customers, companies like Block often face pressure to lower transaction fees or offer more competitive pricing structures.

- Innovation Imperative: Continuous investment in new technologies and features is crucial to stay ahead, adding to operational costs.

- Marketing Expenses: Acquiring new users in a saturated market requires significant marketing and advertising budgets, impacting profitability.

Block's economic environment is shaped by inflation, interest rates, and consumer spending. With US inflation at 3.5% in Q1 2024 and elevated interest rates through early 2024, Block faces increased borrowing costs and potential shifts in consumer preference for its financial products. Economic cycles directly impact Block's transaction volumes, with growth periods boosting revenue and downturns pressuring small business clients and consumer spending on platforms like Cash App.

Preview the Actual Deliverable

Block PESTLE Analysis

The preview you see is the exact Block PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the Block PESTLE Analysis you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Block PESTLE Analysis document you’ll download after payment.

Sociological factors

Block's services, like Cash App and Square, are crucial for digital financial inclusion, offering accessible tools to individuals and small businesses, especially those often overlooked by traditional banks. This directly addresses a societal push for more equitable financial access.

The increasing societal demand for financial equity and broader access fuels the need for Block's user-friendly, low-barrier financial solutions. In 2023, Cash App reported 53 million monthly active users, highlighting its reach in providing these essential services.

This trend perfectly supports Block's core mission of empowering economic independence. The company's focus on simplifying financial management and transactions resonates with a growing population seeking greater control over their finances.

Consumer trust in digital platforms is a critical sociological factor for Block. A significant portion of consumers are increasingly comfortable using digital tools for financial management, with global digital payment volumes projected to reach $11.2 trillion by 2027, up from $6.7 trillion in 2023. However, high-profile data breaches, such as the 2023 Equifax incident affecting millions, can quickly erode this confidence, impacting Block's ability to attract and retain users for its financial services.

Maintaining consumer trust requires proactive measures. For instance, a 2024 survey indicated that 70% of consumers consider data security a top priority when choosing a digital service provider. Block's commitment to transparent data usage policies and demonstrating robust cybersecurity protocols, like the adoption of advanced encryption standards, is therefore essential for fostering long-term user loyalty and ensuring the successful integration of its digital offerings into daily financial and business practices.

The global workforce is increasingly embracing flexible work, with the gig economy continuing its rapid expansion. This sociological shift directly fuels demand for tools that simplify business operations for independent contractors and small businesses. For instance, in 2024, it's estimated that over 60 million Americans participated in the gig economy, a number projected to grow. This trend creates a substantial market for companies like Square, whose payment and business management solutions are essential for this growing segment.

Generational Adoption of Digital Wallets

Generational differences significantly shape the adoption of digital wallets. Younger demographics, especially Gen Z and Millennials, are leading the charge in using mobile payment solutions and digital wallets for everyday transactions, peer-to-peer transfers, and even investment activities through platforms like Block's Cash App. For instance, a 2024 report indicated that over 70% of individuals aged 18-34 use digital wallets for online purchases, a stark contrast to older age groups.

Block's strategy must acknowledge these evolving consumer behaviors. By focusing on user-friendly interfaces and integrating features that appeal to digitally native generations, the company can effectively capture a larger share of this growing market. This includes offering seamless integration with social platforms and providing accessible financial tools that resonate with younger users' lifestyles.

The increasing comfort of younger generations with digital financial tools presents a significant opportunity for Block to expand its user base. Catering to their preferences for convenience and integrated digital experiences is key to driving future growth and market penetration in the evolving fintech landscape.

- Gen Z and Millennial Dominance: These generations are primary drivers of digital wallet adoption, utilizing platforms like Cash App for a wide array of financial activities.

- Peer-to-Peer Payments: Cash App's success is largely attributed to its appeal to younger users for easy money transfers between individuals.

- Investment Integration: The inclusion of investing features within digital wallets, like those offered by Block, further cements their utility for younger demographics.

- Market Penetration Strategy: Block's ability to adapt its offerings to generational preferences is critical for expanding its market reach and user acquisition.

Societal Values and Ethical Business Practices

Societal values increasingly shape business success, with consumers and investors prioritizing ethical conduct and social responsibility. Block, Inc. faces scrutiny regarding its environmental impact, particularly Bitcoin's energy use, which is a significant societal concern. For example, in 2024, the debate around Bitcoin's Proof-of-Work energy consumption intensified, with reports highlighting its substantial carbon footprint, a factor that can influence public perception and regulatory approaches.

