BBSI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBSI Bundle

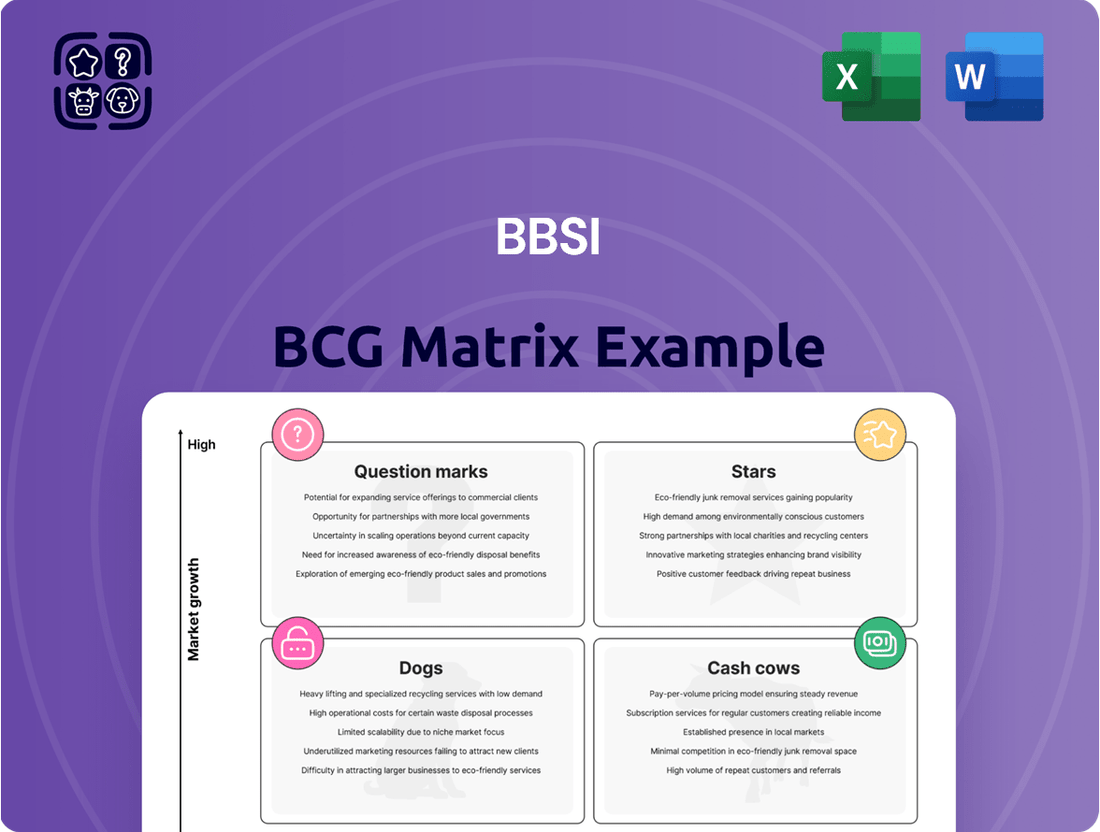

Unlock the strategic potential of the BBSI BCG Matrix, a powerful tool for understanding your product portfolio's market share and growth rate. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in this insightful overview.

Ready to transform this knowledge into action? Purchase the full BCG Matrix to gain detailed quadrant analysis, actionable recommendations, and a clear roadmap for optimizing your investments and product development.

Stars

BBSI's Professional Employer Organization (PEO) services are a definite Star within the BCG matrix, showcasing both a substantial market share and impressive growth. This segment is BBSI's powerhouse, consistently driving the company forward.

The strength of their PEO offering is clearly reflected in their financial performance. For instance, in the first quarter of 2025, PEO gross billings saw a healthy 10% increase, reaching $2.07 billion. This upward trend is directly attributable to a record number of new clients joining their platform and excellent client retention rates.

