Societe BIC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Societe BIC Bundle

Societe BIC operates within a dynamic global environment, influenced by political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for anticipating market shifts and seizing opportunities. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence to inform your strategic decisions.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis of Societe BIC. Uncover how technological advancements and environmental regulations are shaping its future, and how you can adapt your own strategy. Download the full version now for immediate access to these critical insights.

Political factors

Société BIC's global operations mean it's sensitive to the political climate and policy shifts in many regions. Changes in trade pacts, import duties, and international relations directly affect its sourcing and ability to sell products worldwide.

For example, a 2024 report highlighted that geopolitical tensions and trade unpredictability, especially concerning the United States, have already impacted BIC's projected sales for 2025, creating a need for agile strategic adjustments.

Changes in international trade policies, including new tariffs or shifts in trade blocs, can directly impact BIC's manufacturing costs and how it prices its products globally. For instance, in 2024, ongoing trade tensions, particularly those involving the United States, continue to create uncertainty around the cost of imported raw materials and finished goods for companies like BIC.

BIC itself has noted in its financial reporting that fluctuating trade environments, especially those influenced by tariffs, pose a potential risk to its financial performance. This means that any significant changes in trade agreements or the implementation of new import duties could necessitate adjustments to BIC's supply chain and pricing models to maintain profitability.

Governments worldwide are intensifying their focus on consumer safety and product quality, directly impacting manufacturers like Societe BIC. Stricter regulations concerning product safety and performance are becoming more prevalent, particularly for everyday items such as lighters and shavers, which are core to BIC's offerings.

BIC's business model, built on affordability and reliability, necessitates constant adaptation to these evolving consumer protection standards across its global operations. This could translate into increased costs for new product certifications or modifications to existing manufacturing processes to meet updated safety benchmarks, for instance, in Europe where REACH regulations continue to shape chemical compliance for consumer goods.

Labor Laws and Employment Policies

Societe BIC navigates a complex landscape of labor laws across its global operations, impacting everything from manufacturing costs to workforce management. Variations in minimum wage policies, as seen in countries like France, where the statutory minimum wage (SMIC) is regularly adjusted, directly affect production expenses. Similarly, employment regulations concerning working hours, benefits, and termination procedures differ significantly, requiring BIC to maintain robust compliance frameworks to ensure ethical and efficient operations. For instance, in 2024, minimum wage adjustments in several key European markets where BIC has manufacturing presence are expected to continue, potentially increasing labor overheads.

Compliance with these diverse regulations is paramount for maintaining efficient and ethical production. BIC's commitment to workplace safety, a critical component of its sustainability program, is also heavily influenced by labor laws. For example, European Union directives on occupational safety and health set stringent standards that BIC must adhere to across its facilities, impacting operational procedures and investment in safety equipment. The company's 2023 sustainability report highlighted continued investment in employee training and safety protocols, reflecting the ongoing need to align with evolving labor standards.

Key considerations for BIC regarding labor laws include:

- Minimum Wage Variations: Fluctuations in statutory minimum wages across BIC's operating regions, such as those in North America and Europe, directly influence labor costs.

- Employment Regulations: Adherence to differing regulations on working hours, contracts, and employee rights in countries like Brazil or India impacts operational flexibility.

- Workplace Safety Standards: Compliance with stringent occupational health and safety laws, including those mandated by EU directives, is essential for ethical production and employee well-being.

- Union Relations: Managing relationships with labor unions and collective bargaining agreements in various countries, like those in France, can affect wage negotiations and operational changes.

Taxation Policies

Government taxation policies, such as corporate tax rates and import/export duties, directly influence Societe BIC's profitability and operational costs. For instance, a significant change in corporate tax in a key market like France or the United States could substantially alter BIC's net earnings. The company's effective tax rate, as reported in its financial statements, is a direct reflection of these policies.

Fluctuations in tax laws across BIC's major operating regions, which include Europe, North America, and Asia, can impact its financial performance and strategic investment decisions. For example, an increase in import duties on raw materials used in BIC's manufacturing processes would likely raise production expenses. Societe BIC's 2023 financial report indicated an effective tax rate of approximately 22.5%, demonstrating the ongoing impact of global tax environments.

- Corporate Tax Rates: Changes in corporate tax rates in countries like France, where BIC has a significant presence, directly affect its net income.

