Bio-Rad Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Rad Bundle

Unlock the strategic potential of Bio-Rad's product portfolio with a clear understanding of their position within the BCG Matrix. See which innovations are poised for growth and which are generating consistent returns.

Go beyond this snapshot and acquire the complete Bio-Rad BCG Matrix report. It provides detailed quadrant analysis, actionable insights, and a roadmap to optimize your investment and product development strategies.

The full Bio-Rad BCG Matrix is your key to navigating market dynamics and making informed decisions. Purchase it now to gain a competitive edge and drive Bio-Rad's future success.

Stars

Bio-Rad's droplet digital PCR (ddPCR) technology is a standout performer, firmly placing it in the Star quadrant of the BCG Matrix. This advanced technology is at the forefront of a market experiencing robust expansion.

The global digital PCR market is on a strong upward trajectory, with projections indicating a compound annual growth rate of 16.84% through 2030. This signifies substantial opportunity and increasing demand for these sophisticated diagnostic tools.

Further solidifying its Star status, Bio-Rad's ddPCR consumables captured an impressive 57.38% of the digital PCR market in 2024. This commanding market share, coupled with the sector's high growth, clearly positions ddPCR as a leading product with significant future potential.

Bio-Rad is actively participating in the booming single-cell analysis sector. This market is projected to see substantial expansion, with the U.S. segment alone anticipated to grow at a compound annual growth rate of 19% between 2025 and 2030.

The company is strengthening its position through strategic product launches, such as the ddSEQ Single-Cell 3' RNA-Seq Kit, and acquisitions, like that of Saber Bio. These moves are designed to enhance Bio-Rad's portfolio and capture a greater share of this rapidly growing market.

Bio-Rad's food safety testing products are a strong contender in a rapidly expanding market. The global food safety testing sector is projected to hit USD 26,268.17 million by 2025, with an anticipated compound annual growth rate of 7.8% through 2033. This robust growth signifies a significant opportunity for companies like Bio-Rad.

The company's commitment to innovation is evident with recent product launches, such as the XP-Design Assay Salmonella Serotyping Solution in March 2025. Such advancements directly address the increasing demand for reliable and efficient food safety solutions, positioning Bio-Rad to capitalize on market trends.

Furthermore, Bio-Rad experienced a notable increase in sales for its food safety products in Q2 2025. This sales surge underscores the growing market demand and highlights Bio-Rad's successful strategy in meeting these needs, solidifying its presence in this vital and growing industry.

Process Chromatography Products

Bio-Rad's process chromatography products are a key driver within its Life Science segment. This business is experiencing robust growth, with projections indicating low double-digit expansion for 2025, an upward revision from earlier high single-digit forecasts. This acceleration played a crucial role in the Life Science segment's sales uplift during the second quarter of 2025.

The impressive growth trajectory for process chromatography products suggests Bio-Rad holds a strong market standing. Although precise market share figures aren't publicly available, the strong performance indicates a leading role in a vital and expanding segment of biopharmaceutical manufacturing.

- Strong Growth: Projected low double-digit growth for 2025, an increase from previous high single-digit outlooks.

- Segment Contribution: Significantly boosted Life Science segment sales in Q2 2025.

- Market Position: Implies a leading position in a growing biopharmaceutical production niche.

Oncology and Gene Therapy Assays (ddPCR based)

Bio-Rad is strategically leveraging its Droplet Digital PCR (ddPCR) technology to capture significant growth in oncology and gene therapy. This includes expanding into areas like oncology diagnostics and minimal residual disease (MRD) monitoring, where precision is paramount.

The company's commitment is evident through substantial investments and key collaborations. For example, a partnership with Geneoscopy aims to advance colorectal cancer screening, and a collaboration with Oncocyte supports transplant monitoring. These moves underscore Bio-Rad's focus on high-growth clinical applications.

The ddPCR platform is well-positioned to capitalize on the rapid evolution and increasing demand within these therapeutic sectors. Bio-Rad's existing strength in ddPCR provides a solid foundation for its expansion into these lucrative and dynamic markets.

- Oncology Diagnostics: ddPCR offers high sensitivity for detecting cancer mutations and monitoring treatment efficacy.

