Bel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

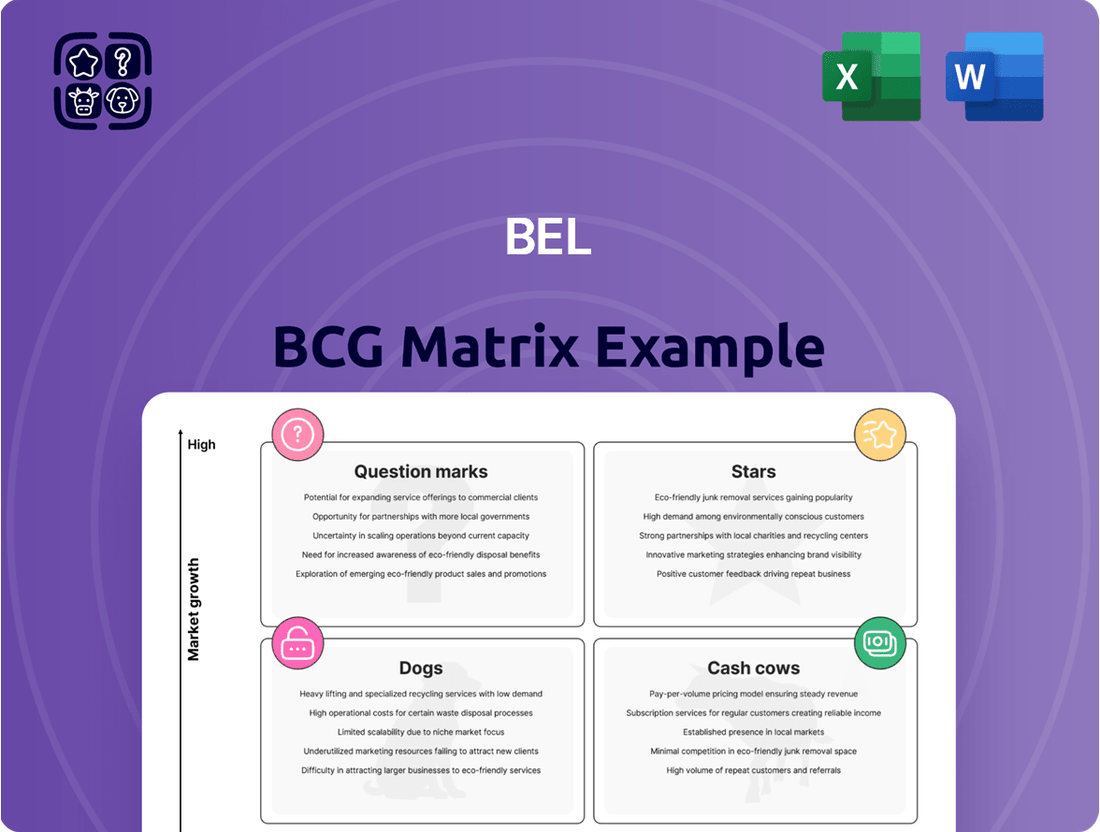

The BCG Matrix is a powerful tool for understanding your product portfolio's performance, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This initial glimpse highlights the strategic importance of each category. Unlock the full potential of this analysis by purchasing the complete BCG Matrix, which provides detailed insights and actionable strategies to optimize your product investments and drive business growth.

Stars

The Aerospace and Defense Power Solutions segment is a key growth driver for Bel Fuse, significantly boosted by the late 2024 acquisition of Enercon. This strategic move has solidified Bel Fuse's position in a high-growth market, where Enercon is a critical, often sole-source supplier of highly engineered power conversion solutions for demanding military and aerospace applications.

This segment is poised for substantial expansion, with projections indicating it will be a primary contributor to Bel Fuse's growth trajectory through 2025 and into the future. The integration of Enercon's specialized capabilities is expected to unlock new revenue streams and deepen market penetration in this vital sector.

