Bilia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilia Bundle

Bilia's strengths lie in its extensive dealer network and strong brand recognition within the automotive sector. However, understanding the full scope of their opportunities and potential threats requires a deeper dive.

Want the full story behind Bilia's market position, including critical weaknesses and emerging opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bilia's strength lies in its comprehensive full-service offering, functioning as a true one-stop shop for vehicle owners. This includes everything from new and used car sales to authorized servicing, financing, car washes, and even fuel. This integrated approach significantly boosts customer convenience, encouraging loyalty by catering to a wide array of needs throughout the entire vehicle ownership journey.

This robust service model not only diversifies Bilia's revenue streams but also plays a crucial role in improving customer retention. For instance, in 2023, Bilia reported strong performance across its various business segments, with service operations contributing significantly to overall profitability, underscoring the value of their integrated approach.

Bilia's extensive European presence, operating in countries like Sweden, Norway, Denmark, Germany, and the UK, offers significant geographical diversification. This broad reach helps buffer the company against localized economic downturns. For instance, in Q1 2024, Bilia reported a strong performance in its Swedish operations, which helped offset slightly softer results in other regions, demonstrating the benefit of its diversified footprint.

Bilia's strength lies in its diverse brand portfolio, encompassing a wide range of reputable car manufacturers. This multi-brand approach attracts a broader customer base, mitigating risks associated with reliance on any single brand's performance. For instance, in 2023, Bilia's sales were spread across brands like Volvo, Toyota, and Mercedes-Benz, demonstrating this diversification.

Established Customer Relationships

Bilia's established customer relationships are a significant strength. As a long-standing provider of automotive services, the company has likely fostered deep loyalty among its clientele, translating into consistent repeat business and a strong foundation for future growth. This trust, built over years of service, also fuels positive word-of-mouth referrals, a powerful and cost-effective marketing tool.

The company's extensive history in the automotive sector has allowed it to cultivate a robust customer base. For instance, Bilia reported a strong performance in 2023, with net sales increasing by 11% to SEK 30,015 million, indicating a healthy demand from its existing customer network. This sustained customer engagement is a testament to the value Bilia delivers.

These enduring relationships are invaluable assets that contribute to Bilia's market stability and competitive edge. The high level of customer retention minimizes the need for extensive and costly new customer acquisition efforts. This focus on existing relationships ensures a predictable revenue stream and allows Bilia to concentrate resources on enhancing its service offerings.

Key aspects of Bilia's customer relationship strength include:

- High Customer Loyalty: Demonstrated by repeat business and long-term engagement.

- Brand Recognition: A well-established and trusted name in the automotive service industry.

- Positive Word-of-Mouth: Referrals from satisfied customers reduce acquisition costs.

- Service Continuity: Customers rely on Bilia for ongoing maintenance and support needs.

Integrated Business Model

Bilia's integrated business model is a significant strength, combining vehicle sales with a comprehensive suite of after-sales services, financing, and accessory offerings. This synergy allows Bilia to maximize revenue from each customer interaction, creating a robust ecosystem that is less dependent on volatile new car sales alone. For instance, in the first quarter of 2024, Bilia reported that its services segment continued to perform well, contributing a substantial portion to overall profitability, underscoring the value of this integrated approach.

This model captures value across multiple customer touchpoints, from initial purchase to ongoing maintenance and future upgrades. Such deep customer engagement translates into higher lifetime value, as customers are more likely to return for repeat business and ancillary services. Bilia’s strategy focuses on building long-term relationships, which is crucial for sustained growth in the automotive retail sector.

The benefits of this integrated approach are evident in Bilia's financial performance:

- Enhanced Customer Loyalty: By offering a complete automotive solution, Bilia fosters stronger customer relationships and encourages repeat business.

- Diversified Revenue Streams: The integration of sales, service, parts, and financing creates multiple income sources, reducing reliance on any single segment.

- Increased Profitability: Capturing value at various stages of the customer lifecycle, particularly through high-margin after-sales services, boosts overall profitability.

- Resilience: The diverse revenue streams make the business model more resilient to economic downturns or fluctuations in specific market segments.

