Beasley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

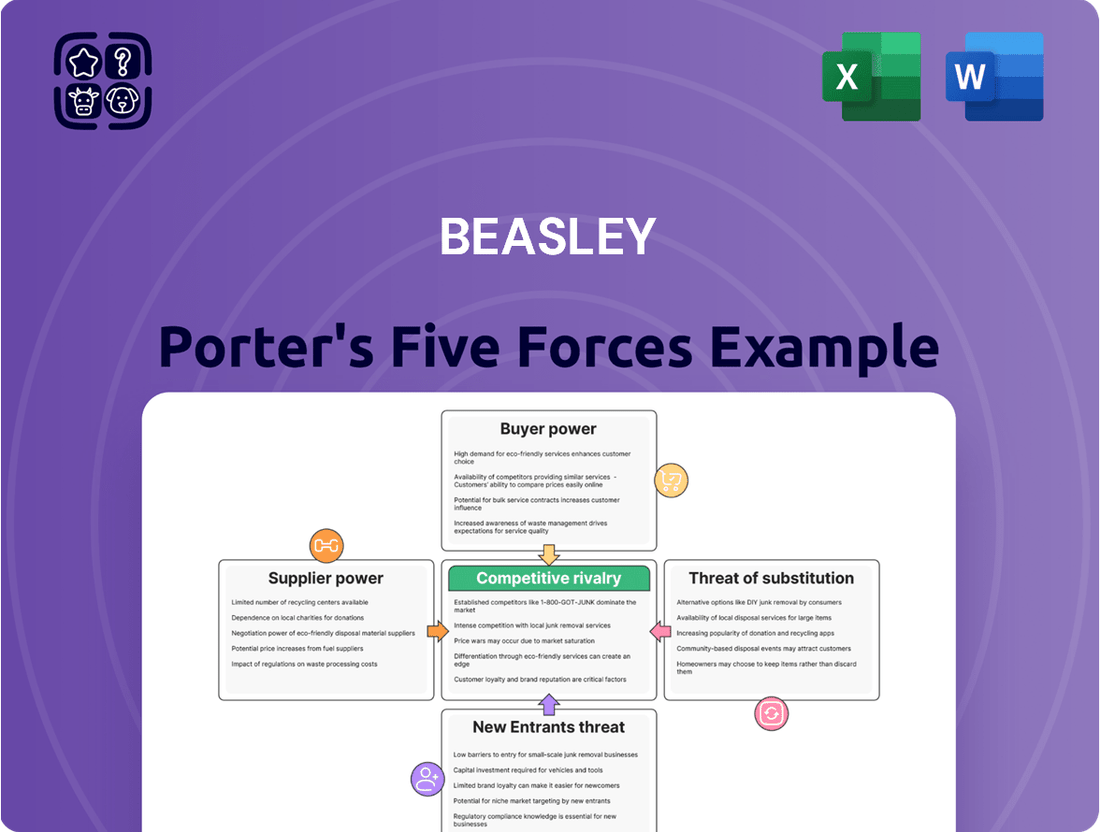

Beasley's Porter's Five Forces Analysis reveals the intense competitive landscape they navigate, from the power of buyers to the threat of new entrants. Understanding these forces is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Beasley’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Content creators and talent hold considerable bargaining power over Beasley. The reliance on popular on-air personalities, local news anchors, and specific music artists means these individuals can command higher compensation or more favorable terms due to their ability to draw audiences. For instance, a highly successful morning show host can significantly impact listenership, giving them leverage.

This leverage is amplified when a particular show or artist has a deeply engaged and loyal following. Beasley's ability to attract and retain these key talents directly influences its revenue streams, making these suppliers potent. If a star personality moves to a competitor, it can lead to a substantial loss of audience share.

To counter this, Beasley must focus on developing new talent and diversifying its content sources. By nurturing emerging personalities and exploring a wider range of programming, the company can reduce its dependence on any single individual or group, thereby diminishing supplier bargaining power.

