Bath & Body Works PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works Bundle

Bath & Body Works operates within a dynamic environment shaped by political stability, economic fluctuations, evolving social trends, technological advancements, environmental consciousness, and a complex legal framework. Understanding these external forces is crucial for navigating the competitive retail landscape.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Bath & Body Works. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Bath & Body Works' fiscal 2025 outlook directly addresses the financial implications of current trade tariffs on imports from China and other nations. These tariffs are a significant consideration, potentially raising the cost of goods sold and impacting overall profitability.

To counter these effects, the company is strategically leaning on its largely U.S.-based supply chain. This approach is designed to minimize the financial strain and operational disruptions that could arise from international trade policies.

Navigating this dynamic trade landscape is paramount for Bath & Body Works. Success in managing these external political factors will be key to sustaining competitive pricing strategies and ensuring healthy profit margins in the coming fiscal year.

Bath & Body Works navigates a complex web of government regulations focused on product safety and clear labeling. Agencies like the U.S. Food and Drug Administration (FDA), Health Canada, and the EU's Scientific Committee on Consumer Safety set stringent guidelines that the company must follow. For instance, in 2023, the FDA continued its focus on cosmetic ingredient safety, prompting companies to review their formulations. Staying compliant with these ever-changing rules is crucial to prevent costly legal battles and maintain customer confidence in their products.

The company's commitment to safety is evident in its rigorous, multi-stage process. This involves thorough ingredient vetting, extensive product testing, and ongoing monitoring of regulatory updates. For example, in 2024, the company likely invested significant resources in ensuring its product formulations met updated allergen disclosure requirements in key markets like the European Union. This proactive approach helps mitigate risks and reinforces Bath & Body Works' reputation for quality and safety.

Changes in labor laws and employment policies, particularly in North America, directly influence Bath & Body Works' operational expenses and staffing strategies. For instance, shifts in minimum wage regulations can lead to increased labor costs. In 2024, many US states and cities saw minimum wage hikes, with some reaching $15 or more per hour, impacting retail businesses like Bath & Body Works.

The company also navigates a competitive labor market, which can further drive up wages and benefits to attract and retain employees. This competitive pressure, coupled with potential unionization efforts, could elevate overall expenses and potentially affect operational efficiency across its widespread retail footprint and supply chain operations.

Geopolitical Instability and International Expansion Risks

Bath & Body Works' international expansion strategy, targeting at least 30 net new store openings globally in 2025, is directly impacted by geopolitical instability. Navigating diverse political landscapes in new markets presents significant compliance risks, requiring careful attention to local laws and regulations.

Cultural differences also pose a challenge; understanding and adapting to varying consumer preferences is crucial for successful market penetration. While international sales currently form a smaller segment of Bath & Body Works' overall revenue, the company views these markets as key drivers for incremental growth.

- Geopolitical Risk: Increased global tensions can disrupt supply chains and affect consumer spending in international markets.

- Regulatory Compliance: Adhering to varying legal frameworks in each new country is essential for operational continuity.

- Cultural Adaptation: Tailoring product offerings and marketing strategies to local cultural nuances is vital for brand acceptance.

- Expansion Targets: The company's goal of 30+ net new international store openings in 2025 underscores the importance of mitigating these political factors.

ESG Regulatory Scrutiny and Reporting Requirements

Increased scrutiny on Environmental, Social, and Governance (ESG) practices presents both challenges and opportunities for Bath & Body Works. Evolving regulatory landscapes, particularly concerning climate disclosures and supply chain ethics, could necessitate additional compliance costs and impact operational strategies. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, mandates extensive ESG data disclosure, setting a precedent that may influence global reporting standards.

Bath & Body Works has proactively addressed ESG, aiming to set science-based greenhouse gas emissions reduction goals by 2025. This commitment reflects an understanding that robust ESG performance is crucial for maintaining investor confidence and attracting environmentally conscious consumers. Companies failing to meet these expectations risk reputational damage and potential divestment from ESG-focused funds, which are increasingly influential in capital markets.