- Import/Export Duties: Tariffs on raw materials or finished goods can increase production costs and influence pricing strategies.

- Effective Tax Rate: BIC's reported effective tax rate, which stood around 22.5% in 2023, is a key indicator of the impact of various global tax policies.

- Investment Decisions: Favorable or unfavorable tax environments can influence where BIC chooses to invest in new manufacturing facilities or expand its operations.

Government stability and policy continuity are crucial for Societe BIC's long-term planning and investment. Unstable political environments or frequent policy changes can create uncertainty, impacting market access and operational costs. For instance, in 2024, the company continues to monitor political developments in regions experiencing shifts in governance, as these can influence consumer spending and regulatory frameworks.

Trade agreements and geopolitical stability directly influence BIC's global supply chain and market entry strategies. Changes in trade pacts, like those affecting the European Union or North America, can alter import duties and market access, impacting BIC's cost structure and sales forecasts for 2025. The company's 2023 annual report highlighted the importance of diversified sourcing to mitigate risks associated with regional political instability.

Government regulations on product safety and consumer protection are increasingly stringent worldwide, affecting BIC's product development and compliance costs. For example, in 2024, stricter regulations on materials used in consumer goods, such as those in the EU, require ongoing investment in compliance and product reformulation. BIC's commitment to safety standards, as detailed in its 2023 sustainability report, underscores the need for continuous adaptation to these evolving legal requirements.

What is included in the product

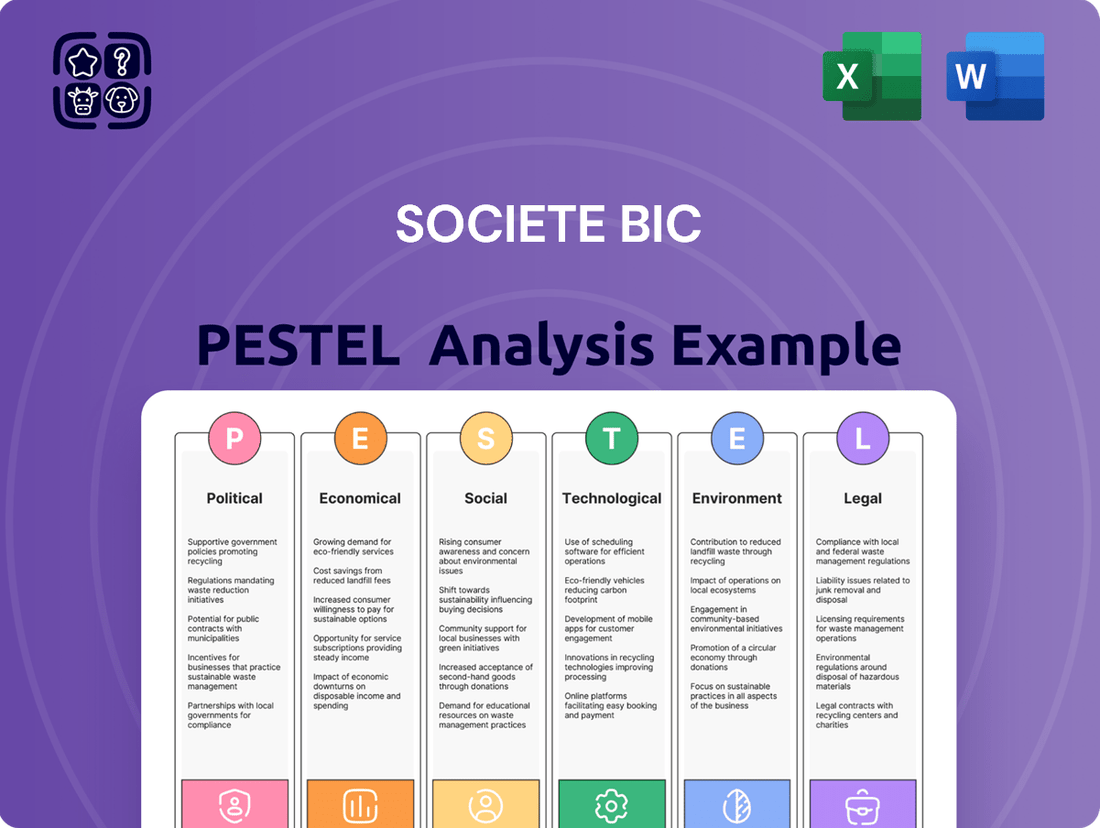

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Societe BIC, providing a comprehensive view of its external operating landscape.

