Bio-Rad Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Rad Bundle

Bio-Rad operates within a dynamic life sciences industry, where the threat of new entrants and the bargaining power of buyers significantly shape its competitive landscape. Understanding these forces is crucial for any stakeholder seeking to navigate this complex market. The full analysis provides a comprehensive breakdown of all five forces, offering a strategic roadmap for Bio-Rad’s future success.

Ready to move beyond the basics? Get a full strategic breakdown of Bio-Rad’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Bio-Rad's reliance on specialized raw materials and components for its life science research and clinical diagnostics products means that a concentrated supplier base significantly impacts its operational costs. When few suppliers exist for critical inputs, their ability to dictate terms and prices escalates, directly affecting Bio-Rad's profitability.

For instance, if a key reagent or a specialized component has only two or three primary manufacturers globally, those suppliers hold substantial leverage. This concentration can lead to price increases or supply disruptions, forcing Bio-Rad to absorb higher costs or seek less optimal alternatives. In 2023, the global market for certain life science reagents saw price increases averaging between 5-10% due to supply chain constraints and increased demand, a trend that would directly impact companies like Bio-Rad.

The uniqueness of inputs is a key factor in the bargaining power of suppliers for Bio-Rad. When Bio-Rad relies on highly specialized reagents, chemicals, or equipment that are proprietary or patented, suppliers of these critical components gain considerable leverage. For instance, if a particular enzyme or a specialized piece of machinery is only available from a single source, Bio-Rad's options for sourcing become severely restricted.

This dependency limits Bio-Rad's ability to negotiate prices or terms, as switching to an alternative supplier would likely involve significant costs, extensive validation processes, or even a compromise in the performance and quality of their own advanced instruments. In 2024, companies heavily reliant on patented biotechnology inputs often faced price increases from suppliers due to the lack of competitive alternatives.

High switching costs significantly bolster a supplier's bargaining power, and Bio-Rad is no exception. If Bio-Rad needs to change suppliers for crucial components, especially those deeply embedded in sophisticated systems like its Droplet Digital PCR technology or its clinical diagnostic instruments, it could incur substantial expenses. These costs might include the complex and time-consuming processes of requalifying new materials, revalidating established manufacturing processes, or even redesigning existing instruments to accommodate different components.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Bio-Rad's business, thereby becoming direct competitors, is a significant factor influencing supplier bargaining power. If suppliers possess the capability and the motivation to enter Bio-Rad's market, their leverage naturally escalates. This scenario is particularly relevant when suppliers can leverage their existing expertise and resources to offer Bio-Rad's products or services directly to end customers.

However, this threat is often mitigated in highly specialized industries like biotechnology, where Bio-Rad operates. The complex manufacturing processes, stringent regulatory compliance, and established distribution networks required in this sector represent substantial barriers to entry for most suppliers. Bio-Rad's existing investment in these areas inherently reduces the likelihood of suppliers successfully integrating forward.

For instance, the life sciences tools market, where Bio-Rad is a key player, demands significant capital expenditure for research and development, manufacturing facilities, and global distribution. Companies like Thermo Fisher Scientific, a major competitor to Bio-Rad, demonstrate the scale of investment required, with revenues exceeding $40 billion in 2023. This high barrier means that most suppliers to Bio-Rad, often smaller, specialized component manufacturers, lack the resources and expertise to replicate Bio-Rad's integrated business model.

- Forward Integration Threat: Suppliers may become competitors if they can integrate forward into Bio-Rad's value chain.

- Industry Specialization: Bio-Rad's highly specialized life sciences market presents high barriers to entry for suppliers seeking forward integration.

- Capital & Regulatory Hurdles: The significant capital investment and regulatory compliance needed in this sector limit suppliers' ability to compete directly with Bio-Rad.

- Competitive Landscape: Major players like Thermo Fisher Scientific, with over $40 billion in 2023 revenue, highlight the scale of investment that deters smaller suppliers from forward integration.