- ESG Scrutiny: Growing regulatory focus on ESG can lead to increased compliance burdens and reporting costs for companies like Bath & Body Works.

- Reputational Impact: Failure to meet ESG standards can negatively affect brand image and consumer trust.

- 2025 Emissions Goals: Bath & Body Works' commitment to setting science-based greenhouse gas reduction targets by 2025 highlights its proactive stance on sustainability.

- Investor Confidence: Transparent and effective ESG reporting is becoming a key factor for investors evaluating long-term company value and risk.

Government trade policies, including tariffs on goods from China, directly impact Bath & Body Works' cost of goods sold and profitability, as highlighted by their fiscal 2025 outlook. The company's strategy to leverage a largely U.S.-based supply chain aims to mitigate these financial risks and operational disruptions. Success in navigating these political trade dynamics is crucial for maintaining competitive pricing and healthy profit margins.

What is included in the product

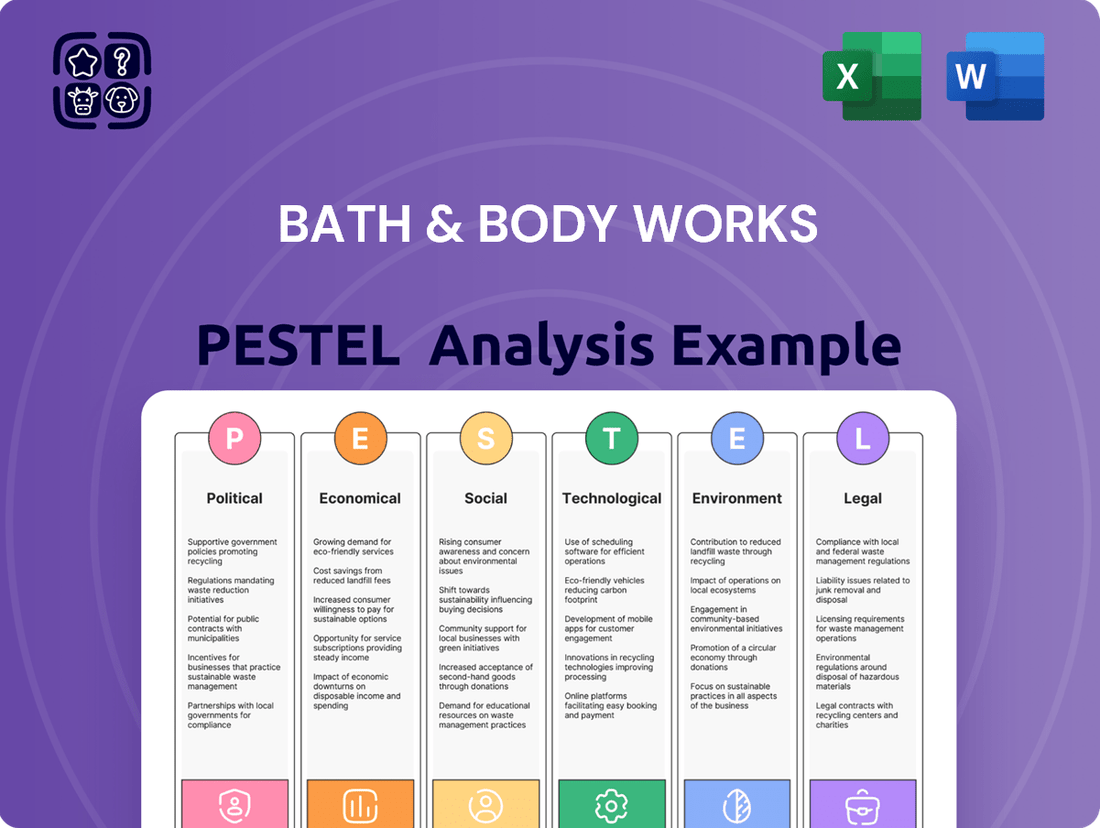

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bath & Body Works, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats stemming from these dynamic forces.

