BBSI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBSI Bundle

BBSI's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for navigating the market effectively.

The complete Porter's Five Forces Analysis for BBSI offers a comprehensive, data-driven framework to dissect these pressures. Unlock actionable insights to drive smarter decision-making and gain a strategic edge.

Suppliers Bargaining Power

BBSI's ability to secure workers' compensation insurance is a critical component of its service offering, making insurance carriers powerful suppliers. While the workers' compensation market has been relatively stable, with some insurers reporting healthy profits, the landscape is shifting. Factors like rising wage inflation and increasing medical costs are creating upward pressure on premiums.

This inflationary environment could empower insurance carriers to demand higher rates from PEOs like BBSI in 2025. For instance, the U.S. Bureau of Labor Statistics reported a 4.1% increase in wages for private industry workers in the year ending December 2023. Simultaneously, medical inflation, as measured by the Consumer Price Index for medical care, also saw an uptick. These trends directly impact the cost of providing workers' compensation coverage, giving insurers greater leverage in negotiations with PEOs.

The increasing reliance on advanced HR technology, including AI and sophisticated analytics, positions technology providers as a significant force in the PEO industry. BBSI, like its competitors, depends on these specialized vendors for cutting-edge solutions. For instance, the global HR technology market was projected to reach over $30 billion in 2024, highlighting the substantial investment and innovation in this sector.

The specialized and rapidly evolving nature of these HR tech solutions can grant considerable bargaining power to suppliers. If only a few vendors offer highly integrated systems with advanced AI capabilities, they can command higher prices or dictate terms. This concentration of expertise and limited availability of truly differentiated offerings can shift leverage towards the technology providers.

BBSI's reliance on specialized expertise, particularly in legal and compliance fields, directly impacts supplier bargaining power. The need for professionals adept at navigating intricate and evolving employment laws means that a scarcity of such talent can drive up costs. For instance, the demand for specialized HR and legal consultants, especially those with in-depth knowledge of state and federal labor regulations, remained robust through 2024, reflecting the ongoing complexity of compliance for businesses.

Dependence on Healthcare Benefit Providers

BBSI's ability to offer comprehensive employee benefits, a cornerstone of its service, hinges on its relationships with healthcare and other benefit providers. The market power and concentration of these suppliers directly affect the cost and quality of the benefits BBSI can extend to its clients. This dependency can significantly shape BBSI's competitive advantage and its overall value proposition.

The bargaining power of these healthcare benefit providers is a critical factor for BBSI. For instance, in 2024, the average annual premium for employer-sponsored family health coverage in the U.S. reached an estimated $24,000, according to the Kaiser Family Foundation. This figure highlights the substantial costs involved and the potential leverage held by insurance carriers and healthcare networks that BBSI must partner with to assemble its benefit packages.

- Supplier Concentration: A few dominant insurance carriers or large hospital networks can dictate terms, increasing costs for BBSI.

- Uniqueness of Offering: If specialized or niche benefits are required, BBSI might have fewer provider options, strengthening supplier power.

- Switching Costs: The administrative effort and potential disruption involved in changing benefit providers can make BBSI hesitant to switch, even if terms are unfavorable.

- Threat of Forward Integration: While less common in this sector, a powerful provider could theoretically develop its own PEO-like services, bypassing intermediaries like BBSI.

Switching Costs for BBSI's Internal Systems

BBSI's reliance on specific internal technology and insurance platforms can significantly impact supplier bargaining power. If these systems are deeply integrated, the cost and effort involved in migrating to new providers become substantial barriers.

This integration creates a lock-in effect, where switching to alternative suppliers is complex and expensive. For instance, if BBSI's core client management and payroll processing rely on proprietary software from a single vendor, that vendor gains considerable leverage in pricing and contract terms.

- High Integration Costs: The expense associated with data migration, system re-configuration, and employee retraining can deter switching.

- Operational Disruption: A change in critical systems could lead to temporary disruptions in service delivery, impacting client satisfaction.

- Vendor Lock-in: Dependence on a specific vendor's technology can limit BBSI's flexibility in negotiating terms or adopting more cost-effective solutions.

The bargaining power of suppliers for BBSI is a significant consideration, particularly concerning insurance carriers and HR technology providers. High switching costs and the specialized nature of these services can give suppliers considerable leverage.

