Benefytt PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benefytt Bundle

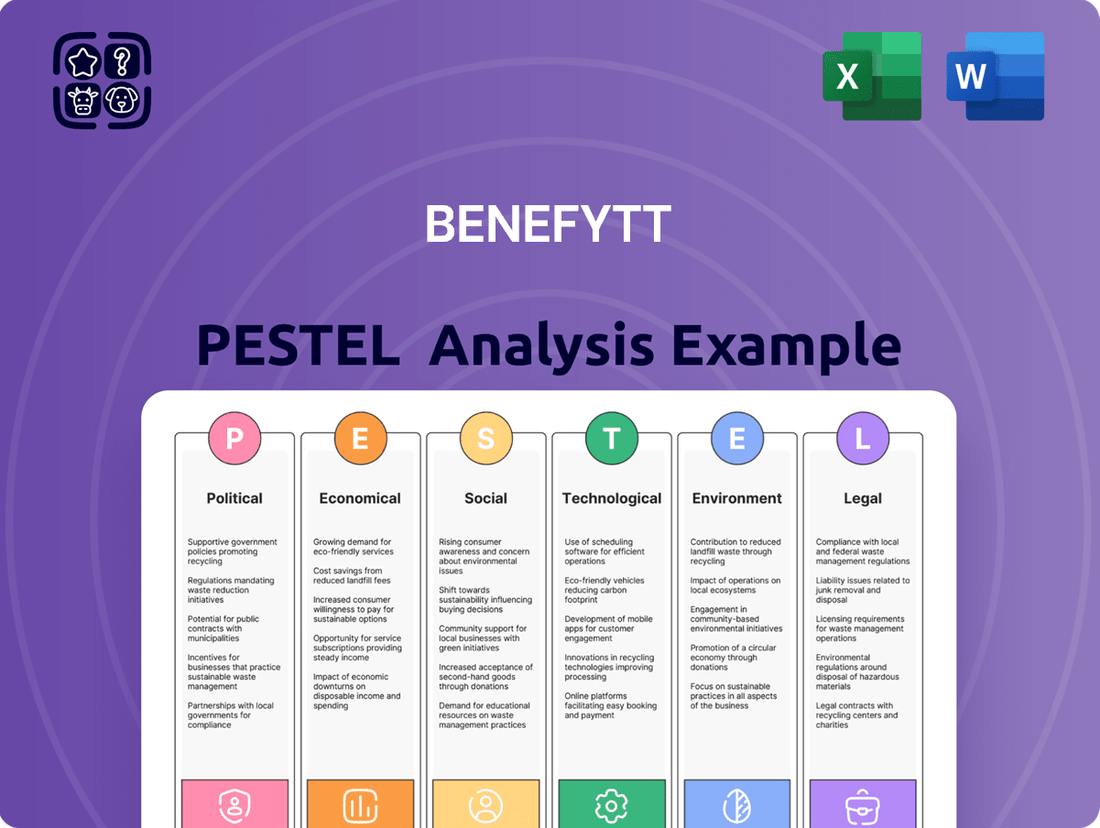

Navigate the complex external landscape impacting Benefytt with our expert-crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping their future. This comprehensive report provides actionable insights for strategic planning and competitive advantage. Download the full version now to gain a crucial edge.

Political factors

Shifts in federal and state healthcare policies, including potential modifications to the Affordable Care Act (ACA), Medicare, and Medicaid, directly influence the insurance products Benefytt Technologies can offer and the consumer groups it targets. For instance, legislative debates around ACA subsidies or changes to Medicaid eligibility could open new avenues for Benefytt's e-commerce platform or introduce operational hurdles.

The political landscape's stability concerning healthcare reform is crucial for Benefytt's strategic planning; for example, the Centers for Medicare & Medicaid Services (CMS) announced in late 2023 that the Medicare Advantage and Part D prescription drug program final premiums would increase by an average of 3% in 2024, impacting the competitive environment for plans Benefytt might offer.

Benefytt Technologies operates within a heavily regulated insurance landscape. Federal oversight, such as through the Centers for Medicare & Medicaid Services (CMS) for Medicare-related products, and state-level insurance departments dictate licensing, sales practices, and consumer protections. For instance, the National Association of Insurance Commissioners (NAIC) continuously updates model laws impacting market conduct and solvency, which Benefytt must adhere to.

Consumer protection laws are paramount, requiring transparency in policy offerings and prohibiting deceptive practices. In 2024, regulatory bodies are increasingly scrutinizing digital sales platforms and data privacy, with potential for new rules governing online insurance marketplaces and the handling of sensitive consumer information. Benefytt's proactive compliance strategy, including robust anti-fraud measures, is essential to navigate these evolving requirements and avoid significant penalties.

