Benefytt Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benefytt Bundle

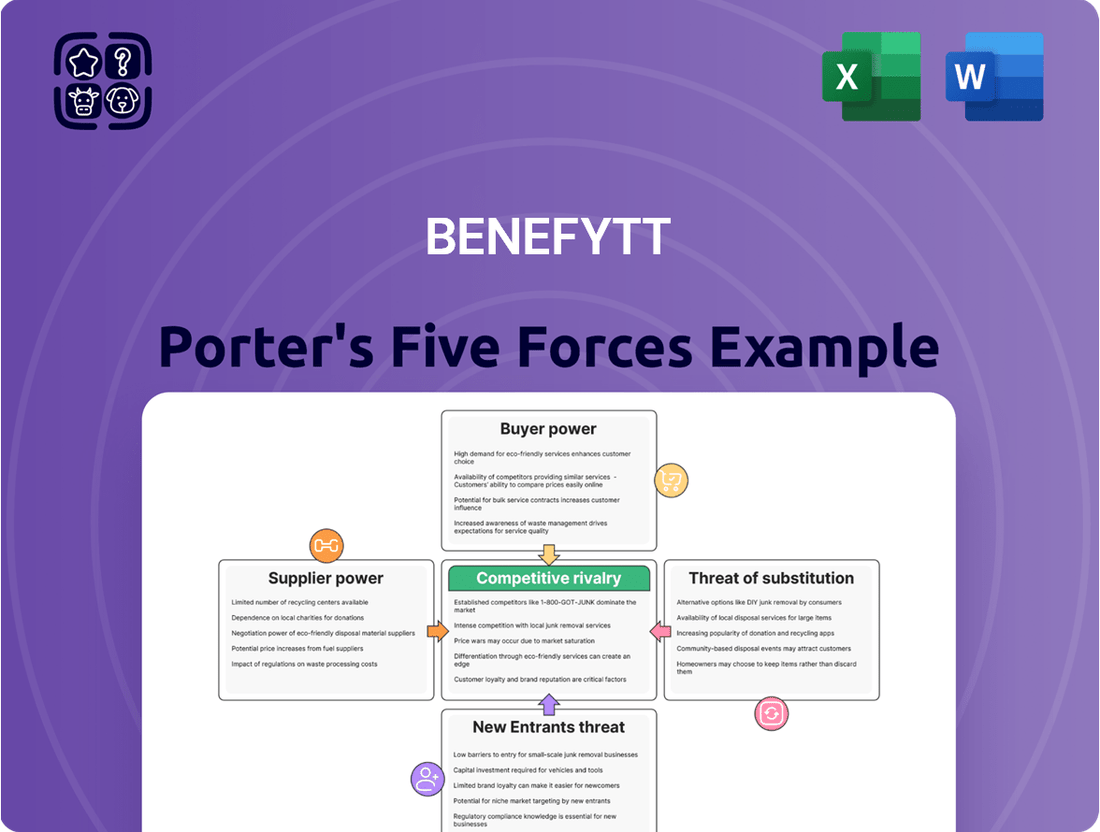

Understanding the competitive landscape is crucial for any business, and Benefytt is no exception. Our Porter's Five Forces Analysis delves into the core pressures shaping Benefytt's market, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Benefytt’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Benefytt's reliance on a diverse range of insurance plans from various carriers directly impacts supplier bargaining power. If a few major insurance carriers hold a significant market share or offer highly sought-after, specialized products, their leverage over Benefytt escalates.

The company's success in providing a comprehensive marketplace hinges on cultivating strong relationships with a wide spectrum of insurance providers. For instance, in the 2024 individual health insurance market, major carriers like UnitedHealthcare and Anthem collectively covered a substantial portion of enrollees, indicating their potential to exert influence.

Benefytt's switching costs from one insurance carrier to another are a significant factor in supplier bargaining power. These costs involve integrating new data feeds, adapting technology platforms, and retraining staff, all of which require substantial effort and resources.

For instance, a complex migration of policyholder data and claims processing systems could take months and incur millions in IT expenditure. If these switching costs are high, insurance carriers gain leverage, as Benefytt would be hesitant to incur such expenses and disruptions.

In 2024, the increasing complexity of health insurance regulations and the need for seamless digital customer experiences mean that the technical integration alone can represent a substantial barrier. Therefore, high switching costs for Benefytt directly strengthen the bargaining power of its insurance carrier suppliers.

