Bio-Rad PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Rad Bundle

Uncover the critical external factors shaping Bio-Rad's trajectory with our comprehensive PESTLE analysis. From evolving regulations to technological advancements, understand the forces driving the life sciences industry. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis today and gain a decisive competitive advantage.

Political factors

Government funding for scientific research, especially in areas like biomedical science, plays a crucial role in shaping the landscape for companies such as Bio-Rad. These investments directly influence the pace of early-stage development in various disease areas, which in turn impacts the demand for Bio-Rad's life science products.

For instance, potential reductions in federal research grants, like those sometimes proposed for agencies such as the National Science Foundation (NSF), could create headwinds for innovation and slow down the pipeline of new discoveries that rely on advanced research tools. The NSF's budget, which has seen fluctuations, directly impacts the availability of funds for academic and institutional research.

Conversely, consistent or increased government investment in research creates a more predictable and supportive environment for scientific advancement. This sustained funding not only encourages new research but also drives consistent demand for the sophisticated instruments and reagents that Bio-Rad provides to researchers worldwide.

Changes in healthcare policy significantly shape the clinical diagnostics landscape, directly impacting companies like Bio-Rad. For example, shifts in reimbursement policies, such as those experienced by Bio-Rad's diabetes testing segment in China, can lead to fluctuations in revenue and affect gross margins. These regulatory adjustments are a critical consideration for strategic planning.

The global push towards earlier disease detection and personalized medicine, often spurred by government-backed health initiatives, is creating a robust demand for sophisticated diagnostic solutions. Bio-Rad is well-positioned to capitalize on this trend, as its product portfolio is designed to meet the evolving needs of modern healthcare, including advanced molecular diagnostics and immunoassay systems.

Global trade policies significantly influence Bio-Rad's operations, impacting everything from the cost of raw materials to the accessibility of its diagnostic and life science products. For instance, changes in tariffs, like those seen in trade disputes affecting key manufacturing regions or markets, can directly increase Bio-Rad's cost of goods sold. In 2024, ongoing geopolitical shifts and the potential for new trade agreements or restrictions continue to create a dynamic environment for companies like Bio-Rad that rely on international supply chains and diverse market access.

Regulatory Environment for Biotechnology and Diagnostics

The regulatory environment for biotechnology and diagnostics is a dynamic area that significantly influences Bio-Rad's operations. Governments worldwide are actively updating and streamlining regulations for biotechnology products and medical devices, including in vitro diagnostics. These changes directly affect product development timelines and market entry strategies for companies like Bio-Rad.

A key development is the increasing oversight of laboratory-developed tests (LDTs) by regulatory bodies such as the U.S. Food and Drug Administration (FDA). This heightened scrutiny is reshaping compliance requirements for diagnostic tests. For instance, the FDA's proposed framework for LDT oversight, expected to be finalized in 2024 or 2025, will likely necessitate more rigorous validation processes for these tests. This trend drives demand for Bio-Rad's validated instruments and quality control solutions, as laboratories need to ensure their tests meet enhanced regulatory standards.

- Evolving Regulations: Expect continued updates to global regulations for biotech and diagnostic products through 2025.

- FDA Oversight of LDTs: Increased FDA scrutiny on LDTs, potentially finalized in 2024/2025, will require enhanced compliance for diagnostic tests.

- Demand for Validation: Stricter regulations are boosting the market for validated instruments and quality control systems, benefiting Bio-Rad.

Geopolitical Stability

Geopolitical stability is a crucial consideration for Bio-Rad. Instability in key operational or sales regions can significantly impact its global supply chains and revenue streams. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022, have continued to create supply chain fragilities for many global companies, including those in the life sciences sector, potentially affecting Bio-Rad's access to raw materials or distribution channels.

A stable political climate in countries where Bio-Rad operates and markets its products is fundamental for predictable growth and minimizing operational risks. For example, trade disputes or the imposition of economic sanctions, such as those seen impacting trade with certain nations in recent years, could restrict Bio-Rad's ability to access vital markets or engage in cross-border commerce, thereby affecting its sales performance.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of goods and materials, impacting Bio-Rad's manufacturing and delivery schedules.

- Market Access Restrictions: Political conflicts or sanctions can lead to the closure of markets, limiting Bio-Rad's sales opportunities.

- Operational Risk: Unstable political environments increase the risk of unforeseen operational challenges, such as regulatory changes or security concerns.

Government funding for research, particularly in life sciences, directly fuels demand for Bio-Rad's products. For example, the U.S. National Institutes of Health (NIH) budget, a key source for biomedical research, saw an increase in its appropriations for fiscal year 2024, signaling continued support for scientific exploration.

