Benefytt SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benefytt Bundle

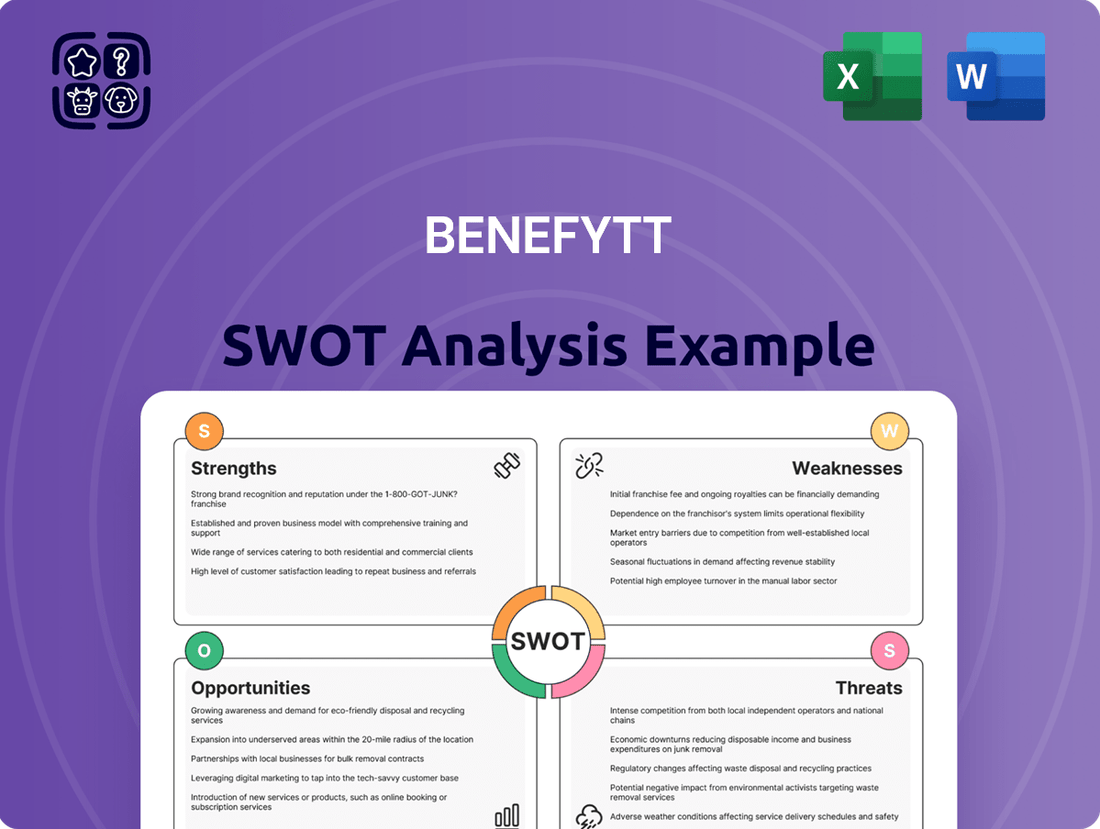

Our Benefytt SWOT analysis offers a compelling glimpse into their market standing, highlighting key strengths and potential challenges. Understanding these dynamics is crucial for anyone looking to invest or compete in this space.

Want the full story behind Benefytt's competitive edge and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Benefytt Technologies excels by focusing on technology and data analytics to power its private e-commerce marketplaces for health and life insurance. This approach allows them to connect consumers with a wide selection of insurance plans from numerous carriers, personalizing the shopping journey. Their operations are heavily reliant on sophisticated agent technology systems and policy administration platforms.

Benefytt Technologies leverages established e-commerce marketplaces like healthinsurance.com, providing a digital pathway for consumers to learn about, shop for, and purchase Medicare Advantage and private health insurance. This online infrastructure serves as a highly scalable distribution channel, directly connecting Benefytt with a broad customer base seeking health coverage.

The marketplace model inherently offers significant advantages in consumer convenience and choice. By consolidating various insurance plans, Benefytt's platforms empower individuals to compare options easily, a crucial factor in today's health insurance landscape. For instance, in 2024, the demand for accessible online health insurance shopping continues to grow, with a significant portion of consumers preferring digital channels for plan selection and enrollment.

