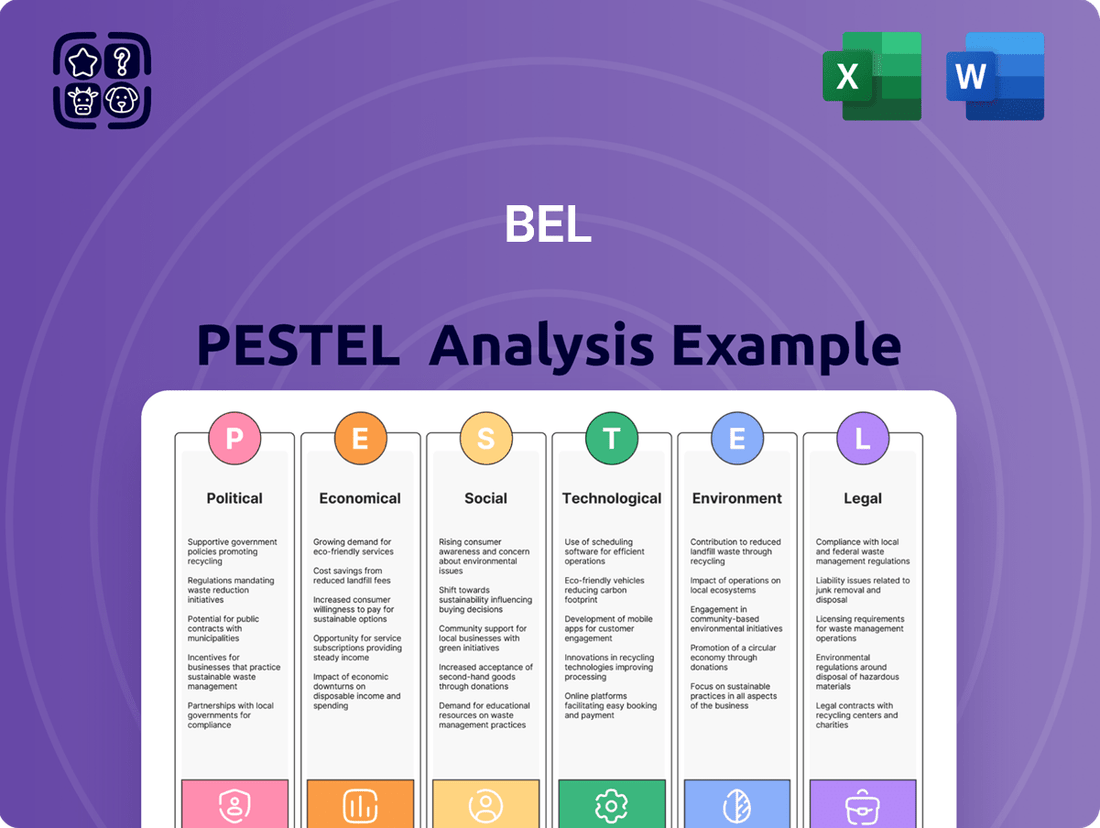

Bel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Bel. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Geopolitical trade tensions, particularly between the U.S. and China, continue to cast a long shadow over the global electronic components market. These ongoing disputes have resulted in increased tariffs, creating a volatile environment for manufacturers. For companies like Bel Fuse Inc., this translates to higher sourcing costs and a need to constantly re-evaluate supply chain strategies to mitigate potential disruptions and cost increases.

The impact of these trade skirmishes is tangible. For instance, in 2023, the U.S. maintained tariffs on a wide range of Chinese goods, including many electronic components, with rates often exceeding 7.5%. This uncertainty forces businesses to consider diversifying their manufacturing and sourcing locations, a process that can be both time-consuming and expensive, directly affecting profit margins for the fiscal year 2024.

Government initiatives, like the U.S. CHIPS Act, are channeling significant funds into boosting domestic semiconductor manufacturing. This legislation, enacted in August 2022, allocated $52.7 billion for semiconductor research, development, and production, aiming to bolster supply chain resilience and lessen reliance on foreign sources.

This trend towards reshoring and nearshoring is gaining momentum, fueled by escalating overseas production costs and increasing geopolitical uncertainties. Companies with established or developing localized manufacturing capabilities are poised to benefit from this strategic shift, potentially seeing improved cost structures and reduced supply chain risks.

