Bath & Body Works Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works Bundle

Bath & Body Works navigates a competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes in the personal care market. While brand loyalty offers some buffer, the ease with which consumers can switch to similar products keeps pricing and product innovation critical.

The full analysis reveals the strength and intensity of each market force affecting Bath & Body Works, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Bath & Body Works benefits from a largely U.S.-based, vertically integrated supply chain, notably through its Beauty Park facility in Ohio. This consolidation, involving contract fillers and packaging producers, underpins essential value chain operations.

This concentrated supplier group, while enabling agility and cost efficiencies, presents a potential risk. If a significant portion of key ingredients or packaging relies on a limited number of specialized suppliers, their bargaining power could increase, especially if readily available alternatives are scarce.

Bath & Body Works' significant investment in its 'Beauty Park' campus, a hub of over a decade of vertical integration, directly combats supplier power. This internal manufacturing capability allows for production cycles as swift as four weeks for certain Stock Keeping Units (SKUs), enabling rapid adaptation to evolving consumer preferences.

This agility in production, coupled with the internalization of a substantial portion of finished goods and component manufacturing, significantly reduces Bath & Body Works' reliance on external suppliers. By controlling more of its value chain, the company effectively mitigates the bargaining power that suppliers might otherwise wield.

Developing new supplier relationships for specialized ingredients or manufacturing processes incurs substantial switching costs for Bath & Body Works. These costs encompass rigorous quality control measures, necessary formulation adjustments, and significant logistical reconfigurations to ensure product consistency and brand integrity.

Bath & Body Works is actively working to mitigate these supplier switching costs. For instance, their strategic initiative to shift production of items like lip tubes and hand soap pumps back to North America aims to decrease reliance on specific international suppliers and the associated expenses and complexities of switching.

Uniqueness of Inputs

Bath & Body Works' reliance on unique fragrance components and proprietary formulations can amplify supplier bargaining power. While many personal care ingredients are standard, the company's emphasis on expertly crafted scents means certain fragrance oils or complex chemical compounds might be sourced from a limited number of specialized suppliers. This uniqueness, especially if tied to patents or exclusive development, gives those suppliers more leverage in price negotiations.

The company's commitment to innovation and frequent new product launches necessitates a steady supply of novel ingredients. If these innovative inputs are developed and controlled by only a few external partners, their ability to influence terms with Bath & Body Works increases. For instance, a supplier holding exclusive rights to a popular new scent molecule could command higher prices.

- Proprietary Formulations: Bath & Body Works' signature scents often involve complex blends, potentially requiring specialized fragrance houses or chemical suppliers.

- Limited Supplier Pool: The uniqueness of certain fragrance ingredients can restrict the number of viable suppliers, concentrating power.

- Innovation Dependence: The company's strategy of introducing new collections means it may depend on suppliers capable of providing novel or exclusive raw materials.

- R&D Collaboration: Partnerships for developing new scents could create dependencies on specific suppliers for unique inputs.

Supplier Contribution to Quality and Differentiation

Suppliers play a vital role in shaping the quality and unique appeal of Bath & Body Works' offerings. This is especially true for the intricate art of fragrance creation and the presentation through packaging. The brand’s promise of delivering desirable, trend-setting luxuries at accessible price points hinges significantly on the caliber and dependability of its supplier network.

Maintaining Bath & Body Works' esteemed brand image and fostering enduring customer loyalty are directly influenced by the company's reliance on high-quality, consistent suppliers. These partners are instrumental in ensuring that the products consistently meet customer expectations for premium feel and performance.

- Fragrance Expertise: Key suppliers provide specialized knowledge and high-grade ingredients essential for developing the unique and popular scents that define Bath & Body Works.

- Packaging Innovation: Suppliers contribute innovative and aesthetically pleasing packaging solutions that enhance product appeal and brand perception.

- Supply Chain Efficiency: Strong supplier relationships enable a streamlined supply chain, crucial for Bath & Body Works' strategy of offering affordable luxury.

- Quality Assurance: Reliable suppliers ensure the consistent quality of raw materials and finished components, directly impacting the final product's perceived value and customer satisfaction.

Bath & Body Works faces moderate bargaining power from its suppliers, particularly those providing unique fragrance components and proprietary formulations. The company's reliance on specialized ingredients for its signature scents means a limited number of fragrance houses or chemical suppliers may hold significant leverage, especially if these inputs are patented or exclusively developed. For example, in 2024, the personal care industry continued to see consolidation among key ingredient suppliers, which can increase their pricing power.

