Bilia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilia Bundle

Bilia's competitive landscape is shaped by powerful forces like supplier bargaining power and the threat of new entrants. Understanding these dynamics is crucial for navigating the automotive retail sector.

The complete report reveals the real forces shaping Bilia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bilia's reliance on a limited number of major global car manufacturers for new vehicles and original spare parts significantly concentrates supplier power. Manufacturers like Volvo, Polestar, BMW, and Mercedes-Benz, with their strong brand recognition and advanced technology, dictate terms, limiting Bilia's sourcing flexibility.

Bilia faces significant supplier bargaining power due to high switching costs for car manufacturers. Transitioning to represent a different car brand or altering existing authorized service agreements would necessitate substantial investments. These include acquiring new specialized tools for diverse vehicle architectures, retraining technicians, and overhauling marketing and sales strategies, all of which solidify suppliers' leverage.

Brand authorization significantly bolsters a supplier's bargaining power. For Bilia, being an authorized dealer means access to specific vehicle models, genuine parts, and manufacturer-approved service procedures, all vital for customer satisfaction and warranty adherence.

This exclusive access, however, creates a dependency for Bilia on its manufacturers. This reliance grants the car brands considerable leverage over Bilia's operational decisions and pricing structures, effectively increasing the suppliers' influence.

In 2024, the automotive industry continued to see strong brand loyalty, with consumers often prioritizing authorized service centers for new vehicles. This trend reinforces the value of brand authorization for dealerships like Bilia, and by extension, the bargaining power of the manufacturers.

Potential for Forward Integration by OEMs

Car manufacturers are increasingly exploring direct-to-consumer sales models, especially for electric vehicles. This shift could potentially bypass traditional dealerships, impacting their role and bargaining power. For instance, by 2024, several major automotive groups are expected to have launched or expanded their online sales platforms, directly engaging with customers.

This move towards direct sales represents a long-term threat to retailers like Bilia. As manufacturers gain more control over the customer relationship and pricing, the leverage of established dealerships could diminish. The European market is still adapting, but the trend suggests a future where the traditional dealership model might be significantly altered.

- OEM Forward Integration Threat: Manufacturers moving to direct sales models.

- EV Focus: This strategy is particularly prevalent in the electric vehicle segment.

- European Market Evolution: The direct-to-consumer model is still developing in Europe.

- Impact on Retailers: Potential reduction in the bargaining power of dealerships like Bilia.

Supplier Influence on Pricing and Terms

Car manufacturers wield considerable bargaining power over dealerships like Bilia. Their strong brand recognition and control over vehicle production and parts supply mean they can set wholesale prices and dictate dealership terms. This directly impacts Bilia's cost of goods sold and overall profitability. For instance, in 2024, major automotive groups continued to manage their supply chains tightly, leading to limited negotiation leverage for individual dealerships on bulk orders.

- Manufacturer Control: Automakers dictate wholesale prices and dealership agreement terms.

- Brand Strength: High brand recognition enhances manufacturer leverage.

- Supply Chain Dominance: Control over production and parts limits dealer negotiation power.

- Profitability Impact: Supplier pricing directly influences Bilia's cost structure and margins.

Bilia's suppliers, primarily major car manufacturers, hold significant bargaining power. This is due to their strong brand equity, control over vehicle supply, and the high costs associated with Bilia switching manufacturers. In 2024, continued strong consumer preference for established brands and authorized service centers meant manufacturers could dictate terms, impacting Bilia's margins.

The trend of manufacturers exploring direct-to-consumer sales, especially for electric vehicles, further amplifies supplier leverage. By controlling the customer interface and pricing, manufacturers can reduce dealership autonomy. This shift, evident in 2024 platform expansions by several global automakers, poses a long-term challenge to Bilia's traditional dealership model and its negotiation standing.