Music licensing companies like ASCAP, BMI, and SESAC wield substantial bargaining power over radio broadcasters such as Beasley Broadcast Group. These performing rights organizations control access to a vast catalog of music, making them essential partners for any radio operator seeking to broadcast popular songs. Their control over intellectual property means Beasley has limited alternatives for sourcing the content its business model relies on.

The financial impact of these licensing agreements is significant. For instance, in 2023, the Radio Advertising Bureau reported that music licensing fees represent a substantial portion of operating expenses for radio stations. Any increase in royalty rates, which these organizations have the power to implement, directly squeezes Beasley's profit margins. This dependence creates a situation where Beasley must accept the terms offered, as the cost of not licensing the music would be prohibitive.

Suppliers of specialized broadcast equipment, transmission towers, and advanced studio technology can exert significant bargaining power over Beasley. While the market offers choices, the need for specific, high-quality gear or proprietary software for digital platforms can restrict Beasley's alternatives, potentially driving up equipment acquisition costs. For instance, in 2024, the global broadcast and professional video equipment market was valued at approximately $12.5 billion, with specialized components often commanding premium prices due to R&D investment and limited competition.

News and Information Wire Services

Beasley's reliance on news and information wire services like the Associated Press (AP) and Reuters grants these suppliers a degree of bargaining power. The unique and essential nature of timely, accurate news content, particularly for stations aiming to be leading local information hubs, amplifies this leverage. For instance, in 2024, the demand for reliable news reporting remained high, especially during periods of significant local or national events.

However, the increasing prevalence of citizen journalism and diverse alternative news outlets can mitigate the suppliers' power. These emerging sources offer competition, potentially reducing Beasley's dependence on traditional wire services for certain types of content. This dynamic suggests that while wire services remain important, their absolute control over information dissemination is gradually being challenged.

- Supplier Leverage: Wire services possess leverage due to the necessity of timely, accurate news for local stations.

- Competitive Landscape: The rise of citizen journalism and alternative news sources can diminish supplier bargaining power.

- Content Dependency: Beasley's need for unique and essential news content influences supplier negotiations.

Esports Game Publishers and Leagues

The bargaining power of suppliers in Beasley Porter's esports division is significant, primarily due to their reliance on specific game titles and their associated leagues. Publishers like Riot Games, Valve, and Activision Blizzard hold immense sway as they own the intellectual property and orchestrate major tournaments. This control allows them to dictate terms for team participation, broadcast rights, and advertising within the competitive gaming landscape.

This supplier power directly impacts Beasley's operational costs and revenue potential. For instance, in 2024, the licensing fees for popular esports titles can represent a substantial portion of a team's budget. Furthermore, publishers can influence the revenue-sharing models for prize pools and in-game item sales, directly affecting Beasley's profitability from its esports ventures. The exclusivity of certain leagues means Beasley has limited alternatives if negotiations with a key publisher falter.

- Game Publishers Control IP: Publishers like Riot Games (League of Legends) and Valve (Dota 2) own the core intellectual property, making their games essential for esports teams.

- League Dominance: Major leagues, often run by publishers, are the primary platforms for competition, giving publishers leverage over team involvement and revenue streams.

- Limited Alternatives: The specialized nature of esports means teams often cannot easily switch to different games or leagues without significant disruption and potential loss of audience.

The bargaining power of suppliers for Beasley Broadcast Group is a critical factor in its operational efficiency and profitability. Key suppliers include talent, music licensing organizations, equipment providers, and news wire services. The ability of these suppliers to influence costs and terms significantly impacts Beasley's financial performance.

Talent, such as popular on-air personalities, can command higher compensation due to their direct impact on audience engagement and revenue. Music licensing groups like ASCAP and BMI hold considerable power as they control access to essential music content, leading to substantial licensing fees that affect profit margins. Specialized equipment suppliers can also leverage their position, particularly for proprietary broadcast technology, impacting acquisition costs.