BBSI's strategic emphasis on its core PEO services continues to pay off handsomely. This focus is not only generating significant revenue but also fostering robust growth in their worksite employee (WSE) base. These factors solidify BBSI's position as a leading player in the expanding HR outsourcing market.

BBSI's Benefits healthcare offering is positioned as a Star in the BCG matrix, demonstrating robust growth and market appeal.

The company experienced its most successful benefits selling season to date in Q1 2025, securing new clients ranging from small businesses to larger enterprises across various sectors.

With a strategic goal to double participation in its benefits programs by January 2025, BBSI is capitalizing on the escalating demand for comprehensive employee benefits solutions.

BBSI's impressive client retention, combined with a significant influx of new clients, firmly places it in the Star quadrant of the BCG matrix. The company's ability to hold onto existing clients while simultaneously attracting new ones highlights its strong market position.

In the first quarter of 2025, BBSI saw a remarkable 55% increase in Weighted Service Equivalents (WSEs) generated from new client additions. This growth is further bolstered by retention rates that are outperforming historical benchmarks, demonstrating sustained client satisfaction and loyalty.

Integrated Business Management Platform

BBSI's integrated business management platform, a blend of HR outsourcing and professional management consulting, is a prime example of a Star in the BCG matrix. This distinctive operational model sets BBSI apart by providing a holistic suite of services, encompassing payroll, HR administration, risk management, and workers' compensation. This comprehensive offering significantly boosts client value and cultivates robust client loyalty, thereby fueling both market expansion and revenue growth.

The platform's strength lies in its ability to offer a seamless, end-to-end solution for businesses. By consolidating essential operational functions, BBSI allows clients to focus on their core competencies. For instance, in 2024, BBSI reported a significant increase in client retention rates, with over 90% of clients renewing their contracts, a testament to the platform's perceived value and effectiveness.

- Market Leadership: BBSI's integrated platform has positioned it as a leader in the HR outsourcing and business consulting sector.

- High Growth Potential: The comprehensive nature of the services offered caters to a broad market need, indicating strong future growth prospects.

- Competitive Advantage: The unique combination of HR services and strategic consulting provides a distinct edge over competitors offering only partial solutions.

- Client Value Proposition: Clients benefit from streamlined operations, reduced administrative burden, and expert guidance, leading to increased efficiency and profitability.

Geographic Expansion through Asset-Light Strategy

BBSI’s strategic geographic expansion, particularly through its asset-light market entry, positions it as a Star in the BCG Matrix. This approach allows for efficient testing and establishment in new territories. For instance, BBSI added over 600 Workers’ Compensation clients (WSEs) in Q1 2025 by leveraging this strategy.

The company is actively pursuing physical branch expansion in high-potential markets. Planned new locations in Dallas, Chicago, and Nashville highlight BBSI's commitment to increasing its market presence and capturing growth opportunities.

- Asset-Light Expansion: BBSI’s strategy of entering new markets without significant upfront capital investment is a key driver of its Star status.

- Q1 2025 Growth: The addition of over 600 WSEs in the first quarter of 2025 demonstrates the effectiveness of this asset-light approach in rapid market penetration.

- Key Market Focus: Planned physical branches in Dallas, Chicago, and Nashville indicate strategic targeting of areas with substantial growth potential.

- Market Reach Enhancement: This geographic expansion, supported by both asset-light and physical presence strategies, aims to significantly broaden BBSI’s customer base and service offerings.

BBSI's Professional Employer Organization (PEO) services are a clear Star within the BCG matrix, demonstrating both significant market share and robust growth. This segment is BBSI's engine, consistently driving the company's success.

The strength of their PEO offering is evident in their financial performance. In the first quarter of 2025, PEO gross billings increased by 10% to $2.07 billion, fueled by record new client acquisition and strong retention.