Importance of Bio-Rad to Suppliers

The significance of Bio-Rad as a customer directly impacts its suppliers' willingness to offer favorable terms. When Bio-Rad constitutes a substantial portion of a supplier's overall revenue, that supplier is likely to be more amenable to negotiation. For instance, if a key supplier for Bio-Rad's life science research products sees a significant percentage of its sales coming from Bio-Rad, it has less leverage to dictate pricing or terms.

Conversely, if Bio-Rad is a minor client for a particular supplier, its bargaining power is considerably weaker. Suppliers catering to a broad market, where Bio-Rad represents a small fraction of their business, are less incentivized to compromise on pricing or service agreements. This dynamic plays a crucial role in shaping the negotiation landscape.

Consider the supply chain for specialized reagents or components. If a supplier's business model relies heavily on large, consistent orders from companies like Bio-Rad, they are more likely to offer competitive pricing to maintain that relationship. In 2023, the life sciences sector saw continued demand for specialized biochemicals, making reliable customers like Bio-Rad valuable.

- Customer Significance: Bio-Rad's revenue contribution to its suppliers is a key determinant of its bargaining power.

- Supplier Dependency: Suppliers highly dependent on Bio-Rad's business are more likely to negotiate favorable terms.

- Market Position: Bio-Rad's influence is diminished with suppliers who serve a diverse customer base.

- Industry Dynamics: In 2023, the life sciences sector's demand for specialized materials meant that consistent buyers like Bio-Rad held considerable sway with their suppliers.

The bargaining power of Bio-Rad's suppliers is considerable, particularly for specialized components and reagents essential to its life science research and clinical diagnostics. When few suppliers exist for critical inputs, their ability to dictate terms and prices escalates, directly impacting Bio-Rad's profitability and operational costs.

For instance, in 2024, companies relying on patented biotechnology inputs frequently faced price hikes from their suppliers due to the lack of competitive alternatives. This situation is exacerbated when switching costs are high, as requalifying materials or redesigning instruments can be prohibitively expensive and time-consuming for Bio-Rad.

While the threat of suppliers integrating forward into Bio-Rad's business exists, the high capital expenditure and stringent regulatory compliance in the life sciences sector, exemplified by major players like Thermo Fisher Scientific (over $40 billion in 2023 revenue), create significant barriers to entry for most suppliers. However, Bio-Rad's value as a customer can influence negotiations; suppliers heavily dependent on Bio-Rad's business are more likely to offer favorable terms.

| Factor | Impact on Bio-Rad | Example (2024 Data) |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited global manufacturers for specific reagents |

| Uniqueness of Inputs | Restricts sourcing options | Proprietary enzymes or patented components |

| Switching Costs | Deters supplier changes | Revalidation of processes for PCR technology |

| Forward Integration Threat | Generally low due to industry barriers | High capital and regulatory hurdles deterring smaller suppliers |

| Customer Significance | Influences supplier negotiation | Bio-Rad's large orders can secure better terms |