News wire services, like the Associated Press, are vital for timely information, granting them leverage, although the rise of alternative news sources offers some mitigation. In the esports division, game publishers possess immense power, dictating terms for participation and revenue sharing, as Beasley's teams depend on their specific game titles and leagues.

| Supplier Type | Leverage Factors | Impact on Beasley | 2024 Data/Context |

|---|---|---|---|

| Talent/On-Air Personalities | Audience draw, unique appeal | Higher compensation demands, retention challenges | High demand for popular personalities can drive up costs. |

| Music Licensing Organizations (ASCAP, BMI) | Control of music catalog, intellectual property rights | Significant licensing fees, direct impact on operating expenses | Music licensing fees are a substantial operating expense; rates are subject to change. |

| Equipment Suppliers | Specialized technology, proprietary software | Premium pricing for essential gear, limited alternatives | Global broadcast equipment market valued at approx. $12.5 billion in 2024. |

| News Wire Services (AP, Reuters) | Timeliness, accuracy, essential content | Negotiating power for service fees, dependence on content | Continued high demand for reliable news reporting in 2024. |

| Esports Game Publishers | Ownership of game IP, control of major leagues | Dictate participation terms, revenue-sharing models, high licensing fees | Licensing fees for popular esports titles can be a major budget item for teams. |

What is included in the product

Beasley Porter's Five Forces Analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of the media industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Advertisers hold considerable sway over Beasley, as they are its main source of income. This power stems from the wide array of advertising options available, with many other media outlets competing for their attention. Beasley's financial performance in Q1 2025 highlighted this challenge, showing a drop in net revenue largely because of a weaker advertising market, especially impacting national ad spending and agency-related revenue.

Large advertising agencies, by consolidating multiple clients and their substantial ad expenditures, can indeed exert significant leverage over Beasley. This power translates into demands for reduced rates, attractive bundled service packages, and more accommodating contract terms. Their capacity to redirect considerable advertising budgets across various media platforms further amplifies their negotiating strength, allowing them to dictate more favorable conditions.

Beasley's own reporting in the first quarter of 2025 highlighted the impact of a softer macroeconomic environment on agency revenue streams. This economic backdrop likely intensifies the pressure from these major agencies, as they too face budget constraints and seek to maximize the return on their clients' advertising investments, potentially squeezing margins for media providers like Beasley.

While listeners don't directly pay Beasley for its radio content, they are essentially the product delivered to advertisers. This means their power is indirect but substantial; a drop in listenership or engagement directly diminishes the value of Beasley's advertising slots.

In 2024, Beasley Media Group reported average weekly listenership figures across its radio stations, which advertisers heavily rely on to gauge reach. A significant decline in these numbers, perhaps due to shifting consumer habits, would directly impact advertising revenue.

The sheer volume of alternative audio options available today, from podcasts to streaming music services, gives listeners more control than ever. This increased choice amplifies their implicit bargaining power, as they can easily switch away from Beasley's offerings if they aren't satisfied or if better alternatives exist.

Esports Viewers and Fans

The bargaining power of customers, specifically esports viewers and fans, is a significant factor for Beasley. Their engagement directly fuels viewership, which in turn dictates the value of advertising and sponsorship deals. Fans can easily shift their attention to numerous streaming platforms, diverse game titles, and a multitude of content creators, meaning Beasley must continuously offer compelling content to retain their audience. A dip in fan engagement can directly translate to reduced revenue for Beasley's esports ventures.

This power is amplified by the sheer volume of content available. For instance, in 2024, the global esports audience was projected to reach over 600 million viewers, a testament to the vastness of the market and the choices fans have.

- Audience Size: The global esports audience is expected to surpass 600 million viewers in 2024, highlighting the significant reach but also the fragmented nature of fan attention.

- Platform Choice: Viewers can access esports content across platforms like Twitch, YouTube Gaming, and dedicated esports league sites, giving them considerable leverage in where they spend their time.

- Content Creator Competition: The rise of individual streamers and content creators means fans have a wide array of personalities and styles to follow, increasing the competition for viewer loyalty.

- Revenue Impact: A decline in fan viewership for a specific team or event can directly impact sponsorship revenue, as advertisers prioritize platforms and content with high, engaged audiences.

