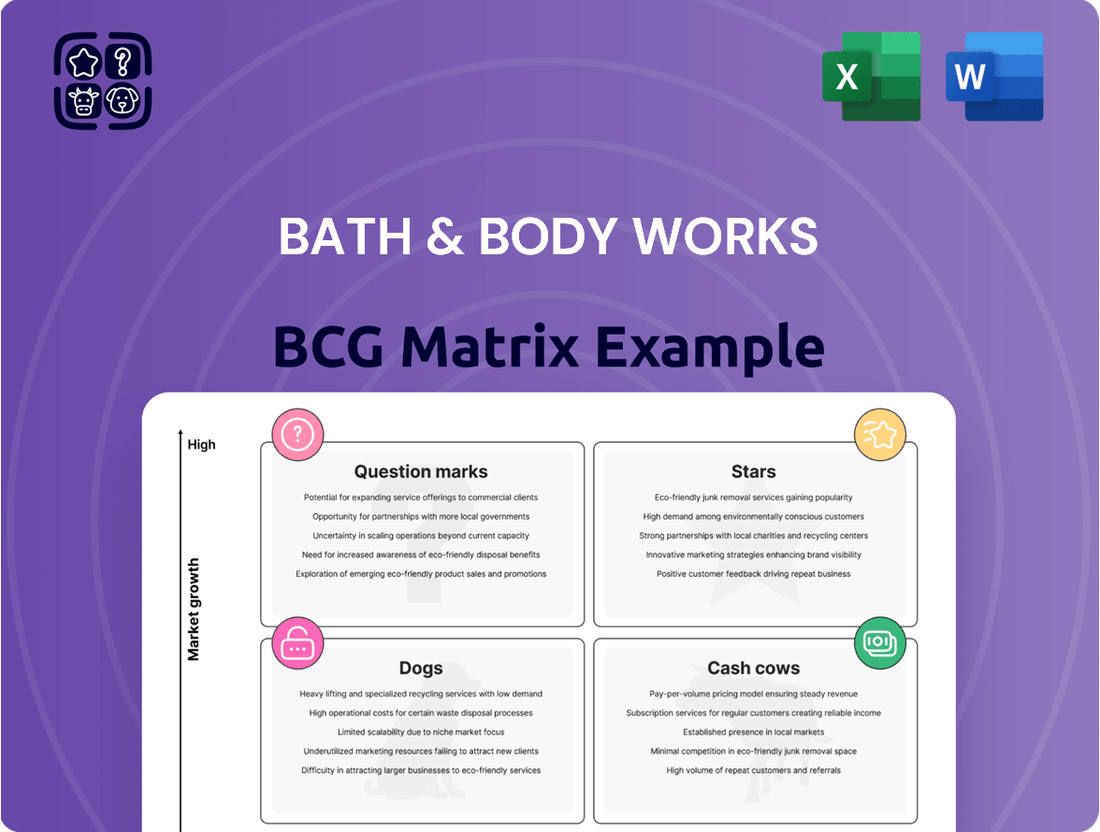

Bath & Body Works Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works Bundle

Explore the strategic positioning of Bath & Body Works' product lines with our insightful BCG Matrix preview. See how their popular collections might be categorized as Stars, Cash Cows, Dogs, or Question Marks, giving you a glimpse into their market performance.

Ready to unlock the full potential of this analysis? Purchase the complete BCG Matrix report for a detailed breakdown, including specific product placements, growth potential, and actionable strategies to optimize your own product portfolio.

Don't miss out on the crucial insights that will guide your next business decisions. Get the full BCG Matrix today and transform your understanding of Bath & Body Works' market dominance and opportunities.

Stars

The Everyday Luxuries Fragrance Collection stands out as a star in Bath & Body Works' portfolio. This collection has been a key growth engine, prompting the brand to extend its offerings into new product categories such as body wash and body cream.

The sustained popularity and positive customer reception of this line, particularly evident in Q1 2025, underscore its substantial market share and promising growth trajectory within the dynamic personal care sector.

Bath & Body Works leverages seasonal and limited-edition collections as a core strategy, generating significant sales spikes. For instance, the 'Sweetest Song' collection for Mother's Day and the 'Summerween' collection demonstrate their ability to capture consumer interest with novelty. These releases indicate strong market share during their limited availability and high growth potential within specific timeframes.