What is included in the product

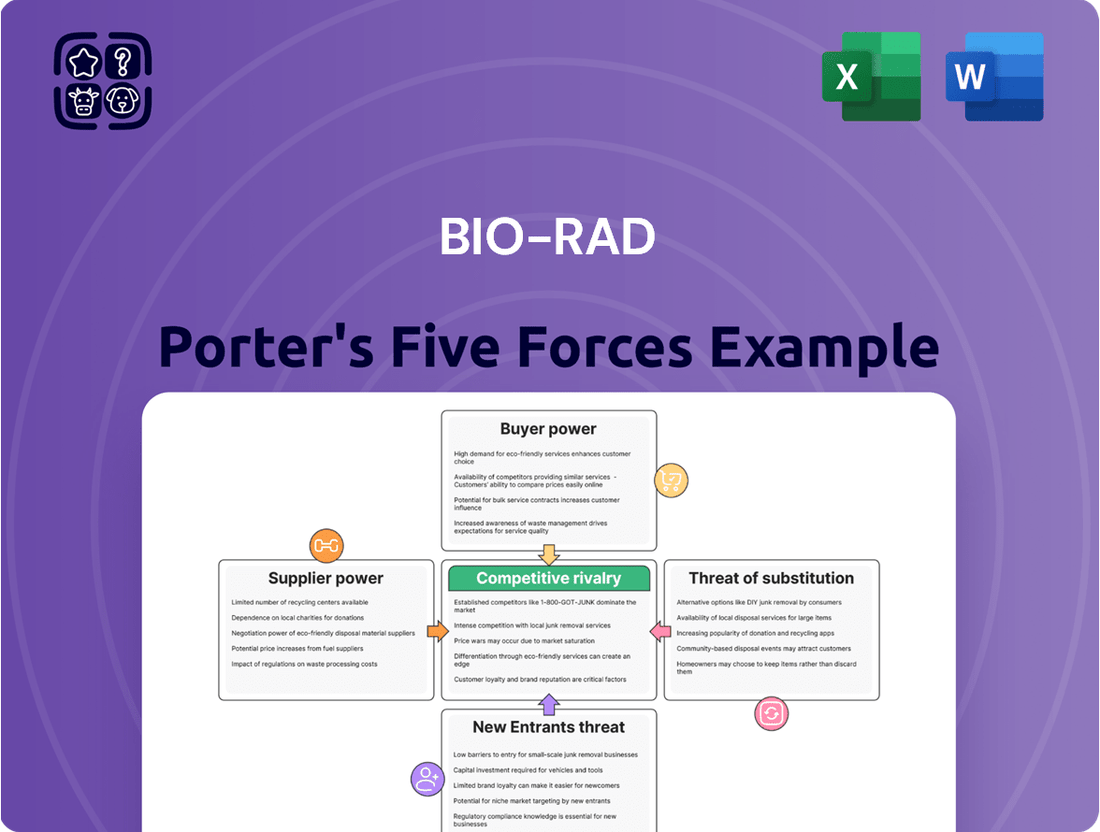

This analysis dissects Bio-Rad's competitive environment by examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Effortlessly identify competitive threats and opportunities with a visual breakdown of each force, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

Bio-Rad's customer base is quite diverse, encompassing universities, research labs, hospitals, and biopharma firms. This wide reach generally dilutes the bargaining power of any single customer.

However, the presence of large institutional buyers or consolidated purchasing groups, like certain hospital networks or government research funding bodies, can indeed create pockets of concentrated customer power. For instance, major university systems or large biopharmaceutical companies that purchase in significant volumes might negotiate more favorable terms.

While specific 2024 data on Bio-Rad's customer concentration is not publicly detailed, the general trend in the life sciences industry shows increasing consolidation among healthcare providers and research institutions. This could potentially amplify the bargaining leverage of these larger entities.

Customers often encounter significant switching costs when moving from one life science or clinical diagnostics product provider to another. These costs are particularly pronounced for integrated systems and when dealing with recurring consumables. For instance, adopting a new system might necessitate extensive personnel retraining and the revalidation of established laboratory protocols.

Furthermore, potential compatibility issues with existing infrastructure can add to the complexity and expense of switching. These barriers effectively reduce the bargaining power of customers, as the effort and investment required to change suppliers are substantial.

Customer price sensitivity for Bio-Rad's products can be quite varied. For instance, academic and research institutions, often operating under tighter budgets, might be more inclined to seek out cost-effective solutions. In contrast, large biopharmaceutical companies, where product performance and reliability are paramount for critical applications, may exhibit lower price sensitivity.

Changes in reimbursement policies can significantly influence a customer's willingness to pay for certain diagnostic tests. A notable example is the impact of lowered reimbursement rates for diabetes testing in China, which can directly affect demand and pricing power for related diagnostic products.

Availability of Substitutes

The availability of substitutes significantly impacts Bio-Rad's customer bargaining power. When customers have numerous alternative technologies or competing products from other manufacturers, their ability to negotiate prices and terms with Bio-Rad increases. For instance, in the life science research market, if alternative reagent suppliers or instrument manufacturers offer comparable performance at a lower cost, Bio-Rad faces pressure to remain competitive.