Bath & Body Works' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

High inflation rates, particularly evident in 2023 and continuing into 2024, have significantly squeezed consumer spending power. This has led to a noticeable decline in demand for discretionary items, directly impacting companies like Bath & Body Works whose product lines fall into this category. For instance, the Consumer Price Index (CPI) saw substantial increases throughout 2023, with core inflation remaining elevated, forcing consumers to prioritize essential goods over non-essential purchases.

Bath & Body Works' sales are inherently sensitive to economic uncertainties and shifts in consumer sentiment. During periods of economic slowdown or high inflation, consumers often reduce spending on items perceived as luxuries, such as candles, lotions, and fragrances. This trend was observed in late 2023 and early 2024, where retail sales data indicated a slowdown in non-essential categories as households managed tighter budgets.

Despite these headwinds, Bath & Body Works has strategically positioned itself to offer what it terms 'affordable luxuries.' The company aims to maintain consumer interest by providing products that offer a sense of indulgence at price points that remain accessible even during challenging economic times. This strategy is crucial for retaining customer loyalty and driving sales volume when consumers are more cautious with their discretionary spending.

Bath & Body Works operates in a highly competitive retail landscape, facing rivals ranging from large department stores to direct-to-consumer brands, all vying for consumer attention in the beauty and personal care sector. This intense competition often forces the company to engage in frequent promotional activities and invest heavily in product innovation, which can put a strain on its gross profit margins. For instance, in fiscal year 2023, while net sales reached $7.56 billion, the company’s gross margin was 43.4%, a figure that can be squeezed by aggressive pricing strategies from competitors.

Despite the competitive pressures, Bath & Body Works benefits from strong brand recognition and a solid position within the generally resilient bath and body product categories. However, maintaining profitability requires diligent cost management alongside its strategic focus on enhancing marketing efforts and leveraging technology to boost sales and customer engagement.

Global supply chain issues, including rising raw material costs and shipping delays, continue to present challenges for Bath & Body Works. These disruptions can impact profitability and the availability of popular products for consumers.

Bath & Body Works benefits from a largely U.S.-based supply chain, with around 80% of its operations located domestically and over half concentrated in Ohio. This geographical advantage offers greater agility in navigating supply chain disruptions compared to companies with more globalized operations.

Despite its U.S.-centric model, Bath & Body Works has still experienced increased logistics costs. The company actively manages these risks through strategic planning and operational adjustments to mitigate the impact on its financial performance.

E-commerce Growth and Digital Investment

The ongoing surge in e-commerce is a key economic driver, with digital channels accounting for a substantial 20% of Bath & Body Works' total sales in 2024. This highlights the critical importance of online presence in today's retail landscape.

Bath & Body Works is actively strengthening its omnichannel approach, aiming to seamlessly integrate its online and physical store experiences to capture evolving consumer shopping habits. This strategy involves significant investment in technology to foster deeper customer personalization and smoother interactions.

While the rapid growth of digital sales may see some normalization, sustained investment in e-commerce capabilities remains essential for Bath & Body Works to maintain and expand its market share in the competitive retail environment.

- Digital Sales Contribution: E-commerce represented 20% of Bath & Body Works' sales in 2024.

- Omnichannel Strategy: The company is investing in technology to enhance its integrated online and in-store experience.

- Future Outlook: Continued digital investment is vital for market share, even as growth rates may moderate.

International Market Growth Potential

International expansion offers Bath & Body Works a substantial economic runway. The company anticipates its international sales to rebound and grow, with projections indicating a 7% increase annually over the next ten years, largely fueled by its global franchise agreements.

Currently, international markets account for approximately 5% of Bath & Body Works' total revenue. However, the company views this segment as a critical driver for future, incremental growth that could define a new phase of its business development.