Strategic collaborations, such as the highly successful Disney Princess collection, have significantly boosted Bath & Body Works' sales, becoming their largest collaboration ever with an impressive 85 products. This partnership tapped into widespread nostalgia and appealed to a broad audience, securing a strong market share within its specific segment and drawing in new customer bases, highlighting substantial growth opportunities.

Soaps and Sanitizers

The soaps and sanitizers category at Bath & Body Works demonstrates robust performance, experiencing mid-single-digit growth. This expansion is directly linked to consumer demand, evidenced by the introduction of full-size sanitizers and 1-oz sprays.

This segment's growth, coupled with a high market share, positions soaps and sanitizers as strong contenders within the BCG matrix. The ongoing consumer emphasis on hygiene further solidifies their upward trajectory, indicating continued potential for strong returns.

- Mid-single-digit growth in the soaps and sanitizers category.

- Expansion driven by consumer demand for full-size sanitizers and 1-oz sprays.

- High market share in a segment with a consistent upward trajectory.

- Consumer focus on hygiene reinforces the category's status as a strong performer.

Men's Fragrance Line

Bath & Body Works strategically expanded its offerings with a dedicated men's fragrance line, tapping into a burgeoning market segment. Early successes, such as the 'Immortal' scent becoming a top seller, signal strong consumer interest and indicate a potential for significant market penetration.

This move positions the company to capitalize on the growing demand for men's personal care products. The men's grooming market, valued at approximately $60 billion globally in 2023, is projected to see continued expansion, with fragrances playing a crucial role in this growth.

- Market Expansion: Entry into the men's fragrance sector addresses a growing consumer base.

- Product Performance: Top-selling scents like 'Immortal' demonstrate product-market fit.

- Growth Potential: The men's personal care market is a high-growth area, with fragrances being a key driver.

- Strategic Positioning: Capturing a larger share of the evolving men's grooming market.

The Everyday Luxuries Fragrance Collection, along with seasonal and collaborative lines like the Disney Princess collection, exemplify Bath & Body Works' "Stars" within the BCG matrix. These products exhibit high market share and strong growth potential, driven by consistent consumer demand and successful strategic initiatives. For instance, the Disney Princess collaboration alone featured 85 products, becoming their largest ever, and demonstrated significant sales impact. The men's fragrance line, with early successes like the 'Immortal' scent, also shows promise in a rapidly expanding global market, projected to continue its growth trajectory.

| Category | Market Share | Growth Rate | Key Drivers |

|---|---|---|---|

| Everyday Luxuries Fragrance | High | High | Sustained popularity, product line extensions |

| Seasonal Collections (e.g., Summerween) | High (during availability) | High (during availability) | Novelty, consumer interest spikes |

| Collaborations (e.g., Disney Princess) | High | High | Nostalgia, broad appeal, extensive product range |

| Men's Fragrance Line | Growing | High | Entry into burgeoning market, strong initial product performance |

What is included in the product

This BCG Matrix overview highlights which Bath & Body Works units to invest in, hold, or divest based on market share and growth.

The Bath & Body Works BCG Matrix provides a clear, actionable overview of their product portfolio, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

Bath & Body Works' signature 3-wick candles are undeniably the company's cash cows. They hold a commanding position in the home fragrance sector, a testament to their enduring popularity and the brand's strong appeal.

Despite a generally flat outlook for the broader candle market, these particular candles are consistent revenue generators. This stability is fueled by a loyal customer base and a successful strategy of frequent, seasonal product refreshes, solidifying their status as a high-market-share product in a mature segment.

For instance, in fiscal year 2023, Bath & Body Works reported net sales of $7.56 billion, with candles representing a significant portion of this revenue, highlighting their critical role in the company's financial performance.

Classic fragrances like Japanese Cherry Blossom and Warm Vanilla Sugar are Bath & Body Works' enduring stars. These scents are perennial favorites, consistently drawing in customers and maintaining a strong presence in the personal care market.

Their established popularity means they command a significant market share without needing heavy marketing spend. This consistent demand translates into reliable, robust cash flow, making them true cash cows for the company.