This dynamic is particularly relevant in segments where technological innovation leads to rapid obsolescence or where new entrants quickly replicate existing solutions. For example, the diagnostics market often sees a proliferation of assays and platforms. If customers can readily switch to a competitor’s diagnostic test or instrument that meets their needs, Bio-Rad’s pricing flexibility is diminished. In 2024, the life science tools market continued to see robust competition, with companies like Thermo Fisher Scientific and Danaher offering a broad range of products that can serve as alternatives to Bio-Rad’s offerings across various research applications.

- High Availability of Substitutes: The life science and clinical diagnostics sectors are characterized by numerous players offering comparable products, increasing customer options.

- Price Sensitivity: Customers, especially in academic research, are often budget-constrained and will actively seek the most cost-effective solutions, amplifying the impact of substitutes.

- Technological Parity: As technologies mature, the differentiation between Bio-Rad's products and those of competitors can decrease, making switching easier for customers.

- Impact on Margins: A high degree of substitutability can put downward pressure on Bio-Rad's profit margins as it competes on price and value.

Customer Information and Transparency

Customers in the life science and clinical diagnostics sectors are typically quite knowledgeable about product details, how well they perform, and what they cost from different suppliers. This awareness, often gained through industry journals and professional gatherings, gives them leverage to seek more favorable pricing and terms.

For instance, in 2024, the increasing availability of comparative product reviews and performance data from independent testing labs further boosts customer transparency. This allows buyers to easily benchmark Bio-Rad's offerings against competitors, strengthening their bargaining position.

- Informed Buyers: Customers possess detailed knowledge of product specifications and performance metrics.

- Price Sensitivity: Access to competitor pricing and performance data empowers customers to negotiate effectively.

- Industry Benchmarking: Transparency in performance allows for direct comparison, increasing customer leverage.

- Negotiation Power: Well-informed customers can demand better pricing and contract terms.

Bio-Rad's customers, particularly large institutional buyers like major university systems or biopharmaceutical companies, can exert significant bargaining power due to their substantial purchasing volumes. This leverage is amplified by the increasing consolidation within the healthcare and research sectors, a trend observed through 2024, which concentrates buying power in fewer hands. While specific customer concentration data for Bio-Rad isn't public, this industry trend suggests a growing potential for customer influence on pricing and terms.

The bargaining power of Bio-Rad's customers is moderately high, driven by the availability of substitutes and informed purchasing decisions. Customers, especially in academic settings, are price-sensitive and actively compare offerings, a trend bolstered in 2024 by increased transparency in product reviews and performance data. Switching costs, while present due to integrated systems and retraining needs, are often outweighed by competitive pricing and technological parity among competitors in the life sciences market.

| Factor | Impact on Bio-Rad | Supporting Data/Observation (as of 2024) |

|---|---|---|

| Customer Concentration | Moderate to High (for large buyers) | Increasing consolidation in healthcare and research sectors in 2024. |

| Switching Costs | Moderate | Significant for integrated systems, but offset by competitive alternatives. |

| Price Sensitivity | High (especially academic) | Budget constraints drive demand for cost-effective solutions. |

| Availability of Substitutes | High | Numerous competitors (e.g., Thermo Fisher, Danaher) offer comparable products. |

| Customer Knowledge | High | Increased access to comparative product reviews and performance data in 2024. |

Preview the Actual Deliverable

Bio-Rad Porter's Five Forces Analysis

This preview showcases the complete Bio-Rad Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the life science and diagnostics industries. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can confidently expect to download this comprehensive report, ready for immediate use, the moment your transaction is complete.

Rivalry Among Competitors

The life science research and clinical diagnostics sectors are intensely competitive, populated by both broad-spectrum industry giants and focused, specialized firms. This dynamic landscape means Bio-Rad faces a significant number of rivals vying for market share.

Key competitors for Bio-Rad include formidable entities such as Abbott Laboratories, Danaher, Roche, Siemens Healthineers, and Thermo Fisher Scientific. These companies often possess substantial resources and established market presence, intensifying the competitive pressure.