- International sales projected to grow at 7% annually over the next decade.

- International operations currently represent 5% of the business.

- Expansion aims to reach new customer demographics and boost sales.

- Global franchise partnerships are central to this growth strategy.

Elevated inflation, particularly through 2023 and into 2024, has eroded consumer purchasing power, leading to reduced spending on non-essential items like those offered by Bath & Body Works. This economic climate necessitates a strategic focus on value, with the company aiming to position its products as accessible indulgences to maintain customer engagement.

The company's reliance on discretionary spending makes it vulnerable to economic downturns and consumer sentiment shifts, as seen in late 2023 and early 2024 retail trends. However, Bath & Body Works' strategy of offering affordable luxuries is designed to mitigate these impacts by appealing to consumers seeking small treats amidst budget constraints.

While international markets currently represent a smaller portion of revenue, at 5%, they are projected for significant growth, with an anticipated 7% annual increase over the next decade, driven by franchise agreements. This expansion is a key element in Bath & Body Works' long-term economic strategy to diversify and capture new customer bases globally.

Preview the Actual Deliverable

Bath & Body Works PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bath & Body Works PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. You'll gain a clear understanding of the external forces shaping the brand's future.

Sociological factors

Consumers are increasingly prioritizing self-care, transforming bath and body routines into moments of indulgence and stress relief. This trend saw a significant boost in 2024, with personal care spending projected to grow. Bath & Body Works is well-positioned to capitalize on this, offering accessible luxury items that cater to this desire for pampering.

This evolving consumer mindset directly fuels demand for premium and specialized personal care products. Bath & Body Works' strategy of offering 'affordable luxuries' resonates strongly, as consumers are willing to spend on items that enhance their well-being. The company's commitment to product innovation, including a wide array of fragrances and seasonal collections, directly taps into this growing market for self-indulgent purchases.

Social media platforms, especially TikTok, are powerful drivers of consumer trends, with viral challenges like #FakeTan and #BlackGirlTanning directly impacting the body care market, signaling emerging product opportunities for Bath & Body Works.

Bath & Body Works actively utilizes social media, including its presence on TikTok Shop, to introduce new product lines and connect with younger consumers, such as Gen Z, who are increasingly influential in shaping market demand.

This digital engagement is vital for Bath & Body Works to maintain cultural relevance and stimulate sales, as evidenced by the platform's growing role in product discovery and purchasing decisions for a significant portion of the target demographic.

Consumers increasingly favor products made with sustainable ingredients and sourced ethically. This trend reflects a broader societal shift towards environmental and social responsibility, influencing purchasing decisions across various demographics.

Bath & Body Works is responding by reformulating products with more sustainable components and enhancing its supplier relationships to ensure ethical sourcing practices. For instance, in 2024, the company continued its efforts to integrate more plant-based ingredients and reduce plastic packaging, aiming for a more eco-conscious product line.

Transparency is key to meeting this demand, so Bath & Body Works is committed to providing customers with clearer information about product ingredients and their origins. This focus on openness builds trust and allows consumers to make choices that align with their values, a critical factor in the evolving retail landscape.

Nostalgia and Seasonal Scent Appeal

Nostalgia is a powerful driver for Bath & Body Works, with many consumers seeking out scents that trigger fond memories, leading to repeat purchases. This sentimentality is a key factor in their success.

Bath & Body Works effectively leverages this by consistently releasing seasonal collections and bringing back beloved, classic scents. For instance, their fall collection, often featuring pumpkin spice and apple scents, consistently performs well, tapping into autumnal nostalgia. In 2023, the company reported strong performance in its fall seasonal offerings, contributing to overall revenue growth.

The company's strategy also includes refreshing its core product lines and engaging in collaborations that resonate culturally. Their partnership with Disney, for example, has proven successful, blending popular characters with signature fragrances to attract a broad customer base. This approach helps maintain brand relevance and appeal across different demographics.

