Bilia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilia Bundle

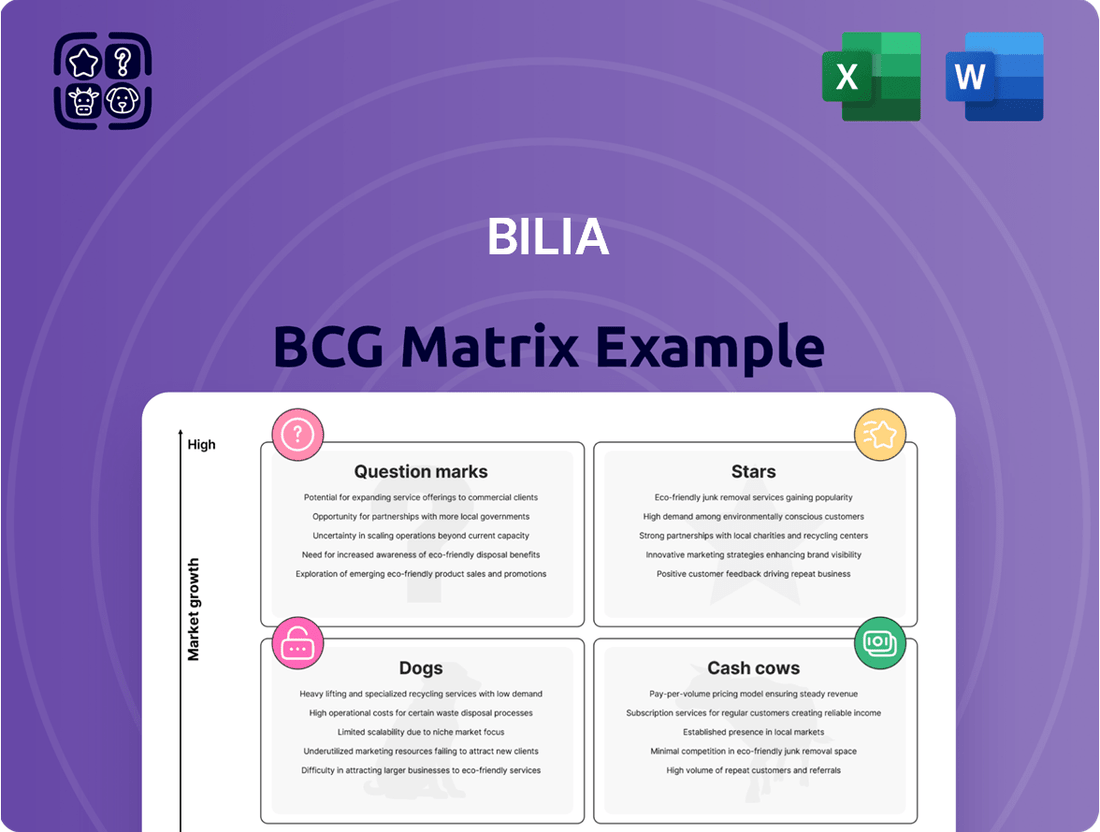

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This preview offers a glimpse into how these classifications can illuminate strategic opportunities and challenges.

To truly leverage the BCG Matrix for your business, you need a comprehensive understanding of each product's position and the actionable insights that follow. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your product strategy and resource allocation.

Stars

Bilia's service business in Norway and Western Europe is a shining example of a star in the BCG matrix. Demand has been robust, leading to increased operational earnings in recent quarters, a clear sign of strength.

This performance suggests Bilia holds a significant market share within a segment that's experiencing growth. Continued investment here is crucial to solidify its leading position.

For instance, Bilia reported a 10% year-over-year increase in its service revenue for the first quarter of 2024 across its Nordic operations, underscoring the strong market reception.

Bilia's acquisition of Volvo Trucks operations, effective July 1, 2025, places it directly into a high-growth segment. This strategic move, replacing its divested Mercedes Trucks business, signals a clear intent to capture market share in a sector poised for expansion.

