Block Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

Block's position in the financial technology landscape is shaped by intense competition, powerful buyer choices, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Block’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Block's reliance on a limited number of key technology providers for essential services like payment processing and cloud infrastructure presents a significant factor in supplier bargaining power. If a few dominant firms control these critical technological components, they can leverage this position to influence pricing and contractual terms, potentially impacting Block's operational costs and flexibility.

For instance, in 2024, the cloud computing market saw continued consolidation, with Amazon Web Services (AWS), Microsoft Azure, and Google Cloud holding a substantial combined market share. Should Block heavily depend on one of these providers for its scalable infrastructure, that provider would possess considerable leverage. Similarly, specialized software or hardware suppliers, if few in number, can dictate terms due to the difficulty Block might face in finding alternative solutions.

The ease with which Block can switch between suppliers for its critical components and services significantly influences supplier power. If there are numerous viable alternatives for payment hardware, cloud infrastructure, or software development kits, Block's own bargaining power is enhanced.

Conversely, if a supplier offers unique or proprietary technologies that are difficult for Block to replicate or find substitutes for, that supplier gains considerable leverage. For instance, in 2023, Block continued to diversify its cloud service providers, reducing reliance on any single entity and thereby strengthening its negotiating position.

Suppliers offering highly specialized or unique inputs, like the specific blockchain technologies utilized by TBD and Spiral, or the high-fidelity audio encoding essential for Tidal, wield significant bargaining power. Block's dependence on these distinct components, lacking easily accessible alternatives, can translate into increased operational expenses or less advantageous contractual arrangements with these providers.

Cost of Switching Suppliers

The financial and operational costs associated with switching suppliers significantly bolster their bargaining power. For Block, if migrating data, integrating new systems, or retraining staff after a supplier change proves costly and disruptive, the company might hesitate to switch even if current suppliers increase prices or offer less favorable terms. For example, in the cloud computing sector, the average cost for a business to migrate its data and applications can range from thousands to hundreds of thousands of dollars, depending on complexity and volume.

These switching costs act as a barrier, making it more difficult for Block to find alternative suppliers and negotiate better deals. This leverage allows existing suppliers to maintain higher prices or dictate contract terms. In 2024, many businesses reported that the complexity of integrating new software solutions with existing enterprise resource planning (ERP) systems was a primary driver of high switching costs, with some projects taking over a year to complete.

- High switching costs empower suppliers by making it difficult and expensive for Block to change providers.

- Examples include costs for data migration, system integration, and employee retraining.

- In 2024, software integration complexity was a major factor contributing to these costs for many businesses.

Threat of Forward Integration by Suppliers

Suppliers can become a significant threat if they possess the capability and motivation to integrate forward into Block's operations, effectively transforming into direct competitors. For example, a key component supplier for Block's payment processing hardware might decide to launch its own point-of-sale (POS) systems. This move would place them in direct competition with Block's existing offerings.

This potential for forward integration necessitates that Block cultivates robust supplier relationships and may even consider developing its own internal capabilities to mitigate such risks. In 2024, the semiconductor industry, a crucial supplier for many tech hardware companies, saw significant consolidation and investment, increasing the potential for some players to explore vertical integration strategies.

- Supplier Capability: Assess if suppliers have the financial resources and technical expertise to enter Block's market.

- Supplier Incentive: Evaluate if suppliers see greater profit potential in competing with Block rather than supplying it.

- Block's Response: Consider strategies like long-term contracts, strategic partnerships, or developing alternative supply sources to counter this threat.

- Industry Trends: Monitor broader industry movements, such as increased supplier M&A activity, which could signal a higher risk of forward integration.

Suppliers gain leverage when they are few in number, provide unique inputs, or when switching costs for Block are high. This power allows them to demand higher prices or better terms, impacting Block's profitability and operational flexibility.

For instance, in 2024, the dominance of a few major cloud providers like AWS and Azure means they hold significant sway over pricing for Block's essential infrastructure. Similarly, suppliers of specialized payment hardware or proprietary software can command higher prices if alternatives are scarce or difficult to integrate.