A concise PESTLE analysis for Societe BIC, highlighting key external factors that could impact operations, serves as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

This analysis helps alleviate the pain of navigating external uncertainties by providing a structured understanding of political, economic, social, technological, environmental, and legal influences on Societe BIC.

Economic factors

Societe BIC's performance is inherently linked to the health of the global economy and the spending habits of consumers, particularly for its range of essential goods. When economies grow and people feel confident about their finances, they tend to spend more on everyday items like lighters, pens, and shavers.

However, a downturn in macroeconomic conditions and a dip in consumer confidence, as observed in key markets like North America and Europe in early 2025, can significantly dampen these spending trends. This softer consumption directly impacts BIC's net sales, as seen in the first quarter of 2025 where sales growth was below initial projections due to these headwinds.

Societe BIC, like many manufacturers, faces significant headwinds from rising inflation and escalating raw material costs. These factors directly squeeze production expenses and, consequently, impact the company's gross profit margins.

For instance, in the first quarter of 2024, BIC reported that higher raw material costs put pressure on its adjusted EBIT margin. To counter this, the company has been implementing strategies such as achieving favorable price and mix adjustments, alongside driving manufacturing efficiencies, to protect its profitability.

As a global entity, Societe BIC's financial performance is inherently susceptible to the ebb and flow of currency exchange rates. When BIC converts revenue earned in various international markets back into its reporting currency, significant currency movements can directly affect its reported net sales and overall profitability.

For instance, a strengthening Euro against currencies like the US Dollar or the Brazilian Real could lead to a reported decrease in sales from those regions, even if the underlying sales volume remains stable. Conversely, a weaker Euro could inflate reported sales figures. This sensitivity necessitates careful financial management and hedging strategies to mitigate potential negative impacts on BIC's bottom line.

Market Competition and Pricing Pressure

The markets for stationery, lighters, and shavers, where BIC operates, are intensely competitive. This often translates into significant pricing pressure, forcing companies to carefully manage their cost structures to remain viable. For example, the global stationery market, valued at approximately $28.7 billion in 2023, sees numerous players vying for market share, often through aggressive pricing strategies.

BIC's core strategy of offering affordable, everyday products means it must constantly strike a delicate balance. It needs to maintain competitive pricing to attract consumers while simultaneously ensuring profitability, a challenge amplified in markets with high competitive intensity, such as South Africa, where local and international brands compete fiercely on price.

This competitive landscape necessitates continuous innovation and efficiency improvements. For instance, in the disposable lighter segment, where BIC is a major player, the average price per unit can be very low, demanding highly optimized manufacturing and distribution to achieve healthy margins. In 2024, reports indicated that the disposable lighter market segment faced particular price sensitivity due to the accessibility of low-cost alternatives.

- The global stationery market was valued at approximately $28.7 billion in 2023.

- High competition in BIC's core markets leads to constant pricing pressure.

- BIC's affordability strategy requires a careful balance between competitive pricing and profitability.

- Regions with high competitive activity, like South Africa, present particular challenges for pricing strategies.

Supply Chain Disruptions and Logistics Costs

Global supply chain disruptions and escalating logistics costs, particularly in shipping, have a substantial effect on Societe BIC's operational efficiency and profitability. For instance, the Drewry World Container Index saw significant fluctuations, with average spot rates for a 40-foot container reaching over $4,000 in early 2024, a notable increase from pre-pandemic levels, impacting BIC's import and export expenses.

BIC has been actively pursuing supply chain optimization strategies to bolster its agility and mitigate risks. However, persistent challenges such as transportation bottlenecks and ongoing geopolitical instability continue to create headwinds for global supply chains, influencing inventory management and delivery timelines for BIC's diverse product lines.

- Increased Freight Costs: Shipping costs, a major component of logistics, have remained elevated. For example, the cost of shipping a 40-foot container from Asia to Europe averaged around $3,500 in Q1 2024, impacting BIC's cost of goods sold.