Bilia's expansive European footprint, spanning Sweden, Norway, Denmark, Germany, and the UK, provides significant geographical diversification. This broad reach acts as a buffer against localized economic slowdowns. For instance, in the first quarter of 2024, Bilia's strong performance in Sweden helped offset slightly weaker results in other markets, highlighting the advantage of its diversified presence.

Bilia's strength is rooted in its comprehensive, full-service model, positioning it as a one-stop shop for vehicle owners. This includes new and used car sales, authorized servicing, financing, car washes, and fuel. This integrated approach enhances customer convenience and fosters loyalty by meeting diverse needs throughout the vehicle ownership lifecycle.

The company's diverse brand portfolio, featuring reputable manufacturers like Volvo, Toyota, and Mercedes-Benz, attracts a wider customer base. This multi-brand strategy reduces the risk associated with over-reliance on any single brand's market performance. In 2023, Bilia's sales were well-distributed across these key brands, demonstrating this diversification effectively.

Bilia's integrated business model, combining vehicle sales with a full spectrum of after-sales services, financing, and accessories, is a key strength. This synergy maximizes revenue per customer and creates a robust ecosystem less vulnerable to fluctuations in new car sales alone. In Q1 2024, the services segment continued its strong performance, contributing substantially to overall profitability, underscoring the model's value.

Bilia's established customer relationships are a significant asset, built on years of service and fostering deep loyalty. This translates into consistent repeat business and a strong foundation for future growth. Positive word-of-mouth referrals, fueled by customer trust, also serve as a powerful and cost-effective marketing channel.

Bilia's extensive history in the automotive sector has allowed it to cultivate a robust customer base. In 2023, net sales increased by 11% to SEK 30,015 million, indicating healthy demand from its existing customer network. This sustained engagement reflects the value Bilia consistently delivers.

These enduring relationships minimize the need for costly new customer acquisition, ensuring a predictable revenue stream and allowing Bilia to focus resources on enhancing its service offerings.

