Societe BIC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Societe BIC Bundle

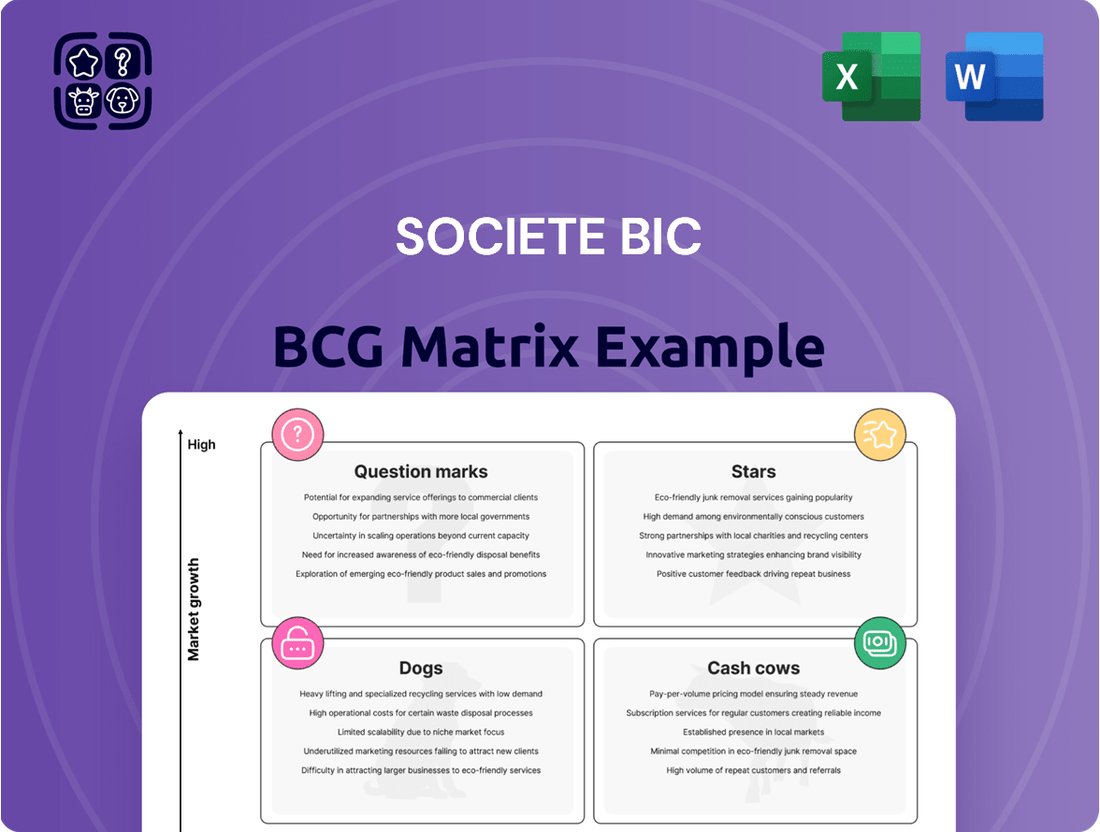

Societe BIC's product portfolio is a fascinating case study in strategic management. Understanding where its iconic lighters, pens, and shavers fall within the BCG Matrix—whether they are Stars, Cash Cows, Dogs, or Question Marks—is crucial for any business strategist. This preview offers a glimpse into their market positioning, but to truly unlock the strategic advantage, you need the full picture.

Dive deeper into Societe BIC's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tangle Teezer, acquired in December 2024, is positioned as a Star in the BCG Matrix for Societe BIC. This market-leading, fast-growing, and profitable detangling haircare company significantly boosted BIC's Blade Excellence division's sales in Q1 2025. Its strong performance is attributed to expanded distribution, especially in e-commerce and modern mass market channels across the US and Europe.

The BIC EZ Reach lighters are a star in Societe BIC's portfolio, particularly shining in Europe with robust double-digit growth in the first quarter of 2025. This impressive performance stems from excellent sales strategies across various markets and memorable advertising efforts.