Political stability significantly impacts consumer confidence, a key driver for Benefytt's sales. In 2024, global political uncertainty, including ongoing geopolitical tensions and upcoming elections in major economies, has led to cautious consumer spending. This hesitancy can translate to delayed or reduced purchases of insurance products, as consumers prioritize immediate needs over long-term financial commitments.

Conversely, a stable political landscape fosters a predictable market, encouraging consumers to invest in future-oriented services like insurance. For instance, regions experiencing sustained peace and predictable governance often see higher rates of insurance penetration. This stability allows companies like Benefytt to forecast demand more accurately and plan product offerings accordingly, potentially boosting sales volumes.

Government Spending on Health Programs

Government spending on health programs directly influences the demand for private healthcare marketplaces like Benefytt. For instance, in 2024, the U.S. government allocated substantial funds to expand Medicare and Medicaid, potentially reducing the immediate need for private insurance for some demographics. However, increased investment in public health infrastructure could also lead to greater consumer awareness and engagement with health services, indirectly benefiting platforms that facilitate access to these services.

Shifts in government spending priorities can create both opportunities and challenges. If public health initiatives focus on preventative care, this could drive traffic to platforms offering related services or information. Conversely, a reduction in subsidies for private health insurance, as seen in some proposed budget cuts for 2025, might push more individuals to seek affordable private options, thereby potentially boosting Benefytt's user base.

- Government health spending in 2024: The U.S. government's budget for health programs continues to be a significant driver of the healthcare landscape, with ongoing investments in areas like public health infrastructure and subsidies for health insurance.

- Potential impact of 2025 budget proposals: Discussions around the 2025 fiscal year budget include potential adjustments to healthcare spending, which could either increase reliance on private sector solutions or bolster public health services.

- Consumer behavior shifts: Changes in government healthcare policy and spending directly influence consumer choices, potentially leading to increased or decreased demand for private e-commerce health marketplaces.

Taxation Policies on Insurance and Digital Services

Changes in taxation policies, particularly concerning insurance premiums and digital services, present a significant political factor for Benefytt Technologies. For instance, shifts in corporate tax rates directly impact the company's net earnings. If corporate tax rates were to increase, Benefytt's profitability could be squeezed, potentially forcing adjustments to its pricing or operational strategies.

Furthermore, taxes levied on insurance premiums could influence consumer demand for Benefytt's offerings. An increase in such taxes might make insurance products less affordable, leading to a decrease in sales volume. Conversely, favorable tax treatment could boost the attractiveness of insurance products and, by extension, Benefytt's platform.

The emergence of digital services taxes (DSTs) is another critical consideration. If governments implement DSTs that apply to online platforms facilitating insurance sales or related services, Benefytt could face additional operational costs. For example, some countries have introduced or are considering DSTs, with rates varying but often impacting revenue generated through digital transactions. Such taxes could necessitate price adjustments for consumers or a re-evaluation of revenue-sharing models with insurance providers.

- Corporate Tax Rate Impact: A hypothetical 1% increase in the US federal corporate tax rate, from 21% to 22%, could reduce Benefytt's net income by a corresponding percentage, assuming no other changes.

- Insurance Premium Tax Effects: If a state were to introduce a 0.5% tax on insurance premiums facilitated through online platforms, it could increase the cost for consumers and potentially dampen demand for certain insurance products.

- Digital Services Tax Scenarios: A 3% digital services tax on revenue generated from online insurance lead generation could directly reduce Benefytt's top-line revenue from those specific activities.

Government regulations, particularly those from the Centers for Medicare & Medicaid Services (CMS) and state insurance departments, are foundational to Benefytt's operations, dictating everything from product offerings to sales conduct. For instance, in 2024, CMS finalized rules that impact Medicare Advantage and Part D plans, influencing the competitive landscape for Benefytt's marketplace. Adherence to National Association of Insurance Commissioners (NAIC) model laws is also critical for market conduct and solvency.

What is included in the product

This Benefytt PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

Benefytt's PESTLE analysis offers a clear, summarized version of external factors, relieving the pain of sifting through lengthy reports for quick referencing during meetings or presentations.

Economic factors

Consumer disposable income is a critical driver for Benefytt Technologies, directly impacting the affordability and demand for their health and life insurance products. When consumers have more money left after essential expenses, they are more likely to invest in comprehensive insurance plans. For instance, in 2024, while inflation has shown signs of moderating, the real disposable income growth in the US, though positive, has been relatively modest, suggesting consumers remain budget-conscious when considering non-essential or higher-tier insurance coverage.

Economic conditions significantly shape this purchasing power. Periods of robust economic growth, which typically see higher wage increases and job security, empower consumers to allocate more funds towards insurance premiums, potentially opting for more robust or supplementary coverage options. Conversely, economic slowdowns or recessions, characterized by rising unemployment and stagnant wages, force consumers to prioritize essential spending, often leading to a reduction in demand for anything beyond basic or subsidized health plans, impacting Benefytt's sales of higher-margin products.