What is included in the product

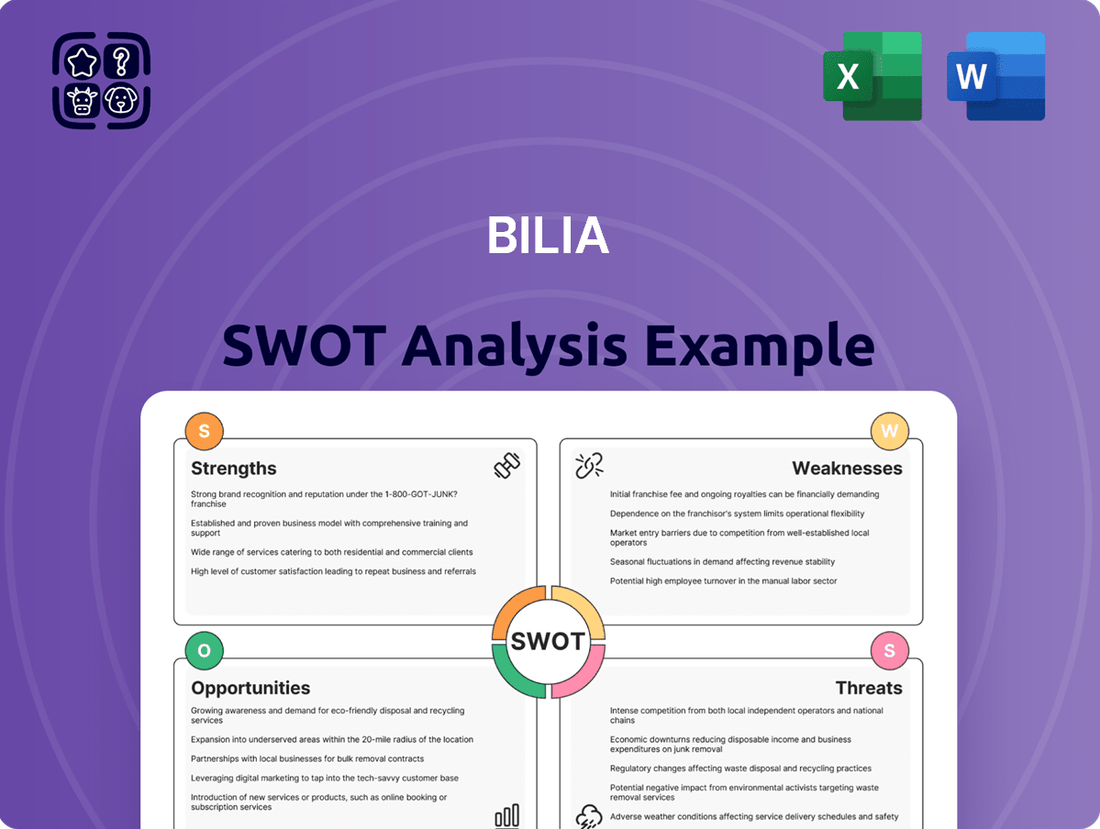

Delivers a strategic overview of Bilia’s internal and external business factors, highlighting its strengths in market presence and opportunities for expansion, while also addressing weaknesses in digital integration and threats from evolving automotive trends.

Bilia's SWOT analysis pinpoints areas for improvement, alleviating the pain of uncertainty by highlighting actionable strategies for growth.

Weaknesses

Bilia's heavy reliance on new car sales cycles presents a significant weakness. In 2023, new car sales in Sweden, Bilia's primary market, experienced a slight decline compared to 2022, reflecting broader economic uncertainties that impact consumer spending on big-ticket items.

This cyclical dependency means Bilia's revenue and profitability can fluctuate considerably based on macroeconomic conditions like interest rates and consumer confidence, making it vulnerable to economic downturns.

Managing Bilia's diverse services, multiple car brands, and operations across numerous European countries creates significant operational complexity. This complexity can drive up administrative expenses and make it difficult to maintain consistent service quality throughout the organization. For instance, in 2023, Bilia operated in 7 countries, managing a wide range of automotive services, from sales to repairs, for various manufacturers.

Bilia's reliance on manufacturer policies presents a significant weakness. As an authorized dealer, the company must adhere to strategic decisions, sales targets, and operational guidelines dictated by the car manufacturers it represents. This can stifle Bilia's ability to make independent strategic choices, forcing it to maintain specific inventory levels and undertake mandated investments, thereby potentially compromising its operational flexibility and profitability.

Capital Intensive Nature

Bilia's business model inherently demands significant capital. Think about the sheer volume of cars needed for inventory, plus the specialized tools for servicing them, and the physical dealerships themselves. This all adds up to a hefty upfront investment.

This capital-intensive nature can put a strain on Bilia's cash flow. It also impacts how efficiently the company is using its invested capital, potentially lowering its return on investment. For instance, in 2023, Bilia's inventory levels represented a substantial portion of its assets, directly reflecting this capital commitment.

The need for substantial financial outlay to adapt to market shifts, like the move towards electric vehicles, can limit Bilia's agility. Without considerable financial resources, responding quickly to new trends or expanding service capabilities becomes a challenge.

- High Inventory Costs: Maintaining a large stock of new and used vehicles requires significant capital.

- Equipment Investment: Specialized tools for diagnostics and repair, especially for EV technology, are costly.

- Infrastructure Expenses: Dealership facilities, showrooms, and service bays represent substantial fixed assets.

- Limited Financial Flexibility: Large capital needs can restrict the company's ability to invest in other growth areas or weather economic downturns.

Brand Image Tied to Automotive Industry

Bilia's brand image is intrinsically tied to the traditional automotive industry, meaning its public perception and business performance are directly influenced by the sector's overall image and challenges. This can be a significant weakness, as negative sentiment surrounding environmental concerns, the pace of electric vehicle adoption, or broader industry disruptions can indirectly tarnish Bilia's brand reputation and diminish its customer appeal.

For instance, as of early 2024, the automotive industry continues to navigate complex supply chain issues and the substantial investment required for the transition to electric vehicles. Bilia, as a major Nordic automotive service and sales company, faces the risk that any negative headlines or consumer concerns about these industry-wide issues could spill over, impacting customer trust and purchasing decisions.