Benefytt Technologies distinguishes itself through a diverse array of product offerings, connecting consumers with a wide spectrum of health and life insurance plans sourced from numerous carriers. This broad portfolio is designed to appeal to a larger customer base by addressing varied insurance requirements.

The company's strategy centers on providing access to a comprehensive selection of plans, positioning Benefytt to effectively serve different market segments and consumer needs. This approach allows them to cater to a wider audience seeking tailored insurance solutions.

Agent Support Platforms

Benefytt's strengths include its robust agent support platforms, notably the Agile Admin system. This technology-driven insurance sales management platform is specifically built for licensed insurance agents, streamlining their operations and client enrollments. By equipping agents with such tools, Benefytt enhances their sales efficiency and expands their market reach, a critical advantage in the competitive insurance landscape.

The Agile Admin platform directly supports business partners by facilitating customer enrollments across a range of insurance products. This technological empowerment is a key differentiator, allowing agents to manage their business more effectively and serve a wider client base. For instance, in 2024, platforms that offer streamlined onboarding and management capabilities have been shown to increase agent productivity by as much as 20%.

- Agile Admin Platform: A dedicated insurance sales management tool for licensed agents.

- Enhanced Sales Efficiency: Empowers agents with technology to improve performance.

- Broadened Outreach: Facilitates wider customer enrollment and business partner support.

- Technological Empowerment: Directly contributes to agent productivity and market penetration.

Reorganization and Potential for a New Start

Benefytt Technologies successfully completed its Chapter 11 restructuring in September 2023, a crucial step that allowed the company to shed significant debt and emerge with a revitalized financial structure. This reorganization provides a clean slate, enabling a strategic pivot and a renewed focus on core business operations. The company exited bankruptcy with a substantially improved balance sheet, positioning it for a more stable future.

This fresh start is a significant strength, as it allows Benefytt to implement new strategies without the burden of its previous financial encumbrances. The restructuring process itself often leads to operational efficiencies and a more agile business model. For instance, companies emerging from Chapter 11 frequently streamline their operations and renegotiate contracts, as Benefytt likely did to improve its cost structure.

The potential for a new start is underscored by the company's ability to navigate a complex bankruptcy process. This demonstrates resilience and a capacity for strategic decision-making under pressure. Benefytt can now concentrate on growth initiatives and market opportunities, leveraging its reorganized framework.

Key aspects of this strength include:

- Successful emergence from Chapter 11 in September 2023

- Opportunity for strategic reset and operational streamlining

- Improved financial foundation for future growth

- Demonstrated resilience and adaptability in navigating financial distress

Benefytt's core strength lies in its advanced technology infrastructure, particularly its proprietary e-commerce marketplaces like healthinsurance.com. These platforms provide a scalable, digital-first approach to connecting consumers with a wide array of health and life insurance products from numerous carriers. This technology-driven model facilitates personalized consumer experiences and efficient plan comparison, a critical advantage in the evolving insurance market.

The company's robust agent support systems, exemplified by the Agile Admin platform, are another significant strength. This technology empowers licensed insurance agents by streamlining sales processes, client enrollments, and overall business management. In 2024, such technological tools have been observed to boost agent productivity by up to 20%, directly enhancing Benefytt's market reach and sales efficiency.

Benefytt's successful emergence from Chapter 11 bankruptcy in September 2023 represents a pivotal strength. This restructuring significantly reduced its debt burden, providing a revitalized financial foundation and enabling a strategic reset. The company is now better positioned to focus on growth and operational improvements without the encumbrance of its prior financial challenges.

| Strength Area | Key Feature | Impact | Data Point (2024/2025 Context) |

|---|---|---|---|

| Technology & Marketplaces | Proprietary e-commerce platforms (e.g., healthinsurance.com) | Scalable customer acquisition, personalized shopping | Online insurance shopping is projected to grow significantly, with digital channels becoming primary for many consumers in 2024. |

| Agent Technology | Agile Admin platform | Enhanced agent productivity, streamlined operations | Platforms offering efficient onboarding and management can increase agent productivity by up to 20% in 2024. |

| Financial Restructuring | Chapter 11 emergence (Sept 2023) | Reduced debt, improved balance sheet, strategic flexibility | Companies emerging from restructuring often see improved operational margins and a renewed focus on core competencies. |

What is included in the product

Analyzes Benefytt’s competitive position through key internal and external factors, including its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential roadblocks into opportunities.