Inflation directly influences the cost of healthcare services, a critical input for insurance carriers. As inflation rises, the expenses associated with medical procedures, pharmaceuticals, and labor increase. This upward pressure on costs for insurers often translates into higher premiums for the plans they offer, including those listed on Benefytt Technologies' marketplace.

For instance, the U.S. Consumer Price Index for Medical Care Services saw a notable increase in 2023, contributing to the overall inflationary environment. If this trend continues into 2024 and 2025, Benefytt Technologies could face challenges. Higher premiums might deter consumers from purchasing insurance, potentially impacting the platform's conversion rates and overall sales volume.

Benefytt must closely monitor these inflationary pressures on insurance carriers. Understanding how these rising costs affect carrier pricing strategies and their willingness to partner or offer competitive rates is crucial for maintaining strong business relationships and ensuring the affordability of insurance products for their customer base.

Unemployment rates significantly influence Benefytt's market. As of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months. Higher unemployment often means fewer individuals have employer-sponsored health insurance, potentially boosting demand for individual plans on Benefytt's platform.

Conversely, a robust job market, indicated by low unemployment, means more people are covered through their employers. For instance, in April 2024, the U.S. unemployment rate was 3.9%. This trend could temper the growth of Benefytt's individual insurance offerings as employer-sponsored coverage remains the primary source for many.

Interest Rate Environment and Carrier Profitability

The prevailing interest rate environment significantly impacts insurance carriers' profitability by affecting their investment income. For instance, as of early 2024, the Federal Reserve maintained higher interest rates compared to the preceding years. This generally benefits carriers by increasing the returns on their substantial investment portfolios, which often consist of bonds and other fixed-income securities. Higher investment income can enable carriers to offer more competitive pricing on their health insurance products listed on Benefytt's platform.

Conversely, a sustained period of lower interest rates, as seen in the decade prior to 2022, can pressure carriers to adjust their strategies. Lower yields on investments might necessitate premium increases or a reduction in certain benefits to maintain profitability. This dynamic directly influences the affordability and attractiveness of the insurance plans available to consumers through Benefytt, potentially limiting product variety or pushing consumers towards higher-deductible options.

The ability of carriers to generate strong investment returns is a key component of their overall financial health, which in turn dictates their capacity to underwrite risk and offer diverse insurance products. For example, a carrier with robust investment income might be more willing to absorb higher claims costs or invest in new product development.

- Higher Interest Rates: Generally improve carriers' investment income, potentially leading to more competitive premiums on Benefytt.

- Lower Interest Rates: Can pressure carriers to increase premiums or reduce benefits to maintain profitability.

- Investment Portfolios: Carriers rely on returns from investments, often in fixed-income securities, to supplement premium income.

- Market Competitiveness: Carriers with better investment performance may offer more attractive and varied product options on Benefytt's marketplace.

Economic Growth and Market Expansion

Economic growth directly fuels the health insurance market. When economies expand, typically measured by Gross Domestic Product (GDP) growth, disposable incomes tend to rise. This increased purchasing power allows more individuals and families to afford private health insurance plans, a key driver for Benefytt Technologies' service demand. For instance, in 2024, global GDP growth was projected to be around 3.2%, indicating a generally favorable environment for consumer spending on essential services like healthcare.

Benefytt Technologies' expansion is closely tied to these economic trends. Robust economic expansion in key markets, such as the United States, where Benefytt has a significant presence, translates into a larger addressable market for their offerings. Conversely, economic downturns or recessions can dampen consumer confidence and reduce the ability to pay for insurance premiums, potentially leading to increased price sensitivity and competition among providers. The U.S. economy, for example, showed resilience in early 2024, with GDP growth estimates hovering around 2.5% to 3.0% for the year, suggesting continued opportunities.

- GDP Growth: Global GDP growth projected at 3.2% for 2024, with the U.S. economy showing similar or slightly higher growth rates.

- Disposable Income: Rising disposable incomes in growing economies increase affordability for private health insurance.

- Market Demand: Economic expansion stimulates demand for health insurance products and services offered by companies like Benefytt.

- Competitive Landscape: Economic contractions can intensify competition as consumers seek more affordable options.

Consumer spending habits are heavily influenced by economic stability and growth. In 2024, while inflation has seen some moderation, consumer disposable income growth in the US has been modest, indicating a cautious approach to discretionary spending, including insurance. Economic downturns, marked by rising unemployment and stagnant wages, force prioritization of essential needs, potentially reducing demand for comprehensive insurance plans.