Businesses Seeking Integrated Marketing Solutions

Businesses seeking integrated marketing solutions now have a wider array of choices, moving beyond traditional audio-only providers. This increased competition among multi-platform media companies, digital marketing agencies, and specialized social media advertisers significantly enhances customer bargaining power. For instance, in 2024, the digital advertising market alone was projected to reach over $600 billion globally, offering businesses numerous avenues to explore beyond traditional media.

This expanded landscape allows clients to readily compare offerings and negotiate for better pricing and customized service packages. They can leverage the availability of diverse vendors to secure more favorable terms, demanding integrated solutions that precisely meet their campaign objectives across various channels.

- Increased Vendor Options: Businesses can choose from a growing number of integrated marketing providers.

- Price Sensitivity: Clients can compare pricing across multiple platforms and agencies.

- Demand for Customization: Customers expect tailored solutions to fit specific marketing needs.

- Negotiating Leverage: The competitive market empowers businesses to negotiate better terms and pricing.

Customers possess significant bargaining power due to the abundance of media choices and the indirect nature of their value to Beasley. Listeners, while not direct payers, are the product delivered to advertisers; a decline in listenership directly reduces the value of advertising slots. The proliferation of podcasts and streaming services in 2024 means listeners can easily switch, amplifying their leverage. This dynamic forces Beasley to constantly engage its audience to maintain advertising revenue.

Full Version Awaits

Beasley Porter's Five Forces Analysis

You're previewing the final version of our comprehensive Porter's Five Forces Analysis. The document you see here is precisely the same, fully formatted, and professionally written analysis that will be available to you instantly after completing your purchase, ensuring no surprises and immediate usability.

Rivalry Among Competitors

The U.S. radio broadcasting industry is characterized by its maturity and significant fragmentation, meaning there are many companies vying for the same audience and advertising revenue. This intense local competition is a key factor for Beasley, which operates 57 AM and FM radio stations across various U.S. markets, directly engaging with this fragmented landscape.

Beasley Broadcast Group faces intense competition from other traditional media like local TV stations, newspapers, and print publications. These outlets all compete for the same advertising dollars, both locally and nationally. For instance, while radio is a strong local ad channel, the overall traditional media ad revenue is expected to shrink, with projections indicating a decline in 2025.

The competitive rivalry within the digital audio space is fierce, with platforms like Spotify and Apple Music capturing significant listener share. These services, alongside the burgeoning podcast market and established satellite radio providers such as SiriusXM, are increasingly vying for the same audience and advertising revenue that once primarily flowed to traditional radio broadcasters.

Digital audio advertising is a rapidly expanding segment, with projections indicating continued robust growth. For instance, the U.S. digital audio advertising market was estimated to be around $4.5 billion in 2023 and is expected to climb, directly impacting traditional radio's ad income by siphoning off a growing portion of marketing budgets.

Esports Industry Competitors

Beasley's foray into esports places it in direct competition with established professional esports organizations, team owners, and a multitude of content platforms operating worldwide. This landscape is characterized by rapid expansion and substantial investment, intensifying the battle for skilled players, lucrative sponsorships, and audience attention.

The esports sector is booming, with the global esports market projected to reach $2.72 billion in 2024, a significant jump from previous years. This growth attracts new players and fuels fierce competition.

- Intense Talent Acquisition: Organizations vie for top-tier players, whose salaries can range from tens of thousands to millions annually, creating a highly competitive talent market.

- Sponsorship Wars: Brands are pouring money into esports sponsorships, with global esports sponsorship spending expected to exceed $1.1 billion in 2024, making it a critical battleground.

- Audience Engagement: Platforms like Twitch and YouTube Gaming command massive viewership, with millions of concurrent viewers, demanding constant innovation in content creation to capture and retain audiences.

Local Advertising Market Dynamics

The competitive rivalry within the local advertising market is intense, particularly for companies like Beasley, whose revenue is heavily tied to this sector. The landscape is shifting rapidly, with digital advertising increasingly dominating. In 2024, digital ad spending in the U.S. continues its upward trajectory, expected to capture a larger share of the total advertising pie.