Weaknesses

Benefytt Technologies has been significantly impacted by severe regulatory penalties, notably a nearly $100 million settlement with the Federal Trade Commission (FTC). This settlement was a direct consequence of allegations concerning deceptive marketing of 'sham health plans,' which led to substantial consumer refunds.

The substantial financial penalty not only strained Benefytt's financial health but also damaged its public reputation. Such regulatory actions highlight a critical weakness in the company's compliance and ethical marketing practices, posing ongoing risks.

Benefytt's brand reputation has been significantly damaged by extensive negative publicity and multiple lawsuits, most notably from the Federal Trade Commission (FTC). These legal actions accused the company of misleading consumers regarding Affordable Care Act (ACA)-qualified plans and billing for unwanted extras, creating a deep-seated distrust among potential customers.

The history of alleged deceptive practices presents a substantial hurdle for Benefytt in its efforts to regain consumer confidence. Many consumers believed they were purchasing robust insurance coverage, only to find they had acquired minimal or no actual protection, leaving them feeling betrayed and vulnerable.

Benefytt faces a significant leadership vacuum following the FTC settlement, which has permanently banned its former CEO and a former Vice President of Sales from marketing healthcare products. This disqualification directly stems from the FTC's finding of deceptive practices, underscoring a severe breakdown in oversight and ethical conduct at the highest levels. The loss of these individuals, particularly the former CEO, represents a substantial blow to the company's operational continuity and strategic vision.

Ongoing Financial Instability Post-Bankruptcy

Despite Benefytt's emergence from Chapter 11 bankruptcy in September 2023, its affiliates, such as Blue Lantern Health LLC and Healthinsurance.com, entered state-administered restructuring in April 2024. This ongoing process highlights persistent financial instability within the broader Benefytt organization. The significant unsecured debt reported by these affiliates underscores the lingering financial strain from the initial bankruptcy, suggesting a continued period of financial fragility.

The continued restructuring efforts by Benefytt's affiliates point to unresolved financial challenges. For instance, the significant unsecured debt levels reported by entities like Blue Lantern Health LLC indicate that the company's financial health remains precarious. This situation creates uncertainty for stakeholders and may hinder future growth initiatives.

- Ongoing Restructuring: Benefytt affiliates entered state-administered restructuring in April 2024, post-Chapter 11.

- Significant Unsecured Debt: Affiliates reported substantial unsecured debt, signaling continued financial strain.

- Financial Fragility: The ripple effects of bankruptcy indicate ongoing weakness across the Benefytt ecosystem.

Decreased Employee Count and Revenue Decline

Benefytt has recently seen a significant reduction in its workforce, with a 27% decrease in employee count over the past year. This sharp decline may signal operational adjustments or challenges in maintaining staff levels. The company's estimated annual revenue stands at $10.9 million, indicating a contraction in its financial performance and overall business scale.

The combined effect of a shrinking employee base and declining revenue suggests potential headwinds for Benefytt. These figures point to possible issues with market positioning or the ability to sustain current operational capacity.

- Employee Reduction: A 27% decrease in the employee count over the last year.

- Revenue Figure: Estimated annual revenue is $10.9 million.

- Implications: Potential operational downsizing and reduced financial scale.

Benefytt's brand has been severely tarnished by regulatory actions, including a nearly $100 million FTC settlement for deceptive marketing of sham health plans. This has led to significant consumer refunds and damaged public trust, highlighting a critical weakness in compliance and ethical practices.

The company faces a leadership void as its former CEO and VP of Sales are permanently banned from marketing healthcare products due to FTC findings of deceptive practices. This disqualification underscores a profound breakdown in oversight and ethical conduct at the highest levels.

Despite emerging from Chapter 11 bankruptcy in September 2023, Benefytt's affiliates, such as Blue Lantern Health LLC, entered state-administered restructuring in April 2024. This ongoing process, coupled with significant unsecured debt reported by these affiliates, signals persistent financial instability and fragility across the organization.