Manufacturers' ability to set wholesale prices and control the supply of new vehicles and genuine parts directly affects Bilia's cost of goods sold. In 2024, tight supply chains and strong demand for popular models limited dealerships' ability to negotiate bulk purchase terms, reinforcing manufacturer dominance.

| Supplier Characteristic | Impact on Bilia | 2024 Context |

|---|---|---|

| Brand Strength & Loyalty | Limits Bilia's negotiation on pricing and terms | High consumer preference for authorized dealers |

| Control over Vehicle Supply | Dictates wholesale prices and availability | Tight supply chains limited dealer negotiation leverage |

| Switching Costs for Bilia | High investment needed to represent new brands | Reinforces dependency on current manufacturers |

| Direct Sales Initiatives | Potential bypass of dealerships, reducing Bilia's role | Automakers expanding online sales platforms |

What is included in the product

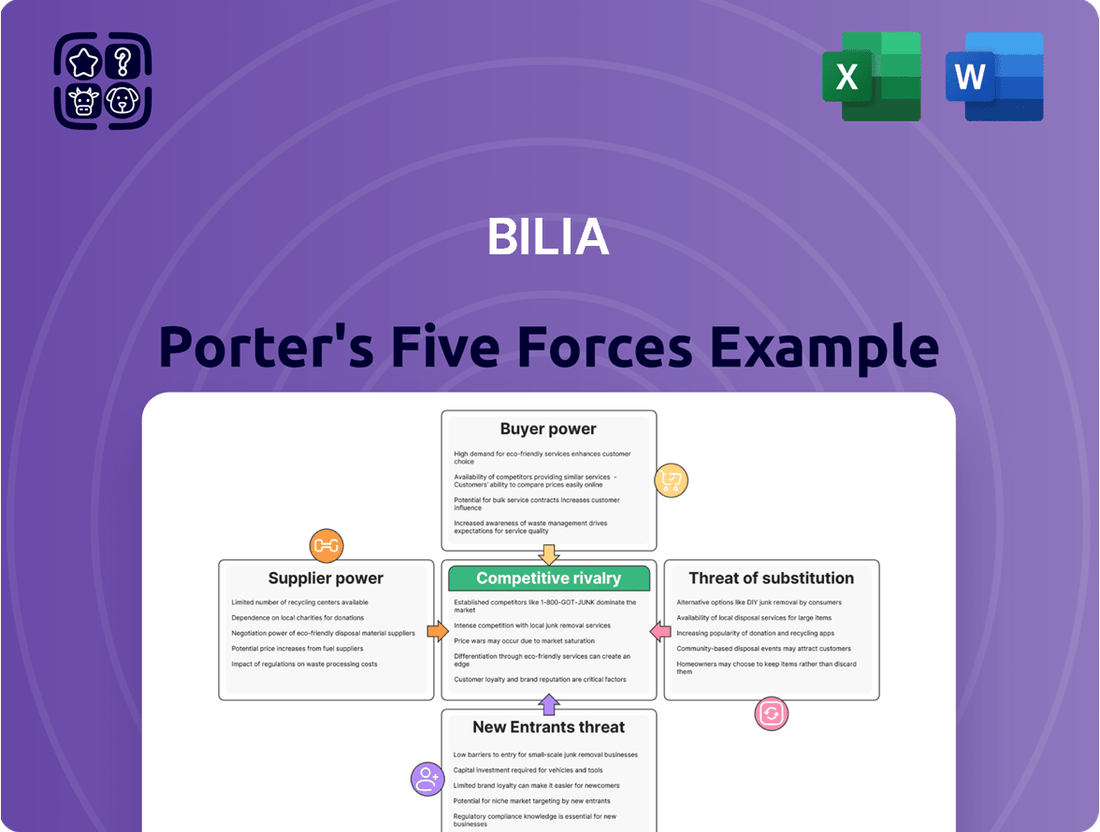

Bilia's Porter's Five Forces analysis dissects the competitive intensity within its automotive retail and service markets, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Understand competitive intensity at a glance, allowing for swift identification of threats and opportunities.

Customers Bargaining Power

Individual customers are showing more caution when buying new cars, especially with economic uncertainties and rising interest rates. This means they are more sensitive to prices, pushing dealerships like Bilia to be competitive with their pricing and financing options to attract buyers.

In 2024, consumer confidence indexes, while showing some fluctuations, generally indicate a hesitant spending environment for big-ticket items like vehicles. For instance, if interest rates for car loans remain elevated, say above 7-8%, buyers will scrutinize sticker prices more closely, directly impacting Bilia's sales volume and profit margins.

Customers in the European automotive market benefit from a vast selection of brands and dealerships, alongside independent multi-brand retailers. This abundance of choice significantly enhances their bargaining power, allowing them to readily compare options and negotiate favorable terms, especially when purchasing new cars.

Bilia's business customers, particularly corporate fleets and large organizations, wield considerable bargaining power. This is primarily driven by the substantial volume of vehicles they purchase, enabling them to negotiate more favorable pricing and terms. In 2023, approximately 60% of Bilia's customer base comprised companies, highlighting the significant influence these entities can exert on the company's sales and profitability.