Bel Fuse Inc. is seeing a significant boost from the defense and commercial aerospace sectors. Their Q1 2025 earnings report highlights this increased exposure and strength, indicating a positive trend for the company.

Government investment in artificial intelligence and advanced military technologies is a key driver. This is expected to sustain strong demand for electronic components, like those Bel Fuse provides, throughout 2025.

Impact of Tariffs on Costs

Tariffs, especially those on electronic components sourced from China, directly elevate the cost of essential inputs. This increase can ripple through the supply chain, potentially leading to higher prices for end consumers. For instance, Bel Fuse Inc. noted that U.S. tariffs affected approximately $8 to $10 million in sales during the first quarter of 2025, underscoring the tangible financial impact of these trade policies.

The imposition of tariffs creates a direct cost burden on companies like Bel Fuse. This can affect their profitability and competitive pricing strategies. The company's Q1 2025 report indicated that these tariffs influenced a significant portion of their sales, demonstrating the sensitivity of their business to international trade regulations.

- Tariff Impact: U.S. tariffs affected $8–$10 million in sales for Bel Fuse Inc. in Q1 2025.

- Cost Increase: Tariffs on electronic components from China raise the cost of key inputs.

- Supply Chain Effects: Increased component costs can be passed up the supply chain, affecting final product prices.

Political Stability in Operating Regions

Political stability in the regions where Bel Fuse Inc. operates and sources components is paramount for maintaining smooth supply chains and manufacturing processes. Instability can lead to unexpected disruptions, impacting production schedules and the availability of critical components.

Geopolitical risks, such as trade disputes or regional conflicts, pose a significant threat to Bel Fuse's operations. For instance, in 2023, ongoing geopolitical tensions in Eastern Europe continued to create uncertainty in global supply chains, affecting component costs and lead times for various industries, including electronics.

To mitigate these risks, Bel Fuse actively pursues supply chain diversification. This strategy aims to reduce reliance on any single region or supplier, thereby enhancing resilience against political and economic shocks. As of early 2024, companies like Bel Fuse are increasingly investing in nearshoring and reshoring initiatives to bolster supply chain security.

- Regional Stability: Bel Fuse operates in diverse global locations, each with its own political landscape. Ensuring stability in these areas is key to consistent operations.

- Geopolitical Impact: Events like the ongoing semiconductor supply chain challenges, exacerbated by geopolitical factors in 2023-2024, highlight the vulnerability of global manufacturing.

- Diversification Strategy: Bel Fuse's approach to diversifying its sourcing and manufacturing footprint is a direct response to mitigate the impact of political instability.

- Risk Management: Proactive management of geopolitical risks is essential for maintaining competitive advantage and ensuring product availability for customers.

Government policies and trade agreements significantly influence the electronic components market. For instance, the U.S. CHIPS Act, with its $52.7 billion allocation for semiconductor manufacturing, aims to strengthen domestic production and reduce reliance on foreign sources, impacting companies like Bel Fuse Inc. by potentially creating new domestic supply chain opportunities and competitive pressures.

Trade tensions, such as those between the U.S. and China, continue to affect global supply chains. Tariffs imposed in 2023 and continuing into 2024 on electronic components increased sourcing costs for businesses. Bel Fuse Inc. reported that U.S. tariffs impacted approximately $8 to $10 million in sales during Q1 2025, highlighting the direct financial consequences of these political decisions.

The drive towards reshoring and nearshoring, partly a response to geopolitical uncertainties and rising overseas costs, is a notable political trend. This shift favors companies with localized manufacturing capabilities, offering potential cost efficiencies and reduced supply chain vulnerabilities. This strategy is a key consideration for businesses navigating the evolving political and economic landscape of 2024-2025.

Government investments in sectors like defense and AI are creating sustained demand for advanced electronic components. This political focus provides a strong tailwind for companies supplying these critical technologies, ensuring continued market opportunities throughout 2025.

| Political Factor | Impact on Bel Fuse Inc. | Data/Context (2024-2025) |

|---|---|---|

| Trade Tariffs | Increased cost of goods sold, reduced profit margins | U.S. tariffs affected $8–$10 million in Bel Fuse sales in Q1 2025. |

| Government Incentives (e.g., CHIPS Act) | Potential for new domestic manufacturing opportunities, increased competition | $52.7 billion allocated to boost U.S. semiconductor production. |

| Geopolitical Stability | Risk of supply chain disruptions, increased lead times | Ongoing geopolitical tensions in Eastern Europe impacted global supply chains in 2023-2024. |

| Defense/AI Spending | Sustained demand for electronic components | Government investment expected to drive strong demand throughout 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Bel across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Bel PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics and potential disruptions by offering clarity and foresight.