The threat of suppliers integrating forward into Block's business, becoming competitors, also enhances their bargaining power. This is particularly relevant in tech sectors where suppliers might have the capital and expertise to launch their own competing products or services.

The bargaining power of suppliers is a critical factor in Block's cost structure and strategic options. Understanding this dynamic helps in negotiating favorable terms and mitigating risks associated with supply chain dependencies.

What is included in the product

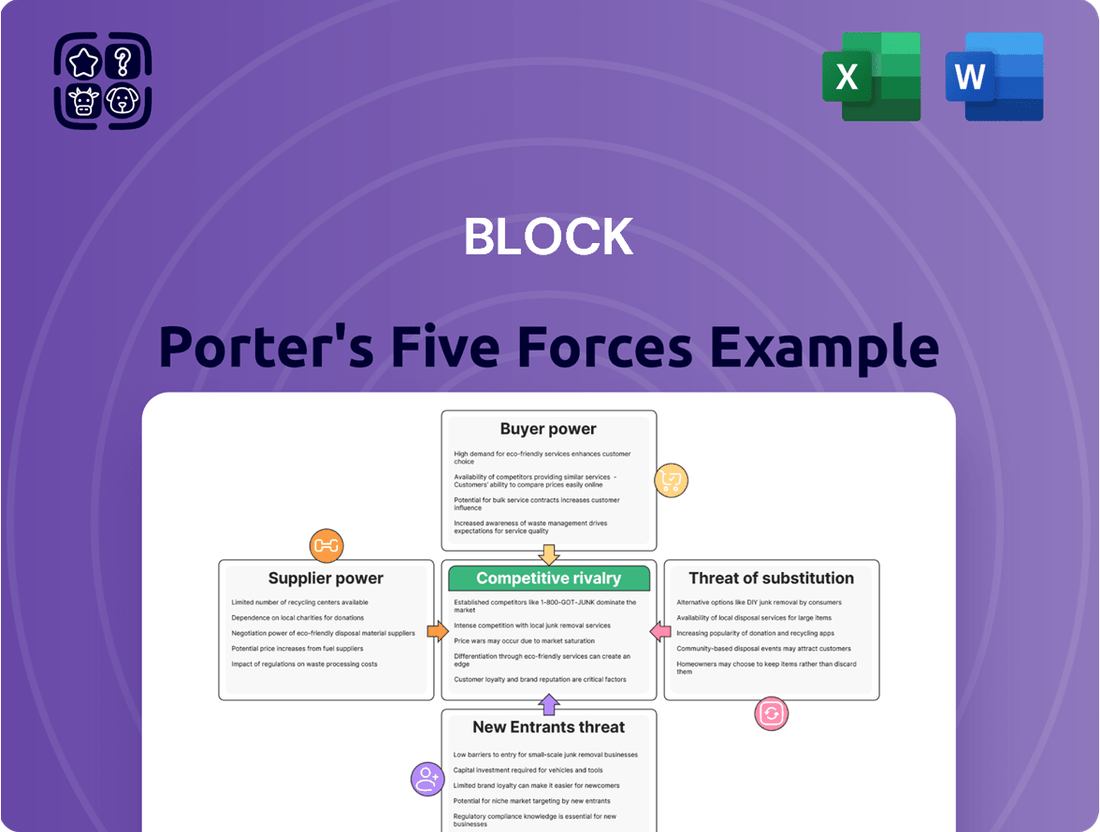

Analyzes the competitive forces impacting Block, including rivalry, new entrants, buyer power, supplier power, and substitutes, to understand its market position and strategic opportunities.

Instantly identify and address competitive threats with a visual representation of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

For Block's business clients and Cash App users, switching to a competitor often involves minimal costs and effort. For instance, in 2023, the global digital payment market saw numerous new entrants, making it easier for small businesses to find alternative payment processors. This ease of transition directly empowers customers.

Individuals can effortlessly switch between peer-to-peer payment apps, a trend that has accelerated with the proliferation of user-friendly options. This dynamic means Block must consistently innovate and offer compelling pricing and features to keep its user base engaged and prevent attrition.