Block's commitment to fair labor, diversity, and community development directly impacts its brand image and customer loyalty. Companies demonstrating strong ethical frameworks are more likely to attract and retain socially conscious customers and employees. A 2025 consumer sentiment survey indicated that over 60% of respondents would switch brands if a company was perceived as unethical, underscoring the financial implications of societal values.

- Consumer Preference: A growing segment of the market, estimated to be 55% by early 2025, actively seeks out brands with demonstrable social responsibility initiatives.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are now a primary consideration for institutional investors, with ESG-focused funds attracting over $3.5 trillion globally by the end of 2024.

- Reputational Risk: Negative publicity surrounding labor practices or environmental impact can lead to significant brand damage, potentially impacting Block's market valuation.

- Talent Acquisition: A strong ethical reputation is crucial for attracting top talent, with 70% of job seekers in 2025 stating that a company's social and ethical stance is a key factor in their employment decisions.

Societal expectations for financial inclusion are a major driver for Block's services. The company's platforms provide access to financial tools for underserved populations, aligning with a global trend toward greater economic equity. By 2024, over 1.4 billion people worldwide remained unbanked, highlighting the significant market opportunity for accessible financial solutions.

Consumer trust in digital financial platforms is paramount. While digital payments are soaring, with global volumes projected to hit $11.2 trillion by 2027, data security concerns remain. A 2024 survey found that 70% of consumers prioritize data security when selecting digital services, making Block's robust cybersecurity measures critical for user retention.

The rise of the gig economy directly benefits companies like Block. With an estimated 60 million Americans participating in the gig economy in 2024, there's a growing need for streamlined payment and business management tools. Block's Square ecosystem caters directly to these independent workers and small businesses.

Generational shifts are also reshaping financial habits. Younger demographics, particularly Gen Z and Millennials, are leading the adoption of digital wallets and peer-to-peer payment apps. A 2024 report indicated that over 70% of 18-34 year olds use digital wallets for online purchases, a trend Block's Cash App is well-positioned to capitalize on.

Block's operations are also influenced by growing societal emphasis on corporate responsibility. Concerns about the environmental impact of cryptocurrencies, like Bitcoin's energy consumption, are significant. By 2024, the debate over Bitcoin's Proof-of-Work mechanism continued, impacting public perception and regulatory discussions.

| Sociological Factor | Impact on Block | Supporting Data (2024-2025) |

|---|---|---|

| Financial Inclusion Demand | Drives adoption of accessible financial tools. | 1.4 billion unbanked globally (2024). |

| Consumer Trust & Data Security | Essential for user acquisition and retention. | 70% prioritize data security (2024 survey). |

| Gig Economy Growth | Creates demand for business management solutions. | Over 60 million gig workers in the US (2024 estimate). |

| Generational Digital Adoption | Younger users drive digital wallet usage. | 70%+ of 18-34 year olds use digital wallets online (2024 report). |

| Social Responsibility Concerns | Influences brand perception, especially regarding crypto. | Ongoing debate on Bitcoin's energy consumption (2024). |

Technological factors

Ongoing innovations in blockchain technology and the cryptocurrency space are critical for Block's strategic initiatives, particularly for projects like TBD and Spiral. These advancements, especially in areas like layer-2 scaling solutions, are crucial for making decentralized finance more accessible and efficient.

Breakthroughs in blockchain scalability, security, and usability directly influence Block's capacity to develop new decentralized financial services and enhance global payment systems. For instance, the increasing adoption of zero-knowledge proofs aims to improve transaction privacy and efficiency, a key area for Block's future offerings.

Block's ability to effectively integrate and leverage these technological advancements is a significant determinant of its future product roadmap and competitive standing in the evolving digital asset market. The company's investment in research and development for these areas underscores their importance to its long-term success.

Block's integration of Artificial Intelligence (AI) and Machine Learning (ML) is a significant technological driver, particularly enhancing fraud detection and personalizing user experiences within its Square and Cash App platforms. For instance, by Q1 2024, Block reported that its AI-driven fraud prevention systems helped mitigate millions of dollars in potential losses, demonstrating a tangible return on its technological investments.

The ongoing advancement and deployment of these AI/ML capabilities are crucial for improving operational efficiency and reducing risk. This technological edge allows Block to offer more sophisticated financial tools and services, directly impacting user engagement and retention. By late 2024, Block was actively investing in R&D for new AI applications, aiming to further automate customer support and streamline transaction processing.

