BBSI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBSI Bundle

Uncover the intricate web of external factors influencing BBSI's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, gain a critical understanding of the forces shaping the company's future. Equip yourself with actionable intelligence to refine your strategies and capitalize on emerging opportunities. Download the full PESTLE analysis now for a decisive competitive advantage.

Political factors

Changes in federal and state labor laws, such as minimum wage increases or new classification rules for independent contractors, directly impact BBSI's core business. For instance, a federal minimum wage hike to $15 per hour, a topic of ongoing discussion and some state-level implementation, would necessitate adjustments in BBSI's payroll processing and client advisory services. These policy shifts require BBSI to update its systems and advise clients on compliance, presenting both a challenge and an opportunity to showcase their HR expertise.

Fluctuations in corporate tax rates directly impact BBSI's client base. For instance, the US federal corporate tax rate, which stood at 21% in 2024, can influence a small business's decision to expand or invest, potentially affecting their need for BBSI's payroll and HR support.

The introduction of new business incentives, such as state-level tax credits for job creation or investment, can also be a significant driver. Many states offer such programs, and their availability and structure can encourage clients to grow, thereby increasing their reliance on BBSI's services for managing that growth.

Conversely, an unfavorable tax environment, perhaps due to increased state or local taxes, could constrain client budgets. This might lead to a temporary slowdown in demand for BBSI's growth-oriented services as businesses focus on managing immediate cost pressures.

The regulatory environment for Professional Employer Organizations (PEOs) significantly shapes BBSI's operations. Changes in state or federal PEO licensing requirements, for instance, could necessitate costly compliance updates or even restrict market access. As of early 2024, the National Association of PEOs (NAPEO) continues to advocate for consistent, national PEO regulations, aiming to reduce the patchwork of state-specific rules that can complicate multi-state operations for companies like BBSI.

Healthcare Policy Changes

Healthcare policy shifts, especially concerning employer-sponsored health benefits and mandates, are highly relevant to BBSI’s core HR management services. For instance, potential adjustments to the ACA or new state-specific health programs could directly impact how businesses manage employee benefits and their associated costs, a key area where BBSI offers guidance.

These policy changes necessitate BBSI's expertise in navigating complex compliance landscapes. For example, if a new federal mandate requires employers to offer specific levels of coverage or imposes new reporting requirements, BBSI must be prepared to advise its clients on adherence. This also extends to state-level initiatives, which can create a patchwork of regulations that businesses must manage.

- Impact on Employer Mandates: Changes in healthcare laws, such as those related to the ACA’s employer shared responsibility provisions, can alter the financial implications for businesses offering health insurance, directly affecting BBSI’s client advisory services.

- Benefit Administration Complexity: New healthcare regulations often increase the complexity of benefit administration, requiring BBSI to update its systems and client guidance to ensure compliance and efficiency.

- Cost Containment Strategies: Policy changes can influence healthcare costs for employers. BBSI’s role includes helping clients implement strategies to manage these costs effectively within the evolving regulatory framework.

- Compliance and Reporting: Adhering to updated healthcare policies, including reporting requirements and employee notification rules, is crucial. BBSI assists clients in meeting these obligations to avoid penalties.

Political Stability and Small Business Confidence

Political stability is a cornerstone for small business confidence. When governments maintain predictable policies and a steady hand, businesses feel more secure about investing and growing. This stability directly translates into a healthier economic environment, which is beneficial for companies like BBSI, as it expands their potential client pool and the demand for their essential human resources and payroll services.

For instance, the U.S. Chamber of Commerce's Small Business Index has shown a correlation between periods of political uncertainty and dips in small business optimism. In late 2023 and early 2024, while overall economic indicators remained mixed, concerns about potential policy shifts ahead of the 2024 election cycle were noted by many small business owners as a factor influencing hiring and capital expenditure decisions.

BBSI, as a provider of outsourced HR, payroll, and risk management, thrives when small and medium-sized businesses are confident and expanding. A stable political landscape reduces the perceived risk for these businesses, encouraging them to hire more employees and invest in their operations, thereby increasing the need for BBSI's core offerings. Conversely, political volatility can lead to a cautious approach from businesses, potentially slowing down growth and impacting BBSI's client acquisition and retention rates.

Political stability fosters small business confidence, directly benefiting BBSI by encouraging growth and hiring. Periods of political uncertainty, such as those leading up to the 2024 U.S. election, have historically been linked to cautious business sentiment, potentially impacting demand for BBSI's services.