For instance, Thermo Fisher Scientific, a major competitor, reported revenues of approximately $42.87 billion in 2023, highlighting the scale of the players Bio-Rad contends with. Similarly, Danaher's life sciences segment generated significant revenue, underscoring the financial muscle of its rivals.

The life science market is poised for significant expansion, fueled by advancements in personalized medicine, the burgeoning field of gene therapy, and the integration of artificial intelligence into diagnostic processes. This upward trajectory presents a fertile ground for innovation and investment.

However, this anticipated growth also acts as a catalyst for heightened competitive rivalry. As market segments expand, companies are increasingly competing to capture market share, leading to a more intense and dynamic competitive landscape.

For instance, the global life science market was valued at approximately $150 billion in 2023 and is projected to reach over $250 billion by 2028, exhibiting a compound annual growth rate (CAGR) of around 11%. This robust growth attracts numerous players, from established giants to agile startups, all vying for dominance.

Bio-Rad actively differentiates its offerings through a relentless focus on innovation and superior quality. This strategy extends beyond individual products to encompass integrated solutions, combining instruments, specialized software, essential consumables, and critical reagents.

This robust product differentiation, exemplified by its advanced Droplet Digital PCR platform, effectively reduces the pressure of direct price competition. In 2023, Bio-Rad reported approximately $2.4 billion in revenue, showcasing the market's reception to its differentiated approach.

Exit Barriers

Bio-Rad, like many in the life sciences sector, faces significant exit barriers that can prolong competitive intensity. These include highly specialized manufacturing equipment, substantial investments in research and development that are difficult to repurpose, and stringent regulatory approvals for products, all of which make exiting the market a costly and complex undertaking. For instance, the development and validation of diagnostic assays, a core area for Bio-Rad, can involve years of work and millions in investment, creating a strong disincentive to abandon the market even during periods of lower returns.

These high exit barriers mean that even if Bio-Rad or its competitors experience declining profitability, they may be compelled to remain in the market. This can lead to sustained price competition and a battle for market share as companies strive to recover their sunk costs.

- Specialized Assets: Bio-Rad's manufacturing facilities and R&D labs are tailored for specific life science applications, making them difficult to sell or redeploy elsewhere.

- Long-Term Contracts: The company may be bound by supply agreements or distribution partnerships that require continued operation.

- Regulatory Hurdles: Obtaining approvals for new products and maintaining compliance with bodies like the FDA represents a significant investment that anchors companies to the industry.

- Employee Expertise: A highly skilled workforce with specialized knowledge in areas like molecular diagnostics is not easily transferable, further increasing the cost of exit.

Diversity of Competitors

Bio-Rad operates within a competitive arena featuring companies with diverse strategic approaches. Some players aim for comprehensive product lines, while others focus on niche, specialized solutions. This variety means competitors might engage in aggressive pricing, prioritize swift product development, or forge strategic alliances, all of which can influence Bio-Rad's standing in the market.

For instance, in the diagnostics sector, Bio-Rad competes with giants like Roche Diagnostics and Abbott Laboratories, which boast extensive portfolios and significant R&D budgets. Simultaneously, it faces smaller, agile firms that might excel in specific areas, such as advanced molecular diagnostics or specialized reagents. This dynamic landscape means Bio-Rad must constantly adapt its strategies to counter a broad spectrum of competitive actions.

- Diverse Competitor Strategies: Companies range from broad-line providers to niche specialists, each employing unique competitive tactics.

- Impact on Bio-Rad: This diversity can manifest as price wars, accelerated innovation cycles, or strategic collaborations that reshape market dynamics.

- Examples of Competition: Bio-Rad contends with large, diversified companies and smaller, highly focused firms within its key markets.