Benefytt has experienced a substantial workforce reduction, with a 27% decrease in employees over the past year, alongside an estimated annual revenue of $10.9 million. These figures suggest potential operational downsizing and a contraction in the company's overall financial scale and market presence.

| Weakness | Description | Impact |

| Regulatory Penalties & Reputation Damage | Nearly $100 million FTC settlement for deceptive marketing; multiple lawsuits. | Eroded consumer trust, damaged brand image, ongoing legal risks. |

| Leadership Disqualification | Former CEO and VP of Sales banned from healthcare marketing by FTC. | Loss of key leadership, operational disruption, perceived ethical lapse. |

| Ongoing Financial Instability | Affiliates (e.g., Blue Lantern Health) in state-administered restructuring (April 2024); significant unsecured debt. | Continued financial strain, uncertainty for stakeholders, hindered growth potential. |

| Operational Contraction | 27% employee reduction in the past year; estimated annual revenue of $10.9 million. | Reduced operational capacity, smaller business scale, potential market share decline. |

Preview Before You Purchase

Benefytt SWOT Analysis

You’re previewing the actual Benefytt SWOT analysis document. The complete, detailed report, exactly as you see it here, will be available immediately after purchase.

Opportunities

Benefytt has a significant opportunity to rebuild trust by adopting more transparent practices, especially given past scrutiny. For instance, in 2023, the company faced regulatory attention regarding its sales methods, highlighting the need for clearer communication. By clearly outlining insurance plan benefits, costs, and any associated fees, Benefytt can directly address consumer concerns.

This commitment to transparency can serve as a powerful differentiator in the competitive insurance landscape. In 2024, consumer surveys indicate a growing preference for providers demonstrating ethical conduct and clear disclosures. By prioritizing integrity, Benefytt can attract a segment of the market actively seeking reliable and upfront service providers, potentially boosting customer acquisition and retention rates.

Benefytt has a significant opportunity to rebuild trust and attract a broader customer base by exclusively offering ACA-compliant and comprehensive health insurance plans. This strategic shift directly addresses the concerns raised in past FTC complaints and aligns with consumer demand for reliable coverage. By focusing on these plans, Benefytt can differentiate itself in a crowded market, particularly from less scrupulous online marketers.

Benefytt can build upon its existing technology and data analytics capabilities to create a more user-friendly and compliant platform. This involves developing intuitive interfaces that clearly present all policy information and associated costs, thereby reducing the likelihood of misleading consumers.

By investing in AI-powered tools, Benefytt can automate compliance checks and offer personalized, accurate health insurance plan recommendations. For instance, in 2024, the health insurance market saw a significant increase in regulatory scrutiny, making robust compliance technology a key differentiator.

Strategic Partnerships with Reputable Insurance Carriers

Benefytt can enhance its market position by forming strategic alliances with highly regarded insurance providers. This approach, emphasizing ethical conduct and robust consumer safeguards, could lead to the establishment of new or the reinforcement of current relationships with established carriers.

These partnerships would significantly boost the credibility of Benefytt's services and broaden the selection of compliant insurance products accessible via its platforms. By aligning with trusted names, Benefytt can actively work towards rebuilding consumer trust in its offerings.

- Enhanced Credibility: Partnerships with reputable carriers lend immediate trust and validation to Benefytt's marketplace.

- Expanded Product Portfolio: Access to a wider array of legitimate insurance products can attract a larger customer base.

- Consumer Confidence: Association with well-known, ethical brands can help alleviate consumer concerns and foster trust.

- Market Differentiation: Strong carrier relationships can set Benefytt apart from competitors, particularly in a crowded market.

Explore New Market Niches or Ancillary Services

Benefytt can tap into underserved markets by offering specialized insurance products or complementary services. For instance, expanding into niche areas like pet insurance or offering financial wellness resources could attract new customer segments. In 2024, the ancillary health benefits market, which includes services like dental and vision, was projected to grow significantly, indicating strong consumer interest in supplementary coverage.

This strategic move could involve developing transparent online platforms for these new offerings, mirroring Benefytt's core strengths. The online insurance market saw substantial growth, with digital channels accounting for an increasing share of new policy sales, reaching an estimated 45% in early 2025, highlighting the potential for online expansion.

- Explore specialized insurance niches: Consider areas like short-term disability or critical illness coverage, which are often sought after by individuals seeking additional financial protection.

- Offer ancillary services: This could include services like telemedicine access, wellness programs, or even financial planning tools that enhance the value of core health insurance.

- Target underserved demographics: Identify groups that may not be adequately served by current offerings, such as gig economy workers or small business owners needing tailored insurance solutions.

