Block Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

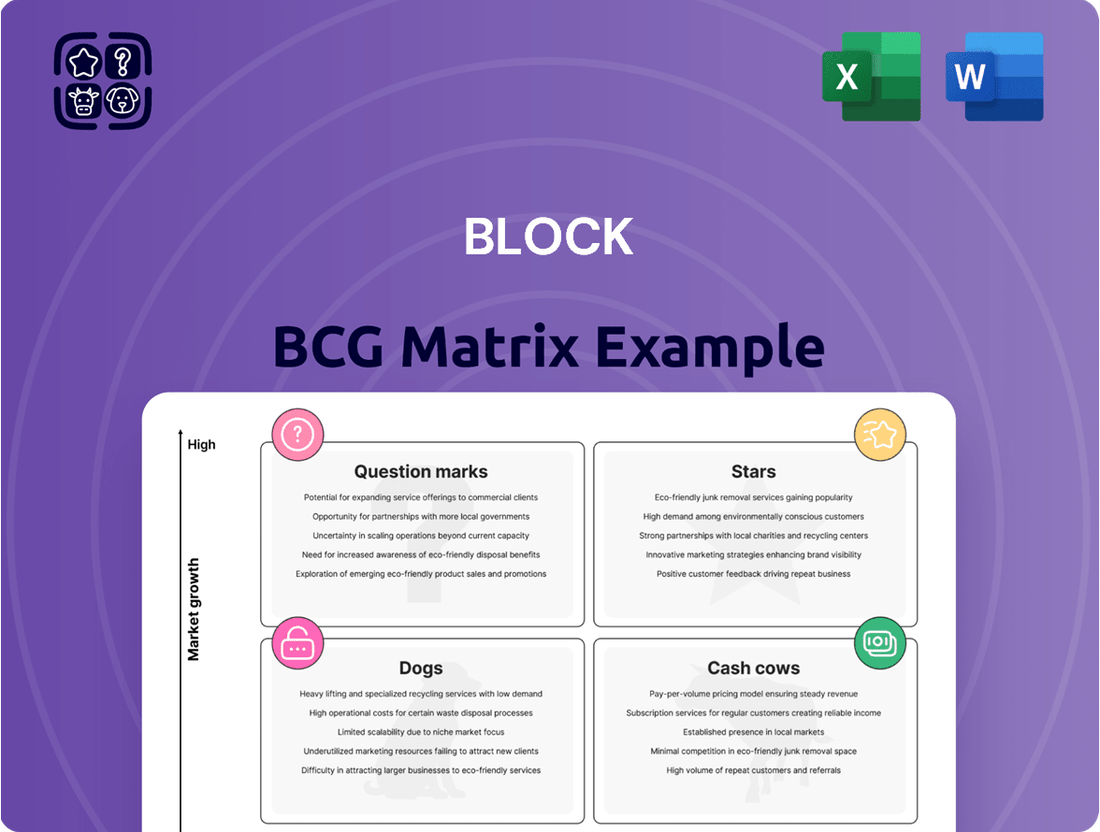

Unlock the secrets to your company's product portfolio with the BCG Matrix. Understand which products are your Stars, Cash Cows, Dogs, and Question Marks to make informed strategic decisions. Purchase the full BCG Matrix for a comprehensive breakdown, actionable insights, and a clear roadmap to optimizing your investments and driving growth.

Stars

Cash App is positioned as a Star in the BCG Matrix for Block, reflecting its high growth and significant market share within the expanding peer-to-peer payment and consumer financial services sector. In 2024, it achieved $16.2 billion in revenue, marking a robust 13.2% year-over-year increase.

The platform's continued expansion is evident in its projected user base of 54.3 million by 2025. Furthermore, Cash App's gross profit reached an all-time high of $5.23 billion in 2024, underscoring its strong financial performance and market dominance.

Square's ecosystem, moving beyond basic payment processing, is a key growth driver. This includes their expanding suite of business management software and banking services, designed to offer merchants a more complete solution. Their strategy of focusing on specific industries and making it easy for new businesses to start using their services, coupled with global expansion, is fueling this growth.

In the first quarter of 2025, Square reported a healthy 9% increase in gross profit year-over-year. This financial performance underscores the success of their strategy to build a comprehensive commerce platform that supports businesses at various stages.