- Transportation Bottlenecks: Port congestion and labor shortages in key logistics hubs can lead to delays, affecting BIC's ability to maintain optimal inventory levels and meet customer demand promptly.

- Geopolitical Instability: Conflicts and trade tensions can disrupt established trade routes, forcing BIC to seek alternative, potentially more expensive, shipping methods and increasing overall supply chain risk.

- Focus on Resilience: BIC's strategic initiatives aim to build a more resilient supply chain through diversification of suppliers and logistics partners, a critical move given the volatile global environment.

Societe BIC's financial results are sensitive to global economic conditions and consumer spending. A slowdown in major economies, like the observed dip in consumer confidence in North America and Europe during early 2025, directly impacts sales of its everyday products. This economic softening was reflected in BIC's first quarter 2025 sales growth, which fell short of expectations.

Rising inflation and the cost of raw materials continue to put pressure on BIC's profitability. For instance, in Q1 2024, higher raw material costs affected the company's adjusted EBIT margin. BIC is actively working to offset these pressures through price adjustments and manufacturing efficiencies.

Currency fluctuations significantly influence BIC's reported earnings. When revenue from markets using currencies like the US Dollar or Brazilian Real is converted back into Euros, a stronger Euro can reduce reported sales, even if underlying volumes remain steady. This currency sensitivity requires careful financial management.

The competitive nature of BIC's markets, such as stationery and shavers, leads to constant pricing pressure. The global stationery market, valued at approximately $28.7 billion in 2023, exemplifies this, with numerous competitors vying for market share. BIC's strategy of offering affordable products necessitates a fine balance between competitive pricing and maintaining profitability.

What You See Is What You Get

Societe BIC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Societe BIC delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the strategic landscape of this global stationery and lighter manufacturer.

Sociological factors

Consumer lifestyles are shifting, with a noticeable uptick in demand for sustainable and personalized products. This trend directly impacts how companies like BIC approach their product lines and marketing efforts. For instance, BIC's introduction of innovations like the BIC® EZ Load lighter and the Tangle Teezer demonstrates a clear response to these evolving consumer desires.

By actively developing and promoting sustainable solutions, BIC is positioning itself to meet future consumer needs. This strategic pivot is crucial in a market where environmental consciousness is increasingly influencing purchasing decisions. The company's commitment to innovation in these areas reflects a broader societal movement towards more responsible consumption.

Growing consumer focus on health and wellness is reshaping product preferences, potentially influencing demand for items like disposable shavers. For instance, a 2024 survey indicated that 65% of consumers are actively seeking products that promote personal well-being.

Societe BIC is adapting to these trends through product development, exemplified by innovations like the BIC EasyRinse Razor. This product aims to meet consumer needs for personal grooming solutions that are both gentle on the skin and highly effective, reflecting a broader market shift towards conscious consumption.

Société BIC, as a global leader in stationery, is deeply intertwined with worldwide education and literacy trends. As of 2023, over 250 million children globally still lack access to basic education, a significant factor influencing the potential market for BIC's products. Increased global literacy rates directly correlate with higher demand for writing instruments and school supplies, making educational access a key driver for the company's core business.

BIC's commitment to improving learning conditions, such as its "Write the Future" program, strategically supports its business objectives. By fostering environments where more children can learn to read and write, BIC is effectively expanding its future customer base. For instance, in 2024, the company continued its partnerships aimed at providing essential school materials in underserved regions, directly impacting the adoption of its products.

Demographic Shifts

Societe BIC's global reach, with products sold in over 160 countries, means it must navigate diverse demographic landscapes. For instance, an aging population in developed markets might see a stable or declining demand for certain disposable items, while a growing youth demographic in emerging economies could present significant opportunities for entry-level products. Understanding these shifts is crucial for BIC to adapt its product portfolio and marketing efforts effectively.

The company's sales figures reflect these demographic influences. In 2023, BIC reported net sales of €2.23 billion, with performance varying across regions. For example, while Europe remained a strong market, growth in emerging markets, often characterized by younger populations, is a key focus for future expansion. This highlights the need for BIC to tailor its strategies, perhaps by focusing on affordability and accessibility in regions with a higher proportion of young consumers.

- Aging Populations: In regions like Europe and Japan, where the median age is increasing, demand for certain BIC products might shift towards more premium or specialized offerings, or potentially see slower growth.