While Bath & Body Works' vertical integration, including its Beauty Park facility, helps mitigate supplier power by controlling a significant portion of its value chain, dependencies remain. The company's strategy of frequent new product launches, driven by innovation, requires a steady supply of novel ingredients. If these innovative inputs are controlled by a few external partners, their ability to influence terms with Bath & Body Works increases, potentially impacting cost of goods sold.

The switching costs for Bath & Body Works to find new suppliers for specialized ingredients or manufacturing processes are substantial. These costs include rigorous quality control, formulation adjustments, and logistical reconfigurations to maintain product consistency and brand integrity. For instance, shifting production of key components like fragrance oils can take considerable time and investment to ensure the final product meets the brand's high standards.

The company's efforts to bring production back to North America, such as for lip tubes and hand soap pumps, directly aim to reduce reliance on specific international suppliers and the associated complexities and costs of switching. This strategic move in 2024 reflects a broader trend of companies seeking to re-shore or near-shore production to gain more control over their supply chains and reduce vulnerability to external supplier pressures.

| Supplier Characteristic | Impact on Bath & Body Works | Mitigation Strategy |

|---|---|---|

| Proprietary Fragrance Components | Increased supplier bargaining power due to uniqueness and limited alternatives. | Diversification of fragrance suppliers where possible; internal fragrance development capabilities. |

| Specialized Packaging Solutions | Potential for higher costs if suppliers offer unique or patented packaging designs. | Standardization of packaging where feasible; long-term contracts with key packaging partners. |

| Raw Material Quality and Consistency | Crucial for brand image; reliance on suppliers to maintain high standards. | Rigorous supplier vetting and quality control; building strong relationships with trusted suppliers. |

| Innovation in Ingredients/Formulations | Dependency on suppliers for novel inputs for new product launches. | Collaborative R&D with key suppliers; exploring multiple innovation partners. |