Digitalization Enhancing Customer Information

Digitalization has dramatically shifted the landscape by empowering customers with unprecedented information access. Online platforms and digital retail solutions now allow consumers to effortlessly research prices, compare vehicle models, and read reviews from other buyers. This transparency directly amplifies customer bargaining power when interacting with dealerships.

- Information Transparency: Customers can now easily access vast amounts of data regarding pricing, features, and competitor offerings online.

- Price Comparison: Digital tools facilitate quick and easy price comparisons across multiple dealerships, putting pressure on individual sellers.

- Review Accessibility: Online reviews and forums provide insights into product quality and dealership experiences, influencing purchasing decisions.

- Negotiation Leverage: Armed with comprehensive information, customers enter negotiations with a stronger understanding of fair market value.

Loyalty in the Service Business

Bilia's strong performance in its service business, a key contributor to its 2024 operational earnings, highlights a notable level of customer loyalty. This loyalty is particularly evident in after-sales services, where customers often depend on authorized dealerships for essential maintenance and repairs.

While the initial purchase of a new vehicle might involve price comparisons and shopping around, the ongoing need for specialized servicing and genuine parts can significantly diminish a customer's bargaining power within the service segment. This reliance translates into a more stable revenue stream for Bilia.

- Bilia's Service Segment Dominance: The service business was a significant driver of Bilia's operational earnings in 2024.

- Customer Loyalty in After-Sales: Customers exhibit loyalty to authorized service providers for maintenance and repairs.

- Reduced Bargaining Power: Reliance on authorized service for ongoing needs limits customer ability to negotiate prices.

- Strategic Advantage: This loyalty provides Bilia with a more predictable and less price-sensitive revenue source.

Customers' bargaining power significantly impacts Bilia, especially in the new car sales segment where a wide array of choices and readily available price comparisons empower buyers. This is amplified by digital platforms offering unprecedented transparency. However, in the crucial after-sales service sector, customer loyalty to authorized dealerships for specialized maintenance and genuine parts can mitigate this power, creating a more stable revenue base for Bilia.

| Factor | Impact on Bilia | 2024 Relevance |

|---|---|---|

| New Car Purchases | High bargaining power due to choice and price transparency | Elevated due to economic caution and interest rates |

| After-Sales Services | Lower bargaining power due to reliance on specialized service | Service segment contributed significantly to 2024 earnings |

| Corporate Fleets | Substantial bargaining power due to high volume purchases | Companies represented ~60% of Bilia's customer base in 2023 |

Preview Before You Purchase

Bilia Porter's Five Forces Analysis

This preview showcases the complete Bilia Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the automotive retail sector. The document you are viewing is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The European automotive retail landscape is notably fragmented, featuring a vast number of authorized dealerships, independent used car specialists, and numerous service centers. This sheer volume of competitors, including players like Bilia, intensifies rivalry as each entity vies for customer attention and loyalty.

This fragmentation means that no single player commands a dominant market share, forcing companies to compete aggressively on price, service quality, and customer experience. For instance, in 2023, the European new car market saw over 12 million registrations, distributed across thousands of dealerships, highlighting the dispersed nature of the sector.

The European new car market saw modest growth in 2024, but forecasts for 2025 suggest sales volumes will plateau or even dip. This lack of expansion means companies are more aggressively competing for existing customers.

For instance, in the first half of 2024, new car registrations across the EU increased by 4.6% compared to the same period in 2023, reaching approximately 5.7 million units. However, industry analysts anticipate this growth rate to slow considerably in the latter half of 2024 and into 2025, with some predicting a slight contraction in overall sales.

Automotive dealerships, including those operated by Bilia, face significant competitive rivalry stemming from their high fixed costs. These costs are tied to maintaining showrooms, service bays, and substantial inventory, creating a constant need for high sales and service volumes to achieve profitability.

In 2024, the automotive industry continued to see intense competition, with dealerships like Bilia needing to push units to cover operational expenses. For instance, the average cost of building and equipping a new car dealership can easily run into millions of dollars, a fixed investment that demands consistent revenue generation.

This pressure to maintain volume often translates into aggressive pricing strategies and promotional offers among competitors. Dealerships must actively compete for market share to ensure their fixed cost base is adequately absorbed, making profitability highly sensitive to sales performance and customer traffic.