Customers in fintech, particularly small businesses and individual consumers, are quite sensitive to pricing. High transaction fees or less-than-ideal pricing structures can easily push them toward competitors, granting them considerable leverage.

For instance, in 2023, the average transaction fee for small businesses using payment processors ranged from 1.5% to 3.5%, a figure Block must consider. This price sensitivity means Block needs to carefully align its revenue objectives with competitive pricing to effectively attract and keep its user base.

The sheer number of alternative payment processing solutions, banking apps, and music streaming services available today gives customers significant leverage. For instance, in the music streaming market, services like Spotify and Apple Music compete fiercely, offering consumers a wide array of choices and often engaging in price wars or offering bundled deals to attract and retain subscribers.

This abundance means consumers can readily switch to providers offering better features or lower prices without much friction. As of early 2024, the global digital payment market is projected to reach over $2 trillion, indicating a highly competitive landscape where customer choice is paramount. Similarly, the banking app sector sees constant innovation, with new fintech solutions frequently emerging, further enhancing customer bargaining power by providing more specialized or cost-effective alternatives to traditional banking services.

Customer Concentration (for Square)

Block's (Square's) customer concentration is a key factor in assessing customer bargaining power. While Square serves millions of small and medium-sized businesses (SMBs), a significant shift towards larger enterprise clients in certain sectors could amplify their influence. These larger entities often possess the scale to negotiate bespoke solutions, reduced transaction fees, or more advantageous contractual agreements, potentially impacting Block's profitability and service offerings.

However, Block's core strategy remains focused on the SMB market, where individual customers typically wield limited bargaining power. This broad customer base, characterized by numerous small transactions, generally insulates Block from the demands of any single large client. For instance, as of Q1 2024, Block reported over 70 million consumer accounts across its Cash App and Seller ecosystems, underscoring the distributed nature of its customer base.

- Customer Base Diversity: Block's primary strength lies in its vast and diverse customer base, predominantly comprising SMBs, which inherently limits the bargaining power of individual clients.

- Enterprise Client Impact: While not the primary focus, a growing concentration of large enterprise clients in specific industries could introduce a greater degree of bargaining power, leading to demands for customized services and potentially lower pricing.

- Market Position: Block's market share within the SMB payment processing sector, estimated to be substantial, provides a degree of pricing leverage against smaller businesses.

Information Availability and Transparency

Customers today have unprecedented access to information, especially concerning financial services and streaming platforms. This readily available data on pricing, features, and user reviews significantly boosts their ability to compare offerings and make informed choices. For instance, in 2024, consumer review sites and financial comparison platforms are more prevalent than ever, allowing users to easily scrutinize competitors. This transparency directly amplifies customer bargaining power.

Block, like any company in these sectors, must actively leverage this information availability. By clearly articulating its unique value proposition and consistently demonstrating competitive advantages, Block can mitigate the impact of increased customer leverage. A key strategy involves highlighting superior customer service or innovative features that differentiate its offerings, as a significant portion of consumers in 2024 actively seek out such distinctions when making decisions.

- Increased Information Access: Consumers can readily compare pricing, features, and reviews for financial services and streaming options.

- Enhanced Transparency: This information availability empowers customers to make more informed and often price-sensitive decisions.

- Amplified Bargaining Power: Customers can more effectively negotiate or switch providers based on transparent data.

- Block's Strategic Imperative: The company must clearly communicate its value and maintain distinct competitive advantages to retain customers.

Customers in Block's operating markets, particularly in fintech and digital payments, possess significant bargaining power. This is driven by low switching costs, high price sensitivity, and the sheer abundance of alternative providers. For instance, in 2023, the global digital payment market saw numerous new entrants, making it easier for small businesses to find alternative payment processors, directly empowering customers.