Regulatory shifts are critical; the FDA's evolving stance on laboratory-developed tests (LDTs), with proposed finalization of new oversight frameworks anticipated for 2024 or 2025, will necessitate enhanced compliance and validation for diagnostic products.

Geopolitical stability impacts Bio-Rad's global operations and supply chains. Ongoing trade tensions and regional conflicts, such as those affecting global shipping routes in 2024, can disrupt the flow of raw materials and finished goods, influencing cost of goods sold and market access.

What is included in the product

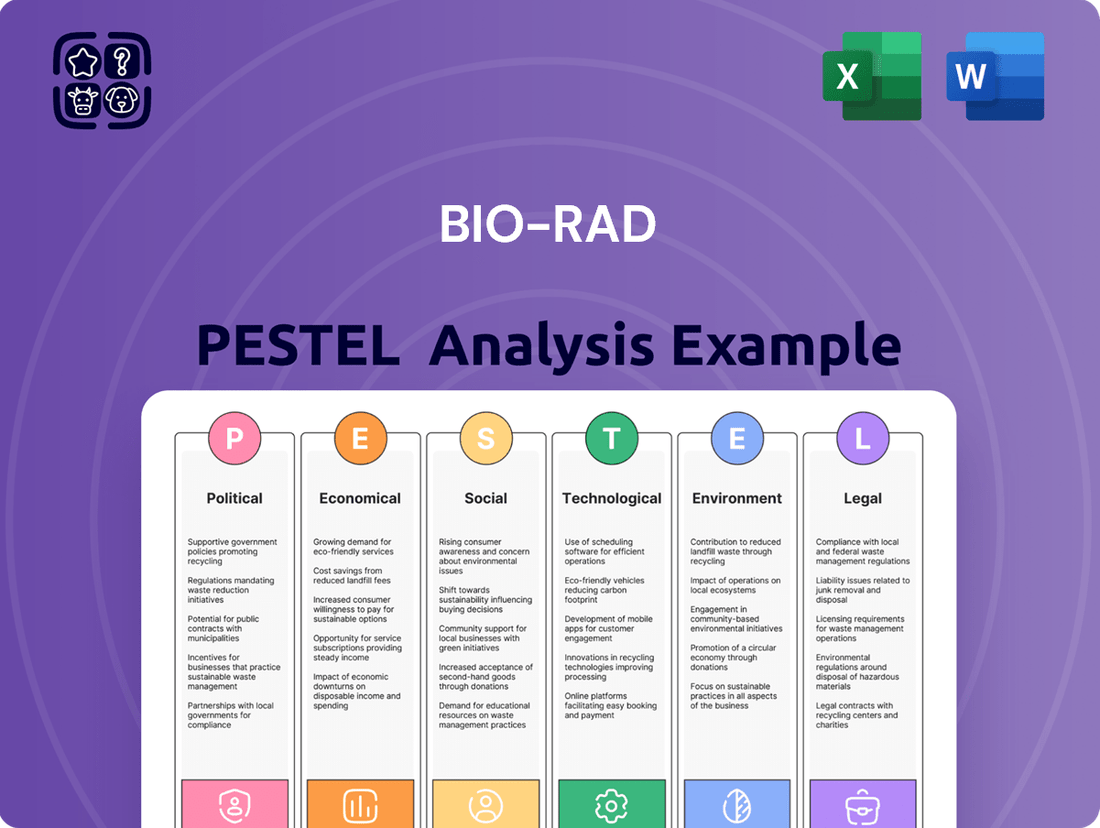

The Bio-Rad PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions and ensuring everyone is aligned on external market factors.

Economic factors

Global economic growth is a significant driver for Bio-Rad's revenue streams. A strong global economy, projected to grow by approximately 2.7% in 2024 according to the IMF, typically translates to increased healthcare spending. This heightened expenditure benefits Bio-Rad by boosting demand for its life science research tools and clinical diagnostic products.

When economies are performing well, pharmaceutical and biotechnology firms are more likely to increase their investment in research and development. This R&D spending directly fuels the need for Bio-Rad's advanced laboratory equipment and consumables. For instance, increased funding for drug discovery and development directly correlates with higher sales of Bio-Rad's reagents and instruments.

Furthermore, robust economic conditions empower governments and individuals to allocate more resources to healthcare. This can manifest as expanded public health initiatives or greater personal spending on diagnostic tests and treatments, all of which positively impact Bio-Rad's market penetration and sales figures.

Investment in life science research and development is a significant driver for Bio-Rad's life science segment. Universities, biotech companies, and pharmaceutical firms are key players here. When they spend more on R&D, it directly translates into greater demand for the instruments, reagents, and consumables that Bio-Rad provides.