- Nostalgia-driven purchases: Consumers frequently buy products that evoke sentimental memories, encouraging loyalty.

- Seasonal appeal: Bath & Body Works' seasonal collections, like their highly anticipated fall scents, capitalize on consumer desire for timely and evocative fragrances.

- Brand collaborations: Partnerships, such as those with Disney, enhance product appeal and reach new customer segments, boosting sales figures.

Loyalty Programs and Customer Engagement

Bath & Body Works leverages its loyalty program as a cornerstone for customer engagement and sales. As of Q4 2024, the program boasted approximately 39 million active members, a significant figure that underscored its importance, with these members contributing around 80% of the company's total sales. This deep integration of loyalty members highlights a strong sociological connection, where customers feel valued and incentivized to continue their patronage.

The company's commitment to nurturing this engagement is evident in its strategic plans for 2025. Further enhancements to the loyalty program are anticipated, aiming to boost customer excitement and optimize reward redemption. Such initiatives are crucial for maintaining brand connectivity and encouraging consistent repeat purchases, reinforcing the sociological bond between the brand and its consumer base.

- Loyalty Program Strength: Approximately 39 million active members in Q4 2024.

- Sales Contribution: Loyalty members account for roughly 80% of total sales.

- Future Enhancements: Plans to further develop the program in 2025 for increased customer engagement.

- Brand Connectivity: The program fosters strong customer relationships and repeat business.

The increasing focus on self-care and wellness significantly boosts demand for Bath & Body Works' indulgent products. This trend is amplified by social media, where platforms like TikTok drive viral product discovery and consumer engagement, particularly with younger demographics like Gen Z.

Consumers are also prioritizing sustainability and ethical sourcing, prompting Bath & Body Works to reformulate products with plant-based ingredients and reduce plastic packaging, as seen in their 2024 initiatives. Nostalgia remains a powerful sales driver, with seasonal collections and beloved classic scents consistently performing well, as evidenced by strong Q3 2023 results.

Bath & Body Works' robust loyalty program, with approximately 39 million active members in Q4 2024 contributing around 80% of total sales, highlights a strong sociological connection and commitment to customer retention, with further program enhancements planned for 2025.

Technological factors

Bath & Body Works is significantly investing in its e-commerce capabilities and a robust omnichannel approach. This strategy aims to seamlessly blend online and physical retail, offering customers greater flexibility and convenience.

A key element is the expansion of buy online, pick up in-store (BOPIS) services. In the third quarter of 2024, this option saw a notable 40% increase in customer utilization year-over-year, highlighting its growing importance in the retail landscape.

Technological enhancements are central to this evolution, focusing on delivering personalized customer experiences. These investments are designed to foster deeper customer engagement and support sustained long-term growth for the company.

Bath & Body Works is significantly boosting its marketing efforts, dedicating 3.5% of its sales to these initiatives. A key focus is on enhancing social media engagement to connect with its customer base more effectively.

The company's technology strategy includes upgrading core systems and tools to support advanced personalization. This technological push is designed to enable more targeted marketing campaigns.

By personalizing customer experiences, Bath & Body Works aims to attract new consumers and drive sales conversions. This data-driven approach allows for more relevant messaging and offers, ultimately stimulating revenue growth.

Bath & Body Works relies on its agile, U.S.-centric, vertically integrated supply chain to quickly respond to customer needs. This setup, powered by ongoing technological investments, aims to boost efficiency and mitigate disruptions.

The company is actively investing in supply chain enhancements, with projects initiated in 2024 expected to carry into 2025. These initiatives are designed to further sharpen operational performance and cost control.

Product Innovation and Development Technologies

Technological advancements are crucial for Bath & Body Works' product innovation, enabling swift creation and release of new fragrances and product types. This fuels their expansion into areas like men's grooming, laundry essentials, lip care, and haircare, alongside prestige-level collections. Their agility in leveraging technology for rapid product development is a significant edge in the competitive market.