As a financial technology company, Block is constantly targeted by evolving cybersecurity threats. In 2024, the financial services sector saw a significant increase in sophisticated cyberattacks, with ransomware and phishing remaining prevalent. Block's commitment to investing in advanced encryption, multi-factor authentication, and real-time threat intelligence is crucial for safeguarding the sensitive data of its millions of users and maintaining the integrity of its payment and financial services.

Mobile Technology Evolution and 5G Connectivity

The continuous advancement in mobile technology, including faster processors and more intuitive interfaces, directly benefits Block’s mobile-centric offerings like Cash App and Square Point of Sale. This evolution ensures a seamless user experience, facilitating quicker and more efficient transactions.

The widespread deployment of 5G networks is a significant technological factor. By mid-2024, 5G coverage had expanded considerably, with many developed nations reporting over 50% of their populations having access to 5G signals. This enhanced connectivity allows for richer app functionalities and a broader user base, directly improving the performance and accessibility of Block’s services.

- Increased Transaction Speed: 5G enables near-instantaneous data transfer, reducing processing times for mobile payments and financial operations.

- Enhanced User Experience: Faster speeds and lower latency support more complex features within apps like Cash App, such as real-time investing and peer-to-peer payments.

- Market Expansion: Improved mobile capabilities, driven by 5G, can unlock new markets and user segments previously limited by slower network speeds.

API Integration and Platform Ecosystems

Block's (formerly Square) ability to integrate with other services via APIs is crucial for its ecosystem. This allows businesses to connect their Square point-of-sale and payment systems with essential tools like accounting software (e.g., QuickBooks, Xero) and e-commerce platforms (e.g., Shopify, WooCommerce). For instance, in 2024, Block continued to expand its developer network, with thousands of third-party applications available through its App Marketplace, enhancing the utility of its offerings.

These integrations create a more comprehensive business management solution, streamlining operations and data flow for merchants. The ongoing development of API capabilities, including features like real-time data synchronization and enhanced security protocols, is key to fostering a robust and interconnected platform. By enabling seamless data exchange, Block empowers businesses to manage sales, inventory, customer relationships, and financial reporting more efficiently.

- API Accessibility: Block's developer portal offers robust APIs, enabling connections to over 10,000 apps in its marketplace as of early 2024.

- Ecosystem Growth: The platform ecosystem is designed to support a wide range of business needs, from inventory management to marketing automation, through third-party integrations.

- Data Interoperability: Enhanced APIs facilitate smoother data transfer between Block's services and external business software, reducing manual entry and errors.

Block's strategic advantage is heavily influenced by advancements in artificial intelligence and machine learning, particularly in enhancing fraud detection and personalizing user experiences across its platforms like Cash App and Square. By early 2024, Block reported that its AI-powered fraud prevention systems had successfully averted millions of dollars in potential losses, a clear indicator of the technology's value.

The company's ongoing investment in AI and machine learning is vital for boosting operational efficiency and mitigating risks, enabling the delivery of more sophisticated financial tools that drive user engagement. By the end of 2024, Block was actively channeling resources into research and development for new AI applications, with the goal of automating customer support and streamlining transaction processes.

Technological factors such as blockchain scalability, security, and user-friendliness directly impact Block's ability to innovate in decentralized finance and improve global payment systems. The increasing use of zero-knowledge proofs, for example, is aimed at enhancing transaction privacy and efficiency, areas of significant focus for Block's future product development.

Legal factors

Block, Inc. navigates a complex web of financial regulations, necessitating state-specific money transmitter licenses for its Cash App operations. For example, as of early 2024, obtaining and maintaining these licenses is a continuous process across numerous U.S. states, each with unique requirements. Failure to comply with these stringent legal frameworks, including payment processing rules for its Square ecosystem, could jeopardize its ability to operate and generate revenue.

Block faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, especially concerning Cash App and its cryptocurrency ventures like TBD and Spiral. These rules mandate rigorous identity verification for users and continuous monitoring of transactions to thwart illegal financial activities.

Failure to comply with these legal frameworks can result in substantial financial penalties, with regulatory bodies imposing significant fines. For instance, in 2023, financial institutions globally paid billions in AML-related fines, a trend expected to continue. Block must invest heavily in advanced compliance technology and personnel to mitigate these risks.

Block operates within a stringent global framework of data protection laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations, which continue to evolve with new legislation anticipated in 2024 and 2025, govern every aspect of customer data handling, from collection to disposal. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Adherence to these privacy mandates is not merely a legal obligation but a critical component of maintaining customer trust and brand reputation. Block must continuously adapt its data processing and storage practices to align with these evolving legal requirements, ensuring robust security measures and transparent data usage policies are in place to avoid substantial legal repercussions and safeguard its user base.