In 2024, the U.S. workers' compensation insurance market faced upward pressure on premiums due to rising wage inflation, which saw private industry wages increase by 4.1% in the year ending December 2023. Similarly, the HR technology market was projected to exceed $30 billion in 2024, indicating substantial investment and supplier importance.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on BBSI |

|---|---|---|

| Insurance Carriers (Workers' Comp) | Rising medical and wage costs, market stability | Potential for higher premiums, reduced negotiation flexibility for BBSI |

| HR Technology Providers | Specialized, rapidly evolving solutions, AI integration | Ability to command higher prices, dictate terms due to limited differentiated offerings |

| Benefit Providers (Healthcare) | Supplier concentration, average premium costs | Increased costs for BBSI's benefit packages, affecting its value proposition |

What is included in the product

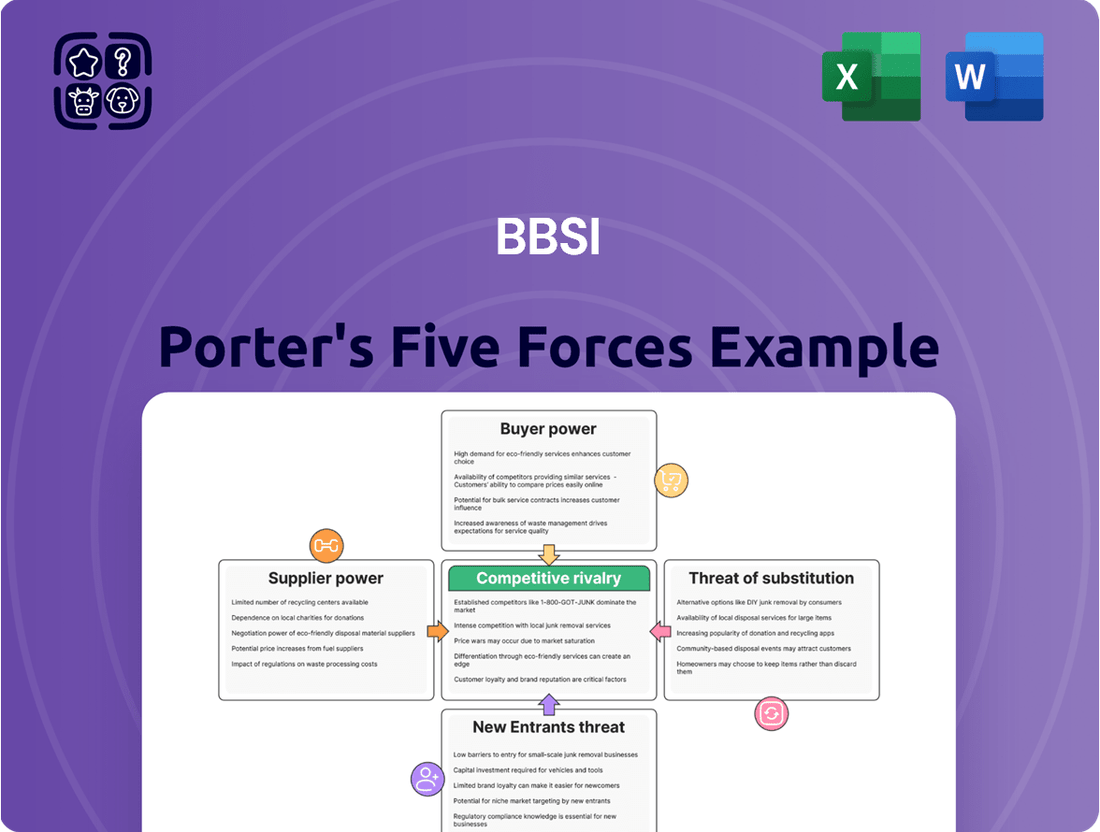

BBSI's Porter's Five Forces analysis meticulously examines the competitive intensity, buyer and supplier power, threat of new entrants, and availability of substitutes impacting BBSI's strategic positioning.

Instantly visualize competitive intensity with a dynamic, interactive dashboard that simplifies complex market dynamics.

Customers Bargaining Power

BBSI's customer base is largely comprised of small and medium-sized businesses (SMBs). This fragmentation means that no single SMB customer accounts for a significant portion of BBSI's total revenue. Consequently, individual customers have limited leverage to negotiate terms or pricing, as BBSI's business model is not dependent on any one client.