Government policies on labor, taxation, and healthcare significantly influence BBSI's operational environment and client needs. For example, changes in minimum wage laws or corporate tax rates, like the U.S. federal rate of 21% in 2024, directly affect business costs and their reliance on outsourced HR and payroll solutions.

The regulatory landscape for Professional Employer Organizations (PEOs) is crucial; evolving state and federal requirements, as advocated for by groups like NAPEO, necessitate ongoing compliance efforts and can impact market access for companies like BBSI.

Political factors influencing employer mandates and healthcare benefit administration complexity, such as potential adjustments to the ACA, require BBSI to provide expert guidance to clients navigating these evolving requirements.

What is included in the product

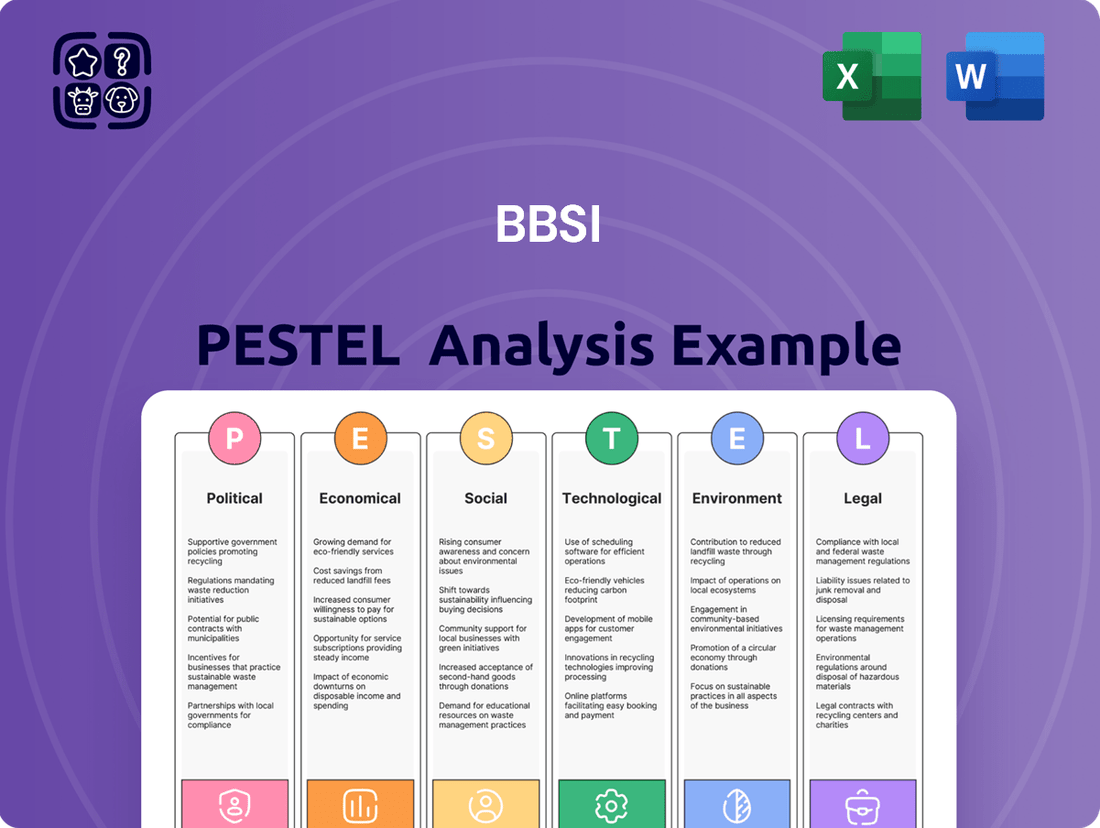

The BBSI PESTLE Analysis offers a comprehensive examination of external macro-environmental factors, dissecting their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

The U.S. economy demonstrated resilience through 2024, with GDP growth projected to be around 2.5% by year-end, according to the Congressional Budget Office. This expansion directly fuels the SMB sector, which accounts for nearly half of all private sector employment. A healthy economic environment translates to increased demand for BBSI's core services like payroll processing, HR support, and risk management, as more businesses are established and existing ones grow.

For BBSI, a robust SMB sector is paramount. In 2024, SMBs continued to be the engine of job creation, and their financial health directly impacts their ability to invest in essential operational support. As of Q3 2024, an estimated 99.9% of U.S. businesses were classified as small businesses, highlighting the vast potential client pool for BBSI's integrated solutions.