What is included in the product

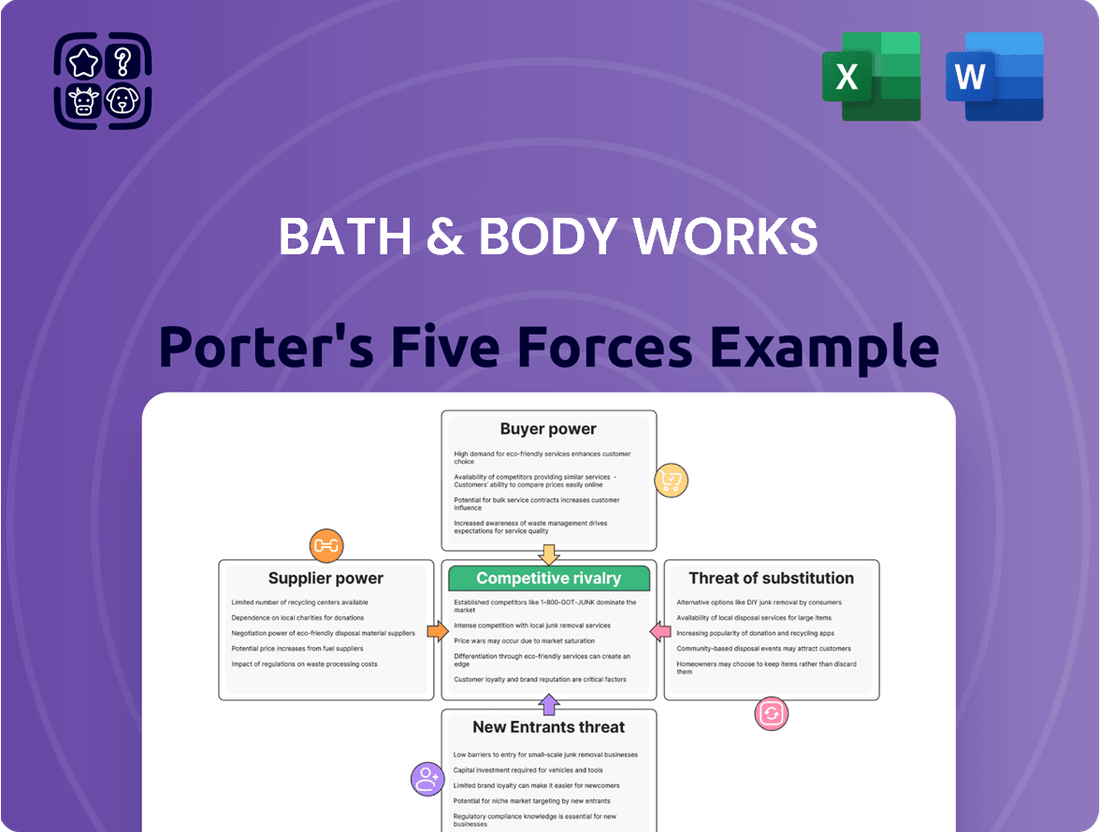

This Porter's Five Forces analysis for Bath & Body Works dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the company's profitability and strategic positioning.

Instantly identify and mitigate competitive threats with a comprehensive Porter's Five Forces analysis, tailored for Bath & Body Works.

Customers Bargaining Power

Bath & Body Works enjoys a dedicated following, with a significant portion of its customers exhibiting high engagement and frequent purchases. This loyalty is cultivated through robust loyalty programs, timely seasonal offerings, and savvy social media and influencer collaborations that foster a deep connection with the brand. For example, in fiscal year 2023, the company reported strong performance driven by these customer relationships, indicating reduced price sensitivity among its core audience.

While Bath & Body Works cultivates brand loyalty, customers in the beauty and personal care sector are increasingly budget-conscious, seeking the best value for their money. This heightened price sensitivity, particularly in light of economic uncertainties and inflation, grants consumers greater leverage to hunt for discounts or opt for less expensive alternatives.

Bath & Body Works addresses this by positioning itself as a provider of 'quality, on-trend luxuries at affordable prices,' complemented by a 'good, better, best assortment' strategy. For instance, in 2024, the company continued to emphasize its tiered product offerings, allowing consumers to select items that align with their immediate spending capacity, thereby mitigating the impact of direct price comparisons with lower-cost competitors.

The proliferation of e-commerce and digital platforms has dramatically increased the availability of information for consumers. Customers can now effortlessly compare prices, read product reviews, and research ingredients across a multitude of brands, all from their devices. This heightened transparency directly fuels their bargaining power, as they are better equipped to identify the best value and quality.

Bath & Body Works actively engages with this trend by maintaining a robust e-commerce presence and utilizing digital marketing strategies. By meeting customers on these online channels, the company ensures accessibility and provides the information consumers seek, thereby navigating and leveraging the increased customer power stemming from readily available data.

Low Switching Costs for Customers

The bargaining power of customers for Bath & Body Works is significantly influenced by low switching costs. For many personal care and home fragrance items, it’s quite easy and inexpensive for a customer to move from Bath & Body Works to another brand. This ease of switching means customers have many choices and can readily explore alternatives without much hassle or financial penalty.

While Bath & Body Works employs loyalty programs to keep customers engaged, the readily available alternatives with similar product assortments limit the company's pricing power. If prices were to increase substantially, customers could easily defect to competitors offering comparable products at lower costs. This dynamic underscores the importance of competitive pricing and continuous product innovation for Bath & Body Works.

- Low Switching Costs: Customers can easily switch between brands for personal care and home fragrance products.

- Price Sensitivity: The ease of switching makes customers more sensitive to price increases.

- Competitive Landscape: Numerous competitors offer similar products, providing ample alternatives.

Diverse Product Line and Frequent Innovation

Bath & Body Works' extensive product range, featuring new collections and seasonal scents released frequently, keeps customers returning. This constant refresh of offerings, including over 100 new products introduced annually, directly combats customer boredom and reduces their incentive to explore competing brands.

The company's commitment to innovation directly addresses shifting consumer tastes, ensuring their product mix remains relevant. For instance, in 2023, Bath & Body Works continued to expand its scent profiles and product categories, responding to trends in home fragrance and personal care.

- Diverse Product Offering: A wide array of soaps, lotions, candles, and body care products.

- Frequent New Releases: Introduction of seasonal and limited-edition collections throughout the year.

- Customer Engagement: New scents and product lines encourage repeat purchases and brand loyalty.

- Adaptability to Trends: Innovation strategy aligns with evolving consumer preferences in the beauty and home goods sectors.

