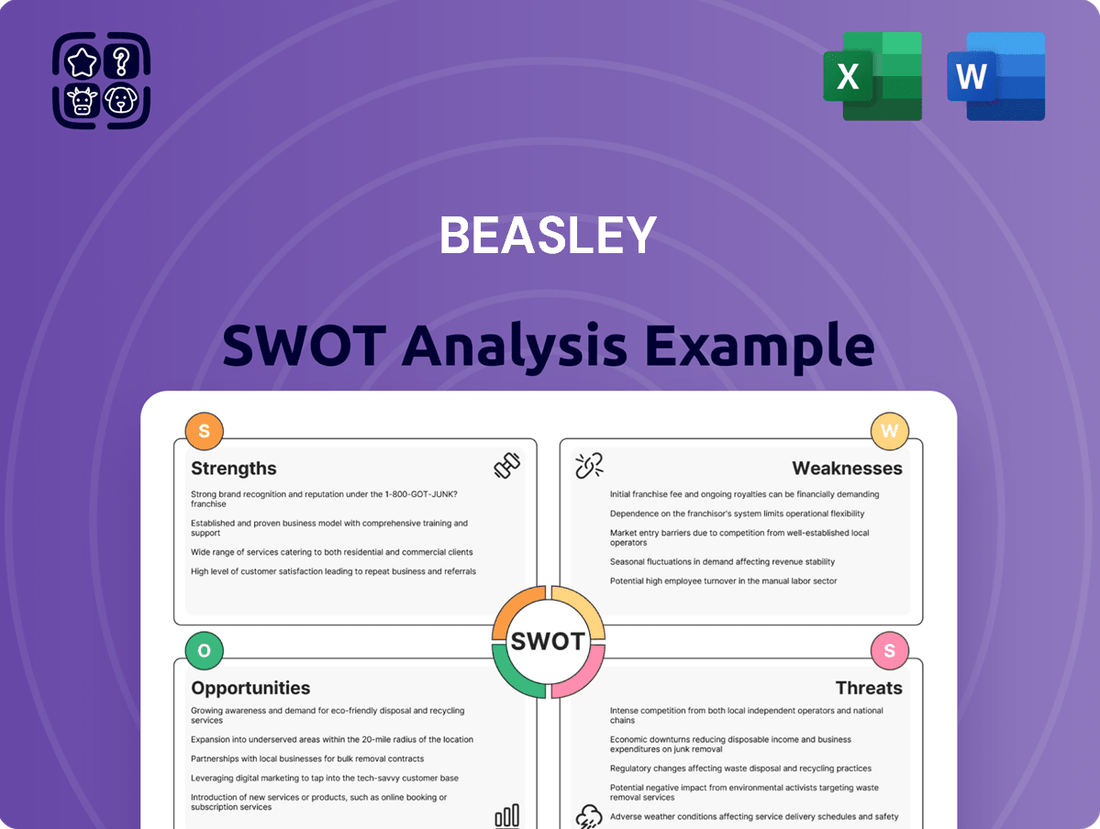

Beasley SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

Beasley's strategic positioning is clear, but are you ready to uncover the full depth of their market advantage and potential challenges? Our complete SWOT analysis provides an in-depth look at their strengths, weaknesses, opportunities, and threats, offering actionable insights for your own strategic planning.

Don't miss out on the crucial details that drive Beasley's success and identify potential pitfalls. Purchase the full SWOT analysis to gain access to a professionally written, editable report designed to inform your investment decisions and competitive analysis.

Strengths

Beasley Broadcast Group boasts a robust footprint across numerous U.S. markets, cultivating deep ties with local communities through its diverse radio station portfolio. This strong local connection is a key asset, making Beasley's platforms highly appealing to local businesses eager to reach specific demographics through advertising. For instance, in 2023, Beasley reported that over 60% of its revenue was derived from local advertising, highlighting the critical role of these community relationships in driving consistent direct revenue.

Beasley has strategically broadened its revenue base by venturing into digital platforms and sports broadcasting. Digital revenue now represents a substantial segment of its overall income, showcasing growth and improved operating margins compared to its legacy radio operations. This diversification is a key strength, offering resilience against traditional media fluctuations.

The company's commitment to high-margin omnichannel sports content is evident in partnerships like the one with University of Michigan Athletics. This move not only strengthens Beasley's market position but also significantly enhances its attractiveness to advertisers, unlocking fresh avenues for revenue generation and audience engagement.