Inflation directly impacts healthcare costs, leading to higher insurance premiums. For instance, medical care services inflation in the U.S. remained a factor in 2023, and continued increases into 2024 and 2025 could make insurance less affordable for consumers on Benefytt's platform. Interest rates also play a crucial role; higher rates in early 2024 generally benefit insurance carriers by boosting investment income, potentially allowing for more competitive pricing on Benefytt's marketplace.

| Economic Factor | 2024/2025 Outlook | Impact on Benefytt |

|---|---|---|

| Disposable Income | Modest growth, consumers remain budget-conscious. | May limit uptake of higher-tier plans. |

| Inflation (Medical Care) | Continued pressure on healthcare costs. | Could lead to higher premiums, impacting affordability. |

| Unemployment Rate | Slight increase (e.g., 4.0% in May 2024). | May increase demand for individual plans if employer coverage declines. |

| Interest Rates | Maintained at higher levels (early 2024). | Benefits carriers' investment income, potentially leading to competitive pricing. |

| GDP Growth | Projected around 3.2% globally for 2024; U.S. around 2.5%-3.0%. | Supports consumer spending and demand for insurance. |

Preview the Actual Deliverable

Benefytt PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Benefytt PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Benefytt.

The content and structure shown in the preview is the same document you’ll download after payment, providing a thorough and actionable PESTLE analysis for Benefytt.

Sociological factors

The U.S. population is aging, with the number of individuals aged 65 and over projected to reach 73.1 million by 2030, a significant increase from 54.1 million in 2019. This demographic shift directly impacts Benefytt Technologies by increasing demand for Medicare Advantage plans and supplemental health insurance products. Understanding generational preferences is also key; for instance, Gen Z and Millennials may prioritize different life insurance features than Baby Boomers.

Growing consumer awareness about health issues and the importance of preventative care is a significant driver for the health insurance market. As individuals become more proactive about their well-being, they are increasingly seeking comprehensive coverage to protect themselves financially. This trend directly benefits companies like Benefytt, whose business model relies on consumers recognizing the value of health and life insurance.

The adoption of health-conscious lifestyles and wellness programs further fuels this demand. For instance, a 2024 survey indicated that 65% of adults are actively trying to improve their health through diet and exercise, suggesting a greater appreciation for the long-term financial security that adequate insurance provides. This heightened focus on personal health translates into a stronger inclination to invest in health and life insurance products.

Digital literacy significantly impacts online insurance adoption. As of 2024, a Pew Research Center report indicated that while a majority of adults in the US are comfortable with online transactions, a notable portion, especially older demographics, still express hesitations with sensitive financial activities like purchasing insurance. This highlights a critical area for Benefytt to address.

Benefytt's e-commerce marketplace growth hinges on bridging this digital divide. For instance, data from 2025 projections suggest that a substantial segment of the senior market, a key demographic for certain insurance products, still prefers in-person or phone interactions for complex financial decisions. This means Benefytt must invest in intuitive user interface design and robust customer support to build trust and facilitate seamless online adoption.

Trust in Online Platforms for Sensitive Information

Societal trust in online platforms for sensitive data, like health and financial information, is a critical factor for Benefytt Technologies. Recent surveys in 2024 indicate a growing public awareness of data privacy, with a significant percentage of consumers expressing concern about how their personal information is handled by tech companies. This heightened sensitivity directly impacts Benefytt's ability to attract and retain customers who are entrusting them with vital personal details.

Benefytt's business model necessitates a strong foundation of trust. Consumers are increasingly scrutinizing the security protocols and data usage policies of online service providers. For example, a 2024 Pew Research Center study found that over 70% of Americans are very or somewhat concerned about companies sharing their personal data with third parties without explicit consent. This societal trend means Benefytt must proactively demonstrate unwavering commitment to data protection and transparency to maintain its competitive edge.

Any perceived vulnerability or past data breach, even if unrelated to Benefytt, can erode public confidence. The widespread reporting of high-profile data breaches in the financial and healthcare sectors throughout 2023 and early 2024 has amplified these concerns. Consequently, Benefytt's success hinges on its ability to cultivate and sustain a reputation for being a secure and trustworthy custodian of sensitive consumer information.

Key considerations for Benefytt include:

- Consumer Perception: Public perception of online security directly influences willingness to share personal health and financial data.

- Data Privacy Concerns: Growing societal anxieties about data breaches and misuse of personal information create a challenging landscape.

- Transparency and Security: Benefytt's reliance on robust security measures and transparent data handling practices is paramount for building and maintaining trust.

- Competitive Landscape: Competitors with stronger trust signals or perceived better security may gain an advantage if Benefytt fails to address these societal factors effectively.

Changing Lifestyles and Work Arrangements

The shift towards remote and hybrid work models, accelerated by events in the early 2020s, significantly impacts insurance needs. For instance, by 2024, an estimated 30% of the global workforce is expected to be working remotely at least part-time, creating a demand for portable and individually purchased health and life insurance plans. This trend necessitates flexible product offerings that cater to those outside traditional employer benefits structures.

The burgeoning gig economy further underscores the need for adaptable insurance solutions. With millions participating in freelance and contract work, many lack employer-provided benefits. In 2024, the freelance economy in the US alone is projected to involve over 70 million workers, highlighting a substantial market segment requiring personalized insurance policies that align with variable income and employment status.