Customers have considerable bargaining power due to the wide availability of substitutes in the personal care and home fragrance markets. This means consumers can easily switch brands if Bath & Body Works' pricing or product offerings become less attractive. In 2024, the competitive landscape remained robust, with numerous brands vying for consumer attention, further empowering buyers.

While Bath & Body Works utilizes loyalty programs to foster retention, the low cost of switching for most of its products means customers are not heavily penalized for exploring alternatives. This accessibility to other brands, coupled with increased price transparency through online channels, allows customers to effectively negotiate value, either by seeking discounts or choosing competitors.

The company's strategy to mitigate this involves offering a tiered assortment of products, from everyday essentials to premium items, catering to different budget levels. This approach, evident in their 2023 and 2024 product assortments, aims to retain customers across various spending capacities by ensuring perceived value and affordability.

| Factor | Impact on Bath & Body Works | Mitigation Strategy |

| Availability of Substitutes | High; customers can easily find similar products from competitors. | Frequent new product introductions and seasonal collections to maintain customer interest. |

| Price Sensitivity | Moderate to High; customers are often looking for deals and discounts. | Tiered product pricing and promotional events (e.g., semi-annual sales). |

| Switching Costs | Low; minimal effort or cost to switch to another brand. | Loyalty programs and exclusive offers to incentivize repeat purchases. |

What You See Is What You Get

Bath & Body Works Porter's Five Forces Analysis

This preview showcases the complete Bath & Body Works Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to valuable strategic insights. You're looking at the actual, professionally formatted analysis, ready for download and use the moment you buy, with no placeholders or hidden surprises.

Rivalry Among Competitors

The beauty and personal care sector, which includes home fragrance, is substantial and expanding, yet it's also highly fragmented with a multitude of competitors. The global personal care market is anticipated to exceed $500 billion by 2025, with the home fragrance segment also showing robust growth. This dynamic environment fosters intense competition.

Bath & Body Works operates in a crowded marketplace, contending with numerous competitors. These include direct rivals like The Body Shop and Lush, which also focus on personal care and home fragrance. Beyond specialty stores, competition arises from department stores, mass-market brands such as Dove and Olay, and a growing number of online-only direct-to-consumer (DTC) brands that can offer specialized products and agile marketing.

The competitive landscape is further intensified by the sheer diversity of offerings. Competitors often present similar product categories, ranging from body lotions and soaps to popular items like candles and air fresheners. These alternatives frequently come with different pricing strategies and distinct brand identities, appealing to a wider spectrum of consumer preferences and budgets. For instance, while Bath & Body Works is known for its premium pricing and seasonal collections, many DTC brands can undercut them on price or focus on niche ingredients.

The fragrance and personal care market is fiercely competitive, with companies like Bath & Body Works constantly vying for consumer attention. This rivalry is fueled by the sector's substantial size and consistent demand, pushing businesses to invest heavily in aggressive marketing campaigns, eye-catching seasonal promotions, and swift product development cycles to secure a larger slice of the market. For instance, in 2023, the U.S. beauty and personal care market was valued at approximately $105 billion, highlighting the significant financial incentives for market share acquisition.

Product Differentiation and Innovation Race

Competitive rivalry within the personal care and home fragrance industry, where Bath & Body Works operates, is intense and often centers on product differentiation. Companies vie for consumer attention through unique fragrance profiles, innovative formulations, and appealing packaging. A strong brand image and a superior customer experience are also key battlegrounds.

The race for innovation is perpetual. Companies are continuously introducing new scents, exploring novel ingredients like natural or clean-label options, and leveraging technologies such as AI to offer personalized product recommendations. This constant stream of newness fuels a dynamic and highly competitive market landscape.

- Fragrance Innovation: Companies like Bath & Body Works frequently launch new seasonal and signature scents, driving repeat purchases.

- Ingredient Trends: The demand for natural and clean-label ingredients is a significant driver of product development and differentiation.

- Customer Experience: In-store ambiance, online user experience, and personalized marketing all contribute to competitive advantage.

- Brand Loyalty: Strong brand recognition and emotional connection with consumers are crucial in retaining market share amidst fierce competition.

Omnichannel Presence and Digital Transformation

Competitive rivalry intensifies as companies like Bath & Body Works increasingly adopt omnichannel strategies, blending physical stores with sophisticated e-commerce operations. This digital transformation is crucial for delivering personalized customer experiences, pushing rivals to invest heavily in technology and artificial intelligence to stay competitive.

