Societe BIC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Societe BIC Bundle

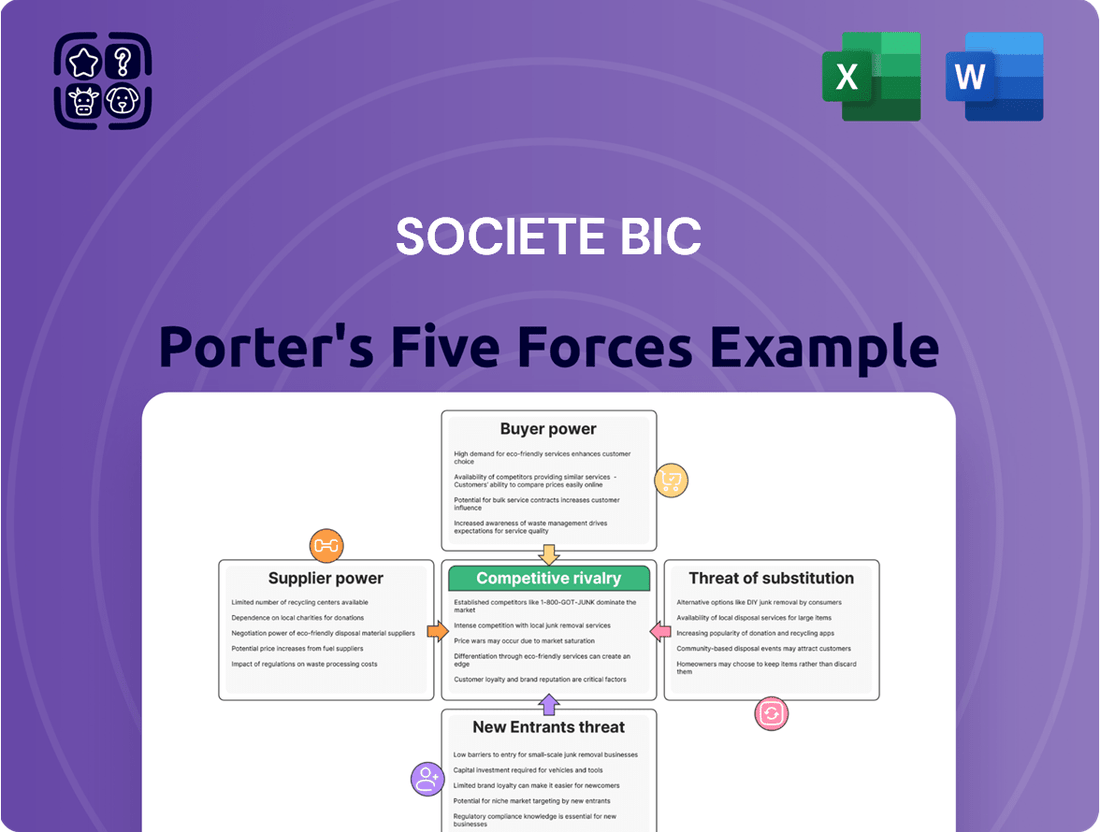

Societe BIC navigates a competitive landscape shaped by moderate buyer power and intense rivalry among established players. While the threat of new entrants is somewhat mitigated by brand loyalty and economies of scale, substitute products present a persistent challenge to their core offerings. Understanding these dynamics is crucial for any strategic evaluation.

The complete report reveals the real forces shaping Societe BIC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Société BIC benefits from a diverse supplier base for its essential raw materials like plastics, inks, and cardboard. This wide network of suppliers reduces BIC's dependence on any single entity, offering significant flexibility in sourcing. For instance, in 2023, BIC reported sourcing components from over 5,000 suppliers globally, underscoring this diversification.

The bargaining power of suppliers for Societe BIC is notably low when it comes to standardized raw materials. Materials like polypropylene and polystyrene, crucial for BIC's iconic pens and lighters, are essentially commodities. This means BIC can easily find alternative suppliers without major production hiccups, significantly reducing any single supplier's leverage. In 2023, around 65% of BIC's raw material inputs were classified as standardized commodities, underscoring this dynamic.