- Leverage digital platforms: Continue to build out user-friendly online portals for seamless customer acquisition and service delivery in these new market segments.

Benefytt has a significant opportunity to rebuild trust by adopting more transparent practices, especially given past scrutiny. For instance, in 2023, the company faced regulatory attention regarding its sales methods, highlighting the need for clearer communication. By clearly outlining insurance plan benefits, costs, and any associated fees, Benefytt can directly address consumer concerns.

This commitment to transparency can serve as a powerful differentiator in the competitive insurance landscape. In 2024, consumer surveys indicate a growing preference for providers demonstrating ethical conduct and clear disclosures. By prioritizing integrity, Benefytt can attract a segment of the market actively seeking reliable and upfront service providers, potentially boosting customer acquisition and retention rates.

Benefytt can build upon its existing technology and data analytics capabilities to create a more user-friendly and compliant platform. This involves developing intuitive interfaces that clearly present all policy information and associated costs, thereby reducing the likelihood of misleading consumers. By investing in AI-powered tools, Benefytt can automate compliance checks and offer personalized, accurate health insurance plan recommendations, a crucial move given the significant increase in regulatory scrutiny in the health insurance market in 2024.

Benefytt can enhance its market position by forming strategic alliances with highly regarded insurance providers. This approach, emphasizing ethical conduct and robust consumer safeguards, could lead to the establishment of new or the reinforcement of current relationships with established carriers. These partnerships would significantly boost the credibility of Benefytt's services and broaden the selection of compliant insurance products accessible via its platforms. By aligning with trusted names, Benefytt can actively work towards rebuilding consumer trust in its offerings.

Benefytt can tap into underserved markets by offering specialized insurance products or complementary services. For instance, expanding into niche areas like pet insurance or offering financial wellness resources could attract new customer segments. In 2024, the ancillary health benefits market, which includes services like dental and vision, was projected to grow significantly, indicating strong consumer interest in supplementary coverage. The online insurance market saw substantial growth, with digital channels accounting for an increasing share of new policy sales, reaching an estimated 45% in early 2025, highlighting the potential for online expansion.

| Opportunity Area | Description | 2024/2025 Data/Trend |

|---|---|---|

| Transparency & Trust Rebuilding | Clearer communication on plan benefits, costs, and fees. | Consumer surveys in 2024 show preference for ethical conduct and clear disclosures. |

| Platform Enhancement & Compliance | User-friendly interfaces, AI for compliance checks and personalized recommendations. | 2024 saw increased regulatory scrutiny in health insurance, making robust compliance tech a differentiator. |

| Strategic Carrier Partnerships | Aligning with reputable insurance providers. | Strengthens credibility and expands compliant product offerings. |

| Market Expansion (Niche & Ancillary) | Offering specialized products (e.g., pet insurance) and ancillary services. | Ancillary health benefits market projected for significant growth in 2024; digital channels accounted for ~45% of new policy sales in early 2025. |

Threats

Benefytt's operations are under intensified regulatory scrutiny, particularly from the FTC, due to past practices involving deceptive marketing and undisclosed 'junk fees.' This heightened oversight, amplified by the FTC's new rule on unfair or deceptive fees taking effect in May 2025, presents a substantial risk of future enforcement actions. Such actions could manifest as fines, mandated changes to business practices, or even operational limitations, directly impacting profitability and strategic execution.

Benefytt faces a significant hurdle due to deep-seated consumer distrust, largely stemming from past Federal Trade Commission (FTC) lawsuits and substantial refunds issued for what were deemed 'sham health plans.' This history has created a negative public perception that will be difficult and expensive to overcome, impacting the acquisition of new customers.

The company's prior operations under names such as Health Insurance Innovations have also contributed to a checkered past that many consumers may still remember, further exacerbating the challenge of rebuilding trust and attracting a broader customer base in the current market landscape.

Benefytt faces intense competition from established insurtech firms such as Clover Health, eHealth, and Oscar. These rivals often boast stronger brand recognition and deeper financial reserves, presenting a formidable hurdle for Benefytt in its efforts to reclaim market share. For instance, Oscar Health reported a revenue of $7.1 billion in 2023, highlighting its substantial market presence compared to smaller competitors.