The United States experienced a robust labor market entering 2024, with the unemployment rate hovering around 3.7% in early 2024, a historically low figure. This tight labor market, characterized by high employment rates, typically spurs demand for BBSI's HR and payroll services as companies actively seek to attract and retain talent, potentially increasing their need for efficient onboarding and benefits administration.

However, this strong demand can also translate to higher wage pressures for BBSI’s clients, impacting their overall labor costs. Conversely, if economic conditions were to shift, leading to increased unemployment, BBSI's value proposition might pivot towards offering cost-saving HR solutions and compliance support for businesses facing workforce reductions or a need to optimize existing staff.

Inflationary pressures in 2024 and early 2025 are directly impacting BBSI's operational expenses, from payroll to vendor costs. For instance, the US Consumer Price Index (CPI) saw a notable increase in the latter half of 2024, putting a squeeze on businesses' margins. This rising cost environment can diminish clients' disposable income and their capacity to invest in BBSI's essential services, potentially slowing demand.

Furthermore, the Federal Reserve's monetary policy, particularly the trajectory of interest rates through 2025, presents a dual challenge. Higher interest rates, as anticipated by many economic forecasts for 2025, make it more expensive for BBSI's clients to borrow capital for growth initiatives. This increased cost of capital can curb expansion plans, thereby reducing the need for BBSI's core offerings that support growing businesses.

Wage Growth and Payroll Costs

Rising wage growth directly influences BBSI's payroll administration services. As average wages increase, the total value of payrolls BBSI manages also grows, potentially increasing revenue from service fees. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for all employees rose by 4.1% over the year ending April 2024.

However, this trend also presents a challenge for BBSI's clients. Higher wages mean increased labor costs, which can strain business budgets. This heightened pressure makes BBSI's expertise in efficient payroll management, tax compliance, and cost-mitigation strategies more valuable than ever. Clients rely on BBSI to navigate these rising expenses effectively.

The dynamic of wage growth necessitates a focus on cost-efficiency within BBSI's service model. Key considerations include:

- Impact on Client Budgets: Higher payroll costs require clients to seek more robust cost-control solutions.

- Demand for Efficiency Services: Increased wage pressure elevates the importance of BBSI's payroll optimization and compliance services.

- Service Value Proposition: BBSI can highlight its role in helping clients manage increased payroll expenses, thus demonstrating enhanced service value.

- Labor Market Trends: Monitoring wage growth helps BBSI anticipate client needs and tailor its offerings to address evolving payroll challenges.

Workers' Compensation Insurance Market Trends

The workers' compensation insurance market is experiencing a dynamic economic landscape, directly impacting BBSI's core services. In 2024, the market has shown signs of stabilization after several years of volatility, with some regions reporting modest premium increases. However, the frequency and severity of claims remain a key driver of pricing, and ongoing inflation in medical costs continues to exert upward pressure on overall expenses.

BBSI's profitability and the attractiveness of its risk mitigation solutions are intrinsically linked to these market trends. For instance, a significant rise in claims frequency, as seen in certain sectors during late 2023 and early 2024, can directly erode profit margins if not adequately managed through pricing adjustments or improved safety protocols. Conversely, a stable or declining claims environment allows for more competitive pricing, enhancing BBSI's market position.

- Premium Stability: While some states saw average premium increases of around 3-5% in early 2024, others experienced flat or even slight decreases, reflecting diverse economic conditions and regulatory environments.

- Claims Trends: Data from the National Council on Compensation Insurance (NCCI) indicated a slight uptick in claim severity in late 2023, primarily driven by rising medical treatment costs.

- Regulatory Impact: Changes in state-specific workers' compensation laws, such as those affecting benefit levels or medical fee schedules, can significantly alter the cost structure for insurers and PEOs like BBSI.

- Inflationary Pressures: Persistent inflation, particularly in healthcare, continues to be a primary economic factor influencing the long-term pricing strategies within the workers' compensation market.

Economic factors significantly shape the landscape for BBSI. The projected GDP growth of approximately 2.5% for 2024 underscores a generally favorable business climate, which typically benefits BBSI's client base of small and medium-sized businesses (SMBs). Conversely, persistent inflation, evidenced by a notable CPI increase in late 2024, can strain client budgets and potentially temper demand for services. Furthermore, the Federal Reserve's anticipated interest rate hikes through 2025 will increase borrowing costs for BBSI's clients, potentially slowing their expansion and thus their need for integrated HR and payroll solutions.