Consumer Protection Laws and Dispute Resolution

Consumer protection laws are crucial for Block, dictating how it engages with its vast user base, especially concerning fee transparency and fair marketing. These regulations are designed to shield consumers from misleading or exploitative tactics, ensuring a level playing field. For instance, in the US, the Consumer Financial Protection Bureau (CFPB) actively enforces rules against unfair, deceptive, or abusive acts and practices, impacting companies like Block that handle financial transactions.

Block must adhere to these stringent rules to prevent costly lawsuits and regulatory penalties, which could significantly damage its reputation. In 2023, U.S. consumer protection agencies reported millions of complaints, highlighting the active enforcement environment. Effective dispute resolution mechanisms are also mandated, ensuring users have clear pathways to address grievances.

- Regulatory Scrutiny: Block operates under various consumer protection statutes, such as the Truth in Lending Act (TILA) and the Electronic Fund Transfer Act (EFTA) in the US, requiring clear disclosure of terms and fees.

- Dispute Resolution Mandates: Regulations often require accessible and timely complaint handling processes, impacting how Block manages customer service and escalations.

- Marketing Compliance: Advertising and promotional materials must be truthful and not misleading, a key area of focus for consumer protection agencies.

- Data Privacy Linkages: Consumer protection often intersects with data privacy laws, like the California Consumer Privacy Act (CCPA), influencing how Block handles user data and consent.

Intellectual Property Rights and Patent Protection

Block’s commitment to protecting its intellectual property, particularly its patents covering payment hardware, software algorithms, and brand trademarks, is a critical legal consideration. This focus is essential for maintaining its competitive edge and preventing unauthorized replication of its technological advancements.

The company actively defends against patent infringements and strategically manages its extensive patent portfolio. For instance, in the first quarter of 2024, Block reported holding over 1,000 patents globally, with a significant portion dedicated to its payment processing and financial technology innovations. This robust IP strategy underpins its market position.

- Patent Portfolio Strength: Block's approximately 1,000+ global patents as of early 2024 provide a strong defensive and offensive capability against competitors seeking to mimic its payment hardware and software.

- Brand Protection: Safeguarding its brand trademarks, including the Block and Square names, is paramount to maintaining customer trust and preventing market confusion, especially as it expands its service offerings.

- Open-Source Navigation: The company must also navigate the legal complexities of contributing to and utilizing open-source projects, particularly within the decentralized finance and Bitcoin ecosystems, ensuring compliance and managing potential licensing issues.

Block's legal landscape is shaped by evolving consumer protection laws, demanding transparency in fees and fair marketing practices. Agencies like the U.S. Consumer Financial Protection Bureau (CFPB) actively enforce rules against deceptive practices, impacting Block's transaction services. Ensuring robust dispute resolution mechanisms is also legally mandated to address user grievances effectively.

Environmental factors

The energy consumption of blockchain technologies, especially Bitcoin mining, presents a significant environmental challenge for Block's Spiral initiative. Estimates suggest Bitcoin's annual energy consumption rivals that of entire countries, with some analyses in 2024 placing it above the usage of Argentina or Sweden.

As climate change concerns escalate globally, Block faces increasing scrutiny over the carbon footprint generated by its Bitcoin-related operations. This heightened awareness could translate into pressure for more environmentally friendly mining methods or the imposition of new regulations on such activities.

Growing investor and public pressure for strong Environmental, Social, and Governance (ESG) reporting significantly impacts Block's operational landscape. Investors are increasingly scrutinizing companies for their commitment to sustainability, ethical supply chains, and environmental footprint reduction. For instance, by the end of 2023, assets under management in ESG-focused funds globally surpassed $40 trillion, indicating a substantial shift in capital allocation towards responsible businesses.

Block must actively demonstrate its dedication to these principles. This includes transparently communicating its efforts in areas like carbon emissions reduction, fair labor practices, and responsible data management. Companies with robust ESG reporting often see improved investor relations, a stronger brand image, and better access to capital, as evidenced by studies showing a correlation between high ESG scores and lower cost of capital.

Block, through its Square offering, confronts significant environmental challenges stemming from the lifecycle of its physical point-of-sale hardware. The generation of electronic waste, or e-waste, is a growing concern globally. For instance, the United Nations Environment Programme reported that global e-waste reached 53.6 million metric tons in 2019, and this figure is projected to climb.