Economic factors

The global semiconductor market is experiencing a substantial upswing, with projections suggesting a 15% growth in 2025, bringing the total market value to an estimated $697 billion. This expansion is heavily fueled by the escalating demand for AI accelerator chips, a critical component in modern computing and artificial intelligence applications.

Looking ahead, this growth trend is anticipated to persist, with the market potentially reaching a remarkable $1 trillion in sales by 2030. This presents a highly favorable and expanding market landscape for companies like Bel Fuse Inc., whose products are integral to the functionality and reliability of electronic devices.

Inflation remains a significant concern, with the US CPI showing a 3.3% year-over-year increase as of May 2024, impacting raw material and component prices in the electronics sector. This persistent cost pressure directly affects manufacturers' margins and necessitates a strategic focus on supply chain optimization and hedging strategies to mitigate volatility.

Companies are responding by exploring longer-term supplier contracts and investing in automation to offset rising labor expenses, a trend likely to intensify as wage growth continues. For instance, the US average hourly earnings saw a 4.1% increase in the year ending May 2024, adding to the operational cost burden for businesses reliant on manual labor.

While electronic component lead times have improved from 2023, with some key semiconductors seeing reductions, the industry still anticipates potential for intermittent shortages. For instance, in early 2024, certain advanced microcontrollers experienced extended delivery windows due to unexpected demand surges. Manufacturers are actively investing in supply chain diversification, aiming to reduce reliance on single sources and build greater resilience against future shocks.

Demand in Key End Markets

Bel Fuse Inc. is seeing robust demand in crucial sectors like defense, commercial aerospace, and the rapidly expanding AI market. This strength in key areas helped offset typical first-quarter seasonality in early 2025.

However, the company anticipates softer demand in other segments, including rail, e-Mobility, and consumer electronics. This creates a varied picture across their different end markets.

- Defense and Aerospace Strength: Bel Fuse reported that demand in these high-growth sectors remained a significant positive driver through Q1 2025.

- AI Market Expansion: The burgeoning artificial intelligence sector is also contributing positively to demand for Bel Fuse's components.

- Softness in Other Sectors: Conversely, the company projects reduced sales volumes in the rail, e-Mobility, and consumer markets for the upcoming periods.

- Mixed Demand Environment: This divergence highlights a mixed demand environment, with strong performance in some areas balancing weaker trends elsewhere.

Currency Fluctuations

Currency fluctuations significantly impact Bel Fuse Inc. as a global operator. For instance, in the first quarter of 2024, the company reported that unfavorable foreign currency movements reduced its net sales by $1.7 million compared to the prior year period. This highlights how shifts in exchange rates can directly affect the cost of imported raw materials and the revenue generated from international sales.

These currency swings can also influence manufacturing expenses. If Bel Fuse sources components or has manufacturing facilities in countries with depreciating currencies, those costs might appear lower in U.S. dollar terms. Conversely, a strengthening local currency could increase production costs, impacting overall profitability.

The competitiveness of Bel Fuse's products in international markets is also tied to currency exchange rates. A stronger U.S. dollar can make its products more expensive for foreign buyers, potentially leading to reduced demand. Conversely, a weaker dollar can make its offerings more attractive abroad, boosting sales volumes.

- Impact on Sales: In Q1 2024, foreign currency headwinds reduced Bel Fuse's net sales by $1.7 million.

- Raw Material Costs: Fluctuations affect the dollar cost of components sourced globally.

- Manufacturing Expenses: Exchange rates influence production costs in overseas facilities.

- International Competitiveness: Currency strength or weakness alters the price of Bel Fuse products for foreign customers.

Economic factors present a mixed outlook for the electronics component sector. While the semiconductor market is projected for robust growth, reaching an estimated $697 billion in 2025, inflation continues to exert pressure. The US CPI rose 3.3% year-over-year in May 2024, increasing raw material costs and impacting profit margins.

Rising labor costs, evidenced by a 4.1% increase in US average hourly earnings in the year ending May 2024, further challenge manufacturers. Companies are increasingly investing in automation to mitigate these expenses.