Government funding plays a vital role in this ecosystem. For instance, in 2023, the U.S. National Institutes of Health (NIH) budget was approximately $47.5 billion, a substantial sum that fuels academic and institutional research. This public sector investment often spurs private sector spending, creating a positive feedback loop for companies like Bio-Rad.

The clinical diagnostics market is experiencing robust growth, fueled by the increasing prevalence of chronic diseases and a growing demand for personalized medicine. This trend directly benefits Bio-Rad's diagnostics segment, as the market is anticipated to continue its upward trajectory, creating a positive outlook for the company's diagnostic products and services.

Currency Fluctuations

As a global player, Bio-Rad's financial results are susceptible to currency exchange rate shifts. When the U.S. dollar strengthens against other currencies where Bio-Rad operates or sells, it can reduce the reported value of foreign earnings and sales when translated back into dollars. Conversely, a weaker dollar can boost these reported figures.

To better understand Bio-Rad's true operational growth, the company often reports currency-neutral sales. For instance, in their Q1 2024 earnings, Bio-Rad noted that currency headwinds impacted reported sales growth, highlighting the importance of this metric for discerning underlying performance. This practice underscores how volatile exchange rates can obscure the actual business momentum.

- Impact on Revenue: A stronger USD can lead to lower reported revenue from international markets.

- Profitability Concerns: Fluctuations can affect the profit margins on goods produced in one currency and sold in another.

- Currency-Neutral Reporting: Bio-Rad uses this to isolate the impact of currency movements from genuine sales performance.

- 2024 Outlook: Companies like Bio-Rad often factor potential currency impacts into their forward-looking financial guidance.

Competition and Pricing Pressures

The life science tools and clinical diagnostics sectors are intensely competitive, often forcing companies like Bio-Rad to contend with significant pricing pressures. This necessitates a constant focus on innovation and efficient cost management to safeguard market share and profitability. For instance, in the third quarter of 2024, Bio-Rad reported a gross margin of 59.9%, reflecting ongoing efforts to optimize its cost structure amidst these market dynamics.

Bio-Rad actively pursues acquisition strategies and implements operational initiatives designed to bolster its competitive standing. These moves are crucial for navigating the challenging pricing environment and enhancing overall financial performance. The company's commitment to innovation is evident in its continuous product development, aiming to offer advanced solutions that justify premium pricing and differentiate it from rivals.

- Intense Market Competition: Both life science tools and clinical diagnostics markets face considerable competition, leading to downward pressure on prices.

- Innovation and Cost Management: Continuous innovation and stringent cost control are vital for Bio-Rad to maintain its market position and profitability.

- Strategic Acquisitions: Bio-Rad utilizes acquisitions to strengthen its competitive edge and improve operational efficiencies.

- Gross Margin Focus: In Q3 2024, Bio-Rad achieved a gross margin of 59.9%, highlighting its efforts to manage costs effectively in a competitive landscape.

Global economic health directly influences Bio-Rad's performance, with a projected 2.7% global growth in 2024 by the IMF suggesting increased healthcare and R&D spending. This economic buoyancy translates into higher demand for Bio-Rad's life science research tools and clinical diagnostics, as well as greater investment from pharmaceutical and biotech firms in new discoveries.

Currency exchange rates significantly impact Bio-Rad's reported financials. For instance, a stronger U.S. dollar can diminish the value of international earnings, a factor Bio-Rad addresses by reporting currency-neutral sales to reveal underlying business momentum, as seen in their Q1 2024 reporting where currency headwinds were noted.

Intense competition within the life science and diagnostics sectors creates pricing pressures, necessitating Bio-Rad's focus on innovation and cost efficiency. The company's gross margin of 59.9% in Q3 2024 reflects these ongoing efforts to manage costs effectively and maintain its competitive edge through strategic initiatives and product development.

| Economic Factor | Impact on Bio-Rad | Supporting Data/Observation |

|---|---|---|

| Global Economic Growth | Increased demand for products and services due to higher R&D and healthcare spending. | IMF projects 2.7% global growth for 2024. |

| Currency Exchange Rates | Fluctuations affect reported international revenue and profit margins. | Bio-Rad uses currency-neutral reporting to isolate operational growth (e.g., Q1 2024). |

| Inflation and Interest Rates | Can increase operating costs and impact investment decisions by customers. | Companies monitor central bank policies for economic stability. |

| Competitive Landscape | Pricing pressures require innovation and cost management for market share. | Bio-Rad's Q3 2024 gross margin was 59.9%. |

Full Version Awaits

Bio-Rad PESTLE Analysis

The Bio-Rad PESTLE analysis preview you're viewing is the exact, fully formatted document you will receive after purchase. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bio-Rad. You'll get the complete, ready-to-use analysis without any surprises.