Small and medium-sized businesses (SMBs) are increasingly aware of the advantages offered by Professional Employer Organizations (PEOs) and other HR outsourcing solutions. This collective knowledge empowers them, turning individual small entities into a more formidable customer base.

The market for HR outsourcing is expanding, with numerous PEOs and alternative service providers emerging. In 2024, the HR outsourcing market was valued at approximately $29.1 billion, demonstrating significant growth and a wide array of options available to businesses seeking to manage their HR functions.

This abundance of choice allows SMBs to readily compare services, pricing, and support levels from different providers. Consequently, customers gain greater leverage to negotiate favorable terms and select the PEO or HR service that best aligns with their specific needs and budget, thereby increasing their bargaining power.

The bargaining power of customers in the PEO industry is significantly influenced by relatively low switching costs. While moving from one Professional Employer Organization (PEO) to another, or even bringing HR functions back in-house, requires some administrative effort, it’s generally not prohibitively complex for small and medium-sized businesses (SMBs).

This perceived ease of transition empowers customers. When SMBs believe they can switch PEO providers without incurring substantial financial penalties or operational disruptions, they gain leverage. This leverage translates into a stronger position to negotiate for better pricing, improved service levels, and more favorable contract terms.

For instance, in 2024, the PEO market is highly competitive, with numerous providers vying for the SMB segment. This competitive landscape, coupled with manageable switching processes, means customers can readily compare offerings and move to a provider that better meets their needs, thereby increasing their bargaining power.

Demand for Customized and Value-Added Services

Customers are increasingly demanding personalized Professional Employer Organization (PEO) services and integrated solutions that go beyond standard payroll and regulatory adherence. This includes a growing need for sophisticated data analytics and robust talent management capabilities.

The desire for bespoke, high-value offerings allows clients to effectively negotiate with PEO providers, prioritizing those who can address their dynamic strategic human resources requirements. For instance, a 2024 survey indicated that 65% of businesses view customized HR solutions as a key factor in selecting a PEO partner.

This shift in client expectations means that PEOs capable of delivering specialized, value-added services gain a competitive edge, while those offering only basic packages may face increased price pressure from informed buyers.

Key demands driving this trend include:

- Personalized HR strategies tailored to specific business goals.

- Advanced workforce analytics for better decision-making.

- Integrated talent acquisition and development programs.

- Scalable solutions that adapt to business growth and change.

Price Sensitivity of Small Businesses

Small and medium-sized businesses (SMBs) often navigate tighter financial landscapes, making them particularly attentive to the costs associated with essential services like administrative support. This inherent price sensitivity directly translates into increased bargaining power for these customers.

For Professional Employer Organizations (PEOs) such as BBSI, this means a constant need to present compelling value propositions. Demonstrating a clear return on investment (ROI) becomes paramount, not just for acquiring new clients but also for retaining existing ones in a competitive market. In 2024, many PEOs reported that competitive pricing and transparent cost structures were key differentiators in client acquisition.

- SMBs' Budget Constraints: Many small businesses operate with limited capital, making them highly responsive to price changes for outsourced services.

- Demand for ROI: Customers expect tangible benefits and measurable cost savings from PEO services to justify their expenditure.

- Competitive Pricing Pressure: PEOs face pressure to offer competitive rates to attract and keep SMB clients who can easily switch providers.

- Service Value Justification: The ability to clearly articulate the value and cost-effectiveness of services directly impacts a PEO's ability to negotiate and retain business.

The bargaining power of customers in the PEO sector is elevated by the increasing availability of specialized HR solutions and a growing client demand for customized services. This trend, evident in 2024 with 65% of businesses prioritizing tailored HR, empowers SMBs to negotiate for value-added offerings beyond basic payroll.

Furthermore, the inherent price sensitivity of SMBs, driven by tighter financial constraints, amplifies their negotiating leverage. In 2024, competitive pricing and transparent cost structures were cited as key differentiators by PEOs, highlighting the direct impact of customer price consciousness on market dynamics.

The competitive landscape of the HR outsourcing market, valued at approximately $29.1 billion in 2024, coupled with manageable switching costs, allows customers to readily compare and move between providers. This ease of transition strengthens their position to demand better terms and pricing.