Currency fluctuations also play a significant role. In Q1 2024, unfavorable foreign currency movements reduced Bel Fuse's net sales by $1.7 million, demonstrating the direct impact on revenue and the cost of global operations.

| Economic Factor | 2024/2025 Data Point | Impact on Electronics Sector |

| Semiconductor Market Growth | Projected 15% growth in 2025 to $697 billion | Strong demand, favorable market conditions |

| US Inflation (CPI) | 3.3% year-over-year (May 2024) | Increased raw material and component costs |

| US Wage Growth (Avg. Hourly Earnings) | 4.1% increase (Year ending May 2024) | Higher labor expenses, driving automation investment |

| Currency Impact (Bel Fuse Q1 2024) | -$1.7 million reduction in net sales | Reduced international revenue, fluctuating input costs |

What You See Is What You Get

Bel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bel PESTLE analysis offers a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the brand. You can confidently proceed with your purchase, knowing you'll get the complete, professionally structured analysis.

Sociological factors

The electronics industry grapples with persistent workforce shortages, particularly in specialized technical roles. This talent gap directly impacts supply chain expansion and operational efficiency, as companies struggle to find skilled labor for advanced manufacturing and R&D. For instance, a 2024 report indicated that over 60% of electronics manufacturers cited a lack of skilled workers as a primary constraint on production.

To counter this, there's a significant emphasis on lifelong learning and upskilling programs, especially those focused on artificial intelligence and automation. The evolving nature of the industry necessitates a workforce adaptable to new technologies and changing job functions, with companies investing heavily in training initiatives to bridge the skills divide.

Consumer demand for sustainable products is a significant driver in the electronics industry. Many consumers are actively seeking out products that are made with recycled materials or are designed for energy efficiency, reflecting a broader societal shift towards environmental consciousness. This trend is particularly pronounced among younger demographics, with surveys in 2024 indicating that over 60% of Gen Z consumers consider a brand's sustainability practices when making purchasing decisions.

Consumers are increasingly demanding smaller, more powerful electronic devices, fueling a trend towards miniaturization and higher-density interconnects in PCB design. This shift is evident in the booming markets for smartphones and wearables, with the global wearable technology market projected to reach $116 billion by 2027, up from an estimated $61 billion in 2023.

Advanced packaging solutions are becoming critical to achieving these slimmer designs and packing more functionality into compact form factors. For instance, the demand for System-in-Package (SiP) technology, which integrates multiple chips into a single package, is growing rapidly, with the SiP market expected to exceed $60 billion by 2025.

Increasing Reliance on Advanced Technology

Societal dependence on advanced technology is accelerating, with AI becoming a cornerstone of product development. By late 2024, approximately 78% of electronics engineers are either shipping AI-enabled products or integrating AI into their current designs. This trend highlights a significant societal shift towards leveraging technology for automation and improved performance across various sectors.

This increasing reliance stems from a desire for enhanced functionality and efficiency. For instance, AI's role in predictive maintenance is transforming industries by minimizing downtime and optimizing resource allocation. Consumers and businesses alike are actively seeking out products and services that offer these advanced capabilities, driving further innovation and adoption.

- AI Integration: Nearly 80% of electronics engineers are incorporating AI into product designs or shipping AI-enabled products as of late 2024.

- Societal Embrace: This widespread adoption signifies a broad acceptance of advanced technology for automation and enhanced user experiences.

- Key Benefits: Automation, predictive maintenance, and improved functionality are primary drivers for this technological reliance.

Evolving Customer Expectations for Performance

Customers today, especially in sectors like defense, aerospace, and high-speed data transmission, have significantly raised their expectations for electronic components. They’re looking for devices that are not only powerful but also small and consume less energy. This trend is a major driver for innovation, pushing manufacturers to develop cutting-edge solutions.

This demand fuels advancements in areas such as advanced packaging techniques, which allow for more functionality in smaller footprints, and the integration of AI in design processes to optimize performance. For example, the global advanced packaging market was valued at approximately $49.5 billion in 2023 and is projected to reach $83.2 billion by 2028, demonstrating the industry's response to these evolving customer needs.

Manufacturers are therefore under constant pressure to not just meet, but consistently exceed these escalating performance benchmarks. This necessitates continuous investment in research and development to stay ahead of the curve.

- Demand for miniaturization and efficiency: Customers across critical industries require electronic components that are smaller, lighter, and more power-efficient.

- Innovation drivers: This customer push is directly leading to advancements in advanced packaging and AI-driven design methodologies.