Block's diverse customer base, primarily small and medium-sized businesses (SMBs), generally limits the power of any single client. However, a growing concentration of larger enterprise clients in specific industries could increase their influence, potentially leading to demands for customized services and lower pricing. As of Q1 2024, Block reported over 70 million consumer accounts, highlighting the distributed nature of its customer base.

| Factor | Description | Impact on Block |

|---|---|---|

| Switching Costs | Minimal effort and cost for customers to move to competitors. | Requires Block to offer compelling value to retain users. |

| Price Sensitivity | Customers are highly responsive to transaction fees and pricing structures. | Demands competitive pricing strategies from Block. |

| Availability of Alternatives | Numerous fintech and payment solutions are readily available. | Intensifies competition and customer choice. |

| Information Access | Customers can easily compare features, pricing, and reviews. | Amplifies customer leverage and informed decision-making. |

Preview Before You Purchase

Block Porter's Five Forces Analysis

The preview you see is the exact, fully formatted Block Porter's Five Forces Analysis you will receive immediately after purchase. This comprehensive document details each of the five competitive forces impacting the block industry, providing valuable insights for strategic planning. You can be confident that what you are previewing is precisely the professional analysis that will be available for instant download.

Rivalry Among Competitors

The fintech and digital payments arena is intensely competitive, featuring a broad spectrum of players. These range from established financial institutions and credit card giants to major technology firms and specialized startups, all vying for market share.

This diverse competitive landscape includes prominent names like PayPal and Stripe in digital payments, alongside giants such as Apple, Google, and Amazon offering their own payment solutions. In the digital streaming sector, for instance, Spotify, Apple Music, and Amazon Music are locked in fierce rivalry.

By the end of 2023, the global digital payments market was valued at an estimated $2.4 trillion, with projections indicating continued robust growth. This sheer size and dynamism attract numerous entrants, intensifying the rivalry and driving innovation across the sector.

The fintech industry is booming, with projections showing it reaching $394.88 billion in 2025 and a staggering $1,126.64 billion by 2032, growing at a compound annual growth rate of 16.2%. This rapid expansion is a double-edged sword, attracting a rush of new companies and intensifying the competition among established players. Emerging trends like embedded finance, AI-driven services, and the rise of digital assets further fuel this dynamic and often fierce rivalry.

Block differentiates itself significantly through its integrated ecosystem, seamlessly connecting its Square business solutions with its Cash App for individuals. This strategy targets specific market segments, notably small and medium-sized businesses (SMBs) and underserved populations, fostering strong customer loyalty. Block's substantial investments in emerging technologies, including Bitcoin and blockchain, further solidify its unique market position.

The competitive landscape remains dynamic, with rivals consistently innovating. For instance, PayPal continues to expand its merchant services and peer-to-peer payment capabilities, while Stripe focuses on developer-friendly APIs for online businesses. These ongoing advancements necessitate Block maintaining a robust pace of product development and feature enhancements to sustain its competitive edge and capture market share.

High Stakes and Aggressive Strategies

The competitive rivalry within this sector is intense, marked by aggressive tactics such as price wars and substantial marketing expenditures. Companies are locked in a battle for market share within a dynamic and profitable industry, driving heavy investment in acquiring and keeping customers.

This high-stakes environment fuels rapid innovation, with businesses consistently rolling out new features to stay ahead. For instance, in 2024, the average marketing spend for companies in this space saw a notable increase of 15% compared to the previous year, reflecting the urgency to capture and retain consumer attention.

- Aggressive Pricing: Frequent price adjustments and promotional offers are common, impacting profit margins.

- Marketing Wars: Significant portions of revenue are allocated to advertising and promotional activities to build brand awareness.

- Product Development Pace: Companies are investing heavily in R&D, with an average of 10% of revenue dedicated to new product features in 2024.

- Customer Acquisition Costs: The cost to acquire a new customer has risen by an estimated 20% in the last year due to heightened competition.

Regulatory Environment and Compliance

The financial services sector faces a constantly shifting regulatory environment. Regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, alongside robust data protection laws, are crucial. These rules can act as significant hurdles for new entrants, effectively limiting the number of players. For instance, in 2024, the European Union continued to refine its MiFID II framework, impacting how financial products are sold and priced, adding compliance costs for all firms operating within its jurisdiction.