Key technological drivers include:

- Advanced R&D Platforms: Utilizing sophisticated research and development tools to accelerate scent formulation and product testing, aiming to shorten the typical 12-18 month product cycle.

- Data Analytics for Trend Spotting: Employing AI and machine learning to analyze consumer behavior and social media trends, informing the direction of new product launches. For instance, in 2024, the company has focused on data-driven insights to identify emerging scent preferences.

- Digital Prototyping and Virtual Testing: Implementing technologies that allow for virtual creation and testing of product packaging and formulations, reducing physical sample waste and speeding up the design process.

Data Analytics for Consumer Insights

Bath & Body Works heavily relies on data analytics to glean crucial consumer insights, allowing them to deeply understand purchasing behaviors and pinpoint emerging market trends. By dissecting information from their loyalty programs, the company gains a clear picture of customer retention rates, typical spending habits, and preferences for cross-channel purchases. This granular, data-driven approach directly informs their product development pipeline, refines their marketing strategies, and shapes overarching business decisions.

For instance, in fiscal year 2023, Bath & Body Works reported that its loyalty program members accounted for a significant portion of its sales, demonstrating the effectiveness of their data collection and engagement strategies. This data allows them to personalize offers and product recommendations, boosting customer lifetime value. The company’s investment in advanced analytics tools is expected to continue growing, enabling more sophisticated segmentation and predictive modeling to anticipate future consumer demands.

- Loyalty Program Impact: Data from loyalty programs provides direct insights into customer lifetime value and repeat purchase behavior.

- Personalization: Analytics enable personalized marketing campaigns and product recommendations, enhancing customer engagement.

- Trend Identification: Analyzing purchasing patterns helps Bath & Body Works identify and capitalize on emerging consumer trends in the beauty and personal care sector.

- Informed Decision-Making: Data analytics underpins strategic decisions across product development, inventory management, and marketing spend.

Technological advancements are critical for Bath & Body Works' agile product development, enabling faster creation and launch of new scents and product categories, including men's grooming and haircare. The company is leveraging advanced R&D platforms to shorten product cycles, aiming to move beyond the typical 12-18 month timeframe.

Sophisticated data analytics, including AI and machine learning, are employed to identify consumer trends and inform new product strategies, with a focus in 2024 on emerging scent preferences. Digital prototyping and virtual testing are also being implemented to streamline the design process and reduce waste.

These technological investments are primarily directed towards enhancing e-commerce capabilities and creating a seamless omnichannel experience, with a notable 40% increase in buy online, pick up in-store (BOPIS) utilization observed in Q3 2024. This focus on personalization aims to deepen customer engagement and drive sustained growth.

Legal factors

Bath & Body Works navigates a complex web of product safety regulations, adhering to standards set by bodies like the U.S. Food and Drug Administration (FDA), Health Canada, and the European Union's Scientific Committee on Consumer Safety (SCCS). This necessitates rigorous ingredient and formula evaluation to ensure all products meet or surpass mandated safety benchmarks.

The company's commitment to safety is underscored by its scientific, multi-tiered approach to product development. This systematic evaluation process is crucial for maintaining consumer trust and avoiding costly recalls or regulatory penalties, especially as scientific understanding and regulatory landscapes evolve rapidly.

Bath & Body Works relies heavily on intellectual property to shield its unique fragrance formulations, product designs, and brand identity from competitors. This protection is vital for maintaining its market position and preventing the unauthorized replication of its popular scent profiles and product innovations.

In 2023, the company continued to invest in securing and enforcing its intellectual property rights, a strategy that underpins its ability to differentiate its offerings. While specific expenditure figures for IP protection aren't publicly detailed, the company's consistent product launches and brand strength suggest ongoing commitment in this area.

Bath & Body Works navigates a complex legal environment concerning data privacy and cybersecurity, a critical aspect for a company with a substantial online footprint and a popular loyalty program. The increasing stringency of regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) necessitates robust compliance measures to protect customer information.