Societe BIC benefits from low switching costs with its suppliers, meaning it doesn't face significant financial or operational hurdles when changing who it buys from. This is largely because many of the raw materials BIC uses, like plastics and metals for its pens, lighters, and shavers, are commodities with multiple readily available sources. For instance, the global plastics market, a key input for BIC, saw significant production capacity expansions leading up to 2024, increasing supplier competition and reducing the leverage any single supplier holds.

Limited Supplier Differentiation

Societe BIC benefits from limited supplier differentiation, particularly with commodity raw materials. Many suppliers operate in competitive markets, offering products that are largely interchangeable. This dynamic empowers BIC to negotiate favorable pricing and terms, as suppliers struggle to differentiate their offerings and command premium prices.

The lack of unique value propositions among many raw material providers significantly restricts their ability to impose stringent conditions or dictate higher costs. For example, in 2024, the global plastics market, a key input for BIC’s pens and lighters, saw increased production capacity, putting downward pressure on raw material prices. This scenario directly translates to stronger bargaining power for large buyers like BIC.

- Limited Differentiation: Suppliers of commodity raw materials to BIC often provide products with minimal differentiation, operating within highly competitive landscapes.

- Negotiating Power: This market structure allows BIC to negotiate more favorable terms and pricing from its suppliers.

- Restricted Supplier Leverage: The absence of unique offerings limits suppliers' capacity to demand higher prices or enforce restrictive conditions on BIC.

Impact of Raw Material Costs

While Societe BIC generally holds a strong position with its suppliers, the company has experienced challenges due to rising raw material costs. Specifically, the lighter segment faced impacts from these fluctuations throughout 2024, demonstrating that even dominant players can be affected by global commodity price volatility.

These cost pressures can directly influence BIC's profitability, highlighting the ongoing need for robust supply chain management and cost-control strategies.

- Increased Raw Material Costs: Global commodity prices, particularly for plastics and fuels used in lighter production, saw upward pressure in 2024.

- Impact on Lighter Segment: The lighter business, a core BIC product, was notably affected by these material cost increases.

- Profitability Concerns: Fluctuations in raw material expenses can directly squeeze profit margins for BIC, even with its established market presence.

- Supply Chain Resilience: The situation underscores the importance of BIC's ongoing efforts to secure stable and cost-effective material sourcing.

Societe BIC's bargaining power with suppliers is generally robust due to its large purchasing volume and the commodity nature of many of its raw materials. This allows BIC to negotiate favorable pricing and terms, limiting individual supplier leverage.

However, global economic conditions can introduce volatility. For instance, in 2024, increased demand for petrochemicals, a key input for BIC's plastics, led to higher raw material costs. This put some pressure on BIC's lighter segment, illustrating that even strong buyers can face challenges from widespread market trends.

| Raw Material Category | 2023 Supplier Count | 2024 Cost Pressure Indicator | BIC's Leverage Factor |

|---|---|---|---|

| Plastics (e.g., Polypropylene) | Thousands globally | Moderate Increase (Petrochemical Demand) | High (Commodity, High Volume) |

| Inks | Hundreds globally | Low to Moderate | High (Standardized Components) |

| Metals (e.g., for shavers) | Hundreds globally | Low to Moderate | High (Commodity, High Volume) |

What is included in the product

This analysis delves into the competitive forces shaping Societe BIC's market, examining the threat of new entrants, the power of buyers and suppliers, and the intensity of rivalry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for BIC.

Customers Bargaining Power

Societe BIC's core strategy targets a mass market that is highly sensitive to price. This means consumers readily switch to competitors if BIC's products are perceived as too expensive. For instance, in the stationery segment, the availability of numerous low-cost brands means BIC must constantly manage its pricing to remain competitive, directly impacting its profit margins.