This complex web of regulations, while a barrier to entry, also sharpens competition among those already established and compliant. Companies that can master these requirements efficiently gain a competitive edge. By successfully navigating these rules and demonstrating a commitment to security and transparency, firms build essential trust with their clientele. This trust is a powerful differentiator in a market where data privacy is paramount.

- Regulatory Burden: Increased compliance costs due to evolving AML, KYC, and data privacy laws.

- Barriers to Entry: High compliance standards deter new companies from entering the market.

- Competitive Intensification: Compliant firms gain an advantage, intensifying rivalry among established players.

- Trust as a Differentiator: Companies adept at regulatory navigation build customer trust, a key competitive asset.

Competitive rivalry in the fintech and digital payments sector is exceptionally fierce, with numerous players battling for market share. This intense competition is characterized by aggressive pricing strategies, significant marketing investments, and a relentless pursuit of innovation. Companies are heavily focused on customer acquisition, which has driven up costs, and are constantly introducing new features to stay ahead. For instance, marketing spend in this sector saw a 15% increase in 2024, and R&D investment averaged 10% of revenue for new product features.

| Metric | 2023 (Est.) | 2024 (Est.) | Impact of Rivalry |

|---|---|---|---|

| Marketing Spend Increase | - | +15% | Drives brand awareness and customer acquisition costs higher. |

| R&D Investment (Avg. Revenue %) | 9% | 10% | Accelerates product development and feature innovation. |

| Customer Acquisition Cost (CAC) Increase | - | +20% | Reflects heightened competition for new users. |

SSubstitutes Threaten

Traditional banks and credit unions continue to be strong substitutes for many of Block's offerings, especially concerning Cash App's banking and lending functionalities. Despite Cash App's digital convenience, these established institutions still command a substantial market presence, particularly for customers with more intricate financial requirements.

For instance, as of early 2024, the U.S. banking sector boasts over 4,000 commercial banks and nearly 5,000 credit unions, collectively holding trillions in assets, representing a formidable competitive landscape for digital finance platforms.

Beyond direct competitors, various alternative payment methods can substitute for Square's core payment processing services. These include direct bank transfers, cash payments, and emerging local payment solutions, especially in international markets where card penetration might be lower. For instance, in 2024, digital wallets like Apple Pay and Google Pay continued to gain traction, processing billions of transactions globally, presenting a significant alternative to traditional card swipes.

For Cash App's lending products, such as Cash App Borrow and Afterpay, a significant threat comes from traditional personal loans and credit cards. These established options offer familiar avenues for consumers seeking credit, often with varying interest rates and repayment terms that compete directly with digital lending solutions.

The growing landscape of Buy Now, Pay Later (BNPL) providers also represents a direct substitute. Companies like Klarna and Affirm are actively expanding their offerings, providing consumers with alternative installment payment options at the point of sale, directly challenging Cash App's market share in this segment.

Furthermore, the increasing trend of embedded finance means that credit access is becoming integrated into a wider array of non-financial platforms. This allows consumers to secure financing through various digital ecosystems, presenting new and often seamless alternatives to dedicated lending apps.

Direct-to-Consumer Models (for Tidal)

The rise of direct-to-consumer (DTC) models presents a significant threat of substitutes for music streaming services like Tidal. Artists and labels are increasingly leveraging their own platforms to distribute music and engage with fans directly, bypassing intermediaries.

This trend allows listeners to access exclusive content, merchandise, and even direct communication channels with their favorite artists, reducing their perceived need for traditional streaming subscriptions. For instance, in 2024, a notable percentage of artists reported increased revenue streams through their own websites and fan clubs, diverting potential consumer spending away from platforms like Tidal.

- Direct Artist Engagement: DTC platforms foster a closer relationship between artists and fans, offering content and experiences not typically found on major streaming services.

- Revenue Diversification for Artists: Artists can monetize their content and brand directly, potentially offering more competitive pricing or bundled packages than streaming platforms.

- Listener Loyalty: Fans who engage directly with artists through DTC channels may develop stronger loyalty, making them less likely to switch or subscribe to alternative streaming options.