Evolving family structures and an increased focus on individual well-being also shape insurance acquisition. Non-traditional family units and a greater emphasis on personal health management mean individuals are more likely to seek coverage independently. Benefytt's strategy must therefore prioritize platforms that simplify the process of finding and managing insurance for a diverse range of lifestyles and personal circumstances.

- Remote Work Growth: Projections indicate a sustained increase in remote work, influencing demand for portable insurance.

- Gig Economy Expansion: The growing number of independent contractors necessitates flexible, individual insurance plans.

- Personalized Needs: Changing lifestyles and family structures drive a demand for tailored insurance solutions.

- Market Adaptation: Benefytt must cater to individuals seeking coverage outside of traditional employer-sponsored benefits.

Societal trust in online platforms for sensitive data, like health and financial information, is a critical factor for Benefytt Technologies. Recent surveys in 2024 indicate a growing public awareness of data privacy, with a significant percentage of consumers expressing concern about how their personal information is handled by tech companies. This heightened sensitivity directly impacts Benefytt's ability to attract and retain customers who are entrusting them with vital personal details.

Benefytt's business model necessitates a strong foundation of trust. Consumers are increasingly scrutinizing the security protocols and data usage policies of online service providers. For example, a 2024 Pew Research Center study found that over 70% of Americans are very or somewhat concerned about companies sharing their personal data with third parties without explicit consent. This societal trend means Benefytt must proactively demonstrate unwavering commitment to data protection and transparency to maintain its competitive edge.

Any perceived vulnerability or past data breach, even if unrelated to Benefytt, can erode public confidence. The widespread reporting of high-profile data breaches in the financial and healthcare sectors throughout 2023 and early 2024 has amplified these concerns. Consequently, Benefytt's success hinges on its ability to cultivate and sustain a reputation for being a secure and trustworthy custodian of sensitive consumer information.

Key considerations for Benefytt include consumer perception of online security, growing data privacy concerns, the paramount importance of transparency and security, and the competitive advantage competitors may gain if Benefytt fails to address these societal factors effectively.

Technological factors

Benefytt Technologies can significantly enhance its operations through advancements in AI and data analytics. These technologies allow for a more personalized insurance shopping experience, improving lead generation and matching consumers with the most suitable plans. For instance, in 2024, the global AI in insurance market was valued at approximately $10.5 billion and is projected to grow substantially, indicating a strong trend towards AI adoption.

Leveraging AI for predictive analytics can help Benefytt anticipate customer needs, while chatbots can streamline customer service, boosting efficiency and satisfaction. Dynamic pricing models, informed by real-time data, can also optimize plan offerings. The rapid pace of AI adoption across the insurance sector means that staying at the forefront of these technological developments is crucial for maintaining a competitive edge.

Benefytt Technologies' reliance on sensitive personal health and financial data underscores the critical need for advanced cybersecurity and data privacy technologies. Continuous investment in robust security infrastructure, including sophisticated encryption and threat detection, is paramount to safeguarding this information. For instance, the global average cost of a data breach reached $4.45 million in 2024, highlighting the significant financial implications of security failures.

Maintaining consumer trust and adhering to evolving data privacy regulations, such as GDPR and CCPA, are directly tied to the effectiveness of Benefytt's technological defenses. The increasing sophistication of cyber threats demands constant vigilance and adaptation of security protocols to prevent breaches and protect sensitive customer information.

The ongoing evolution of e-commerce platforms directly influences Benefytt's user acquisition and retention. As of early 2024, over 60% of consumers prefer shopping online, highlighting the critical need for intuitive interfaces and mobile-first design in insurance platforms. Benefytt's ability to offer a seamless navigation and efficient checkout process is paramount for a superior user experience.

Staying ahead of user experience trends is essential for competitive advantage in the digital insurance landscape. For instance, advancements in AI-powered personalization and one-click purchasing are becoming standard expectations. By embracing these platform technologies, Benefytt can enhance its appeal and customer loyalty, especially as the global e-commerce market is projected to reach $8.1 trillion by 2024.

Integration with Health Tech and Wearables

Benefytt Technologies can significantly enhance its offerings by integrating with the burgeoning health tech sector. This includes connecting with wearable devices and popular health applications to gather real-time user data.

Such integration allows for more precise risk assessments, potentially leading to tailored insurance plans. For instance, by analyzing data from smartwatches or fitness trackers, Benefytt could offer incentives for users who consistently meet health goals, fostering a more proactive approach to wellness among its customer base. This trend is supported by the expanding digital health market, which was projected to reach over $600 billion globally by 2025, indicating a strong consumer appetite for connected health solutions.

- Personalized Risk Assessment: Leveraging data from wearables like Apple Watch or Fitbit for more accurate underwriting.

- Incentivizing Healthy Behaviors: Offering premium discounts or rewards for users who maintain active lifestyles, as tracked by connected devices.