Societe BIC faces significant customer bargaining power due to the high availability of alternatives in its core markets. Consumers can readily find stationery, lighters, and shavers from a multitude of established brands, private labels, and generic producers. This abundance of choice, combined with minimal costs to switch between products, gives buyers considerable leverage.

For instance, in the disposable lighter market, while BIC is a dominant player, numerous competitors offer similar products at various price points. Similarly, the stationery market, encompassing pens, pencils, and notebooks, is saturated with options from global brands to local suppliers. This competitive landscape allows customers to easily compare prices and features, pushing BIC to maintain competitive pricing and product quality to retain market share.

Despite the wide array of available writing instruments and lighters, Societe BIC enjoys a significant advantage due to its strong brand loyalty. Consumers worldwide recognize BIC products, and they frequently emerge as the preferred option in various categories.

This established trust and preference help to temper the bargaining power of customers. Loyal customers are often less sensitive to price fluctuations and more inclined to continue purchasing BIC products, even when alternatives exist.

Underscoring this loyalty, a 2025 survey revealed that BIC was recognized as France's favorite consumer brand, a testament to its enduring appeal and the deep connection it has forged with its customer base.

Influence of Distribution Channels

The bargaining power of customers is significantly shaped by distribution channels, especially large retailers and discounters. These powerful intermediaries can exert pressure on Societe BIC regarding pricing and promotional strategies. For instance, in 2024, European discounters saw significant growth, with some expanding their market share by over 5% in key categories, making them crucial partners for BIC.

This channel influence indirectly benefits the end consumer. When retailers negotiate favorable terms with BIC, these savings are often passed on through more competitive pricing and attractive offers for shoppers. BIC's strategic move to gain distribution in European discounters in 2024 highlights their recognition of this dynamic.

- Retailer Influence: Large retailers act as gatekeepers, and their purchasing volume grants them considerable leverage over BIC's pricing and product placement decisions.

- Discounters' Impact: The rise of discount channels, particularly in Europe where BIC has expanded its presence, allows consumers to access BIC products at lower price points due to retailer negotiations.

- Promotional Pressure: Retailers often demand promotional support from manufacturers like BIC, which can lead to increased marketing costs for BIC but ultimately translates to better deals for consumers.

Evolving Consumer Preferences

Societe BIC faces increasing customer power due to evolving preferences, particularly a growing demand for sustainable and eco-friendly products. This shift empowers consumers who prioritize these attributes, compelling BIC to potentially adapt its product lines and manufacturing. For instance, BIC has been incorporating more recycled content into its products, reflecting this consumer-driven change.

- Consumer Demand for Sustainability: A significant portion of consumers now actively seek out products with lower environmental impact.

- Influence on Product Development: This preference directly influences BIC's innovation pipeline, pushing for greener materials and production methods.

- Market Responsiveness: Companies like BIC that can effectively align with these evolving values are better positioned to retain and attract customers.

Societe BIC contends with substantial customer bargaining power, primarily driven by the widespread availability of substitutes and the price sensitivity of its mass-market consumer base. While BIC benefits from strong brand loyalty, the sheer volume of competing products in stationery, lighters, and shavers means customers can easily switch if prices are not competitive. This dynamic is amplified by the influence of large retailers and discounters, who leverage their purchasing power to negotiate favorable terms, often passing savings onto consumers.

| Factor | Impact on BIC | Customer Leverage |

|---|---|---|

| Availability of Substitutes | High | Customers can easily switch to competitors. |

| Price Sensitivity | High | Consumers are driven by cost-effectiveness. |

| Brand Loyalty | Moderate | Reduces price sensitivity for some customers. |

| Retailer/Discounter Power | Significant | Retailers negotiate lower prices, benefiting consumers. |

| Demand for Sustainability | Growing | Customers prioritize eco-friendly options, influencing BIC. |

Preview Before You Purchase

Societe BIC Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of Societe BIC, detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products. You'll gain deep insights into the strategic positioning and market dynamics affecting BIC's operations and profitability. This professionally formatted analysis is ready for your immediate use, providing actionable intelligence without any surprises.