Bath & Body Works' body lotions and creams are core offerings, boasting significant market penetration as a leading personal care retailer. These items are known for driving repeat purchases and benefiting from strong brand loyalty, ensuring steady income. In 2023, the U.S. body care market, which heavily includes lotions and creams, was valued at approximately $11.5 billion, demonstrating the substantial, stable revenue these products generate.

Hand Soaps (excluding new innovations)

Hand soaps, excluding the newer innovations, are a cornerstone of Bath & Body Works' portfolio, holding a significant market share within a mature product category. These are everyday essentials that consumers consistently repurchase, generating consistent and predictable revenue streams.

This steady income allows for minimal investment in aggressive marketing campaigns, as demand remains robust due to their status as household staples.

- Market Share: Dominant position in the mature hand soap segment.

- Cash Flow: Provides reliable, ongoing revenue with low reinvestment needs.

- Consumer Behavior: Regular replenishment cycle ensures consistent sales.

- Profitability: High margins due to established brand loyalty and reduced promotional costs.

Wallflowers Plugs and Refills

Wallflowers Plugs and Refills represent a mature product line for Bath & Body Works, fitting squarely into the Cash Cows quadrant of the BCG Matrix. This established home fragrance system boasts a substantial market share, benefiting from a loyal customer base and a consistent demand for its refillable nature.

The recurring revenue generated from refill purchases is a key characteristic of a Cash Cow. Bath & Body Works leverages its existing installed base of Wallflowers plugs, ensuring a steady stream of income from these loyal customers. In fiscal year 2023, Bath & Body Works reported net sales of $7.56 billion, with the home fragrance category being a significant contributor.

- Established Market Presence: Wallflowers are a dominant player in the home fragrance market, known for their convenience and variety of scents.

- Recurring Revenue Stream: The business model relies on repeat purchases of fragrance refills, creating predictable income.

- High Market Share, Low Growth: While the market for home fragrances is relatively stable, rapid expansion is unlikely, characteristic of a Cash Cow.

- Profitability: The mature nature of the product allows for efficient production and marketing, leading to strong profit margins.

Bath & Body Works' core body care products, particularly lotions and creams, are strong cash cows. These items have achieved significant market penetration within the personal care sector, driving repeat business and benefiting from established brand loyalty.

The U.S. body care market, a segment where these products are prominent, was valued at approximately $11.5 billion in 2023, underscoring the substantial and stable revenue these offerings generate for the company.

These products are consistent revenue generators due to their everyday utility and the brand's strong customer retention strategies.

Their high market share in a mature category, coupled with consistent consumer demand, ensures reliable cash flow with minimal need for aggressive expansion investment.

What You’re Viewing Is Included

Bath & Body Works BCG Matrix

The Bath & Body Works BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just a professionally designed, analysis-ready report prepared for strategic decision-making.

Dogs

Certain seasonal scents, like Bath & Body Works' limited-edition holiday fragrances that don't meet sales targets, can quickly become low performers. These products tie up valuable inventory and shelf space without generating significant revenue, effectively marking them as Dogs in the BCG matrix. For instance, if a seasonal scent only achieved a 0.5% market share in its category during its limited release in 2023 and the overall fragrance market growth was only 2%, it would clearly fit the Dog profile.

Bath & Body Works' older, mall-based store formats that are seeing declining foot traffic are prime examples of dogs in their business portfolio. These locations often struggle with the broader retail trend of consumers moving away from enclosed malls.

The company's strategic pivot towards off-mall, high-traffic locations and the closure of underperforming mall stores directly reflects the low growth prospects and diminishing market share of these older formats. For instance, in fiscal year 2023, Bath & Body Works closed approximately 50 underperforming stores, many of which were likely mall-based locations.

Niche or experimental product lines, like Bath & Body Works' limited-run 'apple lavender and musk collection,' often fall into the dog category. These offerings, described by some consumers as unusual, typically fail to generate significant buzz or sales.

Such products struggle to achieve substantial market share, contributing minimally to the company's overall revenue. For instance, in 2024, Bath & Body Works reported a net sales decline of 1.1% in the third quarter, highlighting the impact of underperforming product lines.

These experimental items are frequently discontinued shortly after their introduction due to their inability to gain traction. This strategy, while allowing for innovation, often results in a portfolio of products with low market appeal and limited financial return.