Cash App Borrow, a burgeoning micro-lending feature within Block's popular Cash App, is positioned as a star in the company's BCG matrix. This service has already facilitated nearly $9 billion in loan originations, showcasing significant market traction and rapid expansion.

Block is actively enhancing Cash App Borrow by broadening eligibility criteria and increasing loan limits. This strategic move is supported by advancements in underwriting capabilities and continued state-level regulatory approvals, pointing towards a substantial acceleration in Cash App's overall growth trajectory.

Afterpay Integration

Afterpay's integration is a key component of Block's strategy, particularly within its Cash App and Square ecosystems. This move aims to boost sales for Square sellers by offering customers flexible payment options, which in turn can improve customer loyalty and spending.

The company anticipates significant growth from this segment. For 2025, Block is projecting Afterpay to contribute to high-20s percentage growth in its Buy Now, Pay Later gross profit. This highlights Afterpay's role as a major growth engine for Block.

- Afterpay's BNPL offering enhances sales for Square merchants.

- The integration is expected to drive high-20s percentage growth in Block's BNPL gross profit for 2025.

- This positions Afterpay as a significant growth driver within Block's broader financial ecosystem.

AI-driven Product Innovation

Block's commitment to AI-driven product innovation positions it strongly within the Stars quadrant of the BCG Matrix. The company plans to unveil more than 100 new products and features in 2025, a significant surge in development fueled by AI.

These advancements are not just about quantity; they are strategically focused on enhancing operational efficiency for both Block's business units and its end-users. This dual benefit is key to driving future growth and solidifying its market leadership.

Block's strategy explicitly centers on harnessing automation to unlock greater creativity and efficiency across its offerings. This focus is crucial for maintaining a competitive edge in the rapidly evolving tech landscape.

- AI Investment: Block is channeling significant resources into AI development.

- Product Pipeline: Over 100 new AI-enhanced products and features are slated for release in 2025.

- Efficiency Gains: The AI tools aim to boost productivity for businesses and customers alike.

- Strategic Focus: Leveraging automation for increased creativity and efficiency is a core company priority.

Cash App, a key component of Block's portfolio, is firmly positioned as a Star in the BCG Matrix. Its high growth and substantial market share in the expanding peer-to-peer payment sector are evident. In 2024, Cash App generated $16.2 billion in revenue, a notable 13.2% increase year-over-year, and is projected to reach 54.3 million users by 2025.

Cash App Borrow, the micro-lending feature, also shines as a Star. It has facilitated nearly $9 billion in loan originations, demonstrating rapid expansion and strong market acceptance. Block's strategic enhancements to eligibility and loan limits, backed by improved underwriting, are set to accelerate its growth.

Afterpay's integration into Block's ecosystem is driving significant growth, particularly for Square sellers. This Buy Now, Pay Later service is anticipated to contribute to high-20s percentage growth in Block's BNPL gross profit for 2025, solidifying its role as a major growth engine.

Block's aggressive investment in AI further cements its Star status. The company plans to launch over 100 new AI-enhanced products and features in 2025, focusing on boosting efficiency for both businesses and consumers, underscoring a commitment to innovation and market leadership.

| Product/Service | BCG Quadrant | 2024 Revenue (USD Billions) | Year-over-Year Growth (%) | Key Growth Driver |

|---|---|---|---|---|

| Cash App | Star | 16.2 | 13.2 | Expanding P2P payments, financial services |

| Cash App Borrow | Star | N/A (Loan Originations) | Significant | Micro-lending feature, expanded offerings |

| Afterpay | Star | N/A (Contribution to BNPL GP) | High-20s % (Projected for 2025 BNPL GP) | Buy Now, Pay Later integration |

| AI-Driven Innovation | Star | N/A (Investment Focus) | N/A | Over 100 new products/features in 2025 |

What is included in the product

Strategic guidance on investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Core Square Payment Processing, a foundational element for Block, embodies the characteristics of a Cash Cow in the BCG Matrix. Its established position in the market, particularly among small and medium-sized businesses, means it operates in a more mature, albeit competitive, landscape.

