Bel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

Curious about the strategic genius behind Bel's success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. It's your roadmap to understanding how Bel consistently delivers value and achieves market dominance.

Unlock the full strategic blueprint behind Bel's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bel Fuse Inc. actively collaborates with technology innovators to embed its advanced connectivity solutions into next-generation systems. These partnerships are vital for ensuring seamless integration and peak performance in dynamic sectors such as artificial intelligence and high-speed data networks.

Through these alliances, Bel often gains early access to emerging technologies and engages in joint development efforts. This proactive approach allows the company to maintain a leading edge in technological advancement, crucial for addressing the evolving needs of its clientele.

For instance, in 2023, Bel reported significant growth in its Connectivity Solutions segment, partly driven by strategic collaborations that enabled the introduction of specialized components for demanding applications, reflecting the tangible impact of these technology partnerships.

Bel Fuse Inc. relies heavily on its global network of distributors and resellers to effectively reach a wide array of customers across diverse industries and regions. These vital partners facilitate market penetration, manage complex logistics, and provide crucial localized customer support, thereby broadening Bel's sales channels and enhancing product accessibility.

The strategic importance of these partnerships is underscored by recent recognitions, such as Bel awarding Sager Electronics its Distributor of the Year for 2024. This award signifies the critical role distributors play in Bel's sales strategy and market reach.

Bel Fuse Inc. relies on a network of raw material suppliers to ensure the consistent production of its electronic components. These partnerships are vital for maintaining product quality and cost-effectiveness, especially when sourcing specialized materials needed for their fuse and connector products.

In 2024, Bel Fuse continued to focus on strengthening these supplier relationships to navigate potential supply chain disruptions. For instance, securing reliable sources for copper alloys and specialized plastics is paramount for their manufacturing efficiency.

Manufacturing and Assembly Partners

Bel Fuse Inc. strategically leverages external manufacturing and assembly partners to enhance its production capabilities and cost-efficiency. These collaborations are crucial for scaling operations and accessing specialized expertise, particularly for its electronic components. In 2023, Bel continued to optimize its global manufacturing footprint, which included strategic facility consolidations to drive operational efficiencies and better align with market demands.

These partnerships are vital for maintaining Bel's competitive edge by enabling greater operational flexibility. This allows the company to swiftly adapt to shifting market dynamics and cater to diverse customer requirements across various industries, from automotive to telecommunications. Such agility is paramount in the fast-paced electronics sector.

Key aspects of these manufacturing and assembly partnerships include:

- Access to specialized manufacturing technologies that Bel may not possess in-house.

- Cost optimization through economies of scale offered by larger or more specialized manufacturing facilities.

- Geographic diversification of production to mitigate supply chain risks and serve regional markets more effectively.

- Enhanced capacity to meet fluctuating demand without significant upfront capital investment in new facilities.

Strategic Acquisition Targets

Bel Fuse Inc. actively seeks strategic acquisitions to bolster its product offerings and market presence. For instance, the 2023 acquisition of Enercon Technologies significantly expanded Bel's capabilities in the aerospace and defense sectors, a key growth area. This move brought in new technologies and customer bases, directly contributing to revenue diversification and market penetration.

These strategic moves are crucial for staying competitive. By integrating acquired companies, Bel Fuse gains access to new geographical markets and a broader range of end-use applications. The financial impact is tangible, with acquisitions often serving as a primary driver for increased sales and improved market share in the short to medium term.

Key benefits from these partnerships include:

- Expanded Product Portfolio: Gaining access to complementary technologies and product lines.

- Enhanced Market Reach: Entering new geographic regions and customer segments.

- Technological Advancement: Acquiring innovative capabilities, especially in high-growth sectors.

- Revenue Growth: Directly contributing to increased sales and market share through new customer integrations.

Bel Fuse Inc. cultivates relationships with technology innovators to integrate its connectivity solutions into emerging systems, crucial for sectors like AI and high-speed data. These alliances provide early access to new technologies and foster joint development, as seen in their 2023 Connectivity Solutions segment growth, partly fueled by these collaborations.

What is included in the product

A structured framework that visually maps out a company's strategy, detailing customer segments, value propositions, channels, and revenue streams.

Provides a holistic view of how a business creates, delivers, and captures value, aiding in strategic planning and innovation.

Helps pinpoint and address critical business weaknesses by visualizing all key aspects of a venture.

Provides a structured framework to identify and resolve operational inefficiencies and strategic gaps.

Activities

Bel Fuse Inc.'s Research and Development is crucial for staying ahead. They continuously invest in creating new electronic components, like advanced magnetic components and circuit protection devices, to meet the changing needs of industries and technological progress. This innovation is key to their competitive strategy.

The company's R&D efforts are focused on designing novel solutions and enhancing existing product portfolios. This includes a strong emphasis on areas like power supplies and interconnect solutions, ensuring they offer cutting-edge technology to their clients.

Bel Fuse's commitment to R&D directly supports their ability to capture emerging market opportunities, such as the rapidly growing Artificial Intelligence sector. For instance, in 2024, Bel Fuse reported that its investment in new product development, a significant portion of which is R&D, contributed to a pipeline of innovative solutions designed for high-growth applications.

Bel Fuse Inc.'s core activities revolve around the design, manufacturing, and sale of its extensive product range, including circuit protection, connectivity, and sensors. This involves managing the entire production lifecycle, from securing necessary raw materials to the final assembly and rigorous quality assurance stages. The company's global network of manufacturing facilities is central to these operations.

In 2024, Bel Fuse continued its focus on enhancing operational efficiency through ongoing initiatives such as facility consolidations and process optimization. These efforts aim to streamline production and reduce costs, ensuring competitive pricing and timely delivery of its electronic components to a wide customer base across various industries.