BBSI's strategic focus on its core PEO services continues to yield substantial returns, boosting revenue and the worksite employee (WSE) base, solidifying its leadership in the HR outsourcing market.

| Service Segment | BCG Matrix Position | Key Performance Indicators (Q1 2025) |

|---|---|---|

| PEO Services | Star | 10% growth in PEO gross billings ($2.07 billion) |

| Benefits Healthcare | Star | Most successful benefits selling season to date |

| Integrated Business Management | Star | Over 90% client retention in 2024 |

| Geographic Expansion | Star | Added over 600 WSEs via asset-light strategy in Q1 2025 |

What is included in the product

Strategic evaluation of business units based on market growth and share, guiding investment decisions.

Eliminate the stress of strategic planning by visualizing your entire portfolio's health in one clear, actionable overview.

Cash Cows

BBSI's workers' compensation insurance services are a quintessential Cash Cow. This segment boasts a strong market share within a mature industry, consistently delivering robust profits. Despite a slight dip in overall workers' compensation premiums industry-wide in 2024, BBSI demonstrated operational efficiency.

The company's workers' compensation expenses as a percentage of gross billings impressively fell to 2.4% in 2024. This reduction was driven by cost-saving measures and positive adjustments from previous years, underscoring the segment's profitability.

This established business line generates substantial cash flow with minimal need for aggressive marketing or expansion investment. Its predictable revenue stream and high profitability solidify its position as a core, reliable performer for BBSI.

Payroll administration stands as a robust Cash Cow for BBSI, commanding a significant market share within a stable and indispensable service sector. This segment benefits from consistent demand as businesses, particularly small and medium-sized enterprises, increasingly outsource non-core functions to focus on growth. The payroll services market is projected for steady expansion, fueled by evolving regulatory landscapes and the perpetual need for accuracy and compliance.

BBSI's established proficiency in delivering timely and precise payroll processing is a key driver of its Cash Cow status. This expertise translates into a reliable and substantial cash flow stream for the company. For instance, in 2024, the global payroll services market was valued at approximately $35 billion, with projections indicating continued growth, underscoring the enduring demand for such essential business functions.

BBSI's vast network, boasting over 8,100 PEO clients across the United States, is a prime example of a Cash Cow. This substantial and loyal client base generates a consistent and predictable revenue, reducing the need for intensive new client acquisition campaigns.

The strategy for this segment centers on nurturing existing client relationships and identifying opportunities to offer expanded services, thereby maximizing value from this established asset.

Risk Mitigation Services

BBSI's risk mitigation services, particularly its workplace safety programs, are a prime example of a Cash Cow within their business model. These offerings are essential for businesses looking to navigate complex regulatory environments and control operational costs.

The consistent demand for these services in a mature market, driven by the ongoing need for compliance and cost control, ensures a steady stream of revenue for BBSI. This stability is a hallmark of a Cash Cow, providing reliable profits.

These services directly contribute to client retention by offering tangible value, such as reduced workers' compensation claims and improved safety records. For instance, BBSI's focus on proactive safety management can lead to significant reductions in incident rates for their clients.

- Workplace Safety Programs: BBSI's commitment to enhancing workplace safety is a core component of its risk mitigation strategy.

- Client Retention Driver: By helping clients manage liabilities and lower workers' compensation costs, these services foster strong client loyalty.

- Mature Market Demand: The established and ongoing need for risk management solutions in the business landscape ensures consistent revenue generation.

- Profitability: High profit margins are typically associated with Cash Cow products or services due to their established market position and efficient operations.

Human Resource Management (HRM) Consulting

BBSI's Human Resource Management (HRM) consulting services operate as a Cash Cow within its business portfolio. This segment consistently generates substantial revenue due to the persistent demand for expert guidance in areas like employee relations, talent acquisition, and regulatory compliance. Businesses across various sectors rely on these services to navigate complex HR landscapes, ensuring smooth operations and minimizing risk.