Preview the Actual Deliverable

BBSI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive BBSI PESTLE Analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. It offers a strategic overview for informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into BBSI's operating environment.

Sociological factors

The workforce is aging, with the median age of US workers projected to continue rising. This shift necessitates HR solutions that cater to experienced employees, potentially including phased retirement options and extended healthcare benefits. BBSI needs to ensure its offerings support clients in retaining and leveraging the knowledge of older workers while also attracting and integrating younger generations.

Increasing diversity across age, ethnicity, and gender is a defining characteristic of the modern workforce. For instance, by 2025, Gen Z will represent a significant portion of the labor market. BBSI's HR solutions must be adaptable to manage this diversity, offering tailored benefits administration and talent acquisition strategies that resonate with a broader range of employees and comply with evolving inclusion mandates.

The rise of the gig economy and flexible work is fundamentally reshaping employment. By 2024, it's estimated that over 60 million Americans will participate in some form of freelance or gig work, a significant increase from previous years. This trend necessitates a shift in how businesses manage their workforce.

BBSI must adapt its offerings to assist clients in navigating these evolving work structures. This includes ensuring compliance for independent contractors, a crucial aspect given the increasing number of workers operating outside traditional employment. Furthermore, supporting the management of hybrid workforces, which blend remote and in-office staff, is essential for client retention and growth.

Employees today have significantly higher expectations regarding their overall work experience. This includes demanding better benefits packages, a healthier work-life balance, robust mental health support, and clear pathways for professional growth. For instance, a 2024 survey indicated that 70% of employees consider work-life balance a top priority when choosing an employer.

These evolving employee expectations directly shape how businesses approach human resources and talent management. BBSI is positioned to assist clients by offering specialized HR solutions that address these rising demands, helping them to not only meet but exceed employee needs. This focus on well-being and development is vital for boosting employee retention and overall job satisfaction, which are key drivers for the success of small and medium-sized businesses.

Skills Gap and Talent Shortages

Ongoing skills gaps across numerous sectors present a significant challenge for businesses seeking qualified personnel, underscoring the critical need for robust recruitment and retention strategies. For instance, a 2024 report indicated that nearly 70% of U.S. employers faced difficulties in filling open positions due to a lack of skilled candidates, particularly in tech and healthcare.

BBSI's specialized HR services are designed to directly address these talent shortages. They offer comprehensive support in talent acquisition, including targeted sourcing and effective onboarding. Furthermore, BBSI assists clients in developing and implementing crucial training programs and employee development initiatives, thereby building a more skilled and engaged workforce.

- Talent Acquisition: BBSI helps businesses identify and attract candidates with in-demand skills.

- Training & Development: Programs are offered to upskill existing employees and bridge knowledge gaps.

- Retention Strategies: Focus on improving employee engagement and reducing turnover in a competitive market.

- Industry Specific Needs: Tailored solutions to address shortages in fields like advanced manufacturing and cybersecurity.

Social Responsibility and Ethical Practices

Societal expectations for businesses to act responsibly and ethically are growing, impacting how companies manage their employees and operations. This includes a stronger focus on fair labor practices, environmental sustainability, and community engagement.

BBSI can assist clients in creating and implementing policies that reflect these evolving values. This proactive approach not only bolsters a company's public image but also makes it more appealing to a workforce increasingly prioritizing purpose-driven employment.

For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from companies demonstrating strong CSR initiatives. Similarly, a 2025 report found that 65% of job seekers consider a company's ethical standing a significant factor in their decision to apply.

BBSI's expertise helps businesses navigate these social shifts by:

- Developing robust CSR strategies that resonate with stakeholders.

- Ensuring compliance with ethical labor standards and regulations.

- Facilitating employee engagement in socially responsible activities.

- Communicating a company's commitment to ethical practices effectively.

Societal expectations for businesses to act responsibly and ethically are growing, impacting how companies manage their employees and operations. This includes a stronger focus on fair labor practices, environmental sustainability, and community engagement.

BBSI can assist clients in creating and implementing policies that reflect these evolving values. This proactive approach not only bolsters a company's public image but also makes it more appealing to a workforce increasingly prioritizing purpose-driven employment.