Beasley faces significant competition from a diverse range of players, many of whom are digital-native. These competitors offer increasingly sophisticated and targeted advertising solutions, putting pressure on traditional media outlets.

- Digital ad spending in the U.S. is projected to surpass traditional media spending by 2025.

- Beasley's reliance on local advertising makes it vulnerable to digital-first competitors.

- The proliferation of digital advertising platforms intensifies rivalry for local ad dollars.

Beasley Broadcast Group operates in a highly competitive environment, facing rivals across traditional media, digital audio, and the burgeoning esports sector. The fragmentation of the U.S. radio broadcasting industry means numerous companies are constantly vying for listener attention and advertising revenue, a challenge Beasley directly navigates with its 57 stations.

The company's traditional competitors include local TV and print media, all seeking a share of shrinking traditional ad budgets, with overall traditional media ad revenue projected to decline in 2025. Simultaneously, digital audio platforms like Spotify and Apple Music, along with podcasts and satellite radio, are aggressively competing for audience and advertising dollars, a trend underscored by the U.S. digital audio advertising market's estimated $4.5 billion valuation in 2023 and its continued growth.

| Competitor Type | Key Characteristics | Impact on Beasley |

|---|---|---|

| Traditional Media | Local TV, newspapers, print publications | Share diminishing advertising revenue, facing overall market decline. |

| Digital Audio Platforms | Spotify, Apple Music, Podcasts, SiriusXM | Siphon listener share and advertising budgets, growing market share. |

| Esports Sector | Professional organizations, content platforms | Intensified competition for sponsorships and audience attention. |

SSubstitutes Threaten

Digital music streaming services such as Spotify, Apple Music, and Pandora represent a substantial threat of substitutes for traditional radio. These platforms offer vast, on-demand music libraries and personalized listening experiences, directly vying for audience attention and listening time. By 2024, global music streaming revenues were projected to exceed $30 billion, highlighting the significant shift in consumer behavior away from traditional broadcast media.

The proliferation of podcasts and on-demand audio presents a significant threat to traditional radio's spoken-word content. Listeners can now access highly specialized topics and entertainment on their own schedule, often with fewer interruptions than traditional radio. For instance, by the end of 2023, the podcasting industry was projected to generate over $2 billion in revenue, indicating a substantial shift in audio consumption habits.

Social media platforms like TikTok, YouTube, and Instagram are increasingly pulling consumer attention and advertising dollars away from traditional media. These platforms offer highly engaging and interactive video content, directly competing with radio's entertainment role. In 2024, digital advertising spending is projected to reach over $300 billion in the US, with social media capturing a significant and growing share, directly impacting traditional advertising revenue streams.

Online News and Information Portals

Online news and information portals present a significant threat of substitution for Beasley Broadcast Group, particularly concerning local news and information. Websites like local newspaper digital editions, community blogs, and even social media groups offer immediate updates and niche local content that can directly compete with radio programming. This accessibility means consumers can bypass traditional radio for breaking news and community events, potentially diminishing radio's role as a primary information source.

The digital landscape offers a vast array of free or low-cost alternatives. For instance, in 2024, the average American adult consumes over 2 hours of digital news daily, a figure that continues to grow, directly impacting time spent with traditional media. This shift means Beasley must constantly innovate to retain audience attention against these readily available digital substitutes.

- Digital News Dominance: Online news portals provide real-time updates and hyper-local content, directly competing with radio for news consumption.

- Accessibility and Cost: Many digital news sources are free or subscription-based at much lower price points than radio advertising, making them attractive substitutes.

- Audience Fragmentation: The proliferation of online platforms fragments the audience, making it harder for radio to maintain its traditional reach for news.

- 2024 Digital News Consumption: In 2024, digital news consumption continues to rise, with many adults spending significant daily time with online news sources, posing a direct challenge to radio's market share.

Other Entertainment and Media Consumption Options

The threat of substitutes for radio is significant, stemming from the vast array of entertainment and media consumption options available to consumers. Television, movies, video games, and live events all vie for the same leisure time and attention that radio seeks. For instance, in 2024, global spending on video games alone was projected to reach over $200 billion, demonstrating a substantial allocation of discretionary income and time away from traditional media like radio.