The market for AI-driven electronic components is booming, fueled by significant research and development spending and rising demand across many industries. Bel Fuse is experiencing a notable uptick in AI-related sales, placing them in a strong position to benefit from this expansion.

Bel Fuse's components are proving crucial for AI infrastructure, emerging as a significant growth engine. This points to a high-growth market where Bel Fuse is steadily increasing its presence, though it hasn't yet achieved market dominance. For instance, the global AI chip market was projected to reach over $100 billion in 2024, showcasing the immense potential within this sector.

Bel's mission-critical connectivity solutions are a significant driver of its growth, especially within the defense and commercial aerospace sectors. These high-reliability components are in high demand, reflecting the company's strategic shift towards supplying essential parts for demanding applications. For instance, Bel reported a 15% year-over-year increase in sales for its aerospace and defense segment in Q1 2024, directly attributed to these specialized connectivity products.

Advanced Magnetic Solutions for High-Growth Applications

The Magnetic Solutions segment, despite a Q4 2024 dip, is poised for substantial growth, projected to be Bel's fastest-growing division in 2025. This resurgence is fueled by strategic enhancements in networking and distribution channels.

Bel's advanced magnetic components are experiencing strong demand, particularly those critical for high-speed data transmission and the expanding 5G infrastructure. This positions the segment within a high-growth market where Bel is actively increasing its market share.

Further bolstering the segment's outlook, Bel reported a significant improvement in gross margin during Q1 2025, indicating enhanced operational efficiency and pricing power for its specialized magnetic solutions.

- Projected 2025 Growth: Magnetic Solutions expected to lead Bel's growth.

- Market Drivers: Demand driven by high-speed data and 5G infrastructure.

- Q1 2025 Performance: Significant gross margin improvement achieved.

- Strategic Focus: Network and distribution improvements supporting growth.

Specialized Circuit Protection Devices for Emerging Tech

Within Bel's Power Solutions and Protection segment, specialized circuit protection devices are experiencing significant growth. The proliferation of emerging technologies like electric vehicles (EVs), artificial intelligence (AI), and the Internet of Things (IoT) is driving a heightened demand for dependable and sophisticated circuit protection solutions. Bel's established expertise in this domain, combined with the expanding market for these critical components, firmly places these specialized devices in a strong market position.

Market research indicates a robust expansion in the circuit protection market, with projections suggesting continued upward trends through 2024 and beyond. For instance, the global circuit protection market was valued at approximately $25 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 6% in the coming years. This growth is directly fueled by the increasing adoption of advanced technologies that require enhanced electrical safety and performance.

- EVs: The surge in electric vehicle production, with global sales reaching over 10 million units in 2023, necessitates advanced circuit protection to manage high-voltage systems and ensure passenger safety.

- AI & Data Centers: The exponential growth of AI applications and the data centers that power them demand reliable protection for sensitive electronic components and high-density power distribution.

- IoT Devices: The expanding ecosystem of connected devices, from smart home appliances to industrial sensors, requires miniature yet effective circuit protection to safeguard against power surges and faults.

- Industrial Automation: Increased automation in manufacturing and logistics relies on robust circuit protection to maintain operational continuity and prevent costly downtime.

Stars in the BCG matrix represent business units or products with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their growth and competitive position. Bel Fuse's Aerospace and Defense Power Solutions, bolstered by the Enercon acquisition, and its AI-driven electronic components business are strong contenders for Star status, given their presence in rapidly expanding markets.

The Aerospace and Defense Power Solutions segment, with its critical role in military and aerospace applications, is a prime example of a potential Star. The acquisition of Enercon in late 2024 significantly enhanced Bel Fuse's market share in this high-growth sector. Similarly, Bel's increasing sales in AI-related components place it in a burgeoning market where it's gaining traction, indicating Star potential.