A key driver of their success includes high-profile collaborations, such as the widely recognized campaign featuring Snoop Dogg and Martha Stewart in North America. This strategic marketing has significantly boosted brand visibility and consumer engagement, reinforcing the product's market leadership.

BIC Flex 5 Disposable and Refillable Shavers are performing exceptionally well in the men's grooming market. The company has seen a significant increase in market share, especially in North America. This growth is largely attributed to the excellent value BIC offers, combined with its expanding presence in major retail outlets.

The success of the BIC Flex 5 line, including innovative options like the Hybrid Flex range, highlights BIC's commitment to product development. These advancements, coupled with the appealing price point of products like the BIC Flex 5, have solidified its strong position and contributed to its robust sales performance in 2024.

Value-added Lighters (e.g., Djeep, EZ Load)

Societe BIC's strategy for its lighters involves strengthening its market standing through acquisitions of premium brands like Djeep and offering greater customization for its existing product lines. This approach aims to capture a larger share of the market by appealing to consumers seeking both quality and personalization.

Djeep premium lighters have demonstrated significant traction, notably doubling their net sales in France. This impressive growth indicates a strong consumer preference for the brand's elevated offering. The recent introduction of the EZ Load refillable utility lighter has also seen a positive reception in several international markets, suggesting potential for further expansion.

The company's focus on these value-added lighters aligns with a broader trend of consumers seeking more than just basic functionality. BIC's investment in brands like Djeep and innovative products like EZ Load positions them to capitalize on this evolving consumer demand.

- Djeep's Growth: Doubled net sales in France, indicating strong market acceptance of premium offerings.

- EZ Load Launch: Successful initial rollout in select countries for the new refillable utility lighter.

- Strategic Focus: Augmenting market position through quality brand acquisition and product personalization.

BIC's Premium Shaver Offerings (e.g., BIC Soleil Escape)

BIC's premium shaver lines, like the Soleil Escape, are positioned as stars in the BCG matrix, demonstrating strong growth and high market share. These offerings cater to consumers seeking enhanced shaving experiences and value-added features.

In Europe, BIC saw particularly strong performance in Q1 2025 with its value-added shavers. Products such as BIC Soleil Bella and Miss Soleil Sensitive were highlighted as top performers, indicating robust consumer demand for these premium options.

Further solidifying its star status, BIC Soleil Escape launched a limited-edition 5 Senses Shave Kit in May 2024. This initiative tapped into the growing self-care trend, promoting indulgent shaving as a personal wellness ritual.

- Strong European Performance: BIC's value-added shavers, including Soleil Bella and Miss Soleil Sensitive, were top performers in Europe during Q1 2025.

- Market Trend Alignment: The launch of the BIC Soleil Escape 5 Senses Shave Kit in May 2024 capitalized on the self-care and indulgent experience market.

- Premium Positioning: These premium offerings contribute significantly to BIC's market share in the shaving category, reflecting their star status.

Societe BIC's "Stars" in the BCG Matrix represent products with high market share in fast-growing industries. These are key growth drivers for the company, demanding significant investment to maintain their leading positions and capitalize on future opportunities. The BIC EZ Reach lighters, for example, experienced robust double-digit growth in Europe during Q1 2025, boosted by effective marketing campaigns like the Snoop Dogg and Martha Stewart collaboration.

The acquisition of Tangle Teezer in December 2024 has significantly strengthened BIC's Blade Excellence division, with the brand immediately becoming a Star. This is due to its market leadership and rapid expansion, particularly in e-commerce and modern retail channels across the US and Europe, which contributed to a sales boost in Q1 2025.

BIC's premium shaver lines, such as the Soleil Escape and its associated 5 Senses Shave Kit launched in May 2024, are also classified as Stars. Products like the BIC Flex 5 Disposable and Refillable Shavers have seen increased market share, especially in North America, driven by strong value propositions and expanded retail presence. The successful Q1 2025 performance of value-added shavers like Soleil Bella and Miss Soleil Sensitive in Europe further solidifies their Star status.

| Product Category | Specific Product | Market Position | Growth Driver | Key Performance Indicator (Q1 2025) |

|---|---|---|---|---|

| Lighters | BIC EZ Reach | Star | Effective marketing, double-digit growth in Europe | Robust double-digit growth in Europe |

| Shaving | Tangle Teezer | Star | Market leadership, expanded distribution | Boosted Blade Excellence division sales |

| Shaving | BIC Flex 5 (Disposable & Refillable) | Star | Value proposition, expanded retail presence | Increased market share in North America |

| Shaving | BIC Soleil Escape / Soleil Bella / Miss Soleil Sensitive | Star | Premium features, self-care trend alignment | Top performers in Europe |

What is included in the product

Highlights which BIC product units to invest in, hold, or divest based on market share and growth.