Rivalry Among Competitors

Société BIC faces intense competition in its core markets of stationery, lighters, and shavers. These sectors are mature, meaning growth is often incremental, forcing companies to fight harder for existing market share. For instance, the global stationery market, a key area for BIC, was valued at approximately $28.5 billion in 2023 and is projected to grow modestly, intensifying rivalry among established players and emerging regional brands.

Societe BIC's competitive rivalry is intense, yet its strong brand presence and market leadership act as a significant shield. BIC consistently holds the number one or two global position in its primary markets, a testament to decades of brand building and product reliability. This dominance, evident in its widespread availability across over 160 countries, makes it challenging for new entrants or smaller competitors to gain substantial market share.

Competitive rivalry in the stationery, lighters, and shavers sectors is intense, largely fueled by continuous innovation and product differentiation. Companies are constantly striving to capture market share by introducing novel designs, enhanced features, and increasingly, sustainable product options. This dynamic environment necessitates a proactive approach to product development and marketing.

Societe BIC actively participates in this competitive landscape through strategic product introductions and portfolio management. For instance, BIC has launched value-added products such as the BIC EZ Reach lighter, which offers extended reach for safety and convenience. Furthermore, the company continues to innovate within its shaver ranges, introducing new models designed for improved performance and user experience. These efforts are complemented by a strategic streamlining of its product portfolio, ensuring resources are focused on offerings that best meet evolving consumer demands and preferences.

Pricing and Promotional Activities

Price competition is a significant factor for Societe BIC, particularly in its core markets of affordable everyday essentials like pens and lighters. Competitors frequently employ aggressive pricing and promotional tactics to capture market share and maintain customer loyalty. For instance, in 2024, many stationery brands intensified their promotional offers, with discounts often reaching 20-30% on bulk purchases of writing instruments to counter economic pressures and attract price-sensitive consumers.

BIC's strategy to counter this intense price rivalry centers on its long-standing commitment to cost-effectiveness and robust operational efficiencies. By optimizing its manufacturing processes and supply chain, BIC aims to maintain competitive pricing without compromising product quality. This focus allows them to absorb some of the pressure from competitor discounting, ensuring their products remain an attractive value proposition for a broad customer base.

- Intense Price Wars: Competitors frequently engage in aggressive price cuts and promotional campaigns, especially in the disposable lighter and pen segments.

- Promotional Strategies: Common tactics include multi-buy offers, seasonal discounts, and bundled product deals to drive sales volume.

- BIC's Cost Advantage: Societe BIC leverages its scale and manufacturing efficiency to offer competitive pricing, a key differentiator in price-sensitive markets.

- Market Dynamics: The prevalence of private label brands and smaller regional players further intensifies the price competition, forcing established brands to remain vigilant.

Geographic Market Dynamics

The intensity of competition for Societe BIC significantly shifts across different geographic areas. In early 2025, markets like North America presented a more demanding landscape for BIC's lighters and stationery segments, characterized by tougher consumer trends and heightened competitive pressures.

In contrast, BIC has demonstrated strong performance and expanded its market presence in other key regions. For instance, the company has experienced robust growth and secured market share gains within Europe and Latin America throughout 2024 and into early 2025, indicating a more favorable operating environment in these territories.

- North America: Faced challenging consumption trends and higher competitive activity for lighters and stationery in early 2025.

- Europe: Experienced robust growth and market share gains throughout 2024.

- Latin America: Showcased strong growth and increased market share in 2024.

Societe BIC operates in highly competitive mature markets where established brands and numerous smaller players vie for market share. This intense rivalry is particularly evident in stationery, lighters, and shavers, where price sensitivity and continuous product innovation are key battlegrounds.