- Dynamic Product Development: Creating insurance products that adapt based on real-time health data, offering greater value and engagement.

- Market Growth: Capitalizing on the projected 15% compound annual growth rate of the global digital health market through 2027.

Cloud Computing Infrastructure and Scalability

Benefytt Technologies leverages scalable cloud computing infrastructure, like Amazon Web Services (AWS) or Microsoft Azure, to power its e-commerce marketplaces and sophisticated data analytics. This infrastructure allows for rapid adjustments in computing power, ensuring smooth operations even during peak demand periods, a critical factor for customer satisfaction and service reliability.

The ability to scale resources up or down efficiently is fundamental to Benefytt's operational model. For instance, during open enrollment periods for health insurance, demand on their platforms can surge dramatically. Cloud elasticity ensures they can handle this influx without performance degradation, a capability that directly impacts user experience and conversion rates.

Data processing is another area where cloud scalability is paramount. Benefytt's data analytics capabilities, used for market insights and personalized customer experiences, require robust infrastructure to manage and analyze vast datasets. Secure and dependable cloud solutions are therefore essential for maintaining data integrity and delivering timely, actionable intelligence.

Key advantages of this technological factor include:

- Enhanced Agility: Rapidly deploy and scale services to meet market opportunities or seasonal demand.

- Cost Efficiency: Pay-as-you-go models for cloud resources optimize spending compared to maintaining on-premise hardware.

- Improved Reliability: Cloud providers offer high availability and disaster recovery, minimizing downtime.

- Advanced Data Capabilities: Access to cutting-edge tools for big data analytics and machine learning.

Benefytt Technologies' strategic adoption of artificial intelligence and data analytics is pivotal for its growth, enabling personalized customer experiences and efficient operations. The global AI in insurance market, valued at approximately $10.5 billion in 2024, demonstrates the significant trend towards AI integration.

Advanced cybersecurity is non-negotiable, given Benefytt's handling of sensitive data. The average cost of a data breach in 2024 was $4.45 million, underscoring the financial imperative for robust security measures to maintain trust and compliance.

The company's e-commerce platforms must prioritize user experience, with over 60% of consumers preferring online shopping as of early 2024. The global e-commerce market's projected $8.1 trillion value by 2024 highlights the competitive necessity of intuitive digital interfaces.

Integration with the health tech sector offers opportunities for tailored insurance products and incentivizing healthy behaviors, tapping into a digital health market projected to exceed $600 billion globally by 2025.

| Technology Area | 2024 Data/Projection | Impact on Benefytt |

|---|---|---|

| AI in Insurance | Market valued at ~$10.5 billion (2024) | Enhanced personalization, lead generation, customer service efficiency. |

| Cybersecurity | Average data breach cost: $4.45 million (2024) | Crucial for protecting sensitive data, maintaining customer trust, and regulatory compliance. |

| E-commerce User Experience | 60%+ consumers prefer online shopping (early 2024) | Drives need for intuitive interfaces, mobile-first design, and seamless transactions. |

| Digital Health Market | Projected >$600 billion globally by 2025 | Opportunity for data integration from wearables, personalized risk assessment, and health incentives. |

Legal factors

Benefytt Technologies operates under a stringent regulatory environment, particularly concerning data privacy and security. Compliance with laws like HIPAA, the California Consumer Privacy Act (CCPA), and any new federal or state privacy legislation is paramount. Failure to adhere to these regulations, which govern how sensitive health and personal information is collected, stored, and utilized, can result in substantial fines and severe reputational harm.

The dynamic nature of privacy laws necessitates ongoing legal scrutiny and adaptation of Benefytt's data handling practices. For instance, the CCPA, which went into effect in 2020, grants consumers significant rights over their personal information, and its amendments, such as those passed in 2023, continue to shape compliance requirements. Staying ahead of these evolving legal mandates is crucial for maintaining trust and operational integrity.

Benefytt Technologies operates within a highly regulated insurance industry, facing a complex patchwork of state-specific and federal laws. These regulations cover everything from agent licensing requirements to stringent disclosure obligations and advertising standards, particularly for online sales channels.

Navigating these varied legal frameworks across different jurisdictions is crucial for Benefytt's operational reach and significantly impacts its compliance costs. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continues to update model laws impacting digital insurance sales, requiring ongoing adaptation.

Consumer protection laws are a significant legal factor for Benefytt Technologies, especially concerning its online operations. These regulations aim to prevent deceptive advertising, unfair trade practices, and mandate clear pricing and terms for consumers. For instance, the Federal Trade Commission (FTC) actively enforces rules against misleading claims, which could impact Benefytt's marketing strategies. In 2023, the FTC reported over 1.1 million fraud reports, highlighting the constant vigilance required in consumer dealings.