The focus has shifted beyond brick-and-mortar presence to a robust online footprint and engaging digital interactions. For instance, in 2023, many retailers reported significant growth in their digital sales channels, with some seeing e-commerce revenue increase by over 15% year-over-year, directly impacting competitive dynamics.

- Omnichannel Integration: Competitors are enhancing their ability to seamlessly integrate online and offline shopping experiences, offering services like buy online, pick up in-store (BOPIS).

- Digital Engagement: Investment in social media marketing, influencer collaborations, and personalized email campaigns is a key battleground for customer attention and loyalty.

- Technology Investment: Companies are allocating substantial resources to AI-driven personalization, data analytics for customer insights, and improving website/app functionality.

- Customer Experience: The ability to offer a consistent and convenient brand experience across all touchpoints, both digital and physical, is a major differentiator in the current market.

The competitive rivalry within the personal care and home fragrance sector is exceptionally high, driven by a large number of players and the industry's substantial market size. Companies like Bath & Body Works face constant pressure from both established brands and agile direct-to-consumer (DTC) entrants, necessitating continuous innovation in product development, marketing, and customer experience to maintain market share.

The battle for consumer attention is fierce, with rivals frequently launching new seasonal collections and signature scents to encourage repeat purchases and attract new customers. This dynamic means companies must invest heavily in marketing and product innovation to stand out. For instance, in 2023, the U.S. beauty and personal care market was valued at approximately $105 billion, underscoring the significant stakes involved in capturing consumer spending.

Competitors are increasingly focusing on differentiation through unique fragrance profiles, clean or natural ingredients, and compelling brand narratives. The customer experience, both online and in-store, has become a critical battleground, with companies leveraging technology and personalization to build brand loyalty amidst a crowded marketplace.

The omnichannel approach is a key strategy, with companies enhancing their digital presence and integrating online and offline sales channels. This includes investing in AI for personalized recommendations and improving e-commerce platforms, as evidenced by significant year-over-year growth in digital sales channels reported by many retailers in 2023.

| Key Competitor Actions | Impact on Rivalry | Example |

|---|---|---|

| New Product Launches (Seasonal Scents) | Increases pressure for differentiation and innovation | Bath & Body Works' frequent seasonal collections |

| Focus on Natural/Clean Ingredients | Drives product development and shifts consumer preferences | Competitors emphasizing plant-based or ethically sourced ingredients |

| Omnichannel Strategy Enhancement | Requires investment in technology and seamless customer journeys | Offering buy online, pick up in-store (BOPIS) services |

| Digital Marketing & Personalization | Key for customer acquisition and retention | AI-driven product recommendations and targeted social media campaigns |

SSubstitutes Threaten

Consumers are increasingly exploring DIY and homemade personal care and home fragrance products. This trend is fueled by the availability of common ingredients and essential oils, allowing individuals to craft their own alternatives. For instance, the global essential oils market was valued at approximately $2.2 billion in 2023 and is projected to grow, indicating a rising interest in natural ingredients that can be used in homemade products.

The growing consumer preference for natural and clean-label items further encourages this do-it-yourself approach. When consumers opt to make their own lotions, soaps, or candles, it directly reduces their need to purchase similar commercially produced items from companies like Bath & Body Works. This shift represents a significant low-cost substitute that can impact demand for established brands.

Consumers seeking personal wellness and home ambiance can turn to alternatives beyond traditional bath and body products. Aromatherapy diffusers utilizing essential oils, for instance, offer a competitive avenue for creating a desired atmosphere. The global aromatherapy market was valued at approximately $1.7 billion in 2023 and is projected to grow, indicating a significant substitute.

Incense sticks also provide a cost-effective and widely available method for home fragrance, presenting a direct threat. Furthermore, the simple act of maintaining a clean and well-ventilated living space can fulfill the need for a pleasant home environment without requiring specific product purchases. These diverse options fragment the market and dilute the perceived necessity of specialized bath and body items.

The trend toward minimalist beauty routines and multi-purpose products presents a significant threat of substitutes for Bath & Body Works. Consumers are increasingly looking for items that serve multiple functions, potentially reducing their need to purchase a wide array of specialized personal care products. For instance, the practice of 'slugging' with petroleum jelly, a widely available and inexpensive product, can replace the need for some dedicated skincare treatments.