The uniqueness of carrier offerings significantly impacts the bargaining power of suppliers in the insurance market. If specific insurance carriers offer highly specialized or exclusive plans that are essential for attracting particular customer groups, they gain considerable leverage.

Benefytt's business model relies heavily on the breadth and distinctiveness of the plans its suppliers provide. The company's ability to offer a personalized insurance shopping experience is directly linked to the variety and uniqueness of these supplier offerings, which in turn influences Benefytt's relationship with its carrier partners.

Threat of Forward Integration by Carriers

The threat of insurance carriers developing their own direct-to-consumer digital platforms presents a significant challenge to marketplaces like Benefytt. This move would allow carriers to bypass intermediaries, directly engaging with customers and thereby increasing their own bargaining power. Such a shift could reduce the necessity for carriers to rely on third-party distributors, potentially impacting the revenue streams and market position of companies like Benefytt.

In 2024, the digital transformation trend in the insurance sector continued to accelerate. Many carriers are investing heavily in technology to enhance customer experience and streamline distribution. For instance, major insurers are reportedly allocating billions to digital initiatives aimed at improving online sales and service capabilities. This strategic pivot by carriers directly amplifies their leverage, as they gain greater control over customer acquisition and retention, diminishing the dependency on external sales channels.

- Carrier Digital Platform Development: Insurance companies are increasingly investing in proprietary digital platforms to offer products directly to consumers.

- Reduced Reliance on Intermediaries: Successful direct-to-consumer platforms decrease carriers' dependence on marketplaces, strengthening their negotiating position.

- Marketplace Impact: This trend poses a threat to companies like Benefytt, potentially reducing their access to carrier products and customer flow.

- Industry Investment: In 2024, the insurance technology sector saw substantial venture capital funding, with a focus on direct-to-consumer solutions.

Importance of Benefytt to Carriers

Benefytt's substantial business volume can significantly influence the bargaining power of its carrier partners. When Benefytt represents a considerable portion of a carrier's distribution, that carrier might be hesitant to wield strong bargaining power. This is because they would likely want to preserve the valuable relationship and the revenue stream Benefytt provides.

For instance, if a carrier relies on Benefytt for a substantial percentage of its new policy acquisitions, they may be more amenable to Benefytt's terms. This dependency reduces the carrier's leverage, effectively diminishing their supplier power within the partnership.

- Carrier Dependence: The degree to which individual insurance carriers depend on Benefytt for customer acquisition directly impacts their bargaining power.

- Distribution Channel Significance: When Benefytt serves as a primary or significant distribution channel for a carrier, it strengthens Benefytt's position.

- Revenue Impact: Carriers are less likely to exert aggressive bargaining tactics if Benefytt represents a critical revenue source they cannot easily replace.

- Relationship Preservation: The desire to maintain a lucrative distribution partnership often leads carriers to moderate their demands on Benefytt.

The bargaining power of suppliers, specifically insurance carriers, is a critical factor for Benefytt. When a few dominant carriers control a large share of the market, their ability to dictate terms increases significantly. For example, in 2024, the top five health insurance providers in the U.S. collectively insured over 100 million individuals, highlighting their substantial market influence.

High switching costs for Benefytt, such as the expense and time involved in integrating new carrier systems and data, directly empower suppliers. In 2024, the average cost for a large enterprise to switch core insurance administration platforms was estimated to be in the millions of dollars, a significant deterrent.

The uniqueness of carrier offerings also plays a role; if certain carriers provide essential, specialized plans that Benefytt needs to attract specific customer segments, their bargaining power is amplified. Furthermore, carriers developing their own direct-to-consumer platforms in 2024, with many investing billions in digital capabilities, reduces their reliance on marketplaces like Benefytt, thereby increasing their leverage.

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Benefytt, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Customers now have unprecedented access to online comparison tools and educational resources, making it simple to evaluate insurance plans from various companies. This surge in readily available information significantly boosts their ability to find the most advantageous options independently.

For instance, in 2024, platforms like HealthCare.gov reported millions of users actively comparing plans during open enrollment periods, demonstrating the widespread use of these comparison tools. This transparency directly translates to increased customer bargaining power.

For consumers looking at health insurance, switching providers or marketplaces is generally quite straightforward and doesn't involve much expense or hassle. This ease of changing companies means that if customers aren't happy with what Benefytt offers or how much it costs, they can easily look elsewhere, which naturally gives them more leverage.