- Rising performance standards: Manufacturers must continually adapt and improve to meet increasingly stringent performance requirements.

- Market growth in advanced solutions: The market for solutions addressing these demands, like advanced packaging, shows robust growth, reflecting customer priorities.

Societal expectations for technological integration are rapidly evolving, with consumers and businesses alike demanding greater automation and efficiency. This reliance on advanced technology is driving innovation, particularly in areas like artificial intelligence, which is increasingly embedded in new electronic products. By late 2024, a significant majority of electronics engineers were actively incorporating AI into their designs or shipping AI-enabled products, reflecting a broad societal embrace of these advancements for improved functionality and performance.

The increasing demand for smaller, more powerful, and energy-efficient electronic devices is a key sociological factor. This trend is pushing manufacturers towards advanced solutions like System-in-Package (SiP) technology, with the SiP market projected to exceed $60 billion by 2025. Furthermore, consumer consciousness regarding sustainability is influencing purchasing decisions, with a notable percentage of younger consumers prioritizing environmentally friendly products. This societal shift compels electronics companies to focus on eco-friendly manufacturing processes and product lifecycles.

The electronics industry faces ongoing challenges related to workforce skills, with a substantial portion of manufacturers citing a lack of specialized technical talent as a production constraint in 2024. To address this, there's a strong emphasis on lifelong learning and upskilling programs, particularly in fields like AI and automation, to ensure the workforce remains adaptable to technological changes.

| Sociological Factor | Impact on Electronics Industry | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Miniaturization & Efficiency | Drives innovation in advanced packaging and design. | SiP market projected to exceed $60 billion by 2025. |

| Societal Embrace of AI | Accelerates AI integration in product development. | ~78% of electronics engineers shipping AI-enabled products (late 2024). |

| Sustainability Consciousness | Influences consumer purchasing and manufacturing practices. | >60% of Gen Z consider sustainability in purchases (2024). |

| Workforce Skills Gap | Impacts supply chain expansion and operational efficiency. | >60% of manufacturers cite skilled worker shortage as constraint (2024). |

Technological factors

AI is revolutionizing electronic design by automating complex tasks, improving data analysis, and fine-tuning designs for better reliability and performance. For instance, in 2024, companies are increasingly adopting AI-driven simulation tools that can reduce design iteration times by up to 30%, allowing for faster product development cycles.

AI-powered tools are significantly speeding up Printed Circuit Board (PCB) design processes, leading to fewer errors and enabling sophisticated self-learning capabilities for circuit generation and optimization. This advancement is critical as the global PCB market is projected to reach over $100 billion by 2027, with AI integration becoming a key differentiator for market leaders.

The market for advanced semiconductor packaging, including 2.5D, 3D, and fan-out wafer-level packaging, is booming. This surge is directly linked to the escalating demand for AI-powered devices and the massive build-out of data centers. These sophisticated packaging methods are essential for pushing the boundaries of performance, shrinking component sizes, and enhancing heat dissipation in cutting-edge electronics.

The relentless drive for smaller, more capable electronics means Printed Circuit Board (PCB) design must embrace miniaturization and High-Density Interconnect (HDI) technologies. This allows for a greater number of components to be packed into a smaller footprint, crucial for developing the compact and advanced products consumers and businesses demand.

For instance, the smartphone market, a key sector for many electronics manufacturers, saw shipments reach approximately 1.2 billion units in 2024, underscoring the need for increasingly dense circuitry to accommodate advanced features in ever-slimmer designs.

5G/6G Technology Adoption

The widespread adoption of 5G technology is fundamentally reshaping industries, with its infrastructure demanding a significant reliance on specialized radio frequency (RF) components. In fact, over 80% of the network infrastructure for 5G requires these advanced RF parts, including amplifiers and filters, creating a substantial market for their development and production. This trend underscores how crucial these components are for enabling faster speeds and lower latency, which are hallmarks of 5G.

The ongoing evolution towards 6G, and the continuous enhancement of 5G capabilities, are powerful catalysts for innovation within the electronic components sector. Companies are actively developing next-generation solutions designed to meet the increasingly sophisticated demands of these advanced wireless networks. This push for innovation is not just about faster data; it's about enabling entirely new applications and services that were previously unimaginable.

- Market Growth: The global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to grow significantly, driving demand for RF components.

- Component Demand: Over 80% of 5G network infrastructure relies on specialized RF components like amplifiers and filters, highlighting their critical role.