Antitrust and Competition Laws

Antitrust and competition laws are a key consideration for Benefytt Technologies, especially as its marketplace grows. If Benefytt were to achieve significant market dominance or engage in practices that stifle competition among the insurance carriers on its platform, it could face scrutiny under these regulations. For instance, the U.S. Department of Justice and the Federal Trade Commission actively enforce antitrust laws to prevent monopolies and ensure fair market practices.

While Benefytt's model of connecting consumers with multiple carriers might inherently promote competition, proactive compliance is essential. This is particularly true when considering strategic partnerships or potential acquisitions that could alter the competitive landscape. Understanding regulations like the Sherman Act and the Clayton Act in the United States helps Benefytt navigate these complexities and maintain a fair marketplace.

Benefytt's approach to listing providers and managing its platform must align with principles of fair competition. This ensures that all participating carriers have an equitable opportunity to reach consumers, preventing any single entity from gaining an unfair advantage. Adherence to these legal frameworks is vital for long-term operational stability and market trust.

Healthcare Reform Legislation Impact

Major healthcare reform legislation directly shapes the legal landscape for companies like Benefytt Technologies. For instance, the Affordable Care Act (ACA) in the United States introduced new mandates regarding essential health benefits and subsidies, significantly altering the market for individual health insurance plans. As of early 2024, discussions around potential adjustments to ACA provisions continue, which could impact plan designs and consumer eligibility for financial assistance.

Benefytt must closely track legislative developments that could introduce new coverage requirements or alter subsidy structures. Changes to regulatory environments for private health insurance exchanges, such as those debated in Congress throughout 2024, could necessitate adjustments in Benefytt's product offerings and sales strategies to ensure compliance with evolving legal mandates.

- Legislative Mandates: Laws can dictate specific benefits that must be included in insurance plans, directly affecting product development.

- Subsidy Structures: Changes to government subsidies can influence consumer purchasing power and the affordability of insurance products.

- Exchange Regulations: Rules governing private health insurance exchanges can impact how companies market and sell their plans.

- Compliance Costs: Adapting to new legislation often incurs additional compliance costs for insurance providers.

Legal factors significantly shape Benefytt's operations, particularly concerning data privacy and consumer protection. Evolving regulations like the CCPA and FTC guidelines demand constant adaptation to avoid penalties and maintain consumer trust. Furthermore, the complex web of state and federal insurance laws, including those impacting online sales as updated by bodies like the NAIC in 2024, requires diligent navigation and impacts compliance expenditures.

Antitrust laws also play a crucial role, ensuring fair competition on Benefytt's platform, as highlighted by ongoing enforcement by the DOJ and FTC. Healthcare reform, such as potential ACA adjustments discussed in 2024, directly influences the insurance market and necessitates flexibility in Benefytt's product offerings and sales strategies.

Benefytt must navigate a landscape where legislative mandates dictate insurance benefits, subsidy structures influence affordability, and exchange regulations govern market access. These legal frameworks directly contribute to compliance costs and require continuous monitoring of policy changes.

| Legal Factor | Impact on Benefytt | Relevant Data/Trend (2024/2025) |

| Data Privacy Laws (e.g., CCPA) | Requires robust data handling practices; non-compliance leads to fines. | CCPA amendments continue to refine consumer rights; FTC reported 1.1M fraud reports in 2023. |

| Insurance Regulations | Dictates agent licensing, disclosures, and advertising, especially for online sales. | NAIC updates model laws for digital insurance sales in 2024; state-specific variations increase complexity. |

| Consumer Protection | Prevents deceptive advertising and unfair practices; mandates transparency. | FTC actively enforces against misleading claims; consumer trust is paramount for online platforms. |

| Antitrust Laws | Ensures fair competition among listed carriers; prevents monopolistic practices. | DOJ and FTC actively monitor market concentration and competitive practices. |

| Healthcare Reform (e.g., ACA) | Influences plan design, benefits, and consumer eligibility for subsidies. | Ongoing discussions in Congress regarding ACA adjustments in 2024 could alter market dynamics. |

Environmental factors

Societal and investor expectations for corporate social responsibility (CSR) are significantly shaping how companies like Benefytt Technologies operate. This means a strong focus on ethical conduct, clear operations, and positive community impact is no longer optional but a driver of brand loyalty and talent acquisition. For instance, a 2024 survey indicated that 66% of global consumers are willing to pay more for sustainable brands.

Public perception of a company's environmental and social footprint is becoming paramount. Benefytt's commitment to transparent reporting on its social impact, alongside its digital service offerings, directly addresses these growing concerns. Investors are increasingly scrutinizing ESG (Environmental, Social, and Governance) metrics, with sustainable funds attracting over $3.7 trillion globally by the end of 2024, demonstrating a clear market preference for responsible businesses.

Benefytt Technologies relies heavily on digital infrastructure, including data centers and servers, to power its e-commerce and data analytics operations. The environmental footprint of these operations, particularly energy consumption, is becoming a significant consideration. For instance, the global IT sector's carbon emissions were estimated to be around 2-4% of total global emissions in recent years, a figure that continues to draw scrutiny.