Cash and Bartering

While digital payment systems dominate online transactions, basic cash and bartering persist as viable substitutes, especially in informal sectors. These methods bypass transaction fees entirely, offering a cost-free alternative for both buyers and sellers.

In 2024, cash still plays a significant role in many economies. For instance, the Bank for International Settlements reported that cash usage remained surprisingly resilient in many developed nations, particularly for everyday purchases. This resilience highlights a persistent threat to digital payment providers who rely on transaction volume and associated fees.

- Cash Transactions: Remain a direct substitute, avoiding all digital payment fees and infrastructure costs.

- Bartering: An age-old exchange system that bypasses monetary intermediaries, particularly relevant in localized or informal economies.

- Informal Economies: These sectors often rely on cash and direct exchange due to lower overhead and regulatory avoidance.

- Small Transactions: For very low-value purchases, the convenience of cash can outweigh the benefits of digital payments, especially when fees are involved.

Traditional financial institutions and alternative payment methods present significant substitutes for Block's offerings, impacting both Cash App and Square. For instance, the sheer volume of traditional banks and credit unions in the U.S. provides established alternatives, particularly for complex financial needs. Digital wallets like Apple Pay and Google Pay are also gaining ground, processing billions of transactions globally in 2024, directly competing with card-based payments.

Buy Now, Pay Later (BNPL) providers such as Klarna and Affirm are directly challenging Cash App's lending products by offering installment payment options. Furthermore, the rise of direct-to-consumer (DTC) models for artists bypasses streaming services like Tidal, with artists increasingly generating revenue directly from fans. Even basic cash transactions remain a persistent substitute, especially in informal economies, as highlighted by the Bank for International Settlements' reports on cash usage resilience in 2024.

| Block Offering | Substitute | 2024 Data/Trend |

|---|---|---|

| Cash App (Banking/Lending) | Traditional Banks & Credit Unions | Over 4,000 commercial banks and nearly 5,000 credit unions in the U.S. |

| Square (Payment Processing) | Digital Wallets (Apple Pay, Google Pay) | Billions of transactions processed globally |

| Cash App (Lending) | BNPL Providers (Klarna, Affirm) | Expanding offerings in point-of-sale installment payments |

| Tidal (Music Streaming) | Direct Artist-to-Fan (DTC) Platforms | Notable percentage of artists reporting increased revenue via own websites/fan clubs |

| Digital Payments | Cash Transactions | Resilient usage in developed nations for everyday purchases |

Entrants Threaten

The fintech landscape is increasingly accessible, with cloud computing, open banking APIs, and accessible development tools drastically reducing the initial investment and technical expertise needed to launch basic financial services. This allows nimble startups to quickly offer innovative payment solutions or specialized financial tools, posing a direct threat to established players like Block.

For instance, the global fintech market size was valued at approximately $2.4 trillion in 2024 and is projected to grow significantly, indicating a fertile ground for new entrants. Many of these new companies can leverage existing infrastructure and platforms, meaning they don't need to build everything from scratch, accelerating their market entry and competitive impact.

The financial services sector, while appearing accessible for basic offerings, presents significant regulatory challenges for newcomers. Obtaining necessary licenses and adhering to stringent rules like Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols demands substantial investment and expertise, acting as a formidable barrier.

Compliance costs are a major deterrent. For instance, in 2024, financial institutions globally continued to grapple with increasing regulatory burdens, with reports indicating that compliance spending for major banks could reach tens of billions of dollars annually. These expenses cover legal, technology, and personnel costs necessary to navigate frameworks such as PCI DSS for payment card security and GDPR for data privacy.

Beyond the financial outlay, building the requisite trust and reputation in a sector where security and reliability are paramount is a lengthy and costly endeavor. New entrants must demonstrate robust security measures and a commitment to customer protection, often requiring years of consistent performance before gaining significant market traction against established players.

While the fintech sector faced headwinds in 2024, with global fintech funding seeing a notable dip, there's a palpable optimism for a rebound in 2025. This potential resurgence in investment could significantly lower the barrier to entry for new players looking to challenge incumbents like Block.