Differentiation Through Service and Ancillary Offerings

Dealerships, including Bilia, leverage service and ancillary offerings to stand out in a market where the core product—the car itself—is largely dictated by manufacturers. This differentiation is crucial for building customer loyalty and capturing additional revenue streams.

Bilia's strategy emphasizes a comprehensive customer experience beyond the initial sale. This includes high-quality after-sales service, flexible financing options, and convenient add-ons like car washes and fuel sales. These supplementary services are vital for maintaining customer engagement and fostering repeat business.

- Service Quality: Bilia's investment in skilled technicians and modern service facilities directly impacts customer satisfaction and retention, a key factor in competitive rivalry.

- Ancillary Revenue Streams: In 2024, the automotive service sector continued to be a significant profit driver for dealerships, with many reporting service and parts revenue accounting for over 50% of their gross profit.

- Financing and Insurance: Offering attractive financing and insurance packages provides a critical competitive edge, often influencing the final purchase decision for consumers.

- Customer Convenience: Integrated services like car washes and readily available fuel add value and convenience, encouraging customers to consolidate their automotive needs with a single provider.

Impact of EV Transition and Digitalization

The automotive industry's intense rivalry is being amplified by the rapid transition to electric vehicles (EVs) and the pervasive digitalization of sales and service. Companies are locked in a battle to secure market share in the burgeoning EV segment, demanding significant investment in new technologies and manufacturing capabilities. For instance, in 2024, major automakers are committing billions to EV development, with many aiming for over 50% of their sales to be electric by 2030.

This evolution necessitates a strategic pivot. Businesses must not only develop competitive EV models but also invest heavily in charging infrastructure to support their customer base. Furthermore, enhancing the digital customer experience, from online configurators and virtual showrooms to seamless service booking and over-the-air updates, is becoming a critical differentiator. Those failing to adapt risk being outpaced by more agile competitors who embrace these technological shifts.

- EV Investment Surge: Global automakers are projected to invest over $1.2 trillion in electric vehicles and batteries by 2030, signaling a major competitive battleground.

- Digitalization in Sales: By 2024, a significant portion of car buyers utilize online research and purchasing tools, pushing dealerships to bolster their digital presence and customer relationship management systems.

- Charging Infrastructure Race: Companies are actively partnering or investing in charging networks to address range anxiety, a key factor influencing EV adoption and brand loyalty.

- Service Innovation: Digitalization is transforming after-sales service, with a growing emphasis on remote diagnostics, predictive maintenance, and mobile service solutions to improve customer convenience and operational efficiency.

Competitive rivalry in the European automotive retail sector is intense due to market fragmentation, with numerous dealerships and independent sellers vying for customers. This forces companies like Bilia to compete fiercely on price, service, and customer experience, especially as market growth slows.

High fixed costs associated with dealerships necessitate constant sales volume, leading to aggressive pricing and promotional activities. Dealerships also differentiate through superior service quality, ancillary offerings, and financing options to capture and retain customers.

The shift towards electric vehicles and digitalization further intensifies competition, requiring significant investment in new technologies and digital customer engagement to maintain market share.

| Metric | 2023 Data | 2024 Outlook | Key Driver |

|---|---|---|---|

| European New Car Registrations | ~12 million | Slowdown/Plateau | Market saturation, economic factors |

| Dealership Fixed Costs | High (millions USD per dealership) | Consistent Pressure | Infrastructure, inventory holding |

| EV Investment by Automakers | Billions USD | Continued Surge | Technological advancement, regulatory push |

| Digitalization in Car Sales | Significant customer reliance | Increasing importance | Consumer behavior, convenience |

SSubstitutes Threaten

For many urban dwellers, robust public transportation systems and the increasing availability of ride-sharing and car-sharing options present a significant threat of substitution to individual car ownership. These alternatives directly diminish the perceived necessity of purchasing and maintaining a personal vehicle, impacting demand for automotive sales and related services.

In 2024, the global ride-sharing market, including services like Uber and Lyft, is projected to reach over $200 billion, demonstrating a substantial shift in personal mobility preferences. Similarly, advancements in public transit infrastructure in major cities continue to offer cost-effective and convenient alternatives to driving, further intensifying this substitution threat.

The rise of car subscription services and extended rental agreements presents a significant threat of substitutes for traditional car ownership. These flexible models allow consumers to access vehicles without the long-term financial commitment, directly impacting outright sales. For instance, companies like Care by Volvo and various rental agencies are seeing increased uptake, offering a compelling alternative to purchasing a new car, especially for those who value flexibility or have fluctuating mobility needs.