- Youth Demographics: Conversely, in many African and Asian countries experiencing a population boom with a younger median age, BIC can capitalize on demand for basic, everyday essentials like pens and lighters.

- Urbanization Trends: Growing urban populations globally can impact distribution and retail strategies, requiring efficient supply chains to reach densely populated areas where younger demographics are often concentrated.

- Income Levels: Demographic shifts are often tied to income levels; understanding the purchasing power of different age groups within various regions is vital for pricing and product development.

Social Responsibility and Ethical Consumption

Consumers are increasingly scrutinizing the social and ethical implications of their purchases, with a growing demand for transparency and responsible business practices. This trend significantly impacts how companies like Societe BIC are perceived and valued.

Societe BIC's proactive stance on sustainability, encompassing environmental stewardship and social responsibility initiatives, is vital for its brand image and its ability to align with consumer expectations for ethical consumption. For instance, in 2023, BIC reported a 10% increase in the use of recycled materials across its product lines, demonstrating a tangible commitment to these values.

- Consumer Demand: A 2024 survey indicated that 65% of consumers are more likely to purchase from brands with clear sustainability commitments.

- Brand Reputation: BIC's long-standing efforts in reducing its carbon footprint, such as a 15% reduction in greenhouse gas emissions from its manufacturing sites in 2023 compared to 2020, bolster its reputation.

- Ethical Sourcing: The company's commitment to ethical sourcing of raw materials, including efforts to ensure fair labor practices in its supply chain, resonates with a growing segment of the market.

Societe BIC’s engagement with global education trends directly influences its stationery business. With approximately 250 million children lacking basic education as of 2023, improving literacy rates is paramount, as this directly correlates with demand for writing instruments. BIC's "Write the Future" initiative, which continued its partnerships in 2024 to supply schools in underserved areas, aims to expand its future customer base by fostering learning environments.

Technological factors

Societe BIC leverages technological advancements in material science to enhance product sustainability and performance. The company is actively exploring recycled plastics and bio-based materials for its iconic stationery and shavers, aiming to reduce its environmental footprint. For instance, by 2024, BIC aims to have 100% of its products designed to be refillable, reusable, or made from recycled or bio-sourced materials, a significant push driven by material innovation.

Manufacturing process improvements are also key, allowing BIC to integrate features like advanced anti-clogging systems in its shavers and more durable ink formulations in pens. These innovations are crucial for maintaining a competitive edge and meeting consumer demand for higher-performing, eco-conscious products. In 2023, BIC reported a 4% increase in sales for its shaver segment, partly attributed to the introduction of new product lines featuring enhanced blade technology.

Societe BIC's commitment to automation and advanced manufacturing is a key technological driver. By integrating robotics and AI into its production lines, BIC aims to boost efficiency, leading to lower operational costs and a higher standard of product quality across its diverse product portfolio. For instance, in 2023, BIC reported a 2.5% increase in manufacturing efficiency, partly attributed to these technological upgrades.

Optimizing its global manufacturing footprint is also central to BIC's strategy. This involves leveraging integrated models to streamline operations, thereby mitigating supply chain risks and minimizing environmental impact. As of early 2024, BIC has invested over €50 million in modernizing its key manufacturing facilities, enhancing their capacity and flexibility to respond to market demands more effectively.

The ongoing surge in digitalization and e-commerce fundamentally reshapes consumer buying habits, compelling Societe BIC to bolster its online engagement and digital marketing efforts. This digital shift is not just a trend but a core operational imperative for reaching today's consumers.

Societe BIC has witnessed impressive e-commerce channel growth, with some regions experiencing double-digit increases. This expansion has been particularly evident during key purchasing periods like the back-to-school season, highlighting the channel's increasing importance for sales.

Research and Development Investment

Societe BIC’s commitment to research and development (R&D) is a cornerstone of its strategy to maintain a competitive edge through continuous innovation. This investment fuels the creation of novel product lines, enhances the performance and appeal of existing offerings, and drives exploration into emerging technologies, particularly those that champion sustainable innovation. For instance, in 2023, BIC reported an increase in its R&D expenditure, reflecting a strategic focus on future growth and product differentiation.