Bio-Rad faces intense rivalry from large, well-resourced competitors like Thermo Fisher Scientific and Danaher, as well as specialized firms, all competing for market share in a rapidly growing life science sector. This competition is further fueled by the market's expansion, projected to exceed $250 billion by 2028, attracting numerous players. Bio-Rad counters this by differentiating its offerings through innovation and integrated solutions, such as its digital PCR platform, which helps mitigate direct price competition. High exit barriers, including specialized assets and regulatory hurdles, mean competitors are likely to remain in the market, perpetuating competitive intensity.

| Competitor | 2023 Revenue (Approximate) | Key Market Segments |

|---|---|---|

| Thermo Fisher Scientific | $42.87 billion | Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics |

| Danaher (Life Sciences Segment) | Significant Revenue | Biotechnology, Diagnostics, Medical Devices |

| Abbott Laboratories | Not Specified (Overall Revenue) | Diagnostics, Medical Devices, Nutrition, Pharmaceuticals |

| Roche | Not Specified (Overall Revenue) | Pharmaceuticals, Diagnostics |

| Siemens Healthineers | Not Specified (Overall Revenue) | Imaging, Diagnostics, Advanced Therapies |

SSubstitutes Threaten

The life sciences sector is a hotbed of innovation, meaning new technologies can quickly emerge to offer alternatives to Bio-Rad's current product lines. For instance, breakthroughs in next-generation sequencing (NGS) or advanced molecular diagnostic platforms could potentially replace established methods that Bio-Rad currently serves. This rapid technological evolution presents a significant threat, as these new solutions might offer improved efficiency, cost-effectiveness, or novel capabilities. In 2024, the global NGS market alone was valued at approximately $10.5 billion, demonstrating the scale of potential disruption from alternative technologies.

Customers scrutinize substitutes by weighing their performance against their cost. If an alternative technology delivers similar or better outcomes for less money, or if it streamlines workflows, it represents a significant threat to Bio-Rad. For instance, the increasing affordability and capability of next-generation sequencing technologies, like those offered by Illumina, can present a substitute threat to traditional Sanger sequencing methods, which Bio-Rad also serves.

Shifting research paradigms pose a significant threat of substitution for Bio-Rad. As scientific inquiry moves towards novel approaches, such as advanced genomics and AI-driven diagnostics, existing technologies may become less relevant. For example, the growing demand for single-cell analysis, a field where Bio-Rad has offerings, is also seeing rapid innovation from specialized biotech firms, potentially offering more integrated or cost-effective solutions.

In-house Development by Customers

Large research institutions and pharmaceutical companies increasingly possess the internal expertise and resources to develop their own diagnostic assays and research tools. This trend is particularly pronounced for highly specialized or proprietary applications where off-the-shelf solutions may not meet specific needs. For instance, major pharmaceutical players often have dedicated R&D departments capable of creating custom molecular biology tools or analytical platforms, thereby diminishing their dependence on external suppliers like Bio-Rad.

The capacity for in-house development represents a significant threat as it directly bypasses the need for Bio-Rad's products and services. This is especially relevant in areas demanding unique performance characteristics or intellectual property protection. As of 2024, a considerable portion of advanced research and development within the life sciences sector is being internalized, with companies aiming for greater control over their workflows and data.

- In-house capabilities reduce reliance on external suppliers.

- Specialized and proprietary applications are prime candidates for in-house development.

- Major pharmaceutical companies often invest in custom tool development.

- This trend allows for greater control over research workflows and intellectual property.

Regulatory Changes

Regulatory changes represent a significant threat of substitutes for Bio-Rad. For instance, the U.S. Food and Drug Administration's (FDA) ongoing review and potential regulation of laboratory-developed tests (LDTs) could fundamentally alter the landscape for diagnostic products. This shift might favor certain established technologies or methodologies over newer, potentially disruptive ones, thus influencing the adoption of alternative diagnostic approaches.

The evolving regulatory environment can directly impact the cost and complexity of bringing new diagnostic solutions to market. If new regulations impose stricter validation requirements or increase compliance burdens, they could make it more challenging for substitute technologies to gain traction, or conversely, they might create opportunities for substitutes that are designed to meet these new standards more efficiently.

Consider the impact of evolving data privacy regulations, such as those related to health information. Stricter rules might necessitate changes in how diagnostic data is collected, stored, and analyzed, potentially favoring platforms that are inherently more secure or compliant. For example, a shift towards cloud-based diagnostic platforms might be influenced by regulatory demands for robust data security measures.