Sociological factors

The world's population is getting older. By 2050, it's projected that one in six people globally will be aged 65 or over, a significant jump from one in 11 in 2015. This demographic trend directly fuels the healthcare and diagnostics sector, as older individuals typically require more medical attention.

This aging demographic is closely linked to a rise in chronic diseases. Conditions like heart disease, diabetes, and cancer become more prevalent with age, creating a sustained demand for diagnostic tests and continuous medical monitoring. For instance, the global market for in-vitro diagnostics was valued at approximately $82.5 billion in 2023 and is expected to grow substantially, driven in part by this aging population.

Public awareness regarding the importance of early disease detection is significantly on the rise, driving demand for preventive healthcare solutions. This heightened consciousness directly fuels the growth of the clinical diagnostics market, creating a favorable environment for companies like Bio-Rad.

The increasing consumer interest in proactive health management is leading to greater adoption of advanced diagnostic technologies and at-home testing kits. For instance, the global market for in-vitro diagnostics (IVD) was valued at approximately $90 billion in 2023 and is projected to reach over $140 billion by 2030, showcasing this robust demand.

This societal shift aligns perfectly with Bio-Rad's strategic focus on providing innovative solutions in the in vitro diagnostics space. The company's portfolio, which includes advanced testing platforms and reagents, is well-positioned to capitalize on this growing trend for earlier and more accessible disease identification.

The increasing incidence of lifestyle-related diseases like diabetes, cancer, and heart conditions is a significant driver for the clinical diagnostics market. These health challenges necessitate precise and prompt diagnosis, ongoing disease tracking, and effective treatment oversight, all areas where Bio-Rad's offerings are crucial. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely lifestyle-driven, account for an estimated 74% of all deaths globally, underscoring the growing need for diagnostic solutions.

Healthcare Accessibility and Equity

Societal emphasis on enhancing healthcare access and fairness is a significant driver for Bio-Rad. Initiatives like expanding telemedicine and point-of-care diagnostics directly impact the demand and design of diagnostic tools. For instance, the U.S. Department of Health and Human Services reported that telehealth utilization saw a substantial increase, with some surveys indicating a rise of over 60% in early 2024 compared to pre-pandemic levels, highlighting a shift towards more distributed healthcare delivery models.

Bio-Rad's product portfolio is well-positioned to cater to this evolving landscape. Their offerings can serve traditional, centralized laboratory settings but also support the growing need for decentralized testing. This adaptability is crucial as healthcare systems aim to bring diagnostic capabilities closer to patients, potentially reducing wait times and improving outcomes. The market for point-of-care diagnostic devices, for example, was projected to reach over $40 billion globally by 2025, underscoring the commercial opportunity in this area.

- Telemedicine Growth: Increased adoption of virtual consultations necessitates reliable at-home or near-patient diagnostic solutions.

- Point-of-Care Testing: Demand for rapid, accessible diagnostic tests in clinics, pharmacies, and even home settings is rising.

- Decentralized Healthcare: Bio-Rad's ability to support testing outside of central labs aligns with the trend towards distributed healthcare services.

- Health Equity Focus: Efforts to address disparities in healthcare access can drive demand for cost-effective and widely deployable diagnostic technologies.

Public Trust in Science and Healthcare

Public trust in science and healthcare directly influences how readily new diagnostic tools and research advancements are adopted. For Bio-Rad, a company deeply involved in life science research and clinical diagnostics, this trust is paramount. For instance, a 2023 Pew Research Center survey indicated that while a majority of Americans still have confidence in scientists, a significant portion expressed concerns about the politicization of science, impacting willingness to embrace novel healthcare technologies.

Maintaining rigorous quality control and upholding ethical standards in research and product development are therefore essential for Bio-Rad's sustained growth. As Bio-Rad continues to innovate in areas like gene editing and advanced diagnostics, its reputation for reliability and integrity will be a key differentiator. According to Bio-Rad's 2023 annual report, their commitment to quality assurance is reflected in their robust regulatory compliance processes, which are vital for building and retaining stakeholder confidence in a rapidly evolving scientific landscape.

- Impact on Technology Adoption: Declining or fluctuating public trust can slow the uptake of new Bio-Rad products in research labs and clinical settings.

- Ethical Imperative: Bio-Rad's adherence to ethical research practices is non-negotiable for maintaining its social license to operate and innovate.

- Reputational Capital: High public trust translates to stronger brand loyalty and a more favorable market reception for Bio-Rad's scientific and healthcare solutions.

- 2024/2025 Outlook: Continued focus on transparency and scientific integrity will be critical for Bio-Rad to navigate potential shifts in public perception in the coming years.