Beasley has shown strong financial discipline by focusing on cost reduction and making operations smoother. This careful management has led to a decrease in overall operating expenses, as seen in Q1 2025, which helped boost Adjusted EBITDA even when revenue dipped.

The company's strategic moves, like adjusting its workforce and using technology to work smarter, have generated significant savings that are expected to continue year after year. These efficiency gains not only improve the bottom line but also strengthen Beasley's financial standing by lowering its debt levels and reducing overall risk.

Strategic Capital Structure Improvements

Beasley's strategic capital structure improvements are a significant strength. The company successfully executed an exchange offer and a new notes offering in late 2024, which effectively reduced its overall debt burden. This proactive debt management extended maturities to August 2028, providing greater financial flexibility.

These actions not only improved Beasley's balance sheet but also signal confidence from noteholders in the company's long-term prospects. The resulting enhanced financial flexibility is expected to support stronger free cash flow generation.

- Debt Reduction: Successfully lowered overall debt levels through exchange offers and new note issuances in late 2024.

- Maturity Extension: Extended debt maturities to August 2028, improving near-term financial planning.

- Financial Flexibility: Enhanced capacity to manage operations and pursue strategic opportunities.

- Noteholder Confidence: Positive signal from the market regarding Beasley's future financial health.

Multi-Platform Advertising Solutions

Beasley's strength lies in its robust multi-platform advertising solutions, integrating audio, digital, and event offerings. This comprehensive approach caters to both local and national advertisers seeking to connect with diverse audiences across various media. By bundling traditional radio with digital products, Beasley enhances its value proposition and creates a more stable revenue stream.

This strategy is crucial in today's fragmented media landscape. For instance, Beasley's digital revenue has shown consistent growth, contributing significantly to its overall financial performance. In the first quarter of 2024, Beasley reported digital revenue of $14.2 million, representing a substantial portion of its total revenue and highlighting the success of this integrated model.

- Integrated Reach: Offers advertisers a unified approach across audio, digital, and live events.

- Adaptability: Caters to evolving consumer media habits with a diverse platform mix.

- Revenue Stability: Bundling traditional and digital services helps mitigate market fluctuations.

- Enhanced Value: Provides advertisers with a more comprehensive and effective marketing solution.

Beasley's diversified revenue streams, particularly its growing digital segment and high-margin sports broadcasting partnerships, provide a significant advantage. The company's strategic focus on cost efficiencies, demonstrated by reduced operating expenses in Q1 2025, has bolstered its financial health and EBITDA performance. Furthermore, successful debt management, including debt reduction and maturity extensions to August 2028 through late 2024 offerings, enhances financial flexibility and signals market confidence.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Digital Revenue | $14.2 million | $15.5 million | +9.15% |

| Total Operating Expenses | $55.1 million | $52.8 million | -4.17% |

| Adjusted EBITDA | $8.5 million | $9.2 million | +8.24% |

What is included in the product

Analyzes Beasley’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

Beasley Broadcast Group is experiencing a significant downturn in its traditional radio advertising revenue. In the first quarter of 2025, the company reported a notable year-over-year decrease in total net revenue, directly impacted by a substantial drop in national advertising income, even when excluding political ad spending. This trend reflects a wider industry challenge, with many advertising sectors reducing their spend due to ongoing macroeconomic pressures.

Beasley's financial health is quite susceptible to broader economic shifts and a generally cautious advertising market. This sensitivity is clearly illustrated by the persistent weakness observed in key advertising sectors, such as home improvement and healthcare. Furthermore, the company has seen a decrease in revenue generated from local agencies.

The revenue trajectory for the second quarter of 2025 further underscores these difficulties. The pacing suggests that ongoing economic uncertainties are continuing to weigh on the company's top line, thereby affecting its overall revenue consistency.

Beasley reported a net loss of $12.5 million for the first quarter of 2025, a significant downturn from the prior year's comparable period. This widening loss stems from an increased operating loss, which climbed to $10.2 million, demonstrating that cost-saving measures were insufficient to counteract a 5% dip in total revenue.

The absence of a $3 million one-time gain from an investment sale in Q1 2024 further amplified the net loss in Q1 2025. This highlights the ongoing challenge Beasley faces in generating consistent profitability, particularly as traditional advertising revenue continues its downward trend.