The truck market in Europe, for instance, saw a notable increase in registrations in early 2024, with heavy-duty trucks showing particular strength, indicating a favorable environment for Bilia's new venture. If Bilia can leverage Volvo's established brand and its own operational expertise to quickly gain a significant foothold, this segment is likely to qualify as a Star in the BCG matrix.

Bilia's strategic inclusion of new car brands like XPENG and Polestar positions them within the high-growth electric vehicle segment. This move reflects a forward-looking approach to capitalize on evolving consumer preferences for sustainable transportation.

The company's reported increase in order intake for new cars across all its operating regions in 2024 signals robust demand for these modern offerings. This trend suggests that newer brands are resonating well with the market, contributing to Bilia's overall sales momentum.

Continued investment in brands like XPENG and Polestar is crucial for Bilia to secure substantial market share in the rapidly transforming automotive industry. By focusing on these emerging players, Bilia is actively shaping its future portfolio to align with the anticipated dominance of electric mobility.

Digital Sales Channels and E-commerce for Services

Bilia is significantly investing in digital sales channels and e-commerce platforms to streamline car ownership for its customers. This strategic focus on digital innovation aims to capture a growing online market share within the automotive sector.

The rapid increase in digital adoption across the automotive industry makes Bilia's commitment to these channels a key indicator of potential success. If Bilia successfully gains a strong foothold in online service sales, these digital offerings would be classified as Stars in the BCG matrix.

- Digital Service Development: Bilia is actively building out its digital service capabilities, enhancing customer convenience.

- E-commerce Growth: The company is expanding its e-commerce platforms to facilitate easier transactions for car-related services.

- Industry Trend Alignment: These investments align with the automotive sector's broader shift towards digital customer engagement and sales.

- Market Share Capture: Successful capture of significant online market share in services would solidify these as Star products/services.

Financing and Insurance Services Growth

Bilia's financing and insurance services are a critical component of its offering, acting as a significant growth driver. These supplementary services are experiencing robust uptake, directly correlating with increased vehicle sales and Bilia's success in retaining customers. This high growth in demand positions them as a Star in the BCG matrix, indicating strong potential for further market share expansion.

The tight integration of these financial products with vehicle purchases is a key strategy. For instance, in 2024, Bilia reported a significant increase in the take-up rate for its financing options, contributing substantially to overall profitability. This synergy ensures that as Bilia sells more cars, it also sells more associated services, reinforcing the Star status.

- High Growth in Financing Uptake: Bilia's financing solutions saw a notable surge in customer adoption throughout 2024, mirroring the company's overall sales performance.

- Enhanced Customer Retention: The availability of comprehensive insurance packages, bundled with vehicle purchases, has demonstrably improved customer loyalty and repeat business.

- Market Share Expansion Potential: As a high-growth segment, Bilia's financing and insurance services are well-positioned to capture a larger share of the automotive financial services market.

- Strategic Integration Benefits: Tying these services directly to vehicle sales creates a powerful cross-selling opportunity, driving both revenue streams and customer satisfaction.

Bilia's service business in Norway and Western Europe, alongside its strategic expansion into the Volvo Trucks operations and its embrace of new EV brands like XPENG and Polestar, represent key Star segments within the BCG matrix. These areas demonstrate high market growth and Bilia's significant market share, fueled by robust demand and strategic investments. For example, Bilia's service revenue in Nordic operations grew by 10% year-over-year in Q1 2024. The company's financing and insurance services also exhibit strong growth, with a notable increase in financing take-up rates in 2024, reinforcing their Star status.

| Business Segment | Market Growth | Bilia's Market Share | BCG Classification |

|---|---|---|---|

| Service Business (Norway & W. Europe) | High | High | Star |

| Volvo Trucks Operations | High | Growing | Potential Star |

| XPENG & Polestar Sales | High (EV Segment) | Growing | Potential Star |

| Financing & Insurance Services | High | High | Star |

What is included in the product

The Bilia BCG Matrix analyzes Bilia's business units based on market share and growth, guiding investment decisions.