- Brand Vulnerability: Bilia's reliance on the automotive sector makes it susceptible to industry-wide reputational damage.

- EV Transition Impact: Consumer perception of the electric vehicle transition can directly affect Bilia's sales and service revenue streams.

- Market Sentiment: Negative news or trends within the automotive industry can dampen demand for Bilia's offerings.

- Diversification Needs: The current market highlights a potential need for Bilia to explore diversification beyond traditional automotive services to mitigate this weakness.

Bilia's dependence on new car sales cycles is a notable weakness. In 2023, new car sales in Sweden saw a slight dip from 2022, a trend influenced by economic uncertainty impacting large purchases. This cyclical nature means Bilia's financial performance can swing significantly with economic shifts, making it vulnerable to downturns.

What You See Is What You Get

Bilia SWOT Analysis

The file shown below is not a sample—it’s the real Bilia SWOT analysis you'll download post-purchase, in full detail. This ensures you receive the exact, professionally crafted document you see here, ready for your strategic planning.

Opportunities

The burgeoning electric vehicle (EV) market presents a substantial growth avenue for Bilia. As global adoption rates climb, Bilia can capitalize by broadening its EV sales and, importantly, its specialized service capabilities. For instance, in 2023, global EV sales surpassed 13.6 million units, a significant leap from previous years, indicating a strong consumer demand.

Bilia has a prime opportunity to invest in crucial EV infrastructure, such as charging stations, and develop expertise in battery diagnostics and specialized maintenance. This strategic focus can solidify Bilia's position as a go-to provider for EV owners. By Q1 2024, several European markets reported EV market shares exceeding 20%, underscoring the widespread transition.

The automotive industry is seeing a significant shift towards mobility-as-a-service, with consumers increasingly favoring flexible options over outright ownership. This trend is evident in the growing popularity of car subscription models and short-term rental services, which cater to evolving lifestyle needs and offer greater convenience. For instance, the global car subscription market was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating a strong growth trajectory.

Bilia is well-positioned to capitalize on this expanding mobility services market by leveraging its established infrastructure. With a robust network of service centers and existing fleet management expertise, the company can readily introduce and scale new offerings like car subscriptions, short-term rentals, and car-sharing programs. This strategic move allows Bilia to tap into new customer segments and generate diversified revenue streams beyond traditional vehicle sales and maintenance.

Bilia's digitalization of sales and service presents a significant opportunity. Enhancing online sales platforms, virtual showrooms, and digital service booking systems can dramatically boost customer convenience and streamline operations. For instance, in 2023, Bilia reported a continued increase in online sales inquiries, highlighting the growing customer preference for digital interactions.

Further investment in data analytics offers a pathway to more personalized marketing, predictive maintenance, and smarter inventory management. This data-driven approach can lead to higher customer engagement and improved profitability. Bilia's strategic focus on leveraging customer data is expected to refine its service offerings and drive sales growth throughout 2024 and 2025.

Acquisitions and Consolidation

The European automotive retail sector remains quite fragmented, presenting a prime opportunity for Bilia to grow through strategic acquisitions. By acquiring smaller dealerships and service centers, Bilia can effectively broaden its reach across new territories and boost its overall market share. This consolidation is key to unlocking greater economies of scale, which in turn enhances its competitive edge in the market.

Bilia's strategic acquisitions could lead to significant operational efficiencies. For instance, a larger combined entity can negotiate better terms with manufacturers and suppliers, reducing costs. This also allows for the centralization of certain functions like marketing or IT, further streamlining operations. The pursuit of consolidation aligns with industry trends where larger players often gain an advantage through sheer scale and market influence.

- Market Fragmentation: The European automotive retail market is characterized by many smaller, independent players, creating fertile ground for consolidation.

- Geographic Expansion: Acquisitions allow Bilia to enter new regions and strengthen its presence in existing ones, reaching more customers.

- Economies of Scale: Larger operations can lead to cost savings in purchasing, marketing, and administration, improving profitability.