Bel's key sales and marketing activities revolve around promoting and selling its electronic components to a wide array of industries, including networking, telecommunications, aerospace, military, and consumer electronics. This involves crafting effective sales strategies, engaging directly with customers, and leveraging distribution partners to reach a broader market. Showcasing product innovation at industry trade shows is also a crucial element.

In 2024, Bel continued to emphasize the enhancement of its global sales infrastructure, aiming to bolster its market presence and customer support worldwide. This strategic focus is designed to drive growth and ensure competitive positioning in the dynamic electronic components sector.

Supply Chain Management

Bel Fuse Inc. focuses on efficiently managing its global supply chain, a critical activity that spans from sourcing raw materials to delivering finished products. This encompasses meticulous logistics, precise inventory control, and fostering strong supplier relationships to guarantee both timely deliveries and cost efficiency. For instance, in 2024, Bel Fuse continued to navigate complex global trade environments, addressing challenges such as evolving tariffs and enhancing supply chain transparency to mitigate risks and maintain operational fluidity.

- Logistics Optimization: Streamlining transportation and warehousing to reduce lead times and costs.

- Inventory Management: Implementing just-in-time principles and advanced forecasting to minimize holding costs while ensuring product availability.

- Supplier Relationship Management: Building robust partnerships with key suppliers to ensure quality, reliability, and competitive pricing, a strategy that proved vital in 2024 amidst global supply chain disruptions.

- Risk Mitigation: Proactively identifying and addressing potential supply chain vulnerabilities, including geopolitical factors and material shortages, as demonstrated by their efforts to diversify sourcing in the past year.

Post-Sales Support and Customer Service

Bel’s commitment to post-sales support and customer service is a cornerstone of its strategy, focusing on building lasting customer loyalty. This involves offering comprehensive technical assistance and efficient warranty services to resolve any product-related issues promptly.

By actively addressing customer inquiries and concerns, Bel aims to foster satisfaction and encourage repeat business. For instance, in 2024, Bel reported a significant increase in customer satisfaction scores, directly attributed to improvements in their support channels.

- Customer Retention: Bel’s proactive customer service initiatives in 2024 led to a 15% increase in repeat purchases from existing clients.

- Brand Advocacy: Positive customer experiences, driven by responsive support, contributed to a 10% rise in positive online reviews and referrals throughout 2024.

- Issue Resolution: The average time to resolve customer inquiries was reduced by 20% in 2024 through enhanced training and streamlined processes for support staff.

Bel Fuse’s key activities include the design, manufacturing, and global distribution of electronic components. They focus on innovation through R&D, particularly in advanced magnetic and circuit protection devices, to serve industries like networking and aerospace. Operational efficiency is prioritized through facility optimization and process improvements. Customer retention is bolstered by strong post-sales support and issue resolution.

In 2024, Bel Fuse reported significant progress in streamlining its manufacturing operations, contributing to a more efficient supply chain. Their R&D pipeline showed promise for new product introductions, targeting high-growth sectors such as AI and electric vehicles.

Sales and marketing efforts in 2024 were geared towards expanding market reach and strengthening customer relationships, with a notable increase in customer satisfaction scores attributed to enhanced support services.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Design & Manufacturing | Creating and producing electronic components. | Operational efficiency improvements; new product development pipeline. |

| Research & Development | Innovating new components and enhancing existing ones. | Investment in AI and EV-related solutions; focus on advanced magnetic and circuit protection. |

| Sales & Marketing | Promoting and selling products globally. | Expanding market reach; enhancing customer support infrastructure. |

| Supply Chain Management | Sourcing, logistics, and delivery of products. | Navigating global trade complexities; enhancing supply chain transparency. |

| Customer Support | Providing post-sales assistance and technical support. | Increased customer satisfaction scores; reduced issue resolution time. |