The company's commitment to responsible product lifecycle management, from sourcing materials and manufacturing to packaging and end-of-life recycling, is crucial. This includes exploring eco-friendly packaging solutions and extending the durability of hardware. According to the EPA, electronics are one of the fastest-growing waste streams in the United States.

Adhering to evolving e-waste regulations, such as the EU's Restriction of Hazardous Substances (RoHS) directive and similar frameworks in other regions, is a key environmental responsibility for Block. Promoting sustainable hardware practices, including repairability and efficient energy consumption, further solidifies their environmental stewardship.

Climate Change Impact on Operations and Supply Chain

While Block isn't a heavy emitter itself, climate change poses indirect risks. Extreme weather events, such as hurricanes or prolonged heatwaves, could disrupt data center operations, leading to service interruptions and increased cooling costs. For instance, a 2023 report indicated that data centers experienced a 10% increase in energy consumption due to rising ambient temperatures.

Furthermore, Block's global supply chain for hardware components is vulnerable. Climate-related disasters like floods or droughts can impact manufacturing facilities or transportation routes, causing delays and price volatility for essential equipment. The semiconductor industry, a key supplier for Block, has already faced supply chain challenges exacerbated by weather events in recent years.

- Extreme weather events can disrupt data center operations, increasing energy costs for cooling.

- Global supply chains for hardware components are susceptible to climate-related disasters, causing delays and price increases.

- Resilient business planning necessitates assessing and mitigating these indirect environmental risks.

Sustainable Business Practices and Green Initiatives

The increasing global emphasis on sustainability is prompting companies like Block to integrate environmentally conscious practices. This involves actively seeking ways to reduce their environmental impact, such as improving energy efficiency in their facilities and data centers. For instance, many tech companies are investing in renewable energy sources to power their operations; in 2023, the tech sector saw a significant increase in corporate Power Purchase Agreements (PPAs) for solar and wind energy.

Block can enhance its brand reputation and meet evolving stakeholder demands by championing green initiatives. This includes efforts to lower its carbon footprint through optimized logistics and waste reduction programs. Companies that demonstrate strong environmental stewardship often see improved customer loyalty and attract investors focused on ESG (Environmental, Social, and Governance) criteria. In 2024, investments in green technologies and sustainable infrastructure are projected to reach new heights, reflecting this growing market trend.

- Energy Efficiency: Implementing smart building technologies and optimizing data center cooling systems to reduce electricity consumption.

- Carbon Footprint Reduction: Setting science-based targets for emissions reduction and exploring carbon offsetting programs.

- Renewable Energy Adoption: Sourcing a significant portion of energy needs from solar, wind, or other renewable sources.

- Sustainable Supply Chains: Encouraging or requiring suppliers to adopt environmentally responsible practices.

Block's environmental considerations span its diverse operations, from the energy-intensive nature of its Bitcoin services to the physical hardware of its Square ecosystem. The company must navigate growing global concerns about climate change and the increasing demand for transparent ESG reporting from investors and consumers alike.

Block's Bitcoin mining operations contribute to a significant carbon footprint, with Bitcoin's energy consumption in 2024 comparable to that of entire nations. This raises concerns about regulatory scrutiny and investor pressure for more sustainable mining practices.

The lifecycle of Block's point-of-sale hardware, particularly its Square devices, generates electronic waste, a rapidly growing global concern. Adherence to e-waste regulations and the promotion of repairable, energy-efficient hardware are key environmental responsibilities.

Indirectly, climate change poses risks such as extreme weather events disrupting data centers and impacting global supply chains for hardware components. For example, rising ambient temperatures in 2023 led to a 10% increase in data center energy consumption due to cooling needs.

| Environmental Factor | Impact on Block | Mitigation Strategies |

|---|---|---|

| Bitcoin Mining Energy Consumption | High carbon footprint, potential regulatory pressure. | Invest in renewable energy for mining operations, explore more energy-efficient consensus mechanisms. |

| E-waste from Hardware | Environmental pollution, regulatory compliance. | Design for durability and repairability, implement take-back and recycling programs, use eco-friendly materials. |

| Extreme Weather Events | Data center disruptions, increased cooling costs. | Invest in resilient infrastructure, diversify data center locations, improve cooling efficiency. |

| Supply Chain Disruptions | Delays and price volatility for hardware components. | Diversify suppliers, build redundancy in the supply chain, engage suppliers on sustainability practices. |

PESTLE Analysis Data Sources

Our Block PESTLE Analysis is meticulously constructed using data from reputable sources like government economic reports, international policy databases, and leading technology research firms. This ensures each factor, from political stability to environmental regulations, is grounded in current, verifiable information.