The increasing durability and reliability of modern vehicles directly impacts the threat of substitutes by extending vehicle lifespans. This means consumers are holding onto their cars for longer, reducing the frequency of new car purchases. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, up from 12.1 years in 2022, indicating a clear trend towards longer ownership periods.

Focus on Sustainability and Urban Planning

The increasing societal focus on sustainability is a significant factor influencing the threat of substitutes for car ownership. As environmental consciousness grows, consumers are more inclined to explore alternatives that reduce their carbon footprint. This trend is further amplified by urban planning strategies that actively promote greener transportation options.

Urban planning initiatives in many cities are actively redesigning infrastructure to favor walking, cycling, and public transportation. For instance, by 2024, many metropolitan areas are expanding their dedicated bike lanes and improving public transit networks. This makes it more convenient and appealing for individuals to opt out of personal car use for daily commutes and errands.

This cultural shift directly impacts consumer choices. In 2024, we are seeing a noticeable rise in the adoption of car-sharing services and the increased utilization of ride-hailing platforms, especially in urban centers. These alternatives offer flexibility without the long-term commitment and costs associated with car ownership.

- Growing Environmental Awareness: Consumer surveys in 2024 indicate a significant portion of the population is willing to pay more for sustainable products and services, including transportation.

- Urban Mobility Investments: Major cities globally are investing billions into public transport upgrades and cycling infrastructure, making these viable alternatives to private vehicles. For example, Paris aims to double its bike lanes by 2026.

- Rise of Shared Mobility Services: The car-sharing market is projected to grow substantially, with user numbers expected to increase by over 15% year-over-year in key European markets through 2025.

- Policy Support for Green Transport: Governments are implementing policies such as congestion charges and low-emission zones, further incentivizing the use of public transport and active mobility.

Manufacturer Direct-to-Consumer Sales

The rise of manufacturer direct-to-consumer (DTC) sales, especially for new electric vehicle (EV) brands, presents a potent substitute for traditional dealership models like Bilia. This approach allows consumers to bypass intermediaries and purchase vehicles directly from the Original Equipment Manufacturer (OEM).

This DTC trend is gaining momentum, with companies like Tesla leading the charge. In 2023, Tesla's direct sales model continued to influence the automotive industry, demonstrating consumer willingness to engage directly with manufacturers. This model can offer a streamlined purchasing experience and potentially more competitive pricing by cutting out dealership markups.

- Direct-to-Consumer (DTC) sales bypass traditional dealership networks.

- EV manufacturers are increasingly adopting DTC models.

- This offers consumers a direct purchasing channel from OEMs.

- Tesla's success highlights the viability of the DTC approach.

The threat of substitutes for traditional car ownership is multifaceted, encompassing alternative mobility solutions and evolving consumer preferences. These substitutes directly challenge the necessity of owning a personal vehicle, impacting sales and service sectors.

In 2024, the global ride-sharing market is poised to exceed $200 billion, underscoring a significant shift towards flexible transportation. Concurrently, urban areas are enhancing public transit, offering cost-effective and convenient alternatives that intensify this substitution pressure.

Car subscription services and extended rentals provide flexible access to vehicles without long-term ownership commitments, directly impacting new car sales. For instance, companies offering these flexible models are experiencing increased adoption, particularly among consumers who prioritize adaptability.

The increasing lifespan of modern vehicles, with the average age of cars on U.S. roads reaching a record 12.5 years in 2023, reduces the frequency of new purchases. This durability makes owning a car for longer periods a more viable option, thus acting as a substitute for frequent upgrades.

Growing environmental awareness is a key driver for substitute transportation options. Consumers are increasingly seeking greener alternatives to reduce their carbon footprint, a trend supported by urban planning that favors sustainable mobility.

| Substitute Type | 2024 Market Projection/Trend | Impact on Car Ownership |

|---|---|---|

| Ride-sharing & Car-sharing | Global market > $200 billion | Reduces perceived need for personal vehicle ownership |

| Public Transportation | Expansion in major cities | Offers cost-effective, convenient alternative |

| Car Subscriptions/Rentals | Increasing uptake | Provides flexibility without long-term commitment |

| Extended Vehicle Lifespan | Avg. U.S. vehicle age: 12.5 years (2023) | Decreases frequency of new car purchases |

Entrants Threaten

Establishing a comprehensive, multi-country automotive dealership network, as Bilia operates, requires immense capital. Think about the costs for prime real estate in major European cities, building state-of-the-art showrooms and service centers, stocking a wide range of new and used vehicles, and investing in advanced diagnostic and repair equipment. For instance, in 2024, the average cost to build a new car dealership can range from $5 million to $20 million USD depending on size and location, presenting a formidable financial hurdle for any potential new competitor.