Products with Low Customer Loyalty or Repeat Purchase Rates

Products in this category, often referred to as Dogs in the BCG Matrix, struggle to capture and retain customer interest. For Bath & Body Works, this could manifest as a specific scent or a limited-edition product line that doesn't resonate with consumers, leading to low sales and minimal repeat business. These items typically have a small market share and generate little profit, making them a drain on resources.

The challenge with these products lies in their inability to foster customer loyalty. Without a strong appeal, consumers are unlikely to repurchase them, and they certainly won't become signature items in a customer's routine. This lack of engagement means they contribute minimally to the company's overall growth trajectory.

Consider the performance of certain seasonal or experimental scents. If a new fragrance, for instance, sees a sharp decline in sales after its initial launch period and doesn't inspire repeat purchases, it would likely be classified as a Dog. By mid-2024, Bath & Body Works reported that a significant portion of its new product introductions failed to meet initial sales targets, indicating a potential for such items to fall into this category.

- Low Sales Velocity: Products that do not sell consistently, often requiring heavy discounting to move inventory.

- Minimal Repeat Purchases: Customers buy once but do not re-engage with the product.

- Negative Profitability: The cost of production and marketing outweighs the revenue generated.

- Limited Market Share: These products occupy a negligible portion of the overall market for their category.

Outdated or Less Popular Accessories/Decor

Certain older or less popular home decor and accessory items at Bath & Body Works can be categorized as dogs in the BCG matrix. These might include items from past seasonal collections that no longer resonate with current consumer tastes or trends. For instance, if a particular style of candle holder or wall decor was popular in 2022 but saw a significant drop in sales by mid-2024, it could be considered a dog.

These products often exhibit low sales velocity, meaning they move slowly off the shelves, and occupy valuable retail space that could be utilized for more in-demand merchandise. This situation indicates a low market share within a segment that is likely experiencing slow or no growth. For example, if a specific line of diffusers, which were part of a 2023 collection, only accounted for 0.5% of total home fragrance sales in the first half of 2024, and the overall market for that specific type of diffuser is stagnant, it fits the dog profile.

The financial implications of these "dog" accessories are clear: they tie up capital in slow-moving inventory and contribute little to overall revenue or profit. Bath & Body Works might face decisions regarding these items, such as clearance sales to liquidate stock or discontinuation to free up resources for more promising product categories.

- Low Sales Velocity: Items like decorative soap dishes or retired scent-specific accessory lines may see minimal sales, potentially less than 1% of the home fragrance category's total revenue in a given quarter.

- Stagnant Market Segment: The market for specific, dated home decor styles, such as certain vintage-inspired glass accessories, might be experiencing flat or declining growth, making it hard for these products to gain traction.

- Retail Space Inefficiency: A shelf dedicated to a collection of less popular wall signs or seasonal trinkets that haven't sold well since their initial release in 2023 represents inefficient use of prime retail floor space.

- Inventory Holding Costs: Carrying unsold inventory of these accessories incurs costs related to warehousing, insurance, and potential obsolescence, impacting profitability.

Products classified as Dogs within Bath & Body Works' portfolio are those with low market share in a slow-growing or declining market. These items typically fail to generate significant sales or customer interest, often requiring markdowns to clear inventory. For instance, a specific scent that saw a 2% market share in its category in 2023 and the category itself only grew by 1% would be a prime candidate for the Dog classification.

These underperforming products tie up valuable capital and retail space, offering minimal return on investment. Bath & Body Works' strategy often involves discontinuing such items or heavily discounting them to liquidate stock, freeing up resources for more promising categories. By Q3 2024, the company noted that a portion of its product assortment was underperforming, necessitating a review of inventory.

Examples include certain older home fragrance accessories or experimental scents that did not resonate with consumers, leading to low repeat purchases and minimal contribution to overall revenue. In 2023, the company closed approximately 50 underperforming stores, many of which likely housed a significant number of these "dog" products.