Despite facing slower growth compared to Block's more innovative ventures, Square's payment processing remains a powerhouse. In 2024, it facilitated a remarkable $227.6 billion in gross payment volume (GPV), underscoring its enduring market penetration and customer loyalty.

This consistent and substantial GPV translates directly into a reliable and significant source of cash flow for Block. This stable revenue stream is crucial, providing the financial resources needed to invest in and develop other, higher-growth potential business segments within the company.

Bitcoin transactions via Cash App are a significant driver of revenue, demonstrating a strong market position in consumer cryptocurrency dealings. In 2024, these transactions accounted for approximately 62% of Cash App's total revenue, generating $10.1 billion. This makes Bitcoin a substantial cash generator for the platform, despite inherent market volatility.

The Cash App Card, a debit card linked to the popular Cash App, represents a significant Cash Cow for Block within its BCG Matrix. With a robust user base of 24 million in 2024, projected to reach 25 million by Q1 2025, its widespread adoption fuels consistent revenue streams.

This product reliably generates income primarily through interchange fees, a common practice for debit card transactions. Its ability to attract and retain users, leading to high customer inflows and engagement, solidifies its position as a mature, steady cash generator for Block.

Square Banking Products (excluding new lending)

Square's established banking products, including business checking and savings accounts, are a significant contributor to the company's gross profit. These offerings are experiencing increasing adoption among Square sellers, leading to a stable and growing revenue stream.

While not characterized by the rapid expansion seen in newer lending ventures, this segment represents a mature and reliable income source. The growing banking attach rates are a testament to the value proposition for sellers seeking integrated financial solutions.

- Stable Revenue: Business checking and savings accounts provide a consistent income base for Square.

- Increasing Adoption: More Square sellers are utilizing these banking services, boosting revenue.

- Profitability: This segment contributes significantly to the company's overall gross profit.

- Growth Potential: Continued increases in banking attach rates indicate ongoing revenue expansion.

International Square Markets

Square's international markets are demonstrating robust growth, positioning them as potential cash cows within the BCG framework. In the second quarter of 2024, these operations saw a significant 34% year-over-year increase in gross profit. This strong performance outpaces the U.S. market's growth in the same period.

Further bolstering their cash cow status, international markets experienced a 19% year-over-year rise in gross payment volume during Q2 2024. As these markets continue to mature and expand, they are anticipated to become substantial contributors to Square's overall cash flow. This is built upon their already established high market share in various international segments.

- International Gross Profit Growth (Q2 2024): 34% YoY

- International Gross Payment Volume Growth (Q2 2024): 19% YoY

- Market Position: High market share in respective niches

- Future Outlook: Expected to become significant cash contributors as they mature

Cash Cows, within the BCG Matrix, represent established products or services that generate more cash than they consume. They typically operate in mature markets with low growth but high market share, providing stable and predictable revenue streams.

Block's core payment processing, particularly for small and medium-sized businesses, exemplifies a Cash Cow. In 2024, Square facilitated $227.6 billion in gross payment volume, demonstrating its strong market presence and consistent cash generation capabilities.

These established revenue streams are vital, enabling Block to fund investments in its higher-growth potential ventures, such as its expanding ecosystem of financial services and Bitcoin-related offerings.

The Cash App Card, with 24 million users in 2024, is another prime example. It reliably generates income through interchange fees, solidifying its role as a steady cash contributor.

| Block Business Segment | BCG Category | 2024 Key Metric | Significance |

|---|---|---|---|

| Square Payment Processing | Cash Cow | $227.6 billion GPV | Stable, high-volume revenue generator |

| Cash App Card | Cash Cow | 24 million users (2024) | Consistent interchange fee income |

| Square Banking Products | Cash Cow | Increasing seller adoption | Reliable gross profit contribution |

| International Markets (Square) | Potential Cash Cow | 34% YoY Gross Profit Growth (Q2 2024) | Maturing, high-growth revenue streams |

What You’re Viewing Is Included

Block BCG Matrix

The BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis tool, designed to guide strategic decision-making, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Tidal, Block's music streaming service, is often positioned as a potential 'Dog' in the BCG matrix. Reports in 2024 indicated Block was considering scaling back its involvement with Tidal, suggesting it has a low market share in a competitive streaming landscape and limited growth potential. This strategic re-evaluation implies Tidal may be a cash consumer with minimal returns, especially when compared to Block's more robust Bitcoin and financial technology ventures.