As environmental awareness intensifies, there's growing pressure on companies like Benefytt to adopt more energy-efficient technologies and sustainable practices within their IT operations. This could translate into increased investment in green data center solutions and renewable energy sources to power their digital infrastructure. For example, many tech companies are setting ambitious targets for renewable energy procurement for their data centers, with some aiming for 100% by 2025 or 2030.

These shifts towards sustainability in IT can present both challenges and opportunities. While there may be initial operational cost considerations for adopting greener technologies, they can also lead to long-term cost savings through reduced energy consumption and improved efficiency. Furthermore, demonstrating a commitment to environmental responsibility can enhance brand reputation and appeal to an increasingly eco-conscious customer base.

Climate change is increasingly impacting health trends, leading to a rise in certain conditions. For instance, the World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress alone.

These shifts in public health directly influence the insurance industry. As extreme weather events become more common and new health challenges emerge due to environmental changes, insurance carriers must reassess their risk models. This could lead to adjustments in pricing strategies and a potential alteration in the types of health insurance products available through platforms like Benefytt.

Regulatory Pressure for Environmental Reporting

Regulatory pressure for environmental reporting is a growing concern, even for companies not directly involved in manufacturing. Benefytt Technologies, despite its digital focus, may increasingly face demands to disclose its environmental impact, such as energy consumption for its data centers and operational carbon footprint. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which fully applies from January 1, 2024, for large companies, mandates detailed environmental disclosures, setting a precedent that could influence global reporting standards. This trend suggests that companies like Benefytt might need to proactively track and report on their sustainability initiatives to satisfy investors and public interest groups, potentially mitigating future compliance burdens.

The increasing emphasis on Environmental, Social, and Governance (ESG) factors by investors is a key driver behind this regulatory push. By 2025, it's anticipated that a significant portion of institutional capital will be allocated based on ESG criteria. Benefytt Technologies could see investors demanding more transparency regarding its energy efficiency and waste management practices. Proactive engagement with sustainability reporting can enhance corporate reputation and attract environmentally conscious investors.

- Growing Investor Demand: Over 70% of institutional investors consider ESG factors in their investment decisions, a figure projected to rise by 2025.

- EU's CSRD Impact: The Corporate Sustainability Reporting Directive requires extensive environmental data disclosure, influencing global reporting norms.

- Digital Footprint Scrutiny: Even digital businesses face pressure to report on energy usage and carbon emissions from their operations.

- Proactive Mitigation: Early adoption of environmental reporting can reduce future compliance costs and enhance stakeholder relations.

Consumer Preference for Green Businesses

Consumers, especially younger generations like Gen Z and Millennials, are increasingly prioritizing businesses that show a commitment to environmental sustainability. This trend is growing, with a significant portion of consumers willing to pay more for eco-friendly products and services. For Benefytt Technologies, while environmental consciousness isn't a direct factor in insurance decisions, a visible green stance can enhance brand image and attract customers who value corporate responsibility.

Recent surveys highlight this shift:

- Consumer Demand: A 2024 report indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

- Brand Loyalty: Businesses with strong sustainability credentials often see higher customer loyalty, with studies showing a 10-15% increase in repeat business.

- Market Differentiation: In a crowded insurance market, Benefytt Technologies could leverage its environmental initiatives to stand out and appeal to a values-driven consumer base.

- Future Growth: As environmental awareness continues to rise, aligning with sustainable practices could position Benefytt for long-term growth and positive public perception.

Environmental factors significantly influence Benefytt Technologies' operational landscape, particularly concerning its digital infrastructure and the broader insurance market. Growing investor and consumer demand for sustainability, coupled with increasing regulatory scrutiny like the EU's CSRD, necessitates a proactive approach to environmental impact reporting and mitigation. The company's reliance on data centers means energy consumption and carbon footprint are key areas of focus, with a trend towards green IT solutions and renewable energy adoption across the tech sector.

| Environmental Factor | Impact on Benefytt | Data/Trend (2024-2025) | Action/Consideration |

|---|---|---|---|

| Climate Change & Health | Alters health trends, impacting insurance risk models. | WHO projects 250,000 annual deaths from climate change-related illnesses (2030-2050). | Re-evaluate risk assessment and product offerings. |

| IT Sector Emissions | Directly relates to Benefytt's digital operations. | Global IT sector emissions ~2-4% of total global emissions. | Invest in energy-efficient data centers and renewable energy. |

| ESG Investing | Drives demand for transparency and sustainable practices. | Over 70% of institutional investors consider ESG factors; projected rise by 2025. | Enhance ESG reporting and sustainability initiatives. |

| Consumer Awareness | Influences brand perception and loyalty. | >60% of consumers consider environmental impact in purchasing (2024). | Leverage environmental initiatives for brand differentiation. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. These sources provide comprehensive insights into political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks impacting Benefytt.