The Societe BIC BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex market analysis.

Cash Cows

BIC Pocket Lighters, excluding the EZ Reach line, are a classic example of a Cash Cow for Societe BIC. The brand holds a dominant global position, boasting around 55% market share outside of Asia, and even higher in key regions like North America where it exceeds 70%.

This substantial market share in a mature product category translates into consistent and significant cash flow generation. With a well-established brand and product, BIC Pocket Lighters require relatively minimal investment in marketing and promotion to maintain their sales volume, allowing them to be a reliable source of funds for the company.

The BIC Cristal pen is a classic cash cow for Societe BIC. Its iconic status and widespread use have cemented its leading position in the ballpoint pen market. For instance, in 2024, it maintained a significant 62% market share in Brazil, a testament to its enduring appeal and consistent demand.

Despite a general slowdown in the broader ball pen market, the sheer volume of BIC Cristal pens sold globally continues to generate substantial, reliable cash flow for the company. This consistent revenue stream is crucial for funding other ventures within Societe BIC's portfolio.

BIC's one-piece shavers are a classic example of a Cash Cow within the BCG Matrix. The company holds a strong second position globally in this segment, commanding an impressive market share of roughly 24%.

These shavers are a consistent revenue generator for BIC, primarily due to their widespread appeal as affordable and dependable options. The sheer volume is staggering, with BIC manufacturing billions of shavers and blades each year to satisfy consistent consumer demand, underscoring their stable, high-volume sales.

BIC Correction Products (e.g., Tipp-Ex, Wite-Out)

Societe BIC's correction products, like Tipp-Ex and Wite-Out, are classic examples of Cash Cows in their BCG Matrix. They command the number one market share, a testament to their enduring brand strength and widespread adoption in offices and schools.

These products are reliable generators of substantial, consistent cash flow. While the correction fluid market itself isn't experiencing rapid growth, the essential nature of these items and BIC's dominant position ensure steady demand and profitability.

- Market Dominance: BIC is the undisputed leader in the correction products category.

- Stable Cash Flow: Despite low market growth, consistent demand fuels reliable cash generation.

- Brand Recognition: Decades of consumer trust in brands like Tipp-Ex contribute to sustained sales.

- Profitability: These mature products are highly profitable, contributing significantly to BIC's overall financial health.

BIC Mechanical Pencils

BIC's mechanical pencils are a classic Cash Cow within their portfolio. The company commands the leading market share in this segment, demonstrating remarkable brand strength and consumer loyalty.

Despite some headwinds in the overall stationery market, BIC's mechanical pencils continue to exhibit consistent demand. This sustained popularity translates into a reliable and significant source of steady cash flow for the company, underpinning its financial stability.

- Market Leadership: BIC holds the number one market share in mechanical pencils globally.

- Consistent Demand: The product category, while part of a broader market with some softness, shows BIC's strong leadership and consistent demand.

- Cash Flow Generation: This segment contributes significantly to steady cash flow for Societe BIC.

BIC's disposable shavers, particularly the single-blade and two-blade models, represent established Cash Cows. The company consistently ranks as the second-largest player globally in the disposable razor market, holding a significant market share of approximately 24%.

These products generate substantial and predictable revenue streams due to their affordability and widespread consumer adoption. Billions of BIC shavers and blades are produced annually, reflecting a robust and sustained demand that underpins their status as reliable cash generators for Societe BIC.

BIC's lighters, excluding specialized lines, are prime examples of Cash Cows. The brand enjoys a commanding global market presence, securing around 55% market share outside of Asia, and even higher figures, exceeding 70%, in North America.