Bilia BCG Matrix provides a clear, visual overview, alleviating the pain of complex strategic analysis.

Cash Cows

Bilia's core service business stands as a robust Cash Cow within its operations. In 2024, this segment was the primary earnings driver, accounting for a substantial 74% of the company's operational earnings. This highlights its consistent profitability and importance to Bilia's overall financial health.

Further underscoring its strength, the service business contributed 64% of earnings in Q2 2025, demonstrating its continued stability and reliability. This segment thrives in a mature market for vehicle maintenance and repair, where Bilia likely holds a significant market share.

The consistent and substantial cash flow generated by the service business provides a stable foundation for Bilia, enabling investments in other areas of the business or distribution to shareholders. Its resilience across economic cycles solidifies its position as a key Cash Cow.

Bilia's sales of established, high-volume traditional car brands like Volvo, BMW, and Toyota represent significant cash cows. These brands are well-recognized and have loyal customer bases, ensuring consistent demand in mature automotive markets. In 2024, the automotive sector continued to see robust demand for these established players, with brands like Toyota and BMW reporting strong sales figures globally, contributing significantly to Bilia's overall revenue stream.

Sales of used fossil-fueled cars continued to show robust demand in 2024, highlighting a mature and stable market. Bilia's significant market share in this segment ensures consistent profitability and reliable cash flow, requiring minimal additional investment to maintain its position. This steady revenue stream acts as a crucial cash cow for the company.

Tyre and Wheel Services/Tyre Hotels

Bilia's tyre and wheel services, including their 'tyre hotel' offerings, represent a classic cash cow within their business portfolio. These services cater to a recurring need for vehicle owners, a segment that is well-established and demonstrates consistent demand, particularly in mature automotive markets.

The predictable nature of tyre replacement and seasonal storage means these operations generate stable revenue streams. For instance, in 2024, the automotive aftermarket services sector, which includes tyre management, continued to show resilience, with many regions reporting steady growth in service revenue despite economic fluctuations. This stability is key to their cash cow status.

Bilia's established network of dealerships and a large existing customer base are significant advantages. This scale likely translates into a substantial market share for their tyre services, ensuring a consistent volume of business. Such dominance in a mature market allows them to efficiently generate profits without requiring significant investment for growth, reinforcing their role as a reliable cash generator.

- Recurring Revenue: Tyre and wheel services, including seasonal storage (tyre hotels), provide a predictable income stream due to the cyclical nature of vehicle maintenance.

- Mature Market: Operating in a well-established market with stable demand allows for consistent customer acquisition and retention.

- Network Advantage: Bilia's extensive dealership network and customer base support a high market share in tyre services, driving volume and profitability.

- Low Investment Needs: As a cash cow, these services typically require minimal reinvestment for growth, allowing capital to be deployed elsewhere in the company.

Car Wash and Fuel Sales in Sweden

Bilia's fuel business, which includes car washes, is a significant contributor to its operational earnings, primarily within Sweden. This segment operates in a mature market, meaning growth is not explosive, but it offers a dependable revenue stream. Bilia's strong market presence and extensive network ensure it maintains a high market share in this stable sector.

- Market Maturity: The Swedish car wash and fuel market is established, offering predictable demand.

- Revenue Stability: Bilia's operations in this segment generate consistent income.

- Market Share: The company holds a strong position, leveraging its existing infrastructure.

- Contribution to Earnings: This business line is a reliable source of profit for Bilia.

Bilia's core service business is a prime example of a cash cow, consistently generating substantial profits. In 2024, this segment was the main engine for operational earnings, contributing a significant 74% of the company's total. This strong performance continued into Q2 2025, where it accounted for 64% of earnings, underscoring its reliable and stable nature in the mature vehicle maintenance market.

The sales of established car brands like Volvo and BMW also function as cash cows for Bilia. These brands benefit from high customer loyalty and consistent demand in mature automotive markets, ensuring steady revenue. In 2024, global sales for brands like BMW remained strong, directly benefiting Bilia's revenue stream.