What You See Is What You Get

BBSI Porter's Five Forces Analysis

This preview showcases the comprehensive BBSI Porter's Five Forces Analysis you will receive immediately after purchase, ensuring you get the exact, professionally crafted document without any alterations or placeholders. You can trust that the insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products are presented in their complete, ready-to-use format. This means you'll gain instant access to the full, professionally formatted analysis the moment your transaction is complete, allowing you to leverage its strategic value without delay.

Rivalry Among Competitors

The PEO and HR outsourcing market is quite diverse, featuring a broad range of companies. You have major national players like ADP and Paychex, alongside many smaller regional and specialized firms. This creates a competitive landscape with numerous options for businesses seeking HR support.

Despite its fragmented nature, the industry is actively consolidating. Mergers and acquisitions are common, meaning the market is gradually shifting towards fewer, larger companies. This trend suggests that while there are many players now, the future may see more integrated and powerful competitors emerge.

The Professional Employer Organization (PEO) market is on a strong growth trajectory, with expectations for continued expansion through 2025 and beyond. This robust growth environment can soften competitive rivalry.

Instead of solely battling for existing clients, companies in this sector can more readily acquire new ones, which naturally reduces the intensity of direct price competition. For instance, the PEO market was valued at approximately $32.3 billion in 2023 and is projected to reach $53.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.6% during this period, according to some market analyses.

Competitive rivalry in the PEO space is intensified by service differentiation. Companies are actively distinguishing themselves through specialized offerings, leveraging advanced technology like AI and data analytics, and providing robust talent management platforms. This focus on unique value propositions helps them capture market share.

BBSI, for instance, emphasizes its distinct operational platform and highly personalized service as key differentiators. This approach allows them to stand out in a crowded market by offering tailored solutions that go beyond standard PEO services, thereby fostering stronger client relationships and loyalty.

Client Retention as a Competitive Factor

Client retention is a significant competitive differentiator, as it directly impacts a company's stability and growth trajectory. BBSI's success in retaining clients, evidenced by its consistent client base, underscores its capacity to provide enduring value and cultivate strong, long-term partnerships. This focus on retention helps BBSI navigate the competitive landscape by lessening the pressure to constantly chase new business, which can often lead to price wars.

BBSI's strong client retention is a testament to its service model, which aims to be more than just a vendor but a strategic partner. For instance, in 2023, BBSI reported a client retention rate of over 90% for its core payroll and HR services. This high rate suggests that clients find substantial ongoing benefit, reducing the likelihood of them switching to competitors based solely on marginal price differences. This stability allows BBSI to invest more in service enhancements rather than client acquisition.

- High client retention reduces the continuous pressure and cost associated with new customer acquisition.

- BBSI's ability to maintain a loyal client base signifies superior service delivery and value proposition.

- Strong retention mitigates intense rivalry that might otherwise be driven purely by price competition.

- In 2023, BBSI achieved a client retention rate exceeding 90% for its core services.

Competitive Landscape with Diverse Competitors

BBSI navigates a highly fragmented market, facing competition from established Professional Employer Organizations (PEOs), agile staffing agencies, and broad-spectrum HR consulting firms. This means BBSI must continuously differentiate its value proposition to stand out.

The intensity of this rivalry necessitates constant innovation. For instance, in 2024, many PEOs are focusing on integrated technology platforms to streamline HR processes, a trend BBSI also prioritizes to retain clients and attract new ones.

BBSI's competitive set includes companies with varying business models, from those offering highly specialized outsourced HR functions to those providing comprehensive payroll and benefits administration. This diversity demands strategic flexibility.

- BBSI competes with over 900 PEOs in the U.S. market.

- Staffing agencies, a key competitor segment, generated an estimated $130 billion in revenue in 2023.

- General HR consulting firms offer a wide array of services, creating indirect competitive pressure.

The PEO market is highly competitive, with numerous players ranging from national giants to niche regional providers. This fragmentation means businesses have many choices, intensifying rivalry.

However, the industry's growth, projected to reach $53.7 billion by 2030, can somewhat temper direct price wars as new clients are available. BBSI differentiates itself through its operational platform and personalized service, aiming to build loyalty rather than solely competing on price.