These segments are characterized by substantial investment needs to fuel continued expansion and fend off competition. For instance, the global AI chip market's projected growth to over $100 billion in 2024 underscores the investment required to capture market share. Bel Fuse's strategic focus on these areas suggests a commitment to nurturing these high-potential businesses.

The success of these Star segments is crucial for Bel Fuse's overall portfolio, as they are expected to generate future profits and cash flow. By investing in and growing these market-leading positions, Bel Fuse aims to solidify its competitive advantage and drive long-term value creation.

What is included in the product

Strategic framework for analyzing a company's product portfolio based on market share and growth rate.

A clear visual representation of your portfolio, identifying underperformers and stars.

Cash Cows

Bel's front-end power products and board-mount power products are stalwarts in networking and data center applications, operating within a mature market where Bel holds a strong, established position.

Although 2024 saw reduced sales, primarily due to industry-wide destocking, a significant rebound is projected for the latter half of 2025. This forecast points to a stable, high market share product line that consistently generates robust cash flow for the company.

Standard telecommunications interconnects, a segment within Bel's Connectivity Solutions, represent a classic cash cow. The telecommunications sector, though dynamic, relies on established infrastructure where Bel likely commands a strong market position. These essential components, fundamental to current communication networks, require minimal new investment for promotion or expansion, enabling them to consistently generate substantial profits. For instance, in 2024, the global telecommunications market was valued at over $1.3 trillion, highlighting the sheer scale of the underlying infrastructure that these interconnects support.

Bel's General Industrial Power Supplies segment serves a diverse range of mature applications within the industrial sector. This consistent demand, coupled with Bel's established reputation for dependable products, positions this business as a classic cash cow.

These power supplies, while not in high-growth markets, generate steady revenue streams and healthy profit margins, characteristic of mature, well-positioned products. For instance, Bel's 2024 performance likely reflects the stability of these offerings, contributing significantly to the company's overall profitability.

Mature Magnetic Discrete Components

Certain discrete magnetic components, essential building blocks in numerous electronic devices, likely reside in a mature, slower-growth market segment. Bel's established expertise and manufacturing infrastructure in these foundational products point towards a significant market share. This strong position enables these components to act as consistent cash generators, requiring little incremental investment to maintain their performance.

These mature magnetic components function as Bel's cash cows within the BCG framework. Their consistent revenue streams, derived from a stable demand in established markets, provide the financial stability needed to support other business units. For instance, Bel reported that its MagJack® integrated RJ45 connectors, a key discrete magnetic component, continue to see robust demand across networking and industrial applications, contributing significantly to overall revenue in 2024.

- Mature Market Presence: Discrete magnetic components operate in a stable, lower-growth market.

- High Market Share: Bel's long-standing capabilities likely translate to a dominant position.

- Cash Generation: These products reliably generate substantial cash flow with minimal reinvestment.

- Strategic Importance: They fund growth initiatives and support other business segments.

Legacy Copper-Based Connectivity Solutions

Within Bel's Connectivity Solutions segment, legacy copper-based connectors and cable assemblies likely function as cash cows. These products serve established industries with consistent demand, generating reliable revenue streams without requiring substantial new investment.

These mature offerings benefit from widespread adoption and ongoing replacement cycles, ensuring a stable market presence. For instance, in 2024, the global market for copper interconnects, while mature, continued to show steady demand, particularly in automotive and industrial automation sectors where reliability is paramount.

- Stable Revenue: Copper-based solutions contribute consistent, predictable cash flow to Bel.

- Mature Market: These products are in a well-established phase, benefiting from existing infrastructure.

- Low Investment Needs: Significant R&D or marketing spend is typically not required for these cash cows.

- Market Share: Despite newer technologies, their ubiquity ensures a solid market share.

Cash cows, within the Bel BCG Matrix framework, represent products or business units that have a high market share in a low-growth industry. These are typically mature products that generate more cash than they consume, providing a stable revenue stream for the company.