Furthermore, Bilia's tyre and wheel services, including their popular 'tyre hotel' offerings, represent a classic cash cow. These services tap into recurring customer needs in a well-established market, generating predictable revenue streams. The automotive aftermarket services sector, which includes tyre management, showed resilience in 2024, with many regions reporting steady service revenue growth.

Bilia's fuel and car wash operations, particularly in Sweden, also act as cash cows. While operating in a mature market with limited explosive growth potential, these segments provide a dependable revenue stream due to Bilia's strong market presence and extensive network, securing a high market share.

| Business Segment | 2024 Earnings Contribution (Approx.) | Q2 2025 Earnings Contribution (Approx.) | Cash Cow Characteristics |

|---|---|---|---|

| Core Service Business | 74% | 64% | Mature market, consistent demand, high profitability |

| Sales of Established Brands (e.g., Volvo, BMW) | Significant | Significant | Loyal customer base, consistent demand, mature markets |

| Tyre and Wheel Services | Steady | Steady | Recurring need, predictable revenue, minimal investment |

| Fuel and Car Wash (Sweden) | Reliable | Reliable | Mature market, strong market share, dependable income |

What You See Is What You Get

Bilia BCG Matrix

The BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready tool ready for your strategic planning.

Dogs

Bilia's divestiture of its Mercedes Trucks business in Q2 2025 strongly suggests this segment was a Dog in the BCG matrix. This move aligns with the typical strategy for such underperforming assets, which often drain capital without generating substantial returns. For instance, in 2024, the commercial vehicle segment for many automotive groups saw slower growth compared to passenger vehicles, reflecting broader market trends.

New car sales in Sweden faced significant headwinds in 2024 and the first quarter of 2025. Profitability dipped, and sales volumes lagged behind historical norms, largely attributed to economic uncertainty and elevated interest rates. This challenging environment has led to a reclassification of this segment as a 'Dog' within the BCG matrix.

Despite a recent uptick in order intake, the persistent underperformance and market difficulties in Sweden suggest a low market share and limited growth prospects for new car sales. For instance, preliminary data for Q1 2025 indicated a year-on-year decline in registrations for certain key segments, underscoring the ongoing market pressures.

Within Bilia's used car inventory, specific models of electric vehicles (EVs) might be classified as Dogs in a BCG Matrix. By the close of 2024, demand for used EVs experienced a noticeable downturn. This is partly due to the ongoing price reductions in new electric vehicles, which subsequently exerts downward pressure on the resale values of their pre-owned counterparts.

If Bilia possesses a significant stock of used EVs that are seeing rapid depreciation or are proving challenging to sell at a profit, these particular vehicles could be categorized as Dogs. This classification stems from their potential low market share within Bilia's overall used car offerings and the observed negative growth trend in their segment, exacerbated by the broader market shifts in EV pricing and demand.

Body and Paint Shops in Sweden

Bilia's body and paint shops in Sweden are showing signs of weakness, as evidenced by a decline in demand observed in the second quarter of 2025. This downturn is linked to a ripple effect from reduced new car sales in prior years, coupled with a trend of exporting younger used vehicles, which reduces the pool of cars needing repair services.

If Bilia's presence in this Swedish repair market is relatively small and the overall market itself isn't growing, this segment fits the profile of a 'Dog' in the BCG Matrix. This classification suggests the business unit generates low revenue and has limited growth potential, requiring careful consideration for resource allocation.

- Weaker Demand: Q2 2025 saw a noticeable dip in customer traffic for body and paint services in Sweden.

- Contributing Factors: Lower new car sales in preceding years and the export of younger used cars are key drivers of this reduced demand.

- Market Position: A potentially low market share for Bilia within a stagnant Swedish repair market further solidifies this segment's 'Dog' status.