- FDA's proposed regulation of LDTs: This could lead to increased scrutiny and validation requirements for diagnostic tests, potentially impacting the market for certain Bio-Rad products and creating opportunities for compliant substitutes.

- Evolving data privacy laws: Changes in regulations like HIPAA or GDPR could influence the adoption of diagnostic technologies based on their data handling capabilities and security.

- International regulatory harmonization: Differences in regulatory approval processes across countries can create barriers for substitutes trying to enter new markets, but harmonization efforts could also accelerate their adoption.

The threat of substitutes for Bio-Rad is amplified by rapid technological advancements in the life sciences, where new platforms can quickly emerge to challenge existing methods. For instance, the burgeoning field of artificial intelligence in diagnostics and drug discovery offers alternative analytical approaches. The global AI in healthcare market was projected to reach over $100 billion by 2024, indicating the significant potential for AI-powered solutions to substitute traditional laboratory techniques.

Customers often evaluate substitutes based on a combination of performance, cost, and workflow efficiency. If a substitute technology can deliver comparable or superior results at a lower price point or with greater ease of use, it poses a direct threat. For example, advancements in microfluidics are enabling the development of more compact and cost-effective diagnostic devices that could substitute larger, more complex laboratory instruments.

The increasing accessibility of open-source bioinformatics tools and cloud-based data analysis platforms also presents a substitution threat. Researchers can leverage these resources to perform complex analyses that might have previously required specialized software or services from companies like Bio-Rad. This democratization of advanced analytical capabilities empowers users to find alternative pathways for their research needs.

The life sciences sector is characterized by a constant influx of innovative technologies that can serve as substitutes for Bio-Rad's existing product lines. For example, the growing adoption of CRISPR-based gene editing technologies offers alternative methods for genetic research and modification. The CRISPR technology market alone was estimated to be worth billions in 2024, highlighting the scale of potential disruption from these advanced biological tools.

Entrants Threaten

High capital requirements present a significant threat to Bio-Rad. Entering the life science and clinical diagnostics sectors demands massive upfront investment in research and development, sophisticated manufacturing capabilities, and extensive global distribution channels. For instance, developing a new diagnostic assay can cost millions, and establishing the necessary regulatory approvals and market access adds further substantial expense.

The life sciences and diagnostics industry, where Bio-Rad operates, faces significant barriers to entry due to extensive regulatory hurdles. Agencies like the U.S. Food and Drug Administration (FDA) and the European Union's In Vitro Diagnostic Regulation (EU IVDR) impose rigorous standards for product approval and manufacturing. For instance, the average time to gain FDA approval for a new medical device can stretch for years, involving substantial investment in clinical trials and documentation.

These complex and costly regulatory processes, including the need for extensive validation and quality management systems, act as a strong deterrent for potential new entrants. The financial and time commitment required to navigate these pathways effectively discourages smaller or less-resourced companies from entering the market, thereby protecting established players like Bio-Rad.

The life sciences research market, where Bio-Rad operates, is characterized by a high need for specialized expertise and robust intellectual property. Developing cutting-edge diagnostic tools and reagents requires significant investment in research and development, often spanning years and involving highly skilled scientists. For instance, companies entering the gene editing or advanced diagnostics space would need to navigate complex patent landscapes and demonstrate a clear technological advantage.

New entrants face substantial barriers in acquiring the necessary scientific knowledge and protecting their innovations. Bio-Rad, with its extensive patent portfolio and decades of R&D experience, has a significant head start. Competitors would need to either replicate this expertise through costly internal development or acquire existing technologies, a process that is both time-consuming and capital-intensive, potentially requiring billions in investment to establish a competitive R&D pipeline.

Established Brand Loyalty and Customer Relationships

Bio-Rad benefits from deeply ingrained brand loyalty and robust customer relationships, cultivated over years of delivering high-quality products and dependable support. This makes it challenging for newcomers to gain traction.