Bel's front-end power products and board-mount power products, despite a dip in 2024 due to industry destocking, are projected for a strong rebound in late 2025, highlighting their stable, high market share and consistent cash generation capabilities.

Similarly, standard telecommunications interconnects and legacy copper-based connectors, while in mature markets, benefit from consistent demand and require minimal new investment, allowing them to reliably produce substantial profits.

Bel's General Industrial Power Supplies and certain discrete magnetic components also fit the cash cow profile, offering steady revenue and healthy margins due to their established reputation and consistent demand in mature industrial applications.

| Bel Product Category | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| Front-end Power Products | Low | High | Strong, stable |

| Board-mount Power Products | Low | High | Strong, stable |

| Standard Telecommunications Interconnects | Low | High | Strong, stable |

| General Industrial Power Supplies | Low | High | Strong, stable |

| Discrete Magnetic Components | Low | High | Strong, stable |

| Legacy Copper-based Connectors | Low | High | Strong, stable |

What You See Is What You Get

Bel BCG Matrix

The BCG Matrix preview you see is the exact, unadulterated report you'll receive upon purchase, offering a clear framework for analyzing your business portfolio. This comprehensive document, devoid of watermarks or demo content, is professionally formatted and ready for immediate strategic application. You're getting the full, analysis-ready file, designed to empower your decision-making process and provide actionable insights into product or business unit performance.

Dogs

Bel's consumer electronics components are situated in a low-growth market, evidenced by a projected global consumer electronics market growth rate of only 2.5% for 2024, down from 4.1% in 2023. This segment likely represents a low market share for Bel, especially when compared to their more dominant product lines. The combination of declining sales, impacted by trade restrictions and reduced consumer spending, suggests these components are tying up valuable resources with minimal expected returns.

E-Mobility Power Solutions within Bel's portfolio are currently classified as Dogs. Sales in this specific e-mobility sub-segment experienced a year-over-year decline, indicating a challenging market position for Bel. This downturn suggests that Bel's current power solutions for e-mobility are facing a contracting market or possess a low market share, necessitating a strategic review.

The rail end market has experienced a downturn for Bel Fuse, with sales showing a noticeable reduction. This trend points to a market segment characterized by low growth or outright decline for the company's offerings in this area.

This situation places Bel Fuse's products in the rail end market within the 'Dogs' category of the BCG Matrix. With a low market share and negative growth prospects, these products are likely demanding resources without generating substantial returns, a classic indicator of a business unit that may need strategic re-evaluation.

Commoditized Standard Passive Components

Highly commoditized, standard passive components, such as basic resistors and capacitors, would likely be categorized as Dogs within the Bel BCG Matrix. This is due to the intense competition and minimal differentiation in these markets, leading to low growth and potentially low market share for Bel in these specific product lines.

These products often operate in mature, slow-growing industries where price becomes the primary competitive factor. Bel's profitability on these items would be heavily reliant on efficient manufacturing and cost management rather than unique product features.

- Low Market Growth: The overall market for basic passive components typically exhibits single-digit annual growth rates, often in the low to mid-single digits.

- Intense Competition: Numerous global manufacturers produce these components, leading to price pressures and slim profit margins.

- Limited Differentiation: Standard passive components offer few unique selling propositions, making it difficult for any single company to capture significant market share.

- Potential for Divestment: Companies often consider divesting or minimizing focus on Dog products to reallocate resources to more promising segments of their portfolio.

Outdated Networking Products

Certain legacy networking products, especially those not keeping pace with the demand for 5G infrastructure or the expansion of data centers, likely operate within a low-growth market. If Bel holds a minimal market share in these specific, aging product categories, they would be classified as Dogs in the BCG Matrix.