Underperforming Legacy Dealerships/Facilities

Underperforming legacy dealerships and facilities, though not explicitly categorized, represent a significant challenge within the Bilia BCG Matrix framework. These are essentially the question marks or dogs of the portfolio, characterized by low market share in stagnant or declining local markets. For instance, a dealership in a region experiencing population outflow or a significant economic downturn, and which hasn't adapted its offerings or operational efficiency, would fit this description. Such locations often struggle with both sales volume and service revenue, indicating a need for strategic re-evaluation.

These underperformers are often characterized by outdated infrastructure and a failure to adapt to evolving customer expectations and technological advancements in the automotive sector. For example, a legacy facility that hasn't invested in modern service bays or digital customer interaction tools will naturally lag behind competitors. In 2024, many such dealerships are facing increased pressure as the industry shifts towards electric vehicles and online sales models, making their existing business models unsustainable without significant intervention.

- Low Market Share: These facilities typically hold a small percentage of sales within their local market, often below 5% in mature segments.

- Stagnant Market Growth: The geographic areas they serve are not expanding, with local economic indicators showing minimal or negative growth.

- Operational Inefficiencies: Older facilities may suffer from higher maintenance costs and lower productivity compared to newer, more optimized locations.

- Limited Investment Potential: Due to their weak market position and stagnant environment, attracting further investment for modernization is often unfeasible.

The divestiture of Bilia's Mercedes Trucks business in Q2 2025 signals its classification as a 'Dog' in the BCG matrix, reflecting its underperformance. This aligns with the 2024 trend of slower growth in commercial vehicles compared to passenger cars. Similarly, new car sales in Sweden, facing economic uncertainty and high interest rates in 2024 and Q1 2025, have been reclassified as 'Dogs' due to lagging volumes and profitability.

Specific used electric vehicle (EV) models within Bilia's inventory are also likely 'Dogs' due to a noticeable downturn in used EV demand by the end of 2024. This is driven by new EV price reductions, which negatively impact used EV resale values. If Bilia holds a substantial stock of these depreciating or slow-selling used EVs, they fit the 'Dog' profile with low market share and negative segment growth.

Bilia's Swedish body and paint shops are exhibiting 'Dog' characteristics, with demand declining in Q2 2025. This is a consequence of reduced new car sales and the export of younger used cars, shrinking the repair pool. A potentially low market share in a stagnant Swedish repair market further solidifies this segment's 'Dog' status, indicating low revenue and limited growth prospects.

Underperforming legacy dealerships, often characterized by low market share in stagnant local markets and operational inefficiencies, also fit the 'Dog' category. These facilities, failing to adapt to industry shifts like EVs and online sales, faced increased pressure in 2024, making their existing models unsustainable without significant intervention.

Question Marks

Bilia's strategic integration of new electric vehicle (EV) brands, such as Lynk & Co, positions these models within the "Question Marks" quadrant of the BCG Matrix. The EV market is experiencing robust growth, with global EV sales projected to reach over 16 million units in 2024, a significant increase from previous years.

Despite this market expansion, Lynk & Co, as an emerging brand within Bilia's portfolio, likely holds a relatively small market share. This necessitates substantial investment in marketing, distribution, and product development to gain traction and potentially transition these vehicles into "Stars" in the future.

Bilia's exploration into new mobility solutions, such as early-stage car subscription models, positions these ventures as potential Stars or Question Marks on the BCG matrix. While these innovative offerings tap into a high-growth segment of the automotive market, their current market share within Bilia's overall operations is likely to be minimal. For instance, the car subscription market, while rapidly expanding, still represents a fraction of traditional car sales. In 2024, while specific Bilia figures are proprietary, the broader subscription market in Europe saw significant growth, with some analysts projecting double-digit percentage increases annually.

These nascent mobility services require substantial capital investment for development, marketing, and operational scaling, characteristic of Question Marks. The uncertainty surrounding their long-term market viability and profitability means Bilia must carefully assess the potential returns against the ongoing expenditures. The challenge lies in balancing the need for innovation with the financial resources required to establish a strong foothold in these evolving markets.

Bilia's strategic decision to expand MobiliaCare to service all car brands positions it as a significant growth opportunity. This move aims to capture a larger segment of the automotive aftermarket, moving beyond its traditional brands.