The global stationery market, a significant segment for BIC, was valued at approximately $28.5 billion in 2023, with modest projected growth, intensifying competition among established and emerging brands. In 2024, many stationery brands offered discounts of 20-30% on bulk writing instruments to attract price-conscious consumers.

BIC's strong brand recognition and market leadership, holding top positions globally in its core categories, provide a competitive advantage. However, this doesn't negate the pressure from aggressive pricing and promotional tactics employed by competitors, including private label and regional brands.

Geographically, competitive dynamics vary; while North America presented challenges in early 2025 due to tougher consumer trends, BIC achieved robust growth and market share gains in Europe and Latin America throughout 2024.

| Market Segment | 2023 Market Value (approx.) | Key Competitive Factors | 2024/2025 Trend |

|---|---|---|---|

| Stationery | $28.5 billion | Price competition, innovation, private labels | Intensified promotions (20-30% discounts) |

| Lighters | N/A (Mature market) | Price, convenience, brand loyalty | Challenging in North America, growth in Europe/Latin America |

| Shavers | N/A (Mature market) | Performance, user experience, value | Continued innovation and portfolio management |

SSubstitutes Threaten

The rise of digital note-taking and planning apps presents a substantial threat to traditional stationery. For instance, in 2024, the global productivity software market, which includes many of these digital alternatives, was valued at over $70 billion, indicating a strong preference for digital solutions in many sectors. This shift directly impacts the demand for BIC's core products like pens and notebooks.

The threat of substitutes for traditional disposable lighters, like those from Societe BIC, is significant and growing. Refillable lighters, electronic lighters, and even plasma lighters offer compelling alternatives. These substitutes often appeal to consumers seeking greater convenience, reduced environmental impact, and improved safety features compared to single-use disposables.

While BIC has responded by developing its own reloadable lighter options, the increasing adoption of these substitutes directly challenges the sales volume of its core disposable lighter products. For instance, the market for electronic lighters, particularly rechargeable USB lighters, has seen steady growth, with global sales projected to reach billions of units annually by the mid-2020s, indicating a clear shift in consumer preference and a tangible threat to BIC's traditional market share.

The threat of substitutes for Societe BIC's traditional disposable shavers is significant, primarily from electric shavers and other long-lasting grooming tools. These alternatives offer convenience and a different user experience, potentially drawing consumers away from BIC's core product. For instance, the global electric shaver market was valued at approximately $8.5 billion in 2023 and is projected to grow, indicating a strong consumer preference for these substitutes.

While BIC has historically focused on the accessible disposable razor market, the increasing sophistication and adoption of electric grooming devices present a clear challenge. Consumers looking for advanced features, longer-term cost savings, or a different grooming method might choose electric shavers over disposables. This trend is further amplified by the growing popularity of personal grooming and the desire for convenient, efficient solutions.

Societe BIC is actively addressing this threat by diversifying its product portfolio. The acquisition of Tangle Teezer, a brand known for hair care tools, demonstrates a strategic move to expand beyond its traditional offerings and capture a broader segment of the personal care market. This diversification aims to mitigate the impact of substitutes in the shaving category by strengthening its presence in related grooming segments.

Multi-purpose Household Items

The threat of substitutes for Societe BIC's products is significant, particularly from multi-purpose household items. Many of BIC's core offerings, while convenient, have readily available alternatives that can perform similar functions. For instance, matches can easily replace lighters, and a wide array of digital tools and applications can now substitute for traditional pens and paper in many contexts. This broad spectrum of indirect substitutes intensifies competitive pressure on BIC.

Consider the market for writing instruments. While BIC is a dominant player, the rise of digital note-taking and communication has diminished the necessity of physical pens for many tasks. In 2024, the global digital pen market was valued at approximately $2.5 billion, demonstrating a clear shift in consumer behavior. Furthermore, even within the realm of physical writing, lower-cost generic brands or alternative writing tools can serve as substitutes for BIC's pens.