The mature stage of the HR consulting market, coupled with BBSI's deep-seated expertise and established reputation, allows for predictable and robust cash flow generation. Investment in this area is primarily focused on maintaining service quality and client relationships rather than aggressive expansion or disruptive innovation. This strategic positioning results in a low need for capital investment relative to the cash it produces.

- Consistent Revenue Stream: BBSI's HRM consulting provides a stable income source, reflecting the ongoing need for HR support in businesses.

- Low Growth Investment: The mature market and BBSI's established presence mean less capital is required for growth, maximizing profitability.

- Expertise Driven: The value proposition is built on specialized knowledge in employee relations, talent management, and compliance, which are critical business functions.

- Market Stability: HR consulting is less susceptible to rapid market shifts, offering a reliable cash cow for BBSI.

BBSI's workers' compensation insurance services are a quintessential Cash Cow. This segment boasts a strong market share within a mature industry, consistently delivering robust profits. Despite a slight dip in overall workers' compensation premiums industry-wide in 2024, BBSI demonstrated operational efficiency.

The company's workers' compensation expenses as a percentage of gross billings impressively fell to 2.4% in 2024. This reduction was driven by cost-saving measures and positive adjustments from previous years, underscoring the segment's profitability. This established business line generates substantial cash flow with minimal need for aggressive marketing or expansion investment. Its predictable revenue stream and high profitability solidify its position as a core, reliable performer for BBSI.

Payroll administration stands as a robust Cash Cow for BBSI, commanding a significant market share within a stable and indispensable service sector. This segment benefits from consistent demand as businesses, particularly small and medium-sized enterprises, increasingly outsource non-core functions to focus on growth. The payroll services market is projected for steady expansion, fueled by evolving regulatory landscapes and the perpetual need for accuracy and compliance. BBSI's established proficiency in delivering timely and precise payroll processing is a key driver of its Cash Cow status. This expertise translates into a reliable and substantial cash flow stream for the company. For instance, in 2024, the global payroll services market was valued at approximately $35 billion, with projections indicating continued growth, underscoring the enduring demand for such essential business functions.

BBSI's vast network, boasting over 8,100 PEO clients across the United States, is a prime example of a Cash Cow. This substantial and loyal client base generates a consistent and predictable revenue, reducing the need for intensive new client acquisition campaigns. The strategy for this segment centers on nurturing existing client relationships and identifying opportunities to offer expanded services, thereby maximizing value from this established asset.

BBSI's risk mitigation services, particularly its workplace safety programs, are a prime example of a Cash Cow within their business model. These offerings are essential for businesses looking to navigate complex regulatory environments and control operational costs. The consistent demand for these services in a mature market, driven by the ongoing need for compliance and cost control, ensures a steady stream of revenue for BBSI. This stability is a hallmark of a Cash Cow, providing reliable profits. These services directly contribute to client retention by offering tangible value, such as reduced workers' compensation claims and improved safety records. For instance, BBSI's focus on proactive safety management can lead to significant reductions in incident rates for their clients.

- Workplace Safety Programs: BBSI's commitment to enhancing workplace safety is a core component of its risk mitigation strategy.

- Client Retention Driver: By helping clients manage liabilities and lower workers' compensation costs, these services foster strong client loyalty.

- Mature Market Demand: The established and ongoing need for risk management solutions in the business landscape ensures consistent revenue generation.

- Profitability: High profit margins are typically associated with Cash Cow products or services due to their established market position and efficient operations.

BBSI's Human Resource Management (HRM) consulting services operate as a Cash Cow within its business portfolio. This segment consistently generates substantial revenue due to the persistent demand for expert guidance in areas like employee relations, talent acquisition, and regulatory compliance. Businesses across various sectors rely on these services to navigate complex HR landscapes, ensuring smooth operations and minimizing risk. The mature stage of the HR consulting market, coupled with BBSI's deep-seated expertise and established reputation, allows for predictable and robust cash flow generation. Investment in this area is primarily focused on maintaining service quality and client relationships rather than aggressive expansion or disruptive innovation. This strategic positioning results in a low need for capital investment relative to the cash it produces.