Shift in Consumer Priorities and Economic Factors

During periods of economic downturn, consumers often re-evaluate their spending, leaning towards necessities rather than discretionary purchases. This means items like specialty soaps, lotions, and home fragrances, which Bath & Body Works offers, can be viewed as less critical. For instance, in 2023, consumer spending on discretionary goods saw fluctuations as inflation persisted, prompting shoppers to allocate more funds to essentials like groceries and utilities.

This shift directly impacts the threat of substitutes. When budgets tighten, consumers might opt for more affordable alternatives or simply reduce their consumption of these personal care items. They might choose store-brand personal care products or delay non-essential purchases altogether, effectively substituting the value they would have received from Bath & Body Works with savings or other pressing needs.

The economic climate plays a significant role in this substitution. For example, if disposable income decreases, the perceived value of a luxury hand soap diminishes when compared to essential household supplies. This economic pressure can amplify the appeal of substitutes, whether they are lower-priced brands or simply the act of saving money.

- Economic Uncertainty Drives Prioritization: Consumers increasingly favor essential goods over non-essential luxury items during uncertain economic times.

- Substitution with Savings: In 2023, persistent inflation led many households to reduce discretionary spending, substituting purchases of items like personal care products with increased savings or allocation to necessities.

- Impact on Personal Care Spending: Fluctuations in consumer spending patterns directly affect categories like home fragrance and specialty lotions, making them vulnerable to substitution.

- Reduced Disposable Income: A decrease in disposable income makes the perceived value of premium personal care items lower when essential needs must be met first.

Alternative Retail Experiences

Consumers increasingly seek self-care and indulgence through experiences beyond traditional retail. This includes wellness tourism, which saw global revenue projected to reach $1.5 trillion by 2027, and the thriving spa industry, with the US market alone valued at over $18 billion in 2023. These options, while not direct product replacements for Bath & Body Works' offerings, satisfy similar consumer desires for relaxation and personal well-being.

Furthermore, the rise of direct-to-consumer sales from independent artisans and small businesses presents another facet of this threat. These creators often offer unique, handcrafted personal care items and home fragrances, appealing to consumers looking for artisanal quality and personalized experiences. This growing segment taps into a desire for authenticity and novelty that can divert spending from larger retailers.

- Alternative Experiences: Wellness tourism and spa services offer non-product-based self-care solutions.

- Market Size: Global wellness tourism market projected at $1.5 trillion by 2027; US spa market exceeded $18 billion in 2023.

- Artisanal Appeal: Independent artisans provide unique, handcrafted alternatives that cater to a desire for authenticity.

- Need Fulfillment: These substitutes address similar consumer needs for indulgence and personal well-being, potentially impacting demand for traditional retail offerings.

The threat of substitutes for Bath & Body Works is significant, encompassing DIY products, alternative wellness experiences, and even simple household practices. Consumers are increasingly turning to homemade personal care items, driven by accessible ingredients and a desire for natural products, as evidenced by the global essential oils market reaching approximately $2.2 billion in 2023. This trend directly reduces demand for commercially produced goods.

Furthermore, the growing preference for clean-label and minimalist routines encourages the use of multi-purpose items, potentially replacing the need for a variety of specialized products. Economic pressures also play a crucial role; during 2023, persistent inflation led consumers to prioritize essentials over discretionary spending, making items like specialty lotions and home fragrances more susceptible to substitution with savings or lower-cost alternatives.

| Substitute Category | Description | Market Size/Trend Data (Approx.) |

|---|---|---|

| DIY & Homemade Products | Consumers crafting personal care items using accessible ingredients like essential oils. | Global essential oils market: $2.2 billion (2023), growing. |

| Alternative Wellness Experiences | Non-product-based self-care like wellness tourism and spa services. | Global wellness tourism projected $1.5 trillion by 2027; US spa market >$18 billion (2023). |

| Economic Prioritization | Shifting spending from discretionary items to essentials due to inflation. | Consumer spending on discretionary goods fluctuated in 2023 due to inflation. |

Entrants Threaten

Bath & Body Works benefits from robust brand recognition and a deeply loyal customer base, creating a formidable barrier for potential new competitors. Cultivating similar brand trust and customer devotion demands considerable investment in marketing and a significant time commitment, making it difficult for newcomers to gain traction.