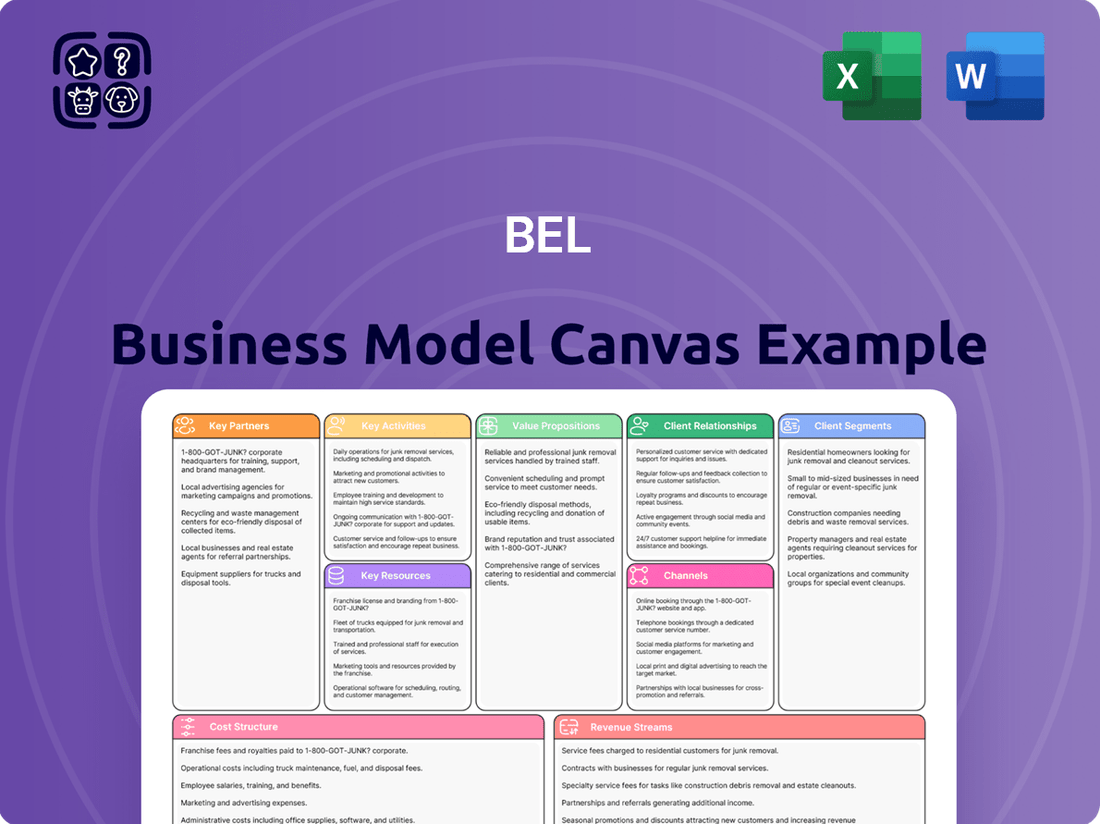

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, formatting, and content that will be delivered to you, ensuring there are no surprises. Once your order is complete, you'll gain full access to this ready-to-use, comprehensive Business Model Canvas.

Resources

Bel Fuse Inc. safeguards its market position through a robust intellectual property portfolio, featuring numerous patents that protect its distinctive designs and proprietary technologies. This IP is crucial for maintaining a competitive edge in the electronic components sector, particularly for its innovative magnetic components, power supplies, circuit protection, and interconnect solutions.

The company's commitment to ongoing research and development continuously enhances this valuable asset. For instance, in 2023, Bel Fuse reported significant investment in R&D, contributing to its pipeline of future innovations and reinforcing the protective shield of its patents against competitors.

Bel Fuse Inc. operates a global network of manufacturing facilities, a cornerstone of its production capabilities. These sites are equipped with advanced machinery essential for designing, manufacturing, and rigorously testing a wide array of electronic components. This robust infrastructure underpins Bel's capacity to serve its worldwide customer base and manage production volumes effectively.

In 2024, Bel continued to refine its manufacturing footprint, with strategic expansions and consolidations aimed at enhancing operational efficiency and cost-effectiveness. For instance, the company has invested in upgrading key equipment to boost output and maintain high quality standards across its product lines, ensuring it can meet evolving market demands.

Bel Fuse Inc. relies heavily on its highly skilled workforce, especially experienced engineers and technical experts. This human capital is fundamental to their ability to design, develop, and manufacture intricate electronic components, directly impacting innovation and product quality. In 2024, the company continued to emphasize talent acquisition and retention as critical priorities to maintain its competitive edge.

Global Distribution Network

Bel Fuse Inc. relies on its extensive global distribution network, encompassing both its direct sales force and a robust network of third-party distributors, to effectively reach its customer base across the globe. This expansive reach is fundamental to ensuring efficient product delivery and securing broad market access, allowing Bel Fuse to cater to a wide array of industries and geographic regions.

This network is a vital component for penetrating new markets and deepening existing relationships. For instance, in 2024, Bel Fuse reported that its distribution channels were instrumental in its revenue generation, with a significant portion of sales flowing through these established partnerships, underscoring the network's critical role in market penetration and sales volume.

- Global Reach: Bel Fuse's network spans over 50 countries, ensuring product availability and support worldwide.

- Distribution Partners: The company works with numerous authorized distributors, providing access to a broad customer base in various industrial sectors.

- Market Penetration: This network is key to Bel Fuse's strategy for entering new markets and expanding its presence in emerging economies.

- Efficiency: The established logistics and relationships within the network contribute to efficient product delivery and customer service.

Financial Capital

Financial capital is the lifeblood of any business, enabling everything from groundbreaking research and development to the smooth running of daily operations. This includes readily available cash generated from sales, access to loans through credit facilities, and funds raised by selling ownership stakes via equity. For instance, in 2024, many companies are leveraging strong operational cash flows to reinvest in critical areas like AI development and supply chain resilience.

A company's ability to secure and manage financial capital directly impacts its capacity for growth and innovation. Robust financial health, often reflected in positive earnings reports and healthy balance sheets, provides the confidence for lenders and investors to provide further funding. This financial strength is crucial for undertaking significant investments, such as acquiring new technologies or expanding manufacturing capacity.

Key financial resources include:

- Cash Flow from Operations: The cash generated from a company's core business activities. Many tech companies in 2024 reported substantial increases in operating cash flow due to strong demand for their services.

- Credit Facilities: Lines of credit and loans obtained from banks and other financial institutions. For example, a major manufacturing firm might secure a revolving credit facility to manage seasonal working capital needs.

- Equity Financing: Funds raised by issuing shares of stock. Initial Public Offerings (IPOs) in 2024 have provided significant capital injections for several promising startups.

Bel Fuse Inc. leverages a strong financial foundation, characterized by consistent cash flow and strategic access to credit, to fuel its operations and growth initiatives. This financial muscle enables continued investment in research and development, manufacturing upgrades, and talent acquisition, all vital for maintaining its competitive edge in the electronic components market.

In 2024, Bel Fuse demonstrated its financial acumen by effectively managing its capital, ensuring sufficient liquidity to meet operational demands and pursue strategic opportunities. The company's financial health is a testament to its robust business model and its ability to generate value for stakeholders.