- Innovation Drivers: The development of 5G and future 6G technologies is a primary driver for advancements in electronic component design and manufacturing.

Developments in New Materials

Innovations in semiconductor technologies are heavily reliant on new materials. For instance, gallium nitride (GaN) and silicon carbide (SiC) are increasingly adopted for their ability to deliver higher performance, significantly reduce power consumption, and offer enhanced functionality in electronic devices. This shift is critical for advancements in areas like electric vehicles and high-speed communication.

Emerging materials like glass interposers are also gaining traction for advanced packaging solutions. Their unique properties, such as excellent electrical insulation and thermal stability, make them ideal for creating more compact and efficient electronic components. This development is crucial for miniaturization trends across consumer electronics and high-performance computing.

- Gallium Nitride (GaN) and Silicon Carbide (SiC): These wide-bandgap semiconductors are enabling power electronics to operate at higher frequencies and temperatures, leading to smaller, more efficient power supplies. For example, GaN transistors can switch power much faster than traditional silicon ones, reducing energy loss.

- Glass Interposers: Offering superior signal integrity and thermal management compared to silicon interposers, glass is becoming a key material for 2.5D and 3D chip stacking. This allows for denser integration of multiple chips, boosting processing power and reducing form factors.

- Market Growth: The global market for GaN and SiC power semiconductors was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, indicating strong adoption and investment in these advanced materials.

Technological advancements are profoundly reshaping the electronics landscape. AI is automating complex design tasks, reducing iteration times by up to 30% in 2024, and enabling sophisticated self-learning capabilities in PCB design, a market projected to exceed $100 billion by 2027. The demand for AI-powered devices is fueling growth in advanced semiconductor packaging, essential for performance and miniaturization.

The push for smaller, more capable electronics necessitates miniaturization and High-Density Interconnect (HDI) technologies, critical for the roughly 1.2 billion smartphones shipped globally in 2024. Furthermore, 5G infrastructure, which relies heavily on specialized RF components (over 80% of its build-out), is a major driver for innovation in electronic components, with ongoing development towards 6G further accelerating this trend.

New materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) are enabling higher performance and reduced power consumption, with their market projected to grow from $1.5 billion in 2023 to over $5 billion by 2028. Glass interposers are also emerging for advanced packaging, offering superior signal integrity and thermal management for denser chip integration.

| Technology Area | Key Advancement | Impact/Market Data |

|---|---|---|

| AI in Design | Automated tasks, faster iteration | Up to 30% reduction in design time (2024); PCB market > $100B by 2027 |

| Advanced Packaging | 2.5D, 3D, Wafer-Level Packaging | Driven by AI device demand and data centers |

| Miniaturization | HDI, smaller form factors | Essential for smartphones (1.2B units shipped in 2024) |

| Wireless Tech | 5G/6G infrastructure | 80%+ of 5G infrastructure requires specialized RF components |

| Semiconductor Materials | GaN, SiC, Glass Interposers | GaN/SiC market: $1.5B (2023) to > $5B (2028) |

Legal factors

Global environmental regulations like RoHS, REACH, and WEEE are increasingly strict, impacting product design and material sourcing. For instance, REACH compliance in the EU requires extensive data submission on chemical substances, with over 25,000 registered by early 2024, demonstrating the growing burden of documentation and testing for businesses.

These mandates necessitate reformulating materials and enhancing transparency in chemical compositions, which can lead to higher production costs. Companies must also redesign products for easier recycling and environmentally sound disposal, adding complexity and investment to their manufacturing processes.

Governments worldwide are intensifying their focus on data privacy, with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) setting stringent standards. For instance, in 2024, fines for GDPR violations reached significant levels, with companies facing penalties for mishandling personal data. This increased regulatory pressure means companies developing electronic products, especially those incorporating Internet of Things (IoT) technology, must prioritize robust data protection measures.

Meeting these evolving cybersecurity requirements for IoT devices is crucial. This involves embedding security features from the design phase, ensuring regular and timely software updates to patch vulnerabilities, and conducting thorough risk assessments. A failure to comply can lead to substantial financial penalties and, more importantly, a severe erosion of customer trust, impacting brand reputation and market share. For example, a major data breach in late 2024 affecting millions of IoT devices highlighted the critical need for proactive cybersecurity strategies.