BBSI's success is further bolstered by its impressive client retention, exceeding 90% for core services in 2023. This high retention reduces the need for constant new client acquisition, a costly endeavor that often fuels aggressive pricing strategies among competitors.

| Competitor Type | 2023 Market Data | BBSI's Competitive Strategy |

|---|---|---|

| PEOs (Total Market) | Valued at ~$32.3 billion | Focus on operational platform and personalized service |

| Staffing Agencies | Generated ~$130 billion in revenue | High client retention (>90% in 2023) |

| HR Consulting Firms | Diverse service offerings | Technological integration (AI, data analytics) |

SSubstitutes Threaten

Businesses, particularly larger small and medium-sized businesses (SMBs) or those with specialized internal knowledge, can opt to handle their payroll, HR, and compliance tasks in-house. This alternative directly bypasses the need for a Professional Employer Organization (PEO).

However, this internal management route demands substantial resources, including dedicated staff, investment in HR technology, and ongoing training to stay current with evolving regulations. For instance, in 2024, the average cost for a dedicated HR manager in the US can range from $70,000 to $120,000 annually, plus benefits, making it a significant overhead for many businesses compared to PEO fees.

The availability of robust HR software solutions also presents a viable substitute. Companies can leverage platforms that automate payroll processing, benefits administration, and compliance tracking, thereby reducing reliance on external PEO services. This trend is reflected in the growing market for HR tech, which was projected to reach over $34 billion globally by the end of 2024.

The rise of sophisticated standalone HR software and cloud-based Human Capital Management (HCM) platforms presents a significant threat of substitutes for PEO services. These solutions, like Workday HCM or ADP Workforce Now, empower businesses to manage payroll, benefits administration, and employee onboarding internally. For instance, in 2024, the global HCM market was valued at over $25 billion, indicating a strong and growing adoption of these self-service technologies.

This increased accessibility to powerful HR tools allows companies to bypass the comprehensive service model of a PEO, opting instead for a more customizable and potentially cost-effective approach. Businesses can select specific modules they need, such as payroll processing or benefits management, rather than engaging a full-service provider. This modularity directly challenges the integrated value proposition of a PEO by offering specialized, often cheaper, alternatives for individual HR functions.

Businesses increasingly turn to specialized consulting firms and independent freelancers for specific HR functions like legal compliance or talent acquisition. This unbundled approach offers flexibility, allowing companies to cherry-pick services rather than committing to a full-service PEO, potentially reducing costs for targeted needs. For instance, the HR consulting market in 2024 is projected to grow, with specialized firms capturing a significant share by offering niche expertise that integrated PEOs may not match.

Temporary Staffing and Recruitment Agencies

Temporary staffing and recruitment agencies present a significant threat of substitution for PEO services. Businesses can bypass the co-employment model by engaging these agencies for specific staffing needs, accessing labor without the comprehensive HR, payroll, and risk management support a PEO offers. For instance, in 2024, the global temporary staffing market was valued at over $500 billion, indicating a substantial alternative for companies seeking flexible workforce solutions.

These agencies focus primarily on talent acquisition and placement, offering a more streamlined, transactional approach compared to the integrated service model of a PEO. This can be attractive to companies that already have robust internal HR departments or prefer to manage payroll and risk independently.

- Lower perceived commitment: Businesses can engage staffing agencies for short-term projects or seasonal demands without the long-term HR integration associated with PEOs.

- Cost-effectiveness for specific needs: For companies requiring only recruitment or temporary placement, agencies can be more cost-effective than a full-service PEO.

- Market size as an indicator: The significant size of the temporary staffing market underscores its viability as a substitute for certain PEO functions.

Direct Employer-Managed Workers' Compensation

While complex, some larger businesses may opt to manage their workers' compensation insurance and claims directly, bypassing a PEO for this crucial risk mitigation. This path demands substantial in-house expertise and financial depth to handle potential liabilities effectively. For instance, in 2024, the average cost of a workers' compensation claim in the construction industry, a sector often facing higher risks, could range from $30,000 to $60,000 depending on the severity, requiring significant reserves for self-managed programs.

The threat of substitutes for BBSI's PEO services in workers' compensation management is present, particularly from larger, self-insured entities. These companies possess the scale and resources to establish internal claims administration and safety programs. For example, in 2023, over 2,000 U.S. companies utilized self-insurance for workers' compensation, demonstrating a viable alternative for businesses with robust risk management capabilities.