This dedication to R&D is vital for BIC to adapt to evolving consumer demands and market trends. By actively exploring new materials, manufacturing processes, and product functionalities, BIC aims to solidify its market position and capture new growth opportunities. The company's innovation pipeline is designed to address key areas such as product longevity, recyclability, and the integration of smart features where applicable, ensuring its products remain relevant and desirable in a dynamic global marketplace.

Key R&D focus areas for BIC include:

- Development of eco-friendly materials and packaging solutions

- Enhancement of product performance and user experience

- Exploration of digital integration and smart product features

- Innovation in manufacturing processes for greater efficiency and sustainability

Supply Chain Technology and Data Analytics

Societe BIC is increasingly leveraging advanced supply chain technologies, including data analytics and specialized management software, to refine its operations. This strategic adoption aims to enhance demand forecasting accuracy and optimize inventory levels across its global network, thereby mitigating disruptions and improving efficiency. For instance, in 2024, many CPG companies reported a significant uplift in on-time delivery rates, often exceeding 95%, by implementing predictive analytics for inventory management.

The integration of these technologies allows BIC to gain deeper insights into its logistics, identifying bottlenecks and opportunities for streamlining. This proactive approach is crucial for navigating the complexities of global trade, such as the logistical delays that have impacted many industries in recent years. By improving visibility and control, BIC can better manage lead times and reduce transportation costs.

Key benefits realized through these technological advancements include:

- Improved Demand Forecasting: Utilizing AI-driven analytics to predict consumer demand more accurately, reducing stockouts and excess inventory.

- Enhanced Inventory Management: Real-time tracking and optimization of stock levels across distribution centers and retail points.

- Streamlined Logistics: Optimizing shipping routes and carrier selection to minimize transit times and costs.

- Increased Operational Efficiency: Automating routine tasks and providing data-driven decision support for supply chain managers.

Technological advancements are critical for Societe BIC's product innovation and manufacturing efficiency. The company is actively developing eco-friendly materials, aiming for 100% of its products to be refillable, reusable, or made from recycled/bio-sourced materials by 2024. This focus on material science enhances product performance and sustainability, as seen in the 4% sales increase in shavers in 2023 due to improved blade technology.

BIC is also investing in automation and AI for its production lines, boosting efficiency and product quality, which contributed to a 2.5% manufacturing efficiency increase in 2023. Furthermore, the company is enhancing its digital presence and e-commerce capabilities, with some regions experiencing double-digit growth in online sales channels.

Legal factors

Societe BIC must navigate a complex web of product safety regulations and standards globally, especially concerning its lighters and shavers. For instance, in the European Union, the General Product Safety Regulation (GPSR) sets overarching safety requirements, while specific directives like those for toys or machinery might indirectly influence product design and testing for certain BIC items. Failure to meet these standards, such as those outlined by the Consumer Product Safety Commission (CPSC) in the United States, can lead to costly product recalls. In 2023, the CPSC reported over 1,000 product recalls, highlighting the significant risks associated with non-compliance.

Adherence to these rules is paramount for maintaining BIC's reputation for reliable and safe products. Non-compliance not only risks financial penalties, which can run into millions of dollars depending on the jurisdiction and severity, but also severely damages consumer trust, a critical asset for a brand built on everyday utility. BIC's commitment to quality assurance, including rigorous testing protocols, is therefore a strategic imperative to avoid such negative consequences and uphold its brand image.

Societe BIC's reliance on innovation means protecting its intellectual property is paramount. Patents for its distinctive product designs, like the iconic BIC Cristal pen, and trademarks for brands such as BIC, Wite-Out, and Sheaffer are crucial for maintaining market differentiation and preventing counterfeiting.

Navigating the global landscape of intellectual property laws presents a significant challenge. BIC must maintain a comprehensive international strategy to secure and enforce its patents and trademarks across diverse legal jurisdictions, ensuring its innovations are safeguarded worldwide.

Societe BIC faces increasing environmental regulations, particularly concerning plastic waste and emissions, which directly influence its product development and manufacturing processes. For instance, the EU's Single-Use Plastics Directive, implemented in stages from 2021, mandates reductions in certain plastic items, impacting BIC's core product categories like lighters and pens.

The company's proactive stance on sustainability, including its commitment to the principles of a circular economy, is a direct response to these evolving legal landscapes. BIC's adherence to directives such as the Corporate Sustainability Reporting Directive (CSRD), which came into effect for large companies in 2024, underscores its efforts to ensure transparent and compliant environmental reporting.