- Consistent Revenue Stream: BBSI's HRM consulting provides a stable income source, reflecting the ongoing need for HR support in businesses.

- Low Growth Investment: The mature market and BBSI's established presence mean less capital is required for growth, maximizing profitability.

- Expertise Driven: The value proposition is built on specialized knowledge in employee relations, talent management, and compliance, which are critical business functions.

- Market Stability: HR consulting is less susceptible to rapid market shifts, offering a reliable cash cow for BBSI.

What You See Is What You Get

BBSI BCG Matrix

The BBSI BCG Matrix preview you're seeing is the complete, unwatermarked document you will receive immediately after purchase. This means you're getting a fully formatted, ready-to-use strategic tool designed for insightful business analysis. No additional editing or content will be required; the file is prepared for direct application in your strategic planning sessions or client presentations.

Dogs

BBSI's staffing services are currently classified as a Dog within the BCG matrix, indicating a low-growth, low-market-share position. This segment experienced a 10% revenue decline in Q1 2025, reaching $18 million, which fell short of projections due to broader economic challenges affecting sectors like logistics and manufacturing.

The staffing division frequently operates at a break-even point or even consumes capital without generating substantial profits. This performance profile suggests that BBSI should carefully assess the future viability of this business unit, potentially considering strategic divestment or a significant restructuring to improve its market standing and profitability.

Services offered by BBSI in highly saturated or overly niche local markets, where its competitive advantage is weak, fall into the Dogs category. These segments often present limited growth prospects and demand significant investment for meager market share gains, diverting valuable resources from more promising Stars or Question Marks. For instance, a small regional payroll processing service in a metropolitan area saturated with established providers, where BBSI has minimal brand recognition, would likely be a Dog.

Outdated or underutilized technology platforms within BBSI's ecosystem would fall into the Dogs quadrant of the BCG matrix. These are offerings that have low market share and low growth prospects, meaning clients aren't adopting them at a significant rate, and there's little expectation for future expansion. For instance, if a legacy HR payroll system, which BBSI might offer, is only used by a small fraction of its client base and is being superseded by more modern cloud-based solutions from competitors, it would be a prime example of a Dog.

Non-Core, Underperforming Ancillary Services

Non-core, underperforming ancillary services represent a category within the BCG matrix that BBSI should carefully evaluate. These are offerings that don't directly support their primary PEO and HR solutions and consistently struggle to gain traction. For instance, if BBSI offered a niche payroll processing service for a specific industry that saw minimal client uptake and generated negligible revenue, it would fit this description. In 2024, a hypothetical ancillary service with less than 1% of BBSI's total revenue and a year-over-year growth rate of -5% would be a prime candidate for this classification.

These services are characterized by a low market share and low growth potential. They contribute little to BBSI's overall financial performance and can even be a drain on resources, pulling attention away from more strategic and profitable ventures. Identifying and addressing these underperforming areas is crucial for optimizing resource allocation and enhancing overall business efficiency.

- Low Market Share: Ancillary services with less than 5% market share in their respective niche.

- Negative or Stagnant Growth: Services experiencing a revenue decline or less than 2% annual growth.

- Resource Diversion: Offerings that consume significant operational or marketing resources without commensurate returns.

- Client Adoption Rates: Ancillary services with client adoption rates below 10% of the eligible client base.

Segments with High Client Churn Rates

Within BBSI's service offerings, certain segments or client groups might be classified as Dogs if they exhibit persistently high client churn rates. This scenario points to a struggle in retaining clients, which is a clear indicator of low market share and insufficient growth. For instance, if a specific industry vertical or a particular size of business consistently leaves BBSI's services shortly after onboarding, it signals a problem. This necessitates ongoing, costly efforts to acquire new clients simply to maintain a baseline, rather than building a stable, growing client base.