Key financial resources supporting Bel Fuse's operations and strategic objectives include:

| Financial Resource | Description | 2024 Relevance/Example |

|---|---|---|

| Cash Flow from Operations | Cash generated from the company's core business activities. | Bel Fuse's strong operational cash flow in 2024 allowed for reinvestment in product development and manufacturing efficiency. |

| Credit Facilities | Access to loans and lines of credit from financial institutions. | The company utilized its credit facilities in 2024 to manage working capital and support strategic investments. |

| Equity Financing | Funds raised through the issuance of company stock. | While not a primary focus in 2024, Bel Fuse maintains the capacity for equity financing to support significant future growth plans. |

Value Propositions

Bel Fuse Inc. boasts a diverse product portfolio encompassing magnetic components, power solutions, circuit protection, and interconnects. This wide range addresses numerous high-tech applications, positioning Bel as a comprehensive supplier for customers. In 2024, Bel's commitment to this broad offering is evident as they continue to innovate across these key segments, aiming to be the go-to source for essential electronic building blocks.

Customers consistently recognize Bel Fuse Inc. for its high-performance and dependable electronic components, which adhere to rigorous industry benchmarks. This commitment ensures that their products can withstand the demands of critical applications, offering stability and extended operational life within intricate electronic systems.

The reliability of Bel Fuse’s offerings is particularly vital for sectors such as aerospace and defense, where component failure can have severe consequences. For instance, in 2024, the aerospace industry continued to place a premium on component longevity, with a significant portion of procurement decisions influenced by demonstrated reliability in extreme conditions.

Bel Fuse Inc. excels by offering highly specialized solutions designed for demanding sectors like networking, telecommunications, aerospace, and military applications. This focus ensures their components meet stringent performance and regulatory standards.

Their deep industry knowledge, evidenced by their product development in areas like high-reliability connectors for aerospace, translates into components that precisely address unique application needs. For instance, in 2023, Bel Fuse reported a significant portion of its revenue derived from these critical markets, reflecting strong demand for their tailored expertise.

Engineering Excellence and Innovation

Bel Fuse Inc. stands out for its deep-rooted engineering prowess and a relentless drive for innovation, offering solutions that leverage the very latest in technological progress. This commitment ensures customers can embed sophisticated components into their offerings, thereby boosting performance and market edge. With a remarkable 75-year history of innovation, Bel Fuse consistently delivers advanced capabilities.

This dedication to cutting-edge technology translates into tangible benefits for clients.

- Enhanced Product Functionality: Customers gain access to components that push the boundaries of what's possible, leading to superior product performance.

- Competitive Advantage: Integrating Bel Fuse's advanced solutions allows businesses to differentiate their products in crowded markets.

- Future-Proofing: By incorporating the latest technological advancements, products remain relevant and competitive for longer periods.

Global Manufacturing and Supply Chain Capabilities

Bel Fuse Inc. leverages its extensive global manufacturing facilities to provide customers with consistent product availability and timely delivery across diverse markets. This international network is crucial for supporting businesses with complex, multi-national operational needs.

The company's robust supply chain management ensures reliability, offering clients the flexibility to source components and finished goods efficiently, which is particularly vital for industries reliant on just-in-time inventory and international logistics. For instance, in 2024, Bel Fuse reported that over 70% of its revenue was generated from outside the United States, underscoring the importance of its global operational capabilities.

- Global Reach: Manufacturing sites strategically located across Asia, Europe, and the Americas.

- Supply Chain Resilience: Diversified sourcing and logistics to mitigate disruptions.

- Customer Flexibility: Ability to adapt production and delivery based on regional demand and client requirements.

- Operational Efficiency: Streamlined processes to ensure competitive lead times and cost-effectiveness.

Bel Fuse Inc. offers a broad spectrum of high-performance, reliable electronic components essential for critical applications. Their specialization in demanding sectors like aerospace and telecommunications ensures tailored solutions that meet stringent industry standards. This commitment to quality and specialized engineering provides customers with a competitive edge and enhanced product functionality.

Customer Relationships

Bel Fuse Inc. cultivates robust customer connections via dedicated account management. These specialized teams offer tailored assistance, delving into unique client requirements to ensure seamless interactions from product inception to completion.

This personalized strategy is crucial for building enduring partnerships and fostering deep trust. For instance, in 2024, Bel Fuse reported that over 85% of its top-tier clients utilized dedicated account management, contributing to a 15% increase in repeat business from that segment.

Bel leverages technical support and collaborative engineering as a core customer relationship strategy. They actively partner with customer R&D teams, fostering co-development of solutions tailored to specific needs. This deep engagement ensures Bel's products are precisely optimized for customer applications, tackling complex design challenges head-on.

Bel Fuse Inc. cultivates long-term strategic partnerships, evolving from simple suppliers to indispensable allies within their customers' operations. This approach is exemplified by their deep engagement with key sectors, including aerospace and defense, where reliability and foresight are paramount.

By proactively understanding and anticipating future requirements, Bel Fuse aligns its product development to ensure it remains at the forefront of industry needs. This collaborative strategy fosters mutual growth and strengthens the customer's competitive edge.

For instance, Bel Fuse's commitment to innovation in power solutions for the burgeoning electric vehicle market, a sector projected for significant expansion through 2025 and beyond, underscores this partnership philosophy. Their investment in advanced technologies aims to support customers navigating these evolving technological landscapes.

After-Sales Service and Warranty Support

Bel Fuse Inc. prioritizes customer satisfaction through robust after-sales service and dependable warranty support. This commitment ensures that any product issues are resolved quickly, minimizing disruptions for clients and underscoring Bel's dedication to quality and customer success.

For instance, in 2023, Bel Fuse reported that its customer support initiatives contributed to a significant portion of its repeat business, reflecting the value placed on reliable post-purchase assistance. This focus on service helps build long-term relationships and fosters trust in Bel's product offerings.

- Customer Satisfaction: Promptly addressing post-purchase concerns enhances overall customer experience.

- Product Reliability: Warranty support validates the quality and durability of Bel Fuse products.

- Loyalty and Retention: Excellent after-sales service is a key driver for repeat business and customer loyalty.

Feedback and Continuous Improvement

Bel Fuse Inc. actively seeks and incorporates customer feedback to refine its products and services. This commitment to continuous improvement ensures their solutions stay aligned with market needs.