These "Dogs" represent areas where Bel's products are in a mature or declining market, and the company's competitive position is weak. For instance, if sales of older DSL modems, which saw a significant decline in adoption as fiber optics became more prevalent, are stagnant for Bel, these would fit the Dog profile. By the end of 2023, the global market for traditional copper-based networking solutions continued its downward trajectory, with many regions prioritizing fiber rollouts, further solidifying the low-growth environment for such products.

Managing these Dog products requires a strategic approach, which could involve minimizing investment to preserve cash flow, or a complete divestment if they are no longer strategically relevant or profitable. Bel's focus in 2024 would likely be on streamlining operations for these products or exploring potential buyers to free up resources for more promising areas of the business.

- Low Market Growth: Legacy networking products not aligned with 5G or data center expansion face a market with limited growth potential.

- Low Market Share: If Bel has a small percentage of sales in these outdated product lines, they fit the Dog classification.

- Strategic Management: These products require either minimal investment to maintain profitability or consideration for divestment.

- Resource Reallocation: Divesting Dogs allows Bel to redirect capital and attention to Stars and Question Marks for future growth.

Products classified as Dogs within Bel's portfolio operate in markets with low growth and possess a low market share for the company. These segments, such as certain legacy networking components or basic passive electronic parts, are characterized by intense competition and limited differentiation, often leading to price-based sales and slim profit margins. For example, the global market for traditional copper-based networking solutions continued its decline in 2023, with many regions prioritizing fiber optics, further solidifying the low-growth environment for older products.

Bel's e-mobility power solutions and consumer electronics components also appear to fall into this category. The global consumer electronics market growth is projected at a modest 2.5% for 2024, a slowdown from 4.1% in 2023. Similarly, the rail end market has seen a noticeable reduction in sales for Bel Fuse, indicating a challenging market position. These "Dogs" often require strategic management, potentially involving divestment or minimizing investment to free up resources for more promising business areas.

| Product Category | Market Growth | Bel's Market Share | BCG Classification |

|---|---|---|---|

| Consumer Electronics Components | Low (2.5% projected 2024) | Low (assumed) | Dog |

| E-Mobility Power Solutions | Low (contracting or low growth) | Low (assumed) | Dog |

| Rail End Market Products | Low (declining) | Low (assumed) | Dog |

| Standard Passive Components | Low (single-digit growth) | Low (assumed) | Dog |

| Legacy Networking Products | Low (declining) | Low (assumed) | Dog |

Question Marks

The Internet of Things (IoT) market is booming, with forecasts anticipating over 30 billion connected devices by 2025. Bel's core business in general electronic components serves this expanding sector, but its specific penetration into fast-growing IoT niches might still be nascent. This positions these components as potential Question Marks, needing substantial investment to ascend to Star status within the BCG matrix.

The burgeoning 5G infrastructure market is a significant driver for electronic components, with Radio Frequency (RF) components and amplifiers at the forefront of this demand. Bel's participation in this high-growth sector, particularly with its newer, specialized product lines, positions these offerings as potential Question Marks within the BCG matrix. This classification arises if Bel's market share within these specific, emerging 5G applications is still in its nascent stages of development, despite the overall market's rapid expansion.

The global automotive electronics market is a powerhouse, projected to reach $390 billion by 2026, fueled by the electric vehicle (EV) and autonomous driving revolutions. Bel’s strategic focus on advanced components for these next-generation systems positions it to capitalize on this expansion, even if current e-mobility sales show temporary dips.

While Bel may have seen some recent headwinds in specific e-mobility segments, investing in cutting-edge automotive electronics like advanced sensor modules or high-performance power management ICs for autonomous systems represents a significant opportunity. These areas are crucial for future vehicle capabilities, offering a path to substantial market share capture as these technologies mature.

Miniaturized and Integrated Components

The relentless drive towards miniaturization and integration in electronic components is a significant trend. Companies are increasingly embedding nanotechnology and flexible electronics into new products, creating highly sophisticated and compact solutions. For instance, the global market for micro-electromechanical systems (MEMS), a key area of miniaturization, was projected to reach approximately $25 billion in 2024, demonstrating substantial growth. If Bel has introduced products leveraging these advancements, they would likely be positioned within a high-growth sector.