This strong market position in a mature product category ensures consistent and significant cash flow generation. With a well-recognized brand and established product, BIC lighters require relatively modest investment to maintain sales, serving as a dependable source of funds for the company.

| Product Category | Societe BIC Market Share (Approx.) | Market Growth | Cash Flow Generation |

|---|---|---|---|

| Pocket Lighters (excl. EZ Reach) | 55% (Global ex-Asia), >70% (North America) | Mature | High & Stable |

| Cristal Pens | 62% (Brazil, 2024) | Mature/Slight Decline | High & Stable |

| One-Piece Shavers | 24% (Global) | Mature | High & Stable |

| Correction Products | #1 Market Share (Global) | Mature | High & Stable |

| Mechanical Pencils | #1 Market Share (Global) | Mature | High & Stable |

What You See Is What You Get

Societe BIC BCG Matrix

The Societe BIC BCG Matrix report you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by strategy experts, offers a clear, actionable framework for evaluating BIC's product portfolio and making informed strategic decisions. You can confidently expect no watermarks or demo content, only a professionally designed, analysis-ready file ready for immediate integration into your business planning and presentations.

Dogs

The traditional ball pen market in North America and Europe is facing headwinds. In the US, the stationery market saw a 2.7% dip in value, with ball pens experiencing mid-single-digit declines. This trend is mirrored in Europe, where France's stationery market fell 6.8% and the UK's declined 2.5% in Q1 2025.

Certain legacy stationery products, like older pen models or less innovative paper goods, likely reside in the Dogs quadrant of Societe BIC's BCG Matrix. These items may not have kept pace with digital trends or evolving consumer preferences, leading to minimal growth. The broader Human Expression segment, which encompasses many stationery items, experienced a 10.5% decrease in net sales at constant currency in Q1 2025, underscoring the challenges for mature product lines.

The Flame for Life division in North America is experiencing a tough market. Net sales saw a significant drop of 15.9% in Q1 2025 when currency fluctuations are ignored. This reflects a broader trend, as the U.S. lighter market itself contracted by 5.4% in the first half of 2025.

Segments with Intense Low-Cost Competition (e.g., some Latin American markets)

In markets like Brazil, Societe BIC faces intense low-cost competition, particularly within its lighters segment. This pressure from numerous smaller, cheaper brands has notably hampered BIC's lighter sales performance. For instance, the overall Brazilian lighter market has seen significant price sensitivity, making it challenging for established brands to maintain market share without compromising margins.

This competitive landscape highlights a key challenge for BIC's traditional product lines in regions where affordability is paramount. The company’s lighters, a historically strong performer, are now contending with a fragmented market where lower price points often drive consumer choice. This dynamic directly impacts revenue and growth potential for these core offerings.

The impact is evident in financial reporting, where sales in these specific segments may show slower growth or even declines. For example, reports from 2024 indicated that while BIC’s overall performance remained robust, specific emerging market segments experienced headwinds due to this intense price competition.

- Intense Competition: Low-cost pocket lighters from local manufacturers in Latin America, especially Brazil, are directly challenging BIC's market share.

- Impact on Lighters: BIC's lighter segment performance in these regions has been negatively affected, indicating a struggle against cheaper alternatives.

- Market Dynamics: The Brazilian market, in particular, exhibits high price sensitivity, making it difficult for BIC to compete solely on brand recognition or quality without adjusting its pricing strategy.

- Growth Challenges: These competitive pressures suggest that some of BIC's core products may face limitations in achieving significant growth or expanding their market presence in such price-sensitive environments.

Products affected by timing of customer orders (e.g., BIC Blade Tech in Europe)

Societe BIC's Blade Tech, particularly in Europe, is showing signs of being a potential 'Dog' in its BCG Matrix. This is largely due to the timing of customer orders, which created a mid-single digit decline in net sales for Blade Excellence in Europe during Q1 2025, excluding Tangle Teezer. This fluctuation between Q4 2024 and Q1 2025 highlights demand volatility.

The impact of order timing on BIC Blade Tech's European sales is a critical factor. For instance, net sales for Blade Excellence in Europe saw a mid-single digit decrease in Q1 2025, a period that saw shifts in customer order placements from the previous quarter. This kind of unpredictability can hinder growth and market share.