Consumer electronics safety standards, such as UL and CE certifications, are constantly being updated to keep pace with new technologies. For instance, the IEC 62368-1 standard, which covers audio, video, and information technology equipment, has seen significant revisions to address emerging hazards from advanced power sources and connectivity.

Compliance is not just a regulatory hurdle but a critical factor for market entry and brand reputation. In 2024, a significant number of product recalls were linked to non-compliance with updated safety protocols, costing manufacturers millions in remediation and lost sales.

Bel, like other companies in the consumer electronics space, must actively monitor and adapt to these evolving standards to ensure its products are safe and readily accepted in global markets. This proactive approach is vital for maintaining consumer trust and avoiding costly penalties or market exclusion.

Extended Producer Responsibility (EPR) Laws

Extended Producer Responsibility (EPR) laws are becoming more prevalent, pushing manufacturers to manage their products from creation through disposal, including collection and recycling. This shift encourages the development of products that are easier to recycle and have a lower environmental footprint. For instance, by the end of 2024, the EU is expected to have implemented EPR schemes for an additional 13 product categories, building on existing frameworks for packaging and electronics.

These regulations directly impact product design, material sourcing, and end-of-life management strategies. Companies are increasingly investing in circular economy initiatives to comply with EPR mandates and gain a competitive edge. By 2025, it's projected that over 70% of major economies will have some form of EPR legislation in place for consumer goods.

- Growing Scope: EPR laws now cover a wider range of products beyond traditional packaging and electronics, extending to textiles, batteries, and furniture.

- Lifecycle Accountability: Manufacturers are responsible for take-back programs, recycling infrastructure, and proper disposal, increasing operational complexity and cost.

- Sustainability Incentive: EPR drives innovation in product design, favoring durability, repairability, and recyclability to reduce end-of-life management burdens.

- Market Impact: Compliance costs and new business models are reshaping supply chains and consumer expectations, with an estimated $50 billion in EPR fees expected globally by 2026.

Intellectual Property Rights Protection

Intellectual property rights protection is a significant legal factor for companies like Bel Fuse Inc. The ongoing accusations by the US against China for intellectual property theft have heightened tensions, particularly in technology and innovation-driven industries. This creates a challenging environment for businesses that rely on proprietary designs and processes.

For Bel Fuse, safeguarding its intellectual property is paramount in a fiercely competitive and fast-changing global marketplace. The company's ability to innovate and maintain a competitive edge is directly linked to the strength of its IP protection measures.

- US-China IP Disputes: The US Trade Representative's office has consistently highlighted IP theft as a major concern in its annual reports, impacting trade relations and technology transfer agreements.

- Impact on Innovation: According to a 2024 report by the U.S. Chamber of Commerce Global Innovation Policy Center, robust IP protection is a key driver of R&D investment, with countries with stronger IP regimes attracting more foreign direct investment in innovation-intensive sectors.

- Bel Fuse's Vulnerability: As a manufacturer of electronic components, Bel Fuse's product designs, manufacturing processes, and brand identity are all susceptible to infringement, making legal safeguards essential for sustained profitability.

Legal frameworks governing product safety and environmental impact are constantly evolving, requiring ongoing adaptation from manufacturers like Bel. For instance, the EU's General Product Safety Regulation (GPSR), fully applicable from December 2024, introduces stricter market surveillance and traceability requirements for all consumer products, including electronics.

These regulations necessitate robust compliance strategies, impacting everything from product design to supply chain management. Failure to adhere can result in significant fines and market access restrictions, as evidenced by the increasing number of product recalls linked to non-compliance, which cost the electronics industry billions globally in 2024.

The global push for data privacy, exemplified by GDPR and similar legislation, also extends to the operational aspects of electronic devices. Companies must ensure their products, especially those with connectivity features, protect user data adequately, a challenge highlighted by a significant increase in data breach litigation against tech firms throughout 2024.

Intellectual property protection remains a critical legal battleground, with ongoing disputes impacting international trade and technology transfer. Bel Fuse, as an innovator in electronic components, must navigate these complexities to safeguard its proprietary technologies and maintain a competitive advantage in the global market.

Environmental factors

Governments worldwide are increasingly scrutinizing e-waste, with many tightening regulations on its import and export to combat illegal trafficking and encourage responsible recycling. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive sets ambitious collection and recycling targets, aiming for 85% of e-waste to be collected by 2025.