The company faces inherent risks of cyberattacks and data breaches, which could severely disrupt operations and tarnish its brand reputation. For instance, in 2023, retail data breaches exposed millions of customer records globally, highlighting the persistent threat landscape. Adherence to these evolving data protection laws is not merely a legal obligation but a fundamental requirement for maintaining customer trust and operational continuity.

Labor and Employment Laws

Bath & Body Works must diligently adhere to labor and employment laws, covering aspects like minimum wage, overtime, workplace safety standards, and robust anti-discrimination policies. Failure to comply can lead to significant penalties and reputational damage. The company actively promotes a culture of inclusivity, stating a zero-tolerance policy for any form of harassment or discrimination.

The potential for unionization among its workforce presents a notable legal and operational consideration. Unionization could impact labor costs, negotiation dynamics, and the company's flexibility in managing its workforce. For instance, in 2023, the retail sector continued to see increased union activity across various companies, impacting wage agreements and benefits.

- Wage and Hour Compliance: Ensuring adherence to federal and state minimum wage laws and overtime regulations is critical.

- Workplace Safety: Maintaining a safe working environment as mandated by OSHA (Occupational Safety and Health Administration) is paramount.

- Anti-Discrimination: Upholding equal employment opportunity laws, prohibiting discrimination based on protected characteristics.

- Union Relations: Navigating potential collective bargaining agreements and labor disputes if unionization efforts gain traction.

International Trade and Customs Regulations

Bath & Body Works' global expansion necessitates careful navigation of international trade and customs regulations. These rules, which include tariffs and import/export restrictions, directly impact the cost and availability of goods. For instance, the company's financial outlook for 2025 acknowledges the ongoing effects of tariffs imposed on products sourced from China, a key manufacturing hub.

Understanding and adhering to these varied international legal frameworks is crucial for maintaining efficient global operations and ensuring profitability. Non-compliance can lead to significant delays, fines, and reputational damage. Key areas of focus for Bath & Body Works include:

- Tariff Rates: Monitoring and managing the impact of varying tariff rates on imported finished goods and raw materials.

- Import/Export Controls: Ensuring compliance with specific country requirements for importing finished products and exporting them to other markets.

- Trade Agreements: Leveraging favorable trade agreements to reduce costs and streamline supply chains.

- Customs Documentation: Meticulously managing all necessary customs declarations and paperwork to avoid penalties.

Bath & Body Works' legal landscape is shaped by stringent product safety regulations, intellectual property protection, and evolving data privacy laws. Compliance with bodies like the FDA and adherence to regulations such as GDPR and CCPA are paramount for maintaining consumer trust and avoiding penalties. The company's 2023 financial reports indicate continued investment in safeguarding its unique fragrance formulations and brand identity, recognizing the critical role of IP in market differentiation.

Environmental factors

Bath & Body Works is making strides in packaging sustainability, targeting 50% of its packaging to be recyclable, reusable, or compostable by 2025. This commitment is evident in initiatives like introducing hand soap refill cartons and transitioning Wallflower refills from plastic trays to paperboard.

The company is also focused on increasing the use of post-consumer recycled (PCR) content in its plastic packaging. For instance, in 2023, they reported that 30% of their plastic packaging contained PCR content, a figure they aim to grow significantly in the coming years.

Bath & Body Works is actively working to reduce its environmental impact. The company has committed to submitting greenhouse gas (GHG) emissions reduction goals to the Science Based Targets initiative (SBTi) by 2025. This initiative requires a thorough understanding of their carbon footprint, including the complex Scope 3 emissions, which encompass indirect emissions from their value chain.

To meet these targets, Bath & Body Works is focused on measuring and establishing baseline carbon footprints across its operations. This includes understanding emissions from raw material sourcing, manufacturing, transportation, and product end-of-life. Their ongoing efforts aim to integrate environmental stewardship into their business practices.