- Minimal Residual Disease (MRD) Monitoring: Essential for tracking treatment response and relapse in cancer patients, a key growth area.

- Cell and Gene Therapy Manufacturing: ddPCR is crucial for quality control and assessing vector integration in these advanced therapies.

- Strategic Partnerships: Collaborations with companies like Geneoscopy and Oncocyte highlight Bio-Rad's commitment to clinical application development.

Bio-Rad's Droplet Digital PCR (ddPCR) technology is a prime example of a Star in the BCG Matrix, demonstrating high growth and a strong market position. The company's ddPCR consumables alone commanded over half of the digital PCR market in 2024, a testament to its leadership in a sector projected to grow at nearly 17% annually through 2030. This positions ddPCR as a key revenue generator with substantial future potential for Bio-Rad.

The company's strategic focus on high-growth areas like oncology diagnostics and gene therapy, powered by its ddPCR platform, further solidifies its Star status. Partnerships and product development in these fields, such as advancements in minimal residual disease monitoring, highlight Bio-Rad's commitment to capturing value in rapidly expanding clinical applications.

Bio-Rad's food safety testing and process chromatography products also exhibit Star-like characteristics, operating within expanding markets. The food safety sector is expected to reach over $26 billion by 2025, and process chromatography is seeing accelerated growth, contributing significantly to Bio-Rad's Life Science segment performance.

| Product Category | BCG Quadrant | Market Growth | Bio-Rad's Position/Data | Key Drivers |

| Droplet Digital PCR (ddPCR) | Star | High (16.84% CAGR projected to 2030) | 57.38% market share for consumables (2024) | Oncology diagnostics, gene therapy, MRD monitoring |

| Food Safety Testing | Star | High (7.8% CAGR projected to 2033) | Recent product launches, increased Q2 2025 sales | Increasing demand for reliable testing solutions |

| Process Chromatography | Star | High (low double-digit growth revised for 2025) | Key driver for Life Science segment sales uplift (Q2 2025) | Biopharmaceutical manufacturing expansion |