The increasing global aging population is a significant demographic shift, with projections indicating a substantial rise in individuals aged 65 and over by 2050. This trend directly correlates with a higher demand for healthcare services and diagnostic solutions, as older populations typically require more medical attention and management of chronic conditions. For instance, the global in-vitro diagnostics market, valued at approximately $90 billion in 2023, is expected to see continued growth, partly fueled by this demographic evolution.

Technological factors

The pace of progress in genomic and proteomic research is accelerating, directly fueling the need for advanced life science instruments. This surge is evident in the growing adoption of technologies like next-generation sequencing (NGS), which saw significant investment and application growth through 2024, enabling deeper biological insights.

Developments in personalized medicine and proteomics are creating a robust demand for sophisticated tools, a trend that strongly benefits Bio-Rad. For instance, the global proteomics market was projected to reach over $10 billion by 2025, underscoring the market's expansion and the reliance on precision tools.

Key technologies such as PCR systems and flow cytometers are foundational to these scientific disciplines, placing Bio-Rad's life science segment at the forefront. The market for PCR consumables and instruments, for example, continued its upward trajectory in 2024, driven by applications in diagnostics and research.

The increasing integration of AI and machine learning in healthcare is a significant technological factor. These advancements are revolutionizing diagnostics, drug discovery, and data analysis, directly impacting companies like Bio-Rad.

AI-driven tools are enhancing diagnostic accuracy and personalizing treatment plans, which opens new avenues for Bio-Rad's product development and market penetration. For instance, by 2024, the global AI in healthcare market was projected to reach over $100 billion, underscoring the rapid adoption and potential for growth.

The digital health revolution, particularly the surge in telemedicine and remote patient monitoring, directly impacts Bio-Rad by increasing the demand for its connected diagnostic devices and sophisticated data management systems. As more healthcare is delivered virtually, the need for reliable, at-home testing solutions and seamless data integration becomes paramount.

This expansion highlights the critical importance of data interoperability and advanced reporting capabilities, areas where Bio-Rad's software and instrument platforms are well-positioned to offer solutions. For instance, the global telehealth market was projected to reach over $200 billion by 2023 and is expected to continue its robust growth through 2025, underscoring the market opportunity for companies providing the necessary technological backbone.

Automation in Laboratories

Automation is significantly reshaping laboratory operations, from life science research to clinical diagnostics. This trend enhances efficiency and minimizes human error, which is crucial for reliable scientific outcomes and patient care.

The increasing reliance on automated systems, including sophisticated robotics in medical testing and research environments, directly fuels demand for specialized instruments and integrated solutions. Companies like Bio-Rad are positioned to benefit from this by providing the necessary compatible hardware and software.

- Increased Efficiency: Automation can speed up sample processing and analysis, allowing labs to handle higher volumes. For instance, automated liquid handling systems can perform thousands of pipetting steps accurately in a fraction of the time a human technician would take.

- Reduced Errors: By removing manual steps, automation significantly lowers the risk of human error in critical processes like reagent addition or data entry. This is vital for reproducible research and accurate clinical diagnoses.

- Demand for Integrated Systems: The market for laboratory automation is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of over 8% through 2027, indicating a strong and sustained demand for interconnected and automated solutions.

Development of Advanced Diagnostic Technologies

The diagnostic landscape is rapidly evolving, driven by continuous innovation in technologies like digital PCR (dPCR) and advanced imaging. These advancements are crucial for improving accuracy and efficiency in disease detection and monitoring.

Bio-Rad's strategic moves, including its acquisition of Stilla Technologies in 2021 for approximately $110 million, underscore its commitment to bolstering its digital PCR capabilities. This acquisition significantly enhances Bio-Rad's portfolio in this cutting-edge area, positioning it to capitalize on growing demand for precise molecular diagnostics.

The integration of Stilla's Naica system, a leading dPCR platform, allows Bio-Rad to offer a more comprehensive suite of solutions. This strategic expansion aims to meet the increasing need for sensitive and quantitative nucleic acid analysis across various applications, from research to clinical diagnostics.

Key technological drivers include:

- Digital PCR (dPCR): Offering absolute quantification of nucleic acids with high sensitivity and precision.

- Advanced Imaging: Enhancing visualization and analysis of biological samples for more accurate diagnostics.

- Automation and AI: Streamlining workflows and improving diagnostic interpretation through intelligent systems.

- Point-of-Care Testing (POCT): Developing rapid and accessible diagnostic tools for decentralized healthcare settings.