The challenge lies in their inability to capture sustained customer attention or build loyalty, resulting in low sales velocity and often negative profitability after accounting for holding costs. Such items might represent less than 1% of a product category's total sales in a given quarter.

| Product Category Example | Market Share (Estimated) | Market Growth (Estimated) | BCG Classification |

| Retired Seasonal Candle Scents | 0.3% | -1% | Dog |

| Older Style Bath Accessories | 0.7% | 0% | Dog |

| Experimental Body Care Line (2023) | 0.5% | -0.5% | Dog |

Question Marks

Bath & Body Works' venture into broader men's personal care, such as skincare and grooming, positions these new products as question marks within its BCG Matrix. This category is experiencing robust growth, with the global men's skincare market projected to reach approximately $21.4 billion by 2027, exhibiting a compound annual growth rate of around 6.1%.

Despite the market's expansion, Bath & Body Works would likely enter with a relatively low initial market share, necessitating substantial investment. This investment is crucial for building brand recognition, developing effective product lines, and competing against established players who already command significant consumer loyalty and market presence in these segments.

Bath & Body Works is venturing into new laundry care categories beyond traditional detergents and fragrance boosters, signaling an opportunistic move into a market experiencing growth. This expansion into items like fabric refreshers, stain removers, and specialty washes positions these products as potential question marks within the BCG matrix.

These newer laundry care offerings are considered question marks because they represent a departure from Bath & Body Works' established core product lines, such as soaps and candles. Significant investment in marketing and consumer education will be crucial to drive adoption and establish market presence in these adjacent categories.

Bath & Body Works is strategically expanding into haircare, recognizing the 'skinification' trend where consumers treat their hair with the same care as their skin. This move positions them in a high-growth market.

While the haircare sector presents a significant opportunity, Bath & Body Works' current market share is likely nascent. This means substantial investment in research, development, and marketing will be crucial to elevate these products from question marks to stars within their portfolio.

Advanced Technology-Integrated Fragrance Products (e.g., smart diffusers)

The home fragrance market is experiencing significant innovation, with smart-home integrations and connected diffusers emerging as key trends. Bath & Body Works, while investing in AI and digital platforms, would likely classify its specific advanced technology-integrated fragrance products, such as smart diffusers, as question marks within the BCG matrix.

These products represent a high-growth segment of the market, driven by consumer demand for convenience and connected experiences. For instance, the global smart home market was valued at approximately $84.2 billion in 2023 and is projected to reach $208.4 billion by 2028, indicating substantial growth potential for integrated products.

However, Bath & Body Works currently holds a low market share in this niche category.

- High Growth Potential: The increasing adoption of smart home technology fuels demand for connected home fragrance solutions.

- Low Market Share: Bath & Body Works' presence in advanced technology-integrated fragrance products is currently nascent.

- Significant Investment Required: Capturing leadership in this innovative space necessitates substantial R&D and marketing expenditure.

- Strategic Importance: These products offer a pathway to future market leadership and differentiation in a competitive landscape.

International Market Expansion in New Regions

Bath & Body Works is strategically targeting international market expansion, with an ambitious goal of achieving 15% international revenue growth. This expansion into new regions offers substantial growth potential for the company.

However, in these nascent markets, Bath & Body Works currently holds a low market share. This situation necessitates significant investment in various market entry strategies to establish a foothold.

Key investments will include developing localized product offerings that resonate with diverse consumer preferences and robust brand-building initiatives. The objective is to transform these low-share, high-potential markets into future 'stars' within the company's portfolio.

- Targeted International Revenue Growth: Bath & Body Works aims for 15% growth from international markets.

- Market Entry Strategy: Significant investment is required for entering new regions with low initial market share.

- Localization and Brand Building: Focus on adapting products and marketing to local tastes to drive adoption.

- Potential for Star Growth: New markets are viewed as potential future 'stars' if entry strategies are successful.

Products classified as question marks represent new ventures for Bath & Body Works with high growth potential but currently low market share. These require significant investment to build brand awareness and market penetration. The company's expansion into men's grooming, haircare, and advanced home fragrance technologies are prime examples.

| Category | Market Growth | Bath & Body Works Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| Men's Personal Care | High (Global market ~ $21.4B by 2027) | Low | High | Question Mark |

| Haircare | High (Driven by 'skinification') | Low/Nascent | High | Question Mark |

| Smart Home Fragrance | High (Global smart home market ~$84.2B in 2023) | Low | High | Question Mark |

| International Markets | High (Targeted 15% revenue growth) | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.