Bath & Body Works is actively enhancing its supplier relationships to guarantee more sustainable ingredient sourcing and responsible practices. This commitment involves collaboration with multi-stakeholder groups and suppliers to mitigate social and environmental risks throughout its supply chain.

The company is prioritizing transparency regarding the ingredients incorporated into its product lines. For instance, in fiscal year 2023, Bath & Body Works reported progress in its responsible sourcing initiatives, with a focus on key raw materials.

Water Protection and Conservation Initiatives

Bath & Body Works is actively engaged in water protection and conservation, evidenced by a significant $1.2 million partnership with The Nature Conservancy for a water protection project in Central Ohio. This initiative underscores a commitment to local environmental impact and the preservation of natural resources crucial for their product ingredients.

The company's strategic focus on protecting these resources aligns with broader environmental concerns and consumer expectations for sustainable practices. Protecting the water sources that yield essential components for their fragrances is a stated priority, demonstrating a forward-thinking approach to supply chain resilience.

- Partnership: $1.2 million investment with The Nature Conservancy in Central Ohio.

- Focus: Local community impact and conservation of water resources.

- Strategic Importance: Protecting natural ingredients vital for fragrance production.

Product Lifecyle Management and Donations

Bath & Body Works actively manages its product lifecycle by partnering with organizations like Good360 to donate surplus or out-of-stock items. This strategy significantly reduces waste by diverting products that might otherwise end up in landfills, thereby lessening environmental impact. For instance, in 2023, Good360 facilitated the distribution of over $1.5 billion in product donations to communities in need, a figure that highlights the scale of such initiatives.

This commitment to product lifecycle management through donations not only addresses environmental concerns but also fosters positive social impact. The donated goods directly support essential services provided by shelters, food banks, and disaster relief organizations, ensuring that usable products reach those who can benefit most. This approach aligns with circular economy principles by extending the useful life of products.

Key aspects of Bath & Body Works' environmental strategy in product lifecycle management include:

- Donation Partnerships: Collaborations with non-profits like Good360 to redistribute excess inventory.

- Waste Reduction: Diverting products from landfills to minimize environmental footprint.

- Social Impact: Providing essential goods to vulnerable populations and disaster-affected areas.

- Circular Economy Contribution: Extending product lifecycles and promoting resourcefulness.

Bath & Body Works is actively working to reduce its environmental footprint through packaging innovation and responsible sourcing. By 2025, they aim for 50% of their packaging to be recyclable, reusable, or compostable, with initiatives like refill cartons and paperboard transitions already in place. The company is also increasing its use of post-consumer recycled (PCR) content, reporting 30% PCR content in plastic packaging in 2023, with plans for further growth.

Furthermore, Bath & Body Works is committed to setting science-based greenhouse gas (GHG) emissions reduction targets by 2025, focusing on measuring and understanding their carbon footprint across the entire value chain. This includes a significant $1.2 million partnership with The Nature Conservancy for water protection in Central Ohio, highlighting their dedication to preserving natural resources essential for their products.

| Environmental Initiative | Target/Status | Key Action/Data |

| Packaging Sustainability | 50% recyclable, reusable, or compostable by 2025 | Hand soap refill cartons, paperboard for Wallflower refills |

| PCR Content in Plastic Packaging | Increasing | 30% PCR content reported in 2023 |

| Greenhouse Gas (GHG) Emissions | Submit reduction goals to SBTi by 2025 | Measuring baseline carbon footprints across operations |

| Water Protection | Partnership with The Nature Conservancy | $1.2 million investment in Central Ohio water project |

| Product Lifecycle Management | Waste Reduction through Donations | Partnership with Good360; over $1.5 billion in product donations facilitated by Good360 in 2023 |

PESTLE Analysis Data Sources

Our Bath & Body Works PESTLE analysis is built on a robust foundation of data from reputable market research firms, government economic reports, and industry-specific publications. We incorporate insights from consumer trend analyses and regulatory updates to ensure a comprehensive understanding of the external environment.