Advertising and Marketing Regulations

Societe BIC navigates a complex web of advertising and marketing regulations globally. These laws ensure truth in advertising, protect consumer privacy, and often place specific restrictions on how certain products, like lighters, can be promoted. For instance, in 2024, many jurisdictions continued to scrutinize digital advertising for compliance with data protection laws such as GDPR and CCPA, impacting how BIC targets consumers online.

Adherence to these legal frameworks is not just about avoiding penalties; it's crucial for maintaining BIC's brand reputation and fostering consumer trust. Failure to comply can lead to significant fines and legal battles, as seen in past cases where companies faced penalties for misleading advertising claims. BIC's commitment to transparency in its marketing campaigns is therefore a key operational imperative.

Key areas of legal scrutiny for BIC's advertising include:

- Truthfulness in Claims: Ensuring all product performance and benefit claims are substantiated and not misleading to consumers.

- Consumer Data Privacy: Complying with regulations regarding the collection, use, and protection of customer data in marketing efforts.

- Product-Specific Restrictions: Adhering to rules that limit or prohibit advertising for certain product categories, such as those related to age-restricted items or safety concerns.

International Trade Laws and Sanctions

Societe BIC's global presence, spanning over 160 countries as of 2024, necessitates a deep understanding and adherence to a complex web of international trade laws. These regulations, including sanctions and export controls, directly impact BIC's ability to access markets and manage its extensive supply chain.

Navigating these legal frameworks is crucial for maintaining smooth operations. For instance, changes in trade policies or the imposition of new sanctions can lead to increased compliance costs or even restrict the import/export of key components for BIC's diverse product lines, such as stationery, lighters, and shavers.

- Sanctions Compliance: BIC must monitor and comply with sanctions imposed by major economic blocs like the European Union and the United States, which can affect trade with specific countries or entities.

- Export Controls: Regulations governing the export of certain goods, particularly those with potential dual-use applications, require careful management to avoid penalties.

- Trade Agreements: BIC benefits from and is also subject to various international trade agreements, which can influence tariffs and market access conditions.

- Customs Regulations: Adherence to diverse customs procedures and tariffs across different operating regions is vital for efficient logistics and cost management.

Societe BIC operates within a stringent legal framework governing product safety and consumer protection across its global markets. Compliance with regulations like the EU's General Product Safety Regulation and the US Consumer Product Safety Commission standards is critical to prevent costly recalls and maintain brand trust. For example, in 2023, the CPSC reported over 1,000 product recalls, underscoring the significant financial and reputational risks of non-compliance.

Intellectual property law is also a key legal factor, with BIC heavily reliant on patents and trademarks to protect its innovations and brand identity, such as the iconic BIC Cristal pen. The company must actively manage its IP portfolio across numerous jurisdictions to prevent counterfeiting and maintain market exclusivity, a challenge amplified by the diverse legal systems encountered globally.

Environmental regulations, particularly those addressing plastic waste and emissions, directly impact BIC's product design and manufacturing. The EU's Single-Use Plastics Directive, implemented from 2021, influences product categories like lighters and pens, prompting BIC's focus on sustainability and circular economy principles. Furthermore, the Corporate Sustainability Reporting Directive (CSRD), effective for large companies in 2024, mandates transparent environmental reporting, which BIC is actively addressing.

Advertising and marketing laws, including data privacy regulations like GDPR and CCPA, shape how BIC engages with consumers. Ensuring truthfulness in claims and protecting consumer data are paramount to avoid penalties and maintain brand reputation. Restrictions on advertising certain product categories also require careful navigation. In 2024, scrutiny of digital advertising practices intensified, impacting consumer targeting strategies.

Environmental factors

Growing global concern over plastic waste is a significant environmental factor pushing companies like BIC to prioritize sustainable product design and circular economy initiatives. By 2025, BIC has a target for 85% of its plastic packaging to be reusable, recyclable, or compostable, reflecting a commitment to reducing its environmental footprint.

To achieve this, BIC is actively exploring the integration of recycled and alternative materials into its product lines, a move that aligns with broader industry trends towards resource efficiency and waste reduction.