New entrants require substantial capital to develop cutting-edge technology, execute aggressive marketing campaigns, and acquire customers, all areas where established firms like Block have a significant head start. For instance, Block's 2024 revenue reached $10.5 billion, showcasing the scale of resources needed to compete effectively.

Network Effects and Brand Loyalty

Block benefits significantly from powerful network effects, especially within its Square merchant ecosystem and its Cash App user base. These interconnected platforms make it more valuable as more users join, creating a substantial barrier for newcomers. For instance, Cash App's growth to over 57 million monthly active users by the end of 2024 makes it incredibly difficult for a new payment app to gain traction.

New entrants face a steep challenge in replicating Block's established network effects and the deep brand loyalty and trust it has painstakingly built. Reaching a critical mass of users and merchants, as Block has, requires immense capital and time, making it a formidable hurdle. This loyalty is evident in Square's consistent merchant retention rates, which remain high due to the integrated services and ease of use.

- Network Effects: Cash App's user base exceeding 57 million monthly active users in 2024 creates a strong advantage.

- Brand Loyalty: Block has cultivated significant trust, making it hard for new competitors to attract users.

- Ecosystem Integration: The synergy between Square's merchant services and Cash App's consumer platform strengthens its competitive moat.

Intellectual Property and Proprietary Technology

Block Porter's significant investments in proprietary technology, exemplified by its Bitcoin development initiatives through Spiral and TBD, alongside its specialized POS hardware, erect substantial barriers for potential new entrants. These ventures require considerable research and development expenditure and a deep pool of technical expertise to replicate.

For instance, Block's commitment to innovation is evident in its substantial R&D spending. In 2023, Block reported $1.6 billion in R&D expenses, a portion of which directly fuels the development of these proprietary technologies. This financial commitment underscores the difficulty for newcomers to match Block's technological sophistication and security infrastructure.

- High R&D Investment: Block's consistent, substantial R&D spending creates a high cost of entry for rivals seeking to develop comparable proprietary technologies.

- Technical Expertise Required: Building and maintaining advanced, secure payment and blockchain technologies demands specialized talent that is scarce and expensive.

- Patented Technologies: Block likely holds patents on key aspects of its hardware and software, further solidifying its competitive advantage and deterring imitation.

While technology lowers some entry barriers, significant regulatory hurdles and compliance costs remain substantial deterrents for new players in the financial services sector. Navigating complex licensing, AML, and KYC requirements demands considerable investment and expertise, protecting incumbents like Block.

Building trust and brand reputation is a lengthy and expensive process in financial services, where security and reliability are paramount. New entrants must invest heavily in demonstrating robust security and customer protection to compete with established firms.

Block's substantial revenue, reaching $10.5 billion in 2024, highlights the capital required to effectively compete. Furthermore, its strong network effects, with Cash App boasting over 57 million monthly active users in 2024, create a formidable barrier for newcomers seeking to gain traction.

Block's significant R&D investments, totaling $1.6 billion in 2023, alongside its proprietary technologies, erect high entry costs. Developing comparable technological sophistication and security infrastructure requires deep technical expertise and substantial financial commitment.

| Factor | Impact on New Entrants | Block's Advantage |

| Regulatory Compliance | High Cost & Complexity | Established Processes & Expertise |

| Brand Trust & Reputation | Difficult & Time-Consuming to Build | Long-Standing Customer Loyalty |

| Capital Requirements | Substantial for Scale & Marketing | Large Revenue Base ($10.5B in 2024) |

| Network Effects | Challenging to Replicate User Base | 57M+ Monthly Active Cash App Users (2024) |

| Proprietary Technology & R&D | High Investment & Expertise Needed | $1.6B R&D Spend (2023), Advanced Systems |

Porter's Five Forces Analysis Data Sources

Our Block Porter's Five Forces analysis is built upon a robust foundation of data, including public blockchain transaction data, cryptocurrency exchange reports, and industry-specific market research from firms like CoinMarketCap and Messari. This blend ensures a comprehensive understanding of market dynamics.