What is included in the product

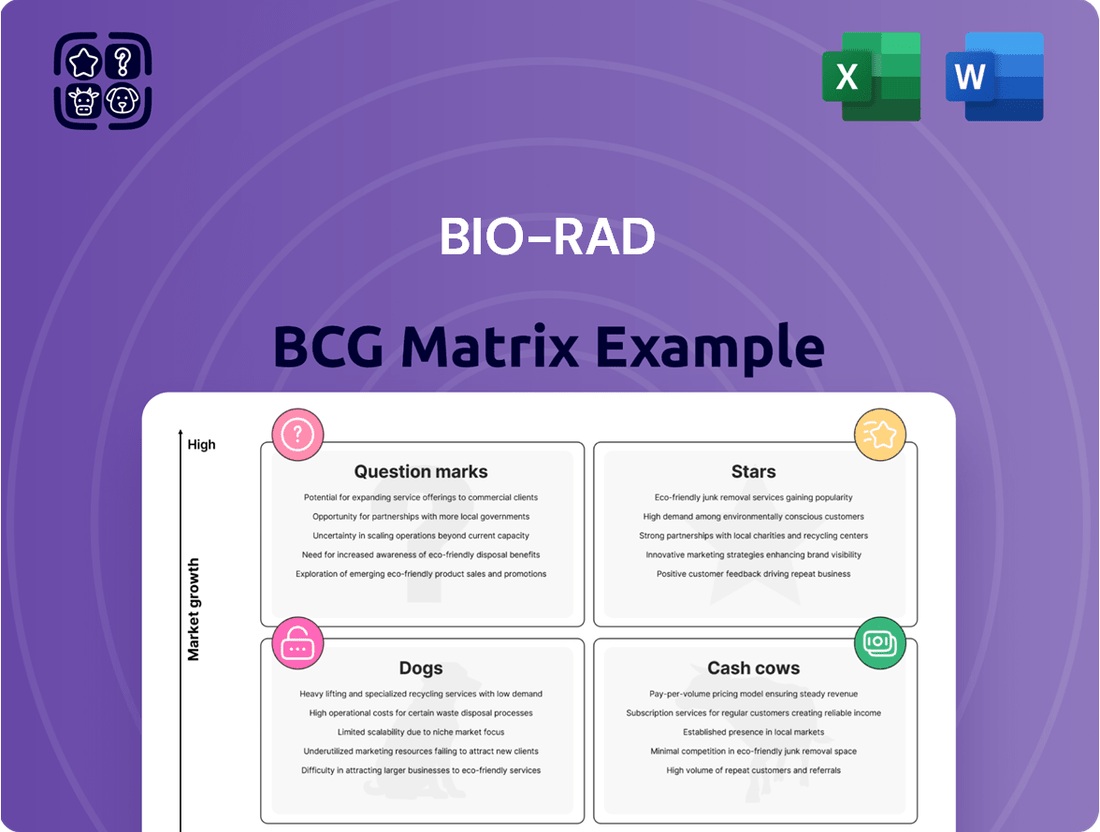

The Bio-Rad BCG Matrix offers a strategic framework for analyzing its product portfolio's market share and growth potential.

It guides decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Clear visualization of your portfolio's performance, simplifying complex strategic decisions.

Cash Cows

Bio-Rad's core clinical diagnostics platforms, encompassing quality control and blood typing, represent significant cash cows. These segments hold strong global market positions, delivering consistent and substantial revenue streams.

For the full year 2024, Bio-Rad reported a 3.7% currency-neutral increase in Clinical Diagnostics sales. This demonstrates the segment's ability to generate reliable cash flow, even in a market characterized by stable or low growth.

Bio-Rad's Quality Control Products, a key component of its Clinical Diagnostics segment, are performing exceptionally well. These products are experiencing robust and consistent demand, acting as a stable revenue generator for the company.

The strong performance of quality control products played a crucial role in offsetting weaker sales in other Bio-Rad segments during the first half of 2025. This resilience highlights their importance to the company's overall financial health, contributing positively to sales figures in Q1 and Q2 2025.

This sustained demand suggests a mature market where Bio-Rad has secured a significant market share. Consequently, these products are generating substantial cash flow with minimal need for reinvestment in growth, positioning them as true cash cows for Bio-Rad.

Bio-Rad's blood typing products are a prime example of a Cash Cow within the company's portfolio. Their consistent demand, much like quality control solutions, bolsters the Clinical Diagnostics segment's steady performance.

These are mature, essential products in a market where Bio-Rad holds a significant competitive edge. This strong market position allows them to generate dependable revenue without the need for heavy, growth-focused investment.

Consumables and Reagents

Bio-Rad's consumables and reagents are prime examples of Cash Cows within its BCG Matrix. This segment is built on a 'razor-and-blade' strategy, where the initial sale of instruments is complemented by the ongoing, high-margin revenue from essential consumables. In 2023, consumables and reagents represented a significant portion, around 70%, of Bio-Rad's total revenue, demonstrating their critical role in generating consistent profit.

This recurring revenue stream is a direct result of a substantial installed base of Bio-Rad instruments across both life science research and clinical diagnostics. The demand for these reagents remains robust and stable, as they are indispensable for the continuous operation of research laboratories and diagnostic facilities. This predictable demand, coupled with higher profit margins on consumables compared to instruments, solidifies their Cash Cow status.

- Recurring Revenue: Consumables and reagents generate approximately 70% of Bio-Rad's total sales, providing a stable income.

- High Profit Margins: These products typically command higher profit margins than the instruments they support.

- Stable Demand: Essential for ongoing research and diagnostics, ensuring consistent sales volume.

- Installed Base Leverage: A large installed base of instruments drives continuous demand for necessary consumables.

Established Immunoassay Systems

Bio-Rad's established immunoassay systems, such as the Bio-Plex Multiplex Immunoassay System, represent significant cash cows within its BCG matrix. These systems are designed for quantifying proteins and peptides, fulfilling a consistent demand in routine laboratory testing. In 2024, the global immunoassay market was valued at approximately $39.5 billion, with established players like Bio-Rad holding a steady share.

These products cater to a mature market, benefiting from a loyal customer base and predictable revenue streams. While not experiencing rapid expansion, their consistent performance provides reliable cash contributions to Bio-Rad. The company's absorbance microplate readers and a comprehensive suite of associated assays further solidify the cash-generating capacity of this segment.