Health and life insurance represent substantial outlays for individuals, directly impacting their purchasing decisions. This inherent price sensitivity compels consumers to actively search for the most cost-effective coverage, thereby intensifying pressure on Benefytt to maintain competitive pricing strategies and attractive offers.

In 2024, the average annual premium for a mid-tier health insurance plan in the United States hovered around $6,000, with deductibles often adding significantly to out-of-pocket costs. Similarly, life insurance premiums vary widely, but even modest monthly payments can be a point of comparison for budget-conscious consumers.

Customer Acquisition Costs for Benefytt

The significant expense associated with acquiring new insurance customers, encompassing marketing, advertising, and sales initiatives, directly enhances the bargaining power of both existing and prospective clients. For instance, in 2024, the insurance industry continued to see substantial investment in digital marketing and lead generation, with customer acquisition costs (CAC) remaining a critical metric for companies like Benefytt.

Given these high customer acquisition costs, Benefytt might find itself compelled to offer more favorable terms or competitive pricing to retain its current customer base or to attract new ones. This dynamic means customers, understanding the effort and expense involved in switching providers, can leverage this knowledge to negotiate better deals.

- High Marketing Spend: Benefytt's investment in marketing and advertising to reach potential policyholders contributes to elevated customer acquisition costs.

- Sales Commission Structures: The compensation paid to sales agents for securing new policies also factors into the overall cost of acquiring a customer.

- Customer Retention Focus: The high cost of acquisition incentivizes Benefytt to focus on customer retention, which can lead to better negotiation leverage for existing customers.

- Competitive Landscape: In a competitive market, the pressure to minimize CAC can make companies more amenable to customer demands for better pricing or benefits.

Diversity of Plan Options and Personalization

Benefytt's approach to offering a diverse array of plan options and personalization directly addresses customer bargaining power. By curating a wide selection, the company aims to make it easier for individuals to find coverage that precisely matches their unique needs and budgets. This focus on tailored solutions can reduce the incentive for customers to shop around extensively or demand lower prices, as the platform itself becomes a valuable differentiator.

In 2024, the insurance market continued to see a strong demand for personalized solutions. Data from industry reports indicated that over 60% of consumers actively seek insurance plans that can be customized to their specific circumstances, rather than opting for one-size-fits-all policies. Benefytt's strategy aligns with this trend, potentially increasing customer loyalty and reducing their leverage by offering a superior, individualized shopping experience.

- Diverse Plan Offerings: Benefytt provides access to a broad spectrum of insurance products, from health and life to supplemental plans.

- Personalization Tools: The platform utilizes technology to help customers compare and select plans based on their individual health profiles, financial situations, and coverage preferences.

- Mitigating Price Sensitivity: When customers perceive significant value in the tailored recommendations and the ease of finding suitable coverage, their focus may shift from purely price-based comparisons to overall value and fit.

- Customer Retention: A highly personalized and efficient shopping experience can foster greater customer satisfaction and retention, thereby lessening the bargaining power derived from the ease of switching providers.

Customers today wield significant power due to readily available online comparison tools and extensive educational resources, simplifying the process of evaluating insurance plans. This heightened transparency, exemplified by millions using platforms like HealthCare.gov in 2024 to compare options, directly amplifies their leverage. The ease of switching providers, with minimal cost or hassle, further empowers consumers to seek better deals from Benefytt or its competitors.

The substantial cost of insurance premiums makes consumers highly price-sensitive, driving them to actively seek the most economical coverage. This pressure compels Benefytt to maintain competitive pricing, as evidenced by average 2024 mid-tier health insurance premiums around $6,000 annually. High customer acquisition costs, including marketing and sales commissions, also bolster customer bargaining power, as companies like Benefytt may offer better terms to retain or attract clients.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Context |

|---|---|---|

| Information Availability | Increases power through easy comparison | Millions used comparison tools in 2024 |

| Switching Costs | Low costs empower switching | Generally low hassle and expense to switch |

| Price Sensitivity | High sensitivity drives demand for lower prices | Average health premiums ~$6,000 in 2024 |

| Customer Acquisition Cost (CAC) | High CAC can lead to better customer terms | Significant investment in digital marketing |

Preview the Actual Deliverable

Benefytt Porter's Five Forces Analysis

This preview showcases the complete Benefytt Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the health insurance industry. The document you see here is precisely what you will receive instantly after completing your purchase, ensuring full transparency and immediate usability. You can trust that this professionally formatted analysis is ready to be integrated into your strategic planning without any further modifications.