Potential for Further Legal Liabilities and Financial Strain

Benefytt Technologies, despite its Chapter 11 bankruptcy filing and reorganization efforts, continues to grapple with significant legal hurdles. A notable ongoing dispute involves coverage under its Directors and Officers (D&O) insurance policies, which could result in substantial legal costs and settlements. This persistent legal entanglements represent a considerable threat, potentially draining financial resources that could otherwise be allocated to operational improvements or strategic growth initiatives.

The company's financial health remains a critical concern, underscored by the ongoing financial distress of its affiliated entities and the contemplation of further restructuring. This precarious financial standing means Benefytt's ability to invest in innovation or expand its market reach is severely limited. The need to manage these ongoing financial pressures and legal liabilities could force a continued diversion of capital, hindering any potential for a robust recovery or future expansion.

- Ongoing legal disputes, including D&O insurance claims, pose a continuous financial risk.

- The financial instability of affiliates and potential for further restructuring highlight ongoing financial strain.

- Legal and financial pressures are likely to divert essential resources away from growth and investment opportunities.

Adverse Changes in Healthcare Policy and Regulations

The healthcare landscape is constantly shifting, and changes in policy, especially concerning the Affordable Care Act (ACA), pose a significant threat to Benefytt. For instance, proposals in late 2024 and early 2025 to modify ACA subsidies or alter essential health benefits could directly impact the demand for and structure of plans Benefytt offers. The company's history of offering non-ACA compliant plans means that any tightening of regulations around short-term health insurance or similar products could necessitate substantial business model adjustments.

Navigating these evolving legal frameworks requires continuous vigilance and investment. Benefytt must remain agile, ensuring its product offerings and marketing strategies consistently meet or exceed new compliance standards. Failure to adapt could lead to regulatory penalties or a loss of market access, a challenge underscored by the ongoing debates in Congress regarding healthcare reform throughout 2024.

- Regulatory Uncertainty: Ongoing discussions about ACA reforms create a volatile operating environment.

- Compliance Costs: Adapting to new regulations may require significant investments in legal and operational adjustments.

- Market Access: Stricter rules on non-ACA compliant plans could limit Benefytt's product portfolio and customer reach.

Benefytt faces significant threats from intensified regulatory scrutiny, particularly from the FTC, due to past deceptive marketing and undisclosed fees. The FTC's new rule on unfair or deceptive fees, effective May 2025, heightens this risk, potentially leading to fines and operational limitations.

Consumer distrust, fueled by past FTC lawsuits and refunds for 'sham health plans,' creates a substantial barrier to customer acquisition. The company's history under names like Health Insurance Innovations further compounds this challenge, making it difficult to rebuild a positive public image.

Intense competition from established insurtech firms like Oscar Health, which reported $7.1 billion in revenue in 2023, presents a formidable challenge. Benefytt also contends with ongoing legal disputes, including D&O insurance claims, which drain financial resources needed for growth.

The company's financial instability and the potential for further restructuring severely limit its ability to invest in innovation or expand its market reach. Evolving healthcare policies, especially regarding the Affordable Care Act (ACA), pose another threat, as changes to subsidies or essential health benefits could impact demand for Benefytt's offerings.

| Threat Category | Specific Threat | Impact | Yearly Financial Impact (Est.) | Mitigation Strategy Example |

| Regulatory | FTC Fee Rule (May 2025) | Fines, operational limits, reputational damage | $5M - $20M+ | Proactive compliance review, transparent fee disclosure |

| Market Perception | Lingering Consumer Distrust | Reduced customer acquisition, higher marketing costs | $10M - $30M+ (in lost revenue) | Robust customer service, transparent communication, verifiable testimonials |

| Competition | Established Insurtech Rivals | Market share erosion, pricing pressure | $15M - $40M+ (in lost revenue) | Niche market focus, innovative product development, strategic partnerships |

| Legal & Financial | Ongoing Legal Disputes (D&O Claims) | Increased legal expenses, capital diversion | $3M - $10M+ (in legal costs) | Aggressive legal defense, explore settlement options, secure adequate insurance |

| Policy Changes | ACA Reform Uncertainty | Product portfolio adjustments, reduced demand for certain plans | $5M - $25M+ (in revenue impact) | Diversify product offerings, monitor legislative developments closely |

SWOT Analysis Data Sources

This Benefytt SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial statements, detailed market research reports, and expert industry analyses to provide a thorough and actionable strategic overview.