While these alternatives aren't direct audio substitutes, they represent powerful indirect competitors. They offer different, often more immersive, experiences that can capture audience engagement. This diversion of consumer attention directly impacts radio's ability to retain listeners and, consequently, affects its advertising revenue potential as brands seek to reach audiences where they are spending their time and money. The rise of streaming services, for example, has fragmented the audio market, with platforms like Spotify and Apple Music offering vast libraries of on-demand music and podcasts, directly competing for listening hours. In 2023, podcast listenership continued to grow, with over 150 million Americans listening to podcasts monthly, a segment that often draws listeners away from traditional radio programming.

- Broad Entertainment Competition: Television, movies, video games, and live events all compete for consumer leisure time, diverting attention from radio.

- Indirect Impact on Radio: These substitutes, while not audio-specific, represent alternative ways for audiences to spend time and for advertisers to reach consumers, indirectly affecting radio's share of attention and ad revenue.

- Digital Alternatives: Streaming services and podcasts offer on-demand audio content, directly challenging radio's traditional listener base.

- Market Share Diversion: The increasing popularity of digital entertainment, such as the projected over $200 billion global video game market in 2024, signifies a significant diversion of consumer spending and attention away from traditional media like radio.

The threat of substitutes for traditional radio is multifaceted, primarily driven by the digital revolution. Consumers now have an unprecedented array of choices for audio and information consumption, directly impacting radio's listenership and advertising revenue. These substitutes range from on-demand music streaming services to podcasts and even social media platforms that capture attention and advertising dollars.

Digital music streaming services like Spotify and Apple Music offer vast libraries and personalized experiences, directly competing for listening time. By 2024, global music streaming revenues were projected to exceed $30 billion. Podcasts have also surged, with the industry expected to generate over $2 billion in revenue by the end of 2023, offering specialized content on demand. Furthermore, social media platforms such as TikTok and YouTube are increasingly vying for consumer attention and advertising spend, with US digital advertising projected to reach over $300 billion in 2024.

| Substitute Category | Examples | 2023/2024 Data Point | Impact on Radio |

|---|---|---|---|

| Music Streaming | Spotify, Apple Music, Pandora | Global streaming revenues projected >$30 billion (2024) | Direct competition for listening hours and ad revenue. |

| Podcasts | Various platforms | Industry revenue projected >$2 billion (end of 2023) | Captures audience for spoken-word content. |

| Social Media/Video | TikTok, YouTube, Instagram | US digital ad spend projected >$300 billion (2024) | Diverts attention and advertising budgets. |

| Online News | Local news websites, blogs | Significant daily digital news consumption by Americans | Offers real-time, hyper-local information, bypassing radio. |

| Other Entertainment | Video games, streaming TV | Global video game market projected >$200 billion (2024) | Indirectly competes for leisure time and consumer spending. |

Entrants Threaten

The digital landscape has dramatically reduced the hurdles for creating audio content. Individuals and small groups can now launch podcasts, online radio, and digital music channels with minimal upfront costs. This accessibility means a constant stream of new players entering the market, potentially fragmenting audiences and impacting advertising revenue streams.

The rise of new digital advertising platforms, especially those powered by AI and sophisticated data analytics, poses a significant threat. These platforms can offer advertisers highly efficient and precisely targeted campaigns, potentially diverting ad spend away from traditional media like Beasley. For instance, in 2024, the digital advertising market continued its robust growth, with programmatic advertising, a key area for AI-driven targeting, accounting for a substantial portion of total digital ad spend.

Such emerging platforms can disrupt the market quickly by offering innovative solutions that capture market share rapidly. This directly impacts Beasley's ability to grow its digital advertising revenue as advertisers seek out these newer, potentially more effective channels. The agility of these new entrants allows them to adapt to evolving consumer behavior and technological advancements far quicker than established players.