- Enhanced Bargaining Power: Increased size provides greater leverage when negotiating with car manufacturers and parts suppliers.

Upselling Value-Added Services

Bilia has a significant opportunity to enhance customer lifetime value by expanding its offering of value-added services. This includes promoting specialized services like ADAS calibration, which is becoming increasingly critical with the proliferation of advanced safety features in vehicles. For example, the global ADAS market was valued at approximately USD 30 billion in 2023 and is projected to grow substantially, presenting a clear revenue stream for Bilia.

By actively marketing and upselling these supplementary services, Bilia can capture a larger share of customer spending. Offering premium detailing packages, extended warranties that provide peace of mind, and thorough vehicle health checks can differentiate Bilia from competitors and foster customer loyalty. These services often carry higher profit margins compared to basic maintenance, directly contributing to improved profitability.

- Expand ADAS Calibration Services: Capitalize on the growing demand for advanced driver-assistance system calibration, a market projected for strong growth through 2030.

- Promote Premium Detailing: Offer specialized vehicle cleaning and restoration services to cater to customers seeking to maintain their vehicle's aesthetic appeal and resale value.

- Increase Extended Warranty Sales: Leverage customer desire for long-term protection and predictable repair costs by actively promoting extended warranty plans.

- Develop Comprehensive Vehicle Health Checks: Provide detailed diagnostic services that identify potential issues proactively, building trust and encouraging preventative maintenance.

Bilia can capitalize on the expanding electric vehicle (EV) market by increasing its EV sales and specialized service offerings, as global EV sales surpassed 13.6 million units in 2023. The company can also invest in EV infrastructure like charging stations and battery diagnostics, as European markets in Q1 2024 saw EV market shares exceeding 20%. Furthermore, Bilia can leverage its infrastructure to offer mobility-as-a-service options such as car subscriptions, a market valued at $3.5 billion in 2023, to diversify revenue streams.

Digitalization of sales and services, including enhanced online platforms and virtual showrooms, presents a significant opportunity for Bilia, as evidenced by increased online sales inquiries in 2023. Investing in data analytics can refine personalized marketing and predictive maintenance, driving customer engagement and profitability. The fragmented European automotive retail market also offers growth potential through strategic acquisitions, allowing Bilia to expand its reach and achieve economies of scale, thereby improving its bargaining power with manufacturers and suppliers.

Bilia can enhance customer lifetime value by expanding its value-added services, such as ADAS calibration, a market projected for strong growth beyond its 2023 valuation of approximately USD 30 billion. Promoting premium detailing, extended warranties, and comprehensive vehicle health checks can differentiate Bilia, foster loyalty, and improve profit margins.

Threats

Economic downturns, characterized by high inflation and rising interest rates, directly curb consumer spending. For instance, in early 2024, inflation remained a concern in many European markets, impacting disposable incomes.

This reduced purchasing power translates into lower demand for new and used vehicles, Bilia's core products. Furthermore, consumers tend to cut back on non-essential automotive services, affecting Bilia's service revenue streams.

In 2023, the automotive industry globally saw mixed results, with some regions experiencing slower new car sales due to economic pressures, a trend likely to persist into 2024, impacting Bilia's sales volumes.

The automotive retail sector is seeing a surge of new players, particularly those leveraging direct-to-consumer (DTC) models, exemplified by companies like Tesla. These manufacturers can sidestep traditional dealership structures, directly engaging with customers. This shift poses a significant threat to established retailers like Bilia, potentially fragmenting market share.

Online-only used car platforms are also intensifying competition. These digital-first businesses often operate with lower overheads, allowing them to offer competitive pricing. For Bilia, this means increased pressure on its profit margins as it contends with agile, digitally native competitors who can attract customers with convenience and price.

Stricter emissions standards, such as those being implemented across the EU in 2024 and 2025, present a significant challenge for Bilia. These evolving environmental regulations, including potential bans on internal combustion engine (ICE) vehicle sales in various European markets by 2030, necessitate rapid adaptation of inventory and service offerings.