- Matches as a substitute for lighters: This is a classic example of a low-cost, readily available alternative.

- Digital tools replacing pens and paper: Smartphones, tablets, and cloud-based services offer functional replacements for traditional writing and note-taking.

- Alternative writing instruments: While BIC focuses on disposable pens, the market includes refillable pens, mechanical pencils, and even styluses for digital devices.

- DIY or repurposed items: In some instances, consumers might find ways to repurpose common household items for tasks typically handled by BIC products, though this is less prevalent for core BIC items.

Sustainability-Driven Substitutes

The increasing consumer focus on environmental impact is fueling the rise of sustainability-driven substitutes. Products crafted from recycled plastics, biodegradable materials, or sustainably sourced components are gaining traction. This trend directly challenges traditional offerings, compelling established players like Societe BIC to explore and integrate more eco-conscious materials and production methods into their product lines.

For instance, the global market for sustainable packaging, a key area for BIC's product categories, was valued at approximately $250 billion in 2023 and is projected to grow significantly. This growth indicates a strong consumer preference for alternatives that minimize environmental footprints, directly impacting the demand for conventional, less sustainable options.

- Growing Consumer Demand: An increasing number of consumers are actively seeking out products with a lower environmental impact.

- Emergence of Eco-Friendly Materials: Substitutes made from recycled, biodegradable, or sustainably sourced inputs are becoming more prevalent.

- Market Disruption: This shift puts pressure on companies with traditional product portfolios to adapt or risk losing market share to more sustainable alternatives.

- Innovation Imperative: Companies like Societe BIC face the necessity of innovating to incorporate sustainable practices and materials to remain competitive.

The threat of substitutes for Societe BIC's products is multifaceted, encompassing both direct functional replacements and broader shifts in consumer behavior. For instance, while BIC is known for its disposable lighters, the market for refillable and electronic lighters is growing, with global sales of electronic lighters expected to reach billions of units annually by the mid-2020s. Similarly, digital note-taking apps are increasingly substituting for traditional pens and paper, with the global productivity software market exceeding $70 billion in 2024.

The personal grooming segment also faces significant substitution threats, particularly from electric shavers. The global electric shaver market was valued at approximately $8.5 billion in 2023 and continues to expand, presenting a challenge to BIC's disposable razor offerings. Furthermore, a growing consumer emphasis on sustainability is driving demand for eco-friendly alternatives across all product categories, pressuring companies like BIC to innovate with recycled or biodegradable materials.

| Substitute Category | Example BIC Product | Key Substitute | Market Trend/Data Point |

| Ignition | Disposable Lighters | Refillable/Electronic Lighters | Electronic lighter sales projected in billions of units annually by mid-2020s. |

| Writing Instruments | Disposable Pens | Digital Note-Taking Apps | Global productivity software market over $70 billion in 2024. |

| Personal Grooming | Disposable Razors | Electric Shavers | Global electric shaver market valued at ~$8.5 billion in 2023. |

| Sustainability | Various Disposable Products | Recycled/Biodegradable Alternatives | Global sustainable packaging market ~$250 billion in 2023. |

Entrants Threaten

Société BIC enjoys formidable brand recognition and deep-seated consumer loyalty, cultivated over many years. This strong reputation makes it exceptionally difficult for new competitors to quickly gain trust and establish a foothold in the market. The substantial investment in time and resources needed to build a similar brand presence presents a significant hurdle for potential entrants.

BIC benefits immensely from economies of scale in manufacturing and distribution, enabling it to achieve significantly lower per-unit costs. Newcomers would face a steep challenge replicating BIC's cost efficiencies without massive upfront capital and achieving comparable sales volumes. In 2023, BIC produced over 1.5 billion lighters alone, showcasing its production capacity.

Societe BIC benefits from deeply entrenched distribution networks spanning over 160 countries, a significant hurdle for potential new entrants. These established relationships with major retailers, wholesalers, and burgeoning e-commerce platforms provide unparalleled market reach.