BBSI's value proposition in this area includes simplifying complex regulations and providing access to specialized claims adjusters and legal counsel, which can be costly for individual businesses to replicate. However, the potential cost savings and direct control offered by self-management remain a significant substitute, especially for companies with low claim frequency and severity, or those with a strong internal risk management culture. The ability to directly invest in preventative safety measures and influence claims outcomes can be a powerful draw.

Key considerations for businesses evaluating this substitute include:

- Internal Expertise: The necessity of having dedicated, knowledgeable staff for claims handling, regulatory compliance, and safety program development.

- Financial Capacity: The ability to maintain adequate reserves to cover potential claim payouts, legal fees, and administrative costs.

- Risk Tolerance: The company's willingness to assume the full financial risk associated with workplace injuries.

- Administrative Burden: The significant time and resources required to manage all aspects of a workers' compensation program.

The threat of substitutes for PEO services primarily stems from businesses managing HR functions internally or utilizing specialized HR software. Companies can opt to build their own HR departments, invest in HR technology, or engage with niche service providers. These alternatives offer flexibility and potentially lower costs for specific needs.

The growing HR tech market, projected to exceed $34 billion globally by the end of 2024, highlights the increasing availability and adoption of tools that automate payroll, benefits, and compliance. Similarly, the global HCM market, valued at over $25 billion in 2024, showcases a strong trend towards self-service HR solutions.

Furthermore, specialized consulting firms and freelancers provide targeted expertise in areas like legal compliance or talent acquisition, allowing businesses to unbundle HR services. Temporary staffing agencies also offer an alternative for workforce management, with the global temporary staffing market valued at over $500 billion in 2024, providing a significant substitute for certain PEO functions.

| Substitute Category | Key Characteristics | 2024 Market Data/Relevance |

|---|---|---|

| In-house HR Management | Requires significant internal resources, staff, and technology investment. Offers direct control. | Average US HR Manager salary: $70,000 - $120,000+ annually. |

| HR Software & HCM Platforms | Automates payroll, benefits, compliance; offers modularity and customization. | Global HR Tech Market: >$34 billion. Global HCM Market: >$25 billion. |

| Specialized HR Consulting/Freelancers | Provides niche expertise for specific functions (legal, talent acquisition). Flexible, cost-effective for targeted needs. | HR Consulting Market: Projected growth in 2024, capturing niche expertise. |

| Temporary Staffing Agencies | Focuses on talent acquisition and placement; transactional approach. Bypasses co-employment. | Global Temporary Staffing Market: >$500 billion. |

Entrants Threaten

The PEO industry presents a formidable threat of new entrants due to significant capital demands. Companies looking to enter must invest heavily in underwriting capabilities, especially when assuming workers' compensation liabilities, and in robust technology infrastructure. For instance, establishing the necessary systems and reserves can easily run into millions of dollars, a substantial hurdle for many aspiring businesses.

Furthermore, the regulatory landscape for PEOs is complex and multifaceted, spanning state and federal employment laws. New entrants need considerable investment in legal and compliance expertise to navigate these intricate requirements, which include licensing, tax filings, and adherence to various labor standards. This regulatory burden acts as a significant deterrent, effectively limiting the number of new players who can realistically enter the market.

The need for significant economies of scale presents a substantial barrier for new entrants in the PEO market. To offer competitive benefits packages, negotiate favorable insurance rates, and achieve cost efficiencies, PEOs must pool a large number of client employees. For instance, in 2024, leading PEOs often manage payroll and HR for hundreds of thousands of employees, allowing them to secure group discounts on health insurance and workers' compensation that smaller operations cannot match.

New companies entering the PEO space find it challenging to rapidly build the necessary employee volume to compete effectively on price and benefit offerings. This makes it difficult to match the established players like BBSI, who have already leveraged their scale to optimize costs and enhance their value proposition to clients.

Building a strong brand reputation and client trust in the professional employer organization (PEO) space is a significant barrier for new entrants. BBSI, for instance, has cultivated decades of client relationships through consistent, high-quality service delivery. This established trust is not easily replicated by newcomers who lack a proven track record.

New PEOs face the challenge of overcoming the inertia of existing client loyalty. For 2024, the PEO industry continued to see consolidation, with larger players acquiring smaller ones, often citing the value of established client bases and brand recognition. This trend underscores how difficult it is for new entities to break into a market where trust is paramount and takes years to build.