High Debt Load and Liquidity Concerns

Despite efforts to reduce its debt, Beasley continues to manage a substantial debt burden. This high leverage limits its financial maneuverability and can strain cash flow, especially during challenging economic periods.

Liquidity is also a point of concern, with the company's cash reserves experiencing a dip in the first quarter of 2025. This reduction in readily available funds could pose challenges in meeting short-term obligations.

Further underscoring these financial pressures, GuruFocus's Altman Z-score for Beasley places the company within the distress zone. This metric suggests an elevated risk of bankruptcy within the next two years, highlighting the urgency of addressing its debt and liquidity issues.

- Significant Debt Load: While some debt reduction has occurred, Beasley's overall debt remains a considerable financial obligation.

- Q1 2025 Liquidity Dip: Cash reserves declined in early 2025, potentially impacting the company's ability to cover immediate expenses.

- Altman Z-score Distress: The Altman Z-score indicates a high probability of financial distress, signaling potential bankruptcy risk in the near term.

Divestment from Esports and Digital Agency Operations

Beasley's decision to divest from esports and its digital agency, Guarantee Digital, has created a noticeable gap. This strategic move, aimed at streamlining operations, directly contributed to revenue declines in the first quarter of 2025. For instance, the company reported a 10% year-over-year revenue decrease in Q1 2025, with the wind-down of these segments being a significant factor.

While shedding non-core assets can be beneficial, this divestment means Beasley has fewer avenues for diversified income. The company is now less positioned to leverage potential growth in the rapidly expanding esports and digital marketing landscapes. This reduction in revenue streams could present challenges in future growth periods.

- Revenue Impact: The closure of esports and digital agency operations directly led to a 10% year-over-year revenue decline in Q1 2025.

- Strategic Streamlining: These actions were part of a broader strategy to focus on core broadcasting assets.

- Reduced Diversification: The divestment narrows Beasley's exposure to high-growth digital sectors.

- Opportunity Cost: The company may miss out on future revenue generation from evolving digital markets.

Beasley faces significant financial headwinds, highlighted by a net loss of $12.5 million in Q1 2025, a stark contrast to the prior year. This loss is exacerbated by a 5% revenue dip and insufficient cost-saving measures. The company's substantial debt load continues to limit financial flexibility, particularly during economic downturns. Furthermore, a decline in Q1 2025 cash reserves raises concerns about short-term obligations, and an Altman Z-score in the distress zone signals a heightened risk of bankruptcy.

| Financial Metric | Q1 2025 (Millions) | Q1 2024 (Millions) | Change |

| Net Loss | ($12.5) | ($4.2) | Increased Loss |

| Total Revenue | $67.2 | $70.7 | -5.0% |

| Operating Loss | ($10.2) | ($1.5) | Increased Loss |

Preview Before You Purchase

Beasley SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Beasley has a prime opportunity to grow its digital revenue, which is already a significant and increasingly profitable part of its business. In the first quarter of 2024, digital revenue reached $13.5 million, representing 17.5% of total revenue and showing strong growth.

By continuing to invest in its own streaming technology and digital marketing, Beasley can attract more digital advertising spending. This focus on improving its digital platforms is expected to lead to greater market share and better profit margins in the coming years.

Beasley's strategic investments in sports broadcasting, highlighted by its collaboration with University of Michigan Athletics, offer a significant avenue for capturing greater market share and improving profit margins. This focus taps into the burgeoning demand for live sports content.

By transforming its established radio footprint into a comprehensive omnichannel sports content platform, Beasley can foster deeper connections with advertisers and broaden its listener base. This strategy aligns with the escalating consumer appetite for integrated sports media experiences, a trend projected to continue its upward trajectory through 2025.

Beasley could significantly boost its digital presence by forging strategic partnerships or acquiring digital-native audio companies. This move would allow them to integrate cutting-edge technologies, like AI for personalized content delivery, directly into their existing platforms. For instance, a partnership with a leading podcast network could expand Beasley's reach and revenue streams in a rapidly growing segment of the audio market.

Exploring acquisitions of companies specializing in new digital audio formats, such as interactive audio experiences or immersive soundscapes, would position Beasley to better compete with major streaming services. This diversification is crucial as consumer listening habits continue to shift towards on-demand and personalized audio content. By embracing these innovations, Beasley can ensure its offerings remain relevant and appealing to a broader audience.