Technological advancements are a primary driver for Bio-Rad, particularly in genomics, proteomics, and diagnostics. The accelerating pace of genomic and proteomic research fuels demand for sophisticated life science instruments, with next-generation sequencing (NGS) seeing substantial investment and application growth through 2024.

The global proteomics market was projected to exceed $10 billion by 2025, highlighting the reliance on precision tools like Bio-Rad's PCR systems and flow cytometers. Furthermore, the integration of AI and machine learning in healthcare, with the global AI in healthcare market projected to surpass $100 billion by 2024, is revolutionizing diagnostics and drug discovery, creating new avenues for Bio-Rad's product development.

The digital health revolution, including telemedicine, is increasing demand for Bio-Rad's connected diagnostic devices and data management systems, with the telehealth market expected to continue robust growth through 2025 after reaching over $200 billion by 2023. Automation in laboratories is also a key trend, enhancing efficiency and reducing errors, with the laboratory automation market projected to grow at a CAGR exceeding 8% through 2027.

Bio-Rad's strategic acquisition of Stilla Technologies for approximately $110 million in 2021 bolstered its digital PCR (dPCR) capabilities, a technology offering high sensitivity and absolute quantification of nucleic acids. Key technological drivers for Bio-Rad include dPCR, advanced imaging, automation, AI, and the development of point-of-care testing (POCT) solutions.

| Technology Area | Key Trend/Development | Impact on Bio-Rad | Market Projection/Data Point (2024/2025 focus) |

|---|---|---|---|

| Genomics & Proteomics | Accelerating research pace, NGS growth | Increased demand for advanced life science instruments | Proteomics market projected >$10 billion by 2025 |

| AI in Healthcare | Revolutionizing diagnostics & drug discovery | New avenues for product development & market penetration | Global AI in healthcare market projected >$100 billion by 2024 |

| Digital Health & Telemedicine | Surge in virtual healthcare delivery | Increased demand for connected diagnostic devices & data systems | Telehealth market projected robust growth after >$200 billion by 2023 |

| Laboratory Automation | Enhancing efficiency & reducing errors | Demand for compatible hardware & software solutions | Laboratory automation market CAGR >8% through 2027 |

| Digital PCR (dPCR) | High sensitivity & absolute quantification | Strengthened portfolio via Stilla acquisition | N/A (Specific acquisition cost provided) |

Legal factors

Protecting intellectual property, especially through patents, is absolutely vital in the life sciences and diagnostics sectors where Bio-Rad operates. While certain elements like biomarkers might not be patentable, the actual sensing technologies and new diagnostic methods developed can secure exclusive rights for a set duration, fostering innovation. Bio-Rad's commitment to a strong IP strategy is evident in its portfolio of patents, which safeguard its groundbreaking products and proprietary technologies.

Data privacy and security are critical for Bio-Rad, especially with its involvement in diagnostic tools and connected devices. Regulations like HIPAA in the U.S. and GDPR in Europe impose strict requirements on how patient data is collected, stored, and processed. Failure to comply can result in significant fines; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Bio-Rad operates under stringent product liability laws, demanding adherence to global safety and quality benchmarks for its life science instruments, reagents, and consumables. For instance, in 2023, the European Union continued to enforce its General Product Safety Regulation, requiring manufacturers to prove their products do not pose risks to consumers. Failure to comply can result in significant fines and reputational damage, impacting Bio-Rad's market standing.

Meeting these rigorous standards is not just about avoiding legal penalties; it's crucial for maintaining customer trust and ensuring the reliability of diagnostic and research results. In 2024, regulatory bodies worldwide, including the FDA in the United States, are increasingly scrutinizing the safety and efficacy of medical devices and laboratory equipment, making proactive compliance a cornerstone of Bio-Rad's operational strategy.

Anti-Corruption and Compliance Laws

Operating globally, Bio-Rad must adhere to stringent anti-corruption and compliance laws like the U.S. Foreign Corrupt Practices Act (FCPA) and similar international regulations. These laws are critical for maintaining ethical business conduct and preventing severe legal repercussions and harm to its reputation.

Failure to comply can result in significant fines. For instance, in 2023, companies faced billions in penalties globally for corruption violations. Bio-Rad's commitment to robust compliance programs, including thorough due diligence on third parties and comprehensive employee training, is paramount to mitigating these risks.

- FCPA Enforcement: The U.S. Department of Justice reported significant FCPA enforcement actions in recent years, highlighting the increasing scrutiny on multinational corporations.

- Global Compliance Standards: Many countries have enacted their own anti-bribery and corruption legislation, requiring Bio-Rad to maintain a consistent, high standard of ethical practice across all its international markets.

- Reputational Risk: A single compliance lapse can lead to widespread reputational damage, impacting customer trust and investor confidence, which is a critical consideration for a publicly traded company like Bio-Rad.