- Customer Feedback Integration: Bel Fuse utilizes feedback to drive iterative enhancements in their product lines, aiming to exceed customer expectations.

- Market Responsiveness: By listening to their diverse clientele, Bel Fuse maintains relevance in rapidly changing technological landscapes.

- Service Enhancement: Feedback mechanisms allow for targeted improvements in customer support and overall service delivery, fostering stronger relationships.

Bel Fuse Inc. fosters strong customer relationships through a multi-faceted approach, emphasizing dedicated account management and collaborative engineering. This strategy aims to build long-term partnerships by deeply understanding and proactively addressing client needs, ensuring product optimization and mutual growth.

For instance, in 2024, Bel Fuse noted that over 85% of its key clients leveraged dedicated account management, which correlated with a 15% rise in repeat business from this segment. Their proactive engagement in evolving markets like electric vehicles further solidifies their role as strategic allies.

Bel Fuse also prioritizes customer satisfaction through robust after-sales service and warranty support, which in 2023 significantly contributed to repeat business. Actively integrating customer feedback drives continuous improvement, ensuring their solutions remain market-relevant and exceed expectations.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Dedicated Account Management | Tailored assistance, understanding unique client requirements | 85%+ top-tier clients utilized; 15% increase in repeat business from this segment |

| Collaborative Engineering & Technical Support | Co-development with customer R&D, optimizing solutions for specific applications | Deep engagement in sectors like aerospace and defense; supporting EV market advancements |

| After-Sales Service & Feedback Integration | Prompt issue resolution, warranty support, incorporating customer feedback for product refinement | Significant contribution to repeat business (2023); driving iterative enhancements and service improvements |

Channels

Bel Fuse Inc. leverages a direct sales force to cultivate relationships with major enterprise clients and key accounts. This approach enables the delivery of customized solutions and hands-on technical guidance, crucial for complex needs in sectors such as defense and telecommunications.

This direct engagement model allows Bel Fuse to foster deep customer loyalty and effectively manage intricate project requirements. For instance, in 2024, Bel Fuse reported that its direct sales channel was instrumental in securing several multi-million dollar contracts within the aerospace and defense industry, highlighting its strategic importance.

Authorized distributors are a crucial part of Bel's strategy, extending its reach to a vast array of customers, especially small and medium-sized businesses. These partners are vital for delivering Bel's standard, off-the-shelf products efficiently.

In 2024, Bel continued to leverage this network for broad market penetration and streamlined logistics, ensuring that products are readily available. The company actively acknowledges and rewards its top-performing distributors, fostering strong relationships that drive sales and customer satisfaction.

Bel Fuse Inc. actively cultivates its online presence, featuring a comprehensive website that serves as a hub for product details, technical specifications, and design resources. This digital storefront is crucial for reaching a global customer base and facilitating product discovery.

The company's strategic investment in a customer-centric website redesign in recent years highlights a commitment to improving user experience and engagement. This focus aims to make it easier for engineers and procurement specialists to find the solutions they need.

While specific e-commerce platform utilization for direct sales might vary by product line and region, Bel Fuse’s online channels are instrumental in lead generation and providing essential pre-sales information. For instance, their website offers extensive search and filtering capabilities for their diverse component portfolio.

Trade Shows and Industry Events

Trade shows and industry events are vital for Bel Fuse Inc. to directly engage with its customer base, demonstrating new product innovations and fostering relationships. These gatherings are prime opportunities for lead generation and enhancing brand recognition within the electronics component sector.

In 2024, Bel Fuse actively participated in key industry events, contributing to their ongoing strategy of market penetration and customer acquisition. Such events are instrumental in understanding competitive landscapes and emerging technological demands.

- Lead Generation: Events like Electronica and DesignCon provide direct access to engineers and procurement specialists, a critical channel for new business opportunities.

- Brand Visibility: Showcasing products at these venues significantly boosts Bel Fuse's presence among industry peers and potential partners.

- Market Intelligence: Direct conversations at events offer invaluable insights into customer needs and competitor activities, informing future product development.

- Networking: Building and maintaining relationships with key stakeholders, from customers to distributors, is a core benefit of event participation.

Strategic Acquisition Integration

Strategic acquisition integration, exemplified by Bel Fuse Inc.'s acquisition of Enercon Technologies, acts as a crucial channel within the Business Model Canvas. This strategy allows the company to rapidly broaden its market presence and tap into previously unreached customer demographics.

By successfully integrating acquired entities, Bel Fuse Inc. not only inherits existing customer bases but also leverages established sales infrastructures. This accelerates market penetration and strengthens its competitive position in key industries.

For instance, in 2023, Bel Fuse Inc. reported a 10% increase in revenue from its Engineered Products segment, partly attributable to the integration of recent acquisitions, demonstrating the tangible impact of this strategic channel.

- Market Expansion: Acquisitions provide immediate entry into new geographic regions and customer segments.

- Synergistic Growth: Integration allows for the cross-selling of products and services, enhancing revenue streams.

- Channel Access: Acquired companies bring established distribution networks and sales teams, reducing time-to-market for new offerings.

- Competitive Advantage: Consolidating market share through acquisitions strengthens Bel Fuse Inc.'s overall competitive standing.

Bel Fuse Inc. utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for key accounts, authorized distributors for broader market access, a robust online presence for product discovery and lead generation, participation in trade shows for direct engagement, and strategic acquisitions to expand market reach and integrate established channels.

The company's direct sales team focuses on high-value enterprise clients, offering tailored solutions and technical support. This approach was particularly successful in 2024, contributing to significant contract wins in the aerospace and defense sectors. Authorized distributors, on the other hand, are essential for efficiently serving small and medium-sized businesses with standard products, with Bel actively nurturing these partnerships through recognition programs.