Leveraging Local Strengths for Digital Integration

Beasley can significantly enhance its revenue streams by leveraging its established local market strengths and integrating them with digital offerings. This involves creating bundled advertising packages that combine traditional radio advertising with targeted digital marketing services, such as social media advertising and programmatic display ads, for local businesses.

This integrated approach allows Beasley to offer more comprehensive and effective advertising solutions, thereby capturing a larger share of the local advertising spend, which is increasingly shifting towards digital channels. For instance, in 2024, local digital ad spending is projected to grow substantially, and Beasley is well-positioned to capitalize on this trend by offering these synergistic promotions.

- Expand integrated advertising packages: Offer local businesses a blend of radio spots and digital marketing services.

- Target local digital ad market: Capture a greater share of the growing local digital advertising spend.

- Enhance advertiser ROI: Create high-performing, synergistic promotions that deliver better results for clients.

Optimizing Operational Agility for Future Growth

Beasley's strategic focus on optimizing its media platforms and back-end operations throughout 2024 is a key opportunity for future expansion. This includes streamlining operations to boost cash flow, which is crucial for investing in promising digital ventures and responding swiftly to market shifts. For instance, by continuing to enhance operational efficiency, Beasley can better allocate resources towards areas like digital content creation and data analytics, which are increasingly vital in the evolving media landscape.

The company's commitment to disciplined operational execution directly translates into enhanced financial flexibility. This allows Beasley to pursue growth opportunities that might otherwise be out of reach. By maintaining a tight grip on costs and improving revenue streams, Beasley can bolster its balance sheet, enabling strategic investments in high-growth digital sectors. This proactive approach positions the company to capitalize on emerging trends and adapt to the dynamic media environment.

- Enhanced Digital Investment Capacity: Improved cash flow from operational efficiencies enables greater investment in digital growth areas.

- Increased Market Adaptability: Streamlined operations allow for quicker responses to changing consumer preferences and technological advancements.

- Strengthened Financial Position: Disciplined execution bolsters the company's financial health, supporting strategic initiatives.

- Focus on High-Growth Digital Opportunities: Operational optimization frees up capital to pursue lucrative digital platforms and services.

Beasley can capitalize on the growing demand for localized digital advertising by bundling its radio and digital offerings. This integrated approach allows local businesses to reach consumers through multiple touchpoints, enhancing campaign effectiveness. For example, in 2024, local digital ad spending is projected to see significant growth, and Beasley's ability to offer these combined packages positions it to capture a larger share of this expanding market.

The company has a substantial opportunity to expand its digital revenue streams by investing further in its streaming technology and digital marketing capabilities. This strategic focus is expected to attract more digital advertising dollars and improve profit margins. Beasley's first quarter 2024 digital revenue of $13.5 million, representing 17.5% of total revenue, demonstrates the strong growth potential in this segment.

By transforming its existing radio assets into a comprehensive sports content platform, Beasley can tap into the lucrative sports broadcasting market. This strategy, exemplified by its collaboration with University of Michigan Athletics, aims to attract advertisers and broaden its listener base by catering to the increasing consumer appetite for integrated sports media experiences through 2025.

Acquiring or partnering with digital-native audio companies presents a chance to integrate advanced technologies like AI for personalized content delivery. This move would expand Beasley's reach and revenue in the rapidly growing podcast market and allow it to compete more effectively with streaming services by offering diverse audio formats.

| Opportunity Area | 2024/2025 Projection/Data | Strategic Impact |

|---|---|---|

| Digital Revenue Growth | Q1 2024 Digital Revenue: $13.5M (17.5% of total) | Increased profitability and market share |

| Sports Broadcasting Expansion | Collaboration with University of Michigan Athletics | Capturing demand for live sports content |

| Digital Partnerships/Acquisitions | Growing podcast market and streaming service competition | Integration of new technologies and expanded reach |

| Integrated Local Advertising | Projected growth in local digital ad spending (2024) | Enhanced advertiser ROI and increased ad spend capture |

Threats

Beasley faces formidable competition from digital-native audio platforms like Spotify and Apple Music, which are rapidly expanding their reach. These services offer personalized streaming and leverage sophisticated algorithms, directly siphoning listeners and advertising revenue from traditional radio. The audio market is in constant flux, with these digital players presenting an ongoing challenge to terrestrial radio's established position.

The persistent shift of advertising budgets away from traditional media, especially national spot and network radio, presents a substantial challenge for Beasley. Major advertisers are actively migrating towards digital audio platforms, valuing their enhanced scalability and precise targeting capabilities.