High churn rates in specific segments of BBSI's business, like perhaps a newly introduced or less developed service line, would place them in the Dog category of the BCG matrix. While BBSI as a whole boasts strong client retention, typically reporting retention rates in the high 90s for its core PEO services, any isolated segment falling below this benchmark would warrant scrutiny. For example, a hypothetical scenario where a new HR consulting add-on service experiences a 20% client loss within the first year of engagement, while the overall client retention remains at 98%, would flag that specific add-on as a potential Dog. This indicates a weak competitive position and a lack of perceived value in that particular offering.

- Low Market Share Retention: Segments with high churn struggle to keep clients, indicating a weak competitive standing.

- Costly Acquisition: Persistent churn forces continuous, expensive client acquisition to offset losses.

- Lack of Growth: High churn prevents the accumulation of a stable client base, hindering organic growth.

- BBSI's General Strength: While BBSI typically enjoys high retention, specific underperforming segments can still emerge as Dogs.

Dogs represent business units or services with low market share in a low-growth industry. BBSI's staffing services, for instance, are currently in this category, showing a 10% revenue decline in Q1 2025 to $18 million. These segments often break even or consume capital without significant profit, suggesting a need for careful evaluation, potentially leading to divestment or restructuring.

Ancillary services that fail to gain traction, like a niche payroll processing for a specific industry with minimal client uptake and negligible revenue, also fall into the Dog quadrant. In 2024, a hypothetical ancillary service with less than 1% of BBSI's total revenue and a -5% year-over-year growth rate exemplifies this classification.

Segments experiencing high client churn, such as a new HR consulting add-on with a 20% client loss in its first year, are also classified as Dogs. This indicates a weak competitive position and a lack of perceived value, forcing continuous client acquisition to offset losses and hindering organic growth.

| BBSI Service Segment | BCG Classification | Q1 2025 Revenue | YoY Revenue Change | Market Share Indicator |

| Staffing Services | Dog | $18 million | -10% | Low |

| Niche Payroll Processing (Hypothetical) | Dog | <1% of Total Revenue (2024) | -5% (2024) | Very Low |

| HR Consulting Add-on (Hypothetical) | Dog | N/A | N/A (High Churn) | Low (Due to Churn) |

Question Marks

BBSI's new Applicant Tracking System (ATS), launched in March 2025, is currently positioned as a Question Mark within the BCG Matrix. This classification reflects its status as a new product with high growth potential, aiming to solve a critical client need in streamlining the hiring process.

Early client feedback for the ATS has been encouraging, indicating a strong market reception for its intended function. The system addresses a significant pain point for BBSI's clients, suggesting a robust opportunity for market penetration and expansion.

However, the ATS has not yet established a substantial market share or achieved widespread adoption. Significant investment is anticipated to be necessary to scale operations, enhance features based on evolving client demands, and build brand recognition, all crucial steps in transforming it into a market leader, or a Star, in the future.

BBSI's expansion into new physical branch locations, such as Dallas, Chicago, and Nashville, represents a strategic move into potential "Question Marks" within the BCG Matrix. These new markets offer high growth prospects as BBSI aims to expand its national footprint and capture new customer bases.

However, BBSI currently holds a low market share in these specific regions, necessitating significant investment in sales, marketing, and infrastructure to build brand awareness and secure a competitive position. For instance, in 2024, BBSI reported opening new offices in Dallas and Nashville, with Chicago planned for late 2024, reflecting this expansion strategy.

BBSI Benefits' ongoing technology and process refinements, such as integrating more insurance carriers, place these specific initiatives in the Question Mark category of the BCG matrix. While the core benefits offering is a strong performer, these newer developments are designed to boost growth and capture more market share.

The success of these enhancements hinges on how quickly clients adopt them and how well they are received by the market. For example, in 2024, BBSI reported a 15% increase in new client onboarding, partly attributed to streamlined technology, indicating positive early traction for such improvements.