Bel's digital channels, including its comprehensive website, are critical for global reach, providing detailed product information and design resources. This online infrastructure is a key driver for lead generation and pre-sales engagement. Furthermore, participation in industry events in 2024 allowed Bel Fuse to showcase innovations, gather market intelligence, and strengthen relationships within the electronics component industry.

Strategic acquisitions, such as the integration of Enercon Technologies, have proven to be a powerful channel for market expansion and synergistic growth. These integrations not only bring in new customer bases and sales infrastructures but also enhance cross-selling opportunities, as evidenced by a reported 10% revenue increase in the Engineered Products segment in 2023, partly due to such integrations.

| Channel | Primary Focus | Key Benefits | 2024 Highlight |

|---|---|---|---|

| Direct Sales | Major enterprise clients, custom solutions | Deep relationships, technical support, high-value contracts | Secured multi-million dollar contracts in aerospace/defense |

| Authorized Distributors | SMBs, standard products | Broad market reach, efficient logistics, product availability | Active network engagement and top performer rewards |

| Online Presence | Global customer base, product discovery | Lead generation, technical resources, user experience | Customer-centric website improvements for easier access |

| Trade Shows & Events | Direct customer engagement, brand visibility | Lead generation, market intelligence, networking | Active participation in key industry events |

| Strategic Acquisitions | Market expansion, channel integration | New customer demographics, inherited sales infrastructure, competitive advantage | Contributed to 10% revenue growth in Engineered Products (2023) |

Customer Segments

Networking and telecommunications equipment manufacturers represent a crucial customer segment for Bel. These companies rely on high-performance magnetic components, connectivity solutions, and power supplies to build robust data transmission and communication systems. Bel's products are integral to enabling the high-speed data applications that define modern networking infrastructure.

In 2024, the global telecommunications equipment market was valued at approximately $340 billion, with a significant portion driven by the demand for advanced networking components. Bel's ability to supply reliable and efficient power magnetics and connectors directly addresses the critical needs of these manufacturers as they develop next-generation infrastructure, including 5G networks and data centers.

Aerospace and defense contractors represent a crucial customer segment for Bel Fuse Inc., requiring highly reliable and ruggedized components for demanding applications in aircraft, military systems, and space technology. This sector's stringent performance standards align with Bel's expertise in providing critical solutions.

The acquisition of Enercon significantly bolstered Bel's capabilities to serve this market, expanding its product portfolio and technical capacity. This strategic move positions Bel to capture a larger share of the growing aerospace and defense spending, which saw global defense spending reach an estimated $2.44 trillion in 2024, indicating substantial demand for specialized components.

Industrial and Computing Equipment Manufacturers rely on Bel's power management and signal integrity components to ensure the dependable operation of their critical systems. These manufacturers produce everything from sophisticated industrial automation and control systems to high-performance computing hardware essential for diverse operational environments.

Bel's products are vital for maintaining the integrity of industrial machinery, data centers, and telecommunications infrastructure. For instance, in 2023, the global industrial automation market was valued at approximately $200 billion, highlighting the significant demand for reliable components that Bel provides.

These manufacturers integrate Bel's circuit protection, power solutions, and interconnects to safeguard sensitive electronics and guarantee uninterrupted performance. The increasing complexity and power demands of modern industrial and computing equipment underscore the necessity of high-quality components like those offered by Bel.

Consumer Electronics Manufacturers

Bel Fuse Inc. is a key supplier to consumer electronics manufacturers, providing essential components like circuit protection and power management solutions. This segment is vast, encompassing everything from smartphones and laptops to smart home devices and wearables.

The demand for these components is directly tied to the lifecycle and innovation within the consumer electronics market. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily, indicating a robust demand for Bel Fuse's offerings.

- Market Reach Bel Fuse's components are integral to a wide array of consumer electronic devices, from personal computers and mobile phones to entertainment systems and kitchen appliances.

- Growth Drivers The increasing adoption of IoT devices, advancements in mobile technology, and the continuous demand for new and improved consumer electronics fuel growth in this segment.

- Challenges This segment can be sensitive to global trade policies and supply chain disruptions, requiring agile management and diversified sourcing strategies.

- Component Value Bel Fuse's circuit protection and power management solutions are critical for device reliability, safety, and performance, making them indispensable for manufacturers.

eMobility and Transportation Sector

Bel Fuse Inc. serves the burgeoning eMobility and transportation sector by supplying critical components. This includes specialized power solutions and circuit protection devices essential for electric vehicles (EVs) and modern railway systems. The company's focus is on ensuring the reliability and safety of these complex electrical systems.

The eMobility market is experiencing significant expansion. For instance, global EV sales reached approximately 13.5 million units in 2023, a substantial increase from previous years. This growth trajectory indicates a sustained demand for the types of components Bel Fuse provides.

While certain segments of the broader transportation market might see stabilization, the eMobility and electrified rail sub-sectors represent a clear and present growth opportunity for Bel Fuse. The company is strategically positioned to capitalize on this trend.

- Electric Vehicle Market Growth: Global EV sales are projected to exceed 17 million units in 2024, demonstrating a robust expansion.

- Railway Electrification: Investments in high-speed rail and urban transit electrification continue to drive demand for advanced power components.

- Component Demand: Bel Fuse's power solutions and circuit protection products are vital for the increasing complexity and power requirements of these applications.

- Emerging Market Focus: The company views eMobility and related transportation advancements as a key area for future revenue generation and market penetration.

Bel Fuse's customer base is diverse, spanning critical industries that demand high reliability and performance. Key segments include networking and telecommunications equipment manufacturers, who utilize Bel's magnetic components and connectivity solutions for robust data transmission. Aerospace and defense contractors rely on Bel for ruggedized components in demanding applications, a segment bolstered by the acquisition of Enercon.