Extended Producer Responsibility (EPR) schemes are gaining traction, shifting the burden of end-of-life product management onto manufacturers. In 2024, several countries expanded their EPR mandates, holding producers financially and operationally responsible for collecting and recycling their electronic goods, thereby incentivizing more sustainable product design.

Governments worldwide are increasingly prioritizing carbon footprint reduction, impacting the electronics sector's supply chain. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving demand for energy-efficient products and sustainable manufacturing processes. This translates to electronics companies needing to minimize their operational emissions and design products with lower energy consumption.

Manufacturers face growing pressure to adopt sustainable materials and meticulously track chemical usage, driven by regulations such as REACH. For instance, the European Chemicals Agency (ECHA) reported in early 2024 that over 23,000 substances were registered under REACH, highlighting the extensive regulatory landscape. This trend necessitates robust supply chain management to ensure ethical sourcing and transparency, meeting both legal obligations and rising consumer demand for eco-conscious products.

Climate Change Impact on Supply Chains

Climate change is a growing concern for supply chains, particularly in the electronics sector. The increasing frequency and severity of extreme weather events, like hurricanes and floods, directly impact the availability and transportation of crucial electronic components. For instance, in 2023, severe flooding in Southeast Asia, a major hub for electronics manufacturing, caused significant production delays and increased shipping costs.

To combat these environmental risks, businesses are prioritizing supply chain resilience. This involves expanding and diversifying their sourcing for key materials and components. A prime example is the push for more localized manufacturing and the development of alternative suppliers in geographically stable regions.

- Increased frequency of extreme weather events disrupts manufacturing and logistics.

- Diversifying sourcing for critical electronic components is a key strategy for resilience.

- Geopolitical shifts and climate impacts are driving nearshoring and friend-shoring initiatives.

Circular Economy Principles in Product Design

Governments worldwide are increasingly promoting circular economy principles, offering incentives for businesses that design products for longevity, repair, and recyclability. This focus on minimizing waste and maximizing resource utilization is reshaping product development strategies. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, sets ambitious targets for waste reduction and resource efficiency, influencing product design mandates.

These environmental shifts encourage companies like Bel to integrate lifecycle thinking into their product design, prioritizing materials that are easily recycled or repurposed. This approach not only addresses regulatory pressures but also taps into growing consumer demand for sustainable products. By 2024, the global market for circular economy solutions was projected to reach significant figures, demonstrating the economic viability of these practices.

- Incentives for Circularity: Governments are providing tax breaks and grants for businesses adopting circular design, such as those focused on product repairability and material reuse.

- Consumer Demand: Studies in 2024 indicated that over 60% of consumers are willing to pay more for products made from recycled or sustainable materials.

- Regulatory Push: Legislation, like the EU's Ecodesign Directive, is increasingly mandating product durability and repairability, impacting design choices.

- Resource Efficiency: Companies are seeing cost savings through reduced material waste and lower disposal fees by embracing circular models.

Environmental regulations are tightening globally, pushing companies towards greater sustainability. For example, the EU's WEEE Directive aims for 85% e-waste collection by 2025, and Extended Producer Responsibility (EPR) schemes are increasingly common, making manufacturers responsible for product end-of-life management. This trend is driving innovation in product design for longevity and recyclability.

Climate change impacts supply chains through extreme weather, disrupting production and logistics. In 2023, Southeast Asian flooding caused significant delays in electronics manufacturing. Consequently, businesses are enhancing resilience by diversifying component sourcing and exploring nearshoring to mitigate these risks.

Governments are actively promoting circular economy principles, offering incentives for businesses that design for repair and recyclability. By 2024, consumer willingness to pay more for sustainable products exceeded 60%, underscoring market demand. Companies are responding by integrating lifecycle thinking into their product development, aiming for resource efficiency and reduced waste.

| Environmental Factor | Impact on Electronics Sector | Key Initiatives/Trends (2024-2025) |

|---|---|---|

| E-waste Regulations | Increased producer responsibility for disposal and recycling. | EU WEEE Directive targets, global expansion of EPR schemes. |

| Climate Change & Extreme Weather | Supply chain disruptions, increased logistics costs. | Focus on supply chain resilience, nearshoring, diversified sourcing. |

| Circular Economy Push | Demand for durable, repairable, and recyclable products. | Government incentives (tax breaks, grants), growing consumer preference for sustainable goods. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources such as the World Bank, International Monetary Fund, and various national statistical offices. We also incorporate insights from leading industry associations and market research firms to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.