Healthcare Reform Legislation

Healthcare reform legislation significantly shapes the landscape for companies like Bio-Rad. Changes in laws can directly affect how medical products gain market access, how they are priced, and the routes they take to reach customers. For instance, the Inflation Reduction Act of 2022 in the US introduced measures aimed at lowering prescription drug costs, which could influence pricing strategies for diagnostic tools and reagents used in conjunction with pharmaceuticals.

Bio-Rad's operational agility is crucial to navigate these shifts. Adapting to evolving healthcare delivery models, such as the increasing emphasis on value-based care and telehealth, requires flexibility. Furthermore, changes in reimbursement policies, which dictate how healthcare providers are paid, can directly impact demand for Bio-Rad's diagnostic solutions. For example, shifts in Medicare or Medicaid coverage for specific tests could alter sales volumes.

- Market Access: Regulatory changes can streamline or complicate the approval and marketing of new diagnostic technologies.

- Pricing Power: Government initiatives to control healthcare costs may impose price ceilings or negotiation frameworks on medical devices and diagnostics.

- Reimbursement Policies: Updates to coding and payment structures for diagnostic procedures directly influence revenue streams.

- Delivery Models: Reforms promoting integrated care or home-based diagnostics necessitate adjustments in product development and distribution.

Bio-Rad's legal environment is complex, encompassing intellectual property protection, data privacy, product liability, and anti-corruption laws. Navigating these regulations is paramount for maintaining market access, ensuring product safety, and upholding ethical business practices across its global operations. Compliance failure can lead to substantial financial penalties and severe reputational damage.

Healthcare reform legislation significantly impacts Bio-Rad's market access, pricing, and reimbursement strategies. Adapting to evolving healthcare delivery models and policy shifts is essential for sustained growth. For instance, changes in diagnostic test reimbursement by entities like Medicare can directly influence Bio-Rad's revenue streams.

| Legal Factor | Impact on Bio-Rad | Example/Data Point (2023-2025) |

|---|---|---|

| Intellectual Property | Safeguards innovation and market exclusivity for technologies. | Bio-Rad actively manages a patent portfolio to protect its diagnostic and life science solutions. |

| Data Privacy (GDPR/HIPAA) | Requires stringent patient data handling, with potential fines up to 4% of global revenue for non-compliance. | Ongoing investments in cybersecurity and data governance to meet evolving privacy mandates. |

| Product Liability | Ensures adherence to global safety and quality standards for all products. | In 2024, regulatory bodies like the FDA continue to increase scrutiny on medical device safety and efficacy. |

| Anti-Corruption (FCPA) | Mandates ethical business conduct, with significant penalties for violations. | Companies faced billions in global penalties for corruption in 2023, underscoring the importance of robust compliance programs. |

| Healthcare Reform | Influences market access, pricing, and reimbursement for diagnostic tools. | Changes in US Medicare reimbursement for specific lab tests can directly affect Bio-Rad's sales volumes. |

Environmental factors

The biopharmaceutical sector is increasingly prioritizing sustainability, pushing companies like Bio-Rad to implement greener manufacturing. This includes optimizing water usage, which is critical in life sciences, and reducing energy consumption in their facilities. For instance, many companies are investing in renewable energy sources to power their operations, aiming to cut greenhouse gas emissions.

Bio-Rad faces pressure to minimize waste throughout its product lifecycle, from raw material sourcing to packaging. This involves exploring biodegradable materials and improving recycling programs within their manufacturing plants and supply chains. The industry trend towards circular economy principles encourages companies to design products for longevity and easier disassembly for recycling.

By 2025, many life science companies are expected to have set ambitious targets for carbon footprint reduction, with some aiming for net-zero emissions by 2030 or 2040. For example, a significant portion of major pharmaceutical manufacturers are publicly committing to science-based targets for emissions reduction, influencing suppliers and partners like Bio-Rad to align their environmental strategies.

Bio-Rad faces significant operational costs due to stringent regulations on hazardous waste disposal, a common challenge in the life sciences sector. For instance, in 2024, companies in the biotech and diagnostics field are increasingly investing in specialized waste treatment facilities and certified disposal services, with some estimates suggesting these costs can represent 5-10% of total operational expenses.

Adherence to environmental protection standards for chemical and biological materials is paramount. Bio-Rad must navigate varying international and national guidelines, such as those set by the EPA in the United States or REACH in Europe, impacting everything from product packaging to end-of-life product management and potentially adding 2-5% to product development costs for compliance.

The life sciences sector is experiencing a growing imperative to curb energy use and integrate renewable energy sources into its operations. This trend directly impacts Bio-Rad's strategic planning, pushing for investments in energy-saving technologies and a shift towards cleaner power to align with global sustainability targets.