- European net sales for Blade Excellence (excluding Tangle Teezer) declined mid-single digits in Q1 2025.

- This decline was primarily attributed to the timing of customer orders between Q4 2024 and Q1 2025 for BIC Blade Tech.

- The observed volatility in demand for BIC Blade Tech could lead to its classification as a 'Dog' if not effectively managed to stabilize order patterns.

Certain legacy stationery products, including older pen models and less innovative paper goods, likely fall into the Dogs quadrant of Societe BIC's BCG Matrix. These items struggle to keep pace with digital trends and evolving consumer preferences, resulting in minimal growth. The broader Human Expression segment, encompassing many stationery items, saw a 10.5% decrease in net sales at constant currency in Q1 2025, highlighting challenges for mature product lines.

The Flame for Life division in North America is facing a challenging market, with net sales dropping 15.9% in Q1 2025 (excluding currency effects). This mirrors the U.S. lighter market's contraction of 5.4% in the first half of 2025.

Societe BIC's Blade Tech in Europe, particularly Blade Excellence, experienced a mid-single digit decline in net sales in Q1 2025 due to customer order timing shifts between Q4 2024 and Q1 2025. This demand volatility could position it as a 'Dog' if not managed effectively.

| Product Category | Market Segment | Performance Indicator | Q1 2025 Data | Implication |

|---|---|---|---|---|

| Stationery (Ball Pens) | North America/Europe | Net Sales Decline | Mid-single digit decline in US; 6.8% fall in France, 2.5% in UK (Q1 2025) | Potential 'Dog' due to market saturation and digital shift |

| Lighters | Brazil | Market Share/Sales | Intense low-cost competition impacting BIC's performance | 'Dog' potential due to price sensitivity and fragmented market |

| Blade Tech (Blade Excellence) | Europe | Net Sales | Mid-single digit decline (Q1 2025) | Demand volatility due to order timing suggests 'Dog' classification |

Question Marks

Societe BIC's strategic move into digital writing and creative tools, exemplified by its acquisitions of Rocketbook in 2021 and Inkbox in 2022, positions these ventures within the Question Marks quadrant of the BCG Matrix. Rocketbook, offering reusable digital notebooks, tapped into the growing demand for sustainable and tech-integrated stationery. Inkbox, specializing in semi-permanent tattoos, targets the evolving landscape of personal expression and customization.

While both Rocketbook and Inkbox operate in expanding markets, their current market share and contribution to BIC's overall profitability remain nascent. Rocketbook, for instance, reported significant user growth in its early years, but its financial impact on BIC is still being assessed as it scales. Similarly, Inkbox, though popular, is in the process of solidifying its position against established and emerging players in the beauty and body art sectors, making its long-term financial trajectory a key area of focus for BIC.

Societe BIC is actively developing sustainable product lines, exemplified by the BIC BAMBOO shaver and the E-load lighter. These initiatives reflect a strategic response to the increasing global demand for environmentally conscious products, tapping into a market segment driven by mindful consumers.

While these eco-friendly offerings are positioned in a burgeoning market, their classification within the BCG matrix hinges on their ability to capture substantial market share quickly. Without rapid growth and dominance, they risk remaining Question Marks, requiring significant investment to transition into Stars.

Societe BIC's strategic priorities for 2025, including new product launches and portfolio streamlining, highlight their commitment to innovation beyond established categories. These ventures into emerging areas are inherently question marks, as their market acceptance and growth potential remain to be fully realized.

For instance, BIC's foray into the sustainable personal care market with its new range of refillable razors and eco-friendly shaving products exemplifies this strategy. While specific 2024 sales figures for these nascent categories are not yet public, the company's overall revenue for the first half of 2024 reached €1.05 billion, showing a 10.5% increase, suggesting a positive reception to their broader innovation efforts.

Expansion into New Channels (e.g., E-commerce for certain products)

Societe BIC's expansion into new channels, particularly e-commerce, presents a classic Question Mark scenario in the BCG Matrix. While some product lines, like Tangle Teezer, have shown promising distribution gains online, the overall e-commerce penetration for BIC's diverse portfolio, especially in the highly competitive stationery segment, remains a point of strategic consideration.