Early-stage TBD initiatives, particularly those not directly tied to core blockchain functionalities, could be categorized as question marks in Block's BCG matrix. These projects, while exploratory, haven't yet demonstrated substantial market adoption or revenue generation. For instance, Block's reported reduction in its stake in TBD, coupled with a strategic shift towards Bitcoin mining, implies that some of these non-core ventures may not be meeting expected performance benchmarks.

Legacy Square Hardware, such as older, standalone point-of-sale terminals not integrated into the broader Square ecosystem, would likely be classified as Dogs in the Block BCG Matrix. These products may have low market share and low growth prospects as Square prioritizes its newer, integrated hardware like the Square Handheld, which aims for higher software attach rates and a more seamless customer experience.

Underperforming Niche Square Software

Within the broad Square ecosystem, certain niche software offerings that have not gained significant adoption or demonstrated strong revenue growth could be categorized as Dogs. These might be products with low market share in their specific sub-segments and limited growth potential. For instance, if a particular industry-specific POS add-on for Square, launched in 2023, only captured 0.5% of its target market by the end of 2024, it would likely fall into this category.

These underperforming niche software products often require significant investment to maintain or improve, yet offer little prospect of substantial returns. Their low market share and stagnant growth indicate a lack of competitive advantage or market fit. For example, a Square feature designed for a very small, specialized business vertical that saw minimal uptake in 2024, perhaps only 1,000 active users, exemplifies this scenario.

- Low Market Share: Niche software within Square may struggle to gain traction, potentially holding less than 1% of their specific market segment.

- Limited Growth Potential: These offerings often face saturated markets or declining demand, showing minimal revenue increase year-over-year.

- Resource Drain: Continued development and support for these products can divert resources from more promising areas of Block's portfolio.

Non-strategic or Divested Ventures

Block's non-strategic or divested ventures represent business units or acquisitions that no longer align with the company's core strategy or have demonstrated poor performance. These are typically characterized by low market share and limited growth prospects, often failing to integrate seamlessly into Block's broader financial ecosystem. While Block has not publicly detailed specific recent divestitures fitting this exact description, this category acknowledges the possibility of such actions to optimize resource allocation and focus on high-potential areas.

Identifying and managing these ventures is crucial for maintaining a healthy portfolio. For instance, if a past acquisition failed to achieve projected synergies or faced declining customer adoption, it would likely be categorized here. The company's strategic reviews would then assess whether divestiture is the most beneficial path forward.

Such a classification allows Block to:

- Streamline operations by shedding underperforming assets.

- Reallocate capital to more promising growth areas.

- Enhance overall profitability and shareholder value.

- Maintain a focused and agile business model.

Dogs in Block's BCG Matrix represent business units or products with low market share and low growth potential. These are often cash consumers that do not contribute significantly to the company's overall performance. For example, legacy Square hardware not integrated into newer systems, or niche software with minimal adoption, fall into this category. Block's strategic reviews aim to identify these areas for potential divestment or restructuring to reallocate resources to more promising ventures.

Question Marks

Block's TBD (Bitcoin and Decentralized Technologies) initiative, focused on building a decentralized internet and Bitcoin, is positioned as a potential 'Question Mark' in the BCG Matrix. Its high growth prospects stem from the burgeoning Web5 and decentralized finance (DeFi) sectors, areas experiencing significant investor and developer interest. For instance, the global DeFi market was valued at approximately $10.5 billion in 2023 and is projected to reach over $40 billion by 2028, indicating substantial growth potential.

Despite these promising growth avenues, TBD likely holds a low market share. The decentralized technology space is still in its early stages, characterized by rapid innovation and a fragmented competitive landscape. This means TBD is investing heavily in research and development to establish its presence and capture future market share, a characteristic of 'Question Mark' assets that require substantial cash infusions to fuel their growth and development before they can potentially become market leaders.

Spiral, Block's open-source Bitcoin development initiative, fits into the question marks category of the BCG matrix. It operates in a rapidly expanding market fueled by growing global interest in Bitcoin as a digital currency, a sector projected for significant future growth.