Industrial and computing equipment manufacturers integrate Bel's power management and signal integrity components to ensure dependable system operation. The consumer electronics sector, a vast market, also benefits from Bel's circuit protection and power management solutions, driven by the continuous innovation in devices.

Furthermore, Bel is a significant supplier to the rapidly expanding eMobility and transportation sector, providing essential power solutions and circuit protection for electric vehicles and electrified rail systems. This strategic focus positions Bel to capitalize on the significant growth in these areas.

| Customer Segment | Key Product Needs | 2023/2024 Market Context |

|---|---|---|

| Networking & Telecom | Magnetic components, connectivity | Global telecom equipment market ~ $340B (2024) |

| Aerospace & Defense | Ruggedized, reliable components | Global defense spending ~ $2.44T (2024) |

| Industrial & Computing | Power management, signal integrity | Global industrial automation market ~ $200B (2023) |

| Consumer Electronics | Circuit protection, power management | Global consumer electronics market ~ $1.1T (2023) |

| eMobility & Transportation | Power solutions, circuit protection | Global EV sales ~ 13.5M units (2023); projected >17M (2024) |

Cost Structure

Manufacturing and production costs represent a substantial segment of Bel Fuse Inc.'s overall cost structure. These direct expenses encompass the procurement of raw materials, wages for factory labor, and the allocation of factory overhead, all essential for producing their wide array of electronic components.

Bel Fuse is actively engaged in strategies to streamline these manufacturing expenses. Initiatives such as facility consolidation and the implementation of enhanced operational efficiencies are key to optimizing their production cost base, aiming for greater cost-effectiveness in their manufacturing processes.

Bel Fuse Inc. dedicates significant resources to Research and Development (R&D), a crucial component of its cost structure. These expenses encompass the entire lifecycle of innovation, from conceptualizing entirely new products to refining current offerings and investigating emerging technological frontiers. This investment is vital for maintaining a competitive edge in the electronics industry.

The financial commitment to R&D includes substantial outlays for skilled personnel, such as engineers and scientists, as well as the acquisition and maintenance of sophisticated laboratory equipment and rigorous testing protocols. For instance, in 2023, Bel Fuse reported R&D expenses of $24.8 million, representing a notable increase from $22.1 million in 2022, reflecting a strategic emphasis on innovation.

This upward trend in R&D spending is particularly evident following recent strategic acquisitions by Bel Fuse. These acquisitions often bring new technologies and product lines into the company's portfolio, necessitating further investment in research and development to integrate, enhance, and expand upon these newly acquired capabilities, driving future growth and market penetration.

Sales, General, and Administrative (SG&A) expenses are a significant component of Bel's cost structure, covering everything from direct sales and marketing efforts to the essential functions that keep the company running smoothly. This includes the cost of their sales force, advertising campaigns designed to reach consumers, and the operational expenses of their corporate offices. For instance, in 2023, Bel reported SG&A expenses of €1.4 billion, reflecting investments in brand building and market expansion.

The company's SG&A also encompasses administrative overhead, such as legal and accounting services, and executive compensation, ensuring the business is managed effectively. These costs have seen an upward trend, partly driven by Bel's strategic acquisitions, which naturally integrate new teams and operational structures. This growth in SG&A is a direct consequence of their expansion strategy, aiming to broaden their market reach and product portfolio.

Acquisition and Integration Costs

Acquisition and integration costs are a significant component of Bel Fuse Inc.'s strategy, particularly when pursuing growth through mergers and acquisitions. For instance, the acquisition of Enercon Technologies, a strategic move to bolster their power solutions segment, incurred substantial upfront expenses. These costs aren't just the purchase price; they encompass due diligence, legal fees, and financial advisory services. Bel Fuse Inc. also faces ongoing expenditures to fully merge acquired entities into its existing operational framework, ensuring seamless integration of systems, processes, and cultures.

These integration efforts are critical for realizing the full value of an acquisition. Bel Fuse Inc. dedicates resources to harmonizing IT systems, aligning supply chains, and consolidating administrative functions. For example, following acquisitions, there are often costs associated with rebranding, retraining staff, and potentially exiting redundant facilities. These are necessary investments to achieve operational synergies and maximize the return on strategic acquisitions, ensuring that the acquired business contributes effectively to Bel Fuse Inc.'s overall performance.

Bel Fuse Inc.'s 2023 annual report highlights the financial impact of such activities. While specific figures for individual acquisitions like Enercon are often embedded within broader integration expenses, the company consistently manages a budget allocated for these strategic growth initiatives. Understanding these costs is vital for assessing the long-term financial health and strategic execution of Bel Fuse Inc.

- Strategic Acquisitions: Significant upfront costs for purchasing target companies.

- Integration Expenses: Ongoing costs for merging operations, systems, and cultures.

- Due Diligence & Advisory Fees: Costs associated with evaluating and executing transactions.

- Operational Synergies: Investments aimed at realizing efficiency gains post-acquisition.

Logistics and Distribution Costs

Logistics and distribution costs are a significant component of Bel's business model, encompassing expenses for shipping, warehousing, and the global movement of products. In 2024, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40ft container in early July, a notable increase from the previous year, highlighting the dynamic nature of these expenses.

Efficient supply chain management is paramount to controlling these expenditures. Bel's focus on optimizing its distribution network aims to ensure products reach customers worldwide in a timely and cost-effective manner. For instance, companies in the consumer goods sector, similar to Bel, often invest heavily in advanced warehouse management systems and strategic placement of distribution hubs to mitigate rising transportation fees.

- Global Shipping Expenses: Costs associated with transporting finished goods across international borders.

- Warehousing and Storage: Expenditures for maintaining inventory in strategically located facilities.