The rise of niche online radio and streaming services poses a significant threat to established players like Beasley. These platforms can carve out highly specific listener segments, offering content tailored to particular demographics or interests that larger broadcasters might overlook. For instance, a service focusing solely on 1980s rock or a specific genre of electronic music can build a fiercely loyal following. This fragmentation of the audience means that listener attention, and by extension, advertising revenue, can be diverted from traditional radio. In 2024, the digital audio advertising market continued its robust growth, with projections indicating a substantial increase, underscoring the appeal and reach of these newer, specialized platforms.

Esports Startups and Investment

The esports landscape is a hotbed for new ventures, with substantial investment pouring into startups. This influx of new organizations, teams, and content creators directly challenges existing players like Beasley's esports division. These newcomers can rapidly build brand recognition, recruit top talent, and secure lucrative sponsorships, thereby escalating competitive pressures.

For instance, the global esports market was valued at approximately $1.38 billion in 2023 and is projected to reach $2.83 billion by 2027, demonstrating its immense attractiveness to new entrants. This rapid expansion fuels a constant stream of startups eager to capture market share.

- Rapid Investment Growth: The esports sector saw significant venture capital funding in 2023 and early 2024, with startups securing millions to establish operations.

- Talent Acquisition: New organizations can quickly build competitive rosters by offering attractive contracts, directly impacting established teams' ability to retain talent.

- Sponsorship Competition: Brands are increasingly allocating marketing budgets to esports, creating a competitive environment for sponsorships that new entrants are actively pursuing.

- Market Expansion: The projected growth of the esports market, with an estimated compound annual growth rate (CAGR) of over 20% in the coming years, makes it an appealing frontier for new businesses.

Consolidation and Diversification by Existing Media Companies

Existing media giants, and even tech behemoths, could significantly increase competitive pressure on local radio and esports by further consolidating or diversifying into these sectors. Their substantial financial backing, existing customer relationships, and advanced technological capabilities present a formidable barrier to smaller, emerging players.

For instance, in 2024, major media groups continued to explore new revenue streams, with some investing in digital content creation and esports event production. This strategic expansion, fueled by billions in annual revenue, allows them to absorb initial losses and aggressively capture market share.

- Consolidation: Large media companies might acquire smaller radio stations or esports teams to gain immediate scale and market presence.

- Diversification: Tech companies with vast user bases could launch their own localized audio streaming services or esports platforms, leveraging existing infrastructure.

- Resource Advantage: These established players can outspend smaller competitors on marketing, talent acquisition, and technology development.

- Market Disruption: Such moves could lead to a more concentrated market, making it harder for new, independent entities to gain a foothold.

The threat of new entrants in the media landscape is amplified by the low cost of digital content creation, allowing individuals and small groups to easily launch podcasts and streaming services. This accessibility leads to a constant influx of new players, fragmenting audiences and potentially impacting revenue for established companies like Beasley. The digital advertising market, particularly AI-driven programmatic advertising, saw continued robust growth in 2024, attracting new platforms that can offer advertisers highly targeted campaigns, diverting ad spend from traditional media.

| Factor | Description | Impact on Beasley | 2024 Data/Projections |

|---|---|---|---|

| Digital Content Creation Costs | Minimal upfront costs for podcasts, online radio, etc. | Increased competition, audience fragmentation. | Continued growth in independent content creators. |

| Digital Advertising Platforms | AI-powered, data-driven targeting. | Diversion of ad revenue from traditional media. | Programmatic advertising a significant portion of digital ad spend. |

| Niche Streaming Services | Targeted content for specific demographics/interests. | Loss of listener attention and advertising revenue. | Digital audio ad market growth underscores appeal of specialized platforms. |

| Esports Market Growth | High investment, rapid startup formation. | Increased competition for talent and sponsorships. | Global esports market valued at ~$1.38 billion in 2023, projected to grow. |

| Media Giant Diversification | Consolidation and expansion into new sectors. | Heightened competitive pressure due to resources. | Major media groups investing in digital content and esports production in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and reliable data. We integrate information from company annual reports, investor presentations, and industry-specific market research reports to capture a comprehensive view of competitive dynamics.