However, this expansion into a broader market means Bilia will likely face established competitors for non-core brands. Consequently, its initial market share in servicing these new brands is expected to be relatively low, characteristic of a 'Question Mark' in the BCG matrix, demanding careful resource allocation and strategic focus to succeed.

Specialized Services for Advanced Vehicle Systems

As vehicles evolve with sophisticated electronics, connectivity, and autonomous driving capabilities, the demand for specialized diagnostic and repair services is growing rapidly. These high-tech systems require advanced tools and highly trained technicians, creating new niche markets within the automotive service industry. Bilia’s strategic focus on developing expertise in these areas, where its current market penetration is still nascent, positions these services as Stars within its business portfolio.

The automotive aftermarket is experiencing a significant shift towards these specialized services. For instance, advanced driver-assistance systems (ADAS) calibration, a key component of autonomous features, is a rapidly expanding segment. Industry projections indicate the global ADAS market could reach over $100 billion by 2028, highlighting the substantial growth potential. Bilia's investment in this domain, aiming to capture a share of this burgeoning market, aligns with the characteristics of a Star in the BCG matrix.

- High Growth Potential: The market for specialized vehicle systems repair, including EV battery diagnostics and ADAS calibration, is experiencing double-digit annual growth rates.

- Developing Market Share: Bilia is investing in advanced training and equipment to build its presence in these new, high-demand service areas.

- Resource Intensive: Establishing leadership in these niches requires significant capital expenditure for specialized tools and ongoing technician education.

- Strategic Investment: Positioning these services as Stars reflects Bilia's commitment to future-proofing its business by capitalizing on technological advancements in the automotive sector.

Small-Scale Acquisitions in Untapped High-Growth Niches

Bilia’s historical success is built on strategic acquisitions, and future small-scale acquisitions in emerging, high-growth niche automotive segments or new geographical areas would represent Question Marks.

These ventures, such as electric vehicle servicing or specialized mobility solutions, demand thorough market analysis and potentially significant upfront investment to establish a foothold and capture market share.

- Emerging Niches: Targeting segments like EV battery diagnostics or autonomous vehicle maintenance offers high growth potential but also carries inherent risks and requires specialized expertise.

- Geographic Expansion: Entering underserved regions necessitates understanding local market dynamics, regulatory landscapes, and consumer preferences, often demanding substantial capital for infrastructure and brand building.

- Investment Needs: Successfully integrating these acquisitions will likely require considerable investment in technology, training, and marketing to compete effectively.

- Bilia's Strategy: Bilia's approach to these Question Marks will be crucial in determining their long-term success in diversifying and expanding their automotive service portfolio.

Question Marks represent Bilia's ventures into new, high-growth markets where the company currently holds a small market share. These are areas requiring significant investment to gain traction and potentially become future Stars.

Examples include the introduction of new electric vehicle brands like Lynk & Co and the expansion of its MobiliaCare service to all car brands. These initiatives are characterized by high market growth but low current market penetration, necessitating strategic resource allocation.

The success of these Question Marks hinges on Bilia's ability to effectively invest in marketing, technology, and talent to capture market share and drive future growth in these evolving automotive segments.

| Bilia's Question Mark Examples | Market Growth Potential | Current Market Share (Estimated) | Investment Needs |

|---|---|---|---|

| Lynk & Co (New EV Brand) | High (Global EV sales projected >16 million in 2024) | Low | Marketing, Distribution, Product Development |

| MobiliaCare (Servicing All Brands) | High (Automotive Aftermarket Expansion) | Low (initially for non-core brands) | Brand Building, Operational Scaling |

| New Mobility Solutions (e.g., Subscriptions) | Very High (Rapidly Expanding Segment) | Minimal | Development, Marketing, Operational Scaling |

| Specialized EV/ADAS Services | Very High (e.g., ADAS market projected >$100 billion by 2028) | Nascent | Advanced Tools, Technician Training |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.