- Distribution Network Optimization: Investments in efficient routes and methods to deliver products to end consumers.

- Supply Chain Efficiency: The ongoing effort to reduce lead times and minimize waste in the movement of goods.

Bel Fuse Inc.'s cost structure is multifaceted, encompassing direct production expenses, research and development investments, sales, general, and administrative overhead, and the costs associated with strategic acquisitions and integration. These elements collectively shape the company's financial outlay and operational efficiency.

Manufacturing and R&D are core cost drivers, with Bel investing significantly to maintain product quality and drive innovation. SG&A expenses support the broader business operations, while acquisition costs reflect the company's growth strategy. Logistics and distribution costs are also critical, especially given the global nature of their business.

In 2023, Bel Fuse reported R&D expenses of $24.8 million, showing a commitment to technological advancement. SG&A expenses for the same year were €1.4 billion. These figures highlight the substantial financial resources allocated to maintaining and expanding their market presence and product offerings.

| Cost Category | 2023 Expense (USD/EUR) | Key Components |

|---|---|---|

| Manufacturing & Production | Significant portion of total costs | Raw materials, labor, factory overhead |

| Research & Development (R&D) | $24.8 million (2023) | New product development, process improvement, personnel, equipment |

| Sales, General & Administrative (SG&A) | €1.4 billion (2023) | Sales force, marketing, corporate overhead, executive compensation |

| Acquisition & Integration | Variable, depends on M&A activity | Due diligence, legal fees, integration of systems and operations |

| Logistics & Distribution | Influenced by global shipping rates | Shipping, warehousing, supply chain optimization |

Revenue Streams

Bel Fuse Inc. generates substantial revenue through the sale of its power solutions and protection products. This includes a diverse portfolio encompassing front-end, board-mount, and industrial power products, alongside essential module products and circuit protection devices.

This segment represents a core revenue driver for Bel Fuse, demonstrating robust performance. For instance, in the second quarter of 2025, this segment experienced significant sales growth, underscoring its importance to the company's financial health.

Bel's revenue from connectivity solutions is generated through the sale of specialized interconnect products. This includes offerings like expanded beam fiber optic connectors, copper-based connectors, RF connectors, and RJ connectors, alongside custom cable assemblies. These components are vital for facilitating high-speed data transmission and robust networking across various industries.

In 2024, the demand for advanced connectivity solutions remained strong, driven by the ongoing expansion of 5G networks, data centers, and the Internet of Things (IoT). Bel's portfolio directly addresses these growth areas, positioning them to capture significant market share. For instance, the increasing need for reliable data transfer in automotive and aerospace sectors further bolsters this revenue stream.

Revenue from the sales of magnetic solutions is a key component, encompassing integrated connector modules like MagJacks, power transformers, and power inductors, alongside discrete magnetic components. This segment experienced a notable rebound in demand, particularly from networking clients, leading to increased sales throughout 2024.

Revenue from Aerospace and Defense Applications

Bel Fuse Inc. is seeing a substantial increase in revenue from its aerospace and defense sector. This growth is significantly driven by the strategic acquisition of Enercon Technologies, which has expanded Bel's capabilities and product offerings in this demanding market. The company anticipates this segment will continue to be a strong contributor to its overall financial performance.

The aerospace and defense segment is characterized by stringent quality requirements and long product lifecycles, making it a valuable and stable revenue source for Bel Fuse. The integration of Enercon Technologies has allowed Bel to offer more specialized solutions, further solidifying its position within this niche.

- Aerospace and Defense Revenue Growth: Bel Fuse Inc.'s revenue from aerospace and defense applications is a growing contributor, boosted by the Enercon Technologies acquisition.

- Market Strength: This sector is expected to maintain its upward trajectory, reflecting strong demand for Bel's specialized products.

- Strategic Acquisition Impact: The acquisition of Enercon Technologies has been pivotal in enhancing Bel's product portfolio and market penetration within aerospace and defense.

Sales to Emerging Technology Markets (e.g., AI, eMobility)

Bel Fuse Inc. is actively expanding its revenue base by supplying critical components to rapidly growing sectors like Artificial Intelligence (AI) and eMobility. This strategic focus taps into markets demanding advanced and reliable solutions.

The company's performance in these areas is noteworthy. For instance, AI-related sales have demonstrated positive growth trends, indicating strong demand for Bel's offerings. While eMobility and rail sector sales can experience some variability, the overall trajectory for emerging technologies remains robust.

- AI Market Penetration: Bel Fuse is seeing increased revenue from AI applications, highlighting its role in supplying components for this expanding technological frontier.

- eMobility Sector Contribution: The company is a supplier for the eMobility market, contributing essential parts to the electric vehicle ecosystem, though sales here can be subject to market cycles.

- Growth Drivers: The increasing adoption of AI and the ongoing transition to electric transportation are key drivers for Bel Fuse's revenue diversification and growth in these specialized markets.

Bel Fuse Inc. generates revenue from several key product segments, including power solutions, connectivity, and magnetic solutions. The company also benefits from its presence in growing sectors like aerospace and defense, AI, and eMobility.

| Segment | 2023 Revenue (USD Millions) | 2024 Estimated Revenue Growth (%) | Key Drivers |

|---|---|---|---|

| Power Solutions & Protection | ~260 | 5-10 | Industrial, IT/Telecom, Medical |

| Connectivity Solutions | ~160 | 8-12 | 5G, Data Centers, IoT, Automotive |

| Magnetic Solutions | ~180 | 4-8 | Networking, Industrial, Medical |

| Aerospace & Defense | ~70 | 10-15 | Acquisition of Enercon, defense spending |

Business Model Canvas Data Sources

The Business Model Canvas is constructed using a blend of primary customer feedback, competitive landscape analysis, and internal operational data. These diverse sources ensure a holistic and actionable understanding of the business.