For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from companies demonstrating strong CSR initiatives. Similarly, a 2025 report found that 65% of job seekers consider a company's ethical standing a significant factor in their decision to apply.

BBSI's expertise helps businesses navigate these social shifts by developing robust CSR strategies, ensuring compliance with ethical labor standards, facilitating employee engagement in socially responsible activities, and effectively communicating a company's commitment to ethical practices.

| Societal Factor | 2024/2025 Data Point | Impact on Businesses | BBSI's Role |

|---|---|---|---|

| Corporate Social Responsibility (CSR) Importance | 70% of consumers prefer companies with strong CSR initiatives (2024). | Enhanced brand reputation and customer loyalty. | Develop and implement CSR strategies. |

| Ethical Employment as a Job Seeker Priority | 65% of job seekers consider ethics when choosing an employer (2025). | Attracting and retaining top talent. | Ensure compliance with ethical labor standards. |

| Work-Life Balance Expectations | 70% of employees prioritize work-life balance (2024 survey). | Increased employee satisfaction and retention. | Advise on flexible work policies and benefits. |

| Gig Economy Growth | Over 60 million Americans in gig work by 2024. | Need for flexible workforce management and compliance. | Assist with independent contractor compliance. |

Technological factors

The surge in automated payroll and HR solutions is reshaping how companies manage their workforce. For BBSI, this means a critical need to integrate advanced automation to streamline client services. Think about how much faster payroll can be processed when systems handle the heavy lifting, reducing the chance of manual errors that can frustrate employees and create compliance headaches.

By embracing these technological advancements, BBSI can boost its efficiency, allowing for quicker turnaround times and more accurate data management. This not only benefits BBSI by optimizing its operations but also provides clients with a more reliable and cost-effective HR outsourcing experience. For instance, a report from Gartner in 2024 projected that by 2025, 60% of HR tasks will be automated, highlighting the urgency for companies like BBSI to adapt.

The widespread adoption of cloud-based HRIS and payroll systems is fundamentally reshaping how businesses manage their workforce. These platforms, like those BBSI leverages, offer unparalleled scalability, allowing companies to easily adjust their HR and payroll operations as they grow or shrink. Accessibility is another major benefit, enabling authorized users to manage employee data and processes from anywhere, at any time.

Real-time data is a game-changer provided by these cloud solutions. This means that information on employee onboarding, payroll processing, benefits administration, and time tracking is instantly updated and available. For BBSI clients, this translates to more accurate payroll, better compliance, and quicker decision-making. For instance, the global HR tech market was valued at approximately $24.3 billion in 2023 and is projected to grow significantly, indicating strong market demand for these advanced systems.

BBSI's strategic advantage lies in its capacity to either offer its own sophisticated cloud-based HRIS and payroll solutions or seamlessly integrate with leading platforms. This ensures clients receive modern, efficient, and user-friendly services that streamline complex HR functions. The ability to provide secure, integrated cloud technology is no longer a luxury but a necessity for delivering competitive business management support in today's digital landscape.

Data analytics is transforming how businesses manage their workforce. By leveraging insights from HR and payroll data, companies can make smarter decisions about staffing, labor costs, and regulatory adherence. For instance, in 2024, businesses are increasingly using predictive analytics to forecast staffing needs, aiming to reduce overspending on temporary staff by up to 15%.

BBSI's advanced reporting and analytical tools offer clients crucial business intelligence. This allows for a deeper understanding of workforce trends, employee performance, and overall operational efficiency. This enhanced visibility is critical for strategic planning, with companies reporting a 10% improvement in strategic alignment after implementing robust business intelligence solutions.

Cybersecurity and Data Privacy

BBSI's reliance on managing sensitive employee and financial data necessitates strong cybersecurity. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial risk. Investing in advanced security protocols is crucial to safeguard BBSI and its clients from costly breaches and potential legal penalties.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is non-negotiable. Failure to comply can result in significant fines; for instance, GDPR fines can reach up to 4% of annual global revenue. BBSI must ensure its practices align with these mandates to maintain trust and avoid legal repercussions.

Artificial Intelligence and Machine Learning Applications

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming how businesses operate, particularly in human resources. These technologies are increasingly used for talent acquisition, creating more efficient and data-driven recruitment processes. For instance, AI can sift through thousands of resumes in seconds, identifying top candidates based on predefined criteria. In 2024, companies leveraging AI in recruitment reported an average 15% reduction in time-to-hire.