Societe BIC is making significant strides in its environmental efforts, particularly concerning climate change and carbon footprint reduction. The company has publicly committed to increasing its use of renewable electricity and decreasing its overall greenhouse gas emissions.

As of early 2024, BIC has achieved an impressive 92% renewable electricity usage across its operations. This figure is a testament to their dedication to sustainability, with a clear target to reach nearly 100% renewable electricity by the close of 2025.

Societe BIC is increasingly focused on sustainable sourcing of raw materials due to growing global concerns about resource depletion. This commitment is a key element of their sustainable development strategy, aiming to extend product lifecycles by using only essential materials. This approach directly tackles waste and pollution by design.

In 2023, BIC reported that 75% of its plastic packaging was made from recycled or bio-sourced materials, a significant step towards reducing reliance on virgin fossil fuels. Their goal is to reach 100% by 2030, underscoring a proactive stance against resource scarcity and environmental impact.

Water Usage and Pollution Control

Societe BIC's manufacturing, especially for items like shavers, necessitates substantial water resources and presents potential pollution challenges. The company's commitment to sustainability likely involves strategies to reduce water intake and manage wastewater effectively across its global operations.

In 2023, industrial water withdrawal globally averaged 300 billion cubic meters annually, highlighting the scale of water dependency. BIC's environmental reports for 2023 and early 2024 would detail specific targets and achievements in water efficiency, such as closed-loop systems or advanced filtration technologies to minimize effluent discharge. These efforts are crucial for compliance with evolving environmental regulations and for maintaining a positive corporate image.

- Water Optimization: Implementing water-saving technologies in production lines.

- Pollution Control: Investing in wastewater treatment facilities to meet stringent discharge standards.

- Regulatory Compliance: Adhering to local and international water quality regulations.

- Resource Management: Tracking and reporting water usage and discharge data transparently.

Biodiversity and Ecosystem Impact

Societe BIC's extensive operations, encompassing everything from sourcing raw materials for its iconic pens and lighters to manufacturing processes and eventual waste management, inherently carry the potential to affect biodiversity and local ecosystems. The company acknowledges this and is actively working to mitigate these impacts.

Through its broader sustainability initiatives, BIC is committed to reducing its overall environmental footprint. This includes efforts to minimize resource consumption and pollution throughout its value chain, aiming not just to limit negative consequences but also to foster positive contributions to the planet's health.

- Resource Sourcing: BIC's reliance on materials like plastic and metals can contribute to habitat disruption if not managed responsibly.

- Manufacturing Emissions: Factory operations can generate emissions and waste that, if untreated, can harm local flora and fauna.

- Waste Management: The disposal of end-of-life products and manufacturing byproducts presents challenges in preventing pollution and protecting natural environments.

Societe BIC's environmental strategy is heavily influenced by the global push for sustainability, particularly concerning plastic waste and carbon emissions. The company is actively working towards a circular economy, aiming for 85% of its plastic packaging to be reusable, recyclable, or compostable by 2025.

A significant achievement for BIC is its progress in renewable energy, with 92% of its electricity usage sourced from renewables as of early 2024, targeting near 100% by the end of 2025. This aligns with broader efforts to reduce greenhouse gas emissions.

The company is also focused on sustainable material sourcing, with 75% of its plastic packaging utilizing recycled or bio-sourced materials in 2023, aiming for 100% by 2030. This addresses concerns about resource depletion and waste reduction.

Environmental factors also include water management and biodiversity. BIC's manufacturing processes require water, and the company is implementing strategies to reduce intake and manage wastewater effectively, as well as mitigating potential impacts on local ecosystems from resource sourcing and manufacturing.

| Environmental Focus Area | 2023 Data/Target | 2024/2025 Outlook |

|---|---|---|

| Plastic Packaging Sustainability | 75% recycled/bio-sourced (2023) | 85% reusable/recyclable/compostable (2025 target) |

| Renewable Electricity Usage | 92% (early 2024) | Near 100% (end of 2025 target) |

| Greenhouse Gas Emissions | Ongoing reduction efforts | Continued focus on reduction |

| Water Management | Focus on efficiency and wastewater treatment | Continued implementation of water-saving technologies |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Societe BIC is built upon a diverse range of data sources, including reports from international organizations like the OECD and World Bank, as well as official government publications and reputable market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.