- Established Product Lines: Bio-Plex Multiplex Immunoassay System and microplate readers are key offerings.

- Market Position: Serves a mature market with consistent demand for routine laboratory testing.

- Financial Contribution: Provides reliable cash flow due to an established customer base.

- Industry Context: The immunoassay market, valued around $39.5 billion in 2024, underscores the stability of these established systems.

Bio-Rad's consumables and reagents are prime examples of Cash Cows. This segment leverages a 'razor-and-blade' model, generating high-margin, recurring revenue from essential supplies that support their instrument base. In 2023, consumables and reagents accounted for roughly 70% of Bio-Rad's total revenue, highlighting their consistent profit generation and minimal reinvestment needs for growth.

The company's established immunoassay systems, such as the Bio-Plex Multiplex Immunoassay System, are also strong Cash Cows. These products serve a mature market with consistent demand for routine laboratory testing, contributing reliable cash flow. The global immunoassay market was valued at approximately $39.5 billion in 2024, indicating the stability of these established systems within a significant market.

Bio-Rad's core clinical diagnostics platforms, particularly quality control and blood typing products, further solidify their Cash Cow status. These segments benefit from strong market positions and consistent demand, providing substantial and reliable revenue streams. For the full year 2024, Bio-Rad's Clinical Diagnostics segment saw a 3.7% currency-neutral sales increase, underscoring the segment's dependable cash-generating capabilities.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) | 2024 Sales Growth (Clinical Diagnostics) |

|---|---|---|---|---|

| Consumables & Reagents | Cash Cow | Recurring revenue, high margins, stable demand | 70% of total revenue | N/A (Segment specific data not provided) |

| Immunoassay Systems (e.g., Bio-Plex) | Cash Cow | Mature market, loyal customer base, consistent demand | N/A | N/A |

| Quality Control & Blood Typing | Cash Cow | Strong market position, essential products, stable revenue | N/A | 3.7% currency-neutral |

Delivered as Shown

Bio-Rad BCG Matrix

The Bio-Rad BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you’ll get a ready-to-use strategic analysis tool. The comprehensive insights and professional design you see here are precisely what will be delivered, enabling immediate application in your business planning. This ensures you acquire a complete and actionable report, meticulously prepared for your strategic decision-making needs.

Dogs

Bio-Rad's diabetes testing products in China are currently positioned as a 'dog' in the BCG matrix. This is largely due to significant headwinds caused by reduced government reimbursements. These policy changes have directly impacted sales, leading to currency-neutral sales decreases within the Clinical Diagnostics segment during the first half of 2025.

The market segment for these products in China is experiencing declining profitability and substantial external pressures. This challenging environment, characterized by low growth prospects and the potential for shrinking market share, solidifies their 'dog' status. For instance, in Q1 and Q2 of 2025, the impact of these reimbursement cuts was clearly visible in the financial reporting of the Clinical Diagnostics division.

Legacy Life Science Instruments within Bio-Rad's portfolio are likely positioned as dogs in the BCG matrix. This is due to a general downturn in core instrument demand, particularly in the United States, as reported in Q2 2025, stemming from reduced government and academic research funding.

Products characterized by minimal innovation and facing declining demand within the struggling academic research sector would fit this dog classification. These instruments may struggle to generate profits, potentially breaking even or becoming cash drains if not strategically managed.

Bio-Rad's Life Science segment faced headwinds in 2024 due to persistent softness in the biotech and biopharma sectors. Products in this area that don't stand out from competitors or operate in crowded markets with limited future growth could be classified as 'dogs.'

These 'dog' offerings, while still part of Bio-Rad's portfolio, likely contribute minimal returns. For instance, basic consumables or reagents in highly commoditized areas might fall into this category, especially if they haven't seen significant innovation or market share gains.

Products in Stagnant Academic Research Markets

Products targeting stagnant academic research markets, especially those lacking significant differentiation, would fall into the 'dogs' category within Bio-Rad's BCG Matrix. The company itself acknowledged these headwinds, reporting challenges in the Americas academic research sector in Q1 2025, which impacted its Life Science segment's sales.