Furthermore, AI and ML are enhancing personalized employee experiences. By analyzing employee data, companies can tailor training programs, benefits, and career paths to individual needs, boosting engagement and retention. Predictive HR analytics, powered by ML, can forecast employee turnover, identify potential skill gaps, and optimize workforce planning. BBSI can enhance its client services by integrating AI-powered tools for more sophisticated talent management and proactive HR strategies, positioning itself as an innovator in the field.

The adoption of AI in HR is a significant trend. By the end of 2025, it's projected that over 70% of large enterprises will have implemented AI-driven HR solutions. This shift presents an opportunity for BBSI to:

- Enhance talent acquisition with AI-powered screening and matching tools.

- Develop personalized employee development plans using ML-driven insights.

- Offer predictive analytics to clients for proactive workforce management and retention strategies.

- Streamline HR operations through AI-driven automation of routine tasks.

Technological advancements are rapidly automating HR and payroll functions, making efficiency and data accuracy paramount. BBSI's ability to integrate these sophisticated cloud-based systems and leverage AI for talent acquisition and personalized employee experiences is key to its competitive edge. The increasing reliance on data analytics for workforce insights and the critical need for robust cybersecurity to protect sensitive information are also defining technological factors.

| Technology Trend | Impact on BBSI | 2024/2025 Data/Projections |

|---|---|---|

| Automation in HR/Payroll | Streamlined operations, reduced errors, faster processing | Gartner projected 60% of HR tasks automated by 2025 |

| Cloud-based HRIS/Payroll | Scalability, accessibility, real-time data for clients | Global HR tech market valued at $24.3 billion in 2023, with significant growth |

| AI/ML in HR | Enhanced talent acquisition, personalized employee experiences, predictive analytics | AI in recruitment reduced time-to-hire by 15% in 2024; 70% of large enterprises to implement AI-driven HR by end of 2025 |

| Data Analytics | Improved workforce insights, strategic decision-making | Businesses using predictive analytics aim to reduce temporary staff overspending by 15% |

| Cybersecurity | Protection of sensitive data, compliance with regulations | Global average cost of data breach reached $4.45 million in 2024 |

Legal factors

BBSI's core business hinges on navigating the intricate web of federal, state, and local labor and employment laws. Staying ahead of constant changes in regulations like the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA), Americans with Disabilities Act (ADA), and Equal Employment Opportunity (EEO) laws is paramount. For instance, the Department of Labor frequently updates wage and hour interpretations, impacting payroll and overtime calculations for businesses across the US.

Maintaining expert legal knowledge and continuously updating its systems and client advisories is crucial for BBSI to help clients avoid significant penalties and litigation. Failure to comply with these evolving mandates can result in substantial fines; for example, violations of wage and hour laws can lead to back pay awards and civil penalties that can quickly escalate. BBSI's role is to proactively manage this compliance burden for its clients.

Workers' compensation regulations vary significantly by state, impacting BBSI's core business of providing payroll and HR solutions that include workers' comp management. For instance, in 2024, states like California saw adjustments to their average weekly wage rates, directly affecting premium calculations and claim payouts. BBSI must navigate these diverse state-specific rules on claims filing deadlines, medical treatment guidelines, and employer reporting requirements to ensure compliance and efficient service for its clients.

BBSI must navigate a complex landscape of data privacy laws, including the California Consumer Privacy Act (CCPA) and similar state-level regulations being enacted across the US. These laws dictate how BBSI collects, uses, and protects sensitive employee and client information, making compliance a critical operational imperative.

Failure to adhere to these stringent data privacy mandates can result in significant legal penalties, with fines under CCPA potentially reaching $7,500 per intentional violation. Maintaining robust data protection practices is therefore essential not only for legal adherence but also for preserving the trust clients place in BBSI's data management capabilities.

Tax Compliance and Payroll Regulations

BBSI's core offering involves navigating the complex landscape of federal, state, and local tax laws, particularly concerning payroll and employment taxes. Staying abreast of evolving tax codes, such as potential adjustments to FICA taxes or state unemployment insurance rates, is crucial for maintaining client compliance. For instance, in 2024, the Social Security tax wage base increased to $168,600, impacting payroll calculations for many businesses.

The dynamic nature of tax legislation means BBSI must continuously adapt its systems and client guidance. For example, changes in state-specific withholding requirements or new reporting mandates for contractor payments, like those that might emerge from updated IRS forms or state tax agency directives, demand proactive adjustments. Failure to comply can result in significant penalties for both BBSI and its clients, underscoring the importance of meticulous tracking.