While Spiral’s long-term vision is to establish Bitcoin as a primary currency, its current direct revenue contribution to Block is likely minimal. Its focus is on building the underlying infrastructure and fostering adoption, rather than immediate profit generation.

Block's new Bitcoin mining initiatives, particularly the Proto open-source platform, are targeting a substantial and expanding hardware market estimated between $3 billion and $6 billion. These ventures represent significant investments with the potential for considerable future growth.

As new endeavors, their current market share and immediate profitability are likely low. This positions them as Question Marks within the BCG matrix, requiring careful observation and strategic decisions regarding further investment or divestment.

Bitkey (Self-custody Bitcoin Wallet)

Bitkey, as Block's self-custody Bitcoin wallet, is positioned as a question mark in the BCG matrix due to its high growth potential in the expanding cryptocurrency market, yet its current market share remains nascent. The increasing global interest in secure, non-custodial digital asset management fuels its growth trajectory, with the total value of cryptocurrencies held in self-custody wallets projected to reach trillions by 2025.

Significant investment in marketing and development is necessary for Bitkey to capture a meaningful share of this dynamic market. Block's commitment to Bitcoin infrastructure development, including its recent investments in Bitcoin mining and its ongoing work on the Lightning Network, suggests a long-term strategy that could bolster Bitkey's adoption. For instance, Block reported a 30% increase in Bitcoin revenue in Q1 2024, indicating a growing ecosystem that Bitkey can leverage.

- High Growth Potential: Driven by the increasing demand for secure, self-custody cryptocurrency solutions.

- Developing Market Share: Bitkey is a newer entrant, requiring substantial effort to build brand recognition and user adoption.

- Cash Consumption: Significant investment in marketing and development is ongoing to establish a foothold.

- Strategic Importance: Aligns with Block's broader commitment to Bitcoin and decentralized finance.

New Geographic Expansions for Square/Cash App

Block's strategic expansion of Square and Cash App into new international markets is a key driver of its growth, positioning these offerings as potential stars in the BCG matrix. For instance, in 2023, Block continued its international push, with Cash App expanding its services to the UK and Square making strides in markets like Australia and Ireland. This aggressive approach taps into vast untapped customer bases, offering substantial revenue potential.

However, these new ventures often begin with a low market share, necessitating significant upfront investment. Block reported that international markets represented a smaller portion of its overall revenue in 2023, but the growth rate in these regions was often higher than in established markets. The company is actively investing in tailoring its services, building local partnerships, and enhancing marketing efforts to capture market share in these developing geographies.

- International Growth Focus: Block's 2023 performance indicated a strong emphasis on expanding its seller ecosystem and peer-to-peer payment services globally.

- Investment in New Markets: Significant capital is allocated to localization, regulatory compliance, and marketing to establish a foothold in regions like Europe and Latin America.

- Early Stage Traction: While market share in newly entered countries is initially low, the long-term potential for user acquisition and transaction volume remains a primary objective.

- Strategic Partnerships: Collaborations with local financial institutions and businesses are crucial for navigating diverse regulatory landscapes and consumer behaviors.

Block's focus on Bitcoin development, including initiatives like TBD and Spiral, represents ventures with high growth potential but currently low market share. These are classic question marks, requiring substantial investment to mature into potential market leaders.

New Bitcoin mining operations, such as the Proto platform, also fall into the question mark category. They target a growing hardware market but are in their nascent stages, demanding significant capital for development and market penetration.

Bitkey, Block's self-custody wallet, aims to capitalize on the expanding cryptocurrency market. Despite its high growth potential, it currently holds a small market share, necessitating ongoing investment in marketing and development to gain traction.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|

| TBD (Decentralized Internet) | High (DeFi, Web5 growth) | Low | High (R&D, infrastructure) |

| Spiral (Bitcoin Development) | High (Global Bitcoin adoption) | Low (Focus on infrastructure) | High (Ecosystem building) |

| Bitcoin Mining (Proto) | High ($3B-$6B hardware market) | Low (New ventures) | High (Capital expenditure) |

| Bitkey (Self-Custody Wallet) | High (Crypto market growth) | Nascent | High (Marketing, development) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry growth data to provide a comprehensive view of product performance and potential.