In 2024, BIC continued to leverage these channels, notably expanding its presence within the discount retail sector and solidifying its online sales infrastructure. This widespread accessibility makes it incredibly challenging for newcomers to replicate BIC's market penetration and secure shelf space.

Capital Requirements and R&D Investment

Entering the market for everyday essentials like those produced by Societe BIC demands substantial upfront capital for manufacturing plants, equipment, and ongoing research and development. This considerable financial barrier effectively discourages many potential new players from entering the competitive landscape.

BIC's commitment to innovation is evident in its continued investment in R&D, which is crucial for maintaining product relevance and developing new offerings. For instance, in 2023, BIC reported R&D expenses of approximately €125 million, highlighting their dedication to staying ahead.

- High Capital Expenditure: Establishing production lines for items like pens, lighters, and shavers requires millions in machinery and infrastructure.

- Research and Development Costs: Continuous innovation in product design, materials, and manufacturing processes necessitates significant R&D budgets.

- Economies of Scale: Existing large-scale producers like BIC benefit from lower per-unit costs, making it difficult for smaller new entrants to compete on price.

- Brand Building Investment: New entrants must also allocate substantial funds to marketing and brand establishment to gain consumer recognition and trust.

Lowered Barriers from E-commerce and Niche Markets

While traditional barriers to entry in the stationery and consumer goods sectors, like established brand recognition and extensive distribution networks, remain significant for Societe BIC, the digital landscape has introduced new dynamics. The proliferation of e-commerce platforms has demonstrably lowered some of these hurdles, enabling nimble new entrants to connect with customers directly. For instance, online marketplaces allow smaller brands to bypass the need for costly physical retail shelf space, reaching a broad consumer base without the massive capital investment previously required.

Furthermore, the ability to target specific niche markets with specialized or differentiated products presents a viable strategy for new competitors. Instead of challenging BIC head-on in its core mass-market segments, these entrants can focus on unmet needs or unique product propositions. This approach allows them to build a loyal customer base and gain traction without immediately facing the full competitive might of an established player like Societe BIC. In 2023, the global e-commerce market for stationery and office supplies was valued at approximately $28 billion, highlighting the accessibility and reach of online channels for new businesses.

- E-commerce Growth: Online sales channels reduce the need for extensive physical retail infrastructure, lowering initial capital requirements for new entrants in the stationery market.

- Niche Market Focus: New competitors can gain a foothold by offering specialized products that cater to underserved segments, thereby avoiding direct confrontation with BIC's established mass-market offerings.

- Digital Reach: Platforms like Amazon and Etsy provide immediate access to a vast customer base, enabling smaller brands to scale without the traditional barriers of widespread distribution.

Societe BIC faces a moderate threat from new entrants due to its strong brand, economies of scale, and extensive distribution. However, the rise of e-commerce and the possibility of targeting niche markets offer avenues for new players to enter. In 2023, BIC's R&D investment of approximately €125 million underscores its commitment to innovation, creating a barrier for those seeking to match its product development capabilities.

| Barrier Type | Description | Impact on New Entrants | BIC's Advantage |

|---|---|---|---|

| Brand Recognition & Loyalty | Established trust and preference among consumers. | High hurdle for newcomers to build comparable reputation. | Decades of consistent product quality and marketing. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants struggle to compete on price without significant scale. | Producing over 1.5 billion lighters in 2023 showcases massive scale. |

| Distribution Network | Access to over 160 countries and established retail relationships. | Difficult for new players to secure shelf space and market reach. | Widespread presence in discount retail and online channels in 2024. |

| Capital Requirements | Substantial investment needed for manufacturing, R&D, and marketing. | Discourages many potential entrants due to high upfront costs. | Ongoing investment in R&D, exemplified by €125 million in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Societe BIC leverages data from company annual reports, investor presentations, and industry-specific market research from firms like Euromonitor and Statista to assess competitive dynamics.