Rivalry Among Competitors

The online health and life insurance sector is teeming with competitors. You'll find everything from large, established e-commerce sites to specialized platforms, and even direct-to-consumer sales channels from insurance companies themselves. This sheer volume and variety of players significantly heats up the competition.

Consider the landscape in 2024: major online brokers like Policygenius and HealthMarkets are actively competing with direct offerings from carriers such as Haven Life and Oscar Health. This multi-faceted competition means consumers have many choices, forcing each player to constantly innovate and offer competitive pricing and user experiences to stand out.

The digital health services market is indeed experiencing substantial growth, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2028. However, this expansion doesn't negate the potential for fierce competition. Many companies are entering this space, all aiming to capture a piece of the burgeoning market, which can lead to intense rivalry.

Similarly, the digital insurance brokerage service market is booming, fueled by greater access to the internet and smartphones. This robust growth attracts numerous participants, creating a crowded landscape where companies must constantly innovate and differentiate themselves to stand out and gain market share.

Benefytt's competitive edge hinges on its capacity to differentiate through advanced technology, robust data analytics, and highly personalized customer journeys. Should rivals readily mimic these technological advancements and data-driven approaches, the intensity of competition escalates significantly.

The insurance sector is undergoing a profound transformation, with artificial intelligence, blockchain technology, and sophisticated data analytics reshaping product development and sales strategies. For instance, in 2024, the global insurtech market was valued at approximately $10.6 billion, demonstrating the significant investment and innovation in this area, which directly impacts differentiation capabilities.

Exit Barriers

High exit barriers in the insurance technology sector, often stemming from specialized assets and significant investments in proprietary software, can trap companies in the market even when they are not profitable. This persistence by struggling firms intensifies competition, as they continue to vie for market share, potentially leading to more aggressive pricing strategies. For instance, in 2024, the continued investment in AI-driven underwriting platforms by established InsurTech players, despite some market consolidation, illustrates how sunk costs can deter exits.

These elevated exit barriers mean that even companies experiencing financial difficulties are incentivized to remain operational. They might do so by cutting costs aggressively or by engaging in price wars to maintain a customer base. This dynamic directly fuels competitive rivalry, as the market is not easily cleared of underperforming entities, creating a more challenging environment for all participants. The ongoing need for regulatory compliance and data security infrastructure further adds to the cost of exiting the InsurTech space.

The consequence of these high exit barriers is a market where the threat of new entrants is somewhat mitigated, but the intensity of rivalry among existing players is amplified. Companies must constantly innovate and optimize their operations to remain competitive, as the presence of entrenched, albeit unprofitable, rivals can depress overall market profitability. For example, the average InsurTech startup in 2024 faced significant challenges in achieving profitability due to these persistent competitive pressures.

- Specialized Assets: InsurTech firms often possess unique technology stacks and data infrastructure that are difficult to repurpose or sell, increasing the cost of leaving the market.

- Long-Term Contracts: Many InsurTech companies operate under long-term agreements with insurers or policyholders, creating obligations that must be fulfilled even during periods of financial distress.

- Brand Reputation and Customer Relationships: The investment in building trust and customer loyalty can be a significant barrier to a clean exit, as companies may feel compelled to maintain service levels.

- Regulatory Hurdles: Exiting the insurance market often involves complex regulatory approvals and wind-down procedures, adding time and expense to the process.

Brand Identity and Loyalty

In the digital insurance landscape, establishing a distinct brand identity and fostering customer loyalty presents a significant challenge. Without strong differentiation, consumers often perceive online marketplaces as similar, leading to intensified competition focused primarily on price and product features.

This dynamic is evident as many consumers in 2024 continue to prioritize cost savings, with surveys indicating that over 60% of individuals actively compare quotes across multiple platforms before purchasing insurance. Consequently, brands that cannot effectively communicate unique value propositions risk being drawn into a price war, eroding profit margins.

- Brand Recognition: Building a memorable brand is crucial in a crowded digital space.

- Customer Loyalty: Repeat business is harder to secure when switching costs are low.

- Price Sensitivity: Consumers often default to the cheapest option if perceived value is equal.

- Feature Differentiation: Unique product offerings can help mitigate direct price competition.

The competitive rivalry within the online health and life insurance sector is intense, driven by a multitude of players ranging from large e-commerce sites to specialized platforms and direct-to-consumer offerings.