Securing authorized dealership agreements with established car manufacturers presents a significant hurdle for new entrants. Manufacturers often prioritize partners with proven track records and substantial financial backing, making it difficult for newcomers to gain access.

Existing strong relationships between Original Equipment Manufacturers (OEMs) and their established dealer networks create a formidable barrier. For instance, in 2024, the average time for a new dealership to be approved by a major automotive brand can extend over a year, involving rigorous vetting processes and substantial capital investment requirements.

Bilia's considerable size allows it to achieve significant economies of scale. This means they can buy cars and parts in bulk, negotiate better prices, and spread their marketing and operational costs over a larger volume of sales. For instance, in 2023, Bilia reported net sales of SEK 133,037 million, demonstrating the sheer scale of their operations.

New companies entering the automotive retail and service market would find it extremely difficult to replicate these cost advantages. Without the same purchasing power and operational efficiencies, new entrants would likely face higher per-unit costs, making it challenging to compete with Bilia on price and attract customers.

Complex Regulatory and Compliance Landscape

The automotive retail and service sector is heavily regulated, presenting a substantial barrier for potential new entrants. Compliance with environmental standards, such as emissions regulations, and consumer protection laws, like warranty requirements, demands significant investment and expertise.

For instance, in 2024, the European Union continued to enforce stringent CO2 emission targets for new vehicles, requiring manufacturers and dealerships to adapt their offerings and operational processes. This complex web of rules, including safety standards and data privacy regulations, necessitates specialized knowledge and resources that can deter newcomers.

New entrants must also contend with industry-specific certifications and licensing, adding further layers of complexity and cost. These requirements ensure a baseline of quality and safety but create a steep learning curve and financial outlay for those looking to enter the market.

Key compliance areas for new entrants include:

- Environmental Regulations: Adherence to emissions standards and waste disposal protocols.

- Consumer Protection Laws: Compliance with warranty provisions, advertising standards, and fair trading practices.

- Safety Standards: Meeting vehicle safety certifications and operational safety protocols.

- Data Privacy: Ensuring compliance with data protection regulations like GDPR for customer information.

Need for Specialized Technological Expertise and Infrastructure

The automotive sector's swift shift towards electric vehicles (EVs) and connected car technologies presents a substantial barrier for new entrants. This transition demands considerable upfront investment in specialized infrastructure, such as charging stations, and advanced diagnostic equipment. For instance, setting up a comprehensive EV charging network can cost millions, a significant hurdle for newcomers.

Furthermore, acquiring and maintaining the necessary technical expertise for servicing these advanced vehicles is crucial. Technicians require ongoing training to stay abreast of evolving software and hardware. In 2024, the demand for EV-certified technicians is projected to outstrip supply, indicating the challenge new businesses face in building a skilled workforce.

- Specialized Infrastructure Costs: Significant capital is required for EV charging stations and advanced diagnostic tools.

- Technical Expertise Gap: A shortage of skilled technicians trained in EV and connected car technologies exists.

- Ongoing Training Investment: Continuous education is necessary to keep pace with rapid technological advancements.

The threat of new entrants for Bilia is significantly low due to the substantial capital required to establish a multi-country automotive dealership network. The high costs associated with prime real estate, showrooms, inventory, and advanced equipment, with new dealership construction averaging $5 million to $20 million USD in 2024, create a formidable financial barrier.

Securing authorized dealership agreements with manufacturers is also a major hurdle, as brands often favor established players with proven financial stability. Furthermore, the deep-rooted relationships between original equipment manufacturers and their existing dealer networks, where new dealership approvals can take over a year in 2024, further solidify this barrier.

Bilia's considerable economies of scale, evidenced by its 2023 net sales of SEK 133,037 million, allow for superior purchasing power and cost efficiencies, making it difficult for newcomers to compete on price. The sector's stringent regulatory environment, covering emissions, consumer protection, and safety standards, alongside the increasing complexity of EV technology and the shortage of skilled technicians, adds further layers of difficulty for potential entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bilia is built upon a robust foundation of data, including Bilia's annual reports, investor presentations, and official company statements. We also incorporate industry-specific market research reports and automotive sector publications for comprehensive competitive intelligence.