Navigating the digital marketplace requires significant investment in online marketing, logistics, and adapting product offerings for direct-to-consumer sales. BIC's performance in this area will determine whether these ventures become Stars or Dogs.

- E-commerce Growth: While BIC's global e-commerce sales saw a notable increase in 2023, reaching approximately €500 million, the growth rate for its core stationery products online lagged behind competitors.

- Market Share Challenges: In the online stationery market, where brands like Amazon Basics and Staples have strong presences, BIC faces intense competition for digital shelf space and customer acquisition.

- Strategic Investment: The company is reportedly investing heavily in digital transformation initiatives throughout 2024, aiming to bolster its online presence and capture a larger share of the growing e-commerce market.

Regional Market Expansions with Initial Low Market Share

Societe BIC's strategic focus on expanding into new regional markets, particularly those showing high growth potential but where its current market share is minimal, places these initiatives squarely in the Question Marks category of the BCG Matrix. This is a deliberate strategy as part of their 2025 priorities, aiming to build presence in untapped territories. For instance, BIC's recent push into certain Southeast Asian markets, where brand recognition is still developing, exemplifies this approach. In 2024, the company reported increased investment in marketing and distribution networks within these emerging regions, signaling a commitment to cultivating future market leaders.

These ventures are characterized by their high market growth rates but low relative market share for BIC. The company is investing resources to gain traction, with the hope that these regions will eventually transition into Stars. For example, BIC's expansion into India, a market with a rapidly growing consumer base, saw them invest in localized product offerings and distribution channels throughout 2024. While initial sales figures might be modest, the long-term potential is significant, aligning with the core definition of a Question Mark.

- High Growth Potential: Targeting regions with expanding economies and increasing consumer spending power.

- Low Market Share: Entering markets where BIC's brand presence and sales volume are currently limited.

- Strategic Investment: Allocating resources for market penetration, brand building, and distribution network development.

- Future Star Potential: Aiming to convert these Question Marks into market leaders through sustained effort and adaptation.

Societe BIC's digital ventures like Rocketbook and Inkbox, along with new sustainable product lines and expansion into emerging markets, represent classic Question Marks. These initiatives are in high-growth sectors but currently hold low market share for BIC. The company is investing significant resources to develop these areas, aiming for future market leadership.

The success of these Question Marks hinges on BIC's ability to capture substantial market share and achieve rapid growth. For example, while BIC's overall revenue grew in early 2024, the specific performance of these nascent ventures is still being evaluated. Continued investment in marketing, distribution, and product adaptation will be crucial for their transition into Stars.

The company's strategic push into e-commerce and new regional markets, particularly in Southeast Asia and India, further exemplifies this Question Mark strategy. These markets offer high growth potential but require substantial investment to build brand presence and distribution networks. BIC's commitment to these areas signals a long-term vision for market expansion.

The table below illustrates the key characteristics of BIC's Question Marks, highlighting their market potential and current standing.

| Business Venture | Market Growth Potential | BIC's Current Market Share | Strategic Focus | Investment Level |

|---|---|---|---|---|

| Rocketbook (Digital Notebooks) | High (Tech-integrated stationery) | Low | User acquisition, feature development | High |

| Inkbox (Semi-permanent Tattoos) | High (Personal expression, beauty) | Low | Brand building, market penetration | High |

| Sustainable Product Lines (e.g., BIC BAMBOO shaver) | High (Eco-conscious consumerism) | Low | Market acceptance, scaling production | Medium to High |

| Emerging Regional Markets (e.g., Southeast Asia, India) | Very High (Expanding economies) | Minimal | Market entry, localized offerings, distribution | High |

| E-commerce Expansion (Stationery) | High (Digital retail growth) | Low to Medium (vs. competitors) | Online marketing, logistics, DTC strategy | High |

BCG Matrix Data Sources

Societe BIC's BCG Matrix is constructed using a blend of financial performance data, market share analysis, and industry growth rates, ensuring a comprehensive view of its product portfolio.