In 2024, major online brokers like Policygenius and HealthMarkets compete directly with carriers such as Haven Life and Oscar Health, forcing constant innovation in pricing and user experience.

The burgeoning digital health services market, projected for over 15% CAGR through 2028, attracts numerous entrants, intensifying rivalry as each company seeks market share.

High exit barriers in InsurTech, due to specialized assets and significant software investments, keep even unprofitable firms competing aggressively, as seen with continued AI underwriting platform investments in 2024 despite market consolidation.

| Metric | 2024 Value | Impact on Rivalry |

|---|---|---|

| Global Insurtech Market Value | ~$10.6 billion | High investment fuels innovation and competition. |

| Consumer Quote Comparison Rate | >60% | Drives price-sensitive competition and necessitates strong value propositions. |

| Digital Health Services CAGR (proj. to 2028) | >15% | Attracts new entrants, increasing competitive intensity. |

SSubstitutes Threaten

Consumers increasingly opt to buy insurance directly from carriers via online portals, phone, or dedicated agents. This direct-to-consumer approach offers a compelling alternative to using a marketplace like Benefytt, potentially bypassing intermediary fees and offering a more streamlined experience.

In 2024, the direct-to-consumer insurance market continued its robust growth. For instance, major health insurance providers reported significant increases in online policy sales, with some seeing over 60% of new business originating from their digital platforms. This trend highlights the growing threat of substitutes as consumers gain confidence in purchasing directly.

Despite the growing popularity of online insurance marketplaces, traditional agents and brokers remain a significant force, particularly for clients seeking guidance on complex policies like life or commercial insurance. In 2024, a substantial portion of insurance sales still channeled through these intermediaries, underscoring their continued relevance for consumers who value personalized service and expert advice.

Other online aggregators and comparison sites present a significant threat of substitutes for Benefytt. Platforms like HealthCare.gov, eHealth, and Policygenius offer consumers a wide array of insurance options, often with user-friendly interfaces and robust comparison tools. These sites directly vie for customer engagement and can siphon potential business away from Benefytt by providing a centralized and convenient alternative for insurance shopping.

Embedded Insurance Solutions

Embedded insurance is a significant threat of substitutes because it integrates coverage directly into customer transactions for other products and services. This seamlessness can divert customers from traditional insurance channels. For instance, purchasing travel insurance when booking a flight bypasses the need to visit an insurance provider's website or speak with an agent.

This trend is accelerating. In 2024, the global embedded insurance market is projected to reach over $300 billion in premiums, demonstrating a substantial shift in how consumers access and purchase insurance. This growth indicates that a growing number of consumers are opting for these convenient, integrated solutions over standalone insurance products.

The appeal of embedded insurance lies in its simplicity and relevance at the point of need. This convenience can erode the customer base for traditional insurance marketplaces. Consider these key aspects:

- Convenience: Insurance is offered at the exact moment a customer is considering a related purchase.

- Reduced Friction: Customers don't have to actively search for insurance separately.

- Potential for Lower Cost: Bundling can sometimes lead to more competitive pricing.

- Increased Accessibility: Insurance becomes available to a broader audience through familiar purchasing platforms.

Government-Sponsored Health Insurance Marketplaces

Government-sponsored health insurance marketplaces, such as those established under the Affordable Care Act (ACA), present a substantial threat of substitutes for private e-commerce health insurance platforms. These government marketplaces offer a wide array of plans, often with significant subsidies that make coverage more affordable for a broad segment of the population. For instance, in 2024, the ACA marketplaces continued to provide substantial financial assistance, with the average subsidy covering a significant portion of premiums for eligible individuals, making them a highly competitive alternative to privately offered plans.

The accessibility and affordability, particularly with enhanced subsidies and extended enrollment periods that have been observed in recent years, directly challenge the market share of private online health insurance brokers. Many consumers, especially those seeking cost-effective solutions, may find the government marketplaces a more attractive and readily available option. This is further amplified when considering the regulatory backing and consumer protections inherent in these government-run entities.

- Government Marketplaces as Substitutes: ACA exchanges offer a direct alternative to private e-commerce health insurance sales.

- Affordability and Subsidies: Enhanced subsidies in 2024 made marketplace plans significantly more budget-friendly for many consumers.

- Accessibility and Enrollment: Extended enrollment periods increase the opportunity for individuals to choose marketplace plans over private options.

- Consumer Preference: Cost-conscious individuals are likely to favor the subsidized, government-backed options.