This strong customer loyalty is a key deterrent to new entrants. For instance, Bath & Body Works was recognized by Newsweek as the number one perfume and cosmetics retailer, underscoring the deep-seated trust and preference consumers have for the brand.

Bath & Body Works benefits significantly from economies of scale in production, with its 'Beauty Park' facility churning out millions of finished goods units annually. This massive output allows for lower per-unit manufacturing costs, a significant barrier for any new player looking to enter the market. New entrants would require substantial upfront capital to build comparable production capacity and achieve similar cost efficiencies, making it difficult to compete on price.

Bath & Body Works boasts a significant advantage with its vast network of over 1,700 retail stores and a well-established e-commerce presence, reaching a broad customer base. This extensive physical and digital footprint creates substantial barriers for new competitors aiming to replicate its market reach and distribution capabilities. The company's strategic expansion into off-mall locations further solidifies its accessibility and market penetration, making it increasingly challenging for new entrants to gain comparable traction.

Access to Supply Chain and Proprietary Formulations

Bath & Body Works benefits from a highly developed, primarily U.S.-based, and vertically integrated supply chain. This includes established relationships with a wide array of manufacturing facilities, making it challenging for newcomers to replicate.

Securing access to dependable suppliers for high-quality ingredients and components, particularly for their signature fragrances, presents a significant hurdle for new entrants. In 2024, the specialty retail sector continued to emphasize unique product differentiation, where ingredient sourcing plays a crucial role.

Proprietary fragrance formulations are a key competitive advantage for Bath & Body Works. Developing and protecting these unique scent profiles requires substantial investment in research and development, acting as a barrier to entry for potential competitors seeking to capture market share in the personal care and home fragrance segments.

- Established Supply Chain Network: Bath & Body Works' extensive network of U.S.-based manufacturing partners provides a stable and efficient production pipeline.

- Ingredient Sourcing Challenges: New entrants face difficulties in securing reliable access to the specialized ingredients and components necessary for high-quality fragrance development.

- Proprietary Formulation Advantage: The company's unique and protected fragrance formulations are a significant differentiator that is costly and time-consuming for competitors to replicate.

Marketing and Advertising Costs

New companies entering the bath and body products market face significant hurdles due to the high cost of marketing and advertising needed to establish brand recognition. Bath & Body Works, for instance, invests heavily in creating compelling campaigns, often featuring seasonal themes and celebrity endorsements, which requires substantial financial backing to replicate.

To effectively compete, a new entrant would need to match or exceed the promotional spending of established players. Bath & Body Works’ robust marketing strategy includes:

- Extensive seasonal promotions: These drive significant traffic and sales throughout the year.

- Loyalty programs: Such as their "My Bath & Body Works Rewards" program, foster customer retention and repeat purchases.

- Influencer marketing: Collaborations with social media personalities amplify reach and build credibility.

In 2023, the company reported advertising and marketing expenses of $383.2 million, highlighting the considerable investment required to maintain its market position and attract new customers in a competitive landscape.

The threat of new entrants for Bath & Body Works is relatively low, primarily due to the substantial capital investment required to establish brand recognition and a comparable distribution network. New players must overcome significant barriers related to marketing, economies of scale, and supply chain integration to compete effectively.

Bath & Body Works’ established brand loyalty, exemplified by its top ranking in perfume and cosmetics retail by Newsweek, makes it difficult for newcomers to attract and retain customers. Furthermore, the company's massive production scale, with millions of units produced annually at its 'Beauty Park,' creates cost advantages that are hard for new entrants to match without significant upfront investment.

| Barrier to Entry | Bath & Body Works Advantage | Implication for New Entrants |

| Brand Recognition & Loyalty | High, recognized as #1 perfume/cosmetics retailer (Newsweek) | Requires massive marketing investment and time to build trust. |

| Economies of Scale | Millions of units produced annually at 'Beauty Park' | New entrants need substantial capital for comparable production capacity and cost efficiency. |

| Distribution Network | Over 1,700 stores, strong e-commerce, expanding off-mall | Reaching a broad customer base requires significant investment in physical and digital infrastructure. |

| Marketing Investment | $383.2 million in advertising/marketing (2023) | New entrants must match or exceed substantial promotional spending. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bath & Body Works is built upon a foundation of robust data, drawing from company annual reports, investor relations disclosures, and industry-specific market research from firms like IBISWorld and Statista. This ensures a comprehensive understanding of competitive dynamics.