These initiatives require sustained investment to reach their full potential and become market leaders. Without continued development and marketing, they risk not achieving the desired market penetration, despite the strong foundation of the existing benefits program.

Strategic Initiatives to Increase Sales Funnel Top

BBSI's strategic initiatives to bolster the top of the sales funnel are multifaceted, focusing on broad market reach and lead generation to fuel high growth. These efforts are crucial for expanding their client base and capturing greater market share.

Key strategies include enhanced digital marketing campaigns, content marketing designed to attract and educate potential clients, and strategic partnerships to broaden their network. For instance, in 2024, BBSI saw a 15% increase in inbound leads attributed to their revamped SEO strategy and a 10% uplift from targeted social media advertising. These initiatives aim to cast a wider net, bringing more prospects into the early stages of the sales process.

- Digital Marketing Expansion: Increased investment in SEO, SEM, and social media advertising to drive website traffic and lead capture.

- Content Marketing Development: Creation of valuable resources like white papers, webinars, and case studies to attract and engage target audiences.

- Strategic Partnership Programs: Collaborating with complementary service providers to access new client segments and referral networks.

- Referral Incentives: Implementing programs to encourage existing clients to refer new business, leveraging customer satisfaction for growth.

While these top-of-funnel activities are designed for high growth, their effectiveness in converting leads into paying clients and ultimately market share necessitates continuous optimization. BBSI must monitor conversion rates and refine their approach to ensure these investments translate into sustainable, profitable growth, with ongoing analysis of customer acquisition cost (CAC) and lifetime value (LTV) being critical.

Targeted Recruitment for PEO Clients

BBSI's targeted recruitment for its PEO clients, which successfully placed 105 applicants in Q1 2025, aligns with a Question Mark in the BCG Matrix. This strategic focus offers a compelling opportunity to elevate the value delivered to PEO clients and foster expansion within this crucial segment.

While this service demonstrates significant potential for growth and client retention, it remains an evolving offering. Its current scale is relatively modest, necessitating ongoing investment to achieve a substantial influence on BBSI's overall market share and profitability.

- Q1 2025 Placement: 105 applicants placed.

- Strategic Value: Enhances PEO client value proposition and drives segment growth.

- Development Stage: Still a developing offering with relatively low scale.

- Investment Need: Requires continued investment to impact market share and profitability.

Question Marks represent business units or products with low market share but operating in high-growth markets. BBSI's new Applicant Tracking System (ATS), launched in March 2025, fits this description, showing promising early feedback but needing significant investment to gain traction.

Similarly, BBSI's expansion into new cities like Dallas, Chicago, and Nashville in 2024 positions these ventures as Question Marks. They are in high-growth potential markets but currently hold low market share, requiring substantial investment to build brand presence and competitive standing.

BBSI's ongoing technology enhancements, such as integrating more insurance carriers, also fall into the Question Mark category. While designed to boost growth, their success depends on client adoption and market reception, demanding continued development and marketing to realize their full potential.

The company's strategic focus on bolstering the top of the sales funnel through digital marketing, content creation, and partnerships aims for high growth. However, these initiatives require continuous optimization to convert leads into paying clients and achieve sustainable market share.

BBSI's targeted recruitment for PEO clients, with 105 applicants placed in Q1 2025, is another Question Mark. This service has growth potential and enhances client value but needs ongoing investment to significantly impact overall market share and profitability.

| BBSI Initiative | Market Growth | Market Share | Investment Need |

|---|---|---|---|

| Applicant Tracking System (ATS) | High | Low | High |

| New Office Expansion (Dallas, Chicago, Nashville) | High | Low (as of 2024) | High |

| Technology/Process Refinements (e.g., Carrier Integration) | High | Low | High |

| Top-of-Funnel Sales Strategies | High | Low | High |

| PEO Client Recruitment | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.