The rise of direct-to-consumer insurance sales and embedded insurance options presents significant substitution threats. In 2024, many insurers reported over 60% of new business coming from their digital platforms, bypassing traditional marketplaces. Embedded insurance, projected to exceed $300 billion in global premiums by 2024, seamlessly integrates coverage into other purchases, reducing the need for separate insurance shopping.

Entrants Threaten

While setting up an e-commerce marketplace might seem less capital-intensive than becoming a full-fledged insurance carrier, the digital insurance platform market still demands substantial investment. Companies need significant funds for advanced technology development, robust data infrastructure, extensive marketing campaigns to build brand awareness, and navigating complex regulatory compliance landscapes.

The health and life insurance industries present significant barriers to entry due to stringent regulatory oversight. New companies must meticulously navigate a complex web of licensing requirements, ongoing compliance mandates, and robust consumer protection laws designed to safeguard policyholders. This demanding landscape can deter potential competitors, as the investment in time and resources to meet these standards is substantial.

New entrants face a significant hurdle in gaining access to insurance carrier partnerships. To offer a competitive range of plans, newcomers must cultivate relationships with numerous insurance providers, a process that requires time and substantial effort.

Established companies like Benefytt Technologies have already built extensive networks with a diverse set of insurance carriers. For instance, in 2024, Benefytt continued to leverage its broad carrier relationships to provide a wide selection of Medicare Advantage and Medicare Supplement plans to its customers.

This established network acts as a considerable barrier to entry, as replicating such a comprehensive web of partnerships would be a lengthy and resource-intensive undertaking for any new competitor aiming to enter the market.

Brand Recognition and Trust

In the insurance sector, where consumer trust is absolutely critical, new entrants face a substantial hurdle in establishing brand recognition and credibility. Traditional, well-established insurance brands have cultivated long-standing relationships with customers, often built over decades, making it difficult for newcomers to gain immediate traction. For instance, in 2024, major insurance providers continued to invest heavily in marketing and customer service to reinforce their brand loyalty, knowing that trust is a primary driver of customer acquisition and retention.

Building this trust requires significant time and consistent positive experiences. New companies must overcome the inherent skepticism consumers may have towards unfamiliar entities, especially when dealing with something as important as financial security and health coverage.

- Brand Loyalty: Established insurers benefit from high customer retention rates, often exceeding 85% for many product lines in 2024.

- Marketing Spend: Major insurance companies allocated billions in 2024 to advertising and brand building efforts to maintain their market position.

- Reputation Management: A single negative customer experience can severely damage a new entrant's nascent reputation, whereas established brands have more resilience.

- Trust as a Differentiator: In a market where product features can be similar, trust becomes a key competitive advantage that is hard for new entrants to replicate quickly.

Technological Expertise and Data Analytics Capabilities

Benefytt's competitive edge relies heavily on its sophisticated technological infrastructure and advanced data analytics capabilities. These tools enable the company to deeply understand customer needs and preferences, thereby personalizing the shopping journey and offering highly tailored insurance solutions. For instance, in 2024, Benefytt reported a significant increase in customer engagement metrics directly attributable to its AI-driven recommendation engines.

New entrants aiming to challenge Benefytt must therefore invest substantially in acquiring or developing comparable technological expertise and data analytics prowess. Without these advanced capabilities, new players will struggle to replicate Benefytt's ability to deliver efficient, user-friendly experiences and customized product offerings. This technological barrier is a significant deterrent, as building such a sophisticated system requires considerable time, capital, and specialized talent.

- Technological Investment: New entrants need to allocate significant capital towards developing or licensing advanced data analytics platforms and AI-driven personalization tools.

- Data Acquisition & Management: The ability to collect, process, and analyze vast amounts of customer data ethically and efficiently is crucial for replicating Benefytt's personalized approach.

- Talent Acquisition: Securing skilled data scientists, AI engineers, and user experience designers is paramount for building and maintaining a competitive technological advantage.

- Integration Complexity: Successfully integrating these new technologies with existing operational frameworks presents a substantial challenge for any new market participant.

The threat of new entrants for Benefytt is moderate, primarily due to significant capital requirements for technology and marketing, coupled with the complexities of regulatory compliance in the insurance sector. Building trust and brand loyalty is a slow, costly process that established players like Benefytt have already navigated.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research from leading firms, and government economic indicators. This blend ensures a comprehensive understanding of competitive pressures.