Complying with these changes can incur substantial costs for Bilia, potentially impacting profitability. For instance, the transition to electric vehicle (EV) infrastructure and training for service technicians requires considerable investment, which could divert resources from other strategic areas.

Technological Disruption in Mobility

The automotive industry is facing significant technological disruption that could reshape demand for traditional car sales and services. Long-term advancements like the widespread adoption of autonomous vehicles (AVs) and the growth of ride-hailing platforms present a substantial threat. For instance, by 2030, the global mobility-as-a-service (MaaS) market is projected to reach hundreds of billions of dollars, potentially reducing individual car ownership. This shift could fundamentally alter Bilia's core business model, impacting sales volumes and the need for traditional after-sales services.

The increasing popularity of ride-sharing and MaaS models, where consumers pay for transportation as a service rather than owning a vehicle, poses a direct challenge. As more people opt for these convenient and often cost-effective solutions, the demand for new car purchases may decline. This trend is already evident, with ride-hailing services accounting for a significant portion of urban transportation in many markets. For example, in 2024, major ride-hailing platforms reported millions of daily active users globally, indicating a substantial shift in consumer behavior.

Furthermore, the development and eventual widespread implementation of autonomous driving technology could further accelerate this transition. AVs could lead to more efficient fleet management for ride-hailing services and potentially reduce the need for private vehicle ownership altogether. This technological evolution might decrease the overall number of vehicles sold to individuals, impacting Bilia's revenue streams from both sales and maintenance. By 2025, several countries are expected to see increased testing and limited commercial deployment of Level 4 and Level 5 autonomous vehicles, signaling the approaching reality of this disruption.

Supply Chain Disruptions

Global events, geopolitical tensions, and shortages of critical components like semiconductors continue to pose a significant threat to Bilia's operations. These disruptions can severely impact the production and delivery of new vehicles, leading to inventory shortages. For instance, the automotive industry faced widespread semiconductor shortages in 2021-2022, causing production cuts across major manufacturers, a situation that can directly affect Bilia's ability to stock vehicles.

The inability to fulfill customer orders due to these supply chain issues directly impacts revenue generation and can lead to significant delays in sales. This can frustrate customers and damage Bilia's reputation for timely service. Such disruptions can create a ripple effect, impacting not only new car sales but also the availability of parts for servicing and repairs, which are crucial revenue streams for dealerships.

- Supply Chain Vulnerability: Bilia, like other automotive retailers, is susceptible to disruptions stemming from global events and geopolitical instability impacting manufacturing.

- Component Shortages: Ongoing shortages of key components, such as semiconductors, continue to limit vehicle production and availability for sale.

- Impact on Sales and Revenue: Inability to secure sufficient inventory directly hinders Bilia's ability to meet customer demand, leading to lost sales and reduced revenue.

- Customer Satisfaction Risk: Delays in vehicle delivery and order fulfillment can negatively affect customer satisfaction and loyalty.

Economic headwinds, including persistent inflation and elevated interest rates in key European markets throughout early 2024, continue to dampen consumer spending power. This directly translates to reduced demand for new and used vehicles, Bilia's primary revenue drivers, and also impacts demand for automotive services.

The automotive retail landscape is increasingly competitive, with direct-to-consumer (DTC) models and online-only used car platforms gaining traction. These agile competitors, often with lower overheads, put pressure on Bilia's profit margins and market share.

Evolving environmental regulations, such as stricter emissions standards being implemented across the EU in 2024 and 2025, necessitate significant investment in adapting inventory and services, potentially impacting profitability.

Technological disruptions, including the rise of mobility-as-a-service (MaaS) and the advancement of autonomous vehicles, threaten to fundamentally alter traditional car ownership models, potentially reducing Bilia's core sales and after-sales revenue streams.

Persistent global supply chain vulnerabilities, exemplified by ongoing semiconductor shortages that impacted vehicle production in 2021-2022, continue to pose a risk to inventory availability and timely order fulfillment, affecting revenue and customer satisfaction.

SWOT Analysis Data Sources

This Bilia SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on Bilia's current standing and future potential.