These 'dog' products are characterized by low market share and low growth, offering minimal potential for future expansion. For instance, if Bio-Rad has legacy reagents or instruments with declining demand in university labs and no compelling new features, they would likely be classified as dogs.

- Low Market Growth: Academic research markets, particularly in certain regions, are experiencing stagnation, limiting the growth prospects for products serving them.

- Limited Differentiation: Products without unique selling propositions or new applications struggle to gain traction in these mature markets.

- Reduced Sales Contribution: As observed in Bio-Rad's Q1 2025 results, these products contribute minimally to overall revenue and profitability.

- Potential for Divestment: Companies often consider divesting or phasing out 'dog' products to reallocate resources to more promising areas.

Products with High Tariff-Related Headwinds

Bio-Rad's potential 'dogs' in the BCG matrix could be products facing significant tariff-related headwinds. The company has projected a $40 million impact from tariffs in 2025, which could affect profitability.

Products that absorb these increased costs without passing them on or losing market share would represent capital inefficiency. These items might struggle to generate sufficient returns, mirroring the characteristics of a 'dog' in the BCG framework.

- Tariff Impact: Bio-Rad anticipates a $40 million tariff-related headwind for 2025.

- Potential 'Dog' Scenario: Products with reduced margins or competitiveness due to tariffs, without compensatory market share gains, could become 'dogs'.

- Capital Trap: Such products might tie up capital without delivering adequate returns, hindering overall portfolio performance.

Bio-Rad's diabetes testing products in China are currently classified as 'dogs' due to substantial declines in government reimbursements, impacting sales negatively. This segment faces a challenging market with low growth and declining profitability, as evidenced by the financial performance of the Clinical Diagnostics segment in the first half of 2025.

Legacy Life Science Instruments also likely fall into the 'dog' category, driven by reduced demand in the US academic research sector stemming from decreased funding. Products lacking innovation and facing a shrinking market are prime candidates for this classification, potentially becoming cash drains.

The company's Life Science segment experienced headwinds in 2024, with some products potentially becoming 'dogs' if they operate in crowded markets without clear differentiation. These offerings typically provide minimal returns and may include commoditized consumables or reagents with stagnant demand.

Products serving stagnant academic research markets without unique features are considered 'dogs'. Bio-Rad reported challenges in the Americas academic research sector in Q1 2025, affecting its Life Science segment sales, further supporting this classification for certain offerings.

| BCG Category | Bio-Rad Product Example | Market Characteristics | Financial Impact (2024-2025) |

|---|---|---|---|

| Dogs | Diabetes testing products in China | Declining profitability, low growth, reduced government reimbursements | Currency-neutral sales decreases in Clinical Diagnostics (H1 2025) |

| Dogs | Legacy Life Science Instruments (US) | Stagnant academic research market, reduced funding, low differentiation | Downturn in core instrument demand (Q2 2025) |

| Dogs | Commoditized Life Science consumables/reagents | Crowded markets, limited innovation, declining demand | Minimal returns, potential cash drain |

Question Marks

Bio-Rad's acquisition of Stilla Technologies in Q3 2025 brought the QX Continuum™ and QX700™ series ddPCR platforms into its fold. These additions are designed to bolster Bio-Rad's position in the burgeoning genomics and applied science sectors.

While Bio-Rad already has a strong ddPCR offering, these new platforms are positioned as Question Marks. They represent significant growth opportunities where Bio-Rad must now actively build market share and brand recognition.

The ddSEQ Single-Cell 3' RNA-Seq Kit, launched in July 2024, represents Bio-Rad's strategic entry into the burgeoning single-cell transcriptomics market. This kit, coupled with the Omnition v1.1 analytic software, is designed to provide researchers with advanced tools for gene expression analysis at the individual cell level, a field experiencing rapid expansion. The single-cell analysis market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 20% in the coming years, driven by advancements in genomics and personalized medicine.

Given its recent introduction and the substantial investment required to capture market share in this competitive space, the ddSEQ kit is classified as a Question Mark in the BCG matrix. While its technological capabilities position it for high growth potential, it currently demands considerable resources for market penetration and adoption. Success will hinge on its ability to demonstrate superior performance and value proposition to researchers, ultimately converting its potential into sustained market leadership.