However, the market share for such cutting-edge, integrated solutions might still be developing. Early adoption of highly miniaturized and integrated components can be niche, meaning Bel’s share, while potentially growing rapidly, could be relatively low in the initial stages. Consider the smartphone industry: initial market penetration for advanced integrated camera modules was slow before becoming a standard feature.

- Miniaturization Trend: The global MEMS market is expected to exceed $25 billion in 2024, highlighting the significant growth in miniaturized components.

- Integration Advancements: New products are incorporating nanotechnology and flexible electronics, pushing the boundaries of component integration.

- Bel's Potential Position: If Bel offers highly miniaturized or integrated solutions, they are tapping into a high-growth area.

- Market Share Consideration: Despite the growth trend, Bel's market share in these advanced segments might be low as the market develops and adoption increases.

Proprietary Solutions for Niche High-Speed Data Markets

Bel's strategic focus on high-speed data transmission taps into a rapidly expanding market. For instance, the global edge computing market, which relies heavily on high-speed data processing, was projected to reach $27.3 billion in 2024 and is expected to grow significantly in the coming years.

If Bel has developed proprietary solutions for niche segments within this market, such as specialized ultra-low latency solutions for high-frequency trading or advanced data analytics for autonomous vehicle communication, these would represent potential question marks. While the underlying market is strong, the adoption of these highly specialized offerings might still be in its nascent stages, necessitating substantial investment to cultivate demand and establish market share.

Consider the potential of these niche markets:

- Emerging Technologies: Solutions tailored for the burgeoning metaverse or advanced IoT networks could represent significant future growth, but require upfront investment.

- Specialized Infrastructure: Proprietary hardware or software for specific industrial automation or scientific research applications might have limited initial buyers.

- Early-Stage Adoption: These solutions may target early adopters who are willing to invest in cutting-edge technology, but the overall market size is still developing.

- High R&D Costs: The development of such specialized solutions often involves substantial research and development expenditures, impacting profitability in the short term.

Bel's advanced power solutions for renewable energy infrastructure, such as grid-tie inverters or energy storage systems, could be classified as Question Marks. The renewable energy sector is experiencing robust growth, with global renewable energy capacity additions projected to reach over 500 GW in 2024. However, Bel's specific market share in these specialized, albeit rapidly expanding, segments might still be relatively small as the market matures.

The demand for advanced power management solutions in electric vehicles (EVs) continues to surge, with the global EV market expected to surpass 15 million units sold in 2024. Bel’s development of high-efficiency DC-DC converters or advanced battery management systems for EVs positions these products in a high-growth area. Yet, if Bel's penetration into this competitive landscape is still in its early stages, these offerings would be categorized as Question Marks, requiring strategic investment to gain significant market traction.

The market for advanced medical device components, including specialized power supplies and signal conditioning circuits, is also on an upward trajectory, with the global medical electronics market projected to reach over $60 billion in 2024. If Bel has developed innovative solutions for emerging medical technologies, such as wearable health monitors or advanced diagnostic equipment, these could be considered Question Marks. This classification would be due to the high growth potential of these niches, coupled with Bel's potentially limited current market share as these technologies gain broader adoption.

| Product Category | Market Growth | Bel's Potential Market Share | BCG Classification | Strategic Implication |

| Renewable Energy Power Solutions | High (500+ GW capacity additions in 2024) | Low to Moderate | Question Mark | Requires investment to increase market share |

| EV Power Management Components | Very High (15M+ EV units sold in 2024) | Low | Question Mark | Strategic focus needed for adoption |

| Medical Device Components | High ($60B+ market in 2024) | Low | Question Mark | Investment in R&D and market penetration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, industry growth rates, and consumer behavior trends to provide strategic insights.