New entrants must overcome significant hurdles to establish trust and product acceptance against Bio-Rad's established reputation. For instance, in the diagnostics sector, where Bio-Rad operates, switching costs for healthcare providers can be substantial, involving retraining staff and validating new systems.

- Established Brand Loyalty: Bio-Rad has cultivated strong brand recognition and trust within the life science and clinical diagnostics markets.

- Customer Relationships: The company maintains long-standing partnerships with researchers, hospitals, and laboratories, built on consistent product performance and service.

- Switching Costs: For many of Bio-Rad's customers, particularly in clinical settings, the cost and complexity associated with switching to a new supplier for critical diagnostic or research tools are considerable deterrents.

- Market Acceptance: New entrants face the difficult task of convincing potential customers to abandon proven, reliable solutions for unproven alternatives, a process that requires significant investment in marketing and sales efforts.

Economies of Scale and Experience Curve

Established players like Bio-Rad leverage significant economies of scale, particularly in manufacturing and research and development. This allows them to spread fixed costs over a larger output, driving down per-unit production expenses.

Furthermore, Bio-Rad benefits from an experience curve, meaning that as they've produced more over time, they've become more efficient. This accumulated operational knowledge translates into cost advantages and process improvements that are challenging for newcomers to replicate quickly.

- Economies of Scale: Bio-Rad's substantial production volumes in areas like diagnostic reagents and life science research tools enable lower per-unit costs through bulk purchasing and optimized manufacturing processes.

- Experience Curve: Years of refining techniques in areas such as chromatography and gene amplification have led to Bio-Rad developing highly efficient workflows and specialized expertise, reducing waste and increasing throughput.

- R&D Investment: Significant and ongoing investment in research and development by established firms like Bio-Rad creates a pipeline of innovative products and processes, further cementing their market position and creating barriers to entry.

The threat of new entrants for Bio-Rad is generally moderate to low, primarily due to substantial barriers. High capital requirements for R&D, manufacturing, and global distribution are significant deterrents. For instance, developing and gaining regulatory approval for a new diagnostic assay can cost millions, as seen with the extensive clinical trials and documentation needed for FDA submissions, which can take years.

Extensive regulatory hurdles, such as those imposed by the FDA and EU IVDR, create a formidable barrier. These stringent requirements for product approval and manufacturing necessitate substantial investment in validation and quality systems, discouraging smaller players. Furthermore, the need for specialized scientific expertise and the protection of intellectual property, including navigating complex patent landscapes, demands considerable R&D investment, potentially billions, to establish a competitive product pipeline.

Bio-Rad also benefits from established brand loyalty and strong customer relationships, making it difficult for newcomers to gain market acceptance. High switching costs for customers in clinical settings, involving retraining and system validation, further solidify Bio-Rad's position. Additionally, economies of scale in manufacturing and R&D, coupled with the experience curve leading to greater efficiency, provide cost advantages that are challenging for new entrants to match quickly.

| Barrier Type | Description | Impact on New Entrants | Example for Bio-Rad |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | Deters new entrants due to substantial financial commitment. | Millions required for new diagnostic assay development and regulatory approval. |

| Regulatory Hurdles | Strict standards from agencies like FDA and EU IVDR. | Slows market entry and increases compliance costs. | Years and substantial investment for FDA approval of medical devices. |

| Specialized Expertise & IP | Need for advanced scientific knowledge and patent protection. | Requires significant R&D investment and legal navigation. | Navigating gene editing patents and developing advanced diagnostics. |

| Brand Loyalty & Switching Costs | Established trust and customer relationships. | Makes customer acquisition difficult and retention easier. | Healthcare providers face costs in retraining and validating new diagnostic systems. |

| Economies of Scale & Experience Curve | Cost advantages from large-scale production and accumulated efficiency. | New entrants struggle to compete on price and efficiency. | Optimized workflows in chromatography and gene amplification reduce costs. |

Porter's Five Forces Analysis Data Sources

Our Bio-Rad Porter's Five Forces analysis is built upon a robust foundation of industry-specific market research, financial reports from Bio-Rad and its competitors, and regulatory filings. We also incorporate data from reputable trade publications and expert analyst reports.