Access to Distribution Channels and Sales Networks

For BBSI, a significant barrier to new entrants lies in the formidable challenge of establishing effective distribution channels and robust sales networks capable of reaching the diverse small and medium-sized business (SMB) market across numerous geographic regions. This requires substantial upfront investment in building out sales teams, marketing infrastructure, and customer support systems.

New companies entering the PEO space would need to allocate considerable capital towards sales and marketing initiatives to even begin competing with the deeply entrenched presence and established relationships that companies like BBSI already possess. For instance, in 2024, the average cost for a B2B company to acquire a new customer can range from $1,000 to $5,000, depending on the industry and sales cycle complexity, a figure that would be magnified for a PEO needing to build a broad SMB client base.

- High Capital Investment: New entrants face substantial costs in developing sales infrastructure and marketing campaigns to penetrate the SMB market.

- Established Networks: Companies like BBSI benefit from existing relationships and distribution channels that are difficult and expensive for newcomers to replicate.

- Sales & Marketing Costs: Significant expenditure is required to build brand awareness and generate leads in a competitive PEO landscape.

- Regional Reach: Achieving widespread coverage across various regions demands a complex and costly logistical and sales network development.

Specialized Expertise and Integrated Service Models

The threat of new entrants in the PEO (Professional Employer Organization) market, particularly concerning specialized expertise and integrated service models, is significantly mitigated by the inherent complexity of the industry. Established PEOs like BBSI offer a comprehensive suite of services, including payroll processing, human resources management, risk mitigation, and benefits administration. This requires a deep, integrated expertise across numerous specialized domains.

New companies entering this space would face a substantial hurdle in assembling a team with the necessary multi-disciplinary skills and developing the sophisticated, interconnected systems required to match the breadth and depth of services provided by incumbents. For instance, navigating the intricacies of workers' compensation, a core PEO offering, demands specialized knowledge in safety, claims management, and regulatory compliance. In 2024, the average PEO client size often falls within the 10-50 employee range, a segment where efficient and compliant HR operations are critical, making the upfront investment in specialized talent and robust systems even more pronounced for new entrants.

- High Barrier to Entry: New PEOs must invest heavily in specialized talent and integrated technology to offer a full spectrum of HR, payroll, risk, and benefits services.

- Expertise Requirement: Successfully managing complex areas like workers' compensation and benefits compliance demands deep, cross-functional expertise that is difficult for new entrants to replicate quickly.

- Incumbent Advantage: Established players like BBSI have built decades of experience and sophisticated operational frameworks, creating a significant competitive advantage against potential newcomers.

- Client Expectations: Businesses seeking PEO services expect a seamless, comprehensive solution, making it challenging for new entrants with less developed service offerings to gain traction.

The PEO industry presents a high threat of new entrants, primarily due to the substantial capital required for operations, regulatory compliance, and economies of scale. New companies must invest millions in underwriting, technology, and legal expertise to navigate state and federal laws.

Furthermore, achieving the necessary scale to offer competitive benefits and negotiate favorable insurance rates is a significant hurdle. For instance, in 2024, leading PEOs managed hundreds of thousands of employees, enabling cost efficiencies unattainable by smaller, newer firms. Building brand reputation and client trust also takes years, making it difficult for newcomers to compete with established players like BBSI who have cultivated long-standing relationships.

| Barrier to Entry | Description | 2024 Impact/Data |

|---|---|---|

| Capital Investment | Underwriting, technology, legal, sales infrastructure | Millions of dollars required for initial setup. |

| Economies of Scale | Negotiating insurance rates, offering competitive benefits | Leading PEOs manage hundreds of thousands of employees for cost advantages. |

| Regulatory Complexity | State and federal employment laws, licensing, tax filings | Requires significant investment in compliance expertise. |

| Brand Reputation & Trust | Cultivating client relationships and a proven track record | Decades of consistent service are needed to build trust. |

| Distribution & Sales | Building sales networks to reach the SMB market | Customer acquisition costs can range from $1,000-$5,000 per client. |

Porter's Five Forces Analysis Data Sources

Our BBSI Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert analyst commentary. This blend ensures a comprehensive understanding of competitive pressures.