For instance, the International Energy Agency reported that global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022, highlighting the accelerating adoption that Bio-Rad must consider. Companies are increasingly evaluated on their environmental footprint, making energy efficiency a critical factor for maintaining competitive advantage and investor confidence.

Supply Chain Environmental Impact

The environmental impact of supply chains, from sourcing raw materials to final product delivery, is under increasing scrutiny. Companies like Bio-Rad are facing pressure to ensure their suppliers align with environmental principles. This includes enhancing transparency and sustainability throughout the entire supply chain to lessen the company's ecological footprint.

Bio-Rad's commitment to sustainability is reflected in its efforts to reduce greenhouse gas emissions across its operations. For instance, in 2023, the company reported a 10% reduction in Scope 1 and Scope 2 emissions compared to its 2020 baseline. This focus extends to its supply chain, where it aims to partner with suppliers demonstrating strong environmental performance.

- Growing Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations affecting supply chain operations, pushing companies like Bio-Rad to adapt.

- Consumer and Investor Demand: There's a rising expectation from consumers and investors for businesses to demonstrate responsible environmental stewardship, influencing purchasing decisions and investment strategies.

- Supplier Audits and Certifications: Bio-Rad is likely to increase its focus on supplier environmental audits and encourage certifications such as ISO 14001 to ensure compliance and drive improvement.

Climate Change and Public Health Concerns

Broader climate change concerns and their potential impact on public health are increasingly shaping research priorities and diagnostic needs. For instance, the World Health Organization (WHO) reported in 2024 that an estimated 99% of the global population breathes air that exceeds WHO guideline limits for air pollution, a direct consequence of climate change-related factors. This escalating public health crisis is driving demand for products that facilitate environmental quality monitoring and the study of climate-related health issues, such as vector-borne diseases and respiratory illnesses.

Bio-Rad, a key player in life science research and clinical diagnostics, is well-positioned to capitalize on these evolving market demands. The company's portfolio, which includes instruments and reagents for environmental testing and disease diagnostics, aligns directly with the growing need for solutions to address climate-induced health challenges.

Specifically, the anticipated increase in demand for products supporting environmental quality monitoring and the study of climate-related health issues presents a significant opportunity. This is evidenced by the projected growth in the global environmental monitoring market, which was valued at approximately USD 5.5 billion in 2023 and is expected to reach USD 8.2 billion by 2028, growing at a CAGR of 8.3% during the forecast period (2023-2028).

- Increased focus on air and water quality monitoring solutions.

- Growing demand for diagnostic tools for climate-sensitive diseases.

- Potential for new product development in environmental health research.

- Opportunities in infectious disease surveillance linked to climate shifts.

Environmental regulations are tightening globally, impacting Bio-Rad's operations and supply chain. Companies are increasingly focused on reducing their carbon footprint, with many setting ambitious net-zero targets by 2030 or 2040. For example, in 2023, Bio-Rad reported a 10% reduction in Scope 1 and 2 emissions from its 2020 baseline.

The life sciences sector faces significant costs for hazardous waste disposal, estimated between 5-10% of operational expenses in 2024. Adhering to standards like EPA and REACH can add 2-5% to product development costs. Growing consumer and investor demand for sustainability also pushes for greater environmental responsibility.

Climate change is driving demand for environmental quality monitoring and diagnostics for climate-sensitive diseases. The global environmental monitoring market was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 8.2 billion by 2028, highlighting a significant growth opportunity for Bio-Rad.

| Environmental Factor | Impact on Bio-Rad | Supporting Data/Trend |

| Climate Change & Health | Increased demand for environmental monitoring and disease diagnostics. | Global environmental monitoring market projected to grow from USD 5.5B (2023) to USD 8.2B (2028). |

| Sustainability Initiatives | Pressure to reduce emissions, optimize water usage, and minimize waste. | Bio-Rad achieved a 10% reduction in Scope 1 & 2 emissions (2023 vs. 2020). |

| Regulatory Compliance | Costs associated with hazardous waste disposal and adherence to standards (e.g., REACH). | Waste disposal costs can be 5-10% of operational expenses; compliance adds 2-5% to development costs. |

| Renewable Energy Adoption | Need to integrate cleaner power sources into operations. | Global renewable energy capacity additions increased by 50% in 2023 (510 GW). |

PESTLE Analysis Data Sources

Our Bio-Rad PESTLE analysis is meticulously constructed using data from leading scientific journals, regulatory bodies like the FDA and EMA, and reputable market research firms specializing in the life sciences. We also incorporate information from industry associations and economic indicators to ensure a comprehensive view.