- Federal Tax Compliance: Adherence to IRS regulations for income tax withholding, Social Security, and Medicare taxes.

- State and Local Tax Laws: Managing varying state income tax rates, unemployment insurance contributions, and local payroll taxes.

- Evolving Tax Codes: Continuous monitoring of legislative changes impacting payroll processing and tax liabilities.

- Reporting Requirements: Ensuring accurate and timely filing of all necessary tax forms, such as W-2s and 941s.

Industry-Specific Licensing and Certifications

As a Professional Employer Organization (PEO), BBSI must navigate a complex web of state-specific licensing and registration requirements. These regulations are crucial for maintaining legal operational status and facilitating expansion into new markets. For instance, in 2024, PEOs operating across multiple states often need to comply with differing state labor laws and PEO registration mandates, which can include bonding requirements or proof of financial solvency.

Maintaining compliance with these industry-specific legal frameworks is non-negotiable for BBSI's continued success and growth. Failure to secure or renew necessary licenses can result in significant penalties and operational disruptions. By 2025, the regulatory landscape for PEOs is expected to become even more intricate, with some states potentially introducing new certification standards related to data security and client protection.

- State Licensing: BBSI must hold appropriate PEO licenses in each state where it provides services, as regulations vary significantly by jurisdiction.

- Certification Requirements: Certain states may require PEOs to obtain specific certifications, such as those from the Employer Services Assurance Corporation (ESAC), to demonstrate financial stability and ethical practices.

- Compliance Burden: The evolving nature of labor laws and PEO regulations necessitates ongoing investment in legal and compliance expertise to ensure adherence across all operating regions.

BBSI operates within a heavily regulated environment, requiring constant adaptation to federal, state, and local labor laws. Staying compliant with legislation like the FLSA, FMLA, and ADA is critical, as evidenced by the Department of Labor's ongoing updates to wage and hour interpretations, which directly impact payroll processing for businesses nationwide.

The company must also navigate a patchwork of state-specific workers' compensation laws, with examples like California's 2024 adjustments to average weekly wage rates influencing premium calculations and claim payouts. Furthermore, BBSI is subject to data privacy regulations such as the CCPA, where non-compliance can lead to substantial fines, potentially $7,500 per intentional violation, underscoring the need for robust data protection practices.

BBSI's adherence to evolving tax codes, including the 2024 Social Security tax wage base increase to $168,600, is paramount for accurate payroll and tax liability management. The company's role as a PEO also necessitates compliance with varying state licensing and registration requirements, with potential new certification standards anticipated by 2025 related to data security.

Environmental factors

BBSI is seeing a growing demand from clients and stakeholders for demonstrable corporate social responsibility. While BBSI's core business of providing HR and payroll services isn't directly tied to environmental impact, the expectation for ethical operations is rising. For instance, in 2024, a significant portion of surveyed businesses indicated that a vendor's CSR practices influenced their purchasing decisions, with many prioritizing sustainability and fair labor.

This trend means BBSI needs to ensure its own operational practices align with these expectations. Demonstrating a commitment to ethical sourcing, employee well-being, and community engagement can bolster BBSI's brand reputation. Companies that actively showcase their CSR efforts, such as through transparent reporting or participation in social initiatives, often find it enhances their appeal to a broader client base, particularly those with strong ESG (Environmental, Social, and Governance) mandates.

The increasing adoption of remote and hybrid work models, spurred partly by environmental concerns such as reducing carbon emissions from commuting, directly influences the demand for traditional office spaces. This shift means BBSI's clients may see reduced operational footprints, impacting their real estate needs and associated environmental impacts.

BBSI can proactively guide its clients in effectively managing these distributed workforces, offering expertise that aligns with growing environmental consciousness and sustainability goals. For instance, a significant portion of the workforce now operates remotely at least part-time, with studies in 2024 indicating that over 60% of jobs can be done remotely, a trend that continues to shape business operations and their environmental externalities.

As BBSI's small and medium-sized business clients increasingly embrace sustainability, there's a growing need for HR policies that reflect these values. This could include programs encouraging green commuting or initiatives focused on workplace waste reduction.

BBSI's expertise in HR guidance positions it to effectively support clients in developing and implementing these evolving internal policies. For example, as of early 2024, a significant portion of SMBs are reporting increased customer demand for sustainable practices, directly influencing their operational and HR strategies.