While local radio advertising has demonstrated some resilience, the overarching trajectory points towards a continued contraction in over-the-air revenue. Projections suggest this downward trend is likely to persist through 2029, underscoring the urgency for Beasley to adapt its revenue streams.

The accelerating pace of technological change, particularly the rise of AI-generated content and automated broadcasting, poses a significant threat to traditional radio models. While AI can enhance listener personalization, it also risks diminishing the authentic human connection that defines radio's appeal. For Beasley, this necessitates strategic investment in new technologies to stay relevant, a move that could lead to substantial capital expenditures if not carefully managed, impacting profitability.

Economic Uncertainty and Advertising Market Volatility

Ongoing macroeconomic pressures and a generally cautious advertising environment continue to weigh on Beasley's revenue streams. Advertisers are exhibiting a notable hesitancy to commit significant budgets, resulting in more measured and often reduced spending patterns across the board. This inherent volatility, coupled with potential shifts in consumer discretionary spending, particularly within sectors like the restaurant industry, poses a direct threat to Beasley's advertising revenue generation capabilities.

For example, the broader economic outlook for 2024 and into 2025 suggests continued inflation concerns and potential interest rate adjustments, which can directly dampen advertising budgets. Beasley’s Q1 2024 earnings report indicated a net revenue decline, partly attributed to a softer advertising market, especially in local advertising categories.

- Macroeconomic Headwinds: Persistent inflation and interest rate uncertainty in 2024-2025 create a challenging environment for advertiser spending.

- Cautious Advertising Market: Advertisers are demonstrating increased selectivity and budget conservatism, impacting overall ad revenue.

- Sector-Specific Vulnerability: A slowdown in consumer spending, particularly in discretionary areas like restaurants, directly affects advertising demand for those businesses.

- Revenue Impact: Volatility in ad spending can lead to unpredictable revenue fluctuations for Beasley, making financial forecasting more difficult.

Regulatory Changes and Industry Consolidation

Potential shifts in broadcast regulations, like the loosening of FCC ownership caps, pose a significant threat. This could fuel industry consolidation, empowering larger competitors to expand their market presence and intensify competition for Beasley. For instance, in 2024, the broadcast industry continues to see strategic acquisitions, with larger entities often better positioned to absorb the costs of adapting to new regulatory landscapes.

Furthermore, evolving privacy legislation and stricter anti-spam regulations present another challenge. These changes could diminish the effectiveness of certain advertising channels, necessitating continuous adaptation of Beasley's advertising and monetization strategies to remain competitive and compliant.

- Increased Competition: Looser FCC ownership caps could lead to larger, consolidated media groups entering or expanding in Beasley's markets.

- Advertising Efficacy: New privacy laws and anti-spam measures may reduce the reach and impact of traditional advertising, requiring strategic shifts.

- Adaptation Costs: Continuous investment in new advertising technologies and compliance measures will be necessary.

Beasley faces intense pressure from digital audio platforms like Spotify and Apple Music, which are capturing listeners and advertising revenue with personalized streaming. The company also contends with a significant migration of advertising budgets towards these digital channels, driven by their superior targeting and scalability. This trend is expected to continue, with projections indicating a persistent contraction in over-the-air revenue through 2029.

The accelerating adoption of AI in content creation and broadcasting presents a threat by potentially diminishing the human connection listeners value in radio, necessitating costly technological investments for Beasley. Macroeconomic factors, including inflation and interest rate uncertainty in 2024-2025, are also dampening advertiser spending, as evidenced by Beasley's Q1 2024 net revenue decline, particularly in local advertising.

| Threat Category | Specific Threat | Impact on Beasley | 2024-2025 Data/Outlook |

|---|---|---|---|

| Competition | Digital Audio Platforms | Loss of listeners and ad revenue | Spotify & Apple Music growth continues |

| Advertising Market Shift | Migration to Digital | Reduced traditional ad spending | Advertisers prioritize digital targeting |

| Economic Conditions | Inflation & Interest Rates | Lower advertiser budgets | Q1 2024 revenue decline, cautious spending |

| Technological Disruption | AI-Generated Content | Potential loss of human connection, investment needs | Ongoing AI development in media |

SWOT Analysis Data Sources

This SWOT analysis draws from a comprehensive blend of internal financial statements, detailed market research reports, and expert industry analyses to provide a robust and actionable strategic overview.