Bio-Rad's new Vericheck ddPCR kits, launched in February 2024, target the burgeoning cell and gene therapy sector. These solutions, including the Replication Competent Lentivirus Kit and Replication Competent AAV Kit, are crucial for ensuring safety in this high-growth, rapidly evolving market.

The cell and gene therapy market is projected to reach over $20 billion by 2027, highlighting the significant opportunity for Bio-Rad's specialized offerings. These kits are positioned as innovative tools for an emerging market, meaning their strategic importance depends on rapid adoption and substantial market penetration.

Advanced Flow Cytometry Dyes

Bio-Rad's recent expansion into advanced flow cytometry dyes, with the August 2024 release of eight new Annexin V StarBright Dyes and 32 new StarBright dyes, positions them within a high-growth market segment. This strategic move aims to equip researchers with enhanced tools for multi-color analysis, a critical capability in modern cell biology and immunology studies.

The success of these new dye lines hinges on their ability to demonstrate clear market adoption and a distinct competitive advantage. While the flow cytometry market is expanding, these specific products, representing a significant new offering, will need to gain traction against established competitors to move beyond an initial low market share within this dynamic field.

- Market Expansion: Bio-Rad's August 2024 launch of 40 new StarBright dyes targets the growing flow cytometry market.

- Competitive Landscape: The new dyes must prove their value and differentiation to capture market share against existing solutions.

- Growth Potential: This product line is situated in a high-growth segment, offering significant future revenue opportunities if adoption is successful.

Emerging Molecular Diagnostic Applications

Bio-Rad is strategically expanding its molecular diagnostics portfolio by focusing on emerging applications, particularly in the realm of minimal residual disease (MRD) monitoring for solid tumors. This initiative leverages their established Droplet Digital PCR (ddPCR) technology, a platform known for its high sensitivity and precision, which is crucial for detecting even minute traces of cancer DNA.

These MRD applications, while currently in their nascent stages for Bio-Rad, represent significant growth opportunities. The company is actively pursuing partnerships to gather robust clinical evidence, a critical step in validating these tests for widespread adoption. Success in these high-potential, low-current-share segments is essential for Bio-Rad to transform these emerging applications into future market leaders, or Stars, within their product portfolio.

- MRD Monitoring for Solid Tumors: Bio-Rad is investing in developing and validating molecular diagnostic tests to track minimal residual disease in patients with solid tumors, aiming to improve treatment efficacy and patient outcomes.

- Leveraging ddPCR Technology: The company's established ddPCR platform provides a strong foundation for these sensitive MRD assays, offering unparalleled precision in detecting low-frequency genetic mutations.

- Clinical Evidence Generation: Bio-Rad is actively partnering with research institutions and healthcare providers to build a strong body of clinical evidence supporting the utility of these emerging applications.

- Future Growth Potential: These emerging applications represent a significant opportunity for Bio-Rad to capture market share in high-growth areas, potentially elevating them to Star status within the BCG matrix if successful.

Bio-Rad's acquisition of Stilla Technologies in Q3 2025 introduced new ddPCR platforms, positioning them as Question Marks. These products represent significant growth potential in genomics and applied sciences, requiring Bio-Rad to actively build market share and brand recognition. The ddSEQ Single-Cell 3' RNA-Seq Kit, launched in July 2024, also falls into this category, targeting the rapidly expanding single-cell transcriptomics market with an estimated CAGR exceeding 20%.

The Vericheck ddPCR kits, released in February 2024 for the cell and gene therapy sector, are another example of Bio-Rad's Question Marks. This market is projected to exceed $20 billion by 2027, underscoring the opportunity for these specialized, emerging solutions. Similarly, the August 2024 launch of new StarBright dyes for flow cytometry, while in a high-growth market, requires Bio-Rad to gain traction against established competitors to secure market share.

Emerging applications in minimal residual disease (MRD) monitoring for solid tumors, leveraging Bio-Rad's ddPCR technology, are also classified as Question Marks. These nascent areas demand significant investment in clinical evidence generation and partnerships to achieve widespread adoption and potential future market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages robust financial statements, comprehensive market research, and industry-specific growth projections to deliver actionable strategic insights.