Regulatory Pressure on Client Industries

BBSI's client base includes businesses in sectors like manufacturing and construction, which face increasing environmental regulatory pressure. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations impacting emissions and waste management across these industries. While BBSI doesn't directly handle environmental compliance, its expertise in workforce management and risk mitigation can help clients navigate the broader operational challenges arising from these regulations.

These regulatory demands can influence a client's operational costs and strategic planning. For example, a manufacturing client might need to invest in new equipment or processes to meet stricter air quality standards, impacting their overall budget and potentially their workforce needs. BBSI's ability to advise on efficient staffing and compliance with labor laws can indirectly support these clients in adapting to such shifts.

- Increased Compliance Costs: Industries like manufacturing saw compliance costs rise, with some estimates suggesting significant annual expenditures on environmental regulations.

- Workforce Adaptability: Clients in regulated industries may require workforce adjustments, such as training for new environmental protocols or hiring specialized personnel, which BBSI can assist with.

- Risk Mitigation: By ensuring robust workforce policies, BBSI helps clients minimize risks associated with labor practices, which is particularly important when operating in highly regulated environments.

Resource Efficiency in Operations

BBSI's commitment to environmental responsibility is evident in its operational efficiency. By actively reducing paper consumption and optimizing energy usage across its facilities, BBSI not only lowers its environmental footprint but also enhances its corporate reputation. For instance, many companies in the professional services sector are increasingly adopting digital workflows, aiming for paperless offices. In 2024, a significant portion of businesses reported a reduction in paper usage by over 20% through digital transformation initiatives.

These internal sustainability efforts translate directly into operational cost savings. Optimized energy consumption, through measures like LED lighting retrofits and smart building management systems, can lead to substantial reductions in utility bills. A study by the U.S. Department of Energy in 2024 indicated that commercial buildings implementing energy efficiency upgrades could see savings of 10-30% on their energy costs.

- Reduced Waste: Implementing digital document management systems minimizes paper waste, a common environmental concern for service-based businesses.

- Energy Savings: Investing in energy-efficient office equipment and practices directly lowers operational expenses and carbon emissions.

- Enhanced Brand Image: Demonstrating a tangible commitment to sustainability appeals to environmentally conscious clients and employees, strengthening BBSI's market position.

- Operational Streamlining: Resource efficiency often goes hand-in-hand with process improvements, leading to more streamlined and cost-effective operations.

Environmental factors are increasingly shaping business operations, influencing client demands for sustainability and driving regulatory changes. BBSI's clients, particularly in sectors like manufacturing, face growing pressure to comply with environmental regulations, impacting their operational costs and workforce needs. For instance, in 2024, many businesses reported increased spending on environmental compliance, with some sectors seeing significant annual expenditures.

The shift towards remote work, partly driven by environmental concerns like reducing carbon footprints, also affects client real estate needs and operational footprints. BBSI can guide clients in managing these distributed workforces, aligning with sustainability goals. Studies in 2024 showed that over 60% of jobs could be performed remotely, a trend that continues to reshape business operations and their environmental impacts.

BBSI's own operational efficiency, through reduced paper consumption and optimized energy usage, not only lowers its environmental footprint but also enhances its market appeal. Many companies in 2024 reported significant reductions in paper usage via digital initiatives. Furthermore, energy efficiency upgrades in commercial buildings can yield substantial savings, with some estimates showing 10-30% reductions in energy costs.

| Environmental Factor | Impact on Clients | BBSI's Role/Opportunity |

|---|---|---|

| Sustainability Demand | Influences purchasing decisions; clients prioritize vendors with strong CSR. | Enhance brand reputation by showcasing ethical operations and ESG alignment. |

| Remote Work Trend | Reduced office space needs; altered operational footprints. | Guide clients in managing distributed workforces and associated environmental externalities. |

| Environmental Regulations | Increased compliance costs and need for workforce adaptability in sectors like manufacturing. | Advise on efficient staffing and risk mitigation related to labor practices in regulated environments. |

| Operational Efficiency | Focus on reducing waste and energy consumption for cost savings and improved image. | Demonstrate commitment through digital workflows and energy-efficient practices, appealing to eco-conscious clients. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable financial institutions, and leading market research firms. We ensure every insight into political, economic